KNOW THE CHRONOLOGY TO START NEO BANK IN INDIA

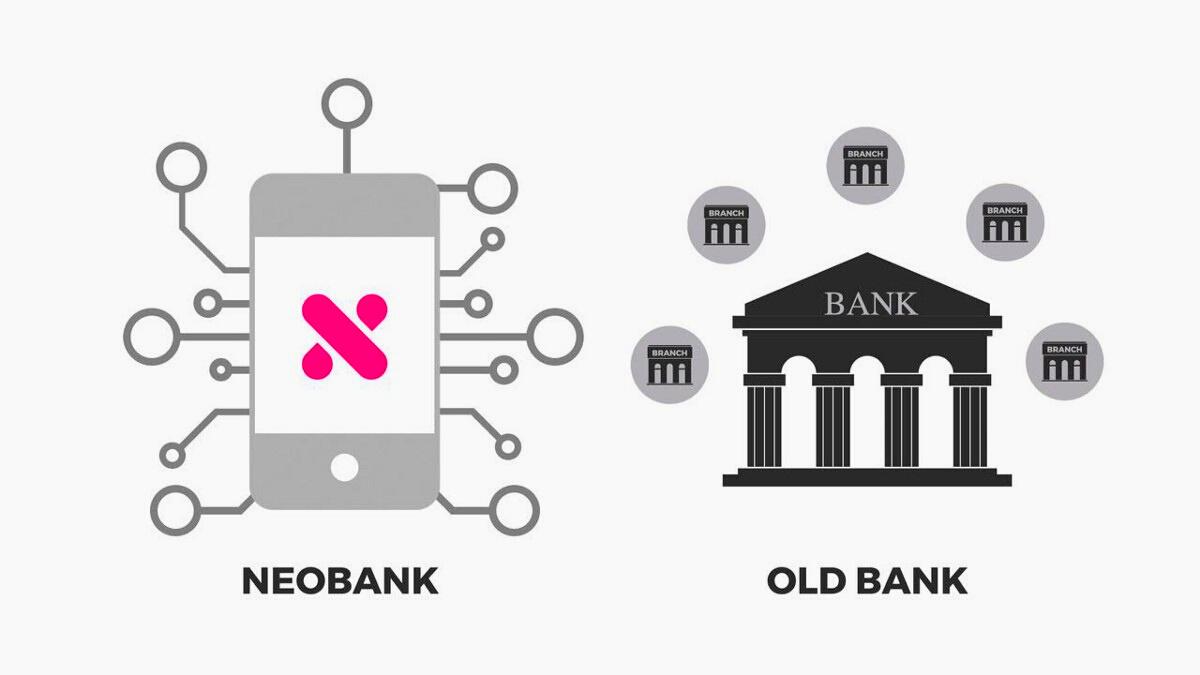

Neo banks use cutting-edge, agile, and lean business models to provide super-fast, mobile-first services free from the constraints of traditional technology, complex value chains, and strict regulatory restrictions. The ambiguity of this online banking system can be reduced if you plan to start Neo bank in India.