FUTURE KNOWLEDGE & BLENDED FINANCE

Connecting more flavours than any other airline.

NATURAL MINERAL WATER FROM SWEDENBRUNNBÄCK 500 ml

Kalium: 2 mg/l Kalcium: 30-33 mg/l Magnesium: 3,4-3,7 mg/l Natrium 6,5-7,0 mg/l

Alkalinitet: 71-87 mg/l Flourid: 0,46-0,67 mg/l Klorid: 15-16 mg/l pH 7,8

@Brunnbäck Sweden Natural Mineral Water org. 559365-3693 www.brunnback.com ° info@brunnback.com

BRUNNBÄCK SWEDEN Natural Mineral Water Carbonated Water 500 ml

Are you up to date on the latest international advancements from G20?

Our 14th Global Briefing Report Review is a comprehensive look into the outcomes and discussions made by the Indonesian Presidency of G20. We provide an in-depth review of the Summit that will give you insight into how it’ll influence global affairs in the future. On top of that, we are excited to share information about upcoming summits throughout the year at groupofnations.com and with our newly launched Podcast show.

Stay informed with our Summit at groupofnations.com so that you can catch everything necessary! Stay ahead of global affairs by understanding what happened during Indonesia’s tenure as G20 President and stay Summit on any new developments related to this organization worldwide.

Discover what topics are being discussed for the upcoming 18th G20 Heads of State & Government Summit in Delhi on 9th-10th September 2023. With our exclusive report reviewing these critical events, you can ensure you never fall behind. You can share your company’s story on how you are providing solutions to some of the world challenges we face today.

We are excited to publish the first-ever COP Global Briefing Report Review, which will be out later in the year. You can go to COP27.eg and see the official website and sign up for the issue. After 27 years of publishing these Summit bespoke publications, we can not thank our knowledge partners enough who believe in the work and share these Global Briefing Reports amongst their networks.

I hope you enjoy it, and please remember to go to Groupofnations.com and sign up for your free issue.

Since 2010, the Business 20 (B20) has been the official dialogue forum for the business community to communicate and share their aspirations with the G20 governments. This year, global economic recovery has been significantly impacted by supply-chain disruptions, pandemic recovery needs, the growing development divide in innovation and technology, and the increasingly pressing nature of the climate crisis. B20 Indonesia, hosted by the Indonesian Chamber of Commerce and Industry (KADIN Indonesia), has brought together global business and thought leaders to address these pressing economic issues from a business perspective.

To that end, B20 Indonesia convened six task forces and an action council, composed of chief executives and senior members of companies and business organizations in G20 countries. These bodies formulated actionable policy recommendations. These recommendations are intended to be adopted and implemented by G20 governments to boost recovery and economic growth. In the recommendations, B20 Indonesia has prioritized three key areas: accelerating the green transition, promoting inclusive growth, and creating equitable access to healthcare.

Climate change has profoundly impacted the global community.

The G20 economies account for around 80 percent of global greenhouse gas emissions, meaning businesses in G20 countries have a significant role to play in achieving a net-zero future. B20 Indonesia is committed to promoting private-led transformation through various pathways, including scaling up renewables and green technologies, tapping into carbon markets, and driving green investments.

The belief that inclusivity and growth should be addressed separately has often hampered efforts to pursue more inclusive and resilient economic recovery and growth. Promoting inclusion is key to unlocking economic growth, according to studies. For instance, increased women’s participation in the global economy could potentially add USD 2.1 trillion in GDP by 2025.

Despite this potential economic benefit, women and micro-, small-, and mediumsized enterprises (MSMEs) still face multiple difficulties in participating in the global value chain. B20 Indonesia is prioritizing the shift to a more sustainable and equitable economy for women and MSMEs through transformative change led by public- and private-sector leaders.

The COVID-19 pandemic will not be the last global health crisis to radically disrupt the global economy. In any given year,

there’s a two percent probability that a global pandemic with a similar worldwide impact on the global economy will occur. We need to invest in and strengthen public health systems to improve overall health resilience. Mitigation of future health crises should be achieved by closing systemic gaps in health infrastructure across populations and regions worldwide. B20 Indonesia is advocating for business players to collaborate to create equitable access to healthcare and bolster health system resilience, especially in low- and middleincome countries.

I am grateful for the constructive support we have received on our policy recommendations, B20 Indonesia Legacy Programs, and side events from our task forces, the action council, International Advocacy Caucus (IAC) members, and all the B20 communities. Your support has played a vital role in shaping and honing our recommendations to make a difference in the broader G20 countries.

Finally, I would like to offer B20 Indonesia’s best wishes, encouragement, and support to B20 India. I trust that their efforts will further amplify the progress the B20 community has made during B20 Indonesia’s presidency and the synergies we have brought to fruition, thus bringing the G20 countries even closer to resilient, sustainable economic growth.

This year, global economic recovery has been significantly impacted by supply-chain disruptions, pandemic recovery needs, the growing development divide in innovation and technology, and the increasingly pressing nature of the climate crisis.ARSjad Rasjid Chairman of the Indonesian Chamber of Commerce and Industry (KADIN Indonesia) and Host of B20 Indonesia

Throughout Indonesia’s G20 presidency, B20 Indonesia has been at the forefront of change in global economic recovery. It hasn’t been easy to navigate the dynamics of the global economy while representing the diverse interests of the B20 business community. At times, we have needed to reflect, take a step back, and reframe our thinking. At other times, we have had to innovate and push ourselves to ensure that our policy recommendations have a real impact on the global economy. I am personally thankful to the business leaders in the task forces, the action council, the IAC, our knowledge partners, and the entire B20 community for the tireless efforts and generous counsel, input, and resources throughout the year. All of you have contributed to the success of B20 Indonesia.

B20 Indonesia is committed to delivering actionable policy recommendations, building on the work of past presidencies, and creating pragmatic real-life progress to accelerate global economic recovery and sustainable growth. Since our inception meeting in January 2022, we have successfully conducted more than 350 key meetings and 130 side events, collecting input from more than 1,200 business players across G20 countries. The diversity of thoughts and aspirations has helped create inclusive outputs of 25 policy recommendations and 68 policy actions for the greater G20 governments to act

upon. I am extremely proud to share the three key breakthroughs we made in our policy recommendations:

B20 Indonesia is prioritizing innovation to unlock post-crisis growth

This includes opening up digital opportunities across the economy, expanding cooperation for better cybercrime response, and increasing funds for green infrastructure through a blended finance mechanism.

B20 Indonesia is empowering MSMEs and vulnerable groups

This is done through building MSMEs’ decarbonization and green financing capabilities; enabling entrepreneurship, business growth, and job creation for MSMEs; and empowering women-led MSMEs and workers in the informal economy, including in rural communities.

B20 Indonesia is supporting increased collaboration between developed and developing countries

This will help mitigate future global crises by creating robust guidelines on health emergency preparedness.

Beyond these, B20 Indonesia has initiated four B20 Indonesia Legacy Programs, which are inspired and derived from Task Force’s and Action Council’s policy recommendations with aim to deliver tangible and pragmatic outcomes to ensure lasting impact beyond the B20 Indonesia’s presidency:

• Carbon Centre of Excellence: platform to empower businesses to unleash carbon trading growth potential through carbon knowledge repository and practicesharing center.

• B20 Wiki: platform to scale up nextgeneration mid-sized companies to take part of the global supply chain.

• One Global Women Empowerment: platform to aggregate existing capacities and networks to accelerate and scale impactful women empowerment efforts globally.

• Global One Shot Campaign: global campaign aims to harness the potential of next-generation vaccines and injectables to help make preventable disease history.

With these breakthroughs, B20 Indonesia would like to invite the B20 communities as well as G20 leaders to support, sustain, and further develop these policy recommendations and B20 Indonesia Legacy Programs beyond B20 Indonesia’s presidency. We hope that B20 Indonesia communique will serve as a call to action to G20 leaders to urgently develop policies centralizing in these areas to advance sustainable and robust global economic growth. Let’s continue and keep this momentum to push forward global recovery, resilience, and growth by strengthening the partnership among business communities and government across G20 countries to recover stronger together.

At times, we have needed to reflect, take a step back, and reframe our thinking. At other times, we have had to innovate and push ourselves to ensure that our policy recommendations have a real impact on the global economy.

Aworldwide raging pandemic and Putin’s brutal war of aggression. The twenties really did not begin auspiciously. The German president’s notion of an epochal turning point hits the mark. The war and the desperate search for alternatives to fossil fuels from Russia somewhat pushed ongoing climate change, probably the greatest and most significant long-term challenge of our time, out of the headlines. As an aid to memory, just a few headlines from recent years: droughts in Australia, deforestation of the rainforest in Brazil, floods in Europe or melting glaciers in the Alps. The consequences of this warming – rising sea levels, climate instability, biodiversity loss, and humanitarian and energy crises, to name a few – pose an existential threat to the future of our society and all our businesses. According to the Intergovernmental Panel on Climate

Change (IPCC) more than a dozen natural systems—from ice sheets to the Amazon rainforest—are at risk of “tipping.”

In this extremely difficult situation, intermediaries like banks play a crucial role and have a resepctive responsibility in steering capital flows in the right direction. However, they can only play this role if they themselves think and act in the long term and are solidly positioned. Let’s face it, neither Liechtenstein as a country nor the institutions themselves are large or significant enough to not have a noticeable impact on global CO2 emissions and their net-zero commitments. And we are privileged to live in beautiful nature and blessed with much wealth and in a country with the highest per capita income in the

world. On the other hand, as a major wealth management location, we are also in a position to exert a disproportionate influence on the investment of funds and thus on the allocation of the so urgently needed capital for the green transition.

Business models of the banks in Liechtenstein have proven themselves as very resilient. They can be described with the traditional values of stability, quality or reliability. This tradition or “thinking in generations” stands for a sustainable business model that places the client at the centre of thinking and acting. Sustainability is also an important pillar of Roadmap 2025, the growth strategy of the Liechtenstein banking centre. The banking centre should play a decisive and formative role in the transformation of the global economy and society towards more sustainability. We do this in the knowledge that our demanding

clientele expects more than just high-quality services. They want financial institutions to contribute to solving the ecological and social challenges of our time.

In 2021, the sustainability issue also gained further political momentum. With the “traffic light” coalition in Germany, the decarbonisation of the economy and society was set as a binding goal for the first time for a large industrialised country. Climate protection in particular and the Sustainable Development Goals (SDGs for short) have thus virtually become the reason of state or the political orientation framework. This fundamental transformation will require immense sums of money over the next few years. At the global level, it is estimated that the annual investment volume to achieve the SDGs amounts to approximately USD 7 trillion. Currently, only one seventh of this is covered by the public sector. A substantial part must come from the private sector. And here, Liechtenstein banks in particular can play an important role as intermediaries and mobilise and channel the required capital.

Probably the most credible commitment of the banking industry to this transformation is the Net-Zero Banking Alliance (NZBA). In the meantime, more than 100 banks from over 40 countries and with total assets of USD 40 trillion, including all three large Liechtenstein banks, have joined forces in this alliance, committed themselves to net zero and given a clear roadmap on the way there.

The investments mentioned above are accompanied by equally large business opportunities. For example, the latest Better Business, Better World report estimates that sustainable and inclusive business models could unlock economic business opportunities worth at least USD 12 trillion per year by 2030 and create up to 380 million jobs worldwide. Perseverance, communication and solidarity are

terms often heard in the West in connection with the war in Ukraine and the sanctions. But they are also prerequisites for a successful fight against climate change. Firstly, all measures must be designed in such a way that they are long-term and can be sustained over a long period of time.

Secondly, good, truthful and transparent communication is needed. Because only those who recognise the sense of measures will also implement them and go the whole distance. And thirdly, it needs a solidary world community in which every country and every person makes their contribution. ■

The Liechtenstein Bankers Associafion was founded in 1969 and is the voice of Liechtenstein banks at home and abroad. It is one of the most important associafions in the country and plays an important role in the successful development of the financial centre. As a member of the European Bankers Federafion (EBF), the European Payments Council (EPC), the European Parliamentary Financial Services Forum (EPFSF), the Liechtenstein Bankers Associafion is an important member of key bodies at European level and plays an acfive role in the European legislafive process. Since 2017, the Liechtenstein Bankers Associafion has also been a member of the Public Affairs Council (PAC) with offces in Washington and Brussels, and since 2018, a member of the internafional network “Financial Centres for Sustainability” (FC4S). With the Roadmap 2025, the LBA has placed an even stronger focus on the two major topic «sustainability» and «digitalisation». As a consequence, the LBA joined the following two initiatives in 2021, each of which is a leader in its field: firstly, it has become an offcial supporter of the UN Principles for Responsible Banking and the Net-Zero Banking Alliance and secondly, it has become an affiliate member of the Canada-based Blockchain Research Institute (BRI), an independent, global think-tank dedicated to inspiring and preparing private- and public-sector leaders to be the catalysts of the blockchain transformation.

The Roadmap2025 is the multi-year strategy of the Liechtenstein banking centre. It is all about “growth through sustainability and innovation”. Ongoing climate change is one of the greatest global challenges. We are the first generation to sustainably destroy our planet and probably the last to prevent it. The financing needed to achieve the Paris climate goals as well as the broader Sustainable Development Goals (SDGs) of the United Nations is enormous. According to PWC, the annual global investment required to achieve the SDGs amounts to 7 trillion US dollars. Currently, only one seventh of this is financed by the public sector. A substantial part must therefore come from the private sector. The financial sector, and banks in particular, can and must therefore play a central role in mobilising and channelling these financial resources. This means a great responsibility, but also brings with it a great opportunity. If we successfully accompany this transformation, we will create the necessary growth to continue to create prosperity. Increasing digitalisation has a huge potential to accelerate the needed transformation for the benefit of our future generations.

CLIMATE PROTECTION IN PARTICULAR AND THE SUSTAINABLE DEVELOPMENT GOALS (SDGS FOR SHORT) HAVE THUS VIRTUALLY BECOME THE REASON OF STATE OR THE POLITICAL ORIENTATION FRAMEWORK. THIS FUNDAMENTAL TRANSFORMATION WILL REQUIRE IMMENSE SUMS OF MONEY OVER THE NEXT FEW YEARS

Metaverse is far from being an unfamiliar word in the technology world. It has proved be a game-changer not only in the gaming world but also as a business opportunity. The overlapping of the physical and digital worlds has opened ways for businesses to reach communities, engage with customers expand their operations across the globe. It has brought the world closer true sense by eliminating geographical and logistical barriers.

A Sustainable Future in the Metaverse all know how the lines of global borders can be blurred in the metaverse. But does it contribute to a more sustainable model of business? In simple words, the sustainability scale is moving upwards with the virtual world technology. The virtual platform discard the challenges companies in running sustainable activities. Digital goods are substituting physical goods, and digital twins are driving the optimization of the physical world. The is slowly leading to the better of planet.

With people opting to lead a cleaner and greener lifestyle, brands are encouraged to initiate energy-efficient environmental-friendly operations. According to a survey by Wunderman Thompson, when it comes to global challenges like climate change, 86% of respondents believe businesses have influential role to play in solving them; 88% of respondents also believe sustainability should be a permanent business practice. Brands can be seen doing their part and maintaining eco-friendly practices.

Looking at the Big Picture of futuristic enterprise, giving customers access to a virtual address, entrepreneurs can minimize their product wastage while saving on substantial operational costs. Similarly, the logistical inconvenience customers traveling for an event ultimately be erased when businesses start hosting virtual events with immersive engagement opportunities. Simultaneously, opting digital virtual operation will contribute to the cost-effectiveness →

→ of services and decrease the wastage of resources like paper and energy and most importantly human effort.

This fast-moving metaverse technology can immediately launch an idea with just a click. Virtual technology can contribute to faster product launches, advertisement pilot testing, real-estate developments, faster reach to the public, and, most importantly, accelerated customer feedback and service.

Business in the virtual world is only growing

As the concept of a virtual world is evolving, the metaverse is unleashing a new door for complete digital disruption. The development of metaverse technology and infrastructure has already seen an investment of about $120 billion. Thanks to Blockchain and NFTs, business offerings’ virtual and augmented realities have become much more accessible and popular among users. In 2022, the global metaverse market was estimated to be $100.27 billion at a CAGR of 47.6%. This is further expected to increase to $1527.55 billion by 2029.

D2C is one such market that does not fail to envision the metaverse’s benefits. D2C brands have established the metaverse as the perfect platform to expand the reach of their offerings. Brands of beauty products, electronics, home décor, real estate, etc., have jumped into the virtual world business.

Business in the metaverse means personalized customer experiences, touching newer markets, and upgradation of products and operational services. Brands like Nike and Louis Vuitton have opened their virtual store for customers to explore. With these stores, such brands can design their store without space, design, or color restrictions. The space is ticking to unlock new opportunities with a new customer base. The world has begun adopting some of the few elements of the metaverse virtual world. Some of them include VR headsets, ultra-fast broadbands, and online digital worlds, which are already functioning, and ready to be accessed by all soon.

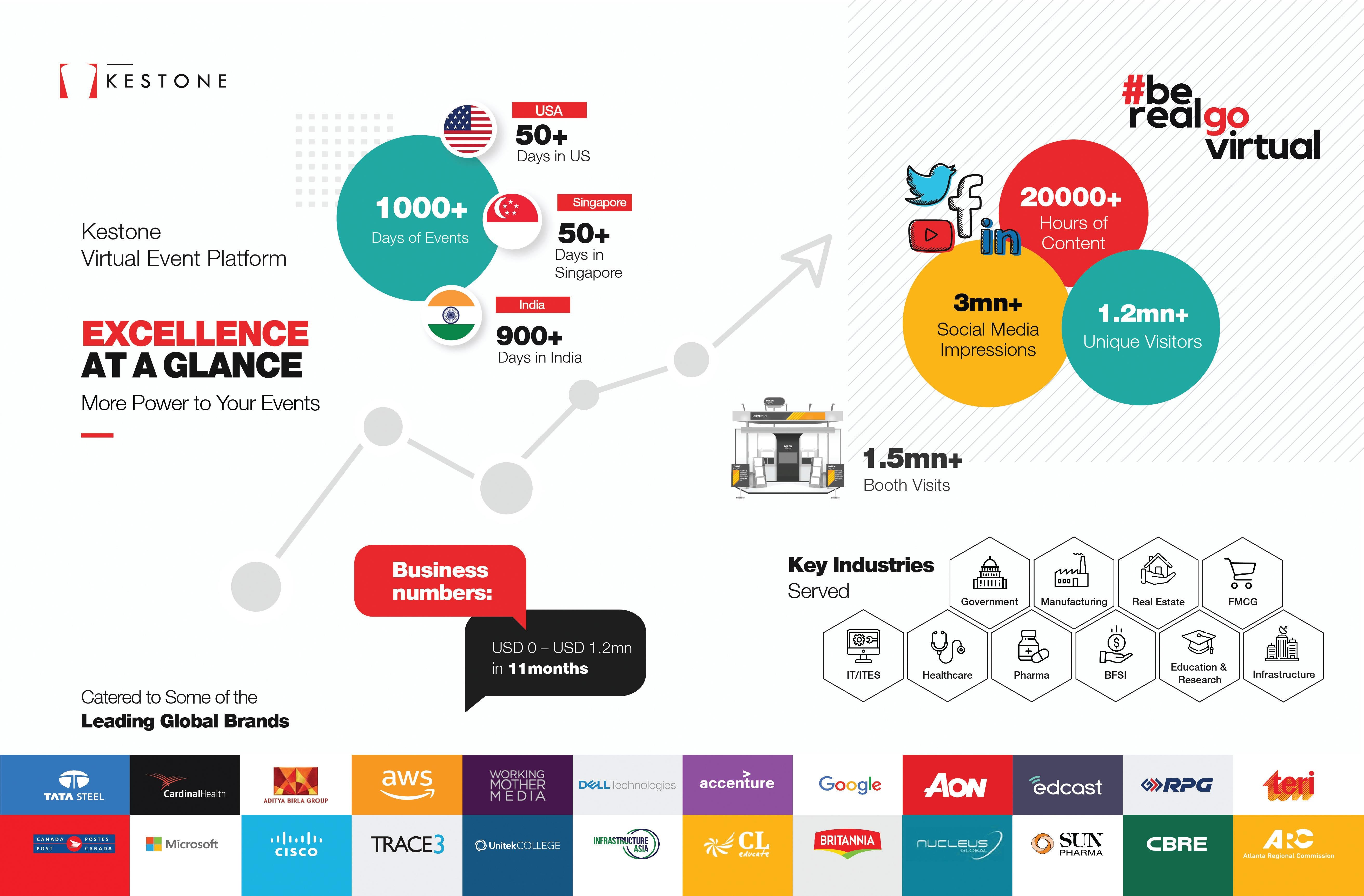

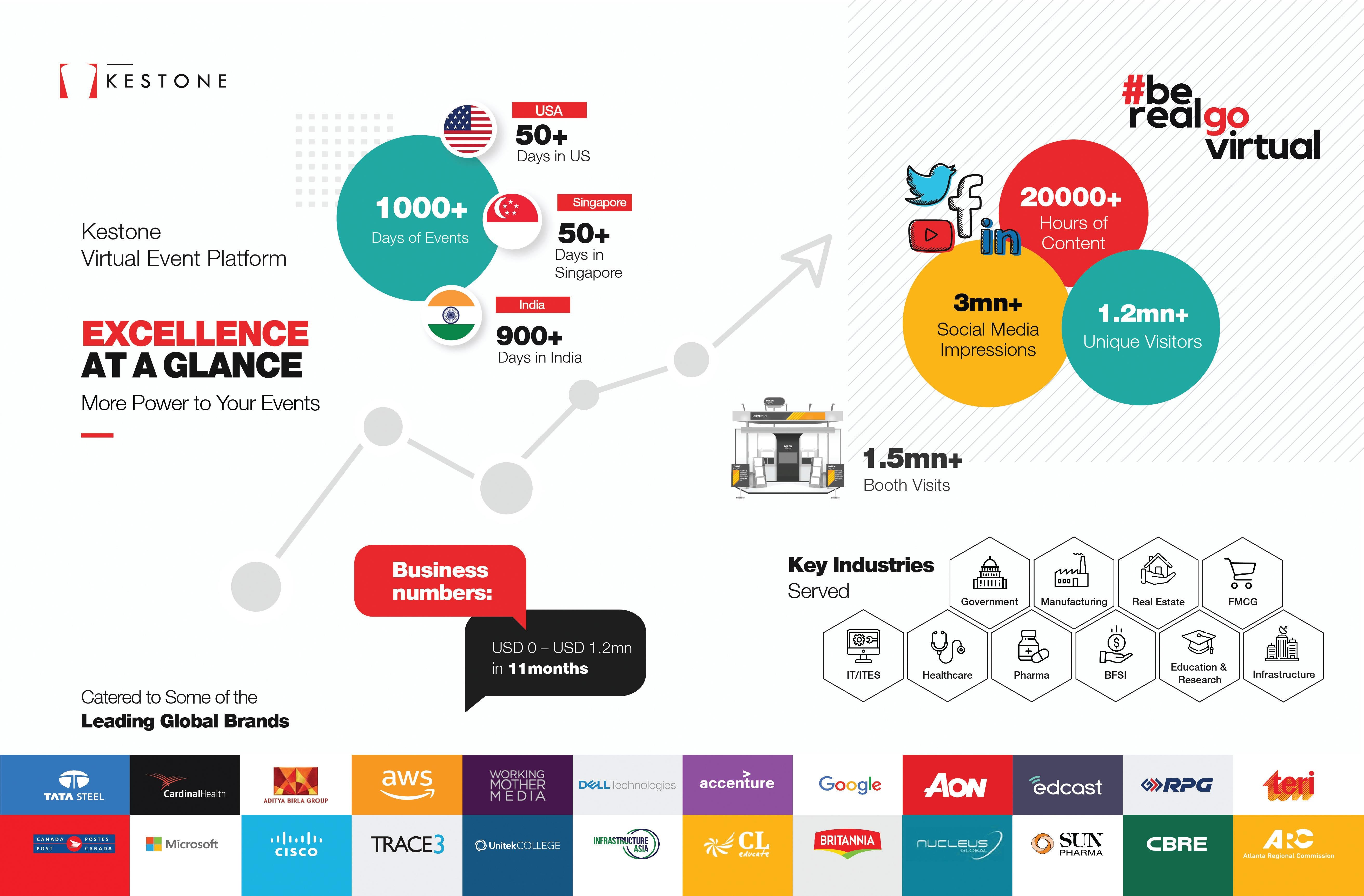

Kestone is powering through with Vosmos

Kestone, the leading global awardwinning data-driven integrated sales and marketing services company founded in 1997, has been on an upward trajectory. They have taken a leap of imagination coupled with technology and designed a new world, creating a virtual cosmos – VOSMOS. The vision of this brand is to make worlds that are simplified, connected, and immersive. These worlds will be self-sufficient, unified, and constantly evolving to suit the mindset of the occupants of Vosmos. Replicating every element of the physical world, Vosmos has emerged as a one-stop solution for businesses to communicate and grow across continents, making Kestone one of the leading MarTech organizations today.

Vosmos offers its clients customized technology solutions, a world to propagate Meta-commerce and virtual events which offer the best of the physical and digital experiences. Their core is – Digital Transformation in the Consumer Space. Their products are based on their advocacy of sustainability. Whether it is saving time by creating a virtual walkthrough of a real-estate project or the human effort of traveling to buy a product or logistical arrangements for an exchange or saving money to gain a skill – they have it all covered. The Metacommerce world of Vosmos will give brands the opportunity to be present in a virtual environment that allows viewing, engagement, and transaction. They have opened stores for brands, educational centers for scalability

of knowledge, office spaces to enrich the work-from-home experience as well and more.

Vosmos has been built on understanding and analyzing customer behavior. Businesses can deliver never -seen-before experiences in education, tourism, shopping, banking, government services, and more. The differentiating factors of Vosmos include:

• Making online interactions real

• Customizing the metaverse virtual space 100%

• Promoting your products 24/7

• Subscribing to a pay-and-use model of the Metaverse virtual world

• Integrating payment gateways for D2C brands in Vosmos

• Virsa, the AI-driven bot, is there for assistance in the metaverse virtual reality

With the D2C business model, brands have eliminated the barriers in the physical world that stand between them and their customers. Now is the time to make brands accessible, experiential, and scalable more than ever before. Their DIY model of creating one’s own store gives business owners the flexibility, ease, and choice of how they want their store to look in Vosmos. This method is not only cost-effective but also can be personalized to suit products and the marketplace.

Brands can now give customers a complete buying experience without being physically present. Virtual stores will have expansive virtual real estate while effortlessly launching new products.

Users can create customer-centric, experiential, and immersive solutions explicitly customized for the brand. Tailor-made DIY art galleries, retail outlets, real estate projects, tours, and events – the Vosmos tech team can bring to life all that one can dream of.

As economies shift and strategies are reinvented, Vosmos is a fast-emerging one-stop shop for customer-centric, experiential, and immersive solutions.

In the words of the team Vosmos“From wherever you are, on a couch or a canoe, you can do almost everything in Vosmos. There is a part of you that can ‘live’ in Vosmos.” ■

With people opting to lead a cleaner and greener lifestyle, brands are encouraged to initiate energy-efficient and environmental-friendly operations.

Join a community of experts and leaders working to build understanding between the people of the Middle East and the United States through non-partisan analysis, research & education in the region’s languages and history, and promotion of Middle Eastern arts and culture.

Become an MEI member today for as little as $50 to receive a subscription to The Middle East Journal, the oldest peerreviewed publication in the US dedicated to the study of the modern Middle East.

Inspiring dialogue. Empowering change. www.mei.edu

At AkzoNobel, we’ve made it our business to deliver the sustainable and innovative solutions that our customers, communities – and the planet – are increasingly relying on. We’re fully focused on ensuring that the pioneering paints and coatings we supply today can help safeguard our world far beyond tomorrow.

to more than 100,000 people in local communities. Beyond 2030, we aim to be carbon neutral by 2050.

Our commitment to sciencebased sustainability targets

Our sustainability targets are aligned with the Paris Agreement and were validated by the Science Based Targets initiative (SBTi). We are the

We’re always looking for new ways to drive sustainable innovation that brings tangible benefits, delivers a positive social and environmental impact, and enables our customers to reach their own sustainability goals. That is why we focus on developing

(WBCSD). A sustainable solution is a product or service that meets at least one of the following criteria:

How we’re tackling climate change and help our customers to do the same. We have developed low embodied carbon products, solutions that require less energy in their application and

THE COMMITMENT WE’VE MADE COVERS THE FULL VALUE CHAIN AND IS ALIGNED WITH THE PARIS AGREEMENT – WHICH AIMS TO LIMIT GLOBAL WARMING AND ENSURE THAT GLOBAL TEMPERATURE RISE DOESN’T EXCEED 1.5˚C ABOVE PRE-INDUSTRIAL LEVELS. THIS INCLUDES OUR OWN OPERATIONS (SCOPE 1 AND 2), AS WELL AS SCOPE 3 UPSTREAM AND DOWNSTREAM. SCOPE 3 COVERS PURCHASED GOODS AND SERVICES, APPLICATION AND USE OF OUR PRODUCTS, AND END-OF-LIFE.

solutions that help the user of the coated object use less energy. Our Cool Chemistry coatings technology helps building owners use less energy for air conditioning in heat intensive regions and our reflective coating for light fixtures can help give up to 30% more output. We have developed innovative coatings allowing for reduced energy usage in the application and curing of coatings including our Low-E powder coatings. Coatings that can dry at ambient temperatures or using UV curing technology allow for reduced energy or faster production thus bringing als economical savings.

Dulux and Sikkens products that contain renewable raw materials. We have rolled out our Dulux Evolve product platform containing 35% of recycled post-consumer paint waste in multiple countries. We are able to help our customers to reduce material use for instance with our Interpon XTR platform allowing for reduced film thickness.

reused and renewed material use

How we’re combating resource scarcity such as using less materials.

As part of our ongoing efforts to deal with resource scarcity, we are using less materials and finding various ways to reuse and recycle our waste. These are reflected in certain

How we are striving to reduce waste in our value chain. We are aiming to achieve 100% reusable waste by 2030. We are developing solutions to help our customers reduce waste in their own processes. We set new standards in sustainability through leveraging technology for automated spraying to reduce overspray and for powder coatings application processes to produce virtually no waste at all. Our high solid products allow us to use less packaging and thus reduce the packaging waste of our customers. →

Longer lasting performance

How our durable products help customers protect surfaces for longer and thus lower costs and save resources. We develop innovative and durable products that protect surfaces for longer, prolonging maintenance cycles, and keeping things more colorful. In the built environment and transportation sectors coated substrates need to resist to weather impacts and our longer lasting solutions help our customers reduce their cope 3 carbon footprint.

How we aim to reduce the use of harmful substances and to reduce

health risks for users and end-users of our products. A great example is our chrome free primer Aerodur HS 2121 we developed for our aerospace customers providing numerous performance, appearance and application benefits. Secondly, we develop solutions that bring particular health and well-being advantages to our customers. As a member of the World Green Building Council we are driving the development of more healthy buildings where people live and work. We have solutions for healthy buildings that significantly improve indoor air quality, help keep surfaces hygienically clean and help contribute through the use of color to more comfort. Examples include our

new Dulux Airsure 99,9% VOC free wall emulsion paints and our Dulux Better Living Air Clean capable of cleaning indoor air from certain harmful substances.

The SPPA gives a holistic view of the sustainability characteristics of our product portfolio and services. Together with our customer-focused product stewardship process, it enables valueselling strategies tailored to specific customer needs. So, we can take a harmonized approach in our portfolio management, creating a unique baseline for future portfolio ambitions.

Product stewardship is our approach to ensuring product safety and its sustainability aspects are considered throughout the value chain – from raw material extraction, R&D, manufacturing, transport, marketing and application, through to end-of-life. Our Product Stewardship Continuous Improvement Tool (PSCIT) helps monitor and drive continuous improvement. And our Priority Substance Program continues to help us identify and control the use of hazardous substances. It’s embedded in our processes and ensures we’re ahead of any changes to regulations. The governance of the program is

THE SPPA GIVES A HOLISTIC VIEW OF THE SUSTAINABILITY CHARACTERISTICS OF OUR PRODUCT PORTFOLIO AND SERVICES. TOGETHER WITH OUR CUSTOMER-FOCUSED PRODUCT STEWARDSHIP PROCESS, IT ENABLES ALUE-SELLING STRATEGIES TAILORED TO SPECIFIC CUSTOMER NEEDS.

assured by the Raw Material Sustainability Group (RMSG).

Buildings are responsible for 38% of global carbon emissions, which makes construction one of the largest contributing sectors to climate change. Most of us also spend a large part of our daily lives inside buildings, so they have an impact on our health and well-being as well. We supply a wide range of sustainable solutions that can help to reduce the environmental footprint –and bring health & well-being benefits to the users – of the built environment. As an industry leader committed to creating more green buildings, our product innovations can play a vital role in making cities and communities

more sustainable. Whether it’s in their design, construction or operation, “green” buildings reduce or eliminate negative impacts and can have a positive impact on our climate and natural environment. Green buildings have both commercial and sustainability benefits. They aim to reduce carbon emissions from the built environment, preserve precious natural resources and improve the quality of life for people who live and work in them. Our solutions for green buildings include solutions that are low emitting products improving indoor air quality; heat reflective paints and coatings helping to reduce the heat island effect in urban areas and environmental product declarations (EPDs) creating material transparency of our sustainable solutions. ■

Pamela Phua has been General Director of AkzoNobel Decorative Paints Vietnam since 2017. At the beginning of 2021, she was appointed to be Product Management Director, Decorative Paints - SESA, being instrumental in developing and maintaining a product portfolio that satisfies market demands and maximizes margins at competitive costs.

Before moving to head Vietnam Paints business, Pamela was the BU R&D Director & Global Director, Exterior Walls. In her 18 years stint in R&D, she has driven the business with new technology development and product implementation across the region, especially in Vietnam market and has successfully launched many innovative products including Dulux Weathershield / Powerflexx, Dulux Pentalite, Dulux Wash & Wear / EasyClean, Dulux Inspire/ Catylac by Dulux and Aquatech.

In her global capacity, Pamela implements the functional and production innovation strategy for exterior wall paint. She spearheads the RD&I functional excellence, standards and capability, and the efficient delivery of processes as the approved standards and processes across the globe.

Together with a special passion for sustainable development, she has led her teams to innovate paintings products and solutions through increasingly sustainable benefits for AkzoNobel customers and the environment. She also actively gets involved in sustainable activities in projects to create inspiring living spaces for local communities and to promote green architecture trends.

Pamela’s expertise and experience has been instrumental in the setting up of industry standards in Singapore. She is the President and Technical Chairperson for the Singapore Paint Industry Association and a management member in the Chemical Standards Council of Singapore. She contributed to the development of various Singapore Standards such as SS 345 (Specification for emulsion paints for decorative paints), SS500 (Specification for elastomeric wall coatings), SS150 (Specification for Emulsion Paints for Decorative purposes), SS 579 (Specification for water- based sealer for interior and exterior uses) and many others. Pamela currently leads Working Group for Fine Ceramics (for photocatalysis) and Waterbased Standards and participates in the Working Group for Energy Efficient Coatings. She is also an A*Star certified auditor for accredited laboratories in Singapore.

About Akzonobel

We supply the sustainable and innovative paints and coatings that our customers, communities –and the environment – are increasingly relying on. That’s why everything we do starts with People. Planet. Paint. Our world class portfolio of brands – including Dulux, International, Sikkens and Interpon – is trusted by customers around the globe. We are active in more than 150 countries and have set our sights on becoming the global industry leader. It’s what you’d expect from a pioneering paints company that’s committed to science-based targets and is taking genuine action to address globally relevant challenges and protect future generations.

For more information, please visit www.akzonobel.com

With a special passion for sustainable development, Pamela is actively involved in projects to create inspiring living spaces for local communities and to promote green architecture trends. She is an author for the G7&G20 summit publication advocating green developments. She is also a keynote speaker in United Nation climate Change Conferences.

Email: Pamela.phua@akzonobel.com

Mobile: +65 90279663

Address: AkzoNobel House, 3 Changi Business Park Vista, #05-01 SDingapore 486051

The G20 Joint Finance and Agriculture Ministers’ Meeting Washington DC, USA, 11 October 2022

The G20 Finance Ministers and Agriculture Ministers met for the first time in Washington D.C. on 11 October 2022. The meeting was convened by the Indonesian G20 Presidency in collaboration with the Kingdom of Saudi Arabia, and was attended by G20 members, invited countries, and international and regional organizations.

1. The Presidency noted that immediate actions are needed to address global food insecurity. The Presidency highlighted that the world is waiting for the G20 to deliver concrete action on this critical issue, and it is G20 members’ responsibility to demonstrate that the G20 can respond effectively to the current crisis through coordinated multilateral action.

2. Members noted that since 2020, risks to food security and nutrition around the world have increased due to numerous factors, such as the unprecedented COVID-19 pandemic and extreme weather events. Many members expressed the view that Russia’s war against Ukraine is exacerbating global food insecurity and called for an end to the war. One member expressed the view that unilateral sanctions are negatively impacting global food insecurity, while some members noted that sanctions related to the war in Ukraine are not targeted at agricultural goods or fertilizers.

3. Many members noted with alarm the increasing food insecurity of vulnerable groups across the world, which has eroded progress in reducing poverty, achieving the Sustainable Development Goals, and is putting vulnerable communities and households at greater risk of poverty and malnourishment.

4. Many members noted that medium- to long-term challenges remain, and more efforts are needed to improve agricultural productivity and capacity, increase sustainable farming practices and respond to climate change, maintain open and transparent trade, and improve the availability of fertilizers.

5. Some members reaffirmed their commitment to use all available policy tools to address the risk of food insecurity. Many members supported the need for increased cooperation to ensure a coordinated global response to tackling food insecurity, and noted

the need to work with other multilateral initiatives in this endeavor, while avoiding duplication.

6. Members welcomed several ongoing initiatives so far to address food insecurity which have been initiated by regional and international forums and organizations. International organizations in the meeting detailed some of their initiatives, including the World Bank Group’s (WBG)’s USD 30 billion food security response and USD 6 billion global platform for private sector intervention; International Monetary Fund’s (IMF)’s Food Shock Window; Asian Development Bank’s (ADB)’s USD 14 billion ambition for addressing food insecurity and the Islamic Development Bank’s USD 10.5 billion food security response program. Some expressed their support for potential debt service standstills if appropriate, under the existing G20 Common Framework for Debt Treatment, however, others emphasized the need to consider country circumstances when assessing debt relief initiatives. At the individual country level, several initiatives were reported by many members in the meeting.

7. Members agreed to ask the Food and Agriculture Organization (FAO) and the WBG to share with us the results of their mapping exercises on food insecurity, which will be consolidated in the future with inputs from technical experts and other relevant international organizations, and will provide a systemic analysis of responses to address food security. This will identify any major gaps in global responses; examine food and nutrition variables and funding; examine the supply and demand of fertilizers; build on the G20 Agricultural Market Information System (AMIS); and identify any medium-term issues that require further technical and systemic analysis. FAO and WBG will report back to us by the 2023 Spring Meetings.

8. Members reiterated their support for open, transparent, inclusive, predictable, and non-discriminatory rules-based multilateral trading systems.

9. The Indonesian G20 Presidency will continue to lead the G20 in closely monitoring the state of global food security in our future meetings and into the Indian G20 Presidency. ■

Members agreed to ask the Food and Agriculture Organization (FAO) and the WBG to share with us the results of their mapping exercises on food insecurity, which will be consolidated in the future with inputs from technical experts and other relevant international organizations, and will provide a systemic analysis of responses to address food security.

Leaders’ Summits are complex events for any country to organize. Whenever the world’s most powerful leaders are brought together for a G7, G20 or UNFCC Council of the Parties (COP) you will find a sharp and focused network of individuals operating behind the scenes to ensure a smooth process for all attendees.

The logistics for any leaders’ summit is vast and require a specific set of skills to safeguard privacy, satisfy protocol requirements and ensure the utmost level of security.

Months, if not years, of effort precedes any meeting of world leaders to shape the agenda and organize the logistics. Experience has shown that the real challenge for event organizers is create a comfortable environment where leaders and their delegations are not distracted by technical problems or poor logistics. That way leaders can focus on shaping global policies and have robust discussions on topics like climate change and pandemic recovery.

The bottom line is that success for a leaders’ summit requires meticulous planning. A successful meeting of world leaders requires military-level precision and a strategic savvy of the political and cultural landscape. Events that bring together world leaders are also characterized by a higher level of scheduling, protocol, security, and contingency planning than other major events. For summits involving world leaders, you often only get one chance to get it right.

But despite best efforts, things do go wrong. Longer than expected meetings, failing to reach consensus, greater interest in how domestic audiences will interpret the meeting outcomes, pandemics, natural disasters, inclement weather and of course logistics or technical problems during the meeting are just some of the scenarios organizers will face.

The current crisis with Russia and Ukraine is a case in point, which will undoubtedly add to the demands on policy and logistics organizers of the G7, EU, G20

and APEC. Programs and agendas will need to be adjusted to provide time for leaders to debate the crisis, delegations will be asking for numerous bilateral and side meetings and a sizeable media presence will also be seeking access to leaders and their delegations. It is a safe assumption that any country organizing a leaders’ summit will need to deal with planning knowns and unknowns from the outset. Experience has shown that the following points will help deliver a successful summit.

• Start the planning as early as possible For any gathering of leaders planning should commence at least three years prior to start. This allows adequate time to undertake detailed logistics planning, develop the events schedule, select venues, recruit and develop a dedicated workforce, select commercial vendors and develop contingency plans. Once the presidency year starts, you have little capacity and time to undertake the level of planning expected for an international event.

•

One of the most important early decisions for organizers is the location of the summit. The decision is often balanced between the desire to show case a city or region, the capacity of a city to accommodate thousands of additional guests, the security environment and practicalities of travelling to the city or region. There is no right or wrong answer to selecting a venue. Mapping out every step of the journey from arriving at an airport to travelling to hotels then to the venue will generally help in making the best decision on location.

The planning and execution of multilateral forums is a complex undertaking for any country involving many governments, non-government, international and commercial stakeholders. Minimize the number of committees and working groups and establish clear roles and decision-making arrangements.

The reason that leaders come together for summits is to consider and progress global policies. The logistics is the enabler. Policy is the content. Planning between the policy and logistics teams must be a unified effort. Almost every policy planning consideration will have a logistics implication.

The key technologies needed to support a successful presidency are a capable registration and accreditation system, a proven virtual platform and simultaneous interpretation. Credible and cost-effective solutions exist. Take the time to evaluate what is available and lock in the necessary technical support as early as possible. It is worth remembering that these systems will be the ‘front face’ of events during the year.

Select key senior staff with established event management experience who can plan and deliver in a highly demanding and changing environment. These events are more challenging and complex than run-of-the mill projects, so your planning team isn’t just a project management

office. Consider incentives to keep the workforce for the entire presidency. Losing staff equates to a loss of corporate knowledge that cannot be quickly replaced.

• Be agile

Events are different than normal government or project work. Decision making needs to be more agile for processes including procurement, issues resolution and media management. Implement processes to change logistics arrangements based on feedback and lessons learnt from other similar events throughout the year.

• Capture lessons learnt

As with any events there will be lessons for future hosts. Commit resources to capturing what worked well and what needs to be improved. Leaders’ summits are unique activities and any insights for future hosts will be well received.

A last point: leaders’ summit are usually short events – less than thirty hours in most cases. To maximize the time that leaders are together always design the presidency year starting with leaders’ summit and working backwards. For example, a desire for a more intimate and less formal leaders’ summit will help officials and ministers shape their work throughout the year. The timing of the summit will also help officials schedule their work accordingly. ■

Months, if not years, of effort precedes any meeting of world leaders to shape the agenda and organize the logistics.

Marie Lam-Frendo Global Infrastructure Hub Chief Executive Officer

Marie Lam-Frendo Global Infrastructure Hub Chief Executive Officer

When the G20 Leaders gathered in Indonesia in November 2022, they faced unparalleled multidimensional crises. The world is experiencing the after-effects of the pandemic, escalating climate change, war in Ukraine, and other issues. Combined, these issues are creating a challenging economic environment that is slowing global recovery and stalling the achievement of the UN’s Sustainable Development Goals (SDGs).

The current situation calls for us to remember that infrastructure is a backbone solution to a healthy climate, safe and resilient societies, and equitable economic recovery. Indeed, infrastructure investment has a strong impact on economic growth, being more effective than other types of public spending. A 2020 Global Infrastructure Hub (GI Hub) study found that the economic multiplier for public investment (including infrastructure) is 1.5 times greater than the initial investment in two to five years.

However, simply investing in any infrastructure is not enough to achieve the positive effect of the investment. The investment needs to be in sustainable infrastructure to achieve global climate targets and the SDGs.

The G20 is improving the sustainability of infrastructure through multilateral action that supports sustainable infrastructure development in G20 countries and around the world. Increasingly, G20 governments have been placing sustainable infrastructure investment at the forefront of their policy initiatives and economic recovery plans, including the Inflation Reduction Act 2022 in the United States, the Long-term Strategy for Low Carbon and Climate Resilience 2050 in Indonesia, the Saudi Green Initiative, and the National Infrastructure Strategy in the United Kingdom.

This trend is also evident in the GI Hub’s analysis of infrastructure stimulus announced by G20 governments postpandemic: 30% of the stimulus is related to the low-carbon transition. However, this is

far from enough, and governments cannot fund the transition alone. Estimates show that roughly USD2.6 trillion is required annually through to 2030 to meet the SDGs and stay on a path to net zero by 2050. →

The current situation calls for us to remember that infrastructure is a backbone solution to a healthy climate, safe and resilient societies, and equitable economic recovery. Indeed, infrastructure investment has a strong impact on economic growth, being more effective than other types of public spending.

→ We need to reduce the shortfall of investment in sustainable infrastructurethe sustainable infrastructure investment gap. Closing this gap could require more than three times the current level of investment in clean energy, and 70% of the spending required is needed in emerging markets and developing economies (EMDEs). Unfortunately, our latest analyses show private investment in infrastructure is declining in middle-and low-income countries where it is needed most. Globally, private investment in infrastructure has been stagnant for eight years running.

Reversing these trends must be a priority for both the public and private sector: without scaling up private investment achieving climate targets will remain a challenge. The task now is to attract private investors to drive forward sustainable infrastructure investment.

This is one of the major infrastructure priorities for the G20 and we’ve been working closely with its Infrastructure Working Group to support the advancement of this work. The G20/GI Hub Framework

Participation to Scale Up Sustainable Infrastructure Investment, recommends acting on four opportunity areas as a priority.

Private investors are aligning their infrastructure investments with the SDGs. They use long-term infrastructure plans to evaluate opportunities and government priorities and to better understand and manage risks, related to market uncertainty, political risks, and stranded assets.

As such, long-term infrastructure plans need to exist, and need to showcase how governments plan to meet the SDGs. But in 2019, we found that 38% of countries still do not publish national infrastructure plans and 28% do not publish pipelines of projects – what needs to change for these countries to seize the opportunities that infrastructure plans create? The framework recommends the following actions:

• International financial institutions and other networks to support governments in the development of long-term infrastructure plans that achieve SDGs and related targets.

• International organisations (IOs) and multilateral development banks (MDBs)

to gather and share data on infrastructure investment trends, performance, and gaps specific to countries and sectors.

• IOs to identify approaches and mechanisms that enable the inclusion of resilience, social, and governance (including just transitions) measurement into investment decisions.

In May 2022, the Brazilian government published a digital platform which provides a summary of infrastructure investment projects, historical investment series, scenarios, and projections of investment indicators. This published pipeline supports the government’s plan to promote and highlight the importance of private investment and promotes a methodology to help infrastructure practitioners assess the sustainability of projects.

There is no one-size-fits-all definition for sustainable infrastructure and there are a multitude of data disclosure standards. Investors are telling us that the proliferation of sustainable infrastructure definitions and data disclosure standards is leading to more complex project preparation and reporting, which in turn makes it harder to finance infrastructure projects – particularly in EMDEs. Better comparability and interoperability of these definitions and standards would improve transparency and better ensure the achievement of ESE objectives while minimising greenwashing. On the flip side, data disclosure standards are needed to provide clarity on physical and transition risks and avoid the greater negative impact of potentially stranding assets. Rather than suggesting new definitions or standards, we believe the solution is better comparability and interoperability between existing definitions for sustainable infrastructure and data disclosure standards. To help drive this forward, the framework recommends the following actions:

• Collaboration between MDBs, national development banks (NDBs), G20 governments, infrastructure asset rating providers, IOs, networks, initiatives, and investors to create better comparability

Governments have key roles to play in reducing legal, regulatory and policy barriers, and implementing incentives and policies to create enabling environments for more and different infrastructure financing. However, despite numerous efforts to achieve this, significant and longstanding gaps in the enabling environment for private investment in infrastructure still exist.

and interoperability with other global standards.

• Infrastructure data platforms to allow the interoperability of sustainable infrastructure data for the benefit of investors.

The last decade has seen significant innovation in finance and technology. New financing solutions can attract private investment in sustainable infrastructure, especially in EMDEs where there is uncertainty of initial returns. For example, blended finance can encourage private participation by taking the first loss or guaranteeing revenues in the early phase of infrastructure operation. Meanwhile infrastructure technology (InfraTech) underpins the sector’s ability to reach net zero - almost 50% of the emissions reductions needed by 2050 depend on InfraTech solutions that are at the prototype or demonstration stage.

The challenge is, these types of innovations are not being adopted at the pace required to make a meaningful difference to investment in sustainable infrastructure. In its 2021 report, The State of Blended Finance, Convergence found that

blended finance flows decreased by 50% in 2020 and that the past five years saw only steady growth rather than the exponential growth needed. To scale up financial and InfraTech innovations and their adoption the framework suggests these key actions:

• MDBs, donors, and investors to build capacity, especially in EMDEs, to replicate successful financial innovation models that will unlock private investment into sustainable infrastructure.

• The G20 to collaborate with partners and develop guidelines to scale up de-risking, blended finance instruments, and effective partnership models involving the private sector.

• Establish and grow a global InfraTech ecosystem to share knowledge, test innovative approaches, and catalyse opportunities.

One example of financing innovation in action is the TURF initiative which aims to facilitate large-scale private sector investment into infrastructure. Launched by Meridiam, in partnership with The Rockefeller Foundation and the United Nations Capital Development Fund, TURF is a global blended finance impact fund.

The fund supports cities to deliver critical resilient infrastructure projects in Europe and Africa and intends to mobilise EU10 billion in private investment.

Priority 4: Enabling environment for implementation

Governments have key roles to play in reducing legal, regulatory, and policy barriers, and implementing incentives and policies to create enabling environments for more and different infrastructure financing. However, despite numerous efforts to achieve this, significant and long-standing gaps in the enabling environment for private investment in infrastructure still exist.

It’s time to be serious about creating a systematic de-risking mechanism to give private investors the confidence to invest in sustainable infrastructure projects closer to investment grade. How can we finally improve regulatory frameworks, transparency, and project preparation facilities to achieve this? The framework suggests these actions:

• Establish a collaborative forum of regulators, global standard-setters, and the banking and insurance sectors to discuss the supervisory and regulatory treatment of infrastructure as an asset class and its climate-related risks.

• IOs, MDBs, NDBs, development finance institutions, domestic financial institutions, and sub-national entities (cities and innovation sandboxes) to share effective policy approaches that mobilise private capital.

• G20 members and the donor community to provide additional funding, resources, and support for infrastructure project preparation.

Looking ahead, we strongly believe that stimulating these actions will scale up private sector participation in sustainable infrastructure investment. And we consider this investment to be the central, urgent problem and opportunity in infrastructure today.

Sustainable infrastructure is an enabler of the transition to net zero and the foundation of a resilient, healthy economy. By helping enable investment to flow, we are creating a world where people can thrive in safe, equitable, and healthy communities.

Collaboration between the public and private sector, which the GI Hub supports as an independent voice at the G20, is vital to advance these actions. Work is already underway on a number of initiatives, and we welcome opportunities to collaborate and engage with partners to realise a sustainable future for all. ■

The Global Infrastructure Hub is a not-for-profit organisation and a knowledge hub for advancing the delivery of sustainable, resilient, and inclusive infrastructure.

Formed by the G20, we collaborate across the public and private sectors to produce data insights, practical tools, and programs that help our stakeholders create positive impacts through infrastructure.

Bali, Indonesia, 15-16 November 2022

1. Fourteen years ago, the Leaders of the G20 met for the first time, facing the most severe financial crisis in our generation. We recognized, as large global economies, that collectively we carry responsibilities and that our cooperation was necessary to global economic recovery, to tackle global challenges, and lay a foundation for strong, sustainable, balanced, and inclusive growth. We designated the G20 the premier forum for global economic cooperation, and today we reaffirm our commitment to cooperate as we, once again, addressserious global economic challenges.

2. We met in Bali on 15-16 November 2022, at a time of unparalleled multidimensional crises. We have experienced the devastation brought by the Covid-19 pandemic, and other challenges including climate change, which has caused economic downturn, increased poverty, slowed global recovery, and hindered the achievement of the Sustainable Development Goals.

3. This year, we have also witnessed the war in Ukraine further adversely impact the global economy. There was a discussion on the issue. We reiterated our national positions as expressed in other fora, including the UN Security Council and the UN General Assembly, which, in Resolution No. ES-11/1 dated 2 March 2022, as adopted by majority vote (141 votes for, 5 against, 35 abstentions, 12 absent) deplores in the strongest terms the aggression by the Russian Federation against Ukraine and demands its complete and unconditional withdrawal from the territory of Ukraine. Most members strongly condemned the war in Ukraine and stressed it is causing immense human suffering and exacerbating existing fragilities in the global economyconstraining growth, increasing inflation, disrupting supply chains, heightening energy and food insecurity, and elevating financial stability risks. There were other views and different assessments of the situation and sanctions. Recognizing that the G20 is not the forum to resolve security issues, we acknowledge that security issues can have significant consequences for the global economy.

4. It is essential to uphold international law and the multilateral system that safeguards peace and stability. This includes defending

all the Purposes and Principles enshrined in the Charter of the United Nations and adhering to international humanitarian law, including the protection of civilians and infrastructure in armed conflicts. The use or threat of use of nuclear weapons is inadmissible. The peaceful resolution of conflicts, efforts to address crises, as well as diplomacy and dialogue, are vital. Today’s era must not be of war.

5. At today’s critical moment for the global economy, it is essential that the G20 undertakes tangible, precise, swift and necessary actions, using all available policy tools, to address common challenges, including through international macro policy cooperation and concrete collaborations. In doing so, we remain committed to support developing countries, particularly the least developed and small island developing states, in responding to these global challenges and achieving the SDGs. In line with the Indonesian G20 Presidency theme - Recover Together, Recover Stronger - we will take coordinated actions to advance an agenda for a strong, inclusive and resilient global recovery and sustainable development that delivers jobs and growth. With the above in mind, we will:

• Stay agile and flexible in our macroeconomic policy responses and cooperation. We will make public investments and structural reforms, promote private investments, and strengthen multilateral trade and resilience of global supply chains, to support long-term growth, sustainable and inclusive, green and just transitions. We will ensure long-term fiscal sustainability, with our central banks committed to achieving price stability.

• Protect macroeconomic and financial stability and remain committed to using all available tools to mitigate downside risks, noting the steps taken since the Global Financial Crisis to strengthen financial resilience and promote sustainable finance and capital flows.

• Take action to promote food and energy security and support stability of markets, providing temporary and targeted support to cushion the impact of price increases, strengthening dialogue between producers and consumers, →

→ and increasing trade and investments for long-term food and energy security needs, resilient and sustainable food, fertilizer and energy systems.

• Unlock further investments for lowand middle-income and other developing countries, through a greater variety of innovative financing sources and instruments, including to catalyze private investment, to support the achievement of the SDGs. We ask the Multilateral Development Banks to bring forward actions to mobilize and provide additional financing within their mandates, to support achievement of the SDGs including through sustainable development and infrastructure investments, and responding to global challenges.

• Recommit to accelerate achievement of the SDGs, achieving prosperity for all through sustainable development.

6. We are deeply concerned by the challenges to global food security exacerbated by current conflicts and tensions. We therefore commit to taking urgent actions to save lives, prevent hunger and malnutrition, particularly to address the vulnerabilities of developing countries, and call for an accelerated

We will take further coordinated actions to address food security challenges including price surges and shortage of foodcommodities and fertilizers globally.

and IMF’s food security responses. We emphasize the importance of building on the G20 Matera Declaration, working together to sustainably produce and distribute food, ensure that food systems better contribute to adaptation and mitigation to climate change, and halting and reversing biodiversity loss, diversify food sources, promote nutritious food for all, strengthen global, regional, and local food value chains, and accelerate efforts to reduce food loss and waste. We will also implement the One Health approach, intensify research on food science and technology, and improve stakeholders’ capacity along the food supply chains, particularly women, youth, smallholder, and marginal farmers as well as fishers.

transformation towards sustainable and resilient agriculture and food systems and supply chains. We commit to protect the most vulnerable from hunger by using all available tools to address the global food crisis. We will take further coordinated actions to address food security challenges including price surges and shortage of food commodities and fertilizers globally. Recalling the G20 efforts such as the Global Agriculture and Food Security Program, we welcome global, regional, and national initiatives in support of food security, and in particular note the progress made by the UN Secretary General’s Global Crisis Response Group on Food, Energy and Finance, as well as the World Bank Group’s

7. We support the international efforts to keep food supply chains functioning under challenging circumstances. We are committed to addressing food insecurity by ensuring accessibility, affordability, and sustainability of food and food products for those in needs, particularly in developing countries and least developed countries. We reiterate our support for open, transparent, inclusive, predictable, and non-discriminatory, rules-based agricultural trade based on WTO rules. We highlight the importance of enhancing market predictability, minimizing distortions, increasing business confidence, and allowing agriculture and food trade to flow smoothly. We reaffirm the need to update global agricultural food trade rules and to facilitate trade in agricultural and food products, as well as the importance of not imposing export prohibitions or restrictions on food and fertilizers in a manner inconsistent with relevant WTO provisions. We are committed to sustained supply, in part based on local food sources, as well as diversified production of food and fertilizers to support the most vulnerable from the disruptions in food trade supply chain. We will avoid adversely impacting food security deliberately. We commit to facilitate humanitarian supplies for ensuring access to food in emergency situations and call on UN Member States and all relevant stakeholders with available resources to provide in-kind donations and resources to support countries most affected by the food crisis, as required and based on assessed needs by governments of affected countries. →

→ We continue to support the carve out of humanitarian activities from sanctions and call on all nations to support this aim, including through current efforts at the UN. We will continue to closely monitor the state of global food security and nutrition.

8. We welcome the Türkiye and UNbrokered two Istanbul Agreements signed on 22 July 2022 and consisting of the Initiative on the Safe Transportation of Grain and Foodstuffs from Ukrainian Ports (Black Sea Grain Initiative) and the Memorandum of Understanding between the Russian Federation and the Secretariat of the United Nations on Promoting Russian Food Products and Fertilizers to the World Markets, on the unimpeded deliveries of grain, foodstuffs, and fertilizers/inputs from Ukraine and the Russian Federation, to ease tension and prevent global food insecurity and hunger in developing countries. We emphasize the importance of their full, timely and continued implementation by all relevant stakeholders, as well as the UN Secretary-General’s calls for continuation of these efforts by the Parties. In this context we highlight other efforts that ensure the flow of agri-food goods such as the EU Solidarity Lanes and the Russian donations of fertilizers facilitated by the World Food Programme. Moreover, we take note of various initiatives addressing food insecurity such as the Arab Coordination Group initiative.

9. We are committed to supporting the adoption of innovative practices and technologies, including digital innovation in agriculture and food systems to enhance productivity and sustainability in harmony with nature and promote farmers and fishers’ livelihoods and increase income, in particular smallholders by increasing efficiency, and equal access to food supply chains. We will promote responsible investments in agricultural research and science and evidence-based approaches. We will continue to strengthen the Agricultural Market Information System (AMIS) as an early warning tool, to enhance food and fertilizer/inputs market transparency, reduce market uncertainties, and support coordinated policy responses for food security and nutrition, through the sharing of reliable and timely data and information.

10. We ask the Food and Agriculture Organization (FAO) and the World Bank Group (WBG) to share with us the results of their mapping exercises on food insecurity, which will be consolidated in the future with inputs from technical experts and other relevant international organizations, and will provide a systemic analysis of responses to address food security. This will identify any major gaps in global responses; examine food and nutrition variables and funding; examine the supply and demand of fertilizers; build on the G20 Agricultural Market Information System (AMIS); and identify any medium-term issues that require further technical and systemic analysis. The FAO and WBG will report back by the 2023 Spring Meetings.

11. We meet at a time of climate and energy crises, compounded by geopolitical challenges. We are experiencing volatility in energy prices and markets and shortage/ disruptions to energy supply. We underline the urgency to rapidly transform and diversify energy systems, advance energy security and resilience and markets stability,

by accelerating and ensuring clean, sustainable, just, affordable, and inclusive energy transitions and flow of sustainable investments. We stress the importance of ensuring that global energy demand is matched by affordable energy supplies. We reiterate our commitment to achieve global net zero greenhouse gas emissions/carbon neutrality by or around mid-century, while taking into account the latest scientific developments and different national circumstances. We call for continued support for developing countries, especially in the most vulnerable countries, in terms of providing access to affordable, reliable, sustainable, and modern energy, capacity building, affordable latest technology within the public domain, mutually beneficial technology cooperation and financing mitigation actions in the energy sector.

12. We reaffirm our commitment to achieve SDG 7 targets and strive to close the gaps in energy access and to eradicate energy poverty. Recognising our leadership role, and guided by the Bali Compact and the Bali Energy Transition Roadmap, we are

committed to finding solutions to achieve energy markets stability, transparency, and affordability. We will accelerate transitions and achieve our climate objectives by strengthening energy supply chain and energy security, and diversifying energy mixes and systems. We will rapidly scale up the deployment of zero and low emission power generation, including renewable energy resources, and measures to enhance energy efficiency, abatement technologies as well as removal technologies, taking into account national circumstances. We recognise the importance to accelerate the development, deployment and dissemination of technologies, and the adoption of policies, to transition towards low-emission energy systems, including by rapidly scaling up the deployment of clean power generation, including renewable energy, as well as energy efficiency measures, including accelerating efforts towards the phasedown of unabated coal power, in line with national circumstances and recognising the need for support towards just transitions. We will increase our efforts to implement the commitment made in 2009 in Pittsburgh to phase-out and rationalize, over the medium term, inefficient fossil fuel subsidies that encourage wasteful consumption and commit to achieve this objective, while providing targeted support for the poorest and the most vulnerable. We will strengthen international cooperation as well as relevant producer-consumer dialogues on securing energy affordability and accessibility by limiting volatility in energy prices and scaling up clean, safe, inclusive, and sustainable technologies, including developing regional energy interconnectivity. We are committed to promote investment in sustainable infrastructure and industry, as well as innovative technologies and a wide range of fiscal, market and regulatory mechanisms to support clean energy transitions, including, as appropriate, the use of carbon pricing and non-pricing mechanisms and incentives, while providing targeted support for the poorest and the most vulnerable.

13. Mindful of our leadership role, we reaffirm our steadfast commitments, in pursuit of the objective of UNFCCC, to tackle climate change by strengthening the full and effective implementation of the Paris Agreement and its temperature goal,

reflecting equity and the principle of common but differentiated responsibilities and respective capabilities in light of different national circumstances. We will play our part fully in implementing the Glasgow Climate Pact and the relevant outcomes of previous COPs and CMAs, in particular COP 26, including the call to revisit and strengthen the 2030 targets in our NDCs, as necessary to align with the Paris Agreement. In this regard, we welcome enhanced climate actions resulting from the new or updated NDCs and invite parties to urgently scale up mitigation and adaptation ambition and means of implementation as well as make progress on loss and damage at COP 27 which is being held in Africa. Noting the IPCC assessments that the impact of climate change will be much lower at a temperature increase of 1.5°C compared with 2°C, we resolve to pursue efforts to limit the temperature increase to 1.5°C. This will require meaningful and effective actions and commitment by all countries, taking into account different approaches, through the development of clear national pathways that align longterm

ambition with short and medium-term goals, and with international cooperation and support, including finance and technology, and sustainable and responsible consumption and production as critical enablers, in the context of sustainable development.

14. We welcome the progress to date towards achieving a Post 2020 Global Biodiversity Framework (GBF). We urge all parties and countries to finalize and adopt the GBF with the view of realizing of 2050 Vision of “Living in harmony with Nature” at the second part of COP15 CBD as a strong framework of action and accountability for halting and reversing biodiversity loss by 2030 and, as appropriate, to update National Biodiversity Strategies and Action Plans accordingly. We emphasize the importance of achieving and synergizing the objectives of the three Rio Conventions. We stress the need for clear and measurable goals and targets for biodiversity and means of implementation and accountability. We commit to strengthen actions to halt and reverse biodiversity loss by 2030 and call on CBD Parties to adopt an ambitious, balanced, practical, effective, robust and transformative post-2020 Global Biodiversity Framework at COP-15 in Montreal. We urge for increased resource mobilization from all sources, including from countries and entities, to provide new and additional financial resources for the implementation of the GBF, once it is negotiated, including to help enable and support developing country parties, and for aligning private and public financial flows with biodiversity objectives. We will scale up efforts to combat biodiversity loss, deforestation, desertification, land degradation and drought, as well as restoring degraded land to achieve land degradation neutrality by 2030, and in support of the G20’s ambition to reduce land degradation by 50% by 2040 on a voluntary basis. We recognize the effort made by a number of countries to ensure that at least 30% of global land and at least 30% of the global ocean and seas are conserved or protected by 2030 and we will help to make progress towards this objective in accordance with national circumstances. We commit to reduce environmental impacts by changing unsustainable consumption and production patterns →

We will increase our efforts to implement the commitmentmade in 2009 in Pittsburgh to phase-out and rationalize, over the medium term, inefficient fossil fuel subsidies that encourage wasteful consumption and commit to achieve this objective, while providing targeted support for the poorest and the most vulnerable.

→ as well as to enhance environmentally sound waste management including by preventing illegal cross- border traffic of waste.