A look at fuel markets in 2023

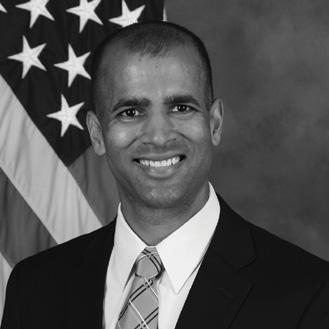

In the Lead: Fish River Food Mart’s Jigar Patel

HCCI Engines

Advances and trends in an alternative to combustion engines.

Supply

22 Managing Your Fleet: In-House or Outsource? There are advantages and disadvantages with both approaches.

Automated wastewater treatment systems help petroleum terminals and tankers remain in EPA compliance. FUEL

28 Moving Earth, Sustainably Big machines, big power and big ideas dominated the

We once again face challenging times as we move into a new year. Fuel prices are high, and inflation is still high. A deepening global recession looms. Causes include a war in Ukraine, aggressive changes in energy policy both domestically and abroad, lingering supply chain disruption from the pandemic, an OPEC unwilling to increase oil production and U.S. fracking operations similarly unwilling to overproduce as they try to recover from the disastrous pandemic supply glut.

Younger generations likely find our current economic situation a surprising circumstance given their life experiences. Some of us older folks see a potential return to the “stagflation” malaise days of the 1970s. Should that happen, how we handle this as a country will determine just how long the malaise lasts.

Inflation was starting to become a real issue in America as the 1970s began. In a move that White House recordings show was more political than economic in nature, the Nixon Administration responded in 1971 with wage and price controls over a broad swath of the economy. The 1973 OPEC oil embargo added another shock to the economic system, and even when the controls were discontinued for other sectors that year, they continued in the petroleum sector through both the Ford and Carter administrations.

The results were not good for consumers. The price controls caused unexpected disruptions in commodities leading to shortages, and fuel was no exception. There were periods where you had gasoline lines and “even and odd” day sales based on license plate number. Prices stabilized but did not drop. Inflation continued to rise.

The results also were not good for the industry either. Investment naturally

dropped, and production lagged. It eventually became “comfortable” with the system and entered a period of its own stagnation. It faced a rude awakening when the price controls were removed. Many operations, from the refinery down to the station on the corner, had to rediscover how to be competitive and efficient. Many were also ill prepared and found themselves on the wrong side of a consolidating industry.

So far this go-round, there have only been some discussions that lean toward a more direct government control of the economy. Threat of a windfall profits tax in the petroleum sector (another disastrous element of the stagflation era) has so far died down with the end of the U.S. midterm elections. It would be hard to imagine it working any better today than it did in the 1970s when it helped tank industry investment.

We still have a mostly functional, mostly free-market global fueling infrastructure. With enough time, it can be surprisingly resilient to both natural and policy driven disruptions short of those that would be catastrophic in nature. However, there always will be the appeal of feel-good, short-term (and shortsighted) solutions to ease consumer grumblings. Let’s try not to go there again.

Keith Reid Editor-in-Chief (847) 630-4760 kreid@fmnweb.com

Kim Stewart Editorial Director (703) 518-4279 kstewart@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

CONTRIBUTORS

Sal Boutureira, John Eichberger, Bob Ingham, Dr. Vikram Mittal, Clay Moore, Joe O’Brien, Allen Schaeffer, Dr. Raj Shah, Ellen Sowerby, Roy Strasburger, Mike Zahajko, Shi Ying Zheng

DESIGN Imagination www.imaginepub.com

Cover image by RonFullHD/Getty Images

Ted Asprooth (847) 222-3006 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Publisher (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

RETAILER/MARKETER MEMBERS

Mark Fitz, president, Star Oilco; Derek Gaskins, chief marketing officer, Yesway; Jeff Reichling, general manager of fuel, Kwik Trip Inc.; Jim Weber, executive vice president of merchandise and marketing, The Spinx Company

VENDOR/SUPPLIER MEMBERS

Regina Balistreri, director of marketing, ADD Systems; Joe O’Brien, vice president of marketing, Source North America Corporation; Kaylie Scoles, marketing director, RDM Industrial Electronics Inc.; Jen Threlkeld, product marketing manager, Dover Fueling Solutions

Fuels Market News Magazine is published quarterly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscription Requests: circulation@fmnweb.com

Keith Reid is the editor-in-chief of Fuels Market News. He can be reached at kreid@fmnweb.com.

POSTMASTER: Send address changes to Fuels Market News Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria, VA, and additional mailing offices.

1600 Duke Street, Alexandria, VA, 22314-2792

PUBLISHED BY

Modern business presents unlimited opportunities for growth. Let ADD Systems help you realize all those possibilities as we meet today’s challenges of customer experience, speed, accuracy, mobility, and ever more important, scalability.

ADD Systems has been providing solutions to the energy distribution industry –retail and wholesale fuel, propane, convenience stores and more – since 1973.

Fuels Market News welcomes the 2023 Editorial Council, which will provide insights and ideas to the FMN editorial team to help expand the quality of our publications and consider innovative developments for the brand. The council consists of a blend of marketers/retailers and supplier/vendors. Here are the 2023 members:

Mark Fitz, president Star Oilco

Star Oilco is a Portland, Oregonbased petroleum company that was founded in 1936. It is one of the largest distributors of biodiesel to both retail and commercial customers in the Portland area. Every diesel engine in the company’s fleet runs on biodiesel. Star Oilco also provides cardlock fuel services through Pacific Pride, as well as on-site and bulk delivery of motor and heating fuels. With over 40 years of experience in cardlock systems, Star Oilco has been providing fuel cardlock services since before computer-aided cardlock security was even an option. It later pioneered commercial cardlock security via software options. In Oregon and Washington, heating oil is diesel fuel. In these states, the allowance for pollutants in the fuel is more flexible for heating and boiler fuels. Star Oilco is committed to only delivering the cleanest, most advanced fuel possible: ultra-low sulfur diesel.

Derek Gaskins, chief marketing officer, Yesway Yesway, a chain of convenience stores with locations in Iowa, Kansas, Texas, Missouri, Oklahoma,

Wyoming, Nebraska, South Dakota and New Mexico, including the Allsup’s Convenience Stores chain, is known for its world-famous burritos. The Fort Worth, Texas-based company is committed to providing customers with a terrific shopping experience by making their lives easier and the day a bit more pleasant. With its fleet management card program, the customer can control all of the vehicle-related expenses in one convenient and flexible program. The fleet operator decides which purchases to allow and the exceptions reported. The result is a fuel card program that empowers both the fleet operator and the drivers. On the retail side, the Yesway Rewards program rewards its most loyal customers. They can use the Rewards card in stores and at the pump to earn points.

Jeff Reichling, general manager of fuel, Kwik Trip Inc. Kwik Trip was founded by the Hansen and Zietlow families in 1965 when the first store opened in Eau Claire, Wisconsin. In 1993, Kwik Trip became Kwik Star for the sites that operate in Illinois and Iowa. Currently, Kwik Trip | Kwik Star operates over 800 stores in Wisconsin, Minnesota, Iowa and Illinois. In 1997, the company opened its first retail carwash, which is now a core component of the operations. The Zietlow family became the sole owner in 2000. Kwik Trip offers a range of store-branded products including Glasers Donuts, Karuba coffees and Nature’s Touch

branded bottled water, juice and dairy products. As well-known as the company is for its in-store offerings, it has received equal attention for its fuel program. Kwik Trip | Kwik Star goes out of its way to serve both the consumer and commercial customer. It currently offers seven grades of gasoline (including E85 and ethanol free), six grades of diesel and DEF, compressed natural gas, liquefied natural gas, propane and electric vehicle charging.

Jim Weber, executive vice president of merchandise and marketing, The Spinx Company

Stewart Spinks formed Spinx in 1972 with a home heating oil delivery service and one convenience store in Greenville, South Carolina. Today, celebrating its 50 th anniversary, Spinx operates more than 80 convenience stores in South Carolina and employs over 1,400 associates through its stores, food operations and related businesses. Inside the store, the company offers a range of fresh food, beverages and snacks. This includes a variety of fried chicken offerings, a biscuit-centered breakfast program, numerous hot sandwiches, wraps and hot dogs. Spinx has a robust carwash program that includes internal washes and club memberships. With fueling, Spinx offers five grades of gasoline (including E85 and ethanol free), two grades of diesel, kerosene and electric vehicle charging. Fueling

options serve both consumer and fleet operators, as does the carwash operation.

Since 1973, ADD Systems has been a leading provider of back office and mobile software for companies in the commercial bulk fuels, heating oil, propane, HVAC, wholesale petroleum, lubricants distribution and convenience store industries. ADD’s software solutions improve clients’ interactions with their customers and bring efficiency, ease of use and greater profits to their organizations. In addition to its software, ADD offers full-service IT support, including cloud hosting, networking, firewall setup and more, with an overall emphasis on security. ADD’s on-site and remote training is tailored to the specific needs of each individual client. Additionally, ADD clients are welcomed into a strong community of users through its ADD User Group, a self-directed, ADD-supported group of users who assist each other and influence ADD product development. ADD Systems is a family business with family values: be honest, be fair and treat others as you would like to be treated.

Joe O’Brien, vice president of marketing, Source North America Corporation

Joe O’Brien, vice president of marketing, Source North America Corporation

Source North America Corporation is one of the largest stocking distributors in the U.S., with 14 facilities that combine to comprise more than 300,000 square feet of warehouse space across the country, anchored by a central warehouse in suburban Chicago. Source specializes in the sale of equipment, parts and materials for the construction and maintenance of gas stations, convenience stores and petroleum and chemical handling facilities. Since its founding in 1979, Source has provided its customers with innovative product solutions that include: POS and fuel management; piping and containment systems; storage tanks and equipment; canopy lighting and submersible pumps.

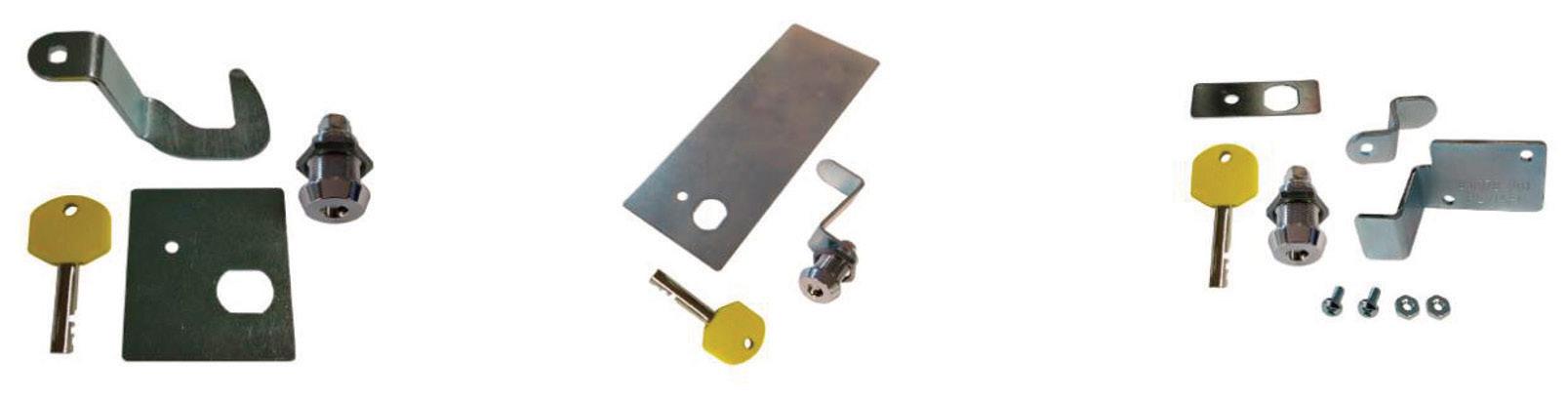

products, patented to stop a transaction in progress and deactivate a breached fuel dispenser. Retrofit alarm kits are available for new and existing fuel dispensers. The company is also a leading remanufacturer of petroleum electronic equipment. RDM specializes in circuit boards, intercoms, displays, printers, card readers, motors, keypads and overlays, POS systems, consoles, tank monitors and probes with new replacement products available. RDM has five fully stocked locations in Colorado, Florida, Indiana, North Carolina and Texas. RDM employs only degreed technicians and engineers and offers free technical support and training.

Jen Threlkeld, product marketing manager, Dover Fueling Solutions

RDM is a premier U.S. manufacturer of the wired Classic and Performance Series intercoms. RDM also manufactures speakers, call boxes and accessories. RDM additionally manufactures Defender One® pump security

Dover Fueling Solutions, part of Dover Corporation, comprises the product brands of Wayne Fueling Systems, OPW Fuel Management Systems, ClearView, Tokheim, ProGauge and Fairbanks, and delivers advanced fuel dispensing equipment, electronic systems and payment, automatic tank gauging and wetstock management solutions to customers worldwide. Headquartered in Austin, Texas, DFS has a significant manufacturing and technology development presence around the world, including facilities in Brazil, China, India, Italy, Poland, the United Kingdom and the United States.

In November 2022, more than 1,800 merchants from across the U.S. called on lawmakers to pass legislation that would bring long-sought competition to credit card swipe fees that drive up costs for consumers.

“Support for swipe fee competition is quickly building, and this letter from a broad cross section of merchants is proof,” said Doug Kantor, NACS general counsel and Merchants Payments Coalition executive committee member. “Signers range from gas stations and grocery stores to Main Street retailers and local restaurants.”

Both letters cited swipe fees averaging over 2% of the transaction that banks and card networks like Visa and Mastercard charge merchants to process credit card transactions. Credit and debit card swipe fees have more than doubled over the past decade, soaring 25% last year alone to a record $137.8 billion. They are most merchants’ highest operating cost after labor and drove up consumer prices by about $900 a year for the average family last year.

“That number is likely even higher today,” the company letter said, referring to the $900 figure. “Because credit card swipe fees are a percentage of the transaction, they are an inflation multiplier” as prices go up.

Visa and Mastercard, which control more than 80% of the credit card market, centrally set the swipe fees charged by banks that issue cards under their brands rather than the banks competing to offer merchants the best deal. They also restrict processing to their own networks, prohibiting competition from other networks that can offer lower fees and better security.

“This blocking of competition drives up prices for merchants and consumers, harms security and strangles innovation,” the company letter said.

In a letter sent by the Merchants Payments Coalition (MPC) to all members of the House and Senate, merchants asked lawmakers to support the Credit Card Competition Act sponsored by Senators Richard Durbin, D-Ill., and Roger Marshall, R-Kan., and Representatives Peter Welch, D-Vt., and Lance Gooden, R-Texas. NACS is a founding member of the MPC.

“This legislation … will bring much-needed competition into the United States credit card market, which has been dominated by only two players for far too long,” the letter said. “As members of the retail community and champions of the free market, we typically do not support government intervention except in cases where a market is not functioning. That is the case with the credit card marketplace in the United States.”

The letter was signed by 1,802 merchant companies, an increase of 134 over a similar letter sent to lawmakers just months earlier in September 2022. A separate letter sent by 236 state and national trade associations representing merchants emphasized the impact of swipe fees on small businesses.

The legislation would require that credit cards issued by the nation’s largest banks be enabled to be processed over at least two unaffiliated networks—Visa or Mastercard plus a network such as NYCE, Star or Shazam. American Express or Discover could also be the second network, but not networks supported by foreign governments like China’s UnionPay. The banks would decide which two networks to enable on a card and merchants would each then decide which to use when a transaction is made, requiring networks to complete over fees, security and service.

The bill would apply only to financial institutions with at least $100 billion in assets—about 30 of the nation’s largest banks and just one credit union—and would have no impact on community banks or small credit unions.

Convenience store swipe fees were $14 billion in 2021, a 26% increase over the year prior and were about 33% higher than that over the first half of 2022.

NACS is asking its members to contact their members of Congress and ask them to co-sponsor the Credit Card Competition Act, S. 4674 and H.R. 8874, using the NACS Grassroots Portal at www.votervoice.net/NACS/ Campaigns/96609/Respond.

The U.S. transportation sector includes nearly 300 million internal combustion engine (ICE) vehicles, and American consumers were on pace to purchase another 14 million in 2022. Despite the rapid increase in electric vehicle sales, the market will continue to be dominated by ICE vehicles for decades to come. In the pursuit of reducing carbon emissions from the transportation sector, finding solutions for these vehicles must be a priority.

The Fuels Institute report “Future Capabilities of Combustion Engines and Liquid Fuels” presents a highlevel summary of research and development projects focused on improving ICE efficiency and emissions and reducing the carbon intensity of liquid fuels. Understanding the objectives and potential benefits of such initiatives is important to better evaluate the potential emission contributions of the transportation sector.

Despite reports that ICE technology development has ceased and that no additional improvements can be had, this study found thousands of current citations pertaining to research that could yield significant improvements in the performance and environmental footprint of these vehicles.

The report is just a snapshot of what might be possible on the path to decarbonizing transportation. Decisionmakers should seek viable solutions and support further progress in technology and fuel formulations in their effort to achieve a lower carbon future. Download a copy at www.fuelsinstitute.org

2023

FEBRUARY

NACS Leadership Forum

February 08–10 | Eden Roc |

Miami Beach, FL

NACS Convenience Summit Asia

February 28–March 02 |

Waldorf Astoria Bangkok |

Bangkok, Thailand

MARCH

NACS Day on the Hill

March 07–08 |

Washington, D.C.

NACS Human Resources Forum

March 20-22 |The DeSoto | Savannah, GA

APRIL

NACS State of the Industry Summit

April 18-20 | Hyatt Regency

DFW International Airport | Dallas, TX

NACS Leadership for Success

April 30-May 05 | Virginia

Crossings Hotel & Conference Center | Glen Allen (Richmond), VA

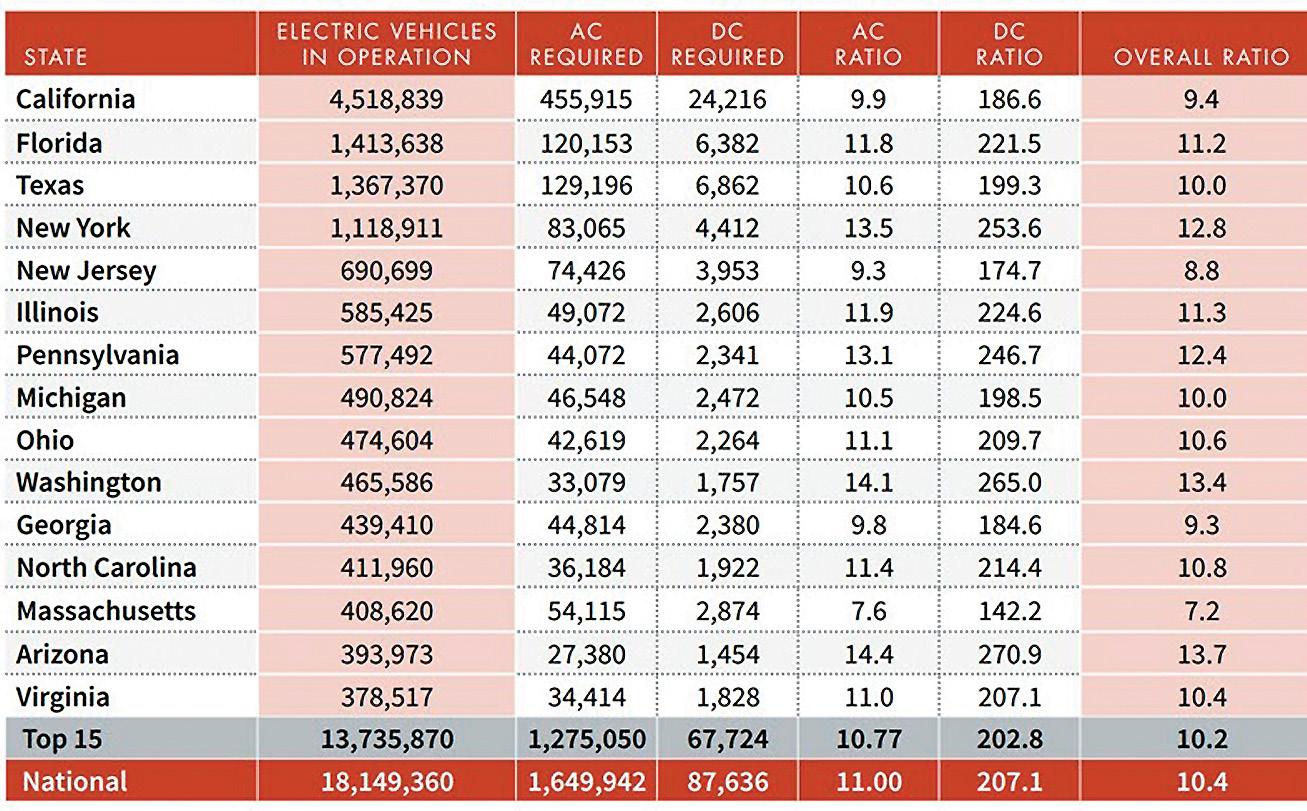

With the U.S. government investing $7.5 billion to build out a network of EV charging stations, now is a good time to ask questions about how many chargers we will need, when, where and what type. It is incumbent upon the government and private entities to invest strategically to maximize the utility of the infrastructure that is deployed to best service drivers and to expedite the establishment of a legitimate business case that can sustain market development over the long term. That is why the Fuels Institute Electric Vehicle Council commissioned S&P Global Mobility (formerly IHS Markit) to produce the report “EV Charger Deployment Optimization—An Analysis of U.S. State-level Electric Vehicle Supply Equipment Demand Forecast and Supporting Infrastructure Considerations.”

S&P Global Mobility developed the study in July 2021, and it does not reflect developments over the past year. The rate of development is more conservative than other forecasts being discussed today. However, it is a more realistic forecast than some of the others and serves as a baseline for analyzing demand for chargers. In addition, the methodology of the report can easily be applied to other forecasts.

S&P Global Mobility forecast that by 2030 the U.S. might sell as many as 2.8 million plug-in electric vehicles (battery electric and plug-in hybrid electric). If light-duty sales remain in the range of 16.5 million units per year, this would translate into a market share of about 17%. Meanwhile, the number of plug-in vehicles in operation by 2030 might eclipse 18 million, which would represent a share of 6% of the total projected fleet of about 307 million.

Not all states are developing at the same pace, and this is projected to remain true through 2030. According to S&P Global’s data and forecast, 15 states in July 2021 accounted for 82% of all EVs in operation, and by 2030, 76% of EVs will remain concentrated in just 15 states. This means that charger deployment strategies must be customized to specific market conditions.

Given the insight found in vehicle registrations, S&P Global Mobility then took a census-track analytical approach, leveraging a variety of market-specific attributes and data points, to determine how many chargers

would be needed in each market. By using the international benchmark for the ideal EV-to-charger ratio of 10.4:1. S&P Global analysts determined that the U.S. may require as many as 1.8 million charging stations by 2030— significantly more than the federal government’s goal of 500,000. Yet, based upon mobility assessments and dwell time analysis, researchers project that 90% or more of these stations could be strategically located Level 2 chargers—a discovery that could save billions in capital investment while still effectively serving the needs of drivers.

Rolling the census-track analysis up to the state level, S&P Global Mobility was able to categorize each state into four levels of EV charger demand priority. This prioritization can help direct investments to the markets where the resulting chargers will have the greatest utilization, thereby benefiting drivers as well as those installing and operating the chargers.

To determine the optimal location for charger installation, S&P Global Mobility included within the report three case studies—Detroit, Michigan; Dallas, Texas; and Portland,

Oregon. Each case study looks at EVs in operation, number of chargers, income and housing composition, driver behavior and points of interest with significant dwell time, etc. These examples can help guide a more granular analysis to ensure that charger investments are delivering the greatest value to their markets.

It is easy to talk about future market development and needs using round numbers that are easy to remember, but this expediency does not result in the optimal investment of resources to support the growing market of electric vehicles. It is essential that infrastructure decisions be strategic in nature and based upon real market needs assessments, especially when taxpayer funds are being used.

There is no definitive answer about what the future will be—there are only projections and scenarios of what it might become. The Fuels Institute and the Electric Vehicle Council hopes this evaluation will serve as a valuable resource to help inform investment decisions and to guide charger deployment to deliver value to all stakeholders involved.

Fifteen states in July 2021 accounted for 82% of all EVs in operation, and by 2030, 76% of EVs will remain concentrated in just 15 states.

John Eichberger is executive director of The Fuels Institute. For more information, visit www.fuelsinstitute.org.

Fuel retailers big and small are defining their strategies for serving a new customer base as efforts to establish a national EV charging network accelerate. Companies including Couche-Tard, Phillips 66, Pilot Co. and more have announced plans to expand EV charging within their enterprises. In conjunction with these developments, petroleum equipment suppliers are fielding questions about EV charging. The following Q+A addresses frequently asked questions for fuel sites considering their next EV charging steps.

Q: HOW CAN FUEL SITE OPERATORS GAUGE THE DEMAND FOR EV CHARGING?

A: “EV Charger Deployment Optimization,” a report released by the Fuels Institute in August 2022, estimates that EVs will make up 6% of registered vehicles in the U.S. by 2030. The report states that 1.8 million charging stations will be needed in the U.S. to adequately charge the EV fleet by the end of the

decade. To help planners and investors understand the level of Electric Vehicle Supply Equipment (EVSE) required to support the growth and adoption of EVs, the report ranks which states most urgently need EV charging equipment to support their state’s rate of EV adoption. StreetLight Data is another resource. This provider of mobility insights has created an EV dashboard that shows the gaps in the existing EV charging network.

Q: WHAT ARE SOME OF THE CONSIDERATIONS FOR SELECTING CHARGING STATIONS FOR A RETAIL FUEL SITE?

A: In urban areas, with limited space and generally shorter driving distances, Level 2 charging may make the most sense. Level 2 charging is also a viable option for customers who have a reason to hang around on-site or at a neighboring location for a few hours. Along highways and in suburban and rural locations, where driving distances tend to be longer, Level 3 DC fast chargers (DCFC) can recharge 80% of a battery in 20 to 30 minutes.

In terms of site logistics, proximity to a power supply, existing electrical capacity and parking space size and orientation are among the many considerations when installing EVSE. Power connection occurs in both the public realm—including the public right-of-way—and the private space. This can add layers of complexity to EVSE installations. According to the Fuels Institute report, “regardless of location or charger type, the specific site plan details can actually provide

the biggest impediment toward EVSE deployment, as utilities, landowners, operators and other stakeholders will weigh in on each specific installation.”

Q: WHAT QUALITIES SHOULD FUEL SITE OPERATORS LOOK FOR IN AN EVSE SUPPLIER AND IN THE EQUIPMENT ITSELF?

A: Service and/or solutions providers that provide turnkey project management can be a tremendous asset for EVSE installations. When selecting a supplier, inquire about:

• A market analysis

• A site survey

• Grant money procurement

• Plug-and-play electrical infrastructure

• Charger payment technology options

• Coordination with various stakeholders

• Installation and maintenance

• Monitoring and notification capabilities

Utilities will unquestionably play a role in EVSE development, but they are not the only game in town. In a coordinated effort to promote businesses in the development of EV charging infrastructure, NACS, NATSO, SIGMA, petroleum marketer associations and various companies have joined the Charge Ahead Partnership coalition. Shopping around for service providers may be an opportunity to simultaneously support local business. Learn more about the coalition at www. chargeaheadpartnership.com

Q: WHAT DO FUEL SITE OPERATORS NEED TO KNOW ABOUT EVSE FUNDING AND ROI?

A: With the announcement of the National Electric Vehicle Infrastructure Formula Program (NEVI), the work and proposals for using federal and state funds to build EV alternative fuel corridors is moving forward. Funding opportunities vary widely from state to state and continue to be developed. That notwithstanding, there are

programs with zero out-of-pocket costs available.

AC Level 2 chargers are often advertised in the $5,000 range or lower, and the slower delivery rates usually equate to a less expensive charge for the customer. While the slower rate also provides the site operator an opportunity to maximize other revenue opportunities for the duration of charging, Level 3 DC chargers offer a charging experience that is much more akin to the time customers at retail fueling sites expect to experience. The price range for Level 3 DC fast chargers can vary greatly, ranging from $30,000 to $80,000, and the high-voltage lines needed for DC fast-charging stations are not always easily accessible, which can inflate installation costs. Any investment in DC fast chargers should incorporate obtaining some funding subsidy to produce a return on that investment in a reasonable timeline.

The Fuels Institute report suggests that a “Goldilocks solution” may emerge:

“The 25 to 50 kW DCFCs have a smaller footprint than those 150 and 350 kW chargers, and while they require power transformers, they are still much less expensive to install and operate in the long run. Furthermore, they provide a decent charge time to both mainstream and high-end EVs without costing the end user as much in charge session fees.”

As EV charger funding opportunities begin to take shape, guidelines and standards for installing charging stations will also evolve. And although much is still in flux at these early stages of EVSE expansion, fine-tuning an approach to EV charging absolutely needs to be part of each retail fueling operation’s larger business strategy. Partnering with a total solutions provider that is familiar with all the challenges associated with profitably operating a convenience operation may be a fuel marketer’s leg up to a more stable transition.

In terms of site logistics, proximity to a power supply, existing electrical capacity and parking space size and orientation are among the many considerations when installing EVSE.”

If you weren’t paying attention, you may have missed the fact that one of the great celebrities of the future was born on July 31, 2022. George Jetson, the man who lives in the future with his wife Jane; his daughter, Judy; and his boy, Elroy, came into the world on that day and will be residing in a city in the sky, traveling by jet car within the next 40 years.

“The Jetsons” animated series envisioned a future where technology solves all problems: Robotic

housekeepers take care of your home, children and pets; automated devices dress you in the mornings; you travel by moving sidewalks inside your house and meals are taken in the form of pills.

Many of these things may come to fruition in the next 40 years, but most likely the technology advancements will not be that fast or complete— we haven’t even received the hover boards that we were promised in “Back to the Future II” yet. However,

one thing “The Jetsons” did get right, was predicting the use of video conferencing where poor George is overseen and harassed by his boss, Mr. Spacely, who is constantly checking up on him. Visions of the future always assume that we will use automation to the fullest extent possible—anything that you can think to do, you can make a machine that will do it. There’s no doubt that automated retail ventures such as coffee machines (BaristaBot, for example), salad robots (Spyce) and Mediterranean bowl dispensers (Mezli) exist today. The idea behind these mechanical innovations is to eliminate labor and its associated costs while, at the same time, provide a cost-effective food offer to the consumer 24 hours a day.

However, retail automation, specifically the use of robots, is going to be less extensive than futurists think. Humans by nature want to have some type of social interaction. The automated food purveyors mentioned here are really nothing more than glorified vending machines and, ultimately, that is not enough for the interaction that humans desire.

Technology can play a role in helping retailers lower their operating costs and provide a better customer experience, but it won’t be by using robots. The technology applications that retailers need to look for today are software programs that automate the mundane and repetitive tasks that prevent staff from looking after customers.

Everything from daily paperwork, inventory ordering and checkout can be automated. By doing this you can free up time for staff to stock and clean shelves, brew fresh coffee or interact with customers in order to increase sales.

While automation can help make sure that you have the right inventory in stock, it’s the humans that need to put it on the shelf. Artificial intelligence (AI) can let you know when certain tasks need to be completed in the store, but it will be actual people who do the cleaning or refilling. Automated checkouts can help release a clerk from behind the counter so that they can engage more with the customer, but they will still need to verify the sale of age-restricted products.

The ROI that you receive from automation will depend upon the size of your operation and the number of employees you have. An important

thing to remember is that if you are the store owner, your time is valuable as well. What additional things could you do to increase sales and customer satisfaction if you weren’t spending time doing repetitive tasks?

Areas of automation worthy of further investigation include inventory ordering, labor scheduling, shift duty assignments, HR paperwork, basic employee training, POS price-book accuracy, creating daily and monthly financial statement from POS data, daily shift sales and cash reconciliations, bank deposit calculations, account payables, payroll administration, fuel ordering and permit and license management.

Similar to using robots to save time, outsourcing jobs to part-time contractors can put tasks such as armor-car-delivered bank deposits, cooler stocking, store cleaning, price-book management and store accounting on an automated schedule with the advantage of people handling the more nuanced parts of the task. While you will have to pay for these services, they may cost less in the long run than having someone on your payroll doing the tasks, and it will free up time for more profitable activities.

Every hour of labor you can save per week is either a reduction in your operating cost or should be reinvested in making the store experience better for your customers. Dedicate your and your team’s time to those tasks that add value for the customer and, ultimately, increase your profits.

You may not have Rosie, the robot maid, in the future, but by implementing technology to use time more productively, you may be able to jet your way to more profits.

Roy Strasburger is the CEO of StrasGlobal. For 35 years StrasGlobal has been the choice of global oil brands, distressed assets managers, real-estate lenders and private investors seeking a complete, turnkey retail management solution.

Retail automation, specifically the use of robots, is going to be less extensive than futurists think. Humans by nature want to have some type of social interaction.

Since the first gas station was built in 1905, fuel spills continue to be a common occurrence that causes millions in property damage, injury and deaths each year. Surprisingly, over 100 years later most gas station operators respond to spills with the same technology—ordinary kitty litter.

December 2020 data from the National Fire Protection Association (NFPA) recorded 4,150 fires at gas stations in the United States. These

fires caused 43 injuries, $30 million in direct property damage and three deaths. Unsurprisingly, the item most often first ignited was “flammable or combustible liquids.”

To the untrained eye, most observers would say that spilled gasoline evaporates and goes away by itself. In a study published in the Journal of Contaminant Hydrology by researchers from Johns Hopkins, experiments were conducted to learn just how much gasoline is spilled and where it

goes. The results were surprising. The researchers estimate that 400 gallons of gasoline are spilled at the average gas station each decade.

Markus Hilpert, senior study leader and senior scientist, stated that “gas station owners have worked very hard to prevent gasoline from leaking out of underground storage tanks, but our research shows we should also be paying attention to the small spills that routinely occur when you refill your vehicle’s tank.”

Why is kitty litter or a similar OIL DRI absorbent used? It is cheap, readily available and absorbs spilled petroleum products. Is using kitty litter to treat a gasoline really an inexpensive option? The full cost of responding to a fuel spill must include the absorbent cost, labor and disposal.

• Absorbent Cost: Kitty litter is inexpensive, ranging from 40 cents to 60 cents per pound.

• Labor Cost: Treating a spill with kitty litter takes 20-30 minutes of labor, with another 20 minutes waiting to absorb. Assuming $15 per hour of employee cost, that adds $7.50 to the clean-up cost (more than 10 times the cost of the kitty litter). The time study included the time to cone-off the spill, spread the kitty litter, sweep up and bag the contaminated kitty litter and then dispose it into the hazmat barrel.

• Disposal Cost: Containing and disposing of hazardous waste is expensive, typically ranging from $500-$1,000 for a drum. In some jurisdictions the “waste generator” owns the waste forever.

Retail fueling sites are regulated by multiple environmental programs that vary by state. Typical hazardous wastes generated include waste fuel, clean-up absorbents (like kitty litter), spent filters and catchment basin waste. Out of the 150 different chemicals that make up gasoline, the four most identified as toxic to humans are benzene, toluene, ethyl benzene and xylene.

Benzene content in gasoline is federally regulated. The current national benzene content in gasoline is about 1% as measured by volume. The reason for this strict regulation is that one gallon of gasoline can contaminate up to a million gallons of water, making it undrinkable.

In my 20-year experience, most gas stations do not have the necessary hazardous safety protocols required by state and federal regulations to handle hazardous waste. The absorbents used to respond to fuel spills are swept up and disposed of with all the rest of the trash. While not ideal, store personnel and leaders typically respond that they “double bag” the

hazardous waste before putting it with the other trash. My favorite response when asking what site operators and leaders do with the waste over the years is: “The OIL DRI fairies come and take it.”

While warnings and fines are given by enforcement agencies to prevent the incorrect disposal of hazardous waste, the immediate risk comes from flammability. As the kitty litter absorbs the fuel spill, that kitty litter continues to be flammable for a long time. The “double bagged” waste builds up volatile organic compounds, creating a fire hazard. Of the more than 5,000 retail fueling site fires reported in the United States according to the NFPA, more than 1 in 10 is caused by outside trash fires.

For site employees cleaning up the spill, flammability is a serious safety concern. During the process the kitty litter continues to be highly flammable, endangering the responder and customers in the spill area.

Despite being the most common solution for over 100 years, utilizing kitty litter on spills is expensive, labor intensive, unsafe and fails to correctly treat gasoline left behind in the concrete. Fortunately, new fire suppression technologies are available and are successful in addressing operational, safety and cost-related issues at gas stations around the globe.

The new technology uses microemulsion to suppress vapors to remove fuel flammability in less than three minutes. Additionally, active hydrocarbon-eating microbes can be used to bioremediate and break down remaining hydrocarbons in the surface over time. Bioremediation is an EPA-recommended process for using microbes to break down hazardous chemicals and contaminants.

The full cost of responding to a fuel spill must include the absorbent cost, labor and disposal.

Mike Zahajko is an industry speaker and the executive vice president for CAF, a leader in outdoor cleaning. Learn more about alternative spill solutions at www.mycaf.com/reactfuel-spill-neutralizer.html

Gone are the days where the only way to measure the fuel level in an underground storage tank (UST) was to insert a long stick into it, “read” the height of the fuel and then consult a tank-strapping chart to extrapolate how much more fuel the UST can accommodate or how long it may be until the fuel runs out. Thankfully, there’s been some noteworthy mechanical and digital advancements in automated tank gauging and fuel monitoring since the days of tank sticking.

But the data these next-level systems can gather and monitor is still

disjointed and largely reactive, with each monitoring component its own little ecosystem with no universal connectivity. The next evolutionary step of site monitoring is a system that not only can pull information from an ATG but also collate, centralize and interpret that data on a minute-by-minute basis and intuitively recognize points of failure before an actual failure occurs.

These systems would also parse this breadth of operational data across compliance, alarms, wetstock and fuel inventory, and then proactively suggest ways they could be used to, for instance, identify the best day or time

to order more fuel, improve nozzle flow before customers complain or be alerted to a fuel system component that may be close to breaking down or becoming out of compliance.

At a typical forecourt fueling site, there are three significant pressure points—fuel inventory, compliance and maintenance—that must be monitored constantly. Any slippage in performance in these areas will put the site at risk of incurring excessive downtime, operational disruptions, out-of-compliance fines or even, in the worst-case scenario, a complete site shutdown.

A forecourt that consistently runs out of fuel won’t be in business for very long. Given ever-changing demand and supply conditions, site operators need to have complete visibility into the fuel level in every UST at all times of the day. Often, however, fuel retailers are at the mercy of their carriers, who

Image Caption Goes Herewill schedule deliveries that will make them profitable, not necessarily the site owner. Which is why “stuffing the tank” or runouts are not uncommon.

Another piece of the inventory puzzle is fuel reconciliation. When a delivery occurs, the operator must be confident that the amount of fuel in the UST is the amount that was ordered since everyone wants to get what they pay for. Traditionally, the only way to confirm the delivery amount was trusting a potential erroneous ATG reading and matching it against the BOL or allowing a threshold of variance per delivery.

Staying in compliance is both a necessity and a headache for retail fueling sites. Storing and tracking testing, permits, certifications and inspection information and staying up to date on any changes in requirements is time-consuming, and there are dire consequences if a fueling site falls out of compliance.

To stay in compliance, site operators must identify the cause and effect when an out-of-compliance condition occurs. To do this, they must have an almost supernatural ability to find an issue before it becomes a problem. For example, when frequent outages occur, it often causes air to get into the fuel supply lines, which in effect will put the system out of compliance and create other maintenance costs.

Industry-wide labor shortages continue to plague fuel retailers. So when a line-leak alarm sounds, how can the site operator know when, or even if, a service tech is available to come out and inspect it?

Additionally, by their nature, maintenance routines can be inefficient. After a call is made to the service provider to schedule a site visit, the technician must travel to the location, troubleshoot the situation and identify the best way to fix the problem, which can be challenging if the root cause is unknown.

The most efficient and profitable retail fueling sites are those that create a symbiotic relationship between the fuel inventory, compliance and maintenance areas of their operations. This is only possible if these three departments have the right data and tools to proactively determine an issue long before it affects the customer.

The next evolution of fuel management solutions can collect, centralize and analyze fuel-site data via a single access point, putting actionable operational insights at the user’s fingertips. Utilizing artificial intelligence and advanced data analytics, these solutions enable operators to gain a full picture of real-time events and fuel losses that pose an efficiency, business or compliance risk, with notifications and workflows to manage each issue to resolution.

Instead of logging into multiple systems, the latest software solutions enable fuel managers to manage by exception on a single platform, remotely diagnose key issues and automate traditionally repetitive tasks such as relying on site staff to enter daily variance totals on a spreadsheet, calling sites for inventory levels to order fuel, or running manual weekly reports to review ATG alarms.

Easy to connect and deploy, these tools perform two previously unattainable tasks when it comes to optimized fuel-site management: 1.) They give users access to all key points of fuel inventory, compliance, alarm and wetstock data on one platform. 2.) They take advantage of next-generation AI algorithms and machine learning to compile and analyze historical operational trends to create a proactive system and workflows that alert site operators to an issue before it becomes a costly problem.

So, while technology will continue to evolve, today’s smart fuel retailers are shifting from a reactive to proactive mindset, armed with the tools to run a more efficient, compliant and profitable fueling operation.

Clay Moore is senior director of product for Leighton O’Brien and can be reached at claymoore@ leightonobrien.com. Leighton O’Brien is a leading global fuel-analytics technology provider that enables retail fuel networks to reduce environmental risk, prolong asset lifespan and optimize capital spend. For more information visit www. leightonobrien.com.

The most efficient and profitable retail fueling sites are those that create a symbiotic relationship between the fuel inventory, compliance and maintenance areas of their operations.

Supply chain issues show the benefits of versatile filters.

BY BOB INGHAMThe year 2022 was full of surprises and, for the fueling industry, not least among those was how supply chain issues would transform what previously seemed like an everyday replacement part into a highly coveted piece of equipment. There were several times when fuel dispenser filters were hard to come by, with demand outpacing the supply that was readily available. Fuel-site operators took dispensers out of service. Regulators temporarily excused overdue filter changes. Fueling customers were greeted by out-oforder pumps.

Fuel dispensers require more maintenance than most other equipment on the premises. The supply chain challenges illuminated the benefit of stocking versatile filters

that support numerous dispenser filtration applications.

Here are some important reasons to stock an inventory of fuel dispenser filters with wide-ranging capabilities.

1. FUEL DISPENSER FILTRATION IS NOT A VALUE-ADD; IT’S A NECESSITY. Many states have minimum requirements for fuel dispenser filtration and fuel quality. Nevertheless, all too often, fuel-site operators underestimate the role of fuel dispenser filters in a fueling system. This is not particularly wise because fuel dispenser filters perform an important job.

Contaminants can be introduced to fuel at any point during the supply and distribution process. By the time a consumer pumps fuel from the dispenser, it may have been contaminated three

or four separate times. Fuel dispenser filters are the last chance to capture harmful particles and prevent them from being pumped into a vehicle and damaging it.

2. FUEL DISPENSER FILTERS ARE NOT SIMPLE PIECES OF EQUIPMENT. Fuel dispenser filters may look simple, but they are actually highly engineered components that must reliably provide filtration and contaminant-sensing capabilities for today’s fueling systems.

For example, water-sensing and phase-separation-detecting filters contain special materials that cause a chemical reaction inside the filters in the presence of certain contaminants. This reaction triggers the filter to swell to help prevent passing the contaminated fuel into the vehicle. The slow flow is also a signal to fuel-site operators that a serious problem in the tank needs to be addressed.

Although not regulated by the U.S. Environmental Protection Agency, fuel dispenser filters still need to be constructed in a leak-proof manner. Cover backplate assemblies should be

formed of thick steel for strength and roll-seamed to the shell to prevent leaks. Additionally, the filter materials—including gaskets—need to be compatible with the fuel passing through the filter and be able to withstand the dispenser’s flow rate.

Fuel dispenser filters that are UL-recognized must meet UL’s standards of component service. PetroClear filters, for example, are recognized as safe to use with E0 to E85 (neat gasoline to ethanol blends containing up to 85% ethanol) and for B0 to B100 (standard petroleum-based diesel to pure biodiesel).

3. FUEL DISPENSER FILTERS DO IMPACT CUSTOMER LOYALTY. While advancements in dispenser engineering and monitoring capabilities promise to help make dispenser maintenance more predictive, it is impossible to avoid dispenser downtime altogether. But it is important for fuel retailers to minimize downtime to provide customers a positive experience at the pump. Fuel dispenser filtration plays a large role in that.

Downtime is exacerbated when filter supplies are in high demand or supply chain issues create delays. A limited pool of service technicians can further extend downtime. A dispenser awaiting replacement filters that would have normally been offline for just a few days could be out of service indefinitely. That pump isn’t generating revenue, nor is it enticing customers to go inside and purchase higher-margin items. Having a surplus supply of filters in inventory can minimize such headaches.

4. THE CHOICES FUEL-SITE OPERATORS MAKE WHEN SELECTING FUEL DISPENSER FILTERS CAN HELP OPTIMIZE DISPENSER MAINTENANCE.

On top of needing safe and reliable equipment, fuel sites are usually combatting multiple fuel quality

issues at any given location, on any given day.

Certain fuels are more susceptible to certain types of fuel quality problems than other fuels. And conditions inside an underground storage tank can vary from one tank to another. As a result, having filters on hand that cover the gamut of capabilities to address the scope of possible fuel quality problems is important for keeping the forecourt running smoothly.

To deliver expanded capabilities and provide flexibility with future dispenser maintenance, the filters should be able to:

• Capture particulate;

• Detect dangerous levels of water and help prevent the water from being dispensed into vehicles;

• Detect phase separation and help prevent ethanol blends that have separated into distinct layers from being dispensed into vehicles.

The size of the filter also makes a difference. Standard fuel dispenser filters measure around 5 inches tall. “Extended life” filters range from around 7 inches tall to 10.5 inches tall, with the latter providing twice the filtration media, which allows the filter to capture more contaminants than a smaller filter before requiring a filter change. The 10.5-inch-tall filters have the potential to decrease filter maintenance by nearly 50% in a properly maintained fueling system that experiences relatively consistent throughput.

Value is perceived differently by everyone, including fuel-site operators and their customers. But with most customer experiences starting at the pump, and so much riding on the dispenser to drive sales inside the convenience store, doing whatever is necessary to keep pumps running seems to make sense. Investing in fuel dispenser filters with a wide range of capabilities may be the answer.

Bob Ingham is the business development manager for PetroClear, a manufacturer of fuel-dispensing filters. He has more than 25 years of experience in filtration and automotive component development. Contact him at robert.ingham@ champlabs.com

Fuel dispenser filters are the last chance to capture harmful particles and prevent them from being pumped into a vehicle and damaging it.

Fleets can be managed either in-house or through outsourcing, which appears to be increasing. Here is a look at the benefits and drawbacks of each approach so busy fleet operators can determine which is the best option for their business.

Choosing an approach to fleet management depends on the type of business, the number of vehicles and assets within the fleet, and most importantly, the available skills and workforce within the business.

A fleet manager’s responsibilities can seem overwhelming. Here are just a few things to consider:

• Vehicle sourcing and purchasing

• Maintenance

• Driver requirements such as license checking

• Purchasing and disposal

• Vehicle funding

• Procurement management

• Fleet administration

• Parking and fines administration

• Driver support and training

• Health and safety compliance

• Vehicle tracking and communications

• Vehicle breakdown and recovery

Although managing this workload doesn’t tend to be a problem for larger fleets with tasks carried out across a team, for smaller fleets this could mean some, if not all, of these tasks can’t be done.

Managing and monitoring costs: You and your team know your business better than any external agency–no matter how good the supplier. Familiarity with the vehicles, drivers and resources can help identify areas of concern before they manifest into bigger problems. That can lead to smarter ways of working with the rest of the business that could save money or improve operational efficiency. You can build individual relationships with suppliers and other specialists to deliver on service-level agreements and negotiate rates to save on both fleet costs and additional unplanned vehicle downtime costs just as an outsourced supplier would.

The big picture: Outsourcing can be great for nailing down specific improvements, especially in certain specialist

areas. But, does the outsourced partner have the big picture in mind? Fully understanding your business’s wider plans and goals is key, and an in-house operation will get this. Sometimes, there might be an improvement that could be made to the fleet operation, which has an impact elsewhere on the business. Only an in-house team might be able to see that. That’s because an external service provider won’t have full access to your sensitive business information.

So, while you might be prepared to negotiate for additional budget funding by demonstrating the longer term cost-benefit analysis, an agency will tend to favor achieving only the targets and objectives as pre-agreed in the contract.

Access to new ideas: Bringing an outsourcer in could be the fresh air your business needs. These specialists spend time working with many different companies’ fleet departments, and as a result bring new best-practice concepts and ideas for your fleet processes.

Ability to focus: Is your business focusing on the wrong thing? Outsourcing fleet management could allow you to concentrate on the things that really drive the business forward. It may be easier to outsource the management of vehicles to a specialist organization to remove management strains and manage associated fleet risk.

Reducing risk: Do you find

managing compliance and industry standards a nightmare? There’s ever-changing legislation to keep up with, too, and depending on the size of the operation, this may be less of a problem for larger fleet departments; however, for smaller ones, the risks can be just too great.

Outsourcing can help alleviate some of this worry. Processes and procedures will already be in place to minimize failure to comply, with tools such as fleet management systems creating auditable trails.

It’s worth noting though, that the overall accountability will still rest with you.

Access to resource and knowledge: Outsourcing often means access to a plethora of specialist systems, tools and knowledge that had previously been unavailable. The systems and tools will in turn allow you access to market intelligence, giving you the ability to benchmark your performance.

The costs: Running a fleet in-house comes with a capital cost. You’ll need to spend on providing the suitable facilities and equipment, and that can be a challenge for larger fleets, let alone smaller ones.

As an example, maintenance tasks carried out in-house will require workshops, equipment and trained staff—all of which can be expensive. These costs need to be compared to outsourced work.

Finding staff: Sourcing high-caliber, trained staff can prove troublesome. Can you find enough of the right people to run your operation?

Access to specialist technology: Do you have the tools and systems in place to manage the department efficiently and to improve your operation?

Some fleets rely on outdated practices such as managing and reporting

through spreadsheets and systems with limited integrations and may overlook costly issues.

Contract management: Once costs have been drawn up as per the contract, the potential to find future spending savings could be limited. That’s because these costs tend to be tied into the contract for the agreed period before they can be reviewed and amended. There are often penalty clauses for such amendments before the end of the contract.

In difficult times, when businesses examine where they can make cutbacks, a reduction to fleet operations may not be possible due to contractual obligations.

There’s nothing worse than needing to let go of the workforce and vehicles through redundancy but still paying for a contracted service that is no longer required or only required in part. Similarly, fleets lose bargaining power in areas such as purchasing vehicle parts. Suppliers and prices will remain as set in the contract, which could prove costly in the longer run.

Slower to move: Discussions with your fleet management organization will need to go through the proper channels, which can reduce efficiency itself. That’s because the correct policies and procedures need to be taken to initiate any changes or areas of concern, which can delay operations. This might make you less agile.

How to decide between in-house or outsourcing fleet management? For smaller fleets that want to retain in-house management, there are options available to help, such as fleet management software. Outsourcing part rather than all of an operation is another option. Read more at fuelsmarketnews.com.

Is your business focusing on the wrong thing? Outsourcing fleet management could allow you to concentrate on the things that really drive the business forward.

Terminals which store oil, petroleum and petrochemicals and even the tankers that transport product must meet U.S. Environmental Protection Agency (EPA) and local wastewater requirements for effluent, including those under the Clean Water Act. The EPA

has identified 65 pollutants and classes of pollutants as “toxic pollutants,” of which 126 specific substances have been designated “priority” toxic pollutants. Failing to meet EPA requirements can result in fines that quickly escalate.

Petroleum can enter the wastewater stream at fuel storage depots as well

as rail, barge and road tanker transport hubs. Often the wastewater is discharged into local sewer or trade waste systems and must meet local environmental specifications. Typical contaminants can include solvents, detergents, grit, lubricants and hydrocarbons.

For petroleum terminals and tanker hubs, this means installing a wastewater treatment system that effectively separates the contaminants from the water so it can be legally discharged into sewer systems or even re-used. However, traditional wastewater treatment systems can be complex, often requiring multiple steps, a variety of chemicals and a considerable amount of labor. Even when the process is supposedly automated, too often technicians must still monitor the

Automated wastewater treatment systems help petroleum terminals and tankers remain in EPA compliance.

equipment in person. This usually requires oversight of mixing and separation, adding of chemicals and other tasks required to keep the process moving. Even then, the water produced can still fall below mandated requirements.

Although paying to have petroleum terminal and tanker wastewater hauled away is also an option, it is extraordinarily expensive. In contrast, it is much more cost effective to treat the industrial wastewater at its source, so treated effluent can go into a sewer, and treated sludge passes a TCLP (toxicity characteristics leaching procedure) test and can be disposed of as nonhazardous waste in a local landfill.

Fortunately, complying with EPA and local wastewater regulation has become much easier with more fully automated wastewater treatment systems. Such systems not only reliably meet regulatory wastewater requirements but also significantly reduce the cost of treatment, labor and disposal when the proper separating agents are also used.

In contrast to labor-intensive multiple-step processes, automated wastewater treatment can help to streamline production, usually with a one-step process, while lowering costs at industrial facilities.

An automated wastewater treatment system can eliminate the need to monitor equipment in person while complying with EPA and locally mandated requirements. Such automated systems separate suspended solids, emulsified oil and heavy metals, and encapsulate the contaminants, producing an easily dewaterable sludge in minutes, according to petrochemical industry consultants at Sabo Industrial Corp.

The water is typically then separated using a dewatering table or bag filters before it is discharged into sewer systems or further filtered for reuse as process water. Other options for dewatering include using a filter press or rotary drum vacuum. The resulting solids are non-leachable and are considered non-hazardous and will pass all required testing.

These systems are available as manual, semiautomatic and automatic batch processors and can be designed as a closed loop system for water reuse or provide a legally dischargeable effluent suitable for the sewer system. A new, fully customized system is not always required. In many cases, it can be faster and more cost effective to add to or modify an industrial facility’s current wastewater treatment systems when this is feasible.

However, because every wastewater stream is unique to its industry and application, each wastewater treatment solution must be suited to or specifically tailored to the application.

The first step in evaluating the potential cost savings and effectiveness of a new system is to sample the wastewater to determine its chemical makeup followed by a full review of local water authority requirements.

The volume of wastewater that will be treated is also analyzed to determine if a batch unit or flow-through system is required. Other considerations include the size restrictions, so the system fits within the facility’s available footprint.

Despite all the advances in automating wastewater treatment equipment, any such system requires effective separating agents which agglomerate with the solids in the wastewater so the solids can be safely and effectively separated.

An automated wastewater treatment system can eliminate the need to monitor equipment in person while complying with EPA and locally mandated requirements.

Sal Boutureira is owner of SABO Industrial Corporation, which has been in the wastewater treatment industry since 1992 and has introduced wastewater treatment solutions to companies in the United States and Europe, translating into millions of gallons of wastewater that are now within compliance for discharge or reuse. Learn more at www.saboindustrial.com or email info@saboindustrial.co m.

Bentonite has a large specific surface area with a net negative charge that makes it a particularly effective adsorbent and ion exchange for wastewater treatment applications to remove heavy metals, organic pollutants, nutrients, etc. In contrast, polymer-based products do not encapsulate the toxins, so systems that use that type of separating agent are more prone to having waste products leach back out over time or upon further agitation.

Today’s automated systems along with the most effective separating agents can provide oil terminal and tanker hub operators with an easy, cost-effective alternative so they remain compliant with local ordinances and the EPA. Although there is a cost to these systems, they do not require much attention and can easily be more economical than paying fines or hauling.

The world trade fair for the off-road mining and construction sectors known as bauma took place October 24-28, 2022, in Munich, Germany. On display were the most massive examples of the heavy equipment that powers global energy and transportation, resource mining and construction sectors.

While big machines dominated the floor at the expo hall, it was the big ideas about a reduced-carbon future, sustainability and productivity that drove the conversation at the 33rd gathering of the world’s largest construction trade show.

Customers in these sectors have specialized needs and demands for

their business and equipment that operates in every corner of the globe in demanding conditions, often 24 hours a day. These needs include being successful in a sustainable and reduced-carbon future. Manufacturers at the trade fair showed they are responding to these needs.

AGCO Power debuted a new family of diesel engines called CORE. “Alternative fuels of the future such as hydrogen, ethanol, methanol, biogas as well as electric hybrid applications set new demands for an engine,” AGCO Power noted. “The CORE engine platform is designed to enable the use of alternative fuels with further development.”

Caterpillar’s commitment to a reduced-carbon future was on display, highlighting a diversity of solutions

Big machines, big power and big ideas dominated the 2022 bauma world trade fair.

and options available covering both new products and strategies for reducing carbon intensity in existing products. Cat’s advanced power solutions approach is all about providing options. New fuels and technology like electric battery packs and hydrogen fuel cells, along with gaseous fueled (natural gas, hydrogen) and diesel engines that are capable of using low-carbon intensity fuels provide an array of customer choice. From the largest machines to the smallest all-electric compact excavators, there are solutions for every application.

FPT Industrial showed off new Stage V emissions-level engines, compact hybrid solutions and new battery pack technology.

John Deere focused on its next generation engine range designed to run on renewable fuels. Current engines are compatible with renewable fuels, ethanol, biodiesel and biofuels such as hydrogenated vegetable oil (HVO). Deere also showcased a diesel-electric powertrain and its latest developments in batteries and electric motors. Taking efficiency beyond the engine, Deere also demonstrated how automation technology in motor graders can boost efficiency and productivity on the job site and lower fuel consumption and emissions, as well as the use of remote monitoring of machine conditions. Volvo Penta expanded its electromobility offerings with a cube battery for underground mining loader equipment. This is a step toward helping customers transition to net-zero emissions and achieving the company’s commitment to the Science Based Targets initiative, where it aims to reach net-zero value chain emissions by 2040.

Yanmar introduced a carbonneutral electrification strategy that will establish it as an all-in-one systems integrator for smart electrified power solutions tailored to the application-specific needs of individual OEMs. Yanmar has several new energy

projects in various sectors, including hydrogen-powered cogeneration, research into hydrogen fuel marine engines, biogas cogeneration, dualfuel power solutions with natural gas, fuel-cell marine technology, smart agriculture and resource recycling technologies.

For existing products in these unique sectors, it’s clear that customer demands for sustainable and decarbonization strategies are high. The use of low-carbon intensity fuels like hydrogenated vegetable oil (HVO), also known as renewable diesel fuel, deliver important near-term options for decarbonizing immediately. HVO is a drop-in replacement for petroleum diesel and can be used in blends with regular diesel fuel of up to 100%.

Sustainability and decarbonization take on many forms beyond equipment and fuel technology choice. In these sectors, with slower turnover of equipment, the remanufacturing of existing engines and equipment is one element of a sustainable strategy. It supports a circular economy, one that minimizes waste and energy consumption in making new products and restoring existing products back to original performance that includes lower fuel consumption than aging products.

Looking at these technology developments in very large machines and equipment brings a much greater appreciation for what it takes to tackle the industrial-size work of mining, construction, lifting, digging and moving material. Diesel powers most all of this equipment today, and from the looks of bauma 2022, it will continue that role in the future only to be enhanced by further innovation in engines and use of low-carbon fuels, being paired with electrichybrid technologies. Hydrogen, other gaseous fuels and fuel-cell propulsion systems will undoubtedly earn a place as well. To meet the challenge of climate change, we need all of these solutions.

Allen Schaeffer is the executive director for the Diesel Technology Forum, a nonprofit organization dedicated to raising awareness about the importance of diesel engines, fuel and technology.

The use of lowcarbon intensity fuels like hydrogenated vegetable oil, also known as renewable diesel fuel, deliver important nearterm options for decarbonizing immediately.

High prices for crude oil and fuel continue to be a tremendous issue throughout the world, driving inflation and impacting global markets amid Russia’s continued war in Ukraine and economies that are still trying to recover from the pandemic.

Fuels Market News interviewed three industry-focused oil and fuels analysts to discuss some of the factors that readers should watch for in the coming months. All were quick to point out that we are living in unusual times right now, making traditional forecasts difficult. All indicated little expectation of major changes in the status quo in the first quarter of 2023, barring extraordinary circumstances. However, they did offer some input on the various factors to watch as things develop.

The core component of refined product prices is typically linked to the price of crude oil, which was averaging in the $90 range at press time. This is down considerably from the peaks over $120 per barrel immediately after the Russian invasion of Ukraine. However, prices have stalled due to several supply and demand factors.

On the supply side, the industry was still recovering from the impact of the pandemic-related oil glut that saw prices plummet (even going negative for a short period), severely financially damaging many producers and hurting investors. Demand and supply were recovering, and then the Ukraine disruption occurred.

The resulting sanctions on oil-producing Russia substantially impacted Europe’s natural gas and refined product supply and disrupted global crude supplies. This has been gradually working itself out. Russia has so far been able to find alternative markets for much of its crude though sales to China, India, Turkey and even Saudi Arabia (though at lower volumes and discounted prices). The United States began to adjust its exports to fill European needs, and the Biden Administration began drawing down the Strategic Petroleum Reserve.

However, there was a lack of aggressive, extra production in regions like the United States to quickly ramp up supply. Further, OPEC+ in October 2022, agreed to production cuts of 2 million barrels per day, though that is not always set in stone.

“There’s a lot of difference between what [OPEC+] says and what the realities are,” said Alan Levine, founder and CEO of the hedging advisory firm Powerhouse. “We have a lot of serious uncertainties overseas, obviously, and we’ll see what emerges as the Saudis look for a new position for themselves in the world. There’s even talk that their ability to produce is somewhat strained as well.”

Geopolitical and economic headwinds are likely to persist into the first quarter, industry experts say.

The rationale for the OPEC+ cuts is straightforward.

“OPEC is saying that they made this cut because they see lower demand growth going forward from global economic issues,” said Brian Milne, energy editor and a product manager with DTN. “What they’re really trying to do is support oil at around $90 a barrel. Will they be successful? Demand can come. Or, when you start seeing demand drops and people lose confidence in the market, you could really see prices just plummet despite those cuts if you didn’t make them in time.”

Several of the analysts noted that the administration’s decision to refill the depleted Strategic Petroleum Reserve at $70 per barrel effectively sets a floor on how low prices can go.

U.S. fracking producers have also been hesitant to ramp up significant production to levels demanded by the Biden Administration, despite accusations of price gouging, threats of windfall profit taxes and favorable current oil prices. There are several factors at play.

“In both Europe and the United States, policy has been going against fossil fuels,” said Milne. “The restrictions on investments, the inability to get certain pipelines approved—in recent years that’s been a disincentive. Not to mention a number of the bigger banks have discouraged any sort of investment in oil production—the whole ESG thing.”

The focus on a future green economy and discouraging investment in traditional fuels is not all that’s impacting increased production. Since the beginning, fracking has involved regular cycles of both boom and bust (and, as already noted, the pandemic was a recent, huge bust period), and there finally appears to be some discipline in the industry.

“You’re hearing a lot of drillers have cleaned up their balance sheets,” Milne said. “They got rid of the debt because they’ve followed this process. That’s why if you look at crude production, it really hasn’t grown this year despite the high prices. So, what you’re seeing is more discipline, not just because of the Wall Street demands but also looking out and saying we want to preserve our reserves.”

What would happen if the war in Ukraine was suddenly decided with complete success for the West, causing sanctions to ease?

The bullish possibility is that all’s right with the world, traditional flows could resume, and buyers could seek to reestablish traditional relationships, Levine said. “Short-term demand from Western buyers boosts prices. Generally, good news encourages optimism and boosts prices. The bearish possibility is prices fall because of a reduced fear premium. No Putin, no dirty bomb and the potential for more Russian output. Demand for war goods, including jet and diesel fuel, falls.”

That leaves the demand side, where the “good” news is anything but good. The health of the global economy (and the U.S. economy more domestically) is likely the major issue weighing on where prices go moving forward.

Milne noted that the United States was in a recession in the first half of the year. “We saw some better growth than anticipated in the third quarter, but there are already signs of struggle,” he said. “Do we flip into negative growth in the fourth quarter? Maybe, maybe not.”

The situation is equally grave, if not more so, globally.

“It’s looking like a global recession is coming, and it’s hard to get out of this box now because you’re seeing inflation pressures,” Milne said. “There are some numbers that just came out from Germany and Italy showing high inflation. So, Europe is stuck in there. We know the U.S. still has high inflation, and the response is going to be through interest rates, and that’s going to curb the demand side.”

Milne noted crude price predictions range from Citibank projecting $65 per barrel WTI (based on predictions of a global economic recession), to Goldman Sachs and Bank of America anticipating $135 per barrel. He sees a price from $70-$85 or so a barrel as more likely going into 2023.

Diesel is under significant pressure globally. Europe lost imports from Russia, there have been refinery strikes in France and a number

“OPEC is saying that they made this cut because they see lower demand growth going forward from global economic issues. What they’re really trying to do is support oil at around $90 a barrel.”

—Brian Milne, energy editor and a product manager with DTN

of refiners have converted from conventional to renewable diesel. The United States has fared better, overall, but is facing some significant logistical issues with diesel on the East Coast.

“Inventories are terribly tight, and the mystery in all of this is we’ve got available crude oil to where we are exporting it,” Levine said. “And refinery operations are still in the upper 80s [percent] of capacity, so you’re still getting reasonable runs. But despite all that, we simply have been incapable of building inventories.”