11 minute read

How PMIF and PYS contributed to higher group premiums

BY MIKE TAYLOR

Many of the objectives of the Government’s changes to insurance in superannuation may have been laudable but one of the outcomes has been higher premiums and higher costs to members.

IIn the approximately two years since the Government introduced its Protecting Your Super (PYS) legislation and its allied Putting Members Interests First (PMIF) the number of people covered by insurance inside superannuation has declined while premiums have risen. Given that one of the key objectives of PYS and PMIF was to reduce account balance erosion by effectively making insurance inside superannuation opt-in for younger and low income members the outcome, at this stage, appears to have fallen significant short of what the

Government had hoped for. As a reminder, the PMIF legislation provided for the cancellation of insurance cover for members with balances below $6,000 (where they didn’t request to keep the cover) from 1 April, 2020, and only start insurance cover for members where they have reached a balance of $6,000 and are age 25 or older. So, what has the bottom line been?

According to data compiled by specialist life insurance research house, Dexx&r, total in-force premiums for group life are down 3.2%. They stood at $6.226 billion at December 2018 and at December 2020 stood at just $6.013 billion.

What is more, the data show that premium charged to members for default cover death and total and permanent disability (TPD) have increased by 15% since January 2018 with Dexx&r’s Mark Kachor making the point that if premiums charged to members had not been increased by 15% over the past two years, the decline of in-force premiums would have been around 18%.

This is telling because it remains generally acknowledged that insurance inside superannuation remains the most common form of life insurance cover carried by Australians and the phenomenon of the PMIF legislation coming at a significant cost to superannuation fund members remaining in the insurance pool was predicted well before 2019.

But the Government’s legislative efforts have not been the only driver for increased premiums in the superannuation arena, with the insurers themselves having broadly sought to reshape what represented chronically unprofitable disability insurance offerings.

This much has been recognised by the Australian Prudential Regulation Authority (APRA) which has expressed long-term concerns about the profitability of disability insurance and as recently as March saw fit to write to superannuation fund licensees and the chief executives of the major life insurers warning about the re-emergence of bad practices.

What APRA said it was worried about was premium volatility and the re-emergence of tendering practices

which put price above service with respect to group insurance mandates.

In short, APRA’s letter suggested that there was a danger that insurers and superannuation funds could repeat the mistakes which gave rise to the significant losses which occurred between 2012 and 2016.

Under the heading “Key areas of concern” APRA’s letter stated:

“Following a period of significant premium reductions and benefit increases for life insurance provided through superannuation, between 2012 and 2016 insurers experienced significant losses. As a result, there were large premium increases, more restrictive cover terms were introduced, and a number of trustees experienced difficulty in obtaining quotes for cover for their members as insurers and reinsurers declined to participate in many tenders. The significant changes in premiums (as a result of premium reductions followed relatively quickly by large increases) was a poor outcome for members.”

“The trends and practices which APRA has observed recently appear similar to those seen in 2012-2016, and have similarly been accompanied by a deterioration in group life insurance claims experience and significant impact on life insurer profitability.

“APRA is concerned that, should these trends continue, members are likely to be adversely impacted through further substantial increases in insurance premiums and/or a reduction in the value and quality of life insurance in superannuation. Indeed, the ongoing viability and availability of life insurance through superannuation may be at risk, adversely impacting access to life insurance cover for a large part of the Australian community.”

Dealing with premium volatility, the letter said that the deterioration in life insurance claims experience within superannuation, and consequent unprecedented losses for insurers, recent APRA data illustrates that insurance premiums per insured member have been escalating during 2020.

“APRA has also observed that material premium increases by insurers have contributed to RSE [registrable superannuation entities] licensees tendering insurance arrangements more frequently.

Continued on page 10

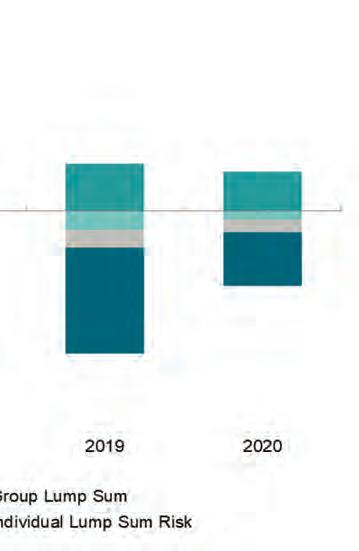

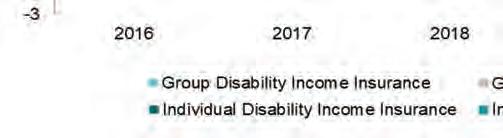

Table 1: Risk products net profi t after tax ($ million)

Individual lump sum Individual disability income insurance Group lump sum Group disability income insurance Total Year to 31 Dec 2019 Year to 31 Dec 2020 Dec Quarter 2020

653.3 543.7

73.0 -1,472.8 -739.9 -97.5 -240.6 -173.5 -7.8 -270.9 -122.5 -108.0 -1,331.0 -492.3 -140.3

Chart 1: Net profi t after tax (risk products)

Continued from page 9

APRA is concerned that, in some cases, the pricing on which tenders are being won by insurers, whilst initially attractive to RSE licensees, may prove to be unsustainable, and therefore likely to lead to significant increases in premiums at the end of premium guarantee or contractual periods.”

“Such price volatility was observed in 2012-2016, following the losses in the group insurance market at that time. Ultimately, members are not best served by such unpredictability and volatility in insurance premiums, with members paying more in future for insurance as a result of unsustainable prices being offered to win tenders in a prior period. This volatility makes it more difficult for members to assess insurance costs and the value of the insurance.”

Hardly surprisingly, APRA ended on the note that it expected life insurers and superannuation funds to “take steps to ensure that insurance offerings and benefits are sustainably designed and priced, provide appropriate value for members, and adequately reflect the underlying risk and expected experience”.

Deloitte superannuation partner, Russell Mason said that there was no question that insurance inside superannuation had gone through a problematic period but he continued to believe that group life insurance represented one of the key benefits which could be delivered by superannuation funds.

He said he was therefore concerned when he heard suggestions from some quarters that insurance inside superannuation should be entirely opt-in.

“If that were to happen then I believe that tens of thousands of superannuation fund members could find themselves at substantial financial risk,” he said.

The implications of making group insurance opt-in for superannuation fund members has also not been lost on specialist actuarial consultancy, Rice Warner, which earlier this year published an analysis noting that the Australian Securities and Investments Commission (ASIC) had estimated that almost 10 million superannuation accounts currently had insurance attached, of which 86% had insurance on default settings.

It was in these circumstances that Rice Warner was exhorting superannuation funds to become more familiar with insurance data.

“The introduction of PYS and PMIF legislation has for many members changed their insurance status and introduced new complex rules for switching cover on and off. This has heightened the risk and prevalence of administrative errors which are notoriously difficult to successfully unwind.”

SOURCE: APRA

STAPLING – another bandage for superannuation

BY HELENA MCGEORGE AND JENNA MOLLROSS

The superannuation fund stapling arrangements contained in Government legislation have laudable objectives but they also come with inherent pitfalls.

TThe Your Future, Your Super package announced in October 2020 as part of the Government’s 2020-21 Budget is designed to “make your super work harder for you”. Following the findings and recommendations of the recent Productivity and Royal Commissions, these reforms are aimed at improving retirement outcomes achieved for all Australians. The Government undertook consultation in relation proposed legislation, with the bill introduced into Parliament for a first reading on 17 February, 2021. An issue that this package tries to tackle is the unintended creation of multiple superannuation accounts, a common consequence of people changing jobs and not electing to have future superannuation contributions paid into an existing account. This can see a person paying duplicate fees and insurance premiums on multiple accounts, eroding their savings that have been accumulated over time. To prevent Australians from facing a proliferation of unintended superannuation accounts, from 1 July, 2021, a person’s existing superannuation account will follow them from job to job (referred to as ‘stapling’), unless they opt to select another fund. The Government estimates that stopping the creation of unintended multiple accounts will boost balances in super by about $2.8 billion over the next decade. While good in principle, there are a number of potential pitfalls that should be considered to ensure this reform achieves the outcomes intended.

Implications for the appropriateness of default insurance cover

A key component of Australia’s superannuation system is the life insurance cover available to members. Funds aim to develop an insurance strategy and design that is appropriate for its membership, taking into account key risk factors such as age and nature of employment. A member’s occupation will likely determine their eligibility for cover, the definitions of illness/disablement that apply and the premiums payable.

Funds aligned to industries and employers with more risky occupations tend to have a default insurance design that better caters for this. In the presence of ‘stapling’, it will be important that a member’s default insurance cover is adjusted appropriately as they shift into and out of riskier occupations.

Implicit advantage for funds aligned to the younger workforce

Funds aligned to industries that typically employ young people, such as retail and hospitality, will likely disproportionately benefit from ‘stapling’ superannuation accounts to individuals across their lifetimes. With low engagement rates in superannuation, both at younger ages and in general, some funds will have a better opportunity to set up superannuation accounts for new workers at the start of their careers. This could drive complacency among those funds that benefit, while others face the risk of an increasingly ageing membership and its associated challenges.

Further, of the handful of funds that are likely to benefit the most from the stapling measures, the majority offer members a single strategy MySuper product as opposed to a lifecycle or glidepath strategy. For a disengaged member, which the ‘stapled’ member may well be, this is disadvantageous as their risk exposure will not adjust with age, having implications for their retirement outcomes.

Risk that Australians are ‘stapled’ to underperforming funds

“The root cause for the majority of the underperforming may create challenges for employers in setting up comprehensive superannuation plans for their staff in the future and see a potential The Your Future, Your Super package and eroded dilution in the specific needs of employee groups introduces measures to hold funds to account for underperformance. However, the new annual performance test will look at historical superannuation balances remains being addressed. A number of the legislative changes to superannuation over the past few years have net investment returns achieved over the the lack of member been focussed on protecting member balances; previous financial year and see members of underperforming funds notified by the following 1 October. ‘Stapling’ superannuation accounts engagement in superannuation.” whether through the Productivity and Royal Commissions or the Protecting Your Super changes. Stapling is the latest of these. In to individuals may see employers make theory, it should protect balances at the contributions into funds that are inception of an individual’s superannuation underperforming when compared to the net investment returns of the journey. default fund offered to employees. However, stapling is not without its pitfalls, as has been noted in Ability for employers to set up a competitive staff superannuation plan this article. The root cause for the majority of the underperforming and eroded superannuation balances remains the lack of member engagement in superannuation. Increasing an individual’s engagement Under Australia’s compulsory superannuation system, employers are with their superannuation, supplemented by education to help them required to have a ‘default’ fund that they can pay compulsory make an informed choice, should still be a key focus of each contributions into if an employee does not choose their own fund. For superannuation fund’s strategic initiatives to ensure that it operates in larger employers, it is common to establish a superannuation plan its members’ best financial interests. through its default superannuation fund to cater for the specific nature Although sound in rationale, regard must be given to the unintended and needs of its employees. An employer can then work with its chosen consequences of the legislation. Ultimately, these highlight the fund to cater for the needs of its staff through initiatives such as important of increasing individuals’ engagement with superannuation financial wellness seminars or advice services. to ensure they are getting the best financial outcomes.

However, funds may now view employers that do not employ a significant number of young people as less attractive, as ‘stapling’ will Helena McGeorge is senior consultant and Jenna Mollross is senior likely mean less new members are gained by default at older ages. This manager at Deloitte.