10 minute read

Robert Outram

STORMY outlook

Extreme weather events and algal blooms are likely to mean pricier premiums for farmers

BY ROBERT OUTRAM

When it comes to the impact of climate change, the insurance industry is on the front line. Last month, HRH Prince Charles, who has long been a champion of the environment, brought representa� ves of the sector together for the launch of the Sustainable Market Ini� a� ve Insurance Taskforce.

The Taskforce involves the heads of 17 fi rms, who have pledged to support the transi� on to a less carbon-intensive economy by expanding insurance coverage for climate-friendly projects and partnering with governments to provide be� er cover against climate-related disasters, which many believe are likely to occur with greater frequency as the planet heats up.

For those insurers specialising in cover for aquaculture, climate-related risks also loom large. Duncan Perrin is Aquaculture Manager with Sunderland Marine, a specialist fi rm covering aquaculture as well as fi shing and coastal vessels, which has been part of the North Group since 2014. His par� cular focus is insurance against stock mortality.

He says: “Agricultural reinsurance in general has been hard hit in the past few years. We have seen wildfi res in California, Australia, and South Africa, and hailstorms in US Midwest. Meanwhile the UK experienced unusual weather this spring, with the lowest average April temperatures recorded. If there’s an unusual weather event, someone somewhere is paying for it!”

Perrin adds: “For aquaculture, what we are seeing more of is algal blooms and storms. These have always happened but now they seem to be more intense. Storm Gloria was an unprecedented weather event [in January 2020]. People lost their lives and there was huge disrup� on along the coast of Spain. These events are increasing in frequency and severity.”

Also specialising in this sector is GAIC, the Global Aquaculture Insurance Consor� um. GAIC was set up in 2009 to insure fi sh and shellfi sh farms for stock mortality exposures that are diffi cult to place in the local market in most countries. The facility is administered by Lloyd’s insurance and reinsurance broker Alwen Hough Johnson Ltd, with capacity provided by certain syndicates at Lloyd’s of London.

Neil Hopkins is an underwriter with GAIC and, having originally trained as a fi sheries biologist, has been an aquaculture insurance specialist throughout his 37-year career. He agrees that climate-related events have led to some big claims in recent years. As he puts it: “Insurers are feeling the pain.”

Hopkins notes that some risks in aquaculture have reduced compared with the past: for example, cage design and moorings are be� er engineered and there are now vaccines for some of the fi sh diseases that previously troubled producers.

He adds, however: “Some risks have worsened. Climate change means storms and drought. There is a longer storm season and very severe storms

Above: Catalonia, Spain with a storm coming in are more frequent. In addi� on the frequency, severity and geographical distribu� on of algal blooms is increasing.”

Insurance is known as a cyclical business, and premium rates go up and down depending on how much capacity on the part of insurers is coming into, or leaving, the market. Right now the cycle is “hardening” a� er a number of “so� ”

Top: Storm Gloria sweeps sand and sea water from the beach Above: Post-storm inspec� on, Mowi, Carradale Opposite: Neil Hopkins years, so farmers can expect to see their premiums con� nue to rise – and not necessarily because their own risk profi le is signifi cantly diff erent.

Insurers are also having to consider how they will approach changing technology and farming techniques within aquaculture. For example, the move to invest in large off shore salmon farms, in order to escape from the restric� ons placed on inshore development and from problems like sea lice, creates new challenges for insurance.

Neil Hopkins comments: “People are pushing the envelope as far as off shore farming is concerned. It is slightly naïve to believe that an off shore farm in an environment with 12 metre waves can be covered by the same insurance as an inshore farm.

“They are larger units too, so all your eggs are in one basket. From the insurer’s perspec� ve, far-off shore mega-farms represent a greater risk.”

Sunderland’s Duncan Perrin also points out concerns: “Value-wise, both the large off shore projects and the RAS projects are a scale larger than what we are currently insuring. There is a lot of value in one place.

“Some of the land-based farms being considered and indeed in the construc� on phase may be the equivalent of upwards of 10 tradi� onal marine farms in one loca� on. These values, and indeed risks, posed by these new sites merit careful considera� on by the insurance industry.”

For the move to off shore aquaculture, he draws parallels with the early days of off shore oil and gas and suggests that aquaculture needs to learn the lessons that were hard won by the energy sector.

The large-scale RAS (recircula� ng aquaculture system) projects in development around the world could pose an even greater headache for insurers when it comes to assessing risk. Sunderland Marine already includes a RAS expert among its risk managers, but in contrast to a typical open net farm at sea, it is clear that every RAS system has its own characteris� cs.

Perrin says: “There may be a large step between a small pilot project and implemen� ng that technology in something that is 10 � mes the size. I’m not sure that it is a straight, easily scalable process.

“Insurers and reinsurers have to be comfortable with the risk. These are highly technical, complex systems.”

GAIC’s Hopkins agrees: “They [RAS systems] are not exposed to storms, plankton or disease in the same way as cage farms, but they have a very high

reliance on machinery, much of which was developed for much smaller systems than those being built now.

“Ongrowing opera� ons are a new experience – we are not happy to cover a brand new RAS facility un� l it has been running for at least six months.”

And he points out: “There are not many experienced RAS technicians and even they are learning the features of the new installa� ons as they go.

“If something goes wrong, it goes wrong very quickly and it can aff ect a lot of fi sh. In comparison even a bad storm loss is likely to leave some of the cages at a tradi� onal site intact.”

It may be that limited appe� te for this kind of risk may either hold back RAS development or land its investors with poten� ally greater fi nancial exposure than they had hoped.

Technology can also be used to mi� gate risk, however. A number of applica� ons are being developed to predict events such as algal blooms and provide an early warning, allowing ac� on to be taken such as oxygena� ng the water in and around the pens.

One example is US-based technology business Scoot Science, which has developed SeaState, a pla� orm which brings together informa� on from thousands of diff erent data points onto a “dashboard”. This gives farmers a window into what’s happening below the surface of the water historically, in the present moment and in the future, allowing them to quickly quan� fy predictable risks in the ocean that threaten marine life. SeaState’s forecas� ng models are focused on providing an early warning of extreme ocean events. Through increased lead-� me farms are able to implement mi� ga� on eff orts and drama� cally reduce losses. A� er an event, farms can also use SeaState to perform forensic audits and to iden� fy specifi c ac� ons that yielded the best results for fi sh welfare. CEO Jonathan LaRiviere says: “Fish farming groups have a high tolerance for unconstrained risk on the water. They’ve done an excellent job monitoring the oceans and yet s� ll consider many ocean risks—like low oxygen waters, large temperature swings, and plankton blooms—unpredictable. We have the tools to constrain those risks and we’re working with farms to increase lead � me for extreme ocean events. We’re doing short-term forecas� ng on the individual farm level and also looking at the longer term trends aff ec� ng regional aquaculture.”

All this should also help insurers to assess the risks for fi sh farms in any given region of the world.

Meanwhile, is there anything a producer can do to help keep premium rises to a minimum? Neil Hopkins has two pieces of advice. First, he says: “Spend � me to put together a good presenta� on of your risks, for your insurers, from mooring diagrams to staff CVs.”

He adds: “Secondly, don’t just focus on price. There is tendency, especially for the large producers, to treat insurance as a commodity. That is completely the wrong approach. You need a bespoke approach because one farmer is very diff erent from another. Your fi nancial posi� on may be very diff erent and that could aff ect, for example, how much of a deduc� ble you can aff ord to retain for your own account in order to achieve a premium saving.”

Ul� mately, however, farmers need to be aware that intensifi ed environmental risks are almost certainly going to mean that insurance cover is likely to get pricier in the foreseeable future. FF

Experience in aquaculture

Don’t ignore the human factor when it comes to risk management

Fish farming is subject to many risks, some of which, such as extreme weather events, cannot be avoided. However, one of the most signifi cant risk factors in fi sh farming is also one of the most avoidable: human error.

The chances of an incident occurring due to human error increase as a worker becomes fatigued and loses concentration. Rapid advances in technology have put artifi cial intelligence (AI) at the disposal of the fi sh farmer, whose usefulness in monitoring routine tasks allows staff to concentrate on the core aspects of their job.

Yet even AI is no substitute for good training and experience.

As the world’s leading insurer of aquaculture risks, Sunderland

Marine has a team of expert risk managers who have direct experience in the aquaculture industry and conduct regular surveys for all policyholders.

The Aquaculture Risk Management team provides general guidance and tailored support on all aspects of production, equipping fi sh farmers with the knowledge they need to make informed decisions and minimise risk.

As part of the service, Sunderland Marine periodically hosts

Event Risk Management (ERM) conferences that are tailored to its policyholders. These events cover a range of topics and allow the policyholder to discuss their needs with risk managers and other leading industry specialists, including in-house experts. Independent speakers at ERM conferences have included academics, government scientists, engineers and technology developers – all of whom have been happy to share their unique insights with our policyholders. Contact duncan.perrin@sunderlandmarine.com or search ‘risk management’ at sunderlandmarine.com for more information on our Aquaculture Risk Management services.

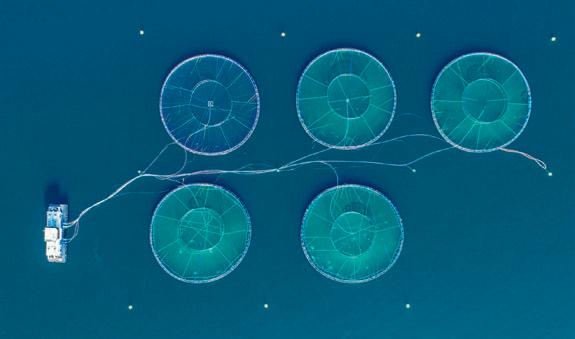

Left: Duncan Perrin, Aquaculture Manager at Sunderland Marine Below: Fish farm pens