3 minute read

CaskX Is The Leading Barreled Bourbon Investment Entity

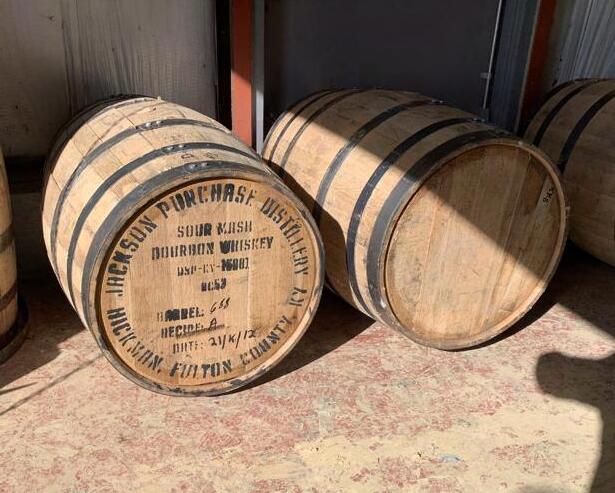

CaskX, a pioneer and market leader in the sale of barreled bourbon investments, continues to secure partnerships with distilleries across the United States in order to offer new opportunities to the company’s growing investor base. By working directly with Kentucky Artisan Distillery, Jackson Purchase Distillery, Old Glory Distilling, Corsair Artisan Distilling and other emerging distilleries, CaskX has facilitated the acquisition of more than 10,000 barrels of American Bourbon by investors around the world. The frm now boasts four locations across three continents, with further expansion expected in 2023.

What is CaskX? CaskX begins by working with clients to build a portfolio of barrels, also known as casks, based on the investors desired objectives. By selecting barrels from specifc regions, distilleries and vintages an investor can achieve the right combination that manages risk, offers the desired holding period and is projected to achieve target returns. Upon purchasing a suitable portfolio, investors receive certifcates for each of the barrels which prove their ownership rights and can be used to transfer the barrels in the event of a future sale. All barrel investments are then stored at a government regulated warehousing facility at either the distillery or a third-party storage provider until the barrels are either bottled or sold to another party. Investments are also fully insured to protect investors from an unforeseen disaster or loss. By investing in whiskey barrels investors are able to help the industry grow by providing cash fow to distilleries in advance of the whiskey being of adequate age for release as bottles.

“Investors are always looking for ways to diversify their portfolios, especially in uncertain times and during stock market volatility, so creating an alternative investment business that’s capitalizing on the growing market value of high-end bourbon has essentially turned into a win-win strategy for both the distillery and the investor,” said Jeremy Kasler, CEO and founder of CaskX. “What’s unique about CaskX is that we beneft the distillery by purchasing directly from them a set amount of un-aged bourbon barrels, while on the fip side we’re the frst to offer individual accredited investors the ability to strengthen their overall investment strategy by investing in a consumer good that has a solid history of appreciating over time.”

“CaskX has played a pivotal role in helping Kentucky Artisan Distillery continue to expand in order to meet the growing demand for bourbon both within the United States and abroad,” said Chris Miller, President of Kentucky Artisan Distillery. “The partnership allows us to generate instant cash fow to fund operations and capital improvements without waiting years for the bourbon to reach maturity. The business model is unique to the industry in allowing private investors to play a role in the future of the distillery and the broader industry by allowing production increases that would not otherwise be possible. And, if growth continues as we expect, those same investors stand to reap signifcant gains from the appreciation of the bourbon as it ages.”

Since the turn of the century Bourbon has enjoyed a renaissance of historic proportions, with no signs of slowing down. According to the Distilled Spirits Council, in the past 10 years the volume of bourbon sold has increased more than 85% in the United States alone with the average price for a bottle of bourbon surging 18.50%. Even more pronounced growth has come in the super premium category as spirits consumers look for higher end expressions to grace their shelves.

Sales volumes in the super premium segment have increased even more signifcantly, rising by more than 400%. Demand has risen to the point that nearly 2 million barrels will be bottled this year, yet supply of older age bourbon remains bleak. In fact, according to the Kentucky Distillers Association there are currently less than 550,000 barrels which are of 6 years of age or older. As consumer demand for premium well-aged bourbon continues to grow and supplies shrink, the prices for bourbon are likely to rise even more.

Facts about Kentucky Bourbon (according to the KAD):

• Kentucky distillers shipped $391 million of products abroad in 2020.

• Kentucky distillers produced 2.4 million barrels of Bourbon in 2020, and now have a record 10.3 million barrels stored in warehouses.

• There are fve times more active distilleries in 2021 than there were in 2009.

• Distillers have invested more than $1.9 Billion over the last 5 years and are projected to invest $3.3 Billion over the next 5 years.

• Less than 3% of barrels in inventory have aged more than 8 years while less than 7% are aged over 6 years.

Founded in 2020 by entrepreneur and long-time businessman Jeremy Kasler, CaskX is a global frm that specializes in building investment portfolios of barreled bourbon and scotch for investors around the world. Capitalizing on the underserved market niche of alternative investing in the barreled spirits market, CaskX works directly with distilleries to purchase and store their barrels, connecting those offerings with accredited investors who purchase a portfolio of barreled spirits to hold for future resale or bottling. The company maintains offces in Australia, Hong Kong, and the United States.

More details about the frm can be found at www.caskx.com