Higginbotham Public Sector (800) 583-6908 www.mybenefitshub.com/huntsvilleisd BCBSTX (866) 355-5999 www.bcbstx.com/trsactivecare

Chubb (888) 499-0425

Superior Vision (800) 507-3800 www.superiorvision.com

Cigna (800) 244-6224 www.cigna.com

5Star Life Insurance (866) 863-9753 www.5starlifeinsurance.com

Higginbotham (866) 419-3519 flexservices.higginbotham.net

Recuro (855) 673-2876 www.recurohealth.com

The Hartford (866) 547-9124 www.thehartford.com

Chubb (833) 453-1680

MASA (800) 423-3226 www.masamts.com

TELUS Health (800) 433-7916 http://login.lifeworks.com

HSA Bank (800) 357-6246 www.hsabank.com

Cigna (800) 244-6224 www.cigna.com

Chubb (888) 499-0425

Cigna (800) 244-6224 www.cigna.com

ID Watchdog (800) 774-3772 www.idwatchdog.com

1

2

3

www.mybenefitshub.com/huntsvilleisd

4

CLICK LOGIN

5

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

(CIS):

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefits Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 31 days of benefit eligible employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

For supplemental benefit questions, you can contact your Benefit Office or you can call Higginbotham Public Sector at (866) 914-5202 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/ huntsvilleisd. Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the Huntsville ISD benefit website: www.mybenefitshub.com/huntsvilleisd. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on September 1, 2024, you must be actively-at-work on September 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector, LLC from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your Benefit Office to request a continuation of coverage.

Description

Health Savings Account (HSA) (IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employee’s names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

Flexible Spending Account (FSA) (IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax-free.

Employer Eligibility A qualified high deductible health plan. All employers

Contribution Source Employee and/or employer

Account Owner Individual

Underlying Insurance Requirement High deductible health plan

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

Does the account earn interest?

Portable?

Employee and/or employer

Employer

None

$1,600 single (2024)

$3,200 family (2024) N/A

$4,150 single (2024)

$8,300 family (2024) 55+ catch up +$1,000

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

$3,200 (2024)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage.

Yes

The district allows a maximum limit of $500. If the amount is over $500 the difference will be forfeited.

No

Yes, portable year-to-year and between jobs. No

Major medical insurance is a type of health care coverage that provides benefits for a broad range of medical expenses that may be incurred either on an inpatient or outpatient basis.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

Maximize your savings

A Health Savings Account, or HSA, is a tax-advantaged savings account you can use for healthcare expenses. Along with saving you money on taxes, HSAs can help you grow your nest egg for retirement.

• Contribute to your HSA by payroll deduction, online banking transfer or personal check.

• Pay for qualified medical expenses for yourself, your spouse and your dependents. Both current and past expenses are covered if they’re from after you opened your HSA.

• Use your HSA Bank Health Benefits Debit Card to pay directly, or pay out of pocket for reimbursement or to grow your HSA funds.

• Roll over any unused funds year to year. It’s your money — for life.

• Invest your HSA funds and potentially grow your savings.¹

You can use your HSA funds to pay for any IRS-qualified medical expenses, like doctor visits, hospital fees, prescriptions, dental exams, vision appointments, over-the-counter medications and more. Visit hsabank.com/QME for a full list.

You’re most likely eligible to open an HSA if:

• You have a qualified high-deductible health plan (HDHP).

• You’re not covered by any other non-HSA-compatible health plan, like Medicare Parts A and B.

• You’re not covered by TriCare.

• No one (other than your spouse) claims you as a dependent on their tax return.

The IRS limits how much you can contribute to your HSA every year. This includes contributions from your employer, spouse, parents and anyone else.2

2023

Maximum contribution limit

$3,850 $7,750 SINGLE PLAN FAMILY PLAN

You may be eligible to make a $1,000 HSA catch-up contribution if you’re:

• Over 55.

• An HSA accountholder.

• Not enrolled in Medicare (if you enroll mid-year, annual contributions are prorated).

Maximum contribution limit

2024

$4,150 $8,300 SINGLE PLAN FAMILY PLAN

¹

A huge way that HSAs can benefit you is they let you save on taxes in three ways.

1 You don’t pay federal taxes on contributions to your HSA.3

2 Earnings from interest and investments are tax-free.

3 Distributions are tax free when used for qualified medical expenses.

2 HSA contributions in excess of IRS limits are subject to penalty and tax unless the excess and earnings are withdrawn prior to the tax filing deadline as explained in IRS Publication 969.

3 Federal tax savings are available regardless of your state. State tax laws may vary. Consult a tax professional for more information.

Visit hsabank.com or call the number on the back of your debit

It’s not easy to pay hospital bills, especially if you have a high-deductible medical plan. Chubb Hospital Cash pays money directly to you if you are hospitalized so you can focus on your recovery. And since the cash goes directly to you, there are no restrictions on how you use your money. average three-day hospitalization cost.¹ average hospital stay.²

5.4 days $30,000

First Hospitalization Benefit

This benefit is payable for the first covered hospital confinement per certificate.

Hospital Admission Benefit

This benefit is for admission to a hospital or hospital sub-acute intensive care unit.

Hospital Admission ICU Benefit

This benefit is for admission to a hospital intensive care unit.

Hospital Confinement Benefit

This benefit is for confinement in hospital or hospital sub-acute intensive care unit.

Hospital Confinement ICU Benefit

This benefit is for confinement in a hospital intensive care unit.

Newborn Nursery Benefit

This benefit is payable for an insured newborn baby receiving newborn nursery care and who is not confined for treatment of a physical illness, infirmity, disease, or injury.

Rehabilitation Unit Admission Benefit

This benefit is for admission to a rehabilitation unit as an inpatient.

• $500

• Maximum benefit per certificate: 1

• $1,500

• Maximum benefit per calendar year: 5

• $3,000

• Maximum benefit per calendar year: 2

• $200 per day

• Maximum days per calendar year: 30

• $400 per day

• Maximum days per calendar year: 30

• $500 per day

• Maximum days per confinementnormal delivery: 2

• Maximum days per confinementcaesarean section: 2

• $500

• Maximum benefit per calendar year: 3

• $500

• Maximum benefit per certificate: 1

• $3,000

• Maximum benefit per calendar year: 5

• $6,000

• Maximum benefit per calendar year: 2

• $200 per day

• Maximum days per calendar year: 30

• $400 per day

• Maximum days per calendar year: 30

• $500 per day

• Maximum days per confinementnormal delivery: 2

• Maximum days per confinementcaesarean section: 2

• $500

• Maximum benefit per calendar year: 5

Waiver of Premium for Hospital Confinement

This benefit waives premium when the employee or spouse is confined for more than 30 continuous days.

Included

We will not pay for any Covered Accident or Covered Sickness that is caused by, or occurs as a result of 1) committing or attempting to commit suicide or intentionally injuring oneself; 2) war or serving in any of the armed forces or units auxiliary; 3) participating in an illegal occupation or attempting to commit or actually committing a felony; 4) sky diving, hang gliding, parachuting, bungee jumping, parasailing, or scuba diving; 5) being intoxicated or being under the influence or any narcotic or other prescription drug unless taken in accordance with Physician’s instructions 6) alcoholism; 7) cosmetic surgery, except for reconstructive surgery needed as the result of an Injury or Sickness or is related to or results from a congenital disease or anomaly of a covered Dependent Child; 8) services related to sterilization, reversal of a vasectomy or tubal ligation, in vitro fertilization, and diagnostic treatment of infertility or other related problems.

A Physician cannot be You or a member of Your Immediate Family, Your business or professional partner, or any person who has a financial affiliation or business interest with You.

Contact the FBS Benefits CareLine via the QR code or (833) 453-1680.

*Please refer to your Certificate of Insurance at https://www.mybenefitshub.com/huntsvilleisd for a complete listing of available benefits, limitations and exclusions. Underwritten by ACE Property & Casualty Company, a Chubb company. This information is a brief description of the important benefits and features of the insurance plan. It is not an insurance contract. This is a supplement to health insurance and is not a substitute for Major Medical or other minimal essential coverage. Hospital indemnity coverage provides a benefit for covered loss; neither the product name nor benefits payable are intended to provide reimbursement for medical expenses incurred by a covered person or to result in any payment in excess of loss.

Recuro has a national network of board certified, state licensed doctors offering medical consultations 24 hours a day, 7 days a week! Recuro doctors diagnose acute non emergent medical conditions and prescribe medications when clinically appropriate.

Top Conditions We Treat

Acne / Rashes

Allergies

Cold / Flu / Cough

GI Issues

Nausea / Vomiting

Respiratory Issues

Ear Problems Fever / Headache UTI’s / Vaginitis

With TRS ActiveCare Plans, each visit incurs a Consult Fee. However, Recuro's Virtual Urgent Care visits have no Consult Fee.

TRS-ActiveCare Primary Plan: $12 per visit TRS-ActiveCare Primary+ Plan: $12 per visit TRS-ActiceCare HD Plan: $30 - $42 per visit

Recuro Health: $0 per visit

Virtual Care through TRS is only available to those employees and dependents who are on the TRS health plan. Recuro is available to all legal dependents regardless if they are on the health plan or not.

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease. For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

Our dental plan helps you maintain good oral health through affordable options for preventive care, including regular checkups and other dental work. Premium contributions are deducted from your paycheck on a pretax basis. Coverage is provided through Cigna

Two levels of benefits are available with the DPPO plan: in-network and out-of-network. You may select the dental provider of your choice, but your level of coverage may vary based on the provider you see for services. You could pay more if you use an out-ofnetwork provider.

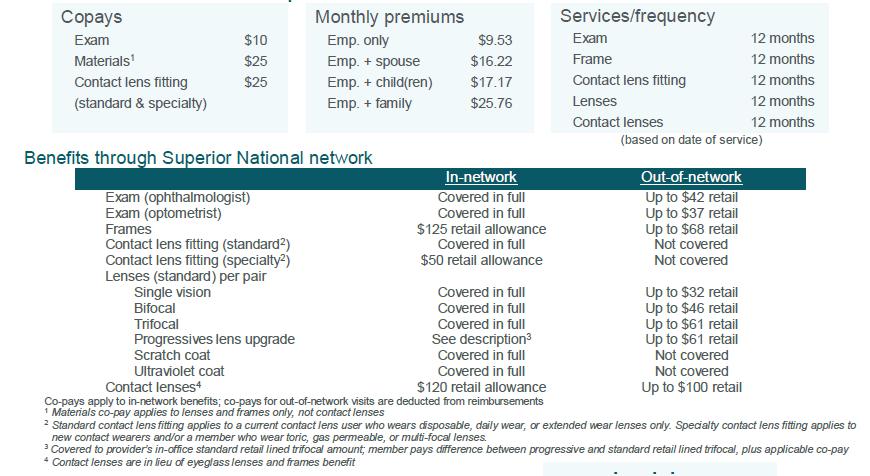

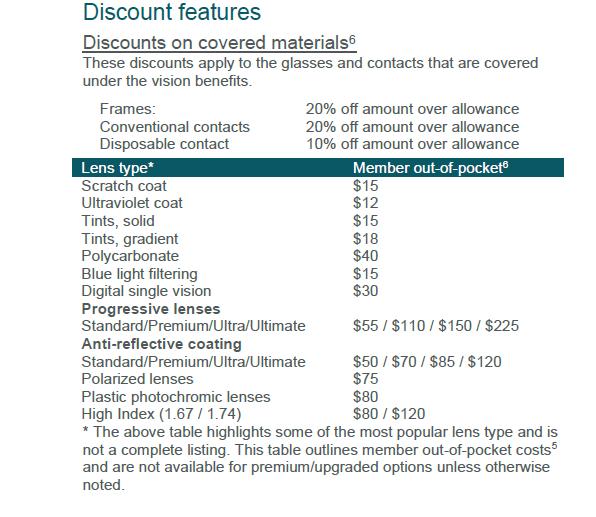

Vision insurance helps cover the cost of care for maintaining healthy vision. Similar to an annual checkup at your family doctor, routine eyecare is necessary to ensure that your eyes are healthy and to check for any signs of eye conditions or diseases . Most plans cover your routine eye exam with a copay and provide an allowance for Frames or Contact Lenses.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

Superior Vision Customer Service 1-800-507-3800

• In-network benefits available through network eye care professionals.

• Find an in-network eye care professional at superiorvision.com. Call your eye doctor to verify network participation.

• Obtain a vision exam with either an MD or OD.

• Flexibility to use different eye care professionals for exam and for eyewear.

• Access your benefits through our mobile app – Display member ID card – view your member ID card in full screen or save to wallet .

Our network is built to support you.

• We manage one of the largest eye care professional networks in the country .

• The network includes 50 of the top 50 national retailers . Examples include:

• In-network online retail Providers :

Members may also receive additional discounts, including 20% off lens upgrades and 30% off additional pairs of glasses.*

A LASIK discount is available to all covered members. Our Discounted LASIK services are administered by QualSight. Visit lasik.sv.qualsight.com to learn more.

Members save up to 40% on brand name hearing aids and have access to a nationwide network of licensed hearing professionals through Your Hearing Network.

*Discounts are provided by participating locations. Verify if their eye care professional participates in the discount feature before receiving service.

ate in Superior Vision Discounts, including the member out pocket features. Call your provider prior to scheduling an

Not all providers participate in Superior Vision Discounts, including the member out-of-pocket features. Call your provider prior to scheduling an appointment to confirm if he/she offers the discount and member out-of-pocket features. The discount and member out-of-pocket features are not insurance. Discounts and member out-of-pocket are subject to change without notice and do not apply if prohibited by the manufacturer. Lens options may not be available from all Superior Vision providers/all locations.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

What is Educator Disability Income Insurance?

Why do I need Disability Insurance Coverage?

Educator Disability insurance combines the features of a short-term and long-term disability plan into one policy. The coverage pays you a portion of your earnings if you cannot work because of a disabling illness or injury. The plan gives you the flexibility to choose a level of coverage to suit your need.

You have the opportunity to purchase Disability Insurance through your employer. This highlight sheet is an overview of your Disability Insurance. Once a group policy is issued to your employer, a certificate of insurance will be available to explain your coverage in detail.

More than half of all personal bankruptcies and mortgage foreclosures are a consequence of disability1

1 Facts from LIMRA, 2016 Disability Insurance Awareness Month

The average worker faces a 1 in 3 chance of suffering a job loss lasting 90 days or more due to a disability2

2 Facts from LIMRA, 2016 Disability Insurance Awareness Month

Only 50% of American adults indicate they have enough savings to cover three months of living expenses in the event they’re not earning any income3

3 Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2018

ELIGIBILITY AND ENROLLMENT

Eligibility

You are eligible if you are an active employee who works at least 20 hours per week on a regularly scheduled basis.

Enrollment You can enroll in coverage within 31 days of your date of hire or during your annual enrollment period.

Effective Date

Actively at Work

Coverage goes into effect subject to the terms and conditions of the policy. You must satisfy the definition of Actively at Work with your employer on the day your coverage takes effect.

You must be at work with your Employer on your regularly scheduled workday. On that day, you must be performing for wage or profit all of your regular duties in the usual way and for your usual number of hours. If school is not in session due to normal vacation or school break(s), Actively at Work shall mean you are able to report for work with your Employer, performing all of the regular duties of Your Occupation in the usual way for your usual number of hours as if school was in session.

Benefit Amount

Elimination Period

Maximum Benefit Duration

You may purchase coverage that will pay you a monthly flat dollar benefit in $100 increments between $200 and $8,000 that cannot exceed 66 2/3% of your current monthly earnings. Earnings are defined in The Hartford’s contract with your employer.

You must be disabled for at least the number of days indicated by the elimination period that you select before you can receive a Disability benefit payment. The elimination period that you select consists of two numbers. The first number shows the number of days you must be disabled by an accident before your benefits can begin. The second number indicates the number of days you must be disabled by a sickness before your benefits can begin.

For those employees electing an elimination period of 30 days or less, if you are confined to a hospital for 24 hours or more due to a disability, the elimination period will be waived, and benefits will be payable from the first day of hospitalization.

Benefit Duration is the maximum time for which we pay benefits for disability resulting from sickness or injury. Depending on the schedule selected and the age at which disability occurs, the maximum duration may vary. Please see the applicable schedules below based on your election of the Premium benefit option.

Premium Option: For the Premium benefit option – the table below applies to disabilities resulting from sickness or injury.

Age Disabled

Prior to 63

Age 63

Age 64

Age 65

Age 66

Age 67

Age 68

Age 69 and older

Pre-Existing Condition

Limitation

Maximum Benefit Duration

To Normal Retirement Age or 48 months if greater

To Normal Retirement Age or 42 months if greater

36 months

30 months 27 months 24 months

Your policy limits the benefits you can receive for a disability caused by a pre-existing condition. In general, if you were diagnosed or received care for a disabling condition within the 3 consecutive months just prior to the effective date of this policy, your benefit payment will be limited, unless: You have been insured under this policy for 12 months before your disability begins.

If your disability is a result of a pre-existing condition, we will pay benefits for a maximum of 1 month.

First cancer benefit

Diagnosis of cancer

Hospital confinement

Hospital confinement ICU

Radiation therapy, chemotherapy, immunotherapy

Alternative care

Medical imaging

Skin cancer initial diagnosis

Attending physician

Hospital confinement sub-acute ICU

Family care

$100 paid upon receipt of first covered claim for cancer; only one payment per covered person per certificate per calendar year

$5,000 employee or spouse $7,500 child(ren) Waiting period: 0 days

Benefit reduction: none

$100 per day – days 1 through 30 Additional days: $100 Maximum days per confinement: 31

$600 per day – days 1 through 30 Additional days: $600 Maximum days per confinement: 31

Maximum per covered person per calendar year per 12-month period:

$10,000

$75 per visit Maximum visits per calendar year: 4

$500 per imaging study Maximum studies per calendar year: 2

$100 per diagnosis Lifetime maximum: 1

$30 per visit Maximum visits per confinement: 2 Maximum visits per calendar year: 4

$300 per day – days 1 through 30 Additional days: $300 Maximum days per confinement: 31

Childcare: $100 per day per child Maximum days per calendar year: 30 Adult day care or home healthcare: $100 per day Maximum days per calendar year: 30

$100 paid upon receipt of first covered claim for cancer; only one payment per covered person per certificate per calendar year

$10,000 employee or spouse $15,000 child(ren) Waiting period: 0 days

Benefit reduction: none

$200 per day – days 1 through 30 Additional days: $200 Maximum days per confinement: 31

$600 per day – days 1 through 30 Additional days: $600 Maximum days per confinement: 31

Maximum per covered person per calendar year per 12-month period: $20,000

$75 per visit Maximum visits per calendar year: 4

$500 per imaging study Maximum studies per calendar year: 2

$100 per diagnosis Lifetime maximum: 1

$50 per visit Maximum visits per confinement: 2 Maximum visits per calendar year: 4

$300 per day – days 1 through 30 Additional days: $300 Maximum days per confinement: 31

Childcare: $100 per day per child Maximum days per calendar year: 30 Adult day care or home healthcare: $100 per day Maximum days per calendar year: 30

Prescription drug in-patient Per confinement: $150 Maximum confinements per calendar year: 6 Per confinement: $150 Maximum confinements per calendar year: 6

Private full-time nursing services

$150 per day Maximum days per confinement: 5

U.S. government or charity hospital Days 1 through 30: $100 Additional days: $100 Maximum days per confinement: 15

Renewability

Portability

Continuity of coverage

Pre-existing conditions limitation

Waiver of premium

Continuity of coverage

Definition of cancer

Definition of cancer

$150 per day Maximum days per confinement: 5

Days 1 through 30: $100 Additional days: $100 Maximum days per confinement: 15

Conditionally Renewable Coverage is automatically renewed as long as the insured is an eligible employee, premiums are paid as due, and the policy is in force.

Portability Employees can keep their coverage if they change jobs or retire while the policy is in-force.

Included

A condition for which a covered person received medical advice or treatment within the 12 months preceding the certificate effective date.

Included

If the certificate replaced another cancer indemnity certificate or individual policy, your coverage under the certificate shall not limit or exclude coverage for a pre- existing condition or waiting period that would have been covered under the policy being replaced. Benefits payable for a pre-existing condition or during the waiting period will be the lesser of the benefits that would have been payable under the terms of the prior coverage if it had remained in force; or the benefits payable under the certificate. Time periods applicable to pre-existing conditions and waiting periods will be waived to the extent that similar limitations or exclusions were satisfied under the coverage being replaced. Continuity of coverage is only extended to the benefits provided under the certificate. The certificate may not include all the benefits provided under the prior coverage.

Cancer means carcinoma in situ, leukemia, or a malignant tumor characterized by uncontrolled cell growth and invasion or spread of malignant cells to distant tissue. Cancer is also defined as cancer which meets the diagnosis criteria of malignancy established by the American Board of Pathology after a study of the histocytologic architecture or pattern of the suspect tumor, tissue, or specimen. Carcinoma in situ means a malignant tumor which is typically classified as Stage 0 cancer, where the tumor cells still lie within the tissue of the site of origin without having invaded neighboring tissue.

The following are not considered cancer: Pre-malignant conditions or conditions with malignant potential; non-invasive basal cell carcinoma of the skin; non-invasive squamous cell carcinoma of the skin; or melanoma diagnosed as Clark’s Level I or II or Breslow less than .75mm.

Plan descriptions Refer to the Certificate of Coverage for details specific to each plan.

No benefits will be paid for a date of diagnosis or treatment of cancer prior to the coverage effective date, except where continuity of coverage applies. No benefits will be paid for services rendered by a member of the immediate family of a covered person. We will not pay benefits for other conditions or diseases, except losses due directly from cancer or skin cancer. We will not pay benefits for cancer or skin cancer if the diagnosis or treatment of cancer is received outside of the territorial limits of the United States and its possessions. Benefits will be payable if the covered person returns to the territorial limits of the United States and its possessions, and a physician confirms

Do you have kids playing sports, are you a weekend warrior, or maybe accident prone? Accident plans are designed to help pay for medical costs associated with accidents and benefits are paid directly to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

Accidental Injury coverage provides a fixed cash benefit according to the schedule below when a Covered Person suffers certain Injuries or undergoes a broad range of medical treatments or care resulting from a Covered Accident. See State Variations (marked by *) below.

Who Can Elect Coverage: Eligibility for You, Your Spouse and Your Children will be considered by Your employer.

You: All active, Full-time Employees of the Employer who are regularly working in the United States a minimum of 20 hours per week and regularly residing in the United States and who are United States citizens or permanent resident aliens or non-United States citizens legally working and living in the United States (Inpats) and their Spouse, Domestic Partner, or Civil Union Partner and Dependent Children who are United States citizens or permanent resident aliens or Spouse, Domestic Partner, or Civil Union Partner or Dependent Child Inpats and who are legally residing in the United States.

You will be eligible for coverage on the first of the month coinciding with or next following date of hire or Active Service.

Your Spouse*: Up to age 100, as long as you apply for and are approved for coverage yourself.

Your Child(ren): Birth to age 26; 26+ if disabled, as long as you apply for and are approved for coverage yourself.

Available Coverage: This Accidental Injury plan provides 24 hour coverage.

The benefit amounts shown in this summary will be paid regardless of the actual expenses incurred and are paid on a per day basis unless otherwise specified. Benefits are only payable when all policy terms and conditions are met. Please read all the information in this summary to understand terms, conditions, state variations, exclusions and limitations applicable to these benefits. See your Certificate of Insurance for more information.

Available Coverage: This Accidental Injury plan provides 24 hour coverage.

The benefit amounts shown in this summary will be paid regardless of the actual expenses incurred and are paid on a per day basis unless otherwise specified. Benefits are only payable when all policy terms and conditions are met. Please read all the information in this summary to understand terms, conditions, state variations, exclusions and limitations applicable to these benefits. See your Certificate of Insurance for more information

(more than 6 inches

Coma (lasting 7 days with no response)

and requires 2 or more

Additional Accidental Injury benefits included - See certificate for details, including limitations & exclusions. Virtual Care accepted for Initial Physician Office Visit and Follow-Up Care.

Death and Dismemberment Benefit

Examples of benefits include (but are not limited to) payment for death from Automobile accident; total and permanent loss of speech or hearing in both ears. Actual benefit amount paid depends on the type of Covered Loss. The Spouse and Child benefit is 50% and 50% respective of the benefit shown.

Preventive Care Benefit*

Wellness Treatment, Health Screening Test and Preventive Care Benefit:* Benefit paid for all covered persons is 100% of the benefit shown. Also includes COVID-19 Immunization, Tests, and Screenings. Virtual Care accepted.

Portability Feature: You, your spouse, and child(ren) can continue 100% of your coverage at the time your coverage ends. You must be under the age of 100 in order to continue your coverage. Rates may change and all coverage ends at age 100. Applies to United States Citizens and Permanent Resident Aliens residing in the United States Only available to United States Citizens, Permanent Resident Aliens and non-United States Citizens working in the United States lawfully (Inpats) while residing in the United States.

Important Definitions and Policy Provisions:

Coverage Type: Benefits are paid when a Covered Injury results, directly and independently of all other causes, from a Covered Accident.

Covered Accident: A sudden, unforeseeable, external event that results, directly and independently of all other causes, in a Covered Injury or Covered Loss and occurs while the Covered Person is insured under this Policy; is not contributed to by disease, sickness, mental or bodily infirmity; and is not otherwise excluded under the terms of this Policy.

Covered Injury: Any bodily harm that results directly and independently of all other causes from a Covered Accident.

Covered Person: An eligible person who is enrolled for coverage under this Policy.

Covered Loss: A loss that is the result, directly and independently of other causes, from a Covered Accident suffered by the Covered Person within the applicable time period described in the Policy.

Hospital: An institution that is licensed as a hospital pursuant to applicable law; primarily and continuously engaged in providing medical care and treatment to sick and injured persons; managed under the supervision of a staff of medical doctors; provides 24-hour nursing services by or under the supervision of a graduate registered Nurse (R.N.); and has medical, diagnostic and treatment facilities with major surgical facilities on its premises, or available to it on a prearranged basis, and charges for its services. The term Hospital does not include a clinic, facility, or unit of a Hospital for: rehabilitation, convalescent, custodial, educational, or nursing care; the aged, treatment of drug or alcohol addiction.

When your coverage begins: Coverage begins on the later of the program’s effective date, the date you become eligible, or the first of the month following the date your completed enrollment form is received unless otherwise agreed upon by Cigna. Your coverage will not begin unless you are actively at work on the effective date. Coverage for all Covered Persons will not begin on the effective date if hospital, facility or home confined, disabled or receiving disability benefits or unable to perform activities of daily living.

When your coverage ends: Coverage ends on the earliest of the date you and your dependents are no longer eligible, the date the group policy is no longer in force, or the date for the last period for which required premiums are paid. For your dependent, coverage also ends when your coverage ends, when their premiums are not paid or when they are no longer eligible. (Under certain circumstances, your coverage may be continued. Be sure to read the provisions in your Certificate.)

30 Day Right To Examine Certificate: If a Covered Person is not satisfied with the Certificate for any reason, it may be returned to us within 30 days after receipt. We will return any premium that has been paid and the Certificate will be void as if it had never been issued.

Critical illness insurance can be used towards medical or other expenses. It provides a lump sum benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke. The money can also be used for non-medical costs related to the illness, including transportation, child care, etc.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

$10,000; $20,000; or $30,000 or $40,000 face amounts

$10,000; $20,000; $30,000 or $40,000 face amounts Child

Included in the employee rate

There is no pre-existing conditions limitation. All amounts are guaranteed issue — no medical questions are required for coverage to be issued.

BENEFIT

Benefits are payable for a subsequent diagnosis of Benign Brain Tumor, Cancer, Coma, Coronary Artery Obstruction, Heart Attack, Major Organ Failure, Severe Burns, Stroke, or Sudden Cardiac Arrest.

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/huntsvilleisd

Employee – If you are an active, full-time, U.S. Employee, regularly working a minimum of 20 hours per week, you are eligible for coverage on the first day of active service.

• Benefit Amount –Units of $10,000 to the lesser of 5 times annual compensation or $500,000.

• Guaranteed Coverage Amount – the lesser of 5 times annual compensation or $200,000.

• Maximum – The lesser of 5 times Annual Compensation or $500,000.

• Benefit Reduction Schedule –Providing you are still employed, your benefits will reduce to 65% at age 65, 45% at age 70, 30% at age 75 and 20% at age 80, 15% at age 85, 10% at age 90, 10% at age 95. Your Spouse* – is eligible provided that you apply for and are approved for coverage for yourself.

• Benefit Amount – Units of $5,000

• Guaranteed Coverage Amount - $50,000

• Maximum – $250,000, not to exceed 50% of the employee’s coverage amount Your Unmarried, Dependent Children – As long as you apply for and are approved for coverage for yourself: Birth to 6 months: $100; 6 months to 25 years age:

• Benefit Amount – Units of $2,000

• Maximum – $10,000

No one may be covered more than once under this plan.

If you pass away or are seriously injured as a result of a covered accident or injury, you or your beneficiaries will receive a set amount to help pay for unexpected expenses, or help your loved ones pay for future expenses after you’re gone.

If, within 365 days of a Covered Accident, bodily injuries result in:

Loss of life; Total paralysis of both upper and lower limbs; Loss of two or more hands or feet; Loss of sight in both eyes; or Loss of speech and hearing (both ears)

Total paralysis of both lower limbs or both upper limbs

Total paralysis of upper and lower limbs on one side of the body; Loss of one hand, one foot, sight in one eye, speech, or hearing in both ears; or Severance and Reattachment of one hand or foot

Total paralysis of one upper or one lower limb; Loss of all four fingers of the same hand; or Loss of thumb and index finger of the same hand

Loss of all toes of the same foot

Group Term Life Insurance to age 121 with Quality of Life

Make a smart choice to help protect your loved ones and your future.

Life doesn’t come with a lesson plan

Help protect your family with the Family Protection Plan Group Level Term Life Insurance to age 121. You can get coverage for your spouse even if you don’t elect coverage on yourself. And you can cover your financially dependent children and grandchildren (14 days to 26 years old). The coverage lasts until age 121 for all insured,* so no matter what the future brings, your family is protected.

Buying life insurance when you’re younger allows you to take advantage of lower premium rates while you’re generally healthy, which allows you to purchase more insurance coverage for the future. This is especially important if you have dependents who rely on your income, or you have debt that would need to be paid off.

Portable

Coverage continues with no loss of benefits or increase in cost if you terminate employment after the first premium is paid. We simply bill you directly.

Life moves fast so having a portable life insurance allows you to keep your coverage if you leave your school district. Keeping the coverage helps you ensure your family is protected even into your retirement years.

44% of American households would encounter significant financial difficulties within six months if they lost the primary family wage earner.

28% would reach this point in one month or less.

Group

Terminal illness acceleration of benefits

Coverage pays 30% (25% in CT and MI) of the coverage amount in a lump sum upon the occurrence of a terminal condition that will result in a limited life span of less than 12 months (24 months in IL).

Protection you can count on

Within one business day of notification, payment of 50% of coverage or $10,000 whichever is less is mailed to the beneficiary, unless the death is within the two-year contestability period and/or under investigation. This coverage has no war or terrorism exclusions.

Convenient

Easy payment through payroll deduction.

Quality of Life benefit

Optional benefit that accelerates a portion of the death benefit on a monthly basis, up to 75% of your benefit, and is payable directly to you on a tax favored basis* for the following:

•Permanent inability to perform at least two of the six Activities of Daily Living (ADLs) without substantial assistance; or

•Permanent severe cognitive impairment, such as dementia, Alzheimer’s disease and other forms of senility, requiring substantial supervision.

Many individuals who can’t take care of themselves require special accommodations to perform ADLs and would need to make modifications to continue to live at home with physical limitation. The proceeds from the Quality of Life benefit can be used for any purpose, including costs for infacility care, home healthcare professionals, home modifications, and more.

2024 Enrollment Plan Year

Guaranteed Issue is offered to all eligible applicants regardless of health status. No Doctor exams or physicals.

Employee: $100,000 | Spouse: $30,000 | Child: $10,000

Enroll to provide peace of mind for your family

To do an initial enrollment or if you have questions please call our customer service at 866-914-5202. Monday - Friday | 8:00 am-6:00 pm CST

The Family Protection Plan offers a lump-sum cash benefit if you die before age 121. The initial death benefit is guaranteed to be level for at least the first ten policy years. Afterward, the company intends to provide a nonguaranteed death benefit enhancement which will maintain the initial death benefit level until age 121. The company has the right to discontinue this enhancement. The death benefit enhancement cannot be discontinued on a particular insured due to a change in age, health, or employment status.

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Emergency Air Ambulance Coverage1

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

Identity theft can affect anyone—from infants to seniors. Each generation has habits that savvy criminals know how to exploit—resulting in over $43 billion lost to identity fraud in the U.S. in 2022. Take action with award-winning ID Watchdog identity theft protection.

Greater Peace of Mind

With ID Watchdog as an employee benefit, you have a more convenient and affordable way to help better protect and monitor your identity. You’ll be alerted to potentially suspicious activity and enjoy greater peace of mind knowing you don't have to face identity theft alone.

We scour billions of data points— public records, transaction records, social media and more—to search for signs of potential identity theft.

We've got you covered with lock features for added control over your credit report(s) to help keep identity thieves from opening new accounts in your name.

Best in

If you become a victim, you don’t have to face it alone. One of our certified resolution specialists will personally manage the case for you until your identity is restored.

Our family plan helps you better protect your loved ones with personalized accounts for adult family members, family alert sharing, and exclusive features for children.

Financial Accounts Monitoring

Social Accounts Monitoring

Registered Sex Offender Reporting

Blocked Inquiry Alerts | 1 Bureau

Customizable Alert Options

National Provider ID Alerts

Integrated Fraud Alerts

With a fraud alert, potential lenders are encouraged to take extra steps to verify your identity before extending credit.

Dark Web Monitoring

Data Breach Notifications

High-Risk Transactions Monitoring

Subprime Loan Monitoring

Public Records Monitoring

USPS Change of Address Monitoring

Telecom & Utility Alerts | 1 Bureau

Credit Score Tracker | 1 Bureau

Personalized Identity Restoration

including Pre-Existing Conditions

Online Resolution Tracker

Lost Wallet Vault & Assistance

Deceased Family Member Fraud

Remediation (Family Plan only)

Credit Freeze Assistance

Solicitation Reduction

Help better protect children with Equifax Child Credit Lock & Equifax Child Credit Monitoring PLUS features marked with this icon

Credit Report Monitoring

Credit Report(s) & VantageScore Credit Score(s)

Credit Report Lock

Subprime Loan Block

within the monitored lending network

Personal VPN and Password Manager

Device Security & Online Privacy

Personal Data Scans & Removal

to $1 Million Up to $1M Stolen Funds Reimbursement -

Essentials

to $1 Million Up to $1M Stolen Funds Reimbursement -

and savings accounts

Essentials Up to $2 Million Up to $2M Stolen Funds Reimbursement - Checking and savings accounts -401k/HSA/ESOP accounts

Home Title Fraud NEW Cyber Extortion

Professional Identity Fraud Deceased Family Member Fraud

The credit scores provided are based on the VantageScore 3.0 model. For three-bureau VantageScore credit scores, data from Equifax, Experian, and TransUnion are used respectively. Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

(1)The Integrated Fraud Alert feature is made available to consumers by Equifax Information Services LLC and fulfilled on its behalf by Identity Rehab Corporation. (2)There is no guarantee that ID Watchdog is able to locate and scan all deep and dark websites where consumers' personal information is at risk of being traded. (3)The monitored network does not cover all businesses or transactions. (4)For low Family Plans, applicable for enrolled family members only. (5)Monitoring from Equifax will begin on your plan start date. TransUnion and Experian will take several days to begin after you create an online account. (6)Locking your Equifax or TransUnion credit report will prevent access to it by certain third parties. Locking your Equifax or TransUnion credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax or TransUnion credit report include: companies like ID Watchdog and TransUnion Interactive, Inc. which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state, and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer’s identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre approved offers of credit or insurance to you. To opt out of preapproved offers, visit www.optoutprescreen.com.

(7)Available for simultaneous use on up to 6 devices. (8)Equip up to 5 devices; 10 with a Family Plan. (10)May be subject to delay or change. To review ID Watchdog Terms & Conditions, go to idwatchdog.com/terms. (9)The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits (www.idwatchdog.com/terms/insurance).

A Flexible Spending Account allows you to pay for eligible healthcare expenses with a pre-loaded debit card. You choose the amount to set aside from your paycheck every plan year, based on your employer’s annual plan limit. This money is use it or lose it within the plan year.

For full plan details, please visit your benefit website: www.mybene itshub.com/sampleisd

www.mybenefitshub.com/huntsvilleisd

The Health Care FSA covers qualified medical, dental and vision expenses for you or your eligible dependents. You may contribute up to $3,200 annually to a Health Care FSA and you are entitled to the full election from day one of your plan year. Eligible expenses include:

• Dental and vision expenses

• Medical deductibles and coinsurance

• Prescription copays

• Hearing aids and batteries

You may have the option to enroll in both a HSA and FSA, however doing so will make your FSA a "Limited" FSA, which means it will only be available for dental and vision expenses. All medical expenses would need to be processed through your HSA.

The Higginbotham Benefits Debit Card gives you immediate access to funds in your Health Care FSA when you make a purchase without needing to file a claim for reimbursement. If you use the debit card to pay anything other than a copay amount, you will need to submit an itemized receipt or an Explanation of Benefits (EOB).

The Dependent Care FSA helps pay for expenses associated with caring for elder or child dependents so you or your spouse can work or attend school full time. You can use the account to pay for day care or baby sitter expenses for your children under age 13 and qualifying older dependents, such as dependent parents. Reimbursement from your Depend ent Care FSA is limited to the total amount deposited in your account at that time. To be eligible, you must be a single parent or you and your spouse must be employed outside the home, disabled or a full-time student.

• Overnight camps are not eligible for reimbursement (only day camps can be considered).

• If your child turns 13 midyear, you may only request reimbursement for the part of the year when the child is under age 13.

• You may request reimbursement for care of a spouse or dependent of any age who spends at least eight hours a day in your home and is mentally or physically incapable of self-care.

• The dependent care provider cannot be your child under age 19 or anyone claimed as a dependent on your income taxes.

• The maximum per plan year you can contribute to a Health Care FSA is $3,200. The maximum per plan year you can contribute to a Dependent Care FSA is $5,000 when filing jointly or head of household and $2,500 when married filing separately.

• You cannot change your election during the year unless you experience a Qualifying Life Event.

• In most cases, you can continue to file claims incurred during the plan year for another 90 days after the plan year ends.

• Your Health Care FSA debit card can be used for health care expenses only. It cannot be used to pay for dependent care expenses.

• The IRS has amended the “use it or lose it rule” to allow you to carry-over up to $640 in your Health Care FSA into the next plan year for eligible employers The carry-over rule does not apply to your Dependent Care FSA.

• Review your employer's Summary Plan Document for full details. FSA rules vary by employer.

Health care reform legislation requires that certain over-the-counter (OTC) items require a prescription to qualify as an eligible Health Care FSA expense. You will only need to obtain a one-time prescription for the current plan year. You can continue to purchase your regular prescription medications with your FSA debit card. However, the FSA debit card may not be used as payment for an OTC item, even when accompanied by a prescription.

Higginbotham Portal

The Higginbotham Portal provides information and resources to help you manage your FSAs.

• Access plan documents, letters and notices, forms, account balances, contributions and other plan information

• Update your personal information

• Utilize Section 125 tax calculators

• Look up qualified expenses

• Submit claims

• Request a new or replacement Benefits Debit Card

Register on the Higginbotham Portal

Visit https://flexservices.higginbotham.net and click Register. Follow the instructions and scroll down to enter your information.

• Enter your Employee ID, which is your Social Security number with no dashes or spaces.

• Follow the prompts to navigate the site.

• If you have any questions or concerns, contact Higginbotham:

∗ Phone – 866-419-3519

• Phone – (866) 914-5202

∗ Questions – flexsupport@higginbotham.net

∗ Fax – 866-419-3516

• Questions – flexsupport@higginbotham.net

• Fax – (866) 419-3516

∗ Claims- flexclaims@higginbotham.net

• Claims – flexclaims@higginbotham.net

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the Huntsville ISD Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the Huntsville ISD Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.