COP29:

THE MIDDLE EAST’S

COP29:

THE MIDDLE EAST’S

MEET THE PIONEERS AND VISIONARY LEADERS INVESTING IN SUSTAINABLE INITIATIVES AND INNOVATIONS THAT CAN CHANGE THE WORLD.

6 I Sidelines

Thinking Green

By Claudine Coletti

18 I The World's Most Exclusive Club

From the fabulously rich to the fabulously famous, this remote patch of Montana wilderness has fewer than 900 homeowners, who are worth more than a combined $290 billion.

By Kerry A. Dolan with Stephen Pastis and Alicia Park

SUSTAINABILITY

The 29th edition of the UN’s Climate Change Conference is set to take place this year in Baku, Azerbaijan, from November 11 to 22. Here’s what you should know about this year’s summit.

By Joyce Abaño

I

MENA witnessed a surge in green bonds and sustainability sukuk issuances in the first eight months of 2024, demonstrating the growing global demand for sustainable finance.

By Mohammad Addam

While fast fashion continues to contribute to climate change, fashion weeks around the world are championing sustainable designers.

By Sara Junaid

I MENA’s

These are some of the green energy projects in the region that recently secured and disclosed significant investments.

By Engy Abdal Monem

30

Since COP28, which was held in the U.A.E. in December 2023, MENA has experienced a transformative shift in less than a year, with more businesses advancing their sustainability agendas.

By Rawan Hassan

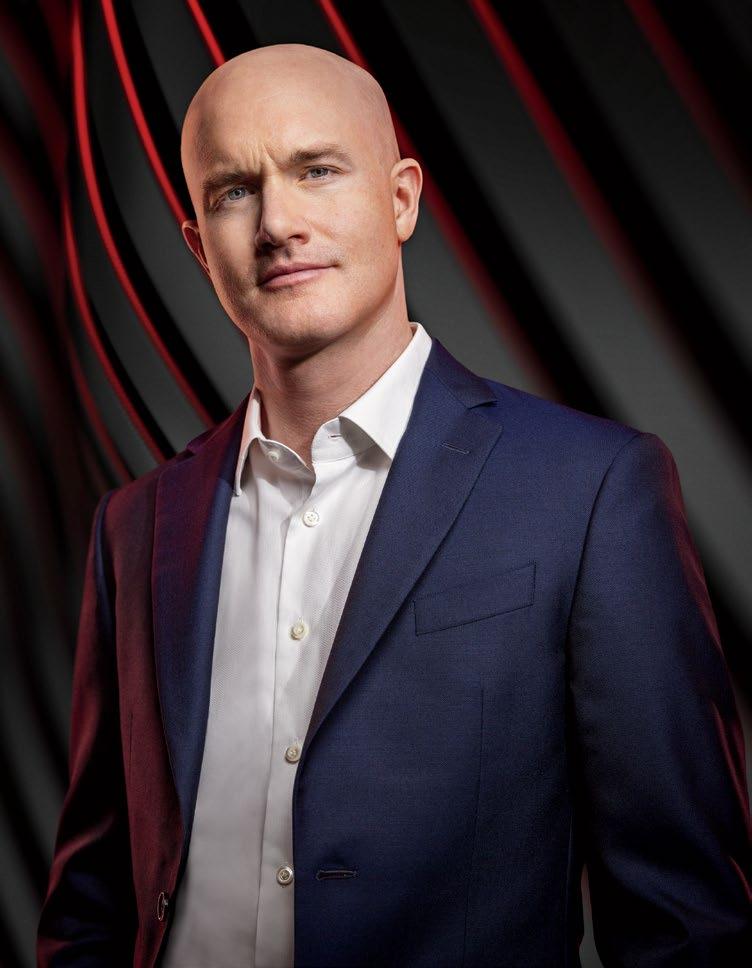

Coinbase’s BRIAN ARMSTRONG created one of crypto’s central players, a fee-gushing monster that currently holds more than a tenth of all the Bitcoin ever minted. But now, in the cause of “decentralization,” he’s making a risky pivot. It’s easy to be an idealist when you’re a billionaire.

By Javier Paz and Steven Ehrlich

The 400 richest people in America are having a rollicking time in the roaring 2020s. In all, they’re worth a record $5.4 trillion, up nearly $1 trillion from last year. A dozen have $100 billion–plus fortunes, also a record. And admission to this elite club is pricier than ever: A minimum net worth of $3.3 billion is required, up $400 million since 2023.

Omar El Hamamsy, Group CEO of Orascom Development Holding, assumed office in 2020 during a global pandemic and steered the company from loss to annual profitability. Now, he’s focused on developing 60 million square meters of virgin land out of the group’s 101 million-square-meter land bank.

By Hagar Omran

Having already invested $50 billion in renewable energy projects across 70 countries and committed another $50 billion over the next decade, the U.A.E. is determined to be a world leader in sustainability. Amna bint Abdullah Al Dahak, the U.A.E.’s Minister of Climate Change and Environment, is spreading the message globally while moving forward with a national agenda.

By Claudine Coletti

48

For Maywand Jabarkhyl, CEO of FBMI and Tanweer Investments, sustainable investment is more than a positive move for the planet; it’s a life-altering opportunity for some of the world’s most vulnerable and disconnected people.

By Jamila Gandhi

Ibrahim Al Zu’bi, Group Chief Sustainability and ESG Officer at ADNOC, is on a journey to make one of MENA’s biggest energy giants one of the world’s most significant sustainability champions. He’s already had a measurable impact.

By Layan Abo Shkier

Iheb Triki and Mohamed Ali Abid, cofounders of Tunisian water-tech startup Kumulus Water, are revolutionizing access to sustainable clean drinking water by sourcing it from air. With their eyes now set on the Saudi market, they are poised for further expansion across MENA, Europe, and beyond.

By Rawan Hassan Mohammed

A target of 2,000 beds to serve the community of the Holy City of Al Madinah Al Munawwarah.

While the Middle East is admittedly well known for its fossil fuels, it is also in no way shying away from the world’s sustainability agenda. Still, there is no denying that there is work to be done. The region is not only one of the world’s most prolific producers of oil, it is also one of its biggest producers and consumers of natural gas. According to energy think tank Ember, in 2023, 16% of the world’s gas came from the Middle East and 76% of the Middle East’s energy came from gas. Other fossil fuels accounted for 18% of the region’s power. There is some diversity among countries, with Jordan producing 23% of its energy from wind and solar power on the one hand, and Bahrain, Iran, Iraq, Kuwait, Lebanon, Oman, Qatar, and Saudi Arabia including less than 1% of wind and solar power in their energy mixes on the other.

Despite this, the biggest economies in MENA have ambitious plans for the future. Last year concluded with COP28, which was hosted in the U.A.E. and saw world leaders come together to make some bold commitments. These included a $792 million loss and damage fund for vulnerable countries and the creation of a global stocktake that contains every element under negotiation and can be used to develop stronger climate action plans by 2025. While one year later the world may not feel as though it has moved very far, Asia is once again preparing to host the world’s leaders at COP29 in Azerbaijan in November. And as we wait to see what this year’s conference brings, this month we too turn our focus to sustainability and the leaders working to implement green practices in their policies and operations.

Our second annual list of the region’s sustainability leaders covers all of MENA’s major sectors: banking and financial services, environmental services, energy and utilities, food and agriculture, green finance, investment and holding companies, manufacturing and industrials, oil and gas, real estate and construction, technology and telecom, transport and logistics, and travel and tourism. It’s a comprehensive catalogue of the business heads leading initiatives to incorporate renewables, recycle waste, reduce emissions, and inspire sustainable innovation. Recognizing the importance of public and private sector cooperation, we also present a list of the government ministers leading from the top to mandate sustainability in business models.

Alongside this, we speak to a cross-section of leaders to delve into the details of how they’re making a difference. This includes Ibrahim Al Zu’bi, Group Chief Sustainability and ESG Officer at ADNOC, who is tasked with making one of the region’s biggest oil and gas companies also one of its most impactful renewable champions, and Amna bint Abdullah Al Dahak, the U.A.E.’s Minister of Climate Change and Environment, who’s representing the country globally to ensure it remains at the forefront of the sustainability agenda.

It’s a data-packed issue. I hope you enjoy learning more.

—Claudine Coletti, Managing Editor

Dr. Nasser Bin Aqeel Al Tayyar President & Publisher nasser@forbesmiddleeast.com

Khuloud Al Omian

CEO & Editor-in-Chief Forbes Middle East khuloud@forbesmiddleeast.com

Claudine Coletti Managing Editor claudine@forbesmiddleeast.com

Laurice Constantine Digital Managing Editor laurice@forbesmiddleeast.com

Fouzia Azzab Deputy Managing Editor fouzia@forbesmiddleeast.com

Amany Zaher Senior Quality Editor amany@forbesmiddleeast.com

Jamila Gandhi Senior Editor jamila@forbesmiddleeast.com

Rawan Hassan Senior Translator rawan@forbesmiddleeast.com

Samar Khouri Reporter samar@forbesmiddleeast.com

Cherry Aisne Trinidad Senior Online Editor aisne@forbesmiddleeast.com

Jason Lasrado Head of Research jason@forbesmiddleeast.com

Nermeen Abbas Senior Researcher nermeen@forbesmiddleeast.com

Elena Hayek Researcher elena@forbesmiddleeast.com

Layan Abo Shkier Research Reporter layan@forbesmiddleeast.com

Ruth Pulkury Senior Vice President - Business Development ruth@forbesmiddleeast.com

Fiona Pereira fiona@forbesmiddleeast.com

Karl Noujaim karl@forbesmiddleeast.com

Sarah Gadallah Hassan sarah.g@forbesmiddleeast.com

Maher El Zein maher@forbesmiddleeast.com

Upeksha Udayangani Senior Client Relations Executive upeksha@forbesmiddleeast.com

Tayyab Riaz Mohammed Financial Controller riaz@forbesmiddleeast.com

Soumer Al Daas Head of Creative soumer@forbesmiddleeast.com

Julie Gemini Marquez Senior Brand & Creative Content Executive julie@forbesmiddleeast.com

Mohammed Ashkar IT Manager ashkar@forbesmiddleeast.com

Habibullah Qadir Senior Payables and Accounting Manager habib@forbesmiddleeast.com

FORBES US

Chairman and Editor-In-Chief Steve Forbes CEO and President Michael Federle

Copyright© 2023 Arab Publisher House

Copyright @ 2023 Forbes IP (HK) Limited. All rights reserved. This title is protected through a trademark registered with the US Patent & Trademark Office Forbes Middle East is published by Arab Publisher House under a license agreement with Forbes IP (HK) Limited. 499 Washington Blvd, 10th floor, Jersey City, NJ, 07310 Founded in 1917

B.C. Forbes, Editor-in-Chief (1917-54); Malcolm S. Forbes, Editor-in-Chief (1954-90); James W. Michaels, Editor (1961-99) William Baldwin, Editor (1999-2010)

Abu Dhabi Office Office 216, Podium 2, Yas Creative Hub, Yas Island, Abu Dhabi, U.A.E. - P.O. Box 502105, info@forbesmiddleeast.com Dubai Office Forbes Middle East Studio, Warehouse No. 16, Garhoud, Dubai - U.A.E. | P.O. Box 502105, Tel: +9714 3995559 Qatar 14-DD2, Commercial Bank Plaza, West Bay, Doha, Qatar readers@forbesmiddleeast.com subscription@forbesmiddleeast.com

Queries: editorial@forbesmiddleeast.com For Production Queries: production@forbesmiddleeast.com

Check our Sustainability Policy

By Claudine Coletti

Sustainability

Having already invested $50 billion in renewable energy projects across 70 countries and committed another $50 billion over the next decade, the U.A.E. is determined to be a world leader in sustainability. Amna bint Abdullah Al Dahak, the U.A.E.’s Minister of Climate Change and Environment, is spreading the message globally while moving forward with a national agenda.

While the arid climates of the oil-rich Middle East may not seem the most natural habitat for a hub of climate change innovation, some recent moves from the U.A.E. have seen it emerge as a global leader in sustainable development. For example, at the end of February, the President of the U.A.E., His Highness Sheikh Mohamed bin Zayed Al Nahyan, launched the Mohamed bin Zayed Water Initiative to confront the urgent challenge of global water scarcity. According to UNICEF, up to four billion people across the world already experience water scarcity at least once a month, and half of the global population could be under water-stressed conditions by 2025. It plans to target investment, accelerate innovation, and expand international cooperation to create solutions to the problem.

It kicked off these intentions just a few days later when it partnered with the XPRIZE Foundation to launch a five-year global competition, XPRIZE Water Scarcity, which has a $119 million prize fund thanks to a $150 million investment from the Mohamed bin Zayed Water Initiative. The goal? To entice teams of inventors and innovators to generate new seawater desalination technologies that could increase our access to clean water.

“The challenge is to help us understand how we can improve our water security in naturally water-scarce environments without having any negative environmental implications,” explains Amna bint

Abdullah Al Dahak, the U.A.E.’s Minister of Climate Change and Environment. “With that comes another focus to launch grants and research and also attract the small solutions that might need a little bit of push or a little bit of support so that they can prove the concept and result in a scalable solution that can benefit the U.A.E. and worldwide.”

According to the minister, water scarcity and food security are among the most urgent climate-related issues currently facing the Middle East. On August 30 2024, she was among the high-level government representatives of the 10 BRICS countries, who gathered in Moscow this year for the BRICS High-Level Dialogue on Climate Change, where they debated the development of sustainable agriculture and the creation of a BRICS grain exchange, among other topics.

“We had very fruitful discussions, especially with me being the new kid on the block and getting to know everyone in the climate landscape,” Al Dahak shares. “When we talk about climate change, we always say what are the most vulnerable countries to climate events? The U.A.E. is already in a hot climate region. One of the challenges that we have been working with since the very beginning is growing our food in arid environments.”

But food and water security is far from just a Middle East problem. According to a 2024 report by the Food Security Information Network and the Global Network against Food Crises, “in 2023, nearly 282 million people or 21.5% of the analyzed population in 59 countries/ territories faced high levels of acute food insecurity requiring urgent food and livelihood assistance.” And this isn’t the only risk arising from increasingly extreme weather conditions and events being caused by climate change. “Climate crises come with so many other issues. Sometimes [people] are cut from the world for a day or several days, which means that their supplies are affected,” says Al Dahak.

• Minister of Industry and Advanced Technology; COP28 President, U.A.E. Special Envoy for Climate Change

Country: U.A.E.

As the U.A.E’s Minister of Industry and Advanced Technology, Al Jaber signed an MoU to establish the U.A.E.-France Bilateral Climate Investment Platform in February 2024, to accelerate the deployment of joint clean energy projects and investments. He has been at the helm of ADNOC since 2016, leading a $23 billion decarbonization strategy and new lowcarbon solutions business. He has also been the chairman of Masdar since 2014 and has served as the U.A.E.’s special envoy for climate change since November 2020. In December 2023, he became the first CEO to serve as COP President during COP28.

• Minister of State for Foreign Affairs and Climate Envoy

Country: Saudi Arabia

Al-Jubeir has been Saudi Arabia’s Minister of State for Foreign Affairs since 2018 and was appointed climate envoy in May 2022 following a royal decree. In May 2024, Al-Jubeir highlighted Saudi Arabia’s commitment to environmental protection through the allocation of $2.5 billion to the Secretariat of the Middle East Green Initiative. In June 2024, he announced a range of national initiatives to boost ocean sustainability, including an assessment and rehabilitation program for habitats in the Red Sea and the Arabian Gulf. The kingdom plans to plant 200 million mangrove trees by 2030 and 1.4 billion by 2100.

• Minister of Climate Change and Environment

Country: U.A.E.

Al Dahak became the U.A.E.’s Minister of Climate Change & Environment in January 2024. She leads environmental initiatives to achieve the U.A.E.’s Net Zero 2050 Strategy, enhance biodiversity, promote agricultural technologies, and ensure food security. She previously held roles at the Ministry of Education and served as the U.A.E.’s government spokesperson during the Covid-19 pandemic.

Abdulrahman AlFadley

• Minister of Environment, Water and Agriculture

Country: Saudi Arabia

AlFadley has been Saudi Arabia’s Minister of Environment, Water, and Agriculture since January 2015. In April 2024, he highlighted the country’s approach to addressing land degradation and desertification through the Saudi Green Initiative, grazing management, and a cloud seeding program. Saudi Arabia plans to expand vegetation cover, combat desertification, rehabilitate agricultural terraces, and improve water resource management and waste treatment through a circular economy. AlFadley is also chairman of the board for the General Food Security Authority, the Saudi Irrigation Organization, and the Agricultural Development Fund, among others.

Razan Al Mubarak

• Managing Director of the Environment Agency – Abu Dhabi (EAD)

Country: U.A.E.

Al Mubarak plays a key role in guiding the U.A.E. toward a more sustainable future while spearheading environmental protection, species conservation, and climate action across West Asia and globally. She has been serving as the President of the International Union for Conservation of Nature since 2021. She also served as a UN Climate Change High-Level Champion for the leadership team of COP28. In June 2024, she was appointed as Co-Chair of the Taskforce on Nature-related Financial Disclosures. Al Mubarak led Abu Dhabi’s commitment in reducing greenhouse gas emissions by 42% by 2030.

Yasmine Fouad

• Minister of Environment

Country: Egypt

Fouad was appointed as Egypt’s Minister of Environment in 2018 to lead a transformational change by creating a more business-oriented enabling environment. Fouad led the presidential initiative “Live Green” between 20202023. In September 2024, Egypt’s Ministry of Environment, the Global Fund for Coral Reefs, USAID, and UNDP partnered to launch the Egyptian Red Sea Initiative, aiming to protect 99,899 hectares of coral reefs.

The U.A.E. took a significant step in addressing this in December 2023, when it hosted COP28, which saw several landmark agreements, including the creation of a $792 million ‘loss and damage fund,’ which was first noted on the COP agenda in 1991 but was finally signed off in Abu Dhabi on the first day of COP28. The fund—which includes $100 million from the U.A.E.—will be allocated to vulnerable countries and communities to help them deal with the repercussions of climate change and support them in building resilience.

Al Dahak explains that this commitment, while a “dream come true” for vulnerable nations, was also an acknowledgment of the importance of climate financing. “It is very high on the agenda and we know it’s high on the agenda with COP29 as well,” she adds. “That will only drive further focus from the international community on the importance of bridging the gaps we have currently.”

As she continues to find her voice within the life-changing climate conversations among the world’s most influential leaders, Al Dahak is clear that she advocates for nature-based solutions, with her foundations rooted in academia and science. “When I was in fourth grade, whenever anyone asked me what I wanted to do I would always say, I want to be a scientist. In a way, I feel like I accomplished that, and now I’m putting that scientific approach into action in a way that will serve not only the national agenda but also the international agenda,” she says.

Having studied computer science and computer engineering, Al Dahak joined the U.A.E.’s Ministry of Education, working in the care and capacitybuilding sector and innovation and entrepreneurship. During the global Covid-19 pandemic, she became the U.A.E. government’s spokesperson. She was appointed to her current role on January 6, 2024. “I’m a hybrid model,” she laughs. “I’ve got the best out of the science and the best out of the engineering and married them in a way that I don’t think the outcomes could have been better for me.”

Still, her passion for nature and science is very much at the forefront,

which clearly comes across as she highlights some of the areas in which the government is investing heavily. This includes the planting of mangrove trees in the U.A.E. and other countries, which can remove four times more CO2 from the atmosphere per hectare than tropical rainforests.

In May 2024, ground was broken on the Mohamed bin Zayed-Joko Widodo International Mangrove Research Centre on the island of Bali in Indonesia. The U.A.E. has invested $10 million in the initiative as part of a commitment to grow 100 million mangrove trees by 2030. “I believe that in nature there is an abundance of solutions, we just have to understand how they work and how we should work with them,” explains Al Dahak.” “We know that the mangrove system is one of the best nature-based solutions. We have mobilized resources and actions along with other countries to ensure that this system is rehabilitated and restored, across not only the U.A.E. but across all possible environments.”

At the BRICS meeting in August, the minister confirmed that the U.A.E. has so far invested around $50 billion in renewable energy projects across 70 countries and has committed another $50 billion over the next decade. However, while this is a clear and positive step toward a greener future, the country remains one of the world’s largest producers of oil and gas. According to the Energy Institute Statistical Review of World Energy, the U.A.E. produced 4.1% of the world’s oil in 2023, making it the eighth-biggest producer in the world.

In December 2023, COP28 President Sultan Al Jaber noted the importance of continuing to supply fossil fuels as needed while also investing in the move to renewables. “Figuring out a fair, just, equitable, responsible, and wellmanaged energy transition is essential for economic and climate progress,” he said in his closing statement. “We must meet the energy demands of our growing populations while providing access to the 800 million people that don’t have access to energy today. We must rapidly build the clean energy system of the future when we

decarbonize the system of today.”

Al Dahak explains that while the world must transition away from fossil fuels, doing so too quickly could have a detrimental impact. “We need to take into account the fact that we need to ensure that there is energy security for countries across the world. Economic development depends on that. People’s livelihoods depend on that,” she emphasizes. “We have to be practical and we have to be pragmatic, but we also have to be innovative.”

That innovative mindset includes working closely with the private sector, investing in new technology and entrepreneurship, but also incentivizing businesses to implement sustainability into their operations. Regulation plays an important role in this change, as does effective enforcement.

In August 2024, the U.A.E. issued its new Federal Decree-Law on the Reduction of Climate Change Effects, which comes into effect on May 30, 2025. The law mandates reporting and emission reduction obligations for public and private entities. Penalties for violating any provisions listed in the law can be punished by fines of a minimum of $13,600 and a maximum of $545,000.

“I think we are one of the first countries to introduce a law with consequences on businesses and sectors if they don’t implement the regulations that are required,” says Al Dahak. “You must strike a balance between incentive and firm regulations. So instead of compelling businesses to act you should also provide an effective incentive. If we can make that value add for the businesses and industries very clear and we show them the direction of the government then they will come on board by default.”

The mother of six is also keen to emphasize the importance of onboarding the education system to ensure that the next generation continues to lead the way to a greener future. While the commitments made so far have set out the intentions, all stakeholders and communities need to be empowered to take action. “We can never say enough is being done. We can always say what else can we do,” she concludes. “We have a responsibility on our shoulders to continue that leadership and ensure that the world continues moving in that direction.”

• Chairman of the Environment Authority Country: Oman

Al Amri has been the chairman of the Environment Authority in Oman since its establishment in 2020. In February 2024, he highlighted the country’s initiative to plant 10 million trees and the recent inauguration of the 500-megawatt Ibri solar power plant in line with Oman’s Vision 2040, during the UN’s Environment Assembly, held in Nairobi, Kenya. Al Amri oversaw the signing of a five-year cooperation program between the Environment Authority and the Global Green Growth Institute in September 2024 to provide access to nature-based solutions, land reclamation, and green finance.

• Minister of Environment Country: Jordan

Radaideh assumed his current role in 2021. In August 2023, the Ministry of Environment announced that Jordan’s goal to reduce its greenhouse gas emissions by 31% by 2030 requires an estimated $10.6 billion in investments. In July 2024, Jordan secured a $45 million funding grant from the Green Climate Fund for its Integrated Landscape Management Initiative project. Radaideh was previously the manager for environment, energy, and water at the Royal Hashemite Court and CEO at SEE NEXUS in Dubai, which worked on sustainable city projects.

• Minister of State for Foreign Trade Country: U.A.E.

Al Zeyoudi was appointed to his current role in July 2020 where he oversees the development of non-oil foreign trade and global trade partnerships. He is at the forefront of the U.A.E.’s economic diversification and enhancing climate investments through economic agreements with nations, most recently Australia, Chile, and India. In the first half of 2024, the U.A.E.’s non-oil trade reached $379.8 billion, an 11.2% increase compared to H1 2023. Al Zeyoudi was previously the U.A.E.’s Minister of Climate Change and Environment from 2016 to 2020. He also held roles at the Ministry of Foreign Affairs and Masdar.

• Minister of Environment and Climate Change Country: Qatar

Al Subaie was appointed as Qatar’s Minister of Environment and Climate Change in January 2024, before which he had been the Minister of Municipality since 2021. His responsibilities include implementing the National Climate Change Action Plan through climate action initiatives. In June 2024, he pointed out that the ministry has many environmental projects and strategies in place, focusing on biodiversity, and natural and terrestrial environments, along with continuing with the afforestation initiatives. Al Subaie stated that the country has designated 27% of its terrestrial area as natural reserves, along with 2% marine reserves.

Mohamed AbdAllah, CEO of Vodafone Egypt, shares insights into the company’s 25 years of success and looks ahead to a future of meaningful connectivity, digital innovation, and impressive customer experience.

In 1998, Vodafone entered the Egyptian market and began making an impact on ground. A quartercentury on, under the leadership of CEO Mohamed AbdAllah, the company continues to build on its legacy through a customer-centric strategy, technological innovation, and significant investment that enables the telecom giant to boost connectivity and enhance lives across the nation.

To date, Vodafone Egypt has invested more than $9.5 billion to connect over 48 million customers and retain its position at the forefront of technological advancement. Over the years, the company has consistently invested in network infrastructure and played a lead role in the evolution of SMS, 3G, 4G, and paving the way to 5G.

Now, as a telecom front-runner, the company is revolutionizing connectivity by enabling its customers to consume more than two billion gigabytes of data annually. This unprecedented capacity transforms how individuals and businesses connect, communicate, and interact. Furthermore, its investment approach and strategy have driven strong financial performance, with total revenues surpassing $1.5 billion in fiscal year 2024, marking a 37.2% growth year on year.

According to the CEO, Vodafone Egypt’s financial success reflects unwavering customer trust in the company and its commitment to digital innovation. Every employee at the company is part of its mission to use technology to connect for a better future.

“We constantly seek new ways to leverage digital technology to improve the quality of life for those connected and unconnected,” explains AbdAllah. The Vodafone Egypt Foundation alone has invested over $40 million in projects improving the lives of 11 million Egyptians since its establishment in 2003.

Across Vodafone Egypt’s initiatives, AbdAllah’s purpose shines through. “My journey has evolved from focusing on personal development and success to realizing a broader purpose centered around making a positive impact on the lives of those around me,” says the business leader. “Leading an organization of 10,000 employees serving over 48 million Egyptians is a humbling experience. It places me in a unique position where our impact extends beyond our

immediate circle, touching the lives of individuals nationwide.”

Through its projects and investments, Vodafone Egypt strives to uplift all socioeconomic groups by ensuring equal access to essential health and education services. Notable projects include the Universal Health Insurance scheme and collaboration with Egyptian University Hospitals, providing Egypt’s first cloud-based healthcare services. These projects currently serve over six million citizens and aim to impact another 26 million. Meanwhile, Vodafone Egypt’s Foundation offers a free educational platform, Ta3limy, which caters to more than 2.5 million beneficiaries, and its partnership with Magdi Yacoub Heart Foundation has facilitated 365 heart surgeries for children in need.

Leading an organization of 10,000 employees serving over 48 million Egyptians is a humbling experience. It places me in a unique position where our impact extends beyond our immediate circle, touching the lives of individuals nationwide.

“We envision a future where every Egyptian, irrespective of background, can thrive in a connected world,” says the chief executive. “Our commitment is to create simple, innovative products and services that make life easier and more connected for everyone.” Indeed, for AbdAllah, connectivity is critical; it facilitates Egypt’s advancement in the digital world and the functional base upon which products, services, experiences, and entire businesses can evolve and grow.

To propel connectivity to a new level, Vodafone Egypt invests in cuttingedge digital services and strives to stay ahead of customer needs, anticipating trends and demands before they arise. With AI advancing rapidly and Gen Z becoming a major customer segment, Vodafone Egypt has pioneered digital services, positioning itself as Egypt’s top entertainment hub. Vodafone Cash was launched in response to the demand for financial inclusion. Today, it is the leading e-wallet in Egypt with over 20 million users. For its part, Ana Vodafone

digital app records around 15 million active users monthly, giving them control over their customer experience.

From a business perspective, especially post-COVID, companies have recognized the need for digital solutions to maintain operations and connectivity. Vodafone Egypt has long been responding to that need by providing digital solutions and a suite of software-as-a-service products through V-Hub, Vodafone’s digital advisory platform, helping businesses, big or small, run efficiently.

As the company has evolved, so too has its CEO. AbdAllah joined Vodafone Egypt at the beginning of its journey and worked his way up to the top. “I started at a company poised to become one of Egypt’s largest, beginning in a small Maadi apartment with just 300 employees,” explains the CEO. “The startup environment offered an incredible learning experience, allowing me to innovate and collaborate with diverse professionals,” he adds. The company

initially aimed to reach 100,000 subscribers within a year but achieved the goal in just eight weeks, drawing significant attention from Vodafone’s U.K. headquarters. “This experience was transformative, helping me learn and grow rapidly,” he recalls.

AbdAllah’s own experience at Vodafone has led to his firm commitment to support colleagues and nurture talent. Vodafone Egypt’s 25 years of success have been driven by dedicated employees – a workforce he describes as a “close-knit family.” The company is inclusive, with women holding over 40% of leadership positions and comprising over 30% of its employees under 30. “This unique culture has made Vodafone Egypt the employer of choice for many prominent leaders,” says the CEO. Looking to the future, AbdAllah continues his mission to evolve Vodafone Egypt from a connectivity provider to an integrated lifestyle partner. “Our new strategy focuses on embedding ourselves into every aspect of our customers’ lives,” explains the chief executive. “We aim to be there when they connect with loved ones, consume content, make payments, and seek education or entertainment.”

For the CEO, innovation is essential for future success and delivering a seamless digital experience.

“Our respect for the needs of our customers, communities, and people guides us forward,” he says. “My goal has always been to drive positive change and inspire through leadership, believing strongly in the power of technology to enrich lives.” https://vodafone.com.eg/

From the fabulously rich to the fabulously famous, this remote patch of Montana wilderness has fewer than 900 homeowners, who are worth more than a combined $290 billion.

NOVEMBER 20–21, 2024

Hockey sticks and techtonic shifts—change happens gradually then all at once. Conventional models of leadership, business and entrepreneurship now face storms of transformations: new administrations and elections worldwide, geopolitical and trade tensions, volatile economic conditions, energy transitions, wildly accelerating tech—the list goes on. Amid this tumult, the 22 nd Forbes Global CEO Conference will gather insights from top CEOs, thought leaders, entrepreneurs and investors as they create new paradigms to move forward, survive and thrive.

For more information, please visit forbesglobalceoconference.com or email info@forbesasia.com.sg

CO-HOST SPONSORS

PRINCIPAL SPONSOR

CORPORATE SPONSORS

SUPPORTING SPONSORS

ive years ago, tech entrepreneur and Shark Tank cohost Robert Herjavec fell in love with the Yellowstone Club. Located about an hour’s drive south of Bozeman, Montana, and some 50 miles north of Yellowstone National Park, the club owns a private mountain with more skiable acres than Killington, Stowe or any other resort on the East Coast. “Amazing place for families and kids,” Herjavec raves, noting that his 6-year-old twins already ski better than his wife, Kym. The couple, who met on Dancing with the Stars, first bought a condo at the club, which is adjacent to the Big Sky ski resort, in 2019 before deciding to build their own place. They spent three years and $28 million (including furnishings) on a 13,500-squarefoot, eightbedroom dream house that features cathedral views of the Rockies. “We have lots of homes. This is our favorite,” Herjavec says. He is not alone. Herjavec is one of 885 members of the ultraswank Yellowstone Club: 15,000 mountainous acres of world-class skiing, golfing, fly fishing and horseback riding. There is a movie theater for kids, a concert venue that has hosted acts including Sting, Norah Jones and James Taylor, and even “sugar shacks” stocked with all sorts of free stuff like candy bars, snacks and hot soups sprinkled across the mountain and greens. The club’s mountain has 21 chairlifts, one gondola, 2,900 skiable acres—and no lift lines. North Carolina real estate billionaire Roy Carroll, who has a house on the same road as Herjavec, says it’s not unusual to be the only person on a run.

“They hit the sweet spot for a multigenerational destination . . . for people aged 8 to 80,” says Carroll, 61, who built a $37 million (assessed value) home there with room for future grandchildren. “I built a house we wouldn’t outgrow for 50 years.”

Perhaps the club’s biggest draw is exclusivity. Applicants need gold-plated references and must submit to a detailed background check. Membership is capped at 914 to prevent over- crowding. Admission requires buying land, a home or a condo. Even the least expensive undeveloped plot will set you back $10 million. Condos start at just under $7 million but average $15.5 million; homes cost $20 million or more. Then there’s a $500,000 refundable deposit and annual dues of $78,000, which cover unlimited skiing and golfing for your immediate family (including parents and grandchildren, but not adult siblings) plus 140 guest days a year. Almost as difficult as getting in is figuring out who else belongs. Justin Timberlake and Jessica Biel are members, as is Mark Zuckerberg. Ditto Tom Brady. Many try to keep their slice of paradise private by owning via LLCs. One knowledgeable local estimates the club has between 50 and 80 billionaire members.

had to file for bankruptcy in 2008. Boston-based real estate investment firm CrossHarbor Capital—alongside about 40 individual Yellowstone Club members—bought it out of bankruptcy in 2009 for $115 million. CrossHarbor managing partner Sam Byrne says they’ve put more than $1 billion into it over the past 15 years, and plan to keep spending more. Why not? Those early backers have already earned 4.5 times their invested capital. Says Byrne, “What we offer is not replicated anywhere.”

FROM RICHEST TO “POOREST,” HERE ARE THE FORTUNES OF 19 BILLIONAIRE MEMBERS OF THE YELLOWSTONE CLUB. THERE ARE UNDOUBTEDLY MANY MORE. Source:

The 29th edition of the UN’s Climate Change Conference is set to take place this year in Baku, Azerbaijan, from November 11 to 22. Here’s what you should know about this year’s summit.

The 29th Conference of Parties (COP29) is a gathering of world leaders, negotiators, climate activists, civil society representatives, youth, and CEOs to jointly address the challenges of climate change, assess the progress in tackling it, and discuss plans and funds for countries to transition towards clean energy. This would include actions from cutting greenhouse gas emissions to financing climate change mitigation in developing countries.

The countries that signed the UN Framework Convention on Climate Change (UNFCCC) treaty agreed in 1994 to attend this event every year, with the presidency and venue rotating among five recognized UN regions. The first UN climate conference was held in Berlin, Germany, in 1995. In 2020, the 26th meeting was postponed due to the COVID-19 outbreak.

The climate conference will kick off with the official opening on November 11, followed by the world leader’s climate action summit for two days, from November 12 to 13. In the following days, the summit will tackle discussions on finance, decarbonization, and adaptation, among many others. The overall tone is to meet the goals of the 2015 Paris Agreement and keep the 1.5°C global warming temperature limitation within reach.

The venue for this year’s conference will be the Baku Stadium. More buildings will be set up around it so that all the plenary sessions of the conference can be held on one site. Mukhtar Babayev, COP29 PresidentDesignate and Azerbaijan’s minister of Ecology and Natural Resources, said at this year’s conference, “previous promises need to be delivered, not re-interpreted and fulfilled, not re-negotiated.”

The UN climate conference will also result in new agreements and treaties, as well as review the contributions of each of the parties. Members who are also party to the Paris Agreement usually submit Nationally Determined Contributions (NDCs) or each country’s plans to reduce emissions and adapt to the impacts of climate change.

Here are some commitments that are expected to be adopted at COP29:

• Climate finance. Building on the $100 billion per year committed in 2009 by developed countries to support climate action in developing nations, a new finance goal, known as the new collective quantified goal, is set to be adopted at COP29.

• Updated NDCs. NDCs, which are submitted every five years to the UNFCCC secretariat, are climate action plans and approaches discussed by more than 50 development and implementing organizations to support countries. The next round of NDCs is due to be communicated between November 2024 and February 2025. The 2025 NDCs, with a time horizon

of 2035, are expected to determine whether the world can get on an emissions trajectory in line with the temperature target of the Paris Agreement and whether countries can build up adequate resilience to climate change.

• Biodiversity and climate. With finances and funding to be tackled in this year’s COP, an alignment of biodiversity and climate is expected. Biennial Transparency Reports (BTR) will also be assessed for publication. Under the Enhanced Transparency Framework, Parties to the Paris Agreement are required to submit BTR every two years, with the first submission due by December 31, 2024.

2023: The COP28 in Dubai, U.A.E., closed with an agreement that signals the “beginning of the end” of the fossil fuel era and the conclusion of the first global stocktake, an assessment of the world’s efforts to address climate change.

2022: The COP27 in Sharm El-Sheikh in Egypt came up with an agreement to create a fund for loss and damage for vulnerable countries dealing with climate disasters, making it a futurestanding agenda item.

2021: The COP26 in Glasgow in the U.K. ended with countries agreeing for the first time to halt the global financing for new fossil fuel projects by the end of 2022 and steer spending into clean energy instead.

MENA witnessed a surge in green bonds and sustainability sukuk issuances in the first eight months of 2024, demonstrating the growing global demand for sustainable finance. The GCC countries and their financial institutions led the charge with several milestone issuances that underlined both regional and international appetites for green and ethical investments.

Qatar’s First Green Bonds: $2.5 billion

In May, Qatar’s Ministry of Finance set a landmark by issuing its first green bonds worth $2.5 billion. Split into two tranches—$1 billion with a five-year maturity and $1.5 billion with a 10-year maturity— the bonds secured spreads of 30 and 40 basis points over U.S. Treasuries, respectively. It achieved the lowest spread ever for any bond issuer in the Middle East, Central and Eastern Europe, or Africa. With a peak subscription demand reaching over $14 billion, and a coverage ratio surpassing 5.6 times.

alrajhi bank

Sustainable Sukuks:

$2 billion

Aiming to boost liquidity for sustainability and social projects under Saudi Arabia’s Vision 2030, alrajhi bank issued the first-ever Sustainable Additional Capital (AT1) Sukuk in U.S. dollars in May, raising $1 billion at a profit rate of 6.375% annually. The issuance was heavily oversubscribed, with demand exceeding $3.5 billion. Also in March 2024, the bank issued a $1 billion U.S. dollar denominated senior unsecured sustainable Sukuk, with a fiveyear maturity and a profit rate of 5.047%.

Abu Dhabi’s clean energy giant, Masdar, raised $1 billion through a dual-tranche

green bond issuance in July, marking its second green bond launch. The $500 million tranches with fiveyear and 10-year maturities were priced at 4.875% and 5.25%, respectively, with strong regional and international demand driving an oversubscription rate of 4.6 times, and a peak subscription demand reaching $4.6 billion. Masdar plans to use the proceeds for greenfield renewable energy projects, underscoring its aggressive growth strategy in raising up to $3 billion in green bonds toward a 100GW renewable energy portfolio by 2030.

DIB’s

In February, Dubai Islamic Bank (DIB), issued its third

Sustainable Sukuk, a $1 billion five-year senior issue with a profit rate of 5.243% per year, and a spread of 95 basis points over five-Year U.S. Treasuries. The issuance oversubscribed 2.5 times, with orders exceeding $2.5 billion. The Sukuk was listed on Euronext Dublin and NASDAQ Dubai.

In March 2024, The Government of Sharjah issued a $750 million 12-year U.S. dollar-denominated 144A/Reg S senior unsecured sustainable bond. The sustainable bond attracted strong investor interest, with an order book exceeding $4 billion and international investors accounted for 67% of total demand. The bond was priced

at a spread of 195 basis points over U.S. Treasuries.

In June, Emirates Islamic, a subsidiary of Emirates NBD, issued its maiden $750 million sustainability Sukuk under its $2.5 billion Certificate Issuance Programme. With a profit rate of 5.431% annually and a spread of 100 basis points over five-year U.S. Treasuries, the Sukuk saw strong demand from global investors, as 44% of the demand came from outside the MENA region, leading to an oversubscription of 2.8 times.

In June, NBK made a groundbreaking debut in green finance with its $500 million green bond, marking Kuwait’s first green issuance. With a six-year maturity and a call date after five years, the bonds drew peak orders of $1.5 billion, reflecting a threetime oversubscription. U.S. investors accounted for 49% of the demand, followed by Middle Eastern (26%), British (18%), European (5%), and Asian investors (2%).

In August, Warba Bank listed $500 million in sustainable

trust certificates on Nasdaq Dubai, marking the first-ever sustainability Sukuk issued in Kuwait as part of the bank’s $2 billion trust certificate issuance program. The Sukuk was oversubscribed 3.6 times with the orders reaching $1.8 billion. The five-year certificates aim to fund eligible sustainable projects, aligning with international sustainability objectives. In September, the bank listed the sustainable sukuk on the London Stock Exchange as well.

AIP, a subsidiary of Aldar Properties, issued a $500 million green Sukuk in May, marking its second foray into green sukuk issuance as part of its $2 billion trust certificate issue program. With a 10-year maturity and a coupon rate of 5.5%, the issuance was oversubscribed four times, reflecting strong demand from both regional and international investors. The funds will be used to refinance existing debt and extend debt maturity.

In January 2024, QIIB became the first institution in Qatar to issue a sustainable Sukuk, raising $500 million through the sustainable “Oryx” Sukuk. The fiveyear Sukuk, part of QIIB’s $2 billion Sukuk program, attracted significant investor interest, with an order book exceeding $4 billion. The Sukuk was priced at a spread of 120 basis points above the five-year U.S. Treasury rate, with a final yield of 5.247% annually, and listed on the London Stock Exchange.

While fast fashion continues to contribute to climate change, fashion weeks around the world are championing sustainable designers.

Concerns about the textile industry as a major pollutant have rapidly entered the mainstream conversation on climate change. Fast fashion, characterized by cheaply made garments that quickly become outdated as trends shift, is often at the center of these discussions. The UN Environment Program reports that the textiles sector as a whole is responsible for nearly 8% of the global greenhouse gases and is responsible for 9% of the microplastic pollution in oceans. In response to this alarming trend, various brands and events are stepping up their efforts toward sustainability.

In Dubai, the Arab Fashion Council is spotlighting several sustainable designers at Dubai Fashion Week. Among them are Dominic Nowell-Barnes’

The Giving Movement, Eric Mathieu Ritter’s Emergency Room, and Thailand’s PIPATCHARA. Launched in Dubai in 2020, The Giving Movement uses recycled polyester, recycled crinkled nylon, waste plastic water bottles, and organic bamboo and cotton in its pieces, with $4 from each purchase given to child welfare and humanitarian aid, raising a total of $7.8 million as of June 2024. Meanwhile, founded in Beirut in 2018, all Emergency Room garments are made of upcycled materials, such as locally sourced vintage or deadstock fabric. In February 2024, Emergency Room partnered with smartphone brand Nothing for their

sustainable collection at the Dubai Fashion Week. Thailand-based accessory brand PIPATCHARA was also founded in 2018, offering 100% handmade designs such as bags crafted using plant-based materials, and recycled bottle caps.

Elsewhere in the world, Paris Fashion Week in March 2024 boasted of its own fair share of sustainable fashion designers. Stella McCartney, daughter of Beatles’ frontman Paul McCartney, showcased her eco-friendly designs at Paris Fashion Week. Her collection was made from 90% ecoresponsible materials, including vegan leather. In the same month, Marine Serre held her showcase of

upcycled clothing at Ground Control, a postal sorting center once owned by railway company SNCF, now transformed into a food hall.

In June 2024, Berlin Fashion Week (BFW) teamed up with Copenhagen Fashion Week (CPHFW) to introduce new sustainability requirements to nearly 35 brands on the official BFW. Developed by CPHFW, these standards aim to encourage fashion brands to adopt more environmentally conscious practices. While minimum standards have been in place at CPHFW for three seasons, BFW’s adoption will involve a phased implementation, with full effect expected by February 2026.

Meanwhile, in August 2024, the Mercedes-Benz Fashion Week Kuala Lumpur (MBFWKL) 2024 was themed “Re:Imagine,” to celebrate innovative designs and sustainable practices. Designers that took part included A-JANE’s and NOIZ’s Alice Chang, Ellie Lim of EL, Justin Yap, and Celest Thoi. In the same month, Amsterdam Fashion Week (AFW) announced a collaboration with Hyundai Motor Europe whereby Hyundai would support MARTAN, a fully circular brand. MARTAN upcycles waste textiles from the luxury hotel industry into ready-to-wear clothing. In turn, Hyundai will release a collection made from its latest EV model, INSTER’s seat material, a fabric created from recycled PET bottles.

Around 15% of the expected energy investments in the Middle East this year are allocated to clean energy projects, and this is expected to more than triple by 2030, according to the International Energy Agency. These are some of the green energy projects in the region that recently secured and disclosed significant investments.

Over $66 billion in agreements for Egypt’s green projects

At the Egypt-EU Investment Conference 2024 in Cairo last June, several agreements were signed for renewable energy production. Among them were four green ammonia agreements signed by the Sovereign Fund of Egypt and the Suez Canal Economic Zone, including an $11 billion deal with German’s DAI Infrastruktur GmbH for a project in East Port Said, a $4.25 billion deal with India’s Ocior Energy at Sokhna Port targeting the European market, a $3.46 billion deal with French’s Voltalia and TAQA Arabia for a project at Sokhna port, and a $14 billion deal signed between a consortium of bp, Masdar, Infinity Power, and Hassan Allam Utilities to develop green ammonia in Sokhna Port. Another agreement was signed between the General Authority for Alexandria Port and Egypt’s New and Renewable Energy Authority and a consortium led by Belgium’s DEME HYPORT

Energy to establish HYPORT Gargoub, a green hydrogen production facility located west of Matrouh. The project, requiring a total investment of $25.7 billion, will be carried out in three stages, with the first phase aiming to produce approximately 320,000 tonnes of green ammonia per year.

The General Authority for Red Sea Ports and the New and Renewable Energy Authority signed an agreement with a consortium of France’s EDF Renewables and the Egyptian-Emirati company, Zero Waste, to produce green hydrogen and its derivatives, as well as green ammonia in Ras Shukeir, Hurghada, with projected total investments of $7.5 billion. These include nearly $2.2 billion for the project’s initial phase, which has an annual production capacity of green ammonia exceeding a million tonnes.

In April 2024, Hydrom signed two green hydrogen

projects in Dhofar worth $11 billion. The first project, in collaboration with a consortium led by Electricité de France S.A., aims to produce approximately 178,000 tonnes of green hydrogen annually by 2030. The second was signed with Actis and Fortescue to produce up to 200,000 tonnes of green hydrogen annually.

In May 2024, Masdar, Infinity Power, and Hassan Allam Utilities signed a land access agreement with the Egyptian Government for a 10 GW onshore wind project valued at over $10 billion. The agreement gives the consortium access to a 3,025 km2 area of land located in West Suhag. The project, which is set to be one of the largest in the world, will generate 47,790 GWh of clean energy annually and cut Egypt’s carbon emissions by around 9% by displacing 23.8 million tonnes of carbon

dioxide each year. The initial agreement of the project was signed at COP27 in late 2022.

In June 2024, the Saudi Power Procurement Company signed power purchase agreements with a consortium of ACWA Power, the Water and Electricity Holding Company (Badeel), and Saudi Aramco Power Company for the development and operation of three new solar photovoltaic projects in Saudi Arabia- Haden, Muwayh and Al Khushaybi, with a combined value of $3.3 billion. The new solar PV facilities are expected to contribute an additional capacity of 5,500 MW of renewable energy to the national power grid once operational in the first half of 2027.

In January 2024, the renewable EPC division of India’s Larsen & Toubro’s Power Transmission & Distribution business secured an engineering, procurement, and construction contract for a 1,800 MWac solar photovoltaic plant in Dubai, with a value ranging from $1.2 billion to $1.8 billion. The plant, part of the sixth phase of the Mohammed bin Rashid Al Maktoum Solar Park, will cut carbon emissions by about 2.4 million tonnes annually.

Since COP28, which was held in the U.A.E. in December 2023, MENA has experienced a transformative shift in less than a year, with more businesses advancing their sustainability agendas.

COP28 in December 2023 marked a pivotal moment, concluding the first global stocktake of climate efforts under the Paris Agreement. Despite ongoing initiatives, global progress had remained slow across key areas, from reducing greenhouse gas emissions to building resilience against climate impacts and allowing more financial support. In response, the MENA region and other global players ramped up their commitment to sustainability.

Reflecting this increased focus, four in five executives in the region report that their companies now have a formal sustainability strategy in place, according to PwC’s Sustainability in the Middle East 2024 survey, with more than half stating that this strategy is fully integrated across their organization. The percentage of respondents citing a lack of leadership buy-in has nearly halved, dropping to just 16% in 2024.

Given that businesses in the region operate in areas increasingly impacted by rising temperatures, and in economies with national agendas focused on diversification and decarbonization, more regional CEOs (15%) identified climate change as a major concern compared to the global average (12%), according to PwC’s 2024 CEO Survey: Middle East findings. Additionally, they were more likely to view it as a key driver for corporate transformation in the next

Eight in ten companies have a formal sustainability strategy (up from 64% in 2023).

Over 50% have fully embedded their sustainability strategy across their organization.

One in two companies now have a CSO or plan to appoint one in the next 12 months.

One in three companies say a lack of internal skills and sustainability expertise remains the biggest challenge.

2.5X more companies plan to access green loans and bonds, up 20% since 2023.

Source: PwC’s Sustainability in the Middle East 2024 Survey

three years (36% versus 30%). A growing trend sees companies establishing top-level sustainability roles, with nearly half (48%) of respondents indicating that their companies now either have a Chief Sustainability Officer or plan to appoint one within the next year. Additionally, CEOs continue to lead sustainability initiatives in about one in six companies.

Another notable progress is the significant rise in the adoption of net-zero greenhouse gas emission targets. Half of the companies surveyed in the region have now committed to net zero, with an additional 26% actively working towards making such a pledge. Leading the charge are airlines like Etihad Airways, oil and gas giants such as Saudi Aramco and

ADNOC, and energy and utilities firms like Saudi’s ACWA Power and stc Group. Logistics leaders like Kuwait’s Agility are also making strides in this critical area of sustainability.

Driven by heightened transparency demands from regulators and investors, there has been a noticeable increase in sustainability reporting, with two-thirds of companies in the Middle East now producing sustainability reports or key metrics. However, 95% of investors covering Middle Eastern companies believe corporate sustainability reports contain unsupported claims, according to PwC’s 2023 Global Investor Survey. Sustainability reporting is largely voluntary in the region, with 66% of companies producing reports in the region following the

Global Reporting Initiative framework. Globally, generative AI is driving innovation and efficiency across industries, but in the Middle East, AI deployment for sustainability is still in its early stages. Most companies are using the technology to enhance capabilities like data analysis and reporting, rather than for deeper operational improvements, such as optimizing supply chains or advancing circular economy models.

A key development over the past year has been the emergence of new funding sources for sustainability efforts. While self-funding remains common, more companies are considering green loans (34%) and capital markets options like green or blue bonds (33%). This reflects broader trends, with the issuance of green bonds and sukuks in the Middle East more than doubling to $24 billion in 2023, according to PwC’s Middle East Economy Watch.

Despite half of the region’s sustainability leaders seeing cost savings as a major driver for sustainability, one in five remains uncertain about the return on investment. This concern is echoed in the PwC 2024 CEO Survey, which shows that 30% of Middle Eastern companies view inadequate returns on climate-friendly investments as a significant challenge, with only 37% willing to accept lower returns for such investments.

Ed

McLaughlin, President

and Chief Technology Officer at Mastercard, explains how technology is powering much more than just payments.

The pace at which technology is evolving all around us remains a modern-day marvel. Even small transformations can enable massive progress, significantly accelerating the rate of change. Take payments as an example. The way we pay for things is vastly different from the status quo just a few years ago.

AI, machine learning, cloud computing, tokenization, and blockchain are driving this shift. And to make sure that technology delivers impact, Mastercard is expanding and applying its vast capabilities to develop, enhance, and co-create solutions to solve a variety of problems in an everchanging environment.

The dynamic nature of the payments industry calls for eggs to be placed in different baskets, and Mastercard is doing exactly that by tapping into new payment flows. That means looking anew at how technology can further enhance acceptance, supply chains, cross-border remittances, businessto-business (B2B) payments, and small and medium enterprise (SME) resilience within multiple sectors.

Retail is one industry where technology is transforming the landscape. AI is enhancing personalization, identifying fraud quicker, and assessing risk to offer appropriate solutions. As just one example, buy now, pay later (BNPL) services offer consumers flexibility and convenience through affordable installments.

Another area where Mastercard sees expanded opportunity is the

transformation of B2B payments. Traditional methods are often slow and inefficient, and Mastercard is modernizing this process by providing digital invoices, automated reconciliation, and swift cross-border payments.

A case in point is the cobranded Dubai Ports World Trade Card launch with ENBD Bank. This Business Credit Mastercard® is designed to transform how SMEs handle their operations. With this card, they can easily access credit lines for port charges associated with container shipments. Meanwhile, the issuance of SME cards in partnership with Boost is making a difference in digital ordering across Nigeria, Kenya, Ghana, Egypt, and South Africa.

In another development, HSBC has deployed the Mastercard Wholesale Program in the Middle

East for the first time. The solution has been designed for and with the travel industry, addressing the lack of visibility, control, and protection associated with manual payment methods. By leveraging virtual cards to digitize the way travel organizations pay each other for each element of a consumer’s trip, the collaboration will boost liquidity and enhance security across the value chain.

Making it simple to send and receive money internationally is one of technology’s greatest feats. As part of a major regionwide partnership, Mastercard is supporting e& as it continues to expand its financial services ecosystem by integrating digital payment services and tools into people’s day-to-day lives. One outcome is providing wallet users with a safe and simple remittance payment option.

There is an inherent thrill in what technology can, or will, be able to do. Yet in equal measure, Mastercard is motivated by the need to encourage investment, talent, compliance, and policies that promote interoperability and inclusion – and to meet the consumer needs unique to each region.

By Javier Paz and Steven Ehrlich

Coinbase’s BRIAN ARMSTRONG created one of crypto’s central players, a fee-gushing monster that currently holds more than a tenth of all the Bitcoin ever minted. But now, in the cause of “decentralization,” he’s making a risky pivot. It’s easy to be an idealist when you’re a billionaire.

W“We’re at a really exciting moment for crypto,” enthuses Brian Armstrong, chief executive and cofounder of Coinbase, the largest publicly traded cryptocurrency exchange in the world. “There is a shift happening from crypto being primarily an asset class that people want to trade to speculate on to it becoming more and more used for daily utility,” he insists. “Four hundred million people or so have used crypto globally.”

That’s debatable. When it comes to crypto, most people care about prices, and those have been on a tear lately. Bitcoin has more than doubled in the last year to around $58,000. More than 20 crypto ETFs holding $54 billion in digital assets are trading in the U.S. Crypto is more widely held than ever and has become an important topic in the presidential election. With Binance CEO Changpeng Zhao and FTX’s Sam Bankman-Fried now both in prison, Armstrong has emerged as the movement’s most prominent spokesperson.

Given that Coinbase’s stock mirrors trading in Bitcoin, Armstrong is a billionaire seven times over at age 41. The cryptocurrency exchange he cofounded 12 years ago to become the “Gmail for

Bitcoin” has a market capitalization of $40 billion and crypto assets under its custody of $270 billion. That includes holding more than $20 billion for BlackRock ($10 trillion in assets under management), now the world’s largest crypto ETF provider. In 2023, the company, which makes around half of its money from trading fees, netted $95 million on revenue of $3.1 billion. This year is on track to be much better: In the first six months of 2024, Coinbase’s revenue amounted to $3.1 billion but net income soared to $1.2 billion.

If there were such a thing as a “Too Big to Fail” institution in the world of digital assets, Coinbase would be it. Just in terms of Bitcoin, Coinbase has custody of 11% of all tokens in existence. For crypto’s second-most important currency, Ether, its share is even larger at an estimated 14% of all tokens. If Coinbase imploded, the consequences could be catastrophic.

Not everyone is a fan. In June 2023, the Securities and Exchange Commission sued Coinbase for acting as an unregistered exchange, broker-dealer and clearing firm—all activities it engages in for more than 14,500 institutions, as well as 8 million active retail customers. The case is likely to go to trial in 2025.

Crypto evangelists hate the idea of centralized power, but operationally, Coinbase is more similar to other command-and-control financial institutions like JPMorgan than it is to something like an employee-owned credit union. Its main businesses are trading, custody and co-managing (with Circle) a huge ($35 billion) stablecoin operation that pegs the value of the USDC token to the U.S. dollar. Coinbase’s dominant position allows it to charge high fees. Purchasing $5,000 of Bitcoin on the exchange will cost you $90. On Kraken it costs $20, and on Robinhood it’s free.

But Armstrong is a crypto idealist, and he isn’t entirely happy with this state of affairs. He wants to disrupt his money machine, creating a whole new infrastructure for rapid-fire transactions, which will not only lower fees but also weaken the control of big tech and financial firms.

“The whole reason I got into this and the mission of Coinbase is around increasing economic freedom in the world,” he says. “The vision here is that crypto is going to power more and more of global GDP. [It will] create sound money, sound financial infrastructure for people all over the world with lower fees, lower friction.”

The key element in Armstrong’s latest corporate push is Base, which launched in August 2023. Base is a so-called Layer 2 platform. Instead of being a self-sufficient

By William Baldwin

Money that folds is going out of style. You can participate in its digital successors by buying into the volatile earnings stream of a crypto exchange or a Bitcoin miner. Or you could settle for a business in a more mundane line of work. Who’s servicing the credit card reader at a shoe store? That might be Global Payments, which trades at 19 times the earnings that Value Line expects this year. Contrast this company with Block, which is, with its Square payment processing, in the same line of work, but which also has an exciting sideline speculating in, and helping consumers speculate in, Bitcoin. Maybe you don’t need the excitement.

William Baldwin is Forbes’ Investment Strategies columnist.

blockchain like Bitcoin, Ethereum and Solana, it is designed to improve upon Ethereum by potentially processing thousands of transactions per second, costing less than a cent each. Ethereum can handle only about a dozen transactions per second, each costing an average of $1. It’s a huge improvement, but still far less than existing financial networks. Visa’s global processing network, VisaNet, can handle 65,000 transactions a second.

Armstrong would like his low-cost Base to be interoperable with other Ethereum-based blockchains and support decentralized versions of Facebook, YouTube, Google, Uber and X. He’s also onboarding merchants ranging from Anheuser-Busch to Wharton business school using his Coinbase Commerce service, taking aim at the likes of PayPal, Mastercard and Visa, which charge fees as high as 3% per transaction. Coinbase Commerce charges only 1%. But consumer adoption has been slow. The network processes fewer than 2,000 transactions daily. Visa does that many every second.

“Some of these businesses might have only 5% margins, and 2% of it is going to the card network,” Armstrong says. “There’s no reason it needs to be this way. It’s an unnecessary tax on the economy.”

According to Oppenheimer analyst Owen Lau, Base’s estimated 1 million active users are expected to contribute $100 million to Coinbase’s revenue in 2024. Most of that is from trading fees (this is crypto, after all).

Ironically, if Coinbase is going to be even more successful with Base, it will have to give up control—and share fees. Coinbase is currently Base’s only “sequencer,” crypto jargon for operator or supervisor. To become decentralized, Base will require more sequencers. If Base had four sequencers, Coinbase might earn only 25% of the total fees.

Talk of lower fees and revenue dilution may not win Coinbase long-term fans on Wall Street. In the short term, shareholders don’t seem to mind. Shares of Coinbase have nearly doubled in the last 12 months. As long as the price of crypto keeps soaring—and the geeks keep trading it— Armstrong can spout as much idealistic claptrap as he wants.

FINAL THOUGHT

“THE REAL TRICK IN HIGHLY RELIABLE SYSTEMS IS SOMEHOW TO ACHIEVE SIMULTANEOUS CENTRALIZATION AND DECENTRALIZATION.”

—Karl E. Weick

THE LIST THE RICHEST PEOPLE IN AMERICA

THE 400 RICHEST PEOPLE IN AMERICA are having a rollicking time in the roaring 2020s. In all, they are worth a record $5.4 trillion, up nearly $1 trillion from last year. A dozen have $100 billion–plus fortunes, also a record. And admission to this elite club is pricier than ever: A minimum net worth of $3.3 billion is required, up $400 million since 2023. Despite the high bar, 23 newcomers managed to break into the ranks, having grown their fortunes in everything from mundane plastic pipes to cutting-edge artificial intelligence.

ILLUSTRATION BY JAYA NICELY FOR FORBES

$244 billion • SELF-MADE SCORE:

SOURCE: Tesla, SpaceX

AGE: 53 • RESIDENCE: Austin, TX

PHILANTHROPY SCORE: ♥

Tesla’s self-proclaimed “technoking” tops The Forbes 400 for the third straight year, despite losing $7 billion as shares of his electric vehicle maker fell 14% and a Delaware judge voided $56 billion of his stock options in January. In May, Musk’s new AI startup, xAI, raised $6 billion at a $24 billion valuation. A month later, his rocket maker, SpaceX, launched a tender offer valuing the company at around $210 billion, up from nearly $180 billion. In an X post seen by 220 million, Musk endorsed Donald Trump within an hour of the assas sination attempt on the former president. Trump now vows to name Musk to a new government efficiency commission if elected.

$197 billion • SELF-MADE SCORE:

SOURCE: Amazon

AGE: 60 • RESIDENCE: Miami, FL

PHILANTHROPY SCORE: ♥♥

Since last summer, Bezos has snapped up three homes on Miami’s “billionaire bunker” island for $234 million. He has the cash: Since moving to tax-friendly Florida last November, the Amazon founder has offloaded more than $8 billion (pretax) of his shares; he still owns 9% of the e-commerce Leviathan, whose stock is up 29%. The Bezos Earth Fund, through which he has given $2 billion of a $10 billion pledge, will hand out up to $100 million to winners of an AI for Climate and Nature challenge beginning later this year.

$181 billion • SELF-MADE SCORE:

SOURCE: Facebook

AGE: 40 • RESIDENCE: Palo Alto, CA

PHILANTHROPY SCORE: ♥♥

No one got richer over the past year, in sheer dollar terms, than Zuck. He’s $75 billion wealthier, and ranks five spots higher, following a 75% runup in Meta Platforms stock. Revenue has been growing more than 20% per quarter, and the social media giant repurchased $31 billion of its shares over the past year. Zuckerberg, who turned 40 in May, has taken on a new look, sporting a gold chain, letting his wavy hair grow out and ditching his uniform hoodie for a shearling jacket. He also surprised his wife, Priscilla, with a seven-foottall statue in her likeness.

13. JIM WALTON & FAMILY

$95.9 billion

• SELF-MADE SCORE:

$175 billion • SELF-MADE SCORE:

SOURCE: Walmart

$47.6 billion

• SELF-MADE SCORE:

SOURCE: Candy, pet food

22. KEN GRIFFIN

$43 billion • SELF-MADE SCORE:

SOURCE: Hedge funds

SOURCE: Oracle

AGE: 76 • RESIDENCE: Bentonville, AR

PHILANTHROPY SCORE: ♥♥

AGE: 80 • RESIDENCE: Woodside, CA

AGE: 84 • RESIDENCE: The Plains, VA

PHILANTHROPY SCORE: N/A

AGE: 55 • RESIDENCE: Miami, FL

PHILANTHROPY SCORE: ♥♥♥

PHILANTHROPY SCORE: ♥

14. ROB WALTON & FAMILY

$94.3 billion

SOURCE: Walmart

• SELF-MADE SCORE:

AGE: 79 • RESIDENCE: Bentonville, AR

PHILANTHROPY SCORE: ♥

15. ALICE WALTON

$89.2 billion

• SELF-MADE SCORE:

SOURCE: Walmart

AGE: 74 • RESIDENCE: Fort Worth, TX

PHILANTHROPY SCORE: ♥♥

It was another banner year for the Oracle cofounder, chief technology officer and more than 40% shareholder, with the software firm’s shares up 12% to record highs. He’s spending accordingly: Ellison splashed out nearly $300 million on a Florida resort in August, adding to his $2 billion–plus real estate portfolio. He also plans to invest a reported $6 billion into the on-again-offagain merger between Paramount Global and Skydance, his son David’s media production company.

$150 billion • SELF-MADE SCORE:

SOURCE: Berkshire Hathaway

AGE: 94 • RESIDENCE: Omaha, NE

PHILANTHROPY SCORE: ♥♥♥♥♥

Rob Walton retired from Walmart’s board in June after more than four decades as a director of the firm his father Sam Walton (d. 1992) cofounded in 1962. He and his siblings’ estimated 35% stake in the retail giant is worth more than ever as shoppers flock to Walmart’s “Every Day Low Price” strategy to escape high inflation, driving both its revenue and shares to all-time highs. Jim still chairs the family’s $26 billion (assets) Arvest Bank Group. Alice, the richest woman in America for the ninth time in 10 years, reclaimed the title of the world’s wealthiest woman in early September from L’Oréal heiress Françoise Bettencourt Meyers of France for the first time since May 2022.

16. JULIA KOCH & FAMILY

$74.2 billion

• SELF-MADE SCORE:

SOURCE: Koch, Inc.

19. JOHN MARS

$47.6 billion

• SELF-MADE SCORE:

SOURCE: Candy, pet food

AGE: 88 • RESIDENCE: Jackson, WY

PHILANTHROPY SCORE: N/A

In August, their Mars Inc. announced it’s gobbling up snack and cereal maker Kellanova (formerly Kellogg’s) for $35.9 billion. The deal will put brands like Pringles, Pop-Tarts and Froot Loops under the Mars umbrella alongside Snickers, M&M’s and Kind bars. It’s the company’s biggest acquisition since it bought Wrigley in 2008 for $23 billion. The Mars siblings own an estimated twothirds of the $50 billion (2023 revenue) business but have no role in daily operations.

21. STEPHEN SCHWARZMAN

$43.6 billion • SELF-MADE SCORE:

SOURCE: Investments

Griffin’s hedge fund, Citadel, the most profitable of all time, raked in $8.1 billion in trading profits last year. Since then, Griffin, never one to leave money idle, has donated $50 million to the University of Miami, dropped $45 million on a Stegosaurus skeleton (a record price in the dinosaur auction business) and shelled out more than $90 million for an estate in Saint-Tropez, France.

23. THOMAS PETERFFY

$40 billion • SELF-MADE SCORE:

SOURCE: Discount brokerage

AGE: 80 • RESIDENCE: Palm Beach, FL

PHILANTHROPY SCORE: ♥

More than seven decades in, the investing legend is staying plenty busy. In August, Berkshire Hathaway became America’s first non-tech company to hit $1 trillion in market capitalization. In June, Buffett—the nation’s greatest philanthropist, with some $60 billion in lifetime giving—donated $5.3 billion of Berkshire stock, with a twist: He clarified that the vast majority of his remaining fortune will go to a charitable trust run by his three children, instead of the Gates Foundation, as was previously assumed.

AGE: 77 • RESIDENCE: New York, NY

PHILANTHROPY SCORE: ♥♥

AGE: 62 • RESIDENCE: New York, NY

PHILANTHROPY SCORE: ♥♥

17. CHARLES KOCH & FAMILY

$67.5 billion

• SELF-MADE SCORE:

$136 billion • SELF-MADE SCORE:

SOURCE: Koch, Inc.

SOURCE: Google

AGE: 88 • RESIDENCE: Wichita, KS

PHILANTHROPY SCORE: ♥♥

AGE: 51 • RESIDENCE: Palo Alto, CA

PHILANTHROPY SCORE: ♥

$130 billion • SELF-MADE SCORE:

SOURCE: Google

AGE: 51 • RESIDENCE: Los Altos, CA

PHILANTHROPY SCORE: ♥♥

In June, Koch Industries became Koch, Inc., as Charles rebranded the increasingly techfocused $125 billion (revenue) conglomerate for the first time since taking over the family firm after his father’s 1967 death. Julia Koch, the widow of his brother David (d. 2019), and her three children paid nearly $700 million that same month for 15% of BSE Global, which owns the NBA’s Brooklyn Nets and the WNBA’s New York Liberty and operates the Barclays Center in Brooklyn.

18. JEFF YASS

$49.6 billion • SELF-MADE SCORE:

SOURCE: Trading, investments

AGE: 66 • RESIDENCE: Haverford, PA

PHILANTHROPY SCORE: ♥

A federal judge ruled in August that Page and Brin’s Google acted illegally to maintain a monopoly in online search, which is responsible for 57% of parent company Alphabet’s sales. (The tech giant reportedly plans to appeal.) Shares hit an all-time high in July thanks to Google’s continued push into generative AI and cloud services, including a partnership with Oracle, before slipping in recent months.

$123 billion • SELF-MADE SCORE:

SOURCE: Microsoft

AGE: 68 • RESIDENCE: Hunts Point, WA

PHILANTHROPY SCORE: ♥♥

“Damn, I’m fired up!” exclaimed Ballmer in August at the grand opening of his Los Angeles Clippers’ new 18,000-seat Intuit Dome stadium, which boasts a 38,000-square-foot circular scoreboard. He bought the Clippers a decade

Yass’ fortune nearly doubled after Forbes revalued his trading firm, Susquehanna International Group—and Yass’ share of profits—based on tax returns leaked to ProPublica. With a potential TikTok ban threatening Susquehanna’s estimated 15% stake in the social media app, Yass has made nearly $70 million of federal political contributions during the 2024 election cycle, including $20.5 million to the Club for Growth Action, a conservative super PAC that has publicly opposed the TikTok ban (but denies having been influenced by Yass).

In August, Schwarzman and his wife announced plans to open their Miramar estate in Newport, Rhode Island, to the public as a museum upon their deaths. They spent $27 million on the Gilded Age mansion in 2021 and have been restoring it ever since. In May, Schwarzman, the cofounder and CEO of $1 trillion (assets) investment firm Blackstone, announced he’s backing Trump for president, two years after vowing to support someone else in 2024.