2 minute read

CONTAINER DATA POINTS TO EXPECTATIONS OF DEMAND REVIVAL AS CHINA REOPENS & RATES STABILIZE

CAx (Container Availability Index) January readings show greater congestion at ports in China as compared to last three years; indicating more containers available in China

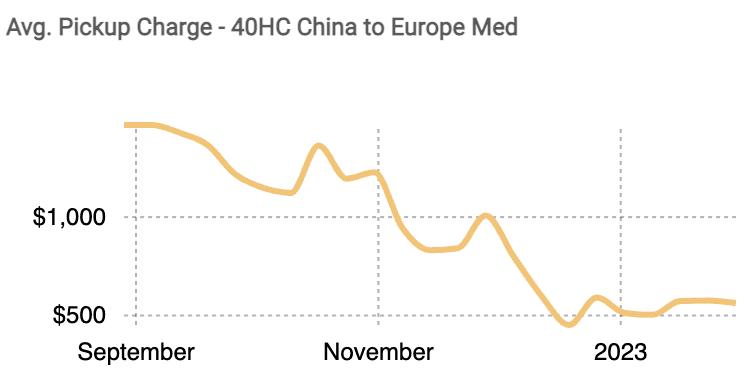

Operators expect demand revival post Lunar New Year, average one-way leasing pickup rates for second-hand containers increase by max 40% on China to Europe & China to US trade lane

As China reopens after three long years of Zero-covid policy, early Lunar New Year and COVID infections kept the overall market bearish, but the January month’s global container trading and leasing data from Container xChange, an online container logistics platform, indicates that the container traders and operators expect a demand rebound into the month of February.

Early indicators already show container operators expecting a demand bounce back—as the pickup charges from China to Europe Med for 40 ft High cube containers have increased by 9.7% from $513 in week 1 to $563 in week 5.

Source: xChange Insights (a subscription-only real-time data tool for container logistics companies)

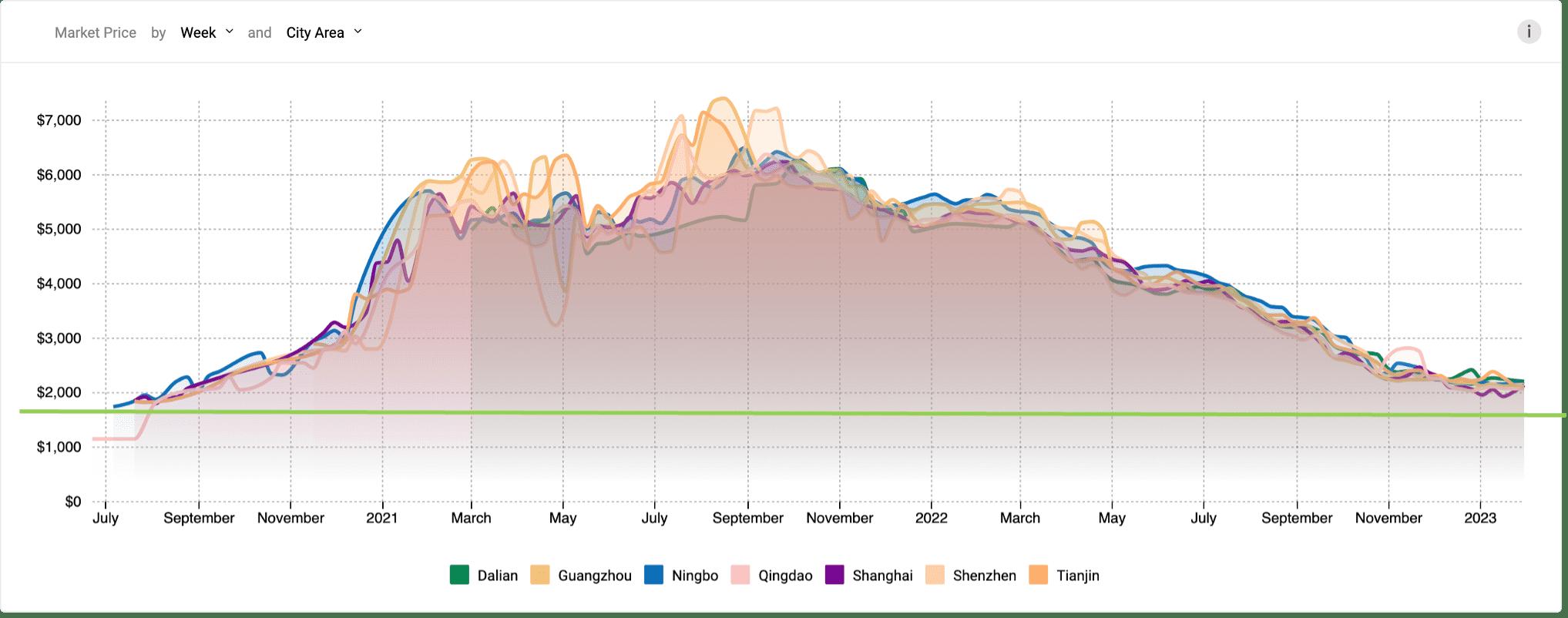

Similarly, average prices for 40 ft high cube containers increased from $3662 in week 1 in China, and increased by 3.6% to $3794 in week 5. Though the increase is not significant, the fact that the downward trajectory has reversed is a good sign for many in the industry.

Source: xChange Insights

As we progress into the new year, according to the latest Container xChange data, the container prices in China show signs of stabilization— though still elevated than 2020 peak shipping and demand boom.

Usually, the rise in inbound containers at this time of the year is because of the seasonal repositioning of containers back to China to balance out after peak season.

Long term view of Average Container prices at key ports in China (40HC cargo worthy), Source: xChange Insights

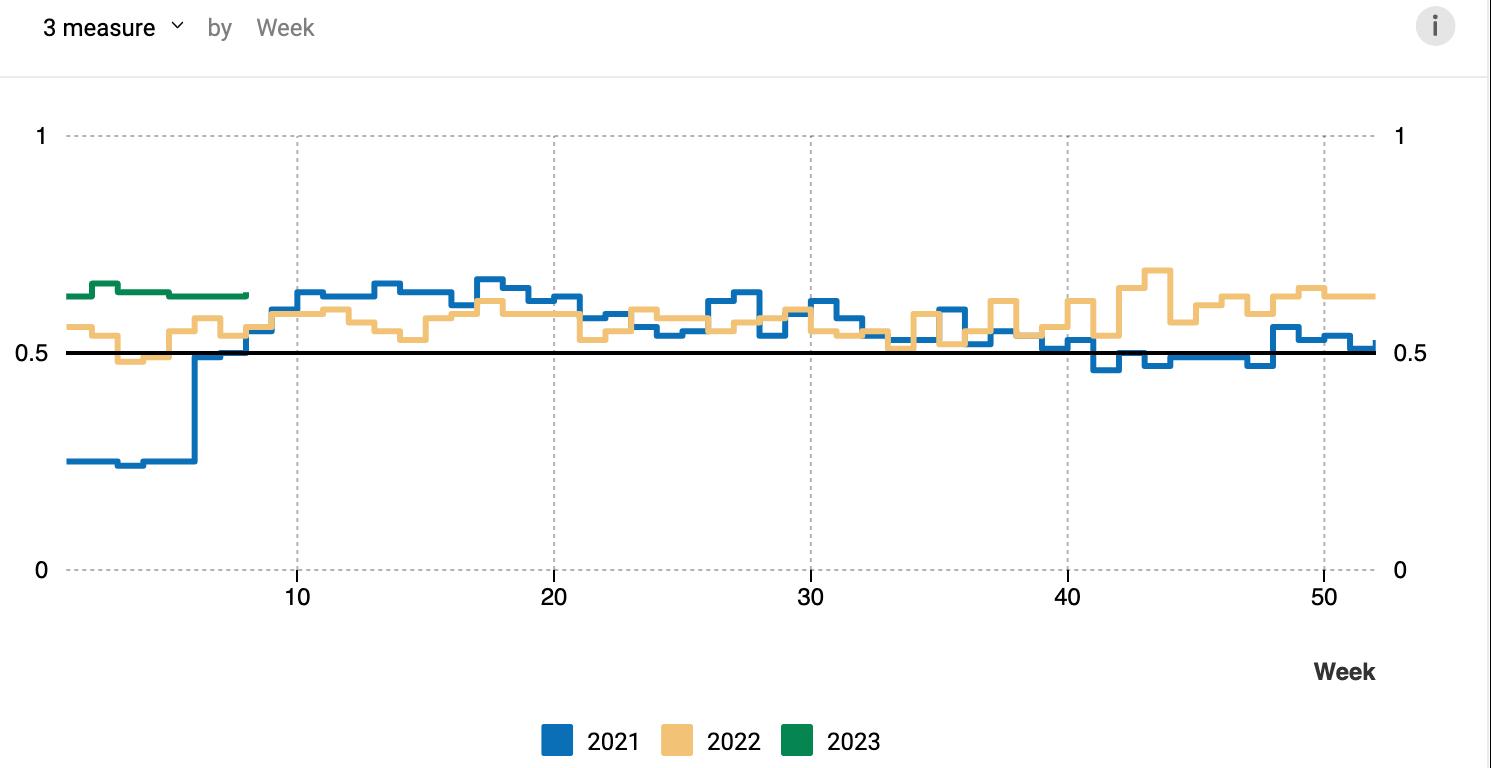

Another key development is the increased availability of containers in China. The CAx readings stay elevated as compared to last three years across the ports of Shanghai, Ningbo, Tianjin and more. This indicates more inbound containers and few outbound containers which corroborates well with the current situation of factory closures in China and labour shortage there because of the infections.

The CAx (Container availability index) measures the ratio of inbound to outbound containers port-wise—and a reading above 0.5 suggest more inbound than outbound containers at the ports in China.

The strategy of repositioning containers back to Asia after the peak season gains strength from the clearance strategy in the US and in Europe. This effectively takes the capacity out of the market, and we see that this has been top priority this year for carriers. The situation further helps in stabilising the prices which has been the need of the hour for the current situation of supply chain globally. The rebound of trade in China, and hence the container trade rebound, will depend on the pace of the reopening in China, that is, how quickly do production volumes return to normal there. It is going to be interesting to see what happens when inventory stock levels in import countries have been rebalanced and there is a need to reorder. Effectively the question is whether importers are still wary of supply chain disruptions that will influence them to buy early or will they return to ‘just-in-time' model. In any case, we do expect to see a demand uptick—also because recent GDP figures make a recession in Europe less likely. However, because demand really plummeted a lot, we will not see demand reviving to precovid levels or even the ‘during covid’ levels too quickly.

Christian Roeloffs, cofounder & CEO, Container xChange

China’s official manufacturing PMI came in at 50.1 for January, up from 47 in December.

Shanghai CAx 2021-23

For more near real-time insights and commentary into the market developments, please visit and subscribe to Daily Dose of Insights with Christian, our cofounder and CEO, on YouTube.