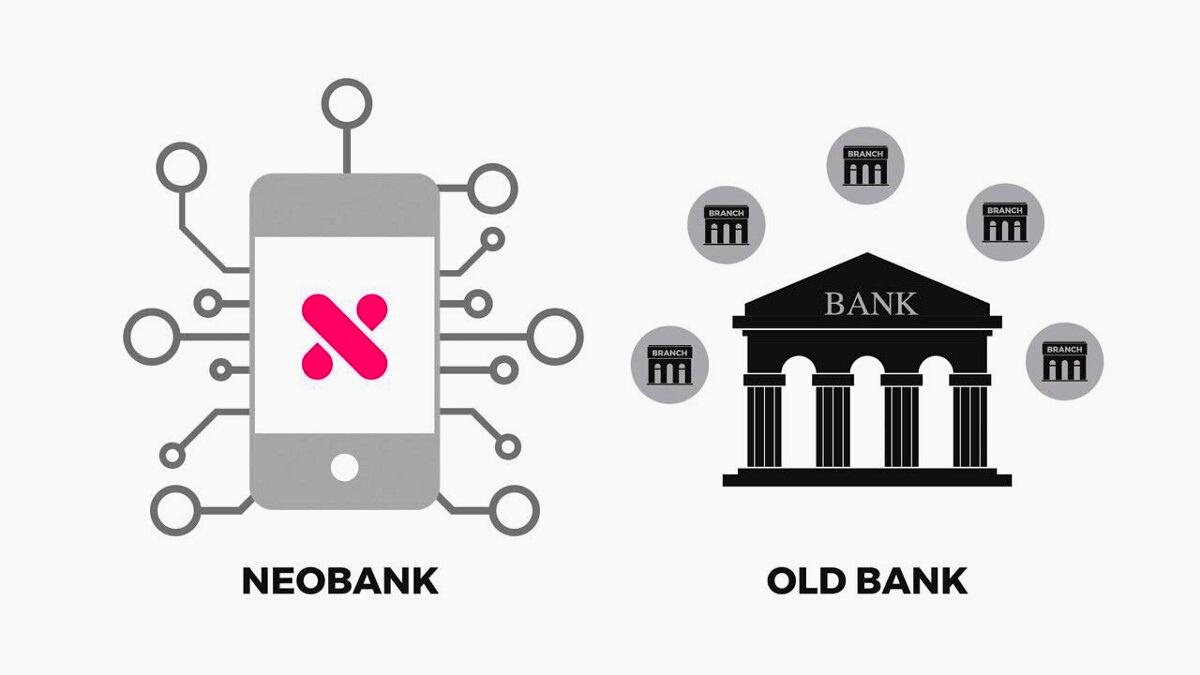

Neo banks are fin-tech companies that associate with conventional banks to offer their clients with cutting-edge banking and financial solutions. Neo banks in India are theoretically and operationally different from those in the west. Neo banks are mostly fin-tech companies or organizations that create inventive banking solutions to address client problems. The RBI asserts that the compliance standards prevent these fin-tech companies or online banking providers from obtaining banking licenses. Neo banking license are currently becoming more and more widespread.

A digital bank that does not have a physical branch location conducts all of its operations online. This is a sizable group of businesses that provide financial services and appeal to today's tech-savvy customers. A fin-tech business that offers cash termination payments, payments for digital and mobile-first financial solutions, and money transfers is Neo Bank. Neo banking license, which lack bank licenses themselves, rely on bank partners to provide banking licensed services. Traditional banks have different requirements than the financial landscape, which is moving in favour of customer satisfaction and experience. Neo Banking is likewise attempting to fill that void.

When selecting how to receive a Neo banking license, you must consider the options accessible in your country and check the rules to ensure compliance. To make the best choice possible, you must take into account a number of factors, including the variety of digital services you want to offer, a geographic area, the time it will take to secure a license, and others.

You should also consider the opportunity to collaborate with independent contractors who offer legal financial services, start a neo-bank, and simultaneously apply for a Neo banking license.

While you wait for it, you could scale a firm and test the waters.

Financial institutions can provide typical banking services, such as accepting customer deposits and loaning money, if they have a full banking license. This license is more restricted than others even if it allows for a greater range of activities. This type of Neo banking license is regularly given out by regulatory bodies like central banks.

In the last several years, there has been substantial development in the financial industry. There are currently more than 2,000 fin-tech businesses functioning in the country as a result of the widespread acceptance of digital payments. Customers are relying less on traditional banks and cash and more on online banking and wallets. The rising volume of digital transactions carried out by Indian consumers has been discussed. More and more people are making it easier to make payments online with Google Pay, Paytm, Phone Pay, and other services. They can effortlessly gain while preserving themselves. All of these things are simpler with a Neo banking license.