14 minute read

I Seizing Opportunities

By Nermeen Abbas

• FEATURE •

Seizing Opportunities

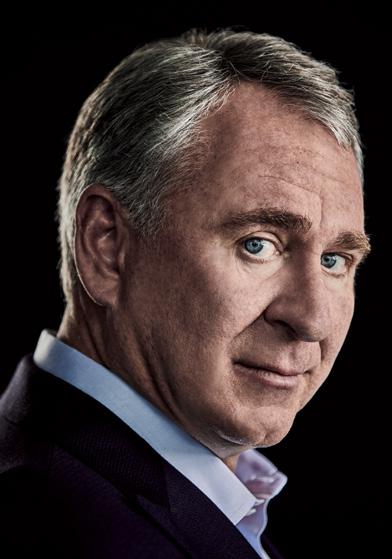

Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group, is poised to gain ground as new windows open for the private sector in Saudi Arabia.

Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group.

F

Family businesses are a key economic force in the Middle East, and with governments increasingly focused on pushing for privatization along with the non-oil private sector, family-owned groups are expected to seize opportunities in new areas while facing global unrest and digitization challenges. “Today, huge industries are further open to the private sector, including tourism, mining, manufacturing, and media,” says Ajlan Bin Abdulaziz Alajlan, Chairman of the Ajlan & Bros Group, an investment conglomerate already working across more than 25 countries.

The Saudi businessman co-founded the family business in 1979 alongside his brothers Mohammed, Fahad, and Saad. The four siblings started off with a small shop in Al-Deira in Riyadh, specializing in fabrics and garments. Since then, they have ventured into several sectors, including manufacturing, construction, real estate, power, logistics, Fintech, retail, mining, entertainment, and healthcare, among others.

Over the last five years, the group has made efforts to align its strategy with the Saudi Vision 2030, which aims to develop and diversify the kingdom’s economy, reduce its dependence on oil and maximize the role of the private sector. Family businesses—which contribute approximately 60% to the GDP of the GCC and about 90% to its private sector economy, according to the Family Business Council—are poised to play a key role in the transition. The Ajlan & Bros Group became a holding company in 2017, approaching diversified sectors. “We’ve been focusing on expanding through partnerships with foreign investors,” reveals Alajlan.

“Family businesses in the region are key partners of governments and are integral to meeting their ambitious goals for the growth of the private sector and the economy,” says Adnan Zaidi, PwC Middle East Entrepreneurial, Private, and Family Business Leader. “It is, therefore, a prime time to further leverage their status and capitalize on the opportunities presented.”

The Ajlan & Bros Group—as part of a consortium with the Olam International Group, the Al Rajhi International Investment Company, and the National Agricultural Development Company—acquired the Second Milling Company in Riyadh in December 2021 in a deal worth $600 million. More recently, a consortium between Moxico and Ajlan & Bros won a $68 million exploration license for the Khnaiguiyah mining site in 2022, which covers an area of 353.8 square kilometers west of Riyadh in the Al Quwaiiyah governorate. And the group is part of the $800 million Jubail 3B Independent Water Project, which is set to filter 570,000 m3 of water per day, enough to supply two million people across Riyadh and Qassim once it becomes operational in 2024. The 25-year water purchase agreement between SWPC and the consortium was signed in June 2022, with Ajlan owning 30%. Looking across other sectors, in 2020 Ajlan & Bros established the facilities management company Dussmann Ajlan & Brothers LLC with German’s Dussmann. In 2021, it launched the logistics company AJEX in partnership with SF Express, ventured into the defense sector through Scopa and TAL, and its Pure Beverages Industry Company launched two new bottled water brands, Ival and Oska. And in 2022, it partnered with Saudi Aramco in carbon fiber manufacturing, plastic recycling, and semiconductor manufacturing, and launched Tiqmo in partnership with SwiftPass. Despite the new ventures, the industrial and real estate arms seem to remain the safe bets against market fluctuations. Alajlan explains that Saudi Arabia has huge potential as it witnesses an increase in demand in several locations. “The population is soaring rapidly in Riyadh, creating a great demand for real estate,” he adds. “Mecca and Medina have a great development and attract pilgrims who create strong activity, while the rising number of factories in the eastern region is spurring demand on housing.” With demand skyrocketing, Ajlan & Bros has many projects on its radar. The group today owns 150 million sqm of developed land, as well as over 70 million sqm yet to be utilized. Beyond Saudi Arabia, Alajlan is eying expansion regionally, targeting mainly other gulf countries and Egypt. “There is huge potential in these

Stay countries, with population growth spurring connected with our latest business news. demand, unlike Europe, for example, where the population is decreasing,” he says. “I believe this is the perfect time to invest in Egypt. There are several promising sectors such as power, water, healthcare, education, and food and beverages, and the currency devaluation works as a catalyst to investment and manufacturing.”

Investments are already flooding into Egypt from Gulf countries, led by the U.A.E. and Saudi Arabia. “Egypt has received around $4 billion in investments from GCC countries since the beginning of 2022,” says Hany Gnena, an Economic Analyst and Lecturer at The American University of Cairo. “Green hydrogen, maritime and transportation, agriculture, automotive, and tourism are currently the most attractive sectors.”

As for the Ajlan & Bros Group, ambitions go far beyond regional borders. “We are planning to pump in more investments in the U.S. and Chinese stock markets, leveraging the low prices,” says Alajlan, without naming specific companies. “In the midst of every crisis lies great opportunity, and I believe there are a lot of attractive opportunities in the global markets right now.” And as the Saudi economy starts to recover, Alajlan is bullish about the future.

“When the economy becomes more solid and national reserves climb, the government tends to pour more investments into mega projects, and the private sector benefits from the hype,” says Alajlan. For someone who has been leading his family business for 43 years, the ups and downs of the economic cycle are something he has gotten used to.

Alajlan recalls his family’s modest beginnings. “My father was a merchant, working in fabrics and garments and food. As children, we used to work with him; this is how we gained our experience in trade,” he remembers. Inspired by their late father and building on what he started, the four brothers decided to establish their own business, “We started off with a small amount of capital that now wouldn’t even buy a flight ticket today,” Alajlan reveals. The fabrics and garment activity grew fast, and they were soon signing dealerships with notable brands, including Yashmagh Projaih, Drosh, and Yashmagh Alsami, along with Ival and Oska for bottled water.

Later, it began direct trading with China and established its first factory there in 1999. Today, the group has more than 5,500 employees working in its factory complex in Shandong, China. While it was venturing into textile manufacturing in China, Ajlan &Bros also entered the real estate sector in its home country. In 2000, it established Abdulaziz Alajlan Sons for Trading & Real Estate Investments Co., which today owns real estate assets worth more than $10 billion and has an international investment portfolio of $3 billion across Asia, Europe, and the U.S.

As the business continues to grow, responsibility is now being handed down to the third generation to preserve the family’s legacy. “All family members from the new generation are working in different sectors within the group. They are not in managerial positions but rather in mid-level positions since they are still learning,” explains the chairman.

According to PwC’s Zaidi, the transition of ownership from the current generation to the next generation is a key obstacle being faced by many family businesses today. “Given the current demographic trends of family businesses in the region, many of them are at a critical juncture with respect to their business ownership lifecycle phase, with transitions set to happen over the next five to ten years,” he stresses. But this is not the only challenge facing the private sector. A lack of qualified local workers, high interest rates, and the rising cost of power and raw materials are also major challenges.

For Alajlan, these are not big concerns. With the business overcoming several crises over four decades—not to mention the pandemic, which he believes was the worst crisis he has ever faced—the leader is now optimistic about the future, seeing promising opportunities lying ahead.

“Our region is growing fast thanks to its huge consumer base,” he reassures. “And we believe this is a very suitable moment to take advantage of it.”

Top Arab Family Businesses

Here are the top three Arab Family Businesses from our September 2022 ranking.

1. Olayan Financing Company

Country: Saudi Arabia Sector: Diversified Establishment: 1947 Chair of the Executive Committee and Deputy Chair: Lubna S. Olayan

2. Mansour Group

Country: Egypt Sector: Diversified Establishment: 1952 Chairperson: Mohamed Mansour

3. Al-Futtaim Group

Country: U.A.E. Sector: Diversified Establishment: 1930 Chairperson: Abdullah Al Futtaim

Scan this QR code to open the website

Positive Insight

Having recently attended COP27 in Egypt, Eugene Willemsen, CEO for PepsiCo for Africa, the Middle East, and South Asia (AMESA), reveals what was discussed and some key announcements.

PepsiCo was a key attendee at COP27. Which theme took prominence? COP27 gave PepsiCo AMESA the opportunity to showcase the catalytic potential of regenerative agriculture in addressing food insecurity, the circular economy, and climate change. In Africa—a continent extremely vulnerable to the effects of climate change and highly dependent on agriculture— PepsiCo has been accelerating its sustainable farming program, which aims to engage with over 250,000 stakeholders in farmer profitability and the economic empowerment of women. COP27 also presented the opportunity to relay key elements of our sustainable strategy—PepsiCo Positive—to co-create climate solutions with a diverse range of stakeholders that could help us reach the net zero target by 2040 and push the envelope on circularity through innovation and youth collaboration.

How is PepsiCo strengthening food security in the region? Sustainable agriculture is at the core of delivering a resilient future. PepsiCo in AMESA is currently utilizing approximately 200,000 acres of land for regenerative agriculture programs, aiming to raise that to over two million acres by 2030. In Africa, 90% of our directly sourced potatoes were sustainably sourced in 2021, whereas in Egypt, 100% of the cane sugar used in our operations is BonSucro certified, ensuring sustainable practices in our value chain and reducing emissions. From partnering with global organizations

like CARE and USAID in Egypt and Uganda, to spreading sustainable farming practices and working on the ground with partners like the World Wildlife Fund, the Nature Conservancy, and the Water Resources Group in South Africa, we recognize the importance of partnerships and utilizing our reach to make a difference.

Can you tell us more about PepsiCo’s recent hackathon launch at COP27? We believe that hackathons can go a long way in encouraging future changemakers to create ideas for a sustainable tomorrow. PepsiCo and the Arab Youth Centre announced the launch of the ‘Arab Youth Hackathon #HackforChange’ at COP27. Funded by the PepsiCo Foundation and implemented by Plug and Play Tech Center, this regional program invites youth entrepreneurs across MENA for a three-day ideation bootcamp followed by mentorship. Continuing the momentum to COP28, winning ideas will be incubated and awarded seed capital to bring their sustainability visions to life.

PepsiCo recently launched recycled plastic bottles in AMESA. Can you tell us more about this initiative? Packaging circularity is key to our sustainability goals. With only one country in AMESA allowing the use of recycled plastic bottles in food and beverage packaging in 2020, we continue to partner with local governments and industry coalitions to hopefully introduce recycled plastic bottles across 10 AMESA countries by 2023 and five African countries by 2025. We were the first large-scale food and beverage company to introduce locally manufactured, 100% recycled plastic bottles in Qatar and Kuwait in 2022, which will be followed by other GCC countries in 2023. Our commitment to accelerating investment in recycling infrastructure will advance our efforts in waste management and the circular economy.

Scan this QR code to open the website

AHS Properties Takes Ultraluxury To The Next Level

In the space of one year, Dubai’s AHS Properties has achieved a gross development value of $550 million. Here, the company’s 23-year-old founder, Abbas Sajwani, explains how he got started and why ultra-luxury is the way ahead.

In the span of just one year, AHS Properties has grown into a thriving business. What is your proudest achievement to date? Our most impressive achievement has been launching our new project on the Dubai Canal — ONE CANAL. We’ve spent a lot of time designing it and the feedback we’ve had is excellent. We’ve done well in terms of the architecture, the interior, and the location of the site. I believe it is ultra-luxury that Dubai hasn’t seen yet.

Who have you collaborated with on ONE CANAL when it comes to architecture and design? We’re working with HBA, who has done the interior, as well as Killa Design, who has done the architecture. As you know, Shaun Killa is the architect of the Museum of the Future in Dubai. We decided to bring the best of the best in both interior and architecture and have them work together to create something that we would be proud of. To top it off, the project will be in collaboration with Fendi Casa. The building contains 24 units. They are all ultra-big penthouses and sky villas, and every unit has a pool. So, we think we’ve created something that hasn’t been seen before.

Aside from your Dubai Water Canal project, what properties have you completed so far, and what can we expect from AHS Properties moving forward? We launched last year with three villas on the Palm Jumeirah and one in Emirates Hills. The three villas on the Palm have all been sold out with a combined value of $75 million. The villa in Emirates Hills is $45 million and will be completed in Q4 2022, so we’re very excited about that and we’ve had lots of interest.

AHS Properties has achieved a gross development value of $550 million in just one year. Looking ahead, we want to continue focusing on luxury, including villas and ultra-luxury mini boutique buildings. We don’t want to go into making skyscrapers, we want to stick to the G plus 10 or G plus 12 ultra-luxury buildings where clients feel as if they are living in a villa in the sky. That’s our concept.

ABBAS SAJWANI Founder, AHS Properties

How would you describe Dubai’s ultra-luxury market and how do you see it developing in the near future? I think Dubai’s ultra-luxury market

One Canal

Uber luxurious Amara Villa at Emirates Hills

Private Pool Deck, One Canal

has really picked up the last year. You have buyers who were never buying in Dubai before. Many of those who typically invest in London and New York have moved here and are all looking to buy. That has driven the market in a big way, and I think that the ultraluxury market now has a shortage of supply, especially when it comes to properties with the ‘wow factor’.

In terms of the factors driving demand, Dubai has significant advantages that many cities in the world don’t: safety, quality of life, and the way it handled the coronavirus, to name a few. A lot of people are very comfortable with Dubai and want to move here, and I think that’s not going to stop. The demand for ultra-luxury will continue to rise. In particular, there are many Europeans from Germany, France, Belgium, and the U.K. coming over, as well as Russians and Chinese.

Your father, Hussain Sajwani, is a stalwart of Dubai’s real estate industry. How influential has he been in your professional development? I am now 23 years old, and since the age of 10, everything that I have learned in terms of property has come from my father. He instilled the property instinct in me from an early age; I used to go to the office with him regularly, and every conversation over lunch and dinner centered around business. Even now, no matter if it’s a weekend or a family trip, my father is always discussing business. He’s really passed that down to me—property is in my blood.

It was my father’s encouragement and knowledge that drove me to start in this industry. Now, as I work to grow the business, I want to continue focusing on ultra-high-end luxury, both in the U.A.E. and internationally.