5 minute read

Fast forward

from Upgrade Issue 8

Many of the trends which emerged in 2019 in corporate travel will continue to be on the agenda in 2020. Some will accelerate and perhaps become mainstream while traction for others will be slower as companies prioritise other issues.

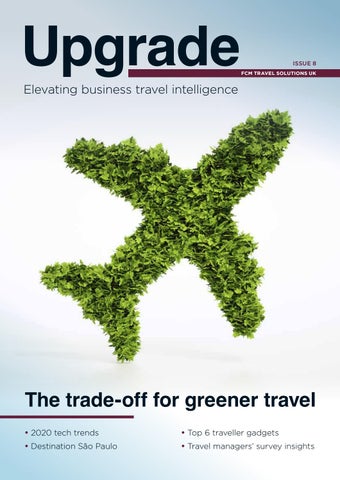

In travel technology, the industry can expect ongoing trends such as the continued explosion in payment mechanisms and the rise and rise of data and how it helps improve the traveller experience. Sustainability and the impact corporate travel has on the environment, and where new technology can play a role, will also be increasingly in the spotlight.

Advertisement

The use of machine learning will permeate across the corporate travel sector as it automates processes and brings efficiency as well as improvements in the travel experience.

In just a few years the number of ways consumers can pay for goods and services has exploded, from online payment systems such as PayPal (owned by eBay) to mobile mechanisms such as Apple Pay, AliPay and WeChat Pay. All predictions are for this trend to continue. Analysis from

Tech trends are impacting the world of business travel in a big way and this looks likely to accelerate during 2020, writes Linda Fox

Amadeus reveals that alternative payment methods overtook cards and cash combined in 2019 for the first time. In Q4 2019 earnings, Apple CEO Tim Cook said there were 3bn Apple Pay transactions and that the app’s transactions and revenue more than doubled yearon-year.

By the end of 2019, UK bank RBS began trialling biometric key fobs for transactions up to £100 while Gemalto announced biometrics would be coming to card payments. What this means for travel suppliers is the need to ensure they can offer the payment methods their customers are using.

With payments comes data - knowing where travellers are spending their money and on what is powerful but it’s only one area where data will be

harnessed. The travel industry has begun to get to grips with the value of the data it is sitting on, how to access it and make it meaningful and there are many examples of this happening.

Airbus, for example, has developed its Skywise platform which is a data lake, or massive data repository, for airlines to store, manage and analyse their data. Advantages, according to the aircraft manufacturer, include the ability to address maintenance problems more quickly and improve operations. Another example is Journera, a data platform that enables travel companies such as hotels, airlines and ground transportation providers to improve the experience for travellers. For example, a hotel might know that a traveller’s flight arrives before the property’s check-in time and offer an earlier check-in. The likes of American Airlines, Hilton, InterContinental Hotels Group, Marriott International, United Airlines and an affiliate of Hyatt Hotels Corporation are utilising this platform, some of whom saw fit to invest in Journera when it launched in 2016. predictions. The search giant Google crunched through masses of historic flight pricing data and offered a flight promotion last summer with a guarantee for consumers that their flight would not go down in price. It branded the initiative a “spectacular success” at a recent travel industry conference.

Others are already on this particular bandwagon, including most of the big online travel players such as booking.com and Expedia.

Google also sees uses for machine learning to help with customer service at call centres as well as in gauging intent and sentiment through language processing.

Established travel companies and startups are also employing machine learning techniques to develop conversational commerce applications (think chatbots) to provide information and book travel or make predictions in areas such as airline disruption.

These examples are large initiatives but smaller developments, also based on data, are helping to improve the traveller experience by delivering relevant information to them while they are on the road. For example, a traveller might be reminded of travel policy on ground transportation when arriving at an airport.

There is little talk about data in travel these days without mention of machine learning which works on samples of data to make predictions and improvements.

Companies such as Expedia Partner Solutions and Google employ machine learning to make pricing For example, startups such as Pilota are using machine learning to predict airline disruptions, while Sabre has been developing its hotel techto enable travellers to pick and choose elements they might want (eg, late checkout). A lot of this technology is still in its infancy but worth watching. AirAsia works with Google Cloud on AI and machine learning for weather predictions.

And, as sustainability comes

increasingly into the spotlight,

data and machine learning will also

be brought to bear in the development

of solutions. On a basic level, carbon

calculators are being talked about

again, with Egencia adding a tool

to gauge CO 2 emissions to its

analytics suite in December. The technology enables travel managers to generate reports on different trips or travel groups.

Other initiatives include the launch by travel consultancy Advito of “Sustainable Collaboration.” Services within the initiative include helping companies set up carbon offset

programmes and employing more sustainable forms of collaboration to reduce trips. The company says that demand from corporates for advice on supporting sustainability initiatives has reached new heights. The above developments are likely to gain traction with 2020 planned as the year for action in the climate change movement.

Another trend to watch is the development of super apps. WeChat in China and others such as Grab provide consumers with access to a range of products and services including communication, ground transport and payment. Mobile devices are already part of billions of consumers’ everyday lives and studies show a desire to access more services from one place so the super app trend is not likely to go away.

Whether travel companies will try to create their own super apps with aggregated travel services will be interesting to watch. Many startups that tried to create specific travel social media services failed because there were already platforms such as Facebook for that.

As 2020 progresses it will be interesting to see how the trends described above play out. Some developments, especially around data and machine learning, will no doubt converge to further enhance the traveller experience and drive efficiency. And others, such as developments in more seamless payment methods, will become the expectation.

Lovingly designed, charismatic hotels in stylish neighbourhoods

W doylecollection.com