6 minute read

EXECUTING AN EVOLUTION

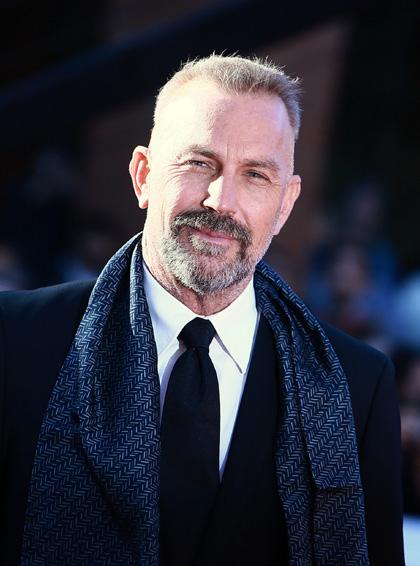

Tarek Hosni, CEO of family-owned Saudi pharmaceuticals giant Jamjoom Pharma, led the company through an IPO in June 2023—the largest the kingdom has seen so far this year. Now he’s looking at new product growth to make the company an international name.

BY JASON LASRADO

On June 20, 2023, Jamjoom Pharmaceuticals Factory (Jamjoom Pharma) debuted on the Saudi exchange, selling 21 million shares, or 30% of its issued share capital. With an offer price of $16, on the first day of trading the company’s share price rose by 30%, closing the day at $20.8. As of July 17, the stock was trading at $33.9, making the offering the Saudi exchange’s largest IPO so far this year and one of its most successful debuts ever. It was an understandably proud moment for Tarek Hosni, CEO of Jamjoom Pharma. The company was valued at $2.4 billion as of July 19. When Jamjoom Pharma applied for the IPO in February 2022, the Saudi Markets were booming. In April 2022, the Tadawul All Share Index (TASI) was above 13,700 points, more than doubling in the two years since March 2020. However, between the application and approval of the IPO in December 2022, the Saudi markets reversed sharply, with the TASI falling to just under 10,100 points. The market then trended sideways over the following three months as the world faced a war in Europe, high inflation, and fears of a global recession.

All in all, it was not the best time for an IPO, but Hosni brought in the Saudi Economic and Development Holding Company (SEDCO) and the Al Faisaliah Group Holding Company as cornerstone investors. Together, the companies subscribed to 5,166,666 shares at the offer price, representing 24.6% of the offer shares and 7.4% of the company’s issued share capital. In the end, Jamjoon Pharma’s IPO was oversubscribed 88.8 times (excluding the shares that were allocated to cornerstone investors) and received great interest among institutional investors in Saudi Arabia and internationally. “The Jamjoom Pharma IPO was a consequential IPO for the Saudi equity capital markets. The IPO has set many precedents for the Saudi main market, being the largest IPO of 2023 following a six-month drought, the largest IPO of a pharmaceutical company, and the first IPO to include cornerstone investor tranche,” says Amir Riad, Head Of Investment Banking at Saudi Fransi Capital, who advised on the deal.

Fadi AlAwami, Financial Advisor and Founder of The Consultation Center, explains that IPOs go a long way in making a country attractive for business. “IPOs are an important factor to measure a country’s economy in terms of creating investment opportunities and to help companies to increase their capital,” he adds. But while Jamjoom Pharma went public to raise capital, the more vital goal was to instill best practices to become a global player. “Raising money was not even 20-30% of our objective. The key was governance,” explains the CEO. Hosni was the right person for the task. Before joining Jamjoon Pharma in 2021, he spent his entire career with two big pharma global players, spending over 30 years working at GlaxoSmithKline and Pfizer.

A pharmacist by training, Hosni started his career with SmithKline & French (now GSK) as a medical representative in Saudi Arabia. He then moved to the U.K. with the company, where he lived for five years and moved into management roles. By 1998, he was head of marketing and commercial for GSK in the Middle East, Africa, Pakistan, and Turkey. In 2001, he moved back to his home country of Egypt as the commercial director of Egypt and Sudan until 2004, when he moved to the U.A.E. to become regional head of marketing for Wyeth (now Pfizer).

In 2006, Hosni moved to Saudi Arabia as general manager of the Jeddah governorate for Wyeth and nearly tripled its revenue from $60 million in 2006 to $170 million in 2009. When Pfizer acquired Wyeth that year, he moved again, this time to the U.A.E. as regional president for nutrition in Africa and the Middle East, where he increased revenues from $150 million in 2009 to $271 million in 2017. By the time Hosni left Pfizer in 2018, he was leading a billion-dollar business, making it the best-performing big pharma company in the region.

While heading Pfizer’s middle eastern business, Hosni was looking to strike partnerships and alliances in the two biggest markets in the Middle East and

Africa, namely South Africa and Saudi Arabia. It was through this that he first met the Jamjoom family. In 2020, he was contacted about taking the role of CEO at Jamjoom Pharma, but he was initially reluctant to join, having spent over three decades in big pharma. However, once the owners shared their vision for the company, it piqued his interest. “I always admired some of the other examples where domestic companies became strong regional players and then became international,” he explains.

Hosni joined Jamjoom Pharma in April 2021. His task right from the beginning was to make changes with the intention of going public. He set about putting the right people and processes in place and increasing transparency, reviewing the strategy of the company in order for it to be more appealing to shareholders. “I really enjoyed every moment, you don’t get an opportunity like this to transform, perform, change the structure, go for IPO, and we have done this in a very short time,” he adds, recalling the journey.

Jamjoom Pharma’s history goes back to 1957 when a group of brothers from the Jamjoom family entered the pharmaceutical distribution sector through an acquisition led by Yousuf Mohammed Salah Jamjoom. At that time, the company was known as Jamjoom Medical Store, which evolved into one of the country’s largest pharmaceutical distributors under a holding company called Abdullatif Mohammed Salah Jamjoom and Brothers, with partnerships with pharmaceutical giants like Pfizer and Allergan. As the pharmaceutical market in Saudi Arabia started to expand in the early 1990s, Yousuf Jamjoom identified an opportunity to localize pharmaceutical manufacturing capabilities. Yousuf, together with his son Mahmoud, decided to create a state-of-theart manufacturing facility using the latest technology. This led to the establishment of Jamjoom Pharmaceuticals Factory Company. The company started production and commercial operations in 2000. In 2002, it began exporting products outside Saudi Arabia to Bahrain.

Since then, the company has focused on international expansion and innovation. By 2010, Jamjoom products were available in more than 15 countries. By 2015, the company’s annual manufacturing capacity had reached 90 million units, and the following year it established the largest pharma R&D capacity facility in Saudi Arabia.

In 2022, Jamjoon Pharma recorded sales of $244 million, making it a market leader in Saudi Arabia, Egypt, Iraq, and the U.A.E. Today, its primary operating production facility is a 46,500-square-meter state-ofthe-art manufacturing plant in Jeddah, with a production capacity of 113 million units per year. It has a direct and indirect presence in 36 countries in the Middle East and Africa.

The company’s main markets are poised to grow. With over 500 hospitals and 75,000 beds, Saudi Arabia’s public expenditure on healthcare grew to an estimated $50 billion in 2022. This, combined with mandatory health insurance for all private sector employees and their families, is encouraging growth in consumer expenditure on health products and medical services, which hit $7.2 billion last year.

Saudi Arabia currently imports the majority of its pharmaceutical products from the U.S., Europe, China, and India, but as part of its Vision 2030, it aims to achieve 40% of total pharma consumption to come from local production. The kingdom has been actively facilitating technology and research-driven partnerships with global manufacturers such as AstraZeneca, Pfizer and an MoU with GlaxoSmithKline. This, combined with portfolio expansion by existing local manufacturers, resulted in the contribution of local products to the overall pharmaceutical market growing from 30% in 2018 to 36% in 2021. This has encouraged companies like Jamjoom to actively capitalize on the push for localization in expanding its portfolio in both existing and new product lines.

For example, in 2015 and 2019, it launched two new consumer health products, JP Vitamin D3 and Prima D3, after research showed that 80% of Saudi’s adult population was suffering from some form of vitamin D deficiency and over 45% of the market was dominated by liquid products, which are less effective than solid-dose alternatives. The company created a formula for an alternative soft-gel product with a better absorption and stability rate and launched a full suite of vitamin D products, helping it to capture a 40% market share in this category by 2021.

Jamjoom Pharma has over 90 scientists and Ph.D. graduates in its R&D team. Between January 2019 and May 2023, it had over 400 new products approved, with a bioequivalence success rate of 94%. It launched 17 new products in 2021 and has 72 new products in the pipeline, 64% of which have either been submitted for approval to the SFDA or are close to submission. New products contributed 4%, 8%, and 18% to the company’s total revenues in 2019, 2020 and 2021, respectively.

“Being able to participate in the healthcare revolution that is expanding across the globe is essential for counties that aim to provide top-notch therapies,” emphasizes John D. Philips, Director of Research & Innovation at the Abu Dhabi Stem Cells Center. “Capitalizing on this locally gives universities, healthcare organizations, and businesses a platform from which to make exciting discoveries that lead to treatments, drugs, and devices that will be used globally.”

Looking ahead, and Hosni now plans to make Jamjoon Pharma the leading pharma manufacturer in the Middle East and Africa by 2026. “Many of the names you define as big pharma started off as family businesses; some of them still are,” he says. “I would like to see this company evolving in its journey to become a real significant regional player and then evolve to a multinational international player.”