6 minute read

Are CBDCs a threat to Bitcoin?

By James Butterfill

Central Bank Digital Currencies (CBDCs) have garnered considerable attention in the second half of 2020. We expect that there will be an increased hype and lot of confusion in 2021 as the details on how they are structured is revealed.

Advertisement

It wasn’t long ago that some central banks had concluded that distributed ledger technology (DLT) was not at a mature enough stage for use in major central bank payment systems. Central banks around the world reawakened to the prospect of CBDCs in light of COVID-19, which has pushed society to become increasingly cashless. The increasing popularity of Bitcoin may have also have a part to play as it becomes entrenched in electronic commerce, with central banks at risk of losing the intensifying digital currency race.

The allure of greater efficiency through using a digital currency that can help significantly reduce settlement times and reduce accountancy costs has meant central banks are now stepping up a gear. According to the BIS (Bank for International Settlements), more than 80% of central banks are actively researching CBDCs. From March 2016 onwards the Bank of Canada launched Project Jasper, the Monetary Authority of Singapore began project Ubin, the Hong Kong Monetary Authority launched project LionRock and the European Central Bank (ECB) and Bank of Japan launched the joint initiative Project Stella, focussing on cross-border payments. Around 40% have now progressed from conceptual research to experiments or proof of concept and around 10% have developed pilot projects, according to the BIS. China is likely to have the most advanced project for a major economy, known as the Digital Currency Electronic Payment (DC/EP), and is being piloted in four cities.

The ECB’s recent CBDC project concluded its digital euro public consultation in January, but the details remain scant. It will decide to formally create a digital currency by mid2021. There were a high number of responses to their consultation indicating great interest in the initiative, while the ECB President Lagarde said she expects there will be a digital euro. Interestingly, the ECB reiterated the four potential reasons for issuing a CBDC, namely demand for electronic payments, a decline in cash usage, potential dominance of a private digital currency such as Bitcoin and European adoption of a CBDC issued by another central bank.

Here are what we believe are some key considerations: • CBDCs present an array of compelling merits, including the promise of near instantaneous payments and settlements, the eradication of blackmarket transactions, reductions in the costs of cash management and efficiency gains in accounting.

• They also present certain risks. Of these, privacy is perhaps the most pressing.

CBDCs could potentially be programmed to control the spending of citizens, enforce negative yields on deposits and bail-ins, as well as to monitor income and spending in a way that is far more intrusive than we are accustomed to.

• While the momentum established in 2020 has been significant, we should not expect fully functional CBDCs to emerge for some years – certainly not in the western world.

There are a plethora of questions still to be answered, including whether central banks will adopt a direct core ledger with the central bank or use an existing wallet provider utilising Distributed Ledger

Technology, how KYC (know your customer) and AML (anti-money laundering) checks will be carried out, and how to manage the risk of hollowing-out systemically important commercial banks.

CBDCs are likely to become very large and therefore a scalable wallet infrastructure will be required. This could become a big theme in 2021 as central banks look for credible wallet providers.

Finally, I feel it is important to stress that CBDCs are not a candidate to replace Bitcoin. The two are inherently different instruments, the latter being a distributed ledger, peer-

to-peer system, with a predetermined monetary policy where the supply cannot be altered, which acts as an attractive nonsovereign store of value. CBDCs, on the other hand, look as though they will be designed to mirror their respective issuer’s fiat currency.

RHETORIC AROUND GOVERNMENT BAN (UNLIKELY)

The US gold ban of the 1930s was quite unconstitutional and a deeply political move – it was an attempt to prevent bank runs with huge penalties for hoarding. Almost 100 years later, the political risks for gold remain: one entails dollar debasement pushing gold levels higher, and the other is gold being used as a governmental scapegoat for not fixing its paper-based money regime. We believe a similar argument could be made for Bitcoin.

We think Bitcoin does have risks of being banned, but that this is an unlikely outcome. It has been banned in China and India, and although this has reduced its usage, it hasn’t stopped it. In 2018 China volumes of Bitcoin represented 16% of world volumes, it now represents 4%. Bitcoin is incredibly hard to completely eradicate due to its pseudonymous features – hence why we call it a non-sovereign store of value. However, it could be effectively banned for any investor purchasing a fund within a standard regulatory regime.

On balance, governments will more likely try to compete with Bitcoin by issuing their own Central Bank Digital Currencies as an outright ban only increases the risk of it becoming as widely used as black-market money. Furthermore, banning Bitcoin will likely have far greater political consequences than it did in the 1930s as government/central bank profligacy is much more widely known than it was back then. We believe the unprecedented volume of comments protesting FinCen’s recent crypto regulation proposal, as well as the FCA’s recent ban of retail participation in crypto derivatives, are both clear indicators that citizens are increasingly unwilling to stand by in silence while poorly informed or heavy-handed regulations harm their interests. Whilst the Chinese Communist

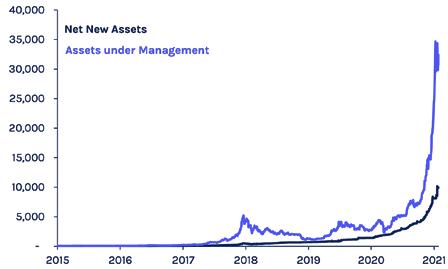

Figure 1: Digital asset ETP & mutual fund new assets

Source: Bloomberg, CoinShares, data available as of close 27 January 2021

Party may act entirely in its own selfinterest and without much fear of political repercussions, the same is not true of Western democratic governments.

DIGITAL ASSET OUTLOOK

2020 has been crucial for Bitcoin. We see it as the year of legitimisation for the broader public and investors, accelerated by the COVID-19 crisis and the consequent rapid escalation of Quantitative Easing. Our conversations with institutional clients have changed considerably over the course of last year. Whereas the interest in Bitcoin was first motivated by a desire for speculative investment opportunities, now seems to be driven by fear for the extreme loose monetary policy and negative interest rates, with clients looking for an anchor for their investments. As understanding of Bitcoin improves, clients have grasped that it has a limited supply and fulfils this role as an anchor for their assets while fiat is being debased.

Over the course of 2020, net new assets (stripping out the price appreciation effect) into digital asset investment products rose from US$ 1.35bn at the start of the year to US$ 8.0bn at the end, with only 24 days of outflows for a total of 250 trading days. Investors are buying and holding, a good indicator that it is slowly developing into a store of value. «

SUMMARY

• Central banks are concerned that they could lose the digital currency race to a private digital currency such as

Bitcoin. • CBDCs offer many attractive features that improve efficiency in settlements and payments while reducing costs. • Privacy is a key concern, which is likely to slow down their development/adoption. • CBDCs could become a systemic threat to incumbent banks. • Bitcoin and CBDCs are very different, with the former being of fixed supply while the latter are backed by fiat currencies.

This article was written by James Butterfill, Investment Strategist, CoinShares.

Disclaimer The information contained in this article is for general information only. Nothing in this article should be interpreted as constituting an offer of (or any solicitation in connection with) any investment products or services by any member of the CoinShares Group where it may be illegal to do so.