38 minute read

Retirement

54

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

As can be seen from Table 1, there is a cash flow deficit of $17,721. While Virushka has $50,000 in her bank account, the deficit can be withdrawn from there. While the $50,000 in the bank account may be sufficient to cover the cash flow deficit for about two-and-a-half years, seeing a depleting bank account balance and having no other liquid assets presents a point of worry for Virushka.

There would need to be some consideration around how to pay for ongoing aged care fees should Virushka live for longer than twoand-a-half years. Some of the options for clients who have a significant cash flow deficit and a relatively low amount of liquid assets may include the Pensions Loans Scheme to unlock further cash flow by borrowing against the family home, financial support from family, keeping and renting or selling the home.

Renting out the former home—social security and aged care assessment

Irrespective of whether the former home is rented out, it is exempt under the social security assets test for two years starting from when Virushka moved into aged care. During this period, Virushka is assessed as a homeowner. After the two-year period, the net value of the family home is assessed as an asset and she is deemed to be a non-homeowner.

In Virushka’s case, the family home is neither resided in by a spouse nor a protected person. This means that for two years upon leaving the family home to move into aged care, from a social security perspective, the home is exempt under the assets test and she is assessed as a homeowner.

From an aged care perspective, as the family home is not resided in by a protected person, the home is assessed as an asset but capped (currently $171,535).

Table 2. Assets test assessment of the former home

Aged care assessment

Resided in by a spouse Exempt

Social security assessment

Exempt

Resided in by a protected person* such as an eligible carer or a close relative** other than a spouse

Exempt Exempt for two years from when the aged care resident (for couples, the second spouse) moved out of the former home.

Resided in by a nonprotected person

Vacant

Sold

Assessed but capped (currently $171,535) During the two-year period, the person is assessed as a homeowner. After the two-year period, the net value of the former home is assessed as an asset and the person is assessed as a non-homeowner.

Proceeds assessed immediately depending on where they are invested. For a couple where one spouse remains in the former home, sale proceeds intended to purchase new home could be exempt under assets test for a period of up to 12 months or extended up to 24 months upon meeting certain criteria.

Source: Challenger * A protected person is a: • spouse • carer who has lived in the home for at least the last two years and is receiving or eligible to receive an income support payment • close relative who has lived in the home for at least the last five years and is receiving or eligible to receive an income support payment, or • dependent child aged under 16 or a full-time student aged under 25. ** A close relative is defined as a parent, sibling, child or grandchild. Income test If the former home is rented out, the assessable income is the same from a social security and aged care perspective. However, the actual amount of assessed income depends on whether the client lodges a tax return.

Where the client lodges a tax return, usually the rental income is reduced by expenses incurred in deriving the income. Typically, expenses such as real estate agent fees, water and council rates, interest on borrowings and repair costs are allowable deductions. However, the following tax deductions are non-allowable from a social security and aged care perspective: • Capital depreciation • Special building write-off • Construction costs.

Where the client does not lodge a tax return, or has yet to lodge a tax return, one-third of the rental income is deemed to be an allowable deduction against the rental income. If the client has a loan on the property and the loan was taken out in relation to purchasing the property, interest expense is allowed as a further deduction from the two-thirds assessable amount.

If we assume a 3% net rental yield so that Virushka generates $30,000 p.a. from renting out the family home valued at $1 million, her cash flow comparison is shown in Table 3.

Table 3. Cash flow comparison upon renting out the family home

Home not rented Home rented

Cash flow

Age Pension Rental income

Investment income

Incidental expenses

Total

Aged care fees

Basic daily fee DAP

Means-tested care fee

Total

Tax

Net cash flow

Source: Challenger $24,552

$500 ($2,600)

$22,452

$19,071 $20,500 $602

Nil

Nil

(17,721)

$11,803 $30,000 $500 ($2,600)

$39,703

$19,071 $20,500 $6,993

$2,511

$2,511

($9,372)

What is apparent from Table 3 is that despite receiving net rent of $30,000 p.a., her net cash flow deficit has only reduced by $8,349. The remaining $21,651 has been consumed by reduced Age Pension ($12,749), increased means-tested care fee ($6,391) because of the rental income being assessed and increased tax liability of $2,511, resulting in a net cash flow gain of $8,349 compared to not renting out the family home.

When the family home is rented out, it may not mean that the entire rental income is retained to fund ongoing aged care fees—there may be a reduced Age Pension, increased means-tested care fee and increased tax liability.

We have not yet discussed a further leakage from the rental income—which is land tax. We will come to this point later in the paper.

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

Retirement

55

One dynamic we can gauge here is that when a person is incometest-sensitive prior to renting out the family home, each dollar of rental income will reduce the Age Pension by 50% and increase the means-tested care fee by 25%.

To test out this rule of thumb, let us assume that Virushka is receiving $5,000 p.a. of income from an overseas government pension. As $4,628 p.a. is the income-free area for a single Age Pension recipient, along with deeming on the $50,000 bank account balance and the $5,000 p.a. overseas pension, Virushka finds herself income-test-sensitive.

Upon receiving $30,000 p.a. rental income, her cash flow comparison in this circumstance is shown in Table 4.

As evident from Table 4, the Age Pension reduced by $15,000 ($24,303 – $9,303) and means-tested care fee increased by $7,519 ($8,245 – $726)—reduced Age Pension representing 50% of the rental income, and increased means-tested care fee representing 25% of the rental income.

It is more challenging to build a similar rule of thumb for clients who are either full Age Pension recipients or assets-test-sensitive prior to renting out the family home and who become income-testsensitive after renting out the home.

Table 4. Income-test-sensitive pre- and post-renting and cash flow comparison

Home not rented Home rented

Cash flow

Age Pension Rental income $24,303

Overseas government pension $5,000 Investment income $500

Incidental expenses ($2,600)

Total $27,203

Aged care fees

Basic daily fee DAP

Means-tested care fee

Total

$19,071 $20,500 $726

$40,297

Tax Nil

Net cash flow

Source: Challenger

($13,094)

$9,303 $30,000 $5,000 $500 ($2,600)

$42,203

$19,071 $20,500 $8,245

$47,816

$1,537

($7,150)

Renting out the former home—personal income tax and capital gains tax implications

Personal income tax As seen from Tables 3 and 4, upon renting out the former home, Virushka had a tax liability. Net rental income would usually form part of taxable income and as her overall income exceeded the tax-free threshold, taking into account applicable tax offsets, this resulted in a tax liability. It is interesting that many aged care residents, upon renting out the former home, find that they have to lodge a tax return and become taxpayers after many years of not paying tax.

Eligible seniors over Age Pension age are usually eligible for a higher tax-free threshold than the ordinary $18,200 tax-free threshold. Due to the legislated personal income tax cuts and increased low-income tax-offset from 1 July 2020, there is some uncertainty around the specific amount of the higher tax-free threshold from 2020/21 onwards. In time, the Australian Taxation Office is expected to provide guidance on the higher tax-free threshold for seniors.

Table 5 shows the higher tax-free threshold in 2019/20.

Table 5. Higher tax-free threshold for eligible seniors in 2019/20

Relationship status Tax-free threshold when eligible for full senior Australian and pensioners tax offset

Single

Couple (each) $32,279

$28,974

Couple separated by illness (each) $31,279

Source: Challenger

Capital gains tax While the main residence exemption has many nuances, two common questions which often arise are whether renting out the former home interferes with the capital gains tax (CGT) main residence exemption and whether there are any adverse issues for the estate or final beneficiaries.

Broadly, where the property is rented out, CGT rules allow an individual to be absent from the property for a period of up to six years and still benefit from the CGT main residence exemption. Despite the property being rented, if Virushka was to sell the property within six years of moving into aged care, she would usually be eligible for the CGT main residence exemption in full.

Another related question is what would happen if rather than Virushka selling the family home during her lifetime, it is disposed of by her estate or by a beneficiary who inherits the property? Generally, as long as the family home was considered to be a main residence of the deceased (that is, within the six-year absence period), the estate or beneficiary usually has two years to settle from date of death to benefit from the CGT main residence exemption in full.

56

Retirement

CPD Questions

Earn CPD hours by completing this quiz via FS Aspire CPD

1. For what period is a person’s former home exempt under the social security assets test when they move into aged care?

a) Two years b) One year c) Four years d) Three years

2. When a person is income-test-sensitive prior to renting out the family home, each rental income dollar will:

a) Reduce the Age Pension 30% and increase the meanstested care fee 20% b) Reduce the Age Pension 25% and increase the meanstested care fee 50% c) Reduce the Age Pension 50% and increase the meanstested care fee 25% d) Reduce the Age Pension 20% and increase the meanstested care fee 30%

3. In terms of the CGT main residence exemption eligibility and renting out their former home, the owner:

a) Forfeits all the exemption if they sell the property within four years of moving into aged care b) Can be absent from the property for up to seven years and still benefit c) Forfeits all the exemption if they sell the property within three years of moving into aged care d) Can be absent from the property for up to six years and still benefit

4. Land tax and renting out the former home in an aged care context:

a) Is subject to relevant state and territory law b) Is subject to a possible exemption if rental income merely covers regular outgoings c) May be payable, depending on the value of the land d) All of the above

5. Which of the following tax deductions are allowable from an aged care and social security perspective?

a) Capital depreciation b) Special building write-off c) Construction costs d) None of the above

6. If a former home is rented out, assessed income depends on whether the client lodges a tax return.

a) True b) False

Visit www.financialstandard.com.au and click ‘FS Aspire CPD’ in the menu or call 1300 884 434 to gain access to the platform.

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

Note: the CGT main residence exemption may apply differently where: • the family home is rented out for more than six years during the lifetime of the aged care resident • the family home is retained for more than two years post-death of the aged care resident, or • the beneficiary who inherits the family home through the estate is a non-tax resident.

Renting out the former home—land tax As discussed earlier, another consideration when considering renting out the former home are potential land tax implications. Land tax has specific jurisdiction-based rules depending on the relevant state or territory. As such, advice should be sought from the relevant government agency administering land tax (such as the State Revenue Office) or an appropriate professional.

Broadly, unless an exemption applies, land tax in the aged care context, may be payable if the owner of the property is no longer living in the property and the property is rented out for more than half of the year and where the value of the land exceeds the prescribed land tax threshold.

Some jurisdictions may have an exemption for aged care residents where the rental income from the former home is no more than is required to pay the cost of regular outgoings such as council, water and energy rates, and maintenance costs of the owner of the property.

Going back to Virushka’s situation, to highlight the land tax issues, had the property been situated either in New South Wales, Victoria or Queensland, using the respective calculators available on the relevant government’s website, the land tax liability based on the value of the land is shown in Table 6.

If we go back to Table 3, renting out the family home for $30,000 p.a. without considering any land tax issues, provided a net cash flow boost of $8,349 compared with not renting—the remaining $21,651 had been consumed by reduced Age Pension, increased means-tested care fee and increased tax liability.

Accounting for land tax liability, depending on the value of the land, would introduce another leakage from the rental income so that the net cash flow boost may be lower. fs

Table 6. Land tax liability depending on land value and specific location

Value of land only Land tax liability in New South Wales

$500,000 Nil

$600,000 Nil

$700,000 Nil

$800,000 $1,156

Land tax liability in Victoria

$775

$975

$1,475

$1,975

Land tax liability in Queensland

Nil

$500

$1,500

$2,500

Source: Challenger

The information in this update is current as at December 2020 unless otherwise specified and is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670, the issuer of the Challenger annuities. The information in this update is general information only about our financial products. It is not intended to constitute financial product advice.

Responsible investmentwww.fsadvice.com.au Volume 16 Issue 01 I 2021

Superannuation:

58 Employees with multiple employers

By Terri Bradford, Morgans Financial Limited

57

58

Superannuation

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

CPD

Earn CPD hours by completing the assessment quiz for this article via FS Aspire CPD.

Worth a read because:

People with multiple employers could breach their concessional contributions cap if they exceed the maximum contribution base. However, they can apply to opt out of the Superannuation Guarantee (SG) for wages from certain employers. This also prevents an employer SG shortfall.

Visit www.financialstandard.com.au and click ‘FS Aspire CPD’ in the menu or call 1300 884 434 to gain access to the platform.

Employees with multiple employers

Terri Bradford

L

egislation has passed allowing employees with multiple employers to opt out of receiving Superannuation Guarantee (SG) payments to avoid unintentionally breaching their concessional contributions cap. This paper examines how to avoid exceeding your annual concessional contributions cap.

Summary of the new rules

The SG rules were established to ensure employees receive a minimum level of superannuation contributions in respect of their employment. Where an employer fails in their obligations to pay the SG, that employer will incur SG interest charges.

The SG rules include a ‘maximum contribution base’ beyond which an employer no longer needs to make superannuation contributions for an employee to avoid liability for the SG charge.

This operates as a ceiling, limiting the amount of superannuation support an employer is obliged to provide for an employee for a quarter. This means salary or wages that exceed the maximum contribution base can be excluded from the calculation of SG contributions.

The problem is that the maximum contribution base for an employee applies to each employer. If an employee has multiple employers, each employer must make superannuation contributions on the earnings they pay to the employee up to the maximum contribution base in order to avoid incurring an SG liability. This occurs even where the employee earns less than the maximum contribution base for each of their employers, but their income in total exceeds the maximum contribution base.

Accordingly, individuals with multiple employers may inadvertently exceed their annual concessional contributions cap. Where an individual’s total concessional contributions (including those made by their employer) exceed their annual concessional contributions cap (currently $25,000), the excess is their ‘excess concessional contributions’ for the financial year.

An individual’s excess concessional contributions are included in their assessable income for the year and taxed at marginal rates less a 15% tax offset (representing the tax paid in the superannuation fund). The individual is also subject to an interest charge, based on the shortfall interest rate to cover the resultant late payment of tax.

The amended rules will now allow the individual to nominate to opt out of the SG system in respect of their wages from certain employers. The opt-out means that eligible individuals can avoid breaching their annual concessional contributions cap as a result of multiple employers making contributions into superannuation on their behalf.

The amendments provide a framework for individuals to apply to the Commissioner of Taxation (Commissioner) for an employer shortfall exemption certificate, which prevents their employer from having a SG shortfall if they do not make superannuation contributions for a period.

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

Superannuation

59

Where the Australian Taxation Office (ATO) issues a shortfall exemption certificate to an employer, the employer’s maximum contribution base for that employee becomes nil for that relevant quarter. The Explanatory Memorandum to the Treasury Laws Amendment (2018 Superannuation Measures No.1) Bill 2019 [now the Treasury Laws Amendment (2018 Superannuation Measures No.1) Act 2019] explains that the employer shortfall exemption certificate does not prevent an employer from making contributions into superannuation on behalf of the employee. Rather, the effect of the certificate is only to remove the consequences of failing to make any contributions for the quarter covered by the certificate.

This means an employer may choose to disregard a certificate and continue to make contributions if, for example, where an employee and employer do not reach agreement on the terms of an alternative remuneration package for the relevant quarter, or if there has not been enough time for an employer to adjust payroll or other business software to discontinue contributions for the employee. Conditions

The ATO may issue an employer shortfall exemption certificate in relation to an individual who has made an application to the ATO (using the approved form) and their employer for a quarter if all of the following conditions are satisfied: • The person is likely to exceed their concessional contributions cap for the financial year that includes the relevant quarter if an exemption certificate is not issued. • The Commissioner is satisfied after issuing the certificate, the employee will have at least one employer that would either have an individual SG shortfall in relation to the employee, and • The Commissioner considers that it is appropriate to issue the certificate in the circumstances.

The Commissioner can only issue an employer shortfall exemption certificate at the request of the person who is the employee to be covered by the certificate.

The Commissioner cannot issue an employer shortfall exemption certificate at the request of the individual’s employer or on the Commissioner’s own initiative.

Evidence is not required to prove “foregone contributions have been substituted for higher wages”. This is on the basis that employees with higher incomes (that is,

Terri Bradford, Morgans Financial Limited

Terri Bradford is Morgans’ director of wealth management. She has worked in the stockbroking and financial planning industry since 1995 and is responsible for the development and distribution of wealth management resources to the Morgans’ network, and ensuring advisers (and their clients) understand the latest rules and regulations applying to all areas of wealth management, including self-managed superannuation. Terri is an SMSF Association Specialist SMSF Adviser and an Associate member of the FPA.

60

Superannuation

CPD Questions

Earn CPD hours by completing this quiz via FS Aspire CPD

1. In the case of an employee with multiple employers, the employee’s maximum contribution base applies:

a) To each employer b) To only one employer c) To none of the employers d) At the Commissioner’s discretion

2. Where the ATO issues a shortfall exemption certificate to an employer in relation to a particular employee:

a) It must be satisfied the employee will have at least two employers with an SG shortfall b) The employer’s maximum contribution base is halved for the relevant quarter c) The employer cannot disregard the certificate and still make contributions d) The employer’s maximum contribution base is nil for the relevant quarter

3. The ATO can only issue an employer shortfall exemption certificate if:

a) Requested by the employee’s employer b) Requested by the employee to be covered c) The Commissioner does so on their own initiative d) Evidence is provided to prove “foregone contributions”

4. The purpose of an employer shortfall exemption certificate is to:

a) Remove the consequences of not contributing for the relevant quarter b) Remove the consequences of not contributing for the relevant financial year c) Prevent an employer contributing on behalf of an employee d) None of the above

5. The amended rules will allow employees to opt out of the

SG system for wages from certain employers.

a) True b) False

6. Only one certificate is issued to a single employee, to cover all their employers

a) True b) False

Visit www.financialstandard.com.au and click ‘FS Aspire CPD’ in the menu or call 1300 884 434 to gain access to the platform.

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

those who are likely to breach their concessional contributions cap through employer contributions) are likely to be in a strong bargaining position with their employers and have voluntarily opted out of SG payments.

The employee must still be receiving contributions from at least one employer Multiple certificates may be issued in relation to a single employee, with each certificate covering a different employer. However, at least one employer must still be required to make contributions for the benefit of the employee. This ensures that an employee will still receive a minimum level of contributions for the financial year.

An application for an exemption certificate may be refused It may be appropriate for the Commissioner to deny an application for an employer shortfall exemption certificate where a person has applied for a certificate that would reduce their contributions by a substantially larger amount than is necessary, relative to another possible certificate or where the Commissioner has already issued a certificate for another quarter in the same financial year.

The Commissioner would also have regard to any circumstances in which an individual has engaged in behaviour that artificially enables them to apply for a certificate.

It should be noted that applications cannot be made for prospective employers.

Once accepted, the Commissioner will issue a notice in writing both to the employee who made the application, and to the employer covered by the certificate. If the application is refused, the Commissioner will notify the employee but not the employer.

The due date for lodging an application is 60 days before the first day of the quarter to which the application relates. fs

Morgans is Australia’s largest national full-service stockbroking and wealth management network. It offers clients all the services and products they need to achieve their investment goals. Its services cover all aspects of financial advice, including financial planning and wealth management; with the goal of building wealth and creating financial security for clients

Responsible investmentwww.fsadvice.com.au Volume 16 Issue 01 I 2021

Investment:

62 Core portfolio allocations By Peter Harper, BetaShares

61

62

Investment

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

CPD

Earn CPD hours by completing the assessment quiz for this article via FS Aspire CPD.

Worth a read because:

Core portfolio exposures should match asset allocation objectives, show compelling value, and be robust in all market cycles. This paper explains the essential elements of core portfolio exposures and how ETFs can help counter a low-return fixed income environment.

Visit www.financialstandard.com.au and click ‘FS Aspire CPD’ in the menu or call 1300 884 434 to gain access to the platform.

Core portfolio allocations

The three most important things

Peter Harper

Core exposures form the foundation of an investor’s portfolio. Key attributes of these exposures are longevity, value and the ability to meet asset allocation objectives. Exchangetraded funds (ETFs) are compelling investment vehicles for core exposures, making it simple for advisers to construct a liquid, transparent and cost-effective foundation for client portfolios.

A critical decision for advisers is the choice of core exposures, which serve as the long-term foundation of client portfolios.

Three essential characteristics of core exposures are that they should: • be able to be held long-term, through all market cycles • meet asset class objectives while enhancing overall portfolio outcomes • demonstrate compelling value, net of fees.

ETFs are well suited for a portfolio’s core exposures, as their liquidity, transparency and cost-effectiveness make it simple for advisers to construct the foundation of client portfolios.

As the foundation of a portfolio, the aim should generally be to hold core exposures for the long term. Reducing turnover helps to minimise transaction costs, and also reduces the number of capital gains tax events for a portfolio.

To qualify as a long-term holding, an exposure should meet the criterion of being robust through all market cycles.

This of course does not mean that an exposure should be expected to produce positive returns through all market cycles. Rather, a core exposure will ideally have some defensive characteristics, and suffer relatively smaller drawdowns in periods of equity market weakness.

Example 1. global equities There are many options available for the international equities component of a portfolio, but one investment style that arguably is particularly well suited to a long-term perspective, is ‘quality’. Quality businesses are those that demonstrate: • high return on equity—a key predictor of efficient use of capital and long-run returns according to academic literature • low debt—indicative of stability and durability through the cycle • strong cash flow generation—indicative of a company’s ability to pay its debts, reinvest in its business, and build reserves to deal with future financial challenges • stable earnings profiles—indicative of quality business models positioned to deliver through good times and bad. Quality companies with durable business models and sustainable competitive advantages are potentially better suited to weather the

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

Investment

63

economic cycle—and as we have seen during the recent COVID-19 crisis, when the ‘flight to quality’ occurs, investor focus has tended to return to current profitability rather than promises of future revenue growth.

In addition to the historical drawdowns tending to be less severe, the road to recovery has also tended to be shorter for these quality companies.

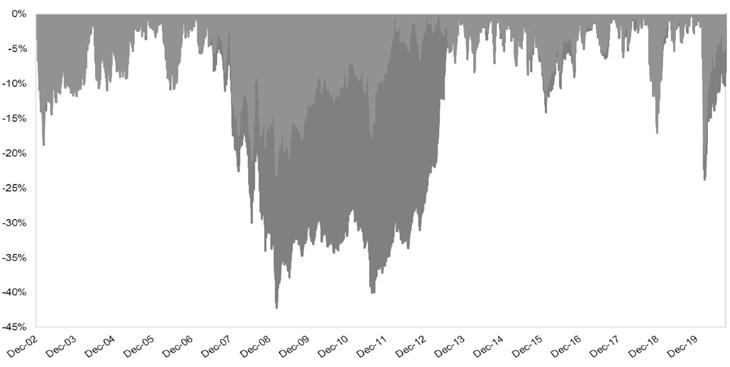

Figure 1 compares the monthly drawdown of an index of global quality shares with broad global shares from December 2002 to September 2020. The iSTOXX MUTB Global ex-Australia Quality Leaders 150 Index (Quality Index) selects quality companies, based on a combined screening and ranking of the four fundamental indicators outlined earlier.

The maximum drawdown during this period was 23.2% for the quality index compared with 42.2% for broad global shares.

Over the 10 years to 30 September 2020, the index of global quality shares returned 17.4% p.a., outperforming the MSCI World ex Australia Index by approximately 4.5% p.a. (Morningstar; past performance is not indicative of future of index or any ETF that aims to track the index).

Given the wide range of funds that provide exposure to any given asset class, it is essential to drill into the details of the various options, to determine which investments best meet clients’ overall portfolio objectives for risk profile and expected returns.

At the risk of stating the obvious, all funds under a given ‘umbrella’ are not necessarily created equal.

For instance, there are significant differences between funds that label themselves ‘ethical/responsible’, with varying standards of integrity and quality in the investment methodologies the funds employ.

Some funds apply stringent environmental, social and governance screens, with additional layers of oversight. This gives investors confidence they will be investing in an ethically screened portfolio that aligns with their values. Others may not apply such rigorous standards, with screening processes that are less strict, and a reliance on off-the-shelf indices without any additional oversight.

Another area where a closer look under the bonnet is called for is a portfolio’s core fixed income exposures.

Example 2. fixed income Many fixed income managers use the Bloomberg AusBond Composite Index (AusBond Composite Index) as a benchmark.

However, the character of this index has changed in recent years due to an increase in government bond issuance (especially short-term bonds), in response to Federal Budget deficits. This trend is likely to continue as a result of extensive COVID-19 stimulus measures.

This poses two potential problems for investors using such indices: 1. Shorter-duration government bond exposures provide little offset of equity risk and pay little (if anything) over cash returns. 2. In the not too distant future, the Bloomberg

AusBond Composite Index (‘composite’ implying it should provide

Figure 1. Drawdown analysis: Quality Index vs MSCI World ex Australia Index

Source: Morningstar Direct, BetaShares. Data as at 30 September 2020. You cannot invest directly in an index. Past performance is not an indicator of future performance of the index or any ETF that aims to track the index. Peter Harper, BetaShares

As BetaShares’cohead of distribution, Peter is responsible for leading sales strategy and execution across all client segments. He also leads the firm’s capital markets activities. Previously, Peter worked in equities and derivatives distribution roles with Macquarie Bank and ABN AMRO (now Royal bank of Scotland). He has also held roles in institutional/ corporate FX sales with ABN AMRO and fixed interest with UBS. Peter holds a Bachelor of Economics degree from the University of Sydney.

64

Investment

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

exposure to a range of Government and corporate bonds) is likely to, for all intents and purposes, resemble a pure government bond exposure, with the ‘corporate’ component becoming an everdiminishing part of the ‘composite’ picture.

This leads to the next, and arguably most significant, inefficiency within the AusBond Composite Index currently.

How well can the AusBond Composite Index defend against equity risk in a multi-asset portfolio? Reserve Bank of Australia (RBA) liquidity and yield curve control have effectively capped government bond yields in Australia out to three years at approximately 0.25% p.a., with the five-year yield not much higher, currently 0.38% p.a. (as at 29 October 2020).

With the AusBond Composite Index having an average duration of only about six years, this means that a significant proportion of the holdings of this index is earning 0.25% p.a. or less.

Putting aside the impact on income for bond holders, the real concern is that, unless the RBA is prepared to use policy to push rates deeply negative, in the event of another equity sell-off, the AusBond Composite Index would have very limited ability to diversify away equity risk in portfolios—not something many investors would have considered.

So, the inefficiency of broad fixed income benchmarks such as AusBond Composite Index is apparent, regarding: • lack of ability to provide any meaningful income above cash • diminishing ability to defend against equity losses in future sell-offs.

What are the fixed income options? What approach can advisers take in this new low-rate era to ensure fixed income exposures meets their clients’ objectives? The answer will be driven primarily by the sophistication of the portfolio: • Portfolios requiring a simple approach may look to an active

manager to address the inefficiencies of broad composite indices. • Portfolios requiring a more bespoke approach, or with more specific objectives in mind, may adopt a ‘building block’ approach.

Simple approach Many portfolios will look to active management to try to manage the inefficiencies of broad composite benchmarks. While such an approach is valid, it relies heavily on the manager’s skill to deliver desired outcomes. Selection of a suitable fund is not made easy by the fact that, according to an S&P Indices versus Active (SPIVA) analysis of fund managers, 81.4% of active fixed income funds have underperformed the AusBond Composite Index benchmark (net of fees) over the last five years to 31 December 2019 (S&P Dow Jones Indices SPIVA scorecard data; past performance is not indicative of future performance).

Building block approach Investors are increasingly building bespoke fixed income portfolios by blending ETFs targeting specific parts of the fixed income spectrum (credit, duration) together to achieve outcomes tailored to an investor’s specific needs or other specific portfolio objectives (for instance, targeting maximum offset of equity risk).

A good illustration of this would be to blend a long-duration government bond ETF, a corporate bond ETF and a floating-rate bond ETF to mimic the duration and segment profile (credit/govt etc.) of the AusBond Composite Index. Doing so can create, at similar cost to the AusBond Composite Index tracking funds, either: • a portfolio with similar yield to the AusBond Composite Index but greater equity diversification properties, or • a portfolio with similar equity diversification properties to the

AusBond Composite Index but yielding substantially more.

A building block approach can avoid holding the inefficient parts of the AusBond Composite Index, for instance, short-duration government paper that yields little more than cash and provides minimal potential for equity diversification.

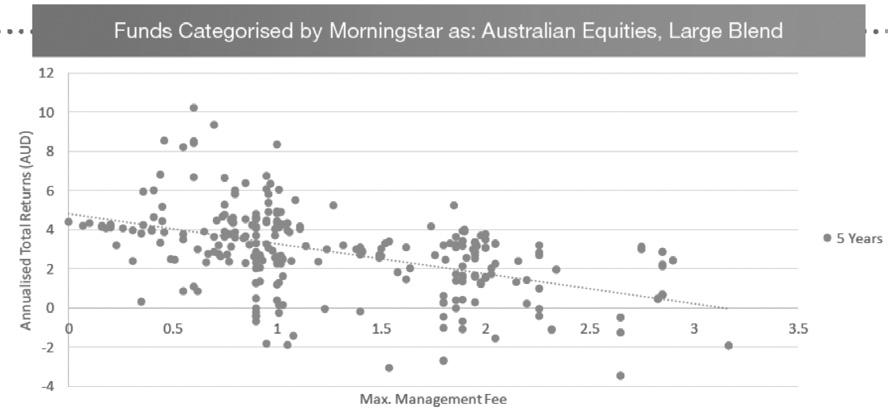

Figure 2. Relationship between management fees and investment returns

Source: Morningstar Direct, five years to 31 May 2020. Past performance is not indicative of future performance.

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

Core exposures should demonstrate compelling value, usually evidenced by strong, long-run, net-of-fee performance.

Historical data has established beyond question that fees matter, with multiple studies documenting the inverse relationship between management fees and investment returns. Figure 2 on the preceding page illustrates this relationship for Equity Australia Large Blend funds.

Additionally, blending multiple active managers of different factors/styles may run the risk of ending up with a combined allocation that looks not dissimilar to the broad passive market but at much higher fees.

These findings all reinforce the importance of selecting cost-effective investments as a portfolio’s core exposures. Money saved on fees can compound returns left in the investor’s pocket. Low-cost options are not restricted to broad market cap-weighted funds.

There is a broader selection than ever of passive, rules-based and smart beta ETFs available on the ASX from a wide range of issuers, giving advisers many choices when it comes to selecting core exposures for their clients.

Example 3. Australian equities SPIVA reports have consistently shown that the majority of active managers have underperformed their benchmark, and that active managers who have performed well typically have not reproduced that outperformance into the future. Recent reports from SPIVA [scorecard data] highlighted that: • 79% of Australian equities active funds underperformed their benchmark in the five years to 31 Dec 2019 • of top-quartile actively managed funds for the year ending

December 2015, none of the 107 Australian equities funds remained top quartile for each of the next four years, and fewer than 20% even remained in the top quartile the following year.

In addition to the chronic long-term underperformance of the average active manager, even in the March 2020 sell-off more than half the active funds underperformed the benchmark, according to the SPIVA Q1 2020 report, debunking the myth that active managers will shine in down markets.

Summary

Core exposures serve as the long-term foundation of client portfolios. To properly fulfil this function, they need to match asset allocation objectives, demonstrate compelling value, and be robust through all market cycles.

ETFs make it simple for advisers to construct a liquid, transparent and cost-effective foundation for client portfolios. fs

This information has been prepared by BetaShares Capital Ltd (ACN 139 566 868 AFS Licence 341181) for a financial adviser audience. It is general information only and does not take into account any person’s particular circumstances. Before making an investment decision regarding any financial product, investors should consider the relevant PDS and their circumstances and obtain financial advice. The PDSs for BetaShares Funds are available at www.betashares.com.au.

Investment

65

CPD Questions

Earn CPD hours by completing this quiz via FS Aspire CPD

1. The author highlights that core exposures:

a) Serve as the medium-term foundation of client portfolios b) Must be robust through a selection of market cycles c) Demonstrate compelling value, net of fees d) None of the above

2. In terms of creating bespoke fixed income ETF portfolios, the building block approach:

a) Avoids the inefficient parts of the AusBond Composite Index, but at a higher cost b) Provides the means to target specific parts of the fixed income spectrum c) Provides higher yields than the AusBond Composite Index, but with less scope for diversification d) Relies too much on the manager’s skill to deliver desired outcomes

3. According the author, broad fixed income benchmarks:

a) Show very limited ability to diversify away equity risk in portfolios b) Have diminishing ability to defend against equity losses in future sell-offs c) Lack the ability to provide any meaningful income above cash d) All of the above

4. As per data cited, active managers:

a) Underperform in down markets b) Outperform in down markets c) Perform best in the long term d) Maintain parity with their benchmark

5. According to the author, a ‘flight to quality’ usually means that investors focus on future profitability.

a) True b) False

6. Historical data has established an inverse relationship between management fees and investment returns over time.

a) True b) False

Visit www.financialstandard.com.au and click ‘FS Aspire CPD’ in the menu or call 1300 884 434 to gain access to the platform.

Finished reading?

Content from this journal is CPD accredited. Go to FS Aspire CPD and search ‘FS Advice’ to start earning CPD hours.

Available for individual and corporate subscribers Administrators can upload exams and build training plans FASEA reporting functionality Access to hundreds of hours of FPA and CPE accredited content

Content from Australian and international thought leaders Claim CPD from events

Track your progress via the live dashboard Device-friendly user interface Access to whitepapers, video, audio and event material Access to FS TechZone, your technical resource library

To request a demonstration call 1300 884 434 or visit www.financialstandard.com.au and click ‘FS Aspire CPD’

Don’t just do your CPD,

discover your professional potential

68 Quick reference

www.fsadvice.com.au

Volume 16 Issue 01 I 2021

News

AMP

ASIC Australian Financial Complaints Authority (AFCA) Australian Taxation Office

Equity Trustees Financial Adviser Standards and Ethics Authority (FASEA) Fidelity Internationa Futurity Investment Group Rest

Rice Warner Synchron TAL

Tax Practitioners Board University of Sydney Walker Lane

Westpac 11

7, 10, 13, 15

6

10

10

8

8

8

7

6

11

7

15

6

6

13 Whitepapers

Taxation & Estate Planning

Challenging a Will based on mental capacity 26

Ethics

Understanding FASEA Code of Ethics values 30

The dangers of ignoring client vulnerability 37

Applied financial planning

Borrowing from others: What is really at stake 42

Insurance

Insurance advice for business clients 46

Retirement

Implications of renting out the family home 52

Superannuation

Employees with multiple employers 58

Investment

Core portfolio allocations 62

INVESTING IN POTENTIAL. DELIVERING ON PERFORMANCE. INVESTING IN POTENTIAL. DELIVERING ON PERFORMANCE.

Franklin Global Growth Fund takes a long-term approach to building high-quality, sustainable portfolios of 35-40 global growth stocks1 for Australian investors. Franklin Global Growth Fund takes a long-term approach to building high-quality, sustainable portfolios

With a focus on high-quality companies with sustainable business models and a high ‘active’ share of 35-40 global growth stocks1 for Australian investors. investment approach, Franklin Global Growth Fund is positioned to benefit from multi-year structural With a focus on high-quality companies with sustainable business models and a high ‘active’ share growth trends in the global economy. investment approach, Franklin Global Growth Fund is positioned to benefit from multi-year structural As long-term investors with an emphasis on bottom-up stock research, we view short-term inefficiencies in growth trends in the global economy. markets as potential opportunities to purchase fundamentally sound companies that meet our strict criteria. As long-term investors with an emphasis on bottom-up stock research, we view short-term inefficiencies in markets as potential opportunities to purchase fundamentally sound companies that meet our strict criteria. Our forward-looking approach to risk management, based on limiting the economic overlap among holdings, results in a diversified and resilient portfolio of global growth stocks. Our forward-looking approach to risk management, based on limiting the economic overlap among holdings, results in a diversified and resilient portfolio of global growth stocks.

Learn more at www.franklintempleton.com.au/globalequity Learn more at www.franklintempleton.com.au/globalequity

REACH FOR BETTER™ REACH FOR BETTER™

1. Average portfolio holdings as at 30/4/20. Portfolio holdings subject to change. 1. Average portfolio holdings as at 30/4/20. Portfolio holdings subject to change. ©2020 Franklin Templeton. All rights reserved. ©2020 Franklin Templeton. All rights reserved. Franklin Templeton Investments Australia Limited (ABN 87 006 972 247) (Australian Financial Services Licence Holder No. 225328) issues this publication for information purposes only and not Franklin Templeton Investments Australia Limited (ABN 87 006 972 247) (Australian Financial Services Licence Holder No. 225328) issues this publication for information purposes only and not investment or financial product advice. It expresses no views as to the suitability of the services or other matters described herein to the individual circumstances, objectives, financial situation, or needs investment or financial product advice. It expresses no views as to the suitability of the services or other matters described herein to the individual circumstances, objectives, financial situation, or needs of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision. A Product Disclosure Statement (PDS) for any Franklin Templeton funds referred to in this document is available from Franklin Templeton at Level 19, 101 Collins Street, Melbourne, Victoria, 3000 decision. A Product Disclosure Statement (PDS) for any Franklin Templeton funds referred to in this document is available from Franklin Templeton at Level 19, 101 Collins Street, Melbourne, Victoria, 3000 or www.franklintempleton.com.au or by calling 1800 673 776. The PDS should be considered before making an investment decision. Morningstar Awards 2020 ©. Morningstar, Inc. All Rights Reserved. or www.franklintempleton.com.au or by calling 1800 673 776. The PDS should be considered before making an investment decision. Morningstar Awards 2020 ©. Morningstar, Inc. All Rights Reserved. Awarded to Franklin Global Growth Fund for Fund Manager of the Year, Global Equities, Australia. Awarded to Franklin Global Growth Fund for Fund Manager of the Year, Global Equities, Australia.

MLC Core Investment List. Now with more on the menu.

Invest in six new SMAs and the Antares Income Fund.

We recently launched the MLC Core Investment List on our Series 2 Wrap to give your clients cost-effective access to our high-quality multi-asset funds. We’ve now added six new Separately Managed Account (SMA) model portfolios and the Antares Income Fund.

Today, with over $1 billion in funds under management, advisers are using the choice and value MLC Core is offering to help them achieve their clients’ goals.

To find out more, speak to your BDM or visit mlc.com.au/adviser/core

Important information: MLC Wrap Investments Series 2 and MLC Navigator Investment Plan Series 2 are Investor Directed Portfolio Services operated by Navigator Australia Limited ABN 45 006 302 987 AFSL 236466 (NAL). MLC Wrap Super Series 2 and MLC Navigator Retirement Plan Series 2 are superannuation products issued by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) through the MLC Superannuation Fund ABN 40 022 701 955. The information is a summary only and should not be relied on for decision making and is provided solely for the use of authorised financial advisers and is not intended for distribution to investors and potential clients. You should obtain and consider the relevant Product Disclosure Statement and the Financial Services Guide before deciding whether to acquire or continue to hold the product. Relevant disclosure documents for each product are available by calling 133 652 or from www.mlc.com.au. The information is correct as at 1 January 2021 but may change in the future. A160448-0121