BISWAS

Stay connected with our latest business news. UAE AED 15 SAUDI ARABIA SAR 15 BAHRAIN BHD 1.5 KUWAIT KWD 1.25 OMAN OMR 1.5 QATAR QAR 15 OTHERS $4 DECEMBER 2022 ISSUE 123 WORLD’S TOP 5 TECH INVESTORS 2022 THE GROWTH OF GIVING IN THE GCC WORLD’S 5 RICHEST INVESTMENT BILLIONAIRES TOP VC-FUNDED INDUSTRIES WORLD’S TOP 5 UNICORNS DECEMBER 2022 ISSUE 123

“COMPLEXITY IS ACTUALLY CREATING THE COMPETITIVE EDGE. THAT IS WHAT IS HELPING US TO SCALE.” THE 50 MOST-FUNDED STARTUPS IN MENA RAISED A TOTAL OF $3.2 BILLION IN 2022. MEET THE ENTREPRENEURS INSPIRING INVESTORS. MENA’S TOP 50 MOST-FUNDED STARTUPS

GAURAV

Founder and CEO of TruKKer

8 I Sidelines

Powered By Entrepreneurs

By Claudine Coletti

12 I World’s Top 5 Tech Investors 2022

Meet the top five listees from Forbes’ Midas List 2022, featuring the world’s leading tech investors.

By Jamila Gandhi

14 I The Growth Of Giving In The GCC

According to a report by LGT, the international Private Banking and Asset Management Group, philanthropy in the GCC area has grown over the last ten years to hit an estimated $210 billion annually, in part driven by an increase in the number of business leaders committing to philanthropic practices.

By Rawan Hassan

STARTUPS

16 I World’s Top 5 Unicorns

There are approximately 1,191 unicorns—a privately-owned firm valued at more than $1 billion—worldwide, worth a collective $3.9 trillion, according to estimates from CB Insights. Here are the world’s top five. Figures are as of October 2022.

By Hagar Omran

18 I Top VC-Funded Industries

These five industries have attracted the most funding from VCs worldwide in 2022, in terms of deals count over the past five years, according to Statista. Here we take a look at how they’re growing.

By Munawar Shariff

22 I In Numbers: MENA’s Gender Gap

In Startup Funding

Investments in MENA startups hit $2.4 billion in the first nine months of 2022, but less than 2% of this was invested in startups solely founded by women, according to a report by Wamda, TiE Dubai, and TiE Women. Here’s a look at other insights from the report, which was based on responses from 125 female founders in MENA.

By Samar Khouri

BILLIONAIRES

24 I World’s 5 Richest Investment Billionaires

Here are the richest five people in the world who built their fortunes from investing, according to Forbes. All five reside in the U.S. and are self-made billionaires. Net worths are as of November 11, 2022.

By Jamila Gandhi

28 I Seizing Opportunities

Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group, is poised to gain ground as new windows open for the private sector in Saudi Arabia.

By Nermeen Abbas

By Nermeen Abbas

34 I Back To Business

William E. Heinecke, billionaire Founder and Chairman of global hospitality group Minor International, sees plenty of reason for optimism in the travel markets. As his hotel company moves forward with a raft of Middle East openings, he’s betting on a steady and profitable period ahead.

By Claudine Coletti

By Claudine Coletti

100 I Thoughts On Inspiration

DECEMBER 2022 FORBESMIDDLEEAST.COM 2 CONTENTS 34 28

LEADERBOARDS MONEY

FEATURE

INTRODUCING THREE NEW COMPANIES THAT WILL BUILD THE FUTURE.

DECEMBER 2022 FORBESMIDDLEEAST.COM 3

THESE PLANS MAY BE SUBJECT TO THE OUTCOME OF LEGALLY MANDATED CONSULTATION IN SOME PARTS OF THE WORLD.

MENA’S TOP 50 MOST-FUNDED STARTUPS

58

Riding High

Noureddine Tayebi, Founder and CEO of North Africanbased multi-sided marketplace Yassir, scratched the surface of an untapped market when he launched the company five years ago. The startup now has the upper hand in the Maghreb region, backed by $193.25 million in funding.

By Hagar Omran

By Hagar Omran

64

Backing Buyers

Jad Antoun, Cofounder and CEO of Huspy, has raised $45 million in less than three years for his end-to-end propertybuying tech startup. With three new acquisitions under his belt, he’s now looking to Europe for expansion.

By Jason Lasrado

By Jason Lasrado

DECEMBER 2022 FORBESMIDDLEEAST.COM 4 CONTENTS

DECEMBER 2022 FORBESMIDDLEEAST.COM 13 - 15 FEBRUARY 2023 Madinat Jumeirah, Dubai, United Arab Emirates

Over six years, Gaurav Biswas, founder and CEO of TruKKer, has raised over $203 million in funding for the truck aggregator and expanded it across the Middle East. Now it’s time to plan for an IPO.

By Samar Khouri

By Samar Khouri

DECEMBER 2022 FORBESMIDDLEEAST.COM 6 December 2022 Issue 123 CONTENTS •

•

INSIDE

On Course 50 COVER STORY

SIDELINES

Powered By Entrepreneurs

Well, I feel like I say this every year, but what a year it has been. Global challenges have once more tested the resolve and resilience of business leaders old and new, but while they have had to adapt and watch out for unexpected bumps in the road, they have also managed to find opportunities and embrace change. This happens every year because that is the nature of the world we live in and the cycle of business—and the ability to innovate, survive, and thrive among it is a core element of the entrepreneurial spirit that we celebrate. We highlight that spirit to the max in our last issue of 2022.

This month we bring you the most-funded startups of the year in MENA, which have attracted a total of over $3.2 billion in capital from investors in 2022. Despite a bumpy global economy, these young companies have seen a slight increase in investor interest—in 2021, as markets recovered from the pandemic, the 50 most funded brought in $3 billion. Of course, just because they’ve attracted funding doesn’t mean they’re future-proof— it’s a well-known fact that most startups fail, and the Middle East has witnessed some big names fall this year. But those in this month’s list have convinced venture capitalists that they have staying power. Time will tell.

Last month we had the pleasure of meeting and getting to know many such young business leaders at our jam-packed and incredibly fun Under 30 Summit, which we held for the first time at the end of November in El Gouna in Egypt. We welcomed a roster of the most amazing speakers – from celebrities to doctors, artists to entrepreneurs, big business leaders, and under30 listers. It was diverse, insightful, and full of energy for the whole three days.

The summit celebrated a number of things. Yes, the spotlight was on the achievers from our 30 Under 30 lists, the latest of which we published in October for the fifth consecutive year. But it was also a hotbed for entrepreneurial ideas and discussions. One of the many things the event provided was a platform for conversations, introductions, debates—and yes, I’m sure pitches—that happened across the campus, in the breaks between panels, and of course, at the after-parties. The event helped build connections and networks that we believe will go on to drive more ideas, more success, and ultimately more innovation and change for the future.

We may be blessed to be able to provide a platform for this development and growth, but it is the people feeding and driving the ecosystem that are the key to it. They are also the sustainable energy that fuels our success—and that includes you, our engaged and esteemed audience. So, on behalf of the whole team, thank you for reading. We look forward to continuing this incredible journey with you in the new year. Enjoy the issue.

—Claudine Coletti, Managing Editor

DECEMBER 2022 FORBESMIDDLEEAST.COM 8 FORBES MIDDLE EAST

DECEMBER 2022 FORBESMIDDLEEAST.COM • DIGITAL CIRCULATION • Number of followers as of December 07, 2022 60,000 Email Subscribers 15,000 Newsletter 60,000 EDMs 2M www.forbesmiddleeast.com Every month Arabic & English • SOCIAL MEDIA PLATFORMS • • DIGITAL STORES • 22,287 Forbes Middle East 355,620 @Forbes.ME @ForbesMENA.English 129,534 @forbesmiddleeast @forbeseventsandlifestyle 633,547 @ForbesME @Forbes_MENA_ 169,163 Forbes Middle East 21,380 @forbesmiddleeast @forbesmiddleeast_arabic 1,988 @Forbesmenaeng @Forbesmena 30 UNDER 30

INNOVATING SINCE 2010

DECEMBER 2022 ISSUE 123

Dr. Nasser Bin Aqeel Al Tayyar President & Publisher nasser@forbesmiddleeast.com

Khuloud Al Omian

Editor-in-Chief Forbes Middle East, CEO - Arab Publisher House khuloud@forbesmiddleeast.com

Editorial

Claudine Coletti Managing Editor claudine@forbesmiddleeast.com

Laurice Constantine Digital Managing Editor laurice@forbesmiddleeast.com

Fouzia Azzab Deputy Managing Editor fouzia@forbesmiddleeast.com

Amany Zaher Senior Quality Editor amany@forbesmiddleeast.com

Jamila Gandhi Senior Reporter jamila@forbesmiddleeast.com

Rawan Hassan Senior Translator rawan@forbesmiddleeast.com

Samar Khouri Online Editor samar@forbesmiddleeast.com

Cherry Aisne Trinidad Online Editor aisne@forbesmiddleeast.com

Research

Jason Lasrado Head of Research jason@forbesmiddleeast.com

Nermeen Abbas Senior Researcher nermeen@forbesmiddleeast.com

Elena Hayek Researcher elena@forbesmiddleeast.com

Layan Abo Shkier Research Reporter layan@forbesmiddleeast.com

Business Development

Ruth Pulkury Senior Vice President - Business Development ruth@forbesmiddleeast.com

Joseph Chidiac joe@forbesmiddleeast.com

Fiona Pereira fiona@forbesmiddleeast.com

Karl Noujaim karl@forbesmiddleeast.com

Natalie Ghazaley natalie@forbesmiddleeast.com

Sarine Nemchehirlian sarine@forbesmiddleeast.com

Sabina Ali sabina@forbesmiddleeast.com

Sarah Gadallah Hassan sarah.g@forbesmiddleeast.com Upeksha Udayangani Client Relations Executive upeksha@forbesmiddleeast.com

Tayyab Riaz Mohammed Financial Controller riaz@forbesmiddleeast.com

Soumer Al Daas Head of Creative soumer@forbesmiddleeast.com

Julie Gemini Marquez Brand & Creative Content Executive julie@forbesmiddleeast.com

Kashif Baig Graphic Designer kashif@forbesmiddleeast.com

Mohammed Ashkar Assistant IT Manager ashkar@forbesmiddleeast.com

Muhammad Saim Aziz Web Developer saim@forbesmiddleeast.com

Habibullah Qadir Senior Operations Manager habib@forbesmiddleeast.com Daniyal Baig Chief Operating Officer daniyal@forbesmiddleeast.com

FORBES US

Chairman and Editor-In-Chief Steve Forbes CEO and President Michael Federle

Copyright© 2019 Arab Publisher House

Copyright @ 2019 Forbes IP (HK) Limited. All rights reserved. This title is protected through a trademark registered with the US Patent & Trademark Office Forbes Middle East is published by Arab Publisher House under a license agreement with Forbes IP (HK) Limited. 499 Washington Blvd, 10th floor, Jersey City, NJ, 07310

Founded in 1917

B.C. Forbes, Editor-in-Chief (1917-54); Malcolm S. Forbes, Editor-in-Chief (1954-90); James W. Michaels, Editor (1961-99) William Baldwin, Editor (1999-2010)

ABU Dhabi Office Office 602, Building 6, Park Rotana Office Complex, Khalifa Park, Abu Dhabi, U.A.E. - P.O. Box 502105, info@forbesmiddleeast.com Dubai Office Office 309, Building 4, Emaar Business Park, Dubai, U.A.E. - P.O. Box 502105, Tel: +9714 3995559, readers@forbesmiddleeast.com subscription@forbesmiddleeast.com

Queries: editorial@forbesmiddleeast.com For Production Queries: production@forbesmiddleeast.com

Legal Partners

LEGAL CIRCLE

Legal Circle FZC • United Arab Emirates Tel: +971 4 583 0716 • Email info@legalcircle.co www.legalcircle.co

EPTALEX • MEG LEGAL SERVICES P.O.Box 182859 • Dubai • UAE Tel +971 4 238 4655 • www.eptalex.com

Abdullah AlHaithami Advocate & Legal Consultants P.O.Box 95561 Dubai • UAE Tel: +971 4 886 8535

Forbes Middle East is legally represented by www.intlawfirm.com

DECEMBER 2022 FORBESMIDDLEEAST.COM 10

FORBES

MIDDLE EAST

Money World’s Top 5 Tech Investors 2022

1. Chris Dixon

Firm: Andreessen Horowitz

Notable Deal: Coinbase

Headquarters: U.S.

Andreessen Horowitz’s general partner Dixon jumped six places from last year to reach number one, thanks to his firm’s continued investment in crypto exchange Coinbase. His focus is on Web3. The company has bet on Coinbase 15 times, across every funding round from its Series B in 2013 to its April 2021 IPO with an $85 billion market cap. The 51-yearold entrepreneur also cofounded cybersecurity company SiteAdvisor, which was acquired by McAfee in 2006, and recommendation tech firm Hunch, which Dixon sold to eBay in 2011. He is also a personal investor in Pinterest, Stripe, and Warby Parker.

2. Micky Malka

Firm: Ribbit Capital

Notable Deal: Coinbase

Headquarters: U.S.

Ribbit Capital founder Malka is credited with some of the highest-profile IPOs of 2021, including Coinbase, Nubank, and Robinhood.

The 48-year-old Venezuelan native founded and sold his first business, a financial brokerage, in his teenage years. Malka established payments startup Bling Nation in 2007, which failed in 2011. The serial entrepreneur founded Ribbit Capital in 2012.

3. Neil Shen

Firm: Sequoia China

Notable Deal: ByteDance

Headquarters: Hong Kong (SAR)

Shen is the founding and managing partner of Sequoia China, the Chinese arm of Silicon Valley’s venture capital firm. He was the Midas List’s top investor for three years until 2021. Before founding

Sequoia China in 2005, the 54-year-old cofounded travel site Ctrip.com, now Trip.com, and worked as an investment banker at Deutsche Bank Hong Kong, Chemical Bank, Lehman Brothers, and Citibank. Besides TikTok parent ByteDance, Sequoia China spearheaded deals for Meituan and Pinduoduo. Forbes estimated his fortune at $3.4 billion as of November 11, 2022.

4. Richard Liu

Firm: 5Y Capital

Notable Deal: Xiaomi Headquarters: Hong Kong (SAR)

Eight-time recurring listee Liu is a founding partner at China’s 5Y Capital, which manages $5 billion in global capital. 2022 marks the 48-year-old’s third year in a top 10 slot on the Midas List. Liu invested in mobilemaker Xiaomi, which went public in 2018. His other stakes include electric vehicle maker XPeng Motors and cloud communications platform Agora. 5Y Capital was formerly known as Morningside Venture Capital.

5. Navin Chaddha Firm: Mayfield Fund

Notable Deal: Poshmark Headquarters: U.S.

Thanks to the IPO of developer tools firm HashiCorp, generalist investor Chaddha returned to the top 10 in 2022 in his 14th Midas List appearance. The 51-yearold managing director’s investments have created over $120 billion in equity value and more than 40,000 jobs. He leads the venture practice at Mayfield and has backed 18 companies that have gone public, including Poshmark and Lyft. His other bets include blockchain software maker Alchemy. In his twenties, he cofounded three companies, including VXtreme, which Microsoft acquired to become Windows Media.

DECEMBER 2022 FORBESMIDDLEEAST.COM 12 LEADERBOARD

BY JAMILA GANDHI

;

PHOTO BY ETHAN PINES FOR FORBES

Forbes’

tech

Meet the top five listees from

Midas List 2022, featuring the world’s leading

investors.

Chris Dixon

DECEMBER 2022 FORBESMIDDLEEAST.COM 13 LEADERBOARD

Money

The Growth Of Giving In The GCC

According to a report by LGT, the international Private Banking and Asset Management Group, philanthropy in the GCC area has grown over the last ten years to hit an estimated $210 billion annually, in part driven by an increase in the number of business leaders committing to philanthropic practices.

The

report

Giving In The Gulf Cooperation Council (GCC): Evolving Towards Strategic Philanthropy by LGT, the Centre for Strategic Philanthropy, and the University of Cambridge Judge Business School reveals that in-depth research on philanthropy in GCC has been limited due to a culture of privacy and discretion in giving practices. The study considered the practice of “Zakat,” which obliges Muslims to give 2.5% of their wealth to charity, and calculated an estimated figure of $210 billion of annual giving based on expert analysis, GCC household wealth, and the net wealth of GCC billionaires, which stood at $29.8 billion, excluding Saudi billionaires, as of November 11, 2022, according to Forbes.

The study also shows that the GCC has made noticeable strides as millennials and Gen-Z take the helm of their family businesses. In general, family businesses contribute greatly to founding and supporting some of the largest philanthropic organizations in the region. They comprise up to 90% of the private sector economy and 80% of the workforce, making them a key player in the region’s voluntary sector.

Family businesses in the

50%

50% of the impact investment organizations are located in the U.S. and Canada. 2% are located in MENA.

$1.2 trillion

Value of impact investing market: $1.2 trillion in assets under management held by 3,349 organizations.

region are now moving towards impact investing, according to PwC, through venture philanthropy and social entrepreneurship. Globally, the impact investing market is valued at $1.2 trillion in assets under management held by 3,349 organizations, according to a 2022 report by the Global Impact Investing Network (GIIN). While 50% of the impact investment organizations are located in the U.S. and Canada, only 2% are located in MENA.

However, philanthropic capital in the region is expected to grow rapidly with the maturation of capital markets, the growing ambitions of family offices

Net wealth of GCC billionaires, excluding Saudi

under the leadership of the next generations, and the diversification of economies away from fossil fuels. Besides generational shifts, LGT reports that GCC philanthropists are increasingly aligned with government priorities for national development, aiming to see a longer-term impact.

With mixed views on the role of philanthropy in supporting developmental goals beyond only charitable relief, there is a need for more opportunities to enhance regulations to cater to the shift towards more strategic approaches. The past decade has seen many efforts by GCC governments to reform

and improve regulatory frameworks to catalyze the growth of the sector, with countries like U.A.E., Kuwait, Bahrain, Saudi Arabia, and Qatar releasing their economic visions that support wide-scale reforms and sustainability, to name a few.

Reports also show growth in the number of philanthropic foundations and non-profit organizations operating in the GCC, with indications that the sector will continue to boom. Over the past few years, the ecosystem has expanded from a small number of organizations to dozens, ranging from broad development funds to specific issue-focused family philanthropies led by the new generations. Traditionally placing great importance on knowledge and learning, funding for education and health dominates, with an added international focus on poverty and disaster relief.

Behavioral shifts have also been noticed after the pandemic, triggering a greater drive for systemic improvements by drawing attention to the importance of developing a robust social infrastructure, such as healthcare and education, all with the need to rely on digitization for the future of giving.

DECEMBER 2022 FORBESMIDDLEEAST.COM 14 LEADERBOARD

BY RAWAN HASSAN; RASTO SK/SHUTTERSTOCK.COM

$29.8 billion

DIFC is proud to partner with GEFI for COP28

DIFC and the Global Ethical Finance Initiative (GEFI) are pioneering the first finance focused initiative for COP28, a strategic partnership to advance the global finance community’s initiatives to address climate matters and advance ESG.

DIFC invites you to engage with the community and join the path to COP28

A partnership with:

difc.ae

Startups

World’s Top 5 Unicorns

There are approximately 1,191 unicorns—a privatelyowned firm valued at more than $1 billion—worldwide, worth a collective $3.9 trillion, according to estimates from CB Insights. Here are the world’s top five. Figures are as of October 2022.

had a net worth of $188.1 billion as of November 10, 2022. It became a unicorn a decade after its inception.

3. SHEIN

Valuation: $100 billion Country: China Chinese fashion and lifestyle e-retailer SHEIN is planning an IPO in the U.S. The potential IPO faces risks of tensions between China and the U.S., while the company is under scrutiny over claims of design theft, labor violations, and the environmental impact of its trendy low-cost apparel.

SHEIN’s IPO would be the largest listing since Chinese ride-hailing company DiDi went public in 2021 with a $70 billion valuation. DiDi delisted from the New York Stock Exchange just 11 months later.

5. Checkout.com

Valuation: $40 billion Country: U.K.

Checkout.com, a cloudbased payments platform headquartered in the UK, has raised $1.8 billion in total funding since launching operations in 2012. In 2022, it raised $1 billion in a Series D round, boosting the company’s valuation to $40 billion. Its primary investors are Altimeter, Dragoneer, Franklin Templeton, GIC, Insight Partners, the Qatar Investment Authority, Tiger Global, and the Oxford Endowment Fund. The company has 21 offices globally and employs over 1,900 people.

5. Canva

1. ByteDance

Valuation: $300 billion

Country: China

Beijing-based ByteDance, which became a unicorn in 2017, is valued at $140 billion according to its last fundraising round in 2020. However, secondary market transactions in 2022 have reportedly placed a higher valuation of $300 billion. The company is best-known for its social video app TikTok and its local version Douyin. Main investors in the company are Sequoia Capital China, SIG Asia Investment, KKR, and SoftBank Group. ByteDance reportedly more than tripled its operating losses in 2021 to over $7 billion.

ByteDance was cofounded in 2012 by Zhang Yiming, who was China’s second richest billionaire as of November 10, 2022, with a net worth of $49.5 billion. Zhang

owns nearly 22% stake of ByteDance. He decided to step down as the company’s CEO in 2021, handing over the position to the company’s cofounder and HR head Liang Rubo who is also a billionaire with a net worth of $2.3 billion as of November 10, 2022.

2. SpaceX

Valuation: $127 billion

Country: U.S.

SpaceX has quadrupled its value in the past three years, hitting a valuation of $127 billion after raising nearly $2 billion of total funding in 2022. The rocket producer raised $250 million in equity in July after completing a funding round of $1.7 billion in equity in May. SpaceX’s key investors are Founders Fund, Draper Fisher Jurvetson, and Rothenberg Ventures.

The company was founded in 2002 by Elon Musk, who

Tiger Global Management, Sequoia Capital China, and Shunwei Capital Partners are investing in the Shenzhenbased company. SHEIN employs nearly 10,000 people and serves more than 150 countries.

4. Stripe

Valuation: $95 billion Country: U.S. and Ireland Stripe, which is dualheadquartered in San Francisco and Dublin, has raised $2.4 billion in total funding to date from Sequoia, Andreessen Horowitz, Tiger Global, Khosla Ventures, LowercaseCapital, Allianz X, and Axa, among others. The company became a unicorn in 2014, and reported a 60% increase in payments to $640 billion in 2021.

Irish billionaire brothers John and Patrick Collison established Stripe in 2010. They own 10% each of Stripe. Both co-founders were worth $8.1 billion, as of November 10, 2022.

Valuation: $40 billion Country: Australia

Canva , a design software maker, reached its current valuation of $40 billion after a $200 million funding round in September 2021, led by T. Rowe Price. Strategic investors include Franklin Templeton, Sequoia Capital Global Equities, Bessemer Venture Partners, Greenoaks Capital, Dragoneer Investments, Blackbird, Felicis, and AirTree Ventures. In October 2022, the company announced that Canva’s monthly users had surpassed 100 million.

Canva launched operations in 2013. Three billionaires cofounded the company—Melanie Perkins, her husband Cliff Obrecht, and Cameron Adams, who signed on as the startup’s third cofounder in June 2012 and now has a 9% stake of Canva. Perkins and Obrecht were worth $6.5 billion each as of November 10, 2022, while Adams’ fortune reached $3.2 billion.

DECEMBER 2022 FORBESMIDDLEEAST.COM 16 LEADERBOARD

/ POOL / AFP

BY HAGAR OMRAN; IMAGE BY BRITTA PEDERSEN

FORBESMIDDLEEAST.COM On air from October on CNN International. For times please go to cnn.com/schedule IN ASSOCIATION WITH

Startups

Top VC-Funded Industries

AI and big data

The global AI market was valued at nearly $59.7 billion in 2021, according to Zion Market Research, and is estimated to reach $422.4 billion by 2028. While North America leads in terms of overall revenue from AI, the market in Asia Pacific is expected to develop at the fastest CAGR, with the use of AI in prominent end-user categories like healthcare, manufacturing, and automotive in China, Japan, South Korea, and Australia leading to this expansion.

According to the Business Research Company, the value of the global big data and analytics services industry grew from $107.9 billion in 2021 to $121.7 billion in 2022. This is forecast to hit $196.95 billion by 2026.

Life sciences and healthcare

Research from Savills reveals that globally the amount of capital raised by life science companies was $803 billion in 2021—43% higher than in 2020. This includes mergers and acquisitions, IPOs, VC, and other types of private equity. In 2022, this percentage is expected to be lower. However, there is considerable growth for life science companies as well as higher demand for their services. The U.S. will still dominate the funding data accounting for a 67% share of the total capital raised by companies in 2021.

Biotechnology has attracted the most life sciences funding with 77% of VC funding in H1 2022, and biotech IPOs have also been popular, with funding percentages at almost 70% between 2018 and 2021, according to CBRE. In January 2022, Baker McKenzie reported that 53% of biotech companies based in the U.S., Asia Pacific, and Europe were seeking growth via VC funding. In one to two years, 52% will pursue venture capital lending, and 51% will seek private equity funding.

Fintech

According to a KPMG report, investments in the Fintech

sector fell globally from $111.2 billion across 3,372 deals in the second half of 2021 to $107.8 billion across 2,980 deals in the first half of 2022. This aligns with the overall decline in investment experienced in the wider technology sector.

The Asia Pacific region attracted a new annual high of Fintech investment but across a fewer number of deals. This new record was driven almost entirely by three large M&A transactions: the $27.9 billion acquisition of Australia-based Afterpay by Block, the $2.1 billion buyout of Japan-based Yayoi by KKR, and the $1.5 billion merger of Australiabased Fintechs Superhero and Swyftx.

Advanced manufacturing and robotics

Advanced Manufacturing Series A funding has grown by 70% over five years, according to a report by Startup Genome, driven by global supply chain issues and a focus on improving efficiency and productivity through automation, monitoring, and failure prediction.

In robotics, the startups that raised a significant amount of investments included medical surgical system startups, including CMR Surgical which raised $600 million in a Series D round at a valuation of $3 billion in June 2021, and Memic Innovative Surgery, which secured $96 million in a Series D round in April 2021.

Blockchain

Over the last five years, early-stage funding into blockchain saw a 91% growth and 12% since last year, according to Startup Genome. Blockchain continues to be primarily used in the banking and financial services sector, where it is transforming traditional models.

Increasingly, blockchainbased solutions are also being used to build more sturdy supply chains, ensure secure health data exchanges, and enhance the hospitality industry, among many other applications.

DECEMBER 2022 FORBESMIDDLEEAST.COM 18 LEADERBOARD BY MUNAWAR SHARIFF

five industries have attracted the most funding from VCs

in 2022, in terms of deals count over the past five

Top VC-Funded

AI and big data 24% Other Sectors 37% Blockchain 9% Life sciences and healthcare 10%

10% Advanced manufacturing and robotics 10% $

These

worldwide

years, according to Statista. Here we take a look at how they’re growing. Source: Statista

Industries In Terms Of Deal Counts Over Last Five years

Fintech

DECEMBER 2022 FORBESMIDDLEEAST.COM arabhealthonline.com Register for free visit 30 Jan - 2 Feb 2023 Dubai World Trade Centre 100,000+ professional visits 51,000 live visitors 3,000+ exhibiting companies 10 CME conferences Build connections. Generate leads. Do business.

Diving Into Deep Tech

What can you tell us about Vurse, and what kind of impact do you expect it to have once launched?

I’ve always had the desire to leverage deep tech to solve major challenges that humanity faces today. Social media has taken the world by storm. There are eight billion people living on earth today and out of those, close to five billion people are using social media.

Even though social media has changed the lives of billions, there are some major issues with the way it’s structured today. Monetization for content creators, ownership of the content and social media itself, and the lack of interaction between content creators and fans, are major issues to name just a few. With Vurse, we’re looking to solve exactly that.

Vurse proposes to offer a unique

The thoughts expressed in this advertorial are those of the client.

and hyper-interactive platform incorporating the best of deeptech available today. This includes AI and machine learning systems that give users exactly the kind of content they want to consume; Web 3.0 technologies such as blockchain and metaverse to tackle monetization, ownership, and enhanced interaction; and high-level data science to study and predict consumer behavior.

DECEMBER 2022 FORBESMIDDLEEAST.COM 20

PROMOTION

Founder and CEO of Vurse, Shadman Sakib, is on the cusp of launching the interactive short-video platform in Dubai. He reveals more about the platform and what he hopes it will achieve.

Shadman Sakib, Founder and CEO of Vurse

Scan this QR code to open the website

It’s the seamless combination of aesthetics and technology that’s exciting and will be a game changer in the way we access and experience social media.

What is your assessment of the deep tech industry in the Middle East, and how do you see it evolving?

When we talk about technology, geography doesn’t matter. It doesn’t matter where you are based. The entire world needs to sit up and pay attention if you want to create products that make a lasting impact. We refer to the global landscape and not just the Middle East. The metaverse, blockchain, and Web 3.0 simply appear to me to be the next evolutionary step in the age of connectivity for individuals who are eager for new experiences.

Having said that, I am definitely of the opinion that a lot of credit and gratitude must be given to the leaders of the Middle East. They have laid the perfect foundation for early adoption of deep tech, and Dubai has been at the forefront. The Dubai government has opened everyone’s eyes to what we should be looking forward to. The metaverse promises to bring our digital and physical lives closer together in terms of health, socializing, efficiency, shopping, and entertainment, and the U.A.E. has embraced this better than any other country that I can think of.

Why did you decide to base yourself in Dubai?

Dubai has always been ahead of the game, the announcement by H.H. Sheikh Hamdan about creating 42,000 jobs in the metaverse sector has been hugely welcomed by the tech world

globally. Even though I moved here prior to this announcement, I am happy to be launching Vurse in a city and country that is making huge strides in the world of tech by making it a national priority.

This government initiative will see a major boost in talent and the economy in the coming years. It is believed that the metaverse will infiltrate every sector and will account for more than $1 trillion in revenues, according to recent studies by JP Morgan.

Dubai will also be the place to attract the best tech minds from around the world with this announcement. A multitude of new businesses will be created in the near future and they will thrive within the metaverse as advertisers and brands understand the importance of investments within this new digital world.

Also, the risk factors in the GCC are much lower due to the fact that there is political stability and safety. Keeping up with the new policies that support technological advancements will be a challenge regionally. The U.A.E.’s lead in the metaverse space is one prime example of how a country is able to be at the forefront of it and how to create the right atmosphere for experts from all over the world to further add value.

From a global perspective, it will help the policymakers understand the need to speed up the process and have thought leaders as a crucial part of the team.

At 27 years old, you are launching this latest venture in the social media world as a young entrepreneur. How did you get to where you are today?

The journey has not been an easy one. Through a lot of trials and

The thoughts expressed in this advertorial are those of the client.

tribulations, I’ve been blessed with some fantastic people around me—whether that’s my family, my cofounder, my friends, or my team members. My passion for technology and my business acumen have led me to this juncture in my entrepreneurial journey. From a very young age, I’ve had the inclination towards solving major problems in the tech space, and I channelled this desire towards building Vurse.

Beyond Vurse, what is next for you? What is your ultimate goal?

I truly believe that we need to bring about a change in the entrepreneurial mindset of today. Most founders today are chasing higher valuations and exits. Of course, there’s nothing wrong with that, but my belief is that when you build a company, you build it with the mindset of creating value that lasts centuries. And to be able to successfully do that, a founder must encapsulate the company through their entire lifetime.

I envision Vurse to be a global leader in the technology landscape for generations to come. Therefore, I cannot think of a life beyond Vurse. Vurse is it for me. All my experiences in life so far have led me to Vurse and it is as if I’ve finally found my true calling. It is with Vurse that I want to leave my mark on the world.

DECEMBER 2022 FORBESMIDDLEEAST.COM 21

PROMOTION www.vurse.com

Startups In Numbers:

MENA’s Gender Gap In Startup Funding

Investments in MENA startups hit $2.4 billion in the first nine months of 2022, but less than 2% of this was invested in startups solely founded by women, according to a report by Wamda, TiE Dubai, and TiE Women. Here’s a look at other insights from the report, which was based on responses from 125 female founders in MENA.

•

65.9% of women startup founders have faced issues raising investment.

• 61.8% •

61.8% believe that more women should be partners in venture capital firms to connect the gender investment gap. • 64.2% •

64.2% believe that startups led by women benefit from women-only investment funds.

$127 million

MENA startups cofounded by men and women raised $127 million in the first nine months of 2022.

Among the femalefounded startups yet to raise any investment, 29.6% say their pitches have been rejected.

38.1% of female-founded startups secured investments in the seed funding stage. Other stages, such as pre-seed and angel, each make up 26.2%. 40.5% •

The majority of investors are equally based in the Middle East and globally. The remaining 19% are in the GCC. • 57.8% •

Compared to international investors, 57.8% of women surveyed said MENA-based investors are less likely to invest in startups led by women.

DECEMBER 2022 FORBESMIDDLEEAST.COM 22 LEADERBOARD BY SAMAR KHOURI

• 29.6% •

•

• 38.1% •

• 65.9% •

Billionaires

World’s 5 Richest Investment Billionaires

Here are the richest five people in the world who built their fortunes from investing, according to Forbes. All five reside in the U.S. and are self-made billionaires. Net worths are as of November 11, 2022.

1. Warren Buffett

Net worth: $106.3 billion

Country: U.S.

Seasoned investor Buffett runs Berkshire Hathaway, which owns dozens of companies, including insurer Geico, battery maker Duracell and restaurant chain Dairy Queen. He first bought stock at age 11 and first filed taxes at age 13. As of November 2022, Berkshire’s $296 billion investment portfolio comprised 49 companies.

The 92-year-old has promised to give away over 99% of his wealth. So far, he has donated more than $49 billion, mostly to the Gates Foundation and his kids’ foundations. Buffett established the Giving Pledge with Bill Gates in 2010, asking billionaires to donate at least half of their wealth to charitable causes.

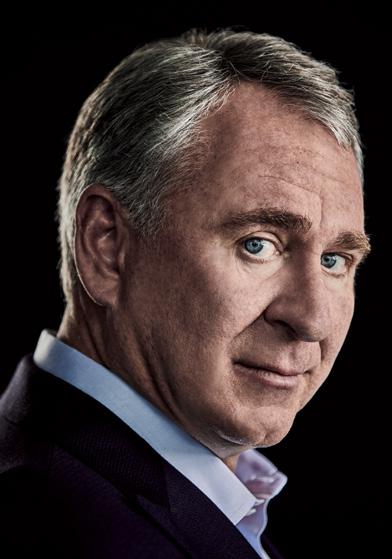

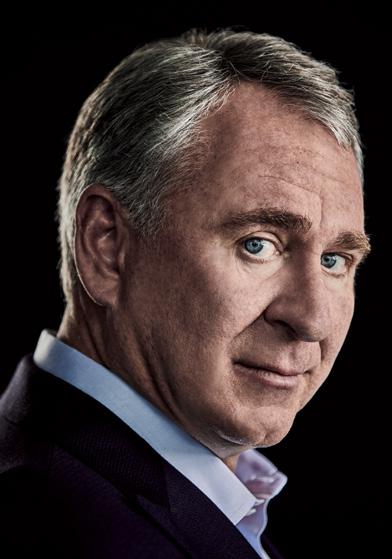

2. Ken Griffin

Net worth: $31.9 billion

Country: U.S.

Griffin is the founder and CEO of Citadel, a Miamibased hedge fund firm that manages roughly $59 billion in investment capital, as of November. He launched Citadel in 1990 but first began trading from his Harvard dorm in 1987, where he put a satellite dish on the roof to get real-time stock quotes. Griffin is also non-executive chairman of Citadel Securities, one of Wall Street’s biggest

market-making firms. The 54-year-old has given $1.5 billion to philanthropic causes.

3. Stephen Schwarzman

Net worth: $31.7 billion

Country: U.S.

Private equity firm Blackstone’s chairman and CEO Schwarzman founded the company with the late

Peter Peterson in 1985. Initially a boutique mergerand-acquisition advisory business, Blackstone grew into the world’s largest alternative asset manager, with $951 billion in assets under management, as of September. The 75-yearold’s first entrepreneurial attempt was a lawn-mowing operation at age 14, employing his younger twin brothers to mow while he brought in clients.

4. Jeff Yass

Net worth: $30 billion

Country: U.S. Yass cofounded Susquehanna International Group, one of Wall Street’s largest and most successful trading firms. Yass started trading on the Philadelphia Stock Exchange in 1981, backed by billionaire Israel Englander. The 64-year-old established Susquehanna with a handful of partners in 1987, with no outside money, naming the firm after the Susquehanna River. The firm made millions in the Black Monday crash of October 1987. It has since invested in hundreds of private companies, including its most valuable holding in TikTok parent ByteDance.

5. Jim Simons

Net worth: $28.1 billion

Country: U.S.

Simons founded Renaissance Technologies, a $50 billion quantitative trading hedge fund firm. Established in 1982, Renaissance is famous for its Medallion Fund, a $10 billion black-box strategy that is only open to Renaissance’s owners and employees. Simons retired in 2010 but still plays an active role in the company and benefits from its funds. The 84-yearold has given $4 billion to philanthropic causes, including Math For America and autism research.

DECEMBER 2022 FORBESMIDDLEEAST.COM 24 LEADERBOARD BY JAMILA

PHOTOGRAPH

GANDHI;

BY AARON KOTOWSKI FOR FORBES

Ken Griffin

The Art of Managing Disruption

The past few years have seen their fair share of disruption, from a global pandemic which put businesses, economies, and individuals under extreme strain to climate concerns, wars, and energy shortages.

As a company that relies heavily on delivering shipments in the shortest time possible, any glimpse of a scenario which can potentially result in broken links, delays, border closure, and more, is considered a risk to service continuity.

While the logistics industry is prone to emergency situations, and global players have robust risk management mechanisms to fall back on, it is worth remembering that no two crises are ever the same. With this in mind, a critical step once the initial shock of an event subsides, is to take note of the lessons learned and set clear priorities for the post-recovery phase. Here, DHL has consistently prioritized three winning verticals as the winning formula for business rebound and operational resilience during crises, centering on employees, customers, and technology.

Adopting an employee-first approach has remained top on DHL’s agenda, especially as the industry continues to witness a transformation in the labor makeup, labor shortages, and talent-retention challenges. The company has always gone above and beyond, investing substantially

in new-age HR practices to foster a culture of unity and trust, where people feel safe, protected, and willing to give it their all, even during the most challenging circumstances.

Customer-centricity is also deemed important, more so now than ever before. Emerging trends in retail and technology, concerns over the environment, and shifting buying habits, have all compromised customer loyalty. The traditional depiction of brand loyalty has taken an evident turn, reversing the roles and putting more pressure on brands to demonstrate commitment, versus customers. DHL has willingly placed customers at the forefront of its value system and pledged to continue to excel in this regard by training and inspiring its employees to set customer success as their ultimate goal.

Next on the list of DHL’s priorities

The thoughts expressed in this advertorial are those of the client.

is technology. Technology innovation and digitalization is something DHL has been heavily focused on, with substantial investments made to improve both DHL’s offering to its customers and the work of its employees. As e-commerce continues on its upward trend, expectations for last-mile delivery innovation remain high, calling for the integration of new technologies to enhance the service offering and guarantee a seamless delivery experience.

The enhancement of predictive capabilities through data and analytics has also proven successful in minimizing operational risk through better planning, visibility, and efficiency of complex operations. In addition, DHL has embraced automation technologies to improve health and safety in the workplace, by facilitating manual activity and reducing risk of injury.

While the world may never be free of disruption, organizations can better safeguard their future by building a resilient and agile business model based on lessons learned and winning formulas that tap into business strengths, to secure operational effectiveness against any future crises.

DECEMBER 2022 FORBESMIDDLEEAST.COM 25 LEADERBOARD

PROMOTION

website

Scan this QR code to open the

Nour Suliman, CEO of DHL Express MENA, shares the company’s winning formula for operational resilience.

www.dhl.com

Nour Suliman, CEO, DHL Express MENA

Growing A Solid Portfolio For Long-Term Sustainability

How has MNH withstood the changes and challenges of the past 75 years?

MNH started with a single drugstore in the heart of Kuwait City, meeting the essential needs of a society that was seeing a tremendous change in its economy and infrastructure thanks to the discovery of oil a few years earlier. The growth of the company came naturally. We expanded by becoming distributors of products needed in the local market, whether relating to health or primary needs. And here is where our success of the decades lies.

As a family business, our growth warranted being innovative and at the forefront of developments across sectors, as well as adapting to changes in consumer behavior. This started shifting significantly in the 1970s, and economic challenges rose globally. This was when MNH accelerated its

diversification plans by expanding its partnerships with world-class brands as well as venturing into innovative homegrown brands beyond pharmaceuticals and consumer healthcare, moving as well into medical equipment, FMCG, food and beverage, and perfumes and cosmetics.

This is how MNH maintained its market position year-on-year, serving its local market far beyond just the mere distribution of products, offering products and services that mirror the company’s business integrity and values.

How has the company’s strategy changed over the years?

Our strategy has changed since the beginning, but one element has remained integral, and that is the importance we place on providing products we truly believe in and that are beneficial to our customers. In the 1940s, the market

The thoughts expressed in this advertorial are those of the client.

was untapped, and there was vast room to grow a strong portfolio of products. As the local market grew, our strategy became more defined and focused on providing products and services that we qualify as “human care.”

Our focus on the quality and benefits of what we offer are the foundation to the success of our business.

How has the pandemic affected business? Is the company ready for possible challenges in the future?

Without a doubt, the pandemic had a negative impact on parts of the business. But what it affected on one side of our portfolio was compensated by the products that we carry on the other.

Pharmaceuticals and food and beverage are two of the safest, if not the safest, sectors in times of crisis. Individuals will always need food and medication. While

DECEMBER 2022 FORBESMIDDLEEAST.COM 26

PROMOTION

As Kuwait’s Mohamed Naser AlHajery and Sons Company (MNH) celebrates its 75th anniversary, CEO Musaed Ibrahim AlHajery discusses the family conglomerate’s growth, challenges, and vision for the future.

other sectors were affected by restrictions and lockdowns, pharmaceuticals and food and beverage increased in market share and recorded higher revenues, compensating for the loss in our other sectors.

The growth we saw in 2020 was sustained in 2021 thanks to a bold plan to continue marketing our products, investing more in digital infrastructure, and encouraging our human capital to maintain our newfound market positions.

The pandemic was a testament to the flexibility and strength of our strategy, first and foremost. It was also a catalyst for fresh opportunities and a drive to maintain new market share.

Can you tell us more about the company’s performance across the sectors it serves?

Our products have a very high penetration in pharmaceuticals, healthcare, and food and beverage. Food specifically can be found in wholesalers, groceries, and retail stores, as well as online on B2B and B2C platforms. This penetration is supported by strong investment in marketing, which we believe is one of our strengths.

What are the company’s other key strengths?

Our diversity gives MNH stability. Diversity in our portfolio and diversity in our capabilities, including our people. Our people are our pride. We all truly believe in what we are selling, and this is how we are able to expand our footprint.

In which industry sectors do you expect to see MNH grow and invest further in the future?

Without a doubt, in the digital world. We started to invest heavily in online platforms years before the pandemic, and that investment yielded fruit in the past three years. We have a major ownership in two ecommerce companies, which enables us to gain from integrated platforms that also sell our products in addition to everything else needed by consumers.

What are your business priorities for the next year?

To ensure we continue providing to our local consumers despite international and external challenges that have a direct impact on our local economy. MNH has weathered economic and geopolitical challenges in the past thanks to its diversified business, and we believe that the challenges we see ahead of us, such as inflation, will be overcome as well.

How has the family involved in the business contributed to its success?

We have a motto as a family: the success of a family business can only be sustained with the

The thoughts expressed in this advertorial are those of the client.

Scan this QR code to open the website

contribution of family members. We are not just investors. On the contrary, we are hands-on, and you will find members in every rank contributing to the business.

Knowledge transfer is an essential element in our strategy, and we have invested in structuring the family succession to ensure the next phase of growth.

Do you have any plans to go public?

It is true that family businesses have been turning to listing in recent years to capitalize on their growth. The appetite for investing in them has also been significant as they are seen as conductors in the diversification of local Gulf markets that have been historically dependent on oil and gas.

MNH enjoys very healthy growth today. Our cash flows have been at their best levels in recent years. Our partnerships are growing, and our operations are acquiring new segments. As both an investor in and operator of brands, we do not see the need to expand to finance growth that we are more than capable of driving ourselves. We already have the capabilities both financially and operationally. What opportunities a listing could bring to our business in the future will be looked at when the time is right.

DECEMBER 2022 FORBESMIDDLEEAST.COM 27

PROMOTION www.hajery.com

By Nermeen Abbas

Seizing Opportunities

DECEMBER 2022 FORBESMIDDLEEAST.COM 28 AJLAN BIN ABDULAZIZ ALAJLAN IMAGE FROM SOURCE

• FEATURE •

Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group, is poised to gain ground as new windows open for the private sector in Saudi Arabia.

Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group.

Family businesses are a key economic force in the Middle East, and with governments increasingly focused on pushing for privatization along with the non-oil private sector, family-owned groups are expected to seize opportunities in new areas while facing global unrest and digitization challenges. “Today, huge industries are further open to the private sector, including tourism, mining, manufacturing, and media,” says Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group, an investment conglomerate already working across more than 25 countries.

The Saudi businessman co-founded the family business in 1979 alongside his brothers Mohammed, Fahad, and Saad. The four siblings started off with a small shop in Al-Deira in Riyadh, specializing in fabrics and garments. Since then, they have ventured into several sectors, including manufacturing, construction, real estate, power, logistics, Fintech, retail, mining, entertainment, and healthcare, among others.

Over the last five years, the group has made efforts to align its strategy with the Saudi Vision 2030, which aims to develop and diversify the kingdom’s economy, reduce its dependence on oil and maximize the role of the private sector. Family businesses—which contribute approximately 60% to the GDP of the GCC and about 90% to its private sector economy, according to the Family Business Council—are poised to play a key role in the transition. The Ajlan & Bros Group became a holding company in 2017, approaching diversified sectors. “We’ve been focusing on expanding through partnerships with foreign investors,” reveals Alajlan.

“Family businesses in the region are key partners of governments and are integral to meeting their ambitious goals for the growth of the private sector and the economy,” says Adnan Zaidi, PwC Middle East Entrepreneurial, Private, and Family Business Leader. “It is, therefore, a prime time to further leverage their status and capitalize on the opportunities presented.”

The Ajlan & Bros Group—as part of a consortium with the Olam International Group, the Al Rajhi International Investment Company, and the National Agricultural Development Company—acquired the Second Milling Company in Riyadh in December 2021 in a deal worth $600 million. More recently, a consortium between Moxico and Ajlan & Bros won a $68 million exploration license for the Khnaiguiyah mining site in 2022, which covers an area of 353.8 square kilometers west of Riyadh in the Al Quwaiiyah governorate. And the group is part of the $800 million Jubail 3B Independent Water Project, which is set to filter 570,000 m3 of water per day, enough to supply two million people across Riyadh and Qassim once it becomes operational in 2024. The 25-year water purchase agreement between SWPC and the consortium was signed in June 2022, with Ajlan owning 30%.

Looking across other sectors, in 2020 Ajlan & Bros established the facilities management company Dussmann Ajlan & Brothers LLC with German’s Dussmann. In 2021, it launched the logistics company AJEX in partnership with SF Express, ventured into the defense sector through Scopa and TAL, and its Pure Beverages Industry Company launched two new bottled water brands, Ival and Oska. And in 2022, it partnered with Saudi Aramco in carbon fiber manufacturing, plastic recycling, and semiconductor manufacturing, and launched Tiqmo in partnership with SwiftPass.

Despite the new ventures, the industrial and real estate arms seem to remain the safe bets against market fluctuations. Alajlan explains that Saudi Arabia has huge potential as it witnesses an increase in demand in several locations. “The population is soaring rapidly in Riyadh, creating a great demand for real estate,” he adds. “Mecca and Medina have a great development and attract pilgrims who create strong activity, while the rising number of factories in the eastern region is spurring demand on housing.” With demand skyrocketing, Ajlan & Bros has many projects on its radar. The group today owns 150 million sqm of developed land, as well as over 70 million sqm yet to be utilized.

Stay connected with our latest business news.

Beyond Saudi Arabia, Alajlan is eying expansion regionally, targeting mainly other gulf countries and Egypt. “There is huge potential in these countries, with population growth spurring demand, unlike Europe, for example, where the population is decreasing,” he says. “I believe this is the perfect time to invest in Egypt. There are several promising sectors such as power, water, healthcare, education, and food and beverages, and the currency devaluation works as a catalyst to investment and manufacturing.”

DECEMBER 2022 FORBESMIDDLEEAST.COM 29

AJLAN BIN ABDULAZIZ ALAJLAN

F

Investments are already flooding into Egypt from Gulf countries, led by the U.A.E. and Saudi Arabia. “Egypt has received around $4 billion in investments from GCC countries since the beginning of 2022,” says Hany Gnena, an Economic Analyst and Lecturer at The American University of Cairo. “Green hydrogen, maritime and transportation, agriculture, automotive, and tourism are currently the most attractive sectors.”

As for the Ajlan & Bros Group, ambitions go far beyond regional borders. “We are planning to pump in more investments in the U.S. and Chinese stock markets, leveraging the low prices,” says Alajlan, without naming specific companies. “In the midst of every crisis lies great opportunity, and I believe there are a lot of attractive opportunities in the global markets right now.” And as the Saudi economy starts to recover, Alajlan is bullish about the future.

“When the economy becomes more solid and national reserves climb, the government tends to pour more investments into mega projects, and the private sector benefits from the hype,” says Alajlan. For someone who has been leading his family business for 43 years, the ups and downs of the economic cycle are something he has gotten used to.

Alajlan recalls his family’s modest beginnings. “My father was a merchant, working in fabrics and garments and food. As children, we used to work with him; this is how we gained our experience in trade,” he remembers. Inspired by their late father and building on what he started, the four brothers decided to establish their own business, “We started off with a small amount of capital that now wouldn’t even buy a flight ticket today,” Alajlan reveals. The fabrics and garment activity grew fast, and they were soon signing dealerships with notable brands, including Yashmagh Projaih, Drosh, and Yashmagh Alsami, along with Ival and Oska for bottled water.

Top Arab Family Businesses

Later, it began direct trading with China and established its first factory there in 1999. Today, the group has more than 5,500 employees working in its factory complex in Shandong, China. While it was venturing into textile manufacturing in China, Ajlan &Bros also entered the real estate sector in its home country. In 2000, it established Abdulaziz Alajlan Sons for Trading & Real Estate Investments Co., which today owns real estate assets worth more than $10 billion and has an international investment portfolio of $3 billion across Asia, Europe, and the U.S.

1. Olayan Financing Company

Country: Saudi Arabia

Sector: Diversified Establishment: 1947 Chair of the Executive Committee and Deputy Chair: Lubna S. Olayan

As the business continues to grow, responsibility is now being handed down to the third generation to preserve the family’s legacy. “All family members from the new generation are working in different sectors within the group. They are not in managerial positions but rather in mid-level positions since they are still learning,” explains the chairman.

2. Mansour Group

Country: Egypt

Sector: Diversified Establishment: 1952 Chairperson: Mohamed Mansour

According to PwC’s Zaidi, the transition of ownership from the current generation to the next generation is a key obstacle being faced by many family businesses today. “Given the current demographic trends of family businesses in the region, many of them are at a critical juncture with respect to their business ownership lifecycle phase, with transitions set to happen over the next five to ten years,” he stresses. But this is not the only challenge facing the private sector. A lack of qualified local workers, high interest rates, and the rising cost of power and raw materials are also major challenges.

3. Al-Futtaim Group

Country: U.A.E.

Sector: Diversified Establishment: 1930 Chairperson: Abdullah Al Futtaim

For Alajlan, these are not big concerns. With the business overcoming several crises over four decades—not to mention the pandemic, which he believes was the worst crisis he has ever faced—the leader is now optimistic about the future, seeing promising opportunities lying ahead.

“Our region is growing fast thanks to its huge consumer base,” he reassures. “And we believe this is a very suitable moment to take advantage of it.”

DECEMBER 2022 FORBESMIDDLEEAST.COM 30 AJLAN BIN ABDULAZIZ ALAJLAN

KITE_RIN/ SHUTTERSTOCK.COM

Here are the top three Arab Family Businesses from our September 2022 ranking.

Positive Insight

PepsiCo was a key attendee at COP27. Which theme took prominence?

COP27 gave PepsiCo AMESA the opportunity to showcase the catalytic potential of regenerative agriculture in addressing food insecurity, the circular economy, and climate change. In Africa—a continent extremely vulnerable to the effects of climate change and highly dependent on agriculture— PepsiCo has been accelerating its sustainable farming program, which aims to engage with over 250,000 stakeholders in farmer profitability and the economic empowerment of women. COP27 also presented the opportunity to relay key elements of our sustainable strategy—PepsiCo Positive—to co-create climate solutions with a diverse range of stakeholders that could help us reach the net zero target by 2040 and push the envelope on circularity through innovation and youth collaboration.

How is PepsiCo strengthening food security in the region?

Sustainable agriculture is at the core of delivering a resilient future. PepsiCo in AMESA is currently utilizing approximately 200,000 acres of land for regenerative agriculture programs, aiming to raise that to over two million acres by 2030. In Africa, 90% of

Having recently attended COP27 in Egypt, Eugene Willemsen, CEO for PepsiCo for Africa, the Middle East, and South Asia (AMESA), reveals what

our directly sourced potatoes were sustainably sourced in 2021, whereas in Egypt, 100% of the cane sugar used in our operations is BonSucro certified, ensuring sustainable practices in our value chain and reducing emissions. From partnering with global organizations

like CARE and USAID in Egypt and Uganda, to spreading sustainable farming practices and working on the ground with partners like the World Wildlife Fund, the Nature Conservancy, and the Water Resources Group in South Africa, we recognize the importance of partnerships and utilizing our reach to make a difference.

Can

entrepreneurs across MENA for a three-day ideation bootcamp followed by mentorship. Continuing the momentum to COP28, winning ideas will be incubated and awarded seed capital to bring their sustainability visions to life.

PepsiCo recently launched recycled plastic bottles in AMESA. Can you tell us more about this initiative?

tell us more about PepsiCo’s recent hackathon launch at COP27?

We believe that hackathons can go a long way in encouraging future changemakers to create ideas for a sustainable tomorrow. PepsiCo and the Arab Youth Centre announced the launch of the ‘Arab Youth Hackathon #HackforChange’ at COP27. Funded by the PepsiCo Foundation and implemented by Plug and Play Tech Center, this regional program invites youth

was discussed and some key announcements. www.pepsico.com

you

The thoughts expressed in this advertorial are those of the client.

Packaging circularity is key to our sustainability goals. With only one country in AMESA allowing the use of recycled plastic bottles in food and beverage packaging in 2020, we continue to partner with local governments and industry coalitions to hopefully introduce recycled plastic bottles across 10 AMESA countries by 2023 and five African countries by 2025. We were the first large-scale food and beverage company to introduce locally manufactured, 100% recycled plastic bottles in Qatar and Kuwait in 2022, which will be followed by other GCC countries in 2023. Our commitment to accelerating investment in recycling infrastructure will advance our efforts in waste management and the circular economy.

DECEMBER 2022 FORBESMIDDLEEAST.COM 31

PROMOTION

Scan this QR code to open the website

AHS Properties Takes Ultraluxury To The Next Level

In the space of one year, Dubai’s AHS Properties has achieved a gross development value of $550 million. Here, the company’s 23-year-old founder, Abbas Sajwani, explains how he got started and why ultra-luxury is the way ahead.

In the span of just one year, AHS Properties has grown into a thriving business. What is your proudest achievement to date? Our most impressive achievement has been launching our new project on the Dubai Canal — ONE CANAL. We’ve spent a lot of time designing it and the feedback we’ve had is excellent. We’ve done well in terms of the architecture, the interior, and the location of the site. I believe it is ultra-luxury that Dubai hasn’t seen yet.

Who have you collaborated with on ONE CANAL when it comes to architecture and design?

We’re working with HBA, who has done the interior, as well as Killa Design, who has done the architecture. As you know, Shaun Killa is the architect of the Museum of the Future in Dubai. We decided to bring the best of the best in both interior and architecture and have them work together to create something that we would be proud of. To top it off, the project will be in collaboration with Fendi Casa. The building contains 24 units. They are all ultra-big penthouses and sky villas, and every unit has a pool. So, we think we’ve created something that hasn’t been seen before.

Aside from your Dubai Water Canal project, what properties have you completed so far, and

what can we expect from AHS Properties moving forward?

We launched last year with three villas on the Palm Jumeirah and one in Emirates Hills. The three villas on the Palm have all been sold out with a combined value of $75 million. The villa in Emirates Hills is $45 million and will be completed in Q4 2022, so we’re very excited about that and we’ve had lots of interest.

AHS Properties has achieved a gross development value of $550 million in just one year. Looking

The thoughts expressed in this advertorial are those of the client.

ahead, we want to continue focusing on luxury, including villas and ultra-luxury mini boutique buildings. We don’t want to go into making skyscrapers, we want to stick to the G plus 10 or G plus 12 ultra-luxury buildings where clients feel as if they are living in a villa in the sky. That’s our concept.

How would you describe Dubai’s ultra-luxury market and how do you see it developing in the near future?

I think Dubai’s ultra-luxury market

DECEMBER 2022 FORBESMIDDLEEAST.COM 32

PROMOTION

Scan this QR code to open the website

ABBAS SAJWANI

Founder, AHS Properties

has really picked up the last year. You have buyers who were never buying in Dubai before. Many of those who typically invest in London and New York have moved here and are all looking to buy. That has driven the market in a big way, and I think that the ultraluxury market now has a shortage of supply, especially when it comes to properties with the ‘wow factor’.

In terms of the factors driving demand, Dubai has significant advantages that many cities in the world don’t: safety, quality of life, and the way it handled the coronavirus, to name a few. A lot of people are very comfortable

with Dubai and want to move here, and I think that’s not going to stop. The demand for ultra-luxury will continue to rise. In particular, there are many Europeans from Germany, France, Belgium, and the U.K. coming over, as well as Russians and Chinese.

Your father, Hussain Sajwani, is a stalwart of Dubai’s real estate industry. How influential has he been in your professional development?

I am now 23 years old, and since the age of 10, everything that I have learned in terms of property has come from my father. He instilled

The thoughts expressed in this advertorial are those of the client.

the property instinct in me from an early age; I used to go to the office with him regularly, and every conversation over lunch and dinner centered around business. Even now, no matter if it’s a weekend or a family trip, my father is always discussing business. He’s really passed that down to me—property is in my blood.

It was my father’s encouragement and knowledge that drove me to start in this industry. Now, as I work to grow the business, I want to continue focusing on ultra-high-end luxury, both in the U.A.E. and internationally.

www.ahs-properties.com

DECEMBER 2022 FORBESMIDDLEEAST.COM

The three villas on the Palm have all been sold out with a combined value of $75 million

Uber luxurious Amara Villa at Emirates Hills

One Canal

Private Pool Deck, One Canal

By Claudine Coletti

Back To Business

William E. Heinecke, billionaire Founder and Chairman of global hospitality group Minor International, sees plenty of reason for optimism in the travel markets. As his hotel company moves forward with a raft of Middle East openings, he’s betting on a steady and profitable period ahead.

Billionaire William E. Heinecke is a busy man. As I sit down to speak to the founder of Bangkok-headquartered hospitality, restaurant, and lifestyle company Minor International Pcl, he’s between meetings at the Anantara

BDowntown Dubai, the latest hotel to be under Minor’s management in the buzzing emirate. Having just landed from London that morning, Heinecke’s next two days in the U.A.E. are packed. As he witnesses his industry recover post-pandemic, the hotelier is glad to be back on the road, keeping an eye out for new opportunities, while checking in on his already locked-in investments.

DECEMBER 2022 FORBESMIDDLEEAST.COM 34 WILLIAM

HEINECKE IMAGE FROM SOURCE

E.

• FEATURE •

William E. Heinecke, billionaire Founder and Chairman of global hospitality group Minor International.

The high-rise luxury hotel where we meet in the heart of the city’s downtown district rebranded from Oberoi to Anantara in July 2022, and is on the cusp of an extensive refurbishment. Anantara is Minor International’s own hotel brand, and while this is Dubai’s third Anantara, it’s the brand’s first city offering here—the other two Anantaras being sprawling resorts on the Palm Jumeirah and the World Islands. For Heinecke though, there’s little difference these days. “We see it now as bi-leisure,” he explains. “People always think of the Anantara as a resort brand because we started in the Maldives and Phuket, and places like that, but in fact we try to do the same thing when we’re in a city. And I haven’t found any traveler yet that doesn’t mind thinking they’re in a resort even if they’re there on business.”

“We have a 10 year track record with the Minor Group as they run our Anantara and Avani properties in Mozambique,” says Dave Anderson, Group CEO of the Aujan Group Holding, which owns the Anantara Downtown. “When it came to a decision on the operator for our Downtown Dubai hotel, the Anantara brand was a compelling choice as the brand positioning will enable us to focus on both the business and leisure markets. In addition, the Minor team brings a strong commercial focus, regional scale and a commitment to people development that resonates with our corporate values.”

Hotels are not Minor International’s only forte. While Minor Hotels currently owns, manages, or has investments in more than 530 hotels, resorts, and serviced suites worldwide, Minor Foods has a portfolio of over 2,400 restaurants and food outlets in 23 countries, and Minor Lifestyle has over 390 points of sale for fashion and lifestyle brands. As of 2021, Minor Hotels accounted for 68% of Minor International’s revenues, with Minor Foods bringing in 28%. More than 75% of the global group’s revenues came from international business.

Still, it’s been a rough couple of years to be in hospitality and retail. In 2021, the Stock Exchange of Thailand-listed company reported total revenues of nearly $2 billion. This put it almost on par with its 2018 performance, but still a long-way from the $3.4 billion it reported in 2019. Heinecke is confident that things are now back on track. “We

had eight quarters of losses,” he admits. This turned around in Q2 2022, when the company reported nearly $850 million in total revenues and $44.6 million in profit. This turnaround continued into Q3 2022, with the company reporting $128.2 million in profit.

For the first nine months of 2022, Minor Hotels reported $66.9 million in profit, up from a $323.3 million loss in the same period in 2021. “I would predict that our fourth quarter this year will be bigger than our fourth quarter in 2019. I think that’s going to be a fairly easy thing to achieve,” adds the founder.

While the global hotel industry has been through arguably one of the toughest periods it’s seen, 2022 has witnessed a major resurgence towards travel. In the Middle East alone, Minor Hotels is now pushing ahead with a raft of new openings in the U.A.E., Oman, Qatar, Bahrain, and Egypt.

This year has already seen the launches of the Anantara World Islands Dubai Resort, the Avani Muscat Hotel, and the Anantara Downtown Dubai, with Q4 set to welcome the Plaza Doha Hotel by Anantara. Next year will see the openings of the NH Collection Doha Oasis Hotel & Beach Club, the NH Dubai The Palm, the Anantara Mina Al Arab Ras Al Khaimah Resort, and the NH Collection Dubai La Suite Hotel. And over the next couple of years the company expects to open the Anantara Sharjah Resort, the Avani Bilaj Al Jazayer Bahrain Resort, Tivoli Bilaj Jazayer Bahrain Resort, and Oaks Egypt New Capital Apartments & Suites.

Heinecke has also confirmed that Minor Hotels will be making its debut in Saudi Arabia, with an Anantara set to launch as part of the vast Diriyah Gate development, which is currently under construction on the outskirts of Riyadh. “Diriyah Gate Development Authority is bringing an unprecedented array of leaders in the luxury hospitality industry to Riyadh,” says Imran Changezi, Director of Hospitality at the Diriyah Gate Development Authority. “Each and every hotel brand has been carefully chosen to compliment the heritage, culture, and historic significance Diriyah represents.”

Aside from its planned hotel openings, Minor International is also now exploring opportunities to expand its fine-dining offerings in the Middle East. In April 2022, the group took over Corbin & King and subsequently absorbed it into the Wolseley Hospitality Group, which it acquired

DECEMBER 2022 FORBESMIDDLEEAST.COM 35 IMAGE FROM SOURCE

WILLIAM E. HEINECKE Stay connected with our latest business news.

E. HEINECKE

in 2017. Minor International now fully owns highend London restaurants including The Wolseley, The Delaunay, and Colbert. “We’re certainly in discussions to bring one of our Wolseley brands here,” Heinecke reveals. “We’re thinking about what we’ll do with them in the Middle East and Thailand.”

As of June 2022, Minor International’s total assets were worth $9.57 billion, and Heinecke says the company’s got the funds for new acquisitions if needed. “We certainly have the cash, now it’s a case of finding the opportunities. We have some fire power if something exciting presents itself,” he divulges. But while he’s in Dubai for business, he says the company doesn’t have a large amount invested in the emirate outside of its restaurants and food franchises. “We’re very big in terms of equity in Europe, but we haven’t really had to invest a lot of money in Dubai because there’s already a lot of money here that’s just looking for good management,” he explains. “We’ve tended to grow with our owners. We only have a handful of owners but they are very influential. We find that if you do a tremendous job for them on one hotel they very quickly reward you with more.”

Europe.” As well as entering Saudi Arabia in the next couple of years, the U.S. and Japan are also now on the radar for further expansion, according to the founder. Minor Hotel’s first property in the U.S.—the NH Collection New York Madison Avenue—opened in 2022.

Today, Minor Hotels has a presence in 56 countries through its Anantara, Avani, Oaks, Tivoli, Elewana, NH Collection, NH, and nhow brands, as well as its management agreements with Marriott, Four Seasons, St. Regis, and Radisson Blu. Heinecke’s personal net worth stood at $1.5 billion as of November 2022.

It hasn’t all been smooth sailing though, with the pandemic years presenting costly challenges. “We suffered. In the course of that we lost close to $1 billion,” admits Heinecke. The asset-rich company was able to weather the storm, partly by selling property. “We sold a handful of hotels, we increased our capital, and today our balance sheet—which was extremely weak due to the NH purchase back in 2018—is stronger than it was pre-covid.”

And while 2022 has proved to be a year of recovery for hospitality—with eager and more-demanding travellers willing to pay much higher-than-normal prices after two years of trepidation—it’s ending with its own set of challenges. Inflation is high, labor is sparce, and energy prices are soaring. “The days of cheap labor, cheap money, and cheap energy are gone,” warns Heinecke. The veteran is unsure that prices seen this year are sustainable, foreseeing that as flights increase and more hotels open, competition will rise and once again the scales will tip to the consumers’ favor.

Having been running his businesses for over 55 years, Heinecke is well-versed in spotting good prospects. Born in the U.S., he grew up in Thailand and founded two businesses in Bangkok in 1967 when he was just 17—an office cleaning company and an advertising company. He created Minor Holding three years later, naming it in recognition of his young age. The company grew slowly and steadily, first venturing into hotels in 1978 with the Royal Garden Resort in Pattaya, Thailand. It entered the food sector in 1980 and lifestyle in 1982, and Heinecke officially became a Thai citizen in 1991 before opening the first Anantara in 2001 in the coastal district of Hua Hin.

Minor Hotels began expanding outside of Thailand in 2005, acquiring Oaks Hotels & Resorts in 2011 and Tivoli in 2016. By 2018, the company was managing or operating around 150 hotels, which more than trebled when it acquired 94% of the NH Hotel Group that year for a reported $2.6 billion. “One of the things that was attractive to us was the fact that NH covered parts of the world that we don’t cover,” says Heinecke. “We had a handful of hotels out there when we bought Tivoli in Portugal and Brazil, but when we acquired NH we got all of South America and

However, travel businesses also have reason for optimism. In 2022, Saudi Airlines resumed flights to Thailand following a three-decade hiatus, leading to a rush of Saudi visitors to the Southeast Asian tourist trap. The reopening of some other key markets could signal similar good news for other hubs. “China cannot stay locked down, and when they open up again you’re going to see a rush of pent-up demand from the Chinese,” predicts Heinecke. “There’s going to be a lot more demand for Dubai than there ever was, demand for Doha, demand in Europe and Africa.”