6 minute read

Business Matters Commission Plan Can Replace Tipping

Commission Plan Can Replace Tipping

by CHARLES MUSGROVE, CPA DIRECTOR, FINANCIAL AND ACCOUNTING SERVICES, CAPSERV360 | ANSWERS THAT COUNT PODCASTER

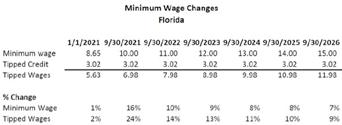

The minimum wage is increasing for many states at a fast pace to $15, but once it hits that amount, it will continue to go up. Florida is one of those states. In November, the voters of Florida narrowly approved Amendment 2, which will increase the minimum wage to $15 by September 2026 with a tip credit of $3.02. So, in September 2026, the minimum wage will reach $15 per hour, and the tipped wage will be $11.98

According to Chad Mackay, the CEO of Fire & Vine Hospitality based out of Seattle, Washington, “these increases are an attack on the tipped employee.” Chad is more than qualified to speak about the burden these increases will impose on full-service restaurant concepts. When Seattle imposed the increases over five years ago, he calculated that the cost to two of his restaurants for tipped employees alone would be over $700,000. Facing this magnitude of cost increase, Chad and his team determined that the best way to survive without eroding profit would be a new compensation model along with implementing service charges. The new compensation model they implemented was a commission-based model for compensating servers and bartenders. The model has proven effective for his portfolio of restaurants that include El Gaucho in Seattle (ElGaucho.com/elgauchoseattle). The plan gives them a long-term solution and not just a short-term Band-Aid.

How does the Commission Model Work?

Simply put, the commission model of compensation is to pay employees based on sales. An additional benefit is under DOL rules, Section 7(i) allows for excluding overtime pay. This exclusion is commonly referred to as the 7(i) Exemption. Under this model, the servers and bartenders, the restaurant’s real sales force, are incentivized to sell more food and booze because their compensation is increased. The restaurant includes a service charge as a percentage of the ticket.

7(i) Exemption

The following is from the U.S. Department of Labor. These are the requirements The increase in the wages is best shown in this chart. Yes, that’s right, a 116% increase for tipped wages and 75% increase for minimum wage.

to meet for overtime to be exempt for commission pay.

If a retail or service employer elects to use the Section 7(i) overtime exemption for commissioned employees, three conditions must be met: 1. The employee must be employed by a retail or service establishment. 2. The employee’s regular rate of pay must exceed one and one-half times the applicable minimum wage for every hour worked in a workweek in which overtime hours are worked. 3. More than half the employee’s total earnings in a representative period must consist of commissions.

Unless all three conditions are met, the Section 7(i) exemption is not applicable, and overtime premium pay must be paid for all hours worked over 40 in a workweek at time and one-half the regular rate of pay.

How do the Numbers Work for the Employees?

In general, the previously tipped employee will now be paid an equal or greater amount of commission pay compared to tips previously earned. In the tipped model, the employee would share tips with other team members,

like hostess, busser, barback and others. In the commission model, the employee does not share commission pay. The bussers, hostesses and other employees now receive all of their pay from the restaurant, and their pay may be increased or decreased depending on amount of shared tips previously received.

A good starting point for the commission percentage is around 15%. The net tips received under the tipping model is approximately 15% after accounting for the shared tips they share. So, this commission model should result in no harm, no pay reduction and the opportunity to make more.

What’s Different for the Customer?

A service charge is now billed to the customers, and the service charge is not an optional pay item but is a required payment on the ticket. Typically the service charge percentage is between 18% and 22%, unless the service charge is tied to a private party or special event. These percentages for a service charge match the range of what is normally tipped by customers. So, in theory, the customer is paying approximately the same amount under this model as customers that tip would pay under the tipping model.

Data over Drama

One of the keys to a successful implementation of this commission model is to base decisions on data. How much should the percentage of commission be? It should be based on historical data of what total pay, including tip have been, including tip share. Historical data for sales, discounts and shift should also be accounted for in determining the commission percentage to use.

Using understandable and relevant data to make decisions and communicate with employees is very important. As questions arise about pay, the data can be a reference point to either support or refute any questions that employees have. This sets the stage for a quick resolution of questions. Accurate and reliable data that is presented in an understandable way will help reduce the drama that could happen around change in compensation plans.

Account for All the Numbers

Restaurants that use the tipping model, which is the majority of full-service restaurants, do not report on their P&L’s about 20% of revenues and costs attributable to the operations of the restaurant. Since the employee owns the tips, tips are not counted as revenue to the restaurant, nor is the cost accounted for as a cost to the restaurant. The revenue and cost are not truly a ‘wash’ since payroll tax cost on the tips are included as a cost of the restaurant. To keep it simple, what other business excludes 20% or more of its revenues and costs?

The service charge and commission model require all costs and revenues associated with the operations of the restaurant to be reported on the P&L of the restaurant. The restaurant owns service charge collected from the customer, and commissions paid to employees, plus associated payroll taxes, are reported on the books, records and P&L of the restaurant. This seems like a great improvement in accounting and financial reporting.

Action Plan to Manage the Wage Increases

In many states, minimum wage is scheduled for a rapid increase to $15 and beyond. Seattle is nearing $17 per hour now. Other states have recently jumped on the train headed to $15, but the rate will not stop there.

Action Plan for Implementing the Commission Model:

1. Gather and analyze data relating to: • Wage and tip by employee • Sales by each tipped employee • Percentage tip share paid out by servers/bartenders 2. Financial projections to show effect of implementation of model, compared to alternative models 3. Financial projection should include sensitivity analysis 4. Reports that can be shared with each employee to reflect historical data and projected compensation under new model

The commission model along with service charge is only one of the options to evaluate to help manage the increase in costs. This sole option has many, many iterations to consider and should be rolled out with extreme care. Successful implementation will take time, a lot of communication, transparency and decisions backed by data. Plan early, plan often and prepare to address questions and issues early. Also, consider consulting with an employment law attorney and CPA/ financial consultant for data analysis and projections.