3 minute read

DIGITAL TRANSFORMATION IN BUSINESS Exploring the Accelerated Adoption of Digital Payments

The Reserve Bank of India (RBI) recently made the decision to withdraw the largest currency note, the Rs 2,000 banknote, from circulation. While still considered legal tender, citizens are encouraged to deposit or e x c h a n g e t h e s e n o t e s b y September 30, 2023. This move has significantly accelerated the adoption of digital payments in India, prompting a transformative shift in the way businesses operate and interact with customers. In this article, we will explore the implications of this withdrawal and its impact on the d i g i t a l t r a n s f o r m a t i o n o f businesses.

Digital Transformation and its Benefits

Digital transformation involves leveraging digital technologies to revolutionise various aspects of an organisation's operations, including product delivery, customer interactions, and operational management This process can yield both positive and negative outcomes. On the p o s i t i v e s i d e , d i g i t a l t r a n s f o r m a t i o n e n h a n c e s efficiency, productivity, and customer service, while also facilitating business expansion into new markets. However, it can also be expensive and disruptive, l e a d i n g t o j o b l o s s e s a s automation replaces human tasks.

A c c e l e r a t e d A d o p t i o n o f

Digital Payments

The withdrawal of the 2000 rupees currency note in India in 2016 created a cash shortage, c o m p e l l i n g individuals to seek alternative m e t h o d s o f p a y m e n t

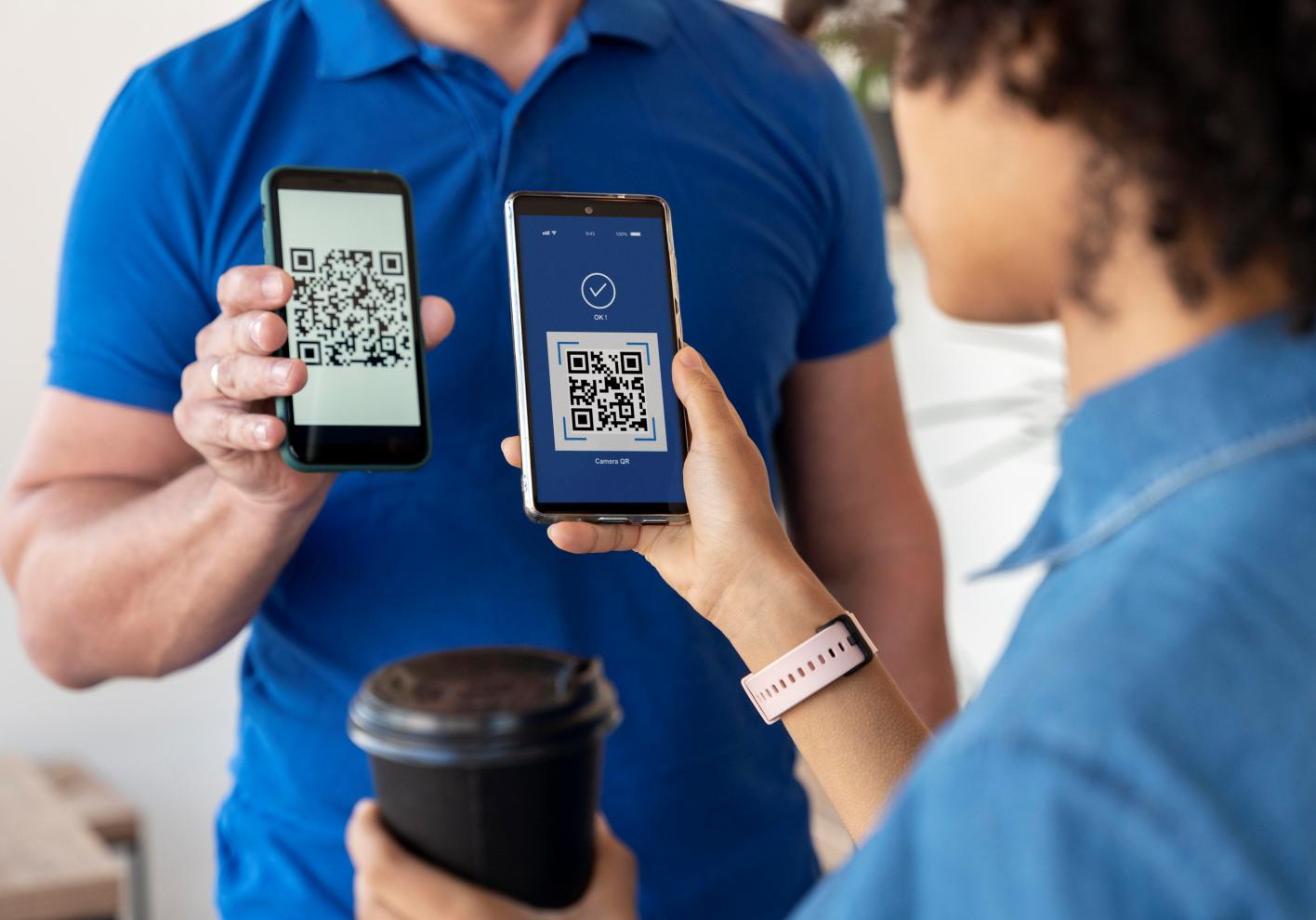

Consequently, the adoption of digital payment solutions, such as mobile wallets a n d o n l i n e t r a n s a c t i o n s , skyrocketed. This a c c e l e r a t e d a d o p t i o n o f digital payments has had several b e n e f i t s f o r b u s i n e s s e s i n India.

1 . C o s t

Reduction: By transitioning to digital payments, businesses c a n m i n i m i s e e x p e n s e s associated with cash handling, such as ATM fees, bank charges, a n d s e c u r i t y c o s t s T h e elimination of cash transactions reduces reliance on physical infrastructure and allows for more streamlined financial operations.

2. Enhanced Customer Service: Offering digital payment options allows businesses to provide c u s t o m e r s w i t h g r e a t e r convenience and flexibility Customers can pay for goods and services online or through mobile wallets, improving the overall purchasing experience. This improved convenience leads to increased customer satisfaction and loyalty.

3. Access to New Markets:

D i g i t a l p a y m e n t s e n a b l e businesses to reach customers who do not have access to traditional banking services. By offering alternative payment methods, businesses can tap into previously underserved markets, expanding their customer base and driving growth.

Future Implications

The accelerated adoption of digital payments in India marks a is expected to grow both in India and around the world.

Here are some key benefits that digital transformation brings to businesses:

1. Increased Efficiency: Digital technologies automate tasks, improve communication, and streamline processes, resulting in enhanced efficiency and productivity. By leveraging automation and digital tools, b u s i n e s s e s c a n a c h i e v e significant operational gains.

2. Improved Customer Service: Digital technologies enable personalised and convenient customer experiences. Businesses can tailor their offerings and services to meet individual needs, thereby increasing customer satisfaction and fostering longterm loyalty.

4. Reduced Costs:

Digital technologies reduce costs through task automation, reduced paper usage, and increased operational efficiency By embracing digital payments, businesses can optimise financial processes, leading to cost savings and improved profitability. Conclusion significant positive development for businesses. As digital technologies continue to evolve, the adoption of digital payments

3. New Market Opportunities: Digital transformation opens doors to new markets and c u s t o m e r s e g m e n t s . B y embracing digital payments, businesses can expand their reach and capitalise on untapped market potential, driving growth and competitiveness.

The withdrawal of the 2000 rupees currency note in India has served as a catalyst for the accelerated adoption of digital p a y m e n t s B u s i n e s s e s a r e l e v e r a g i n g t h i s d i g i t a l transformation to reduce costs, enhance customer service, and explore new market opportunities. As digital technologies continue to evolve, the adoption of digital payments is expected to grow, revolutionising the way businesses operate in India and globally. Embracing digital transformation is crucial for businesses to remain competitive and thrive in the r a p i d l y e v o l v i n g d i g i t a l landscape.