2 minute read

I 3 Green Investment Initiatives Launched By Billionaires In 2022

Billionaires

Advertisement

Billionaires such as Bill Gates, Mackenzie Scott, and Warren Buffett are well known for their philanthropic and environmental initiatives, but they are not the only ultra-rich people supporting the climate change cause. Here are three green impact investment initiatives announced by billionaires in 2022. Net worths are as of October 14, 2022.

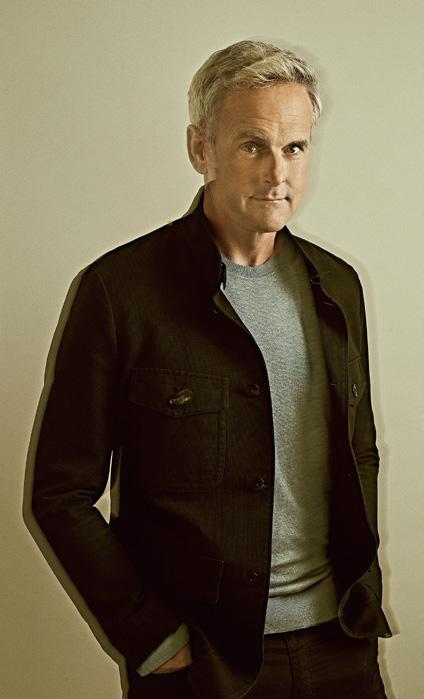

Hayes Barnard Cofounder, Chairman and CEO of GoodLeap • Gautam Adani

Founder and Chairman of Adani Group Net worth: $128 billion Initiative: Energy Transition Adani plans to invest over $100 billion in the next decade, with 70% of this investment allocated to the energy transition. In addition to the Adani Group’s current 20 GW renewables portfolio, the new business will be boosted by another 45 GW of hybrid renewable power generation spread over 100,000 hectares of land—an area 1.4 times that of Singapore. It also plans to commercialize three million metric tons of green hydrogen. In June 2022, the group—which owns Abbot Point Terminal, a controversial coal mining project in Australia—agreed with TotalEnergies to jointly create the world’s largest green hydrogen ecosystem.

• Mukesh Ambani

Founder and Chairman of Reliance Industries Net worth: $85 billion Initiative: Reliance’s Green Transformation Ambani plans to develop end-to-end green energy solutions that can be exported to other countries. In the 2021/22 financial year, Ambani founded the Reliance New Energy Council and announced a $10 billion commitment over three years to clean energy investment. Reliance Industries is also investing in creating an ecosystem of small and medium-scale project consultants and installers pan-India to set up Green Energy generation projects. In January 2022, the group signed an MoU with the government of Gujarat state to invest nearly $80 billion in green projects and other projects in the state over 10 to 15 years.

• Hayes Barnard

Cofounder, Chairman and CEO of GoodLeap Net worth: $4 billion Initiative: Bring Solar Power To U.S. Homeowners Barnard is facilitating financing solar installations for ordinary homeowners, enabling them to pay the cost over 25 years with their monthly utility bill savings. In September 2022, GoodLeap announced that $493 million in loans had been securitized, with an average yield of 5.4% and riskier tranches as high as 8.8%. The overall default rate so far is below 0.8%—less than half the 2% default rate on mortgages. GoodLeap has transacted over $18 billion in loans on its platform since 2018.