Manuel Herrera

The Multifamily Real Estate Group LLC.

Manuel Herrera

The Multifamily Real Estate Group LLC.

Manuel Herrera

The Multifamily Real Estate Group LLC.

Manuel Herrera

The Multifamily Real Estate Group LLC.

March 25, 2024

The multifamily real estate market in Tampa Bay, Florida, faces considerable challenges in the first quarter of 2024, marked by a decade-high vacancy rate of nearly 9%. The imbalance between supply and demand, exacerbated by a steady rise in vacancies over the past 24 months (about 2 years), continues to impact the market dynamics. This report offers an indepth analysis of key indicators and trends shaping the multifamily sector in the region.

• Tampa's multifamily vacancy rate reached a decade high of nearly 9% in the first quarter of 2024, marking a significant rise of approximately 150 basis points over the previous year.

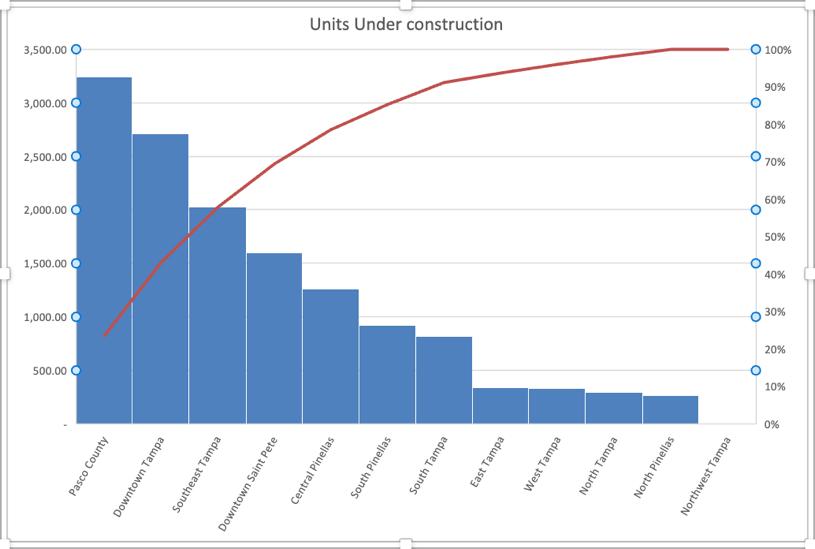

• The construction pipeline remains elevated, with 14,000 units under development, indicating that vacancy is likely to remain above 8% for the foreseeable future.

• Submarkets across the region have recorded negative to limited rent growth, reflecting the imbalance between supply and demand.

• The bulk of vacancy increases have been observed in B and C property classes, rising by 200 basis points year over year to 9.4%, driven by limited renter demand.

• In contrast, B+ and A properties have captured a significant portion of Tampa's renter demand, with 3,700 units of absorption. However, vacancies for higher-end properties continue to hover around decade highs, sitting at 11.5%.

• Pasco County emerges as the most active submarket for new construction, with 4,500 units underway. However, vacancies in Pasco County have increased significantly, up by 500 basis points year over year Market Forecast:

• The trend of limited asking rent growth is expected to continue over the next six to nine months as the market absorbs the pipeline of 14,000 units.

• Asking rent growth is forecasted to return to pre-pandemic levels of around 5% by mid2024, coinciding with a closer alignment of supply and demand equilibrium.

:

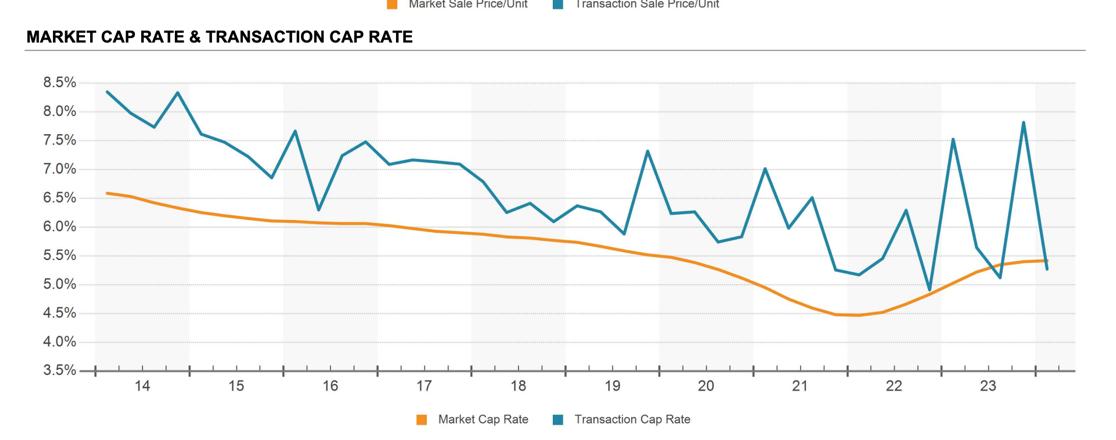

• While Tampa was one of the most heavily transacted markets in Florida in 2023, transaction volumes have declined significantly compared to previous years.

Multifamily deals have become more challenging to execute as buyers underwrite lower rent growth assumptions and face higher debt costs, keeping institutional capital on the sidelines, and exceptionally low CAP rates.

• Conclusion: Tampa Bay's multifamily real estate market faces ongoing challenges due to an imbalance between supply and demand, resulting in elevated vacancy rates and limited rent growth. However, with a forecasted return to equilibrium by mid-2024 and potential stabilization of market dynamics, there are opportunities for recovery and growth in the medium to long term. Investors and developers should closely monitor market trends and adapt strategies accordingly to navigate the evolving landscape effectively.

“Key drivers of a sound multifamily real estate market include: a strong job market, a thriving economy, a business-friendly environment, a balanced supply of affordable housing. ”

Tampa. Bay's economy has notably thrived, emerging as one of Florida's most robust centers in recent years. The region's resilience is underscored by its focus on job creation and population expansion as key indicators of success. Additionally, Tampa's multifamily real estate market has demonstrated exceptional resilience, surpassing many national benchmarks. Supported by a persisting employment growth rate of 2.1 %, over performing the national benchmark of 1.9 %, the region has experienced a surge in demand for multifamily housing followed by a wave of new constructions.

Furthermore, over the past decade, Tampa Bay experienced an extraordinary surge in population, with a remarkable increase of over 412,000 individuals (about half the population of Montana), reflecting an average of 790 new residents arriving weekly. This influx has significantly propelled the demand for housing and underlines the city's economic vibrancy.

Finally, it is true that home affordability is likely to be an important issue in the immediate future, However, the multifamily market emerges as the most efficient solution I addition, Florida

government has passed Senate Bill 102, that promises to free new possibilities for the develop of affordable multifamily development. The official initiative introduces liberal measures that combines tax incentives, availability of new spaces and less regulations, expressly excluding rent regulations.

The Greater Tampa area enjoys a business-friendly environment with low taxes and incentives, attracting numerous corporations and fueling job growth. Tampa Bay has a diverse economy with a strong base in healthcare, finance, and tourism.

Tampa Bay is home to 20 corporate headquarters, including five Fortune 500 companies, and hosts over 500 foreign-owned companies from 40 nations. prominent companies headquartered or with significant operations in the Tampa Bay area includes:

• Tech Data Corporation: A multinational distribution company specializing in IT products and services.

• Syniverse: Provides technology and business services for telecommunications companies worldwide.

• WellCare Health Plans, Inc

• WellCare Health Plans, Inc.: A managed care services company focusing on government-sponsored healthcare programs.

• Lincare Holdings Inc.: Specializes in home healthcare services and medical equipment.

• Raymond James Financial: A diversified financial services company providing investment banking, asset management, and more.

• Tampa Bay Banking Company: A regional bank headquartered in Tampa Bay.

• United Insurance Holdings Corp: A property and casualty insurance company.

Bloomin' Brands: The parent company of popular restaurant chains like Outback Steakhouse and Carrabba's Italian Grill.

• Hooters of America: Headquarters for the famous restaurant chain.

• Lazydays RV: A major RV dealership and service center operator.

Energy and Utilities:

• Tampa Electric Company (TECO Energy): Provides electric services to the Tampa Bay area.

• Mosaic: A leading producer of concentrated phosphate and potash crop nutrients.

• Jabil Inc.: A global manufacturing services company.

• Cott Corporation: Involved in the production of private-label beverages.

The Pasco Economic Development Council has recently taken proactive steps, announcing several significant events poised to bolster the county's economy and demand for labor:

• Bauducco Foods, a Brazil-based company, acquired 72 acres in the City of Zephyrhills to establish a U.S. production and distribution facility, generating 600 jobs and investing over $200 million.

• Gary Plastics Packaging Corp. relocated to Pasco County, expecting to create approximately 555 new jobs and invest $16 million in leasehold improvements.

• Baby Tech Company infant Labs opened a new product assembly location in Port Richey, Florida, expanding its operations from Atlanta, Georgia.

• E-commerce Company NVGTN constructed a 100,000 square foot headquarters in Pasco County, planning to hire 30 new employees.

• Amazon purchased a Pasco County Ready Site for a half-million square foot sortation center near I-75.

These announcements mark a significant influx of investment and job opportunities into Pasco County, contributing to its economic growth and demand for labor. These corporations are poised to play a significant role in their respective industries, shaping the economic landscape of the Tampa Bay region, particularly in Pasco County, and indicating the direction of the Tampa Bay multifamily real estate market.

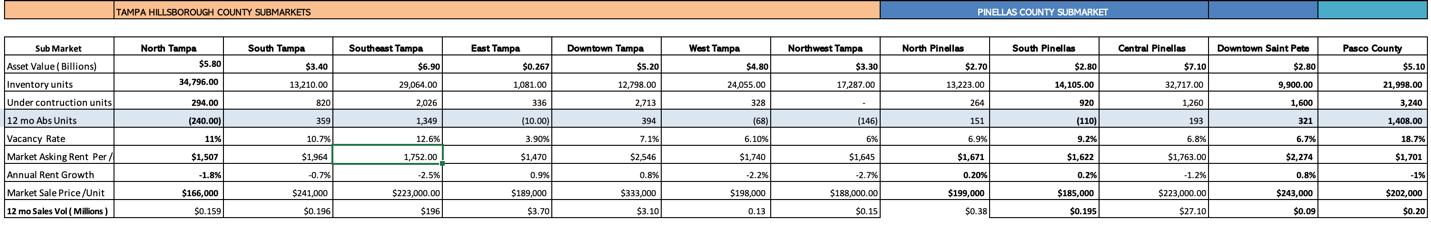

Multifamily real estate markets operate within specific local parameters shaped by demographics, economic variables, and social infrastructure, all influenced by the distinct characteristics of each property. The Tampa Bay Multifamily market aligns with this pattern. Therefore, assessing the potential of multifamily real estate demands a thorough evaluation of submarkets using a diverse set of key indicators. These indicators encompass asset value, inventory units, units under construction, absorbed units, vacancy rates, market rent, rent growth, sale price per unit, sale volume, and cap rate. Through a detailed analysis of these indicators and their interconnectedness, investors can glean valuable insights into the submarket's potential.

Within the Tampa Bay multifamily real estate landscape, there are thirteen distinct submarkets, each characterized by its unique traits and investment opportunities. Among these, seven submarkets are situated within Hillsborough County, the fourth most populous county in Florida. Additionally, three submarkets belong to Pinellas County, renowned as one of Central Florida's affluent areas. Finally, the remaining two submarkets are in Pasco and Hernando counties, each offering its own distinct investment landscape.

“Overall, measuring asset value in the multifamily market is crucial for investors, lenders, and stakeholders as it supplies a quantitative and qualitative assessment of a property's worth. It

helps decision-making, risk management, and portfolio optimization in the dynamic real estate industry.

High asset values write down a robust and potentially lucrative market for multifamily real estate invent. Central Pinellas, Southeast Tampa, North Tampa, Northwest Tampa, and Pasco County appear to be the most prominent submarkets in terms of dollars invested with a total of 30 billion dollars.

“Measuring inventory units in a multifamily market is crucial for investors as it provides valuable insights into supply and demand dynamics, market trends, rental market dynamics, risk assessment, competitive analysis, and portfolio management.”

As of March 2024, the Tampa Bay Market features a total inventory of 224,234 existing rental units. Notably, a significant portion of this inventory is consistent with asset value distribution. Approximately 60% is concentrated within four prominent submarkets: North Tampa, Central Pinellas, Southeast Tampa, and Pasco County.

A high concentration of asset value and rental units in a multifamily real estate market suggests strong demand, a desirable location, as well as a well-established rental market. However, investors should be prepared for increased competition and evaluate the potential for future growth and portfolio diversification within the submarket.

“If new construction leads to an over-supply of units, it can result in low asking rates due to competition and potential challenges for investors. Conversely, if new construction aligns with or slightly lags demand, it will support a healthy balance and potential for growth. Assessing this balance is crucial in understanding the impact on the multifamily market.”

In the Tampa market, the influx of new multifamily construction has significantly impacted vacancy rates, which rose to nearly 9% due to approximately 9,500 newly delivered units. An additional 14,000 units currently under construction are expected to further pressure vacancy rates in the near term. However, demand from renters is anticipated to match these new units in the coming quarters, stabilizing vacancy around 8.5% in the long term. Despite a decrease in construction starts over consecutive quarters due to weakened market fundamentals and challenges in securing construction financing, Pasco County leads in new construction, followed by Southeast Tampa.

These areas, witnessing growth in residential, retail, and industrial sectors, have experienced rising vacancies, and reduced rental prices due to the delivery of numerous units in recent years.

While it's true that the supply of new units in the Tampa multifamily market has outpaced demand in the first quarter of 2024, it's reassuring to know that new construction capital is wisely being distributed to submarkets with the highest potential. Specifically, Pasco County, Southeast Tampa, South Pinellas, and North Tampa are receiving significant attention, which is clear indication of the direction of Tampa's multifamily market expansion.

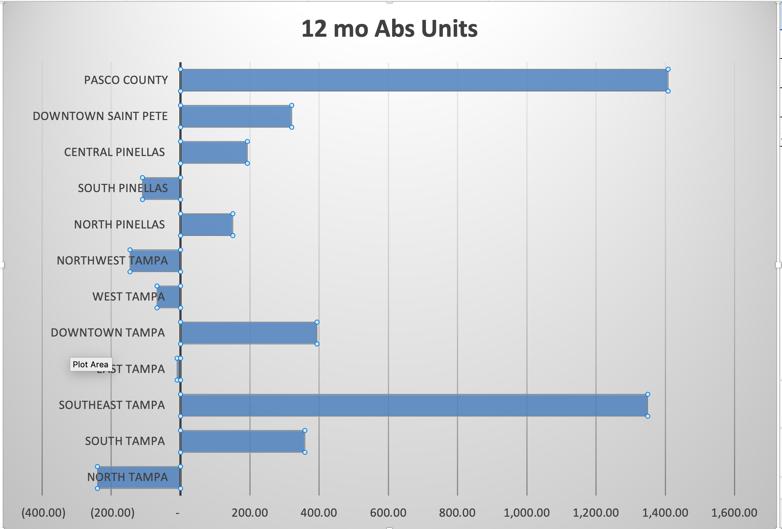

“The 12 Month Absorption Units metric calculates the net change in occupied units during a 12-month period, considering both new leases and units becoming vacant. A positive absorption writes down that more units were leased than vacated, showing a healthy demand and a potentially strong market. Conversely, a negative absorption suggests that more units became vacant than were leased, saying weaker demand or potential oversupply. ”

Despite the high construction activity, Southeast Tampa, Downtown Saint Petersburg, and Pasco County show positive absorption rates, indicating strong demand and active leasing in these regions. the remaining of the submarkets although showing negative absorption the situation is relatively stable. This suggests that the newly constructed units are being absorbed into the market as soon as they become available.

“Overall, rent growth is an essential metric in the multifamily real estate market as it reflects the interplay between supply, demand, and market dynamics. It influences investment decisions, property performance, and market competitiveness, providing valuable insights for stakeholders in the multifamily industry.”

Rent growth in Tampa has slowed drastically to -1.2% annually, down from record highs in 20212022. Thousands of new units flooding the market have intensified competition among landlords, reducing their leverage to raise rents. With 14,000 more units expected, minimal rent growth is forecasted until mid-2024. However, demand is projected to match supply by 20242025, leading to a return of 4-5% rent growth. The bulk of new development is in 4 and 5-star properties, contributing to a -1.5% decrease in asking rents for such buildings.

“The vacancy rate index in multifamily real estate is a key metric that assesses the market's health and influences investment decisions, rental pricing, revenue forecasting, market timing, financing considerations, and policy planning. It provides insights into supply-demand dynamics, helps in identifying investment opportunities and risks, and guides strategies for rental property management and affordable housing initiatives.”

Tampa's multifamily vacancy has steadily increased from a near-historic low of 4.1% in mid-2021 to 9.6% in the first quarter of 2024, representing a 100-basis-point rise. Supply has outpaced demand, with 9,500 units delivered while only 3,700 were absorbed, though this gap is expected to narrow in 2024. Demand has primarily favored higher-tier A and B class communities, absorbing 3,600 units, yet new constructions continue to outpace demand, resulting in a vacancy increase of roughly 50 basis points in these properties, now at 11.5%. Conversely, 3 Star properties have experienced limited demand, absorbing only 420 units while 3,100 came online, causing vacancy within this subset to rise to 9.3%. With approximately 14,000 units under construction, vacancy is forecasted to stabilize in the upper 8% range in the coming years as supply and demand balance out.

It's notable that Pasco County, despite having the highest vacancy rate in the market, also exhibits the highest absorption rate. This suggests a strong demand for housing despite vacancies, indicating dynamic market conditions and potential for rapid adjustment.

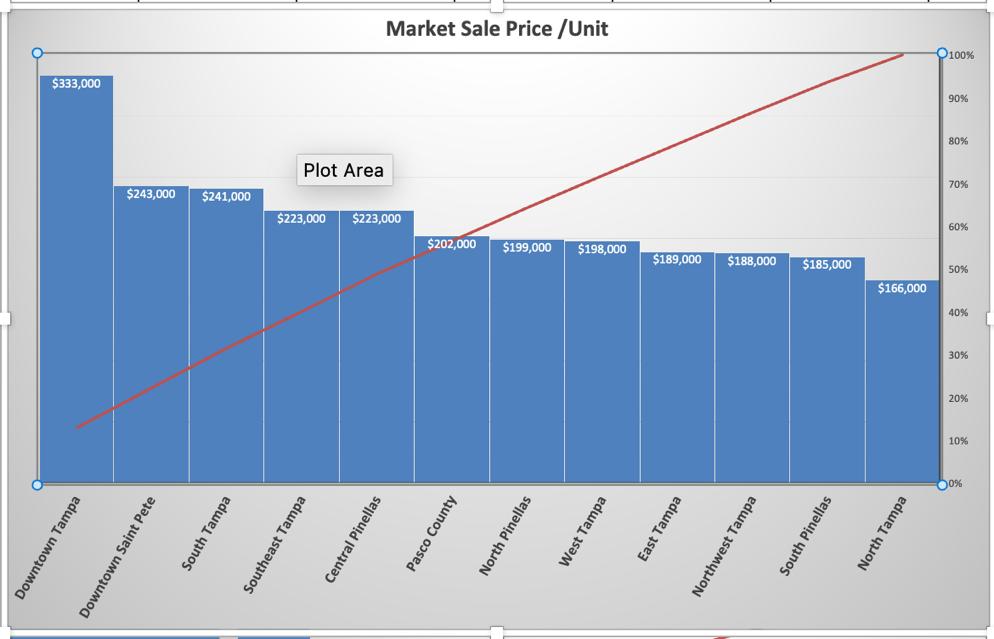

The market sale price per unit serves as a vital metric for assessing market dynamics, formulating pricing strategies, understanding consumer behavior, and making informed business decisions. It provides valuable insights into the competitive landscape, profitability, and overall health of businesses operating in various industries

Despite recent challenges, Tampa's multifamily investment sector has showcased resilience and adaptability. While there's been a decline in investment volume over the past year, amounting to $1.8 billion, it's important to recognize the context. In 2021, the market reached remarkable heights, boasting a sales volume nearing $3 billion, driven by robust renter demand and unprecedented rent growth.

Although multifamily fundamentals have shifted, marked by stabilized asking rent growth and increased competition due to new supply, Tampa's market remains dynamic. Yes, vacancy rates have hit a decade high, and there's an interplay of economic uncertainties and fluctuating interest rates. Yet, amidst these challenges, there's an opportunity for evolution and innovation.

It's true that multifamily deals face more complexities, with a widening gap between buyer and seller expectations. However, this climate has also encouraged a significant shift in the investment landscape. While institutional capital has taken a back seat in recent transactions over $50 million, private buyers have stepped up, emerging as influential players in the market. This signifies an adaptable and diverse investment landscape, showcasing the resilience and potential for strategic growth in Tampa's multifamily sector.

Thank you for reading our report.

As a committed investor in multifamily properties, we understand the importance of timely and accurate market information. We are pleased to present our latest Multifamily Real Estate Quarterly Market Report to assist you in this regard.

Each month, our dedicated team analyzes market trends and identifies investment opportunities, delivering actionable insights specifically tailored to the multifamily real estate sector. Our comprehensive report includes:

• Tampa Bay’s Multifamily Market Fundamentals

• Current Market Trends

• Key performance indicators for various submarkets

• Economic Outlook, and more

In addition to our detailed market analysis, we are hosting exclusive video conferences featuring insights from experienced architectural firms, contractors, developers, local government officials, and other key players in the multifamily real estate industry. These events not only provide valuable networking opportunities but also offer a deeper understanding of the latest industry trends.

If you are interested in receiving exclusive invitations to these insightful events, we invite you to join our team at https://www.mreexchange.com/about-9 Attendance is complimentary for new members.

We value your feedback . If you have any suggestions on how we can improve our reports or events, please do not hesitate to let us know.

Thank you for considering us as your trusted partner in multifamily real estate investment.

Manny J. Herrera

RE license SL3425146

Dalton Wade Real Estate Group

manny.herrera@mreexchange.com

The Multifamily Real Estate Group LLC