09/01/2024 - 08/31/2025

09/01/2024 - 08/31/2025

Higginbotham Public Sector (800) 583-6908

www.region11bc.com

Symetra Group #1263200 (800) 497-3699

www.symetra.com

Cigna PPO Group #3335872

DHMO Group #A30V9 TX (800) 244-6224

www.mycigna.com

Network - Cigna Total DPPO

Voya Group #700681 (800) 955-7736 www.voya.com

ID Watchdog (800) 744-3772 www.idwatchdog.com

BCBSTX (866) 355-5999

www.bcbstx.com/trsactivecare

(817) 882-0800 www.eecu.org

Superior Vision Group #320580 (800) 507-3800 www.superiorvision.com Network - Superior Southwest

CHUBB

Group # 100000207 (972) 506-7129 www.chubb.com

National Benefit Services (800) 274-0503 www.nbsbenefits.com

Clever RX Group #1085 (800) 974-3135 https://cleverrx.com/

(888) 365-1663 www.mdlive.com/fbs

OneAmerica Group #618369 (855) 517-6365 www.oneamerica.com

Unum (866) 679-3054 www.unum.com

MASA Group #B2BESC11 (800) 423-3226 www.masamts.com

1

2

3

4

CLICK LOGIN

5

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

Who do I contact with Questions? For supplemental benefit questions, you can contact your Benefits/ HR department or you can call Higginbotham Public Sector at 866-914-5202 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.region11bc.com. Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

How can I find a Network Provider?

For benefit summaries and claim forms, go to the ESC Region 11 EBC benefit website: www.region11bc.com Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

When will I receive ID cards? If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can log in to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number, and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card. If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

• Log in and complete your benefit enrollment from 07/08/2024 - 08/16/2024

• Update your information: home address, phone numbers, email, and beneficiaries.

• REQUIRED!! Due to the Affordable Care Act (ACA) reporting requirements, you must add your dependent’s CORRECT Social Security numbers in the online enrollment system.

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefit/HR Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Supplemental Benefits: Eligible employees must work 15 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on September 1, 2024, you must be actively-at-work on September 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your HR/Benefit Administrator to request a continuation of coverage.

You are performing your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel If you will not be actively at work beginning 9/1/2024, please notify your benefits administrator.

The period during which existing employees are given the opportunity to enroll in or change their current elections.

The amount you pay each plan year before the plan begins to pay covered expenses.

January 1st through December 31st.

After any applicable deductible, your share of the cost of a covered health care service, calculated as a percentage (for example, 20%) of the allowed amount for the service.

The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

Doctors, hospitals, optometrists, dentists and other providers who have contracted with the plan as a network provider.

The most an eligible or insured person can pay in coinsurance for covered expenses.

September 1st through August 31st.

Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescriptions drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/or consultation services).

Description

Health Savings Account (HSA) (IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employees’ names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

Flexible

Account (FSA) (IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

Employer Eligibility A qualified high deductible health plan All employers

Contribution Source

Employee and/or employer

Employee and/or employer

Account Owner Individual Employer

Underlying Insurance

Requirement

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

High deductible health plan

$1,600 single (2024)

$3,200 family (2024)

$4,150 single (2024)

$8,300 family (2024)

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

None

N/A

$3,200 (2024)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage.

No. Access to some funds may be extended if your employer’s plan contains a 2 1/2-month grace period or $610 rollover provision.

Does the account earn interest? Yes No

Portable?

Yes, portable year-to-year and between jobs.

No

A Health Savings Account (HSA) is a personal savings account where the money can only be used for eligible medical expenses. Unlike a flexible spending account (FSA), the money rolls over year to year however only those funds that have been deposited in your account can be used. Contributions to a Health Savings Account can only be used if you are also enrolled in a High Deductible Health Care Plan (HDHP). For full plan details, please visit your benefit website: www.mybeneitshub.com/sampleisd

www.region11bc.com

A Health Savings Account (HSA) is more than a way to help you and your family cover health care costs – it is also a tax-exempt tool to supplement your retirement savings and cover health expenses during retirement. An HSA can provide the funds to help pay current health care expenses as well as future health care costs.

A type of personal savings account, an HSA is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows tax-free and spends tax-free if used to pay for qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

You are eligible to open and contribute to an HSA if you are:

• Enrolled in an HSA-eligible HDHP (High Deductible Health Plan) Not covered by another plan that is not a qualified HDHP, such as your spouse’s health plan

• Not enrolled in a Health Care Flexible Spending Account, nor should your spouse be contributing towards a Health Care Flexible Spending Account

• Not eligible to be claimed as a dependent on someone else’s tax return

• Not enrolled in Medicare or TRICARE

• Not receiving Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. You can also use HSA funds to pay health care expenses for your dependents, even if they are not covered under your HDHP.

Your HSA contributions may not exceed the annual maximum amount established by the Internal Revenue Service. The annual contribution maximum for 2024 is based on the coverage option you elect:

• Individual – $4,150

• Family (filing jointly) – $8,300

You decide whether to use the money in your account to pay for qualified expenses or let it grow for future use. If you are 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at any time during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

If you meet the eligibility requirements, you may open an HSA administered by EECU. You will receive a debit card to manage your HSA account reimbursements. Keep in mind, available funds are limited to the balance in your HSA.

• Always ask your health care provider to file claims with your medical provider so network discounts can be applied. You can pay the provider with your HSA debit card based on the balance due after discount.

• You, not your employer, are responsible for maintaining ALL records and receipts for HSA reimbursements in the event of an IRS audit.

• You may open an HSA at the financial institution of your choice, but only accounts opened through EECU are eligible for automatic payroll deduction and company contributions.

• Online/Mobile: Sign-in for 24/7 account access to check your balance, pay bills and more.

• Call/Text: (817) 882-0800 EECU’s dedicated member service representatives are available to assist you with any questions. Their hours of operation are Monday through Friday from 8:00 a.m. to 7:00 p.m. CT, Saturday 9:00 a.m. to 1:00 p.m. CT and closed on Sunday.

• Lost/Stolen Debit Card: Call the 24/7 debit card hotline at (800)333-9934.

• Stop by a local EECU financial center: www.eecu.org/ locations.

Download your Clever RX card or Clever RX App to unlock exclusive savings.

Present your Clever RX App or Clever RX card to your pharmacist.

ST EP 1:

Download the FREE Clever RX App. From your App Store search for "Clever RX" and hit download. Make sure you enter in Group ID and in Member ID during the on-boarding process. This will unlock exclusive savings for you and your family!

ST EP 2 :

Find where you can save on your medication. Using your zip code, when you search for your medication Clever RX checks which pharmacies near you offer the lowest price. Savings can be up to 80% compared to what you're currently paying.

FREE to use. Save up to 80% off prescription drugs and beat copay prices.

Accepted at most pharmacies nationwide ST AR T SA VI NG TOD AY W

100% FREE to use

Unlock discounts on thousands of medications

Save up to 80% off prescription drugs – often beats the average copay

Over 7 0% of peopl e c an benefi t fro m a pre sc rip ti on sav ing s c ard due t o high dedu ct ible heal t h plan s, high c opa ys , and being unde r in s ured or u ni ns ur ed

ST EP 3 :

Click the voucher with the lowest price, closest location, and/or at your preferred pharmacy. Click "share" to text yourself the voucher for easy access when you are ready to use it. Show the voucher on your screen to the pharmacist when you pick up your medication.

ST EP 4:

Share the Clever RX App. Click "Share" on the bottom of the Clever RX App to send your friends, family, and anyone else you want to help receive instant discounts on their prescription medication. Over 70% of people can benefit from a prescription savings card.

TH A T IS N O T ONLY CL EVER, I T IS CL EVE R RX .

DID Y OU KNOW?

Ov er 3 0 % of

This is an affordable supplemental plan that pays you should you be inpatient hospital confined. This plan complements your health insurance by helping you pay for costs left unpaid by your health insurance.

For full plan details, please visit your benefit website: www.region11bc.com

Plan Highlights

• No Pre-existing Limitations!

• HSA Compatible!

• Newborns are automatically covered with existing plan first 31 days of life.

• Wellness Screenings- $50 per person per year.

• You must be at work on the effective date to be eligible for coverage.

$2,000

1

Newborn Initial Day Confinement (admission) $500 first day,

Nursing Facility

This benefit is paid only if following a covered hospital stay of at least three consecutive days.

incident(s) pp/pcy $1,000 first day, $100 day 2+, 30 incident(s) pp/pcy

day 2+,

$100 per day, 30 day(s)

$2,000 first day, $100 day 2+, 30 incident(s) pp/pcy

part of your health plan.

Getting sick is always a hassle. When you need care fast, talk to a board-certified MDLIVE doctor in minutes. Get reliable care from the comfort of home instead of an urgent care clinic or crowded ER. MDLIVE is open nights, weekends, and holidays. No surprise costs.

Convenient and reliable care.

MDLIVE doctors have an average of 15 years of experience and can be reached 24/7 by phone or video.

Affordable alternative to urgent care clinics and the ER. MDLIVE treats 80+ common conditions like flu, sinus infections, pink eye, ear pain, and UTIs (Females, 18+). By talking to a doctor at home, you can avoid long waits and exposure to other sick people. Prescriptions.

Your MDLIVE doctor can order prescriptions1 to the pharmacy of your choice. MDLIVE can also share notes with your local doctor upon request.

MDLIVE cares for more than 80 common, non-emergency conditions, including:

• Pink Eye

• Sinus Problems

• Cough

• Ear Pain

• Headache

• Prescriptions

• Sore Throat

• UTI (Females, 18+)

• Yeast Infections

• And more

1Prescriptions are available at the physician’s discretion when medically necessary. A renewal of an existing prescription can also be provided when your regular physician is unavailable, depending on the type of medication.

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease.

For full plan details, please visit your benefit website: www.region11bc.com

PPO Plans

Coverage is provided through Cigna. You may select the dental provider of your choice, but your level of coverage may vary based on the provider you see for services. Your plan allows you to see any licensed dentist, but using an in-network dentist may minimize your out-of-pocket expenses.

How to Find an In-network PPO Dentist

PPO Network: Total Cigna DPPO Network

To search for a dentist on Cigna.com, visit the site and click “Find a Doctor, Dentist or Facility.” Follow the prompts on screen and when asked to choose your plan, select “DPPO/EPO > Total Cigna DPPO.” Or call Cigna for assistance, group number and contact information on page 3.

Claims

you

Allowable Charge, you may be balance billed

In-network dentists will file claims on your behalf. Claim Reimbursement forms on benefits website, group number and carrier contact on page 3.

*Increasing Maximums- When you or your family members receive any preventive care service in one plan year, the annual dollar maximum will increase in the following plan year. When you or your family members remain enrolled in the plan and continue to receive preventive care, the annual dollar maximum will increase in the following plan year, until it reaches the highest level specified.

Cigna DHMO provides scheduled charges for services with your assigned dental office, please check provider availability in your area before enrolling as choices may be limited in rural areas. Your initial provider will be assigned by zip code, employees may change providers by contacting Cigna before use of services.

• $5 Office Visit Fee

• No Annual Maximum

• No Waiting Period

• Ortho options for adults and children to age 19

How to Find an In-network DHMO Dentist

DHMO Network: Cigna Dental Care Access

Go to Cigna.com. Click on “Find a Doctor, Dentist or Facility” at the top of the screen. Under “Not a Cigna Customer Yet?” click “Plans through your employer or school.” Choose the “Dentist” tab. Enter search location – city, state or zip code. Click on the “Pick” button and then “Dental Plans.” Then, under Cigna Dental Care HMO, choose Cigna Dental Care Access, press “Choose.” Or call Cigna for assistance, group number and contact information on page 3.

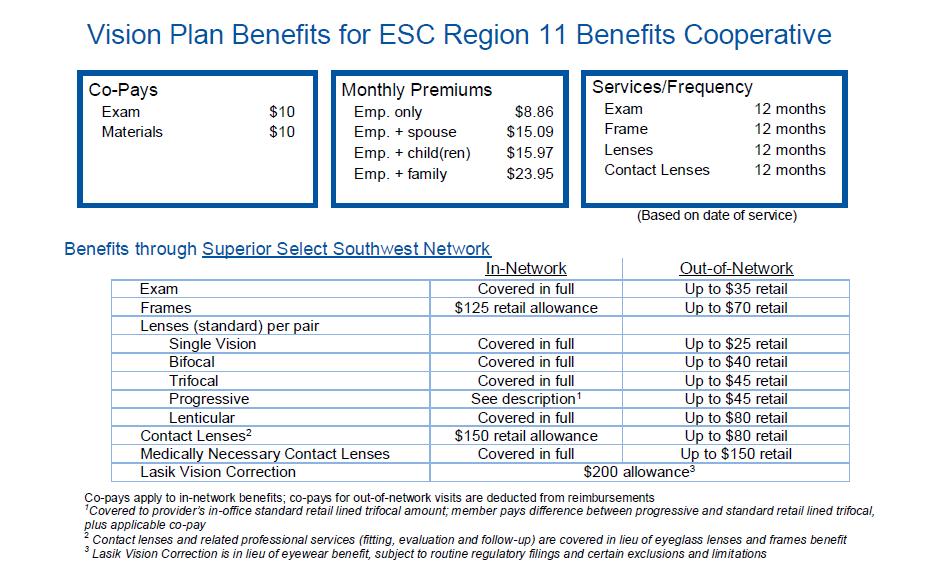

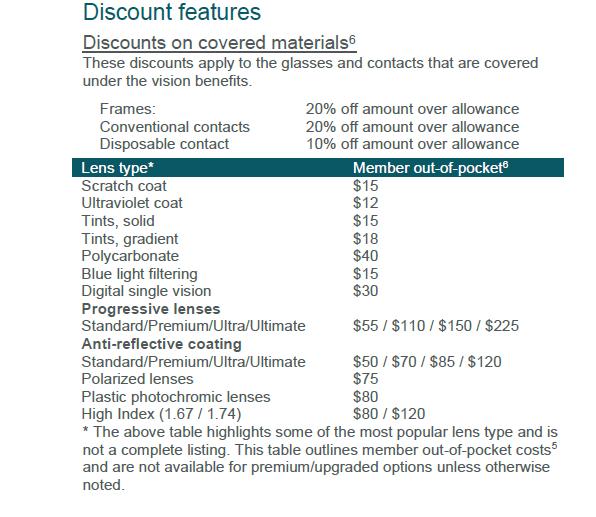

Vision insurance helps cover the cost of care for maintaining healthy vision. Similar to an annual checkup at your family doctor, routine eyecare is necessary to ensure that your eyes are healthy and to check for any signs of eye conditions or diseases . Most plans cover your routine eye exam with a copay and provide an allowance for Frames or Contact Lenses.

www.region11bc.com

For full plan details, please visit your benefit website: www.mybenefitshub.com/escregion11

Superior Vision Customer Service 1-800-507-3800

• In-network benefits available through network eye care professionals.

• Find an in-network eye care professional at superiorvision.com. Call your eye doctor to verify network participation.

• Obtain a vision exam with either an MD or OD.

• Flexibility to use different eye care professionals for exam and for eyewear.

• Access your benefits through our mobile app – Display member ID card – view your member ID card in full screen or save to wallet .

Our network is built to support you.

• We manage one of the largest eye care professional networks in the country .

• The network includes 50 of the top 50 national retailers. Examples include:

• In-network online retail Providers :

Members may also receive additional discounts, including 20% off lens upgrades and 30% off additional pairs of glasses.*

A LASIK discount is available to all covered members. Our Discounted LASIK services are administered by QualSight. Visit lasik.sv.qualsight.com to learn more.

Members save up to 40% on brand name hearing aids and have access to a nationwide network of licensed hearing professionals through Your Hearing Network.

*Discounts are provided by participating locations. Verify if their eye care professional participates in the discount featur e before receiving service.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.region11bc.com

Disability insurance combines the features of a short-term and long-term disability plan into one policy. The coverage pays you a portion of your earnings if you cannot work because of a disabling illness or injury. The plan gives you the flexibility to choose a level of coverage to suit your need. This coverage is provided by OneAmerica.

CLAIMS: Call OneAmerica Disability Claims at (855) 5176365 to file a claim. Group number on page 3.

Effective Date: Coverage goes into effect subject to the terms and conditions of the policy. You must satisfy the definition of Actively at Work with your employer on the day your coverage takes effect.

Benefit Amount: You may select a benefit percentage of 45%, 55% or 65% of your earnings, up to a maximum monthly benefit of $10,000. Benefits are illustrated and paid on a monthly basis.

Elimination Period: This is a period of consecutive dates of disability before benefits may become payable under the contract.

Elimination Period Options:

• 0 days/7 days *

• 14 days/14 days *

• 30 days/30 days *

*Eligible for First Day Hospital Benefit

• 60 days/60 days

• 90 days/90 days

• 180 days/180 days

First Day Hospital: If a Person is Totally Disabled and hospital confined for 24 hours or more with room and board charges during the Elimination Period due to a covered Disability, benefits are payable from the first day of that confinement. Applies to plans with Elimination Periods of 30 days or less.

Total Disability: You are considered disabled if, because of injury or sickness, you cannot perform the material and substantial duties of any gainful occupation, you are not working in any occupation and are under the regular attendance of a physician for that injury or sickness

Pre-Existing Condition Period - 3 months/12 months:

A pre-existing condition is any condition that a person has received medical treatment or consultation, taken or were prescribed drugs or medicine, or received care or services, including diagnostic measures, within a timeframe specified in the contract. A limited benefit will be paid if Disability begins in the first 12 months following the Effective Date; and the Person received medical advice or treatment in the 3 months prior to the Effective Date. If your disability is a result of a pre-existing condition, the carrier will pay benefits for a maximum of 4 weeks.

Maximum Benefit Duration: This is the length of time that you may be paid benefits if continuously disabled as outlined in the contract. Depending on the age at which disability occurs, the maximum duration may vary.

Accident Insurance pays you benefits for specific injuries and events resulting from a covered accident that occurs on or after your coverage effective date. The amounts paid depend on the type of injury and care received. Accident Insurance is a limited benefit policy. It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

www.region11bc.com

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

How about something more severe, like a concussion or broken bone? Most of us have experienced an accident that needed medical attention at least once in our lives. In these situations, your injuries may keep you from performing normal activities, like cooking, cleaning, or even working. Then there are the medial costs because of your injury, which are piled on to your everyday expenses. Accident Insurance can help minimize the financial impact of an accident.

The following list is an example summary of the benefits provided by Accident Insurance. Benefit types and amounts are determined by the plan selected, the circumstances of your accident and the care you receive. You may be required to seek care for your injury within a set amount of time and you may be required to be insured under the policy for a specified amount of time before benefits are payable. For a complete description of your available benefits, exclusions, and limitations, see your certificate of insurance.

• Surgery

• Blood, plasma, platelets

• Hospital Admission

• Hospital Confinement

• Coma

• Transportation

• Medical Equipment

• Physical therapy

• Prosthetic Device

• Burns

• Concussion

You can use the benefit however you like. Below are a few examples of how you can use your benefit:

• Medical deductibles and copays

• Child care

• House cleaning

• Everyday expenses like utilities and groceries

• Torn knee cartilage

• Lacerations / sutures

• Ruptured disk surgical repair

• Tendon, ligament, or rotator cuff surgical repair

• Paralysis

• Dislocations

• Fractures

• Eye Injury

Why should I enroll through my employer?

Premium amounts are deducted from your paycheck, so you don’t have to worry about paying another bill.

Are there any exclusions or limitations?

See the certificate of insurance and riders for a complete list of available benefits, exclusions, and limitations.

Are you ready to file a claim? Submitting a claim is as easy as 1,2,3

This is a summary of benefits only. A complete description of benefits, limitations, exclusions, and termination of coverage will be provided in the certificate of insurance and riders. All coverage is subject to the terms and conditions of the group policy. If there is any discrepancy between this document and the group policy documents, the policy documents will govern. To keep coverage in force, premiums are payable up to the date of coverage termination. Critical Illness Insurance is underwritten by ReliaStar Life Insurance Company (Minneapolis, MN), a member of the Voya® family of companies. Policy form #RL-CI4-POL-16; Certificate form #RL-CI4-CERT-16. Form numbers, provisions and availability may vary by state.

Cancer insurance offers you and your family supplemental insurance protection in the event you or a covered family member is diagnosed with cancer. It pays a benefit directly to you to help with expenses associated with cancer treatment.

For full plan details, please visit your benefit website: www.region11bc.com

A cancer diagnosis and treatment can be an emotionally and physically difficult time. Cancer Insurance is there to help support you by providing cash benefits paid directly to you. Benefits are paid if you are diagnosed with cancer, but also help cover many other cancerrelated services such as doctor’s visits, treatments, specialty care, and recovery. However, there are no restrictions on how to use these cash benefits—so you can use them as you see fit.

Following is a sample of the many types of cash benefits included in this plan, benefit amounts are on the plan summary. There are high and low plan options, choose the right level of coverage during the enrollment period to better protect your family.

Please review the plan summary on the benefit website for details on these new plans.

• Diagnosis of Cancer Benefit

• Hospital Confinement Benefit

• Radiation therapy, chemotherapy, immunotherapy

• Alternative care Benefit

• Attending physician Benefit

• Anesthesia Benefit

• Outpatient surgery facility service

• Reconstructive Surgery

• Second and Third opinion

• Surgical prosthesis

• Skin

• Heart Attack or Stroke Benefit

• Accident and Sickness Benefits

• Preventative and Wellness Benefits

• Specialty Care Benefits

• Family Member Transportation and Lodging

• Home Health Care

• Hospice Care

• Air Ambulance

• Blood, plasma, and platelets

• Bone marrow or Stem cell Transplant

Continuity of coverage: Continuity of coverage is included for employees remaining on the same level plan. Pre-existing condition limitation applies for those changing plan levels or enrolling for the first time.

Pre-existing conditions limitation: A condition for which a covered person received medical advice or treatment within the 12 months preceding the certificate effective date.

No benefits will be paid for services rendered by a member of the immediate family of a covered person.

We will not pay benefits for cancer or skin cancer if the diagnosis or treatment of cancer is received outside of the territorial limits of the United States and its possessions. Benefits will be payable if the covered person returns to the territorial limits of the United States and its possessions, and a physician confirms the diagnosis or receives treatment.

You choose the amount of coverage that’s right for you, and you keep coverage for a set period of time, or “term.” If you die during that term, the money can help your family pay for basic living expenses, final arrangements, tuition and more.

AD&D Insurance is also available, which pays a benefit if you survive an accident but have certain serious injuries. It pays an additional amount if you die from a covered accident.

Why is this coverage so valuable?

If you previously purchased coverage, you can increase it up to $230,000 to meet your growing needs — with no medical underwriting.

What else is included?

A ‘Living’ Benefit — If you are diagnosed with a terminal illness with less than 12 months to live, you can request 50% of your life insurance benefit (up to $750,000) while you are still living. This amount will be taken out of the death benefit, and may be taxable. These benefit payments may adversely affect the recipient’s eligibility for Medicaid or other government benefits or entitlements, and may be taxable. Recipients should consult their tax attorney or advisor before utilizing living benefit payments.

Waiver of premium — Your cost may be waived if you are totally disabled for a period of time.

Portability — You may be able to keep coverage if you leave the company, retire or change the number of hours you work. Employees or dependents who have a sickness or injury having a material effect on life expectancy at the time their group coverage ends are not eligible for portability.

If you are actively at work at least 15 hours per week, you may apply for coverage for:

If you are actively at work at least 15 hours per week, you may apply for

You: Choose from $10,000 to $500,000 in $10,000 increments, up to 7 times your earnings.

Choose from $10,000 to $500,000 in $10,000 increments, up to 7 times your earnings.

If you previously purchased coverage, you can increase it up to $230,000 with no medical underwriting. If you previously declined coverage, you may have to answer some health questions.

If you previously purchased coverage, you can increase it up to $230,000 with no medical underwriting. If you previously declined coverage, you may have to answer some health questions.

Your spouse: Get up to $500,000 of coverage in $10,000 increments. Spouse coverage cannot exceed 100% of the coverage amount you purchase for yourself.

Your spouse: Get up to $500,000 of coverage in $10,000 increments. Spouse coverage cannot exceed 100% of the coverage amount you purchase for yourself.

If you previously purchased coverage for your spouse, they can increase their coverage up to $50,000 with no medical underwriting, if eligible (see delayed effective date). If you previously declined spouse coverage, some health questions may be required.

If you previously purchased coverage for your spouse, they can increase their coverage up to $50,000 with no medical underwriting, if eligible (see delayed effective date). If you previously declined spouse coverage, some health questions may be required.

Your children: Get up to $10,000 of coverage in $5,000 increments if eligible (see delayed effective date). One policy covers all of your children until their 26th birthday.

The maximum benefit for children live birth to 6 months is $1,000.

Your children: Get up to $10,000 of coverage in $5,000 increments if eligible (see delayed effective date). One policy covers all of your children until their 26th birthday.

The maximum benefit for children live birth to 6 months is $1,000.

You: Get up to $500,000 of AD&D coverage for yourself in $10,000 increments to a maximum of 7 times your earnings.

Your spouse:

Your children: Get 50% of employee amount up to $250,000 of AD&D coverage, if eligible (see delayed effective date).

Get 10% of employee amount up to $10,000 of AD&D coverage if eligible (see delayed effective date). The maximum benefit for children live birth to 6 months is $1,000.

No medical underwriting is required for AD&D coverage.

Calculate your costs

1. Enter the coverage amount you want.

2. Divide by the amount shown.

3. Multiply by the rate. Use the rate table (at right) to find the rate based on age. (Choose the age you will be when your coverage becomes effective. See your plan administrator for your plan effective date. To determine your spouse rate, choose the age the spouse will be when coverage becomes effective. See your plan administrator for your plan effective date.)

4. Enter your cost.

Exclusions and limitations

Actively at work

Eligible employees must be actively at work to apply for coverage. Being actively at work means on the day the employee applies for coverage, the individual must be working at one of his/her company’s business locations; or the individual must be working at a location where he/she is required to represent the company. If applying for coverage on a day that is not a scheduled workday, the employee will be considered actively at work as of his/her last scheduled workday. Employees are not considered actively at work if they are on a leave of absence or lay off.

An unmarried handicapped dependent child who becomes handicapped prior to the child’s attainment age of 26 may be eligible for benefits. Please see your plan administrator for details on eligibility. Employees must be U.S. citizens or legally authorized to work in the U.S. to receive coverage. Employees must be actively employed in the United States with the Employer to receive coverage. Employees must be insured under the plan for spouses and dependents to be eligible for coverage.

Exclusions and limitations

Life insurance benefits will not be paid for deaths caused by suicide occurring within 24 months after the effective date of coverage. The same applies for increased or additional benefits.

AD&D specific exclusions and limitations:

Accidental death and dismemberment benefits will not be paid for losses caused by, contributed to by, or resulting from:

• Disease of the body; diagnostic, medical or surgical treatment or mental disorder as set forth in the latest edition of the Diagnostic and Statistical Manual of Mental Disorders (DSM)

• Suicide, self-destruction while sane, intentionally self-inflicted injury while sane or self-inflicted injury while insane

• War, declared or undeclared, or any act of war

• Active participation in a riot

• Committing or attempting to commit a crime under state or federal law

• The voluntary use of any prescription or non-prescription drug, poison, fume or other chemical substance unless used according to the prescription or direction of your or your dependent’s doctor. This exclusion does not apply to you or your dependent if the chemical substance is ethanol.

• Intoxication – ‘Being intoxicated’ means your or your dependent’s blood alcohol level equals or exceeds the legal limit for operating a motor vehicle in the state or jurisdiction where the accident occurred.

Delayed effective date of coverage

Insurance coverage will be delayed if you are not an active employee because of an injury, sickness, temporary layoff, or leave of absence on the date that insurance would otherwise become effective.

Delayed Effective Date: if your spouse or child has a serious injury, sickness, or disorder, or is confined, their coverage may not take effect. Payment of premium does not guarantee coverage. Please refer to your policy contract or see your plan administrator for an explanation of the delayed effective date provision that applies to your plan.

Coverage amounts for Life and AD&D Insurance for you and your dependents will reduce to 65% of the original amount when you reach age 70, and will reduce to 50% of the original amount when you reach age 75. Coverage may not be increased after a reduction.

Your coverage and your dependents’ coverage under the policy ends on the earliest of:

• The date the policy or plan is cancelled

• The date you no longer are in an eligible group

• The date your eligible group is no longer covered

• The last day of the period for which you made any required contributions

• The last day you are actively employed (unless coverage is continued due to a covered layoff, leave of absence, injury or sickness), as described in the certificate of coverage

In addition, coverage for any one dependent will end on the earliest of:

• The date your coverage under a plan ends

• The date your dependent ceases to be an eligible dependent

• For a spouse, the date of a divorce or annulment

• For dependents, the date of your death

Unum will provide coverage for a payable claim that occurs while you and your dependents are covered under the policy or plan.

This information is not intended to be a complete description of the insurance coverage available. The policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations which may affect any benefits payable. For complete details of coverage and availability, please refer to Policy Form

C.FP-1 et al or contact your Unum representative.

Life Planning Financial & Legal Resources services, provided by HealthAdvocate, are available with select Unum insurance offerings. Terms and availability of service are subject to change. Service provider does not provide legal advice; please consult your attorney for guidance. Services are not valid after coverage terminates. Please contact your Unum representative for details.

Unum complies with state civil union and domestic partner laws when applicable.

Underwritten by:

Unum Life Insurance Company of America, Portland, Maine

© 2022 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

Identity theft can affect anyone—from infants to seniors. Each generation has habits that savvy criminals know how to exploit—resulting in over $43 billion lost to identity fraud in the U.S. in 2022. Take action with award-winning ID Watchdog identity theft protection.

Greater Peace of Mind

With ID Watchdog as an employee benefit, you have a more convenient and affordable way to help better protect and monitor your identity. You’ll be alerted to potentially suspicious activity and enjoy greater peace of mind knowing you don't have to face identity theft alone.

We scour billions of data points— public records, transaction records, social media and more—to search for signs of potential identity theft.

We've got you covered with lock features for added control over your credit report(s) to help keep identity thieves from opening new accounts in your name.

Awarded Best in

If you become a victim, you don’t have to face it alone. One of our certified resolution specialists will personally manage the case for you until your identity is restored.

Our family plan helps you better protect your loved ones with personalized accounts for adult family members, family alert sharing, and exclusive features for children.

Financial Accounts Monitoring

Social Accounts Monitoring

Registered Sex Offender Reporting

Blocked Inquiry Alerts | 1 Bureau

Customizable Alert Options

National Provider ID Alerts

Integrated Fraud Alerts

With a fraud alert, potential lenders are encouraged to take extra steps to verify your identity before extending credit.

Dark Web Monitoring

Data Breach Notifications

High-Risk Transactions Monitoring

Subprime Loan Monitoring

Public Records Monitoring

USPS Change of Address Monitoring

Telecom & Utility Alerts | 1 Bureau

Credit Score Tracker | 1 Bureau

Personalized Identity Restoration

including Pre-Existing Conditions

Online Resolution Tracker

Lost Wallet Vault & Assistance

Deceased Family Member Fraud

Remediation (Family Plan only)

Credit Freeze Assistance

Solicitation Reduction

Help better protect children with Equifax Child Credit Lock & Equifax Child Credit Monitoring PLUS features marked with this icon

Credit Report Monitoring

Credit Report(s) & VantageScore Credit Score(s)

Credit Report Lock

Subprime Loan Block

within the monitored lending network

Personal VPN and Password Manager

Device Security & Online Privacy

Personal Data Scans & Removal

Essentials

to $1 Million Up to $1M Stolen Funds Reimbursement - Checking and savings accounts

to $1 Million Up to $1M Stolen Funds Reimbursement - Checking and savings accounts

Platinum, Platinum Plus

Plus only

Plus only

Essentials Up to $2 Million Up to $2M Stolen Funds Reimbursement - Checking and savings accounts -401k/HSA/ESOP accounts

Home Title Fraud NEW

Cyber Extortion

Professional Identity Fraud

Deceased Family Member Fraud

Bureau = Equifax | Multi-Bureau = Equifax, TransUnion | 3 Bureau = Equifax, Experian , TransUnion ® ® ®

The credit scores provided are based on the VantageScore 3.0 model. For three-bureau VantageScore credit scores, data from Equifax, Experian, and TransUnion are used respectively. Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

(1)The Integrated Fraud Alert feature is made available to consumers by Equifax Information Services LLC and fulfilled on its behalf by Identity Rehab Corporation. (2)There is no guarantee that ID Watchdog is able to locate and scan all deep and dark websites where consumers' personal information is at risk of being traded. (3)The monitored network does not cover all businesses or transactions. (4)For low Family Plans, applicable for enrolled family members only. (5)Monitoring from Equifax will begin on your plan start date. TransUnion and Experian will take several days to begin after you create an online account. (6)Locking your Equifax or TransUnion credit report will prevent access to it by certain third parties. Locking your Equifax or TransUnion credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax or TransUnion credit report include: companies like ID Watchdog and TransUnion Interactive, Inc. which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state, and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer’s identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre approved offers of credit or insurance to you. To opt out of preapproved offers, visit www.optoutprescreen.com.

(7)Available for simultaneous use on up to 6 devices. (8)Equip up to 5 devices; 10 with a Family Plan. (10)May be subject to delay or change. To review ID Watchdog Terms & Conditions, go to idwatchdog.com/terms. (9)The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits (www.idwatchdog.com/terms/insurance).

returns); (b) your taxable compensation; (c) your spouse’s actual or deemed earned income.

“Register” in the top right corner, and follow the

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

protects families against out-of-pocket costs for emergency transportation and provides connections with care. Gain peace of mind and shield your finances knowing there’s a MASA plan best suited for your needs.

TRS - REGION 10

Major medical insurance is a type of health care coverage that provides benefits for a broad range of medical expenses that may be incurred either on an inpatient or outpatient basis.

For full plan details, please visit your benefit website: www.region11bc.com

The rates shown apply to the following district(s):

Bonham ISD

CityScape Schools

Education Center Int’l Academy

Evolution Academy

Manara Academy

Maypearl ISD

Palmer ISD

S&S CISD

Trinity Basin Preparatory

UME Preparatory

Van Alstyne ISD

Whitesboro ISD

Winfree Academy Charter Schools

monthly rates do not include employer contributions.

bet your boots

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

The rates shown apply to the following district(s):

Argyle ISD

Aubrey ISD

Bluff Dale ISD

Brock ISD

Callisburg ISD

East Fort Worth

Montessori Era ISD

Erath Excels Academy

Gainesville ISD

Garner ISD

Graford ISD

Huckabay ISD

Jean Massieu Academy

Kennedale ISD

Lake Dallas ISD

Lindsay ISD

Lingleville ISD

Lipan ISD

Little Elm ISD

Morgan Mill ISD

Muenster ISD

Newman International (Academy of Arlington)

Palo Pinto ISD

Ponder ISD

Poolville ISD

Sanger ISD

Santo ISD

Sivells Bend ISD

Stephenville ISD

Three Way ISD

Treetops International School

Trivium Academy (Portico Education Foundation)

Valley View ISD

Walnut Bend ISD

Westlake Academy

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

Use your District’s group # to login to the Benefits app.

District

Academy of Visual and Performing Arts

Argyle ISD

GROUP #

ESC11DD

ESC11B

Aubrey ISD ESC11AAA

Bluff Dale ISD ESC11D

Bonham ISD ESC11E

Brock ISD ESC11F

Callisburg ISD ESC11G

CityScape Schools

ESC11I

Decatur ISD ESC11J

Dell City ISD ESC11K

Dublin ISD ESC11L

East Fort Worth Montessori ESC11M

Education Center Int’l Academy (Arise, Inc dba) ESC11N

Era ISD

ESC11O

Erath Excels Academy ESC11P

Evolution Academy ESC11R

Gainesville ISD

ESC11S

Garner ISD ESC11T

Graford ISD ESC11U

Huckabay ISD ESC11V

Itasca ISD ESC11W

Jean Massieu Academy ESC11X

Kennedale ISD ESC11Y

Lake Dallas ISD ESC11Z

Lindsay ISD

ESC11AA

Lingleville ISD ESC11AB

Lipan ISD

ESC11AC

District

GROUP #

Little Elm ISD ESC11AD

Manara Academy ESC11BB

Maypearl ISD ESC11AE

Morgan Mill ISD ESC11AF

Muenster ISD ESC11AG

Newman International ESC11AH

Palmer ISD ESC11AI

Palo Pinto ISD ESC11AJ

Ponder ISD ESC11AK

Poolville ISD ESC11AL

S & S CISD ESC11CC

Sanger ISD ESC11BA

Santo ISD ESC11AM

Sivells Bend ISD ESC11AN

Stephenville ISD ESC11AO

Three Way ISD ESC11AP

Treetops International School ESC11AQ

Trinity Basin Preparatory ESC11AR

Trivium Academy ESC11AS

UME Preparatory ESC11AT

Valley View ISD ESC11AU

Van Alstyne ISD ESC11AV

Walnut Bend ISD ESC11AW

Westlake Academy ESC11AX

Whitesboro ISD ESC11AY

Winfree Academy Charter Schools ESC11AZ

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the ESC Region 11 EBC Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the ESC Region 11 EBC Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.