6 minute read

POSITIVE SIGNS FOR US TRUCKING DEMAND

For-hire truck tonnages appear to have stabilized and may be on the rise again after softening in the second half of last year, although the truckload market overall remains in an oversupply phase

US for-hire truck tonnages appear to have stabilised and may be on the rise again after softening in the second half of last year, although the US truckload market overall remains in an oversupply phase, with plentiful capacity and prices below their levels last year and the five-year average.

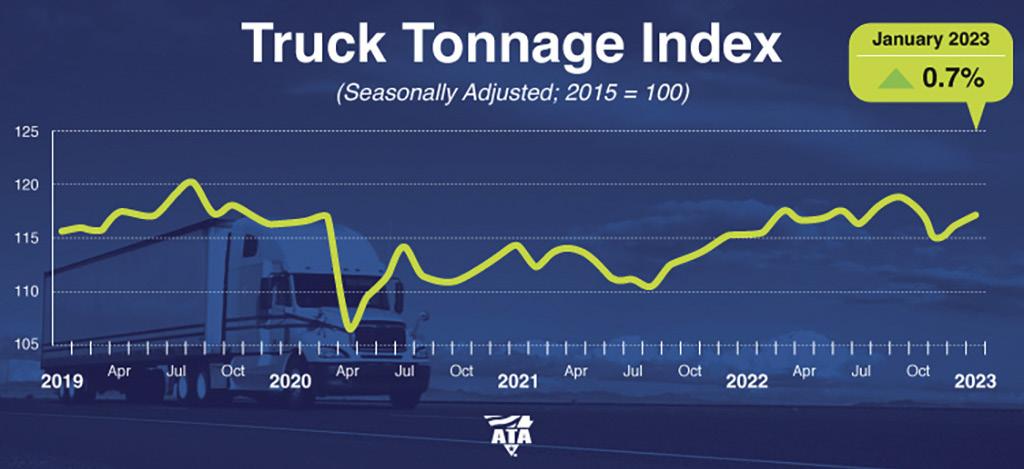

The American Trucking Associations’ (ATA’s) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.7% in January after increasing 1% in December. In January, the index – which is dominated by contract freight as opposed to spot market freight – equaled 117.1 (2015 = 100) compared with 116.2 in December.

Tonnage has increased nicely in the last couple of months. I suspect that some of the gain is attributable to capacity coming out of the network, especially those carriers that primarily operate in the spot market and/or bought expensive used equipment in the last couple of years. This would push more freight to contract carriers, which dominate this index.

Bob Costello, Chief Economist, ATA

It could also be that freight bottomed and is coming up a little too. So, the gain is likely a little higher demand and a little less supply, Costello noted. Despite the increases in December and January, tonnage is still off 1.4% from its recent high in September, Costello said.

Compared with January 2022, the SA index increased 1.5%, which was the seventeenth straight year-over-year gain. In December, the index was up 0.9% from a year earlier. In 2022, compared with the average in 2021, tonnage was up 3.5%.

The ‘not seasonally adjusted’ index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 112.7 in January, 0.4% below the December level (113.2). In calculating the index, 100 represents 2015.

Tonnage rose 3.4% in 2022

ATA had previously reported that the index had shown a slight rise in December after decreasing 2.5% in November and declining overall during the final quarter in 2022. In December, the index equaled 115.2 (2015=100) versus 114.8 in November.

Despite the small gain in December, for-hire truck tonnage clearly decelerated during the final quarter in 2022. In fact, tonnage outperformed some other key metrics that drive truck freight, like housing starts and factory output during the final month of the year. This is probably because contract truckload freight is still outperforming the spot market and less-than-truckload freight after underperforming both of those sectors in 2021.

For all of 2022, tonnage was up 3.4%, which was the best annual gain since 2018.

Despite weakening in the second half, 2022 overall was a solid year for truck freight tonnage. The index’s yearly gains were primarily driven by strength in the first half of 2022, so despite a marked slowdown as the year ended, for the year as a whole, tonnage posted a very solid year overall.

Plentiful capacity options

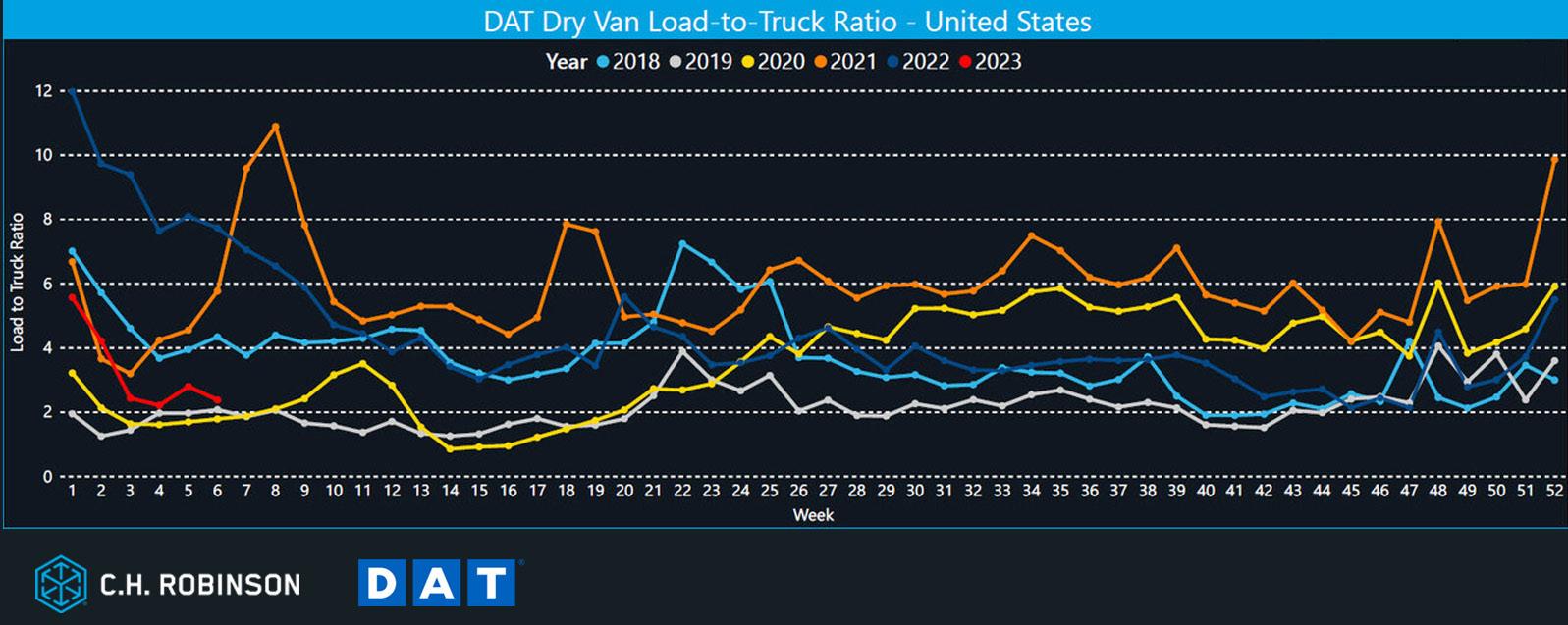

In its mid-February Transportation Market Overview and Freight Trends report, freight forwarding and freight brokerage specialist C. H. Robinson reported that, the for-hire truckload market currently offers rather plentiful capacity options and improved pricing from early 2022. The market correction of late Q1 2022 that continued through last year has persisted and perhaps will for much of 2023.

It said truckload supply continues to be bolstered by strong Class 8 tractor manufacturing and retail sales, with carriers taking delivery of new equipment that they struggled to get during the pandemic, helping to reduce the average age of tractors in fleets.

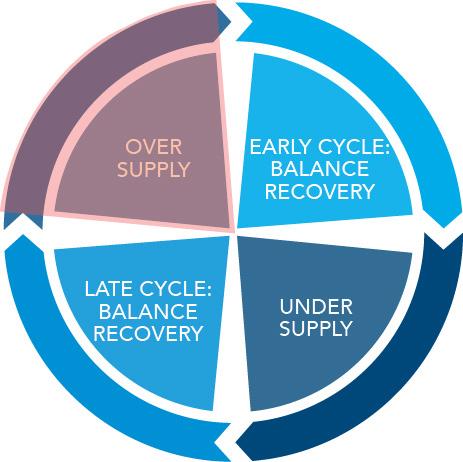

In its February forecast, ACT Research reported the Class 8 tractor fleet might expand another 2.6% in 2023 after a 4% expansion in 2022, C. H. Robinson noted, adding: An increasingly common question asked recently is if the market has started to shift to the early phase of the new cycle, ‘balance recovery’. But it may be too early to call an end to the oversupply phase just yet.

The US forwarder said the market is certainly moving through the oversupply phase and shows some early signs that might suggest the market is in the latter period of this phase. Signs of this include new tractor orders slowing since October 2022, with early figures on January again down month over month (M/M); net revocations of trucking company operating authority have been increasing; net fleet size has contracted four months running.

C. H. Robinson continued:

On their own, these early indicators don’t confirm a material market shift, but they do offer some context into how the carrier community may be viewing today’s truckload markets. New Class 8 orders are still 9.5 months lead time to delivery, so carriers have a lot of backlogged orders yet to be produced and delivered.

Based on FTR reports, the reduction in active trucking companies might suggest some contraction, C. H. Robinson said, but noting that in January, the Bureau of Labor Statistics reported growth in trucking jobs. This could be the continued migration of talent and assets from owner-operators to fleet employed. This migration is a shift where capacity resides rather than a market capacity net loss or gain.

Mixed forecasts

Because analysts are offering a rather wide range of freight volume forecasts, there is a lack of agreement in the forecast for demand expansion, C. H. Robinson said, noting: Across various forms of truckload modes, freight volume forecasts for 2023 range from -4% to 1.7% according to FTR, ACT, and Cass. Dry van is flat or even a few points negative in Y/Y volume growth. The sub-mode forecasts from these analysts suggest that refrigerated freight volumes may have the greatest opportunity. The forecasts for temperature controlled volumes from FTR show a 1.7% year over year (Y/Y) increase.

Price rises unlikely in first half of 2023

As to when the market shift will to a recovering market balance of supply and demand, the forwarder said: Both freight creation and how the carrier community responds to an oversupplied market will determine the answer. It is currently unlikely that cost per mile for the truckload spot market, a leading indicator of balance recovery, will show a pattern of increase in the first half of 2023.

ATA believes trucking serves as a barometer of the US economy, representing 72.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled an estimated 11 billion tons of freight in 2021, with motor carriers collecting around $875 billion, or 80% of total revenue earned by all transport modes, ATA calculates.

Pricing discipline continues for LTL carriers

On the less-than-truckload (LTL) side, C. H. Robinson noted that carriers have experienced dramatic tonnage swings similar to the broader freight market through the pandemic, adding: While LTL tonnage is continuing to decline Y/Y against difficult comparisons, pricing is holding. ACT Research estimates that LTL rates appear to have risen among the publicly traded LTL carriers by 7.1% Y/Y in Q4 2022. It’s important to remember that as these dramatic variances occur, the crossdock terminal capacity is virtually unchanged. Even with the recent decline in tonnage, LTL volumes continue to press upon the limits of LTL capacity. Where the truckload capacity displayed an ability to create capacity during the pandemic period, LTL capacity at best grew 1-2% in 2021 and 2022. With that foundation of capacity limitation to available freight volumes, carriers continue to display pricing disciplines against their published general rate increases (GRI).

Will Waters, contributing editor, FORWARDER magazine

Con-Tra America Corp. is an established freight forwarding, logistics, and consultancy company based in Somerset, New Jersey. Alongside being versed in maritime transport, Con-Tra America Corp. specializes in road and rail freight. Bringing you constantly creative, cost-effective solutions for any sort of road block. Let us be your chassis, we’ll carry your weight so you don’t have to.

• Road and rail drayage throughout North America utilizing both FCL & LCL. Using intermodal solutions to navigate issues such as port congestion, delays, and price increases to help cut costs, save time, and create a more reliable route. We often advise using 53’ rail containers seeing that assests associated with them are more readily available.

• Transportation: Final Mile delivery, FTL & LTL, and groupage services allow us to ship anything for you whether it is 100 pallets or just 1, even if you need multiple destinations.

• Storage and distribution from and to any of our 3PL warehousing locations. This can involve frozen, temperature controlled, and ambient storage and transport all over the North American territory.

95 Commerce Dr Somerset, NJ 08873

(541) 300 6977 sales@contraamerica.com