5 minute read

Daring Investors section Pages

DARING INVESTORS SECTION Friendly disclaimer warning

The following personal recommendations are not advice to buy the stock at the moment of your reading. Stock market trading is a discipline and determining the right timing to move in/out is an art. The comments and the list of companies are essentially friendly recommendations for you to follow these promising companies and check carefully when to step in at the right moment for you.

THE CASE FOR INVESTING IN THE HELIUM INDUSTRY

Although helium is the second most prevalent element in the universe, there have recently been some (thankfully baseless) worries that there won't be enough of it to power MRI machines, magnetic rail lines, and the rebirth of the LTA sector. However, with the recent discovery of more than a trillion liters of helium gas in a previously unknown reservoir buried under Tanzania, the known reserves of helium throughout the world have increased. But where does helium come from? Helium is formed by the radioactive decay of materials like uranium and thorium over millions of years. It is gathered underground or collected in the mix of oil and gas drilling in particular. Because helium is so light, it can readily escape from our atmosphere. It is also an inert gas, which means it won't combine with other substances to form particles that will remain in the atmosphere. At a temperature of -269 °C, helium becomes a liquid. This extremely low temperature makes it possible to create superconductors, which allow us to move large electrical currents through substances. This is employed in both quantum computing and other applications, such as helping to create the magnetic field in an MRI machine, with helium used by the approximately 36,000 MRI machines in use worldwide. One of the fastest trains in the world, the Maglev fast train in Shanghai, uses superconductors to generate a powerful magnetic field that causes the train to hover and allows it to move at speeds of more than 400 km/h. I bet you didn't realize helium was part of it! It is also integrated as a gas in the fabrication of optical fibers, which power the world's high-speed internet connections.

The need for helium is growing as a result of developments in technology and science. And since helium is increasingly needed for scientific purposes, people are actively searching for it underground rather than just obtaining it as a byproduct of oil and gas. In order to decrease the amount of helium lost into the environment, it is now common to recover it after usage and recapture it – via membrane – enabling previously utilized helium to be liquefied once more. So, in which companies to invest? Air Liquide ( F ra n c e ) a n d Linde ( Ge m a n y) a re tw o g ia n t c o n s e rva tive groups that are the bigger players in this field. At Ras Laffan Industrial City in Qatar, Air Liquide has just begun operating the largest helium purification and liquefaction unit in the world. The new unit has a yearly helium production capability of about 58 million cubic meters. Helium is purified and liquefied by Air Liquide using advanced, proprietary processes at a very low temperature (-269°C). The liquefaction apparatus is the biggest in the world, measuring 20 meters long and over 8 meters high. This new unit and the existing plant at this location will be able to create 25% of the

helium now produced globally, placing Qatar as the second-largest producer in the world (USA is the no

Air Liquide will purchase 50% of the helium quantities produced by this new unit and the old one under a long-term arrangement with RasGas and Qatargas. The Group will be one of the primary players in the global helium market thanks to access to this important helium supply. Stock market ticker AI:FP. Check market information at: The Air Liquide share | Air Liquide AI Stock Price | Air Liquide S.A. Stock Quote (France: Euronext Paris) | MarketWatch Air Liquide SA - Company Profile and News - Bloomberg Markets Second, is LINDE – a big player in multiple industrial gases as well as helium, under NYSE Ticker LIN.

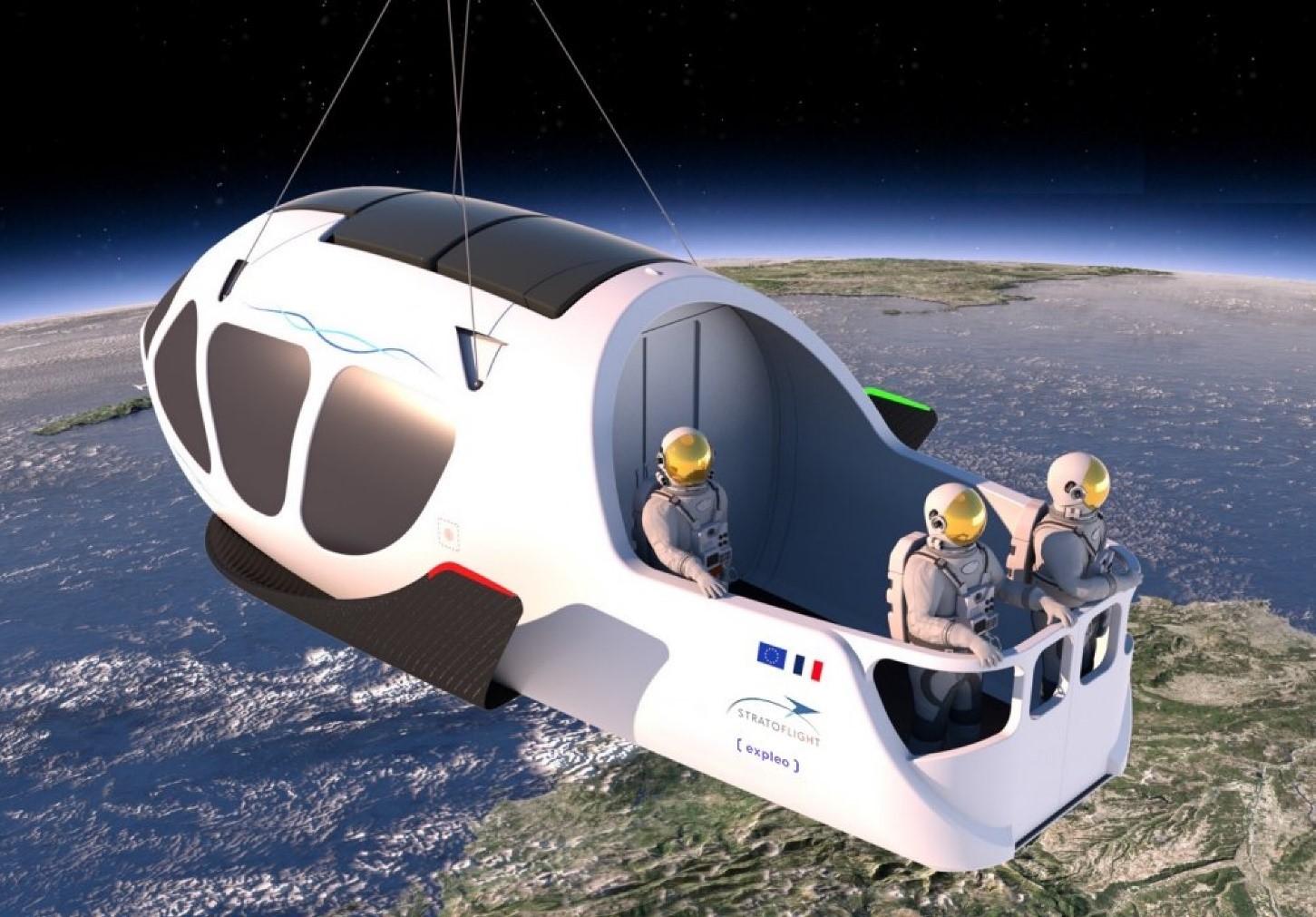

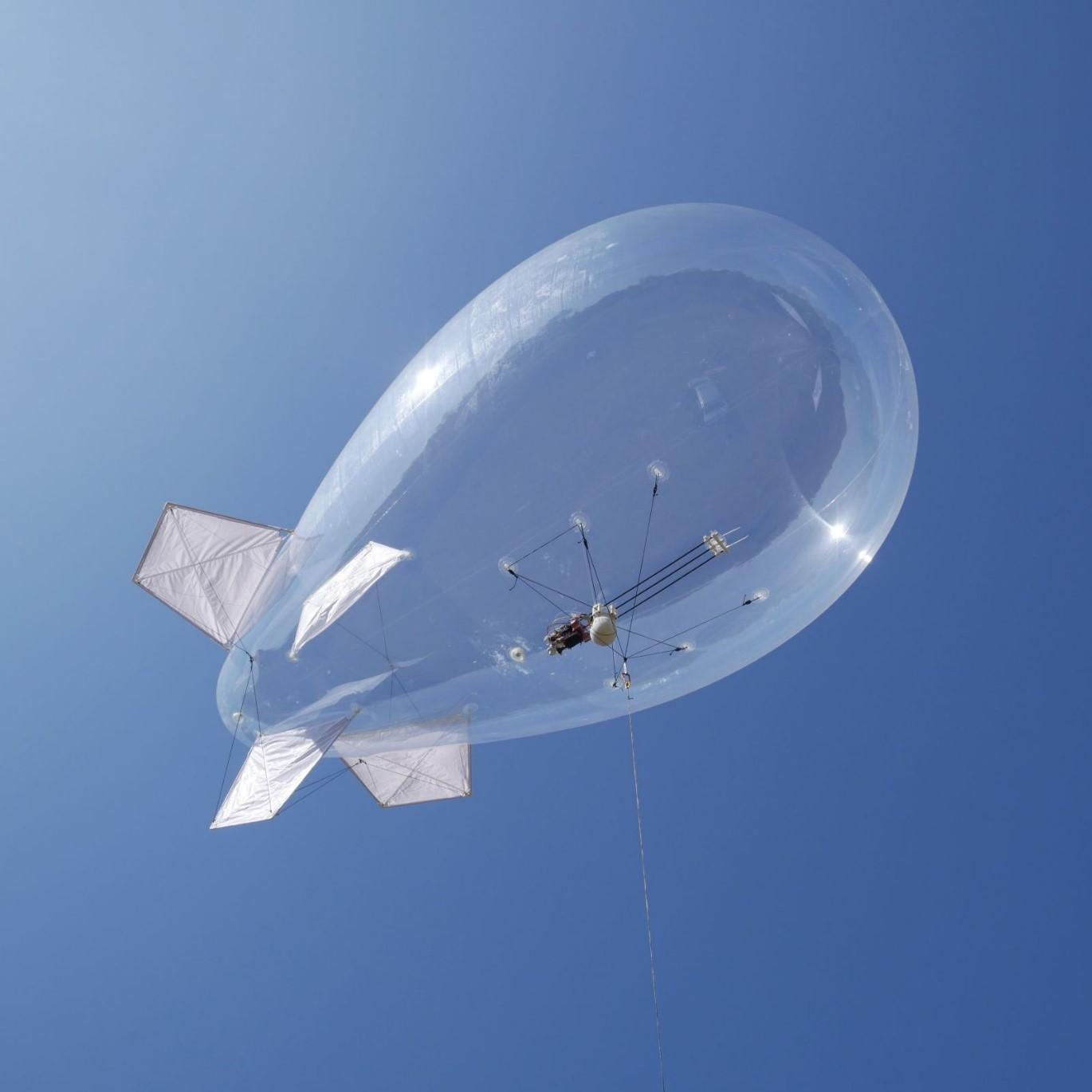

LTA’S RENAISSANCE IS AN INVESTMENT OPPORTUNITY

The freight and passenger LTA sector is now about to take off after decades of disappointment. Transport and cargo logistics LTAs will experience increasing demand in a wide range of both existing and new sectors after the initial investment barrier is overcome. Because of the size of the market, there will be rivalry, but there will also be many possibilities for early-stage investors to focus on particular sector niches and yet see enough demand to pay for the costs and generate large profits. Being optimistic, when technology reaches its peak, freight LTAs could transport products at a per-ton-mile cost that is about equivalent to long-distance trucking. Electric airships would be substantially less expensive and emit no carbon dioxide, albeit being slower than freight jets. These considerations allow for some valid conclusions to be drawn about the need and role for freight airships globally. At truck-competitive pricing, the market for cargo airships ought to be greater than 140 billion ton-miles annually, capturing the majority of air freight. Today, the most promising LTA company is Flying Whales (France) for the cargo sector. HAV (UK) has taken the lead in passenger transport but neither are publicly quoted (yet), so it’s worth keeping an eye out for IPOs that will certainly happen. The only conservative and safe bet with a solid foot in the LTA sector is THALES (France), which you just read about under the European HAPS consortium that is starting in Q1 2023. Electrical systems for aircraft and the military are designed and constructed by Thales. In addition to providing telecommunications satellites, signaling systems, flight deck systems, avionics equipment, and navigation solutions, the company also offers air traffic control and maintenance services and provides services to the global aviation, space, transportation, defense, and security markets. Check all the market information: stock market ticker HO:FP.