5 minute read

Never Fear the Balance Bill

Never Fear the Balance Bill THE KEYS TO A SUCCESSFUL REFERENCE BASED PRICING MODEL

By Megan Freedman

Advertisement

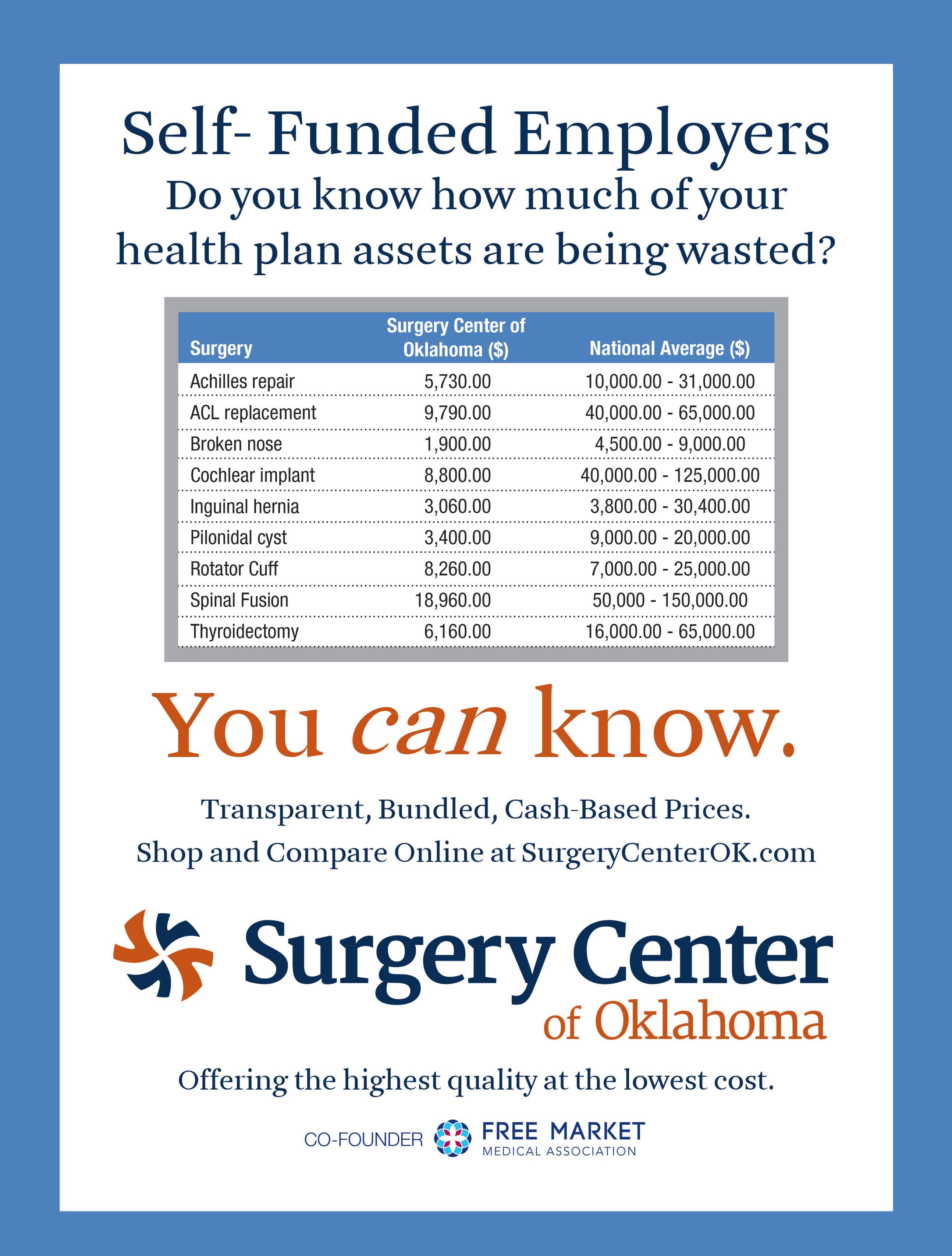

Many self-funded employers in the U.S. are intrigued by the idea of the free market movement but have not attempted to implement any direct contracts with free market friendly physicians and surgery centers. There are many reasons for this hesitation, including the belief that a carrier is the only viable TPA option, or that network discounts will save them money.

However, many employers believe that the only way to be able to direct contract is to not have a network at all. Often, these employers are uncomfortable with the idea of their employees facing possible balance billing. Rental networks that will allow an employer to direct contract do exist, but they may not be available in the employer’s area or are not the solution the employer desires. Luckily, there are new out-of-the box solutions and vendors that can help ease this transition non-traditional reimbursement strategies work effectively, while reducing balance billing concerns.

Reference Based Pricing (RBP) is not new. In fact, references are used to determine the reasonableness of a charge by many plans. Reference prices can include things like a purchased reasonable and customary list, Medicare, an online retailer price, and other resources such as the FMMA ShopHealth Marketplace.

Combining a Medicare Plus reference based pricing strategy with an enhanced free market benefit tier is an innovative approach that has not yet gained widespread recognition. This strategy effectively combines the best of both worlds, offering true plan savings, and cost containment, while having an “easy button” for participants (which is also the best deal and quality!).

Keys to a Successful RBP Centered Plan Design

There are specific strategies that will bolster the success of any benefit design that incorporates RBP. It is important to keep in mind that having this type of plan design is not a “set it and forget it” strategy.

The keys to a successful RBP + Free Market benefit plan are:

Incenting utilization of free market providers at an enhanced benefit tier.

A 100% benefit tier is an incentive that patients are reluctant to pass up. Utilization of this benefit tier eliminates ALL possibility of balance billing. This is the “easy button” for participants and is also the best value in terms of cost and quality.

Accuracy in Payment.

Using the most recent Medicare fee schedule reduces the chances of balance billing. One important question to ask a potential RBP repricing vendor is how frequently their Medicare fee schedules are updated.

Participant Education.

Educating participants on their benefits and offering them talking points to discuss costs with their physician helps them feel in control of where they seek care.

It is important to combine guidance about how their benefits work with education about self-funding. High claims also impact the participants in terms of salaries, raises, premium contributions, bonus potential, etc.

Provider Education.

Reaching out to providers in the local community to discuss fair and reasonable reimbursements opens the door to a cooperative relationship. Skipping this step can often lead to an antagonistic view of the plan by providers. Some may be opposed to any reimbursement that is not tied to a percentage off billed charges but being able to share this knowledge prior to a claim occurring allows the employer and their participants to take appropriate steps.

Patient Advocacy.

When a balance bill does happen, having a robust patient advocacy program in place significantly reduces these bills and can lead to direct contracting options.

Networks Don’t Protect from ALL Balance Bills...

Another important fact to keep in mind, is that the providers who are most likely to balance bill participants are rarely contracted with any network.

The services that are the most likely to generate a balance bill include air ambulance services, emergency room physician charges, and anesthesia. Outrage over “Surprise Bills” tied to these services has led to legislative efforts in many states to make balance billing illegal, even becoming a topic of discussion in Congress.

$50,000.00 AIR AMBULANCE

$40,000.00

$48,410.00

$30,000.00

$20,000.00

$10,000.00

$10,673.78 $8,894.82

$0.00 TOTAL BILLED PLAN LIMIT 120% OF MEDICARE MEDICARE ALLOWED AVERAGE BILLED CHARGE FOR OUT-OF-NETWORK AIR AMBULANCE VERSUS MEDICARE AVERAGE PAYMENT

The True Impact of Balance Billing

The anxiety around employees being terrorized by overzealous provider collections for every single medical service they get has been overstated. Outside of the specific services listed above, and a few other less common services, balance billing is not that common when the reimbursement is reasonable.

When a reasonable RBP reimbursement is offered, such as an amount over the provider’s current Medicare rate, the actual number of balance bills is quite low. FMMA member Payer Compass, a reimbursement technology company, shows a balance bill rate of less than ►

12 NEVER FEAR THE BALANCE BILL ■ M EG A N F R E E D M A N 1% of processed claims.

FMMA members are seeing similar results. A member TPA, The Kempton Group, reports a balance bill rate of 0.378% for 2019, with less than 10 providers refusing to negotiate below billed charges. A 6,000 life self-funded plan reports similar results with a balance bill rate of 0.74%, with only 2 providers refusing to negotiate further.

In both examples, the average payment accepted was 165% of the provider’s Medicare reimbursement. As a comparison, network contracted rates for hospital systems typically range from 200% - 2,000% percent above the Medicare reimbursement. An additional benefit to consider when making the decision to move to an RBP reimbursement model is participant motivation.

Empowering participants to make choices based on the aspects that are most important to them is a strong motivator. Removing in-network restrictions, which often rewards participants for choosing a lesser value provider, encourages more in-depth education about cost and quality. LEARN MORE: If the idea of implementing this kind of program seems overwhelming, or you have specific questions on how it can work, there are FMMA members who can help. A program created from a collaborative partnership between Payer Compass and The Phia Group, combines RBP reimbursement technology with participant education, advocacy, and legal support. Either of these members would be more than happy to talk to you about adding an RBP solution to your plan. $2,500.000 $2,000,000 $1,500,000 $1,000,000 $500,000

$0.00 140 LIFE SELF-FUNDED EMPLOYER $2,127,258 $1,018,709 $1,213,117 PPO ALLOWED AMOUNT PPO ALLOWED % OF MEDICARE MEDICARE PLUS AVERAGE ACCEPTED MEDICARE PLUS SAVINGS EXAMPLE