Unilever to spin off ice cream business

Wall's, Ben & Jerry's and other

Aldi to open 800 US stores over five

Discount retailer aiming to increase footprint in

Unilever to spin off ice cream business

Wall's, Ben & Jerry's and other

Aldi to open 800 US stores over five

Discount retailer aiming to increase footprint in

CEO & Executive Editor

CEO & Executive Editor

Cesar Pereira

Cesar Pereira

While the trend for protein enhancement is long established in fast moving consumer goods (FMCG), this trend – and in particular the notion of ‘food as fuel’ – is now accelerating further, as we discover in our latest Insight By Gama Compass. This all fits within a wider trend for product positioning that targets ‘performance’ and the ‘everyday athlete’, as the distinction between food and supplements becomes ever more blurred. Turn to page 12 for the full story.

Running parallel to the 'food as fuel' trend is innovation in cultured and fermented protein, and we run the rule over one such product in this segment on page 16. Nature's Fynd Dairy-Free yoghurt is a novel dairy analogue that also underlines growing interest in fungi as a health-oriented ingredient.

Elsewhere, we look back on the latest editions of Natural & Organic Products Europe, Food & Drink Expo and The Vaper Expo, and speak to industry thought leaders about the future of the meat and dairy sector.

Enjoy our latest issue.

Cesar Pereira CEO, Gama

Peter House, Oxford Street, Manchester, M1 5AN United Kingdom

Company Number: GB 8773764

phone: +44 1618188700 info@gamaconsumer.com @GamaConsumer

www.gamaconsumer.com

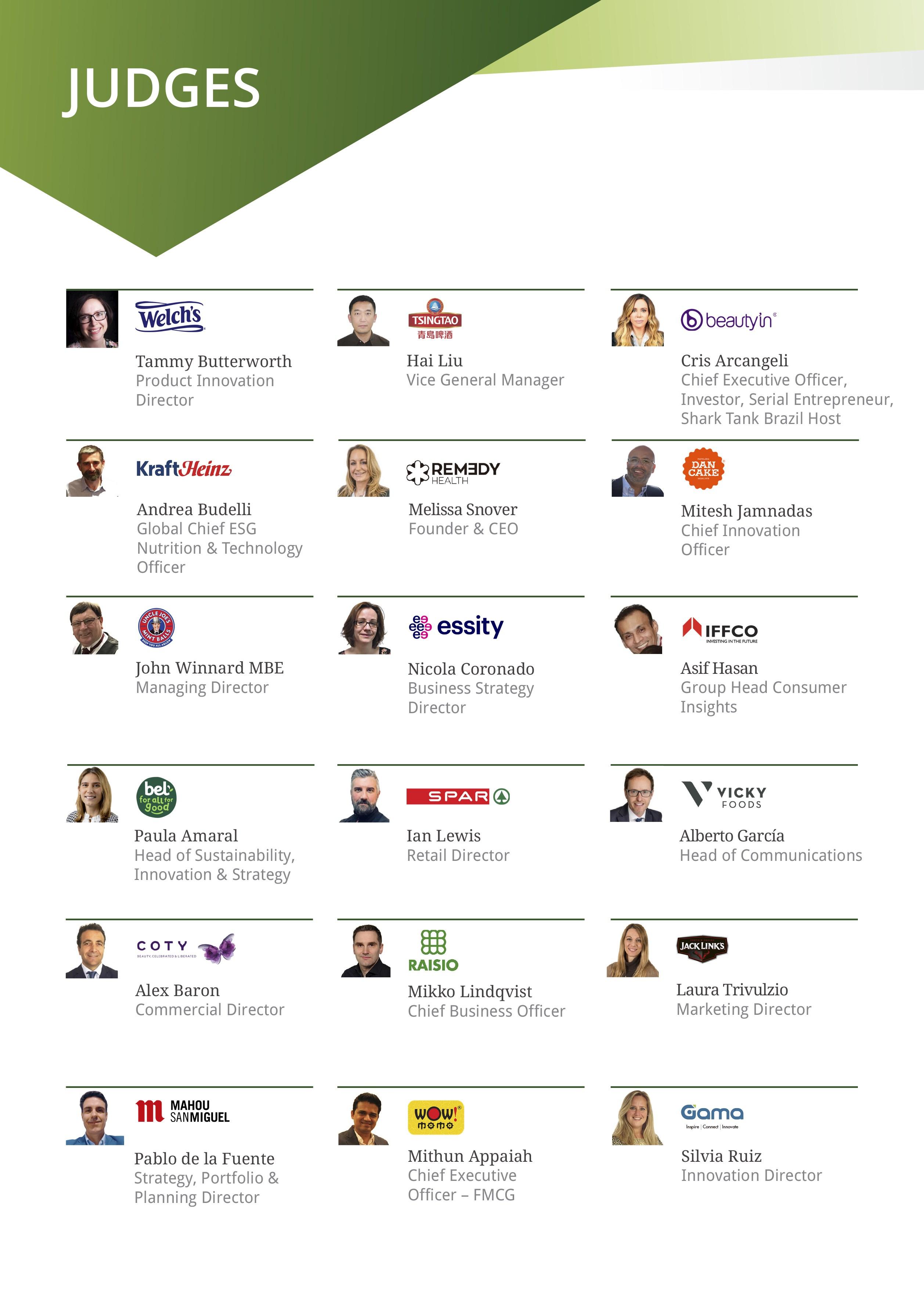

Industry Insight: Anna Bosch Güell

Tradeshow Insight: Natural & Organic Products Expo 2024

Tradeshow Insight: Food & Drink Expo 2024

Tradeshow Insight: The Vaper Expo May 2024

Look Ahead: InterTabac 2024

Insight By Gama Compass: 'Food as fuel' trend gets supercharged

Innovation Insight: Nature's Fynd Dairy-Free Yoghurt

Industry Insight: Paula Amaral

Look Ahead: Speciality & Fine Food Fair 2024

Unilever, the multinational consumer goods giant, has announced plans to spin off its ice cream divison into a separate business entity as it seeks ways “to accelerate its Growth Action Plan (GAP)”.

The ice cream business has a portfolio of the top ten most popular global ice cream brands, including Wall’s, Magnum and Ben & Jerry’s, which collectively generated revenue of around €7.9 billion ($8.53 billion) in 2023, the company said.

In a statement, Unilever also announced the launch of a “productivity programme” targeting €800 million ($864 million) in cost savings over three years, and impacting 7,500 predominantly office-based roles. The company said that, after the spin-off of the ice cream business, it would reorganise itself into four Business Groups named Beauty & Wellbeing, Personal Care, Home Care and Nutrition.

Commenting on the move, Unilever chair Ian Meakins said: “The separation of Ice Cream and the delivery of the productivity programme will help create a simpler, more focused, and higher performing Unilever. It will also create a world-leading ice cream business, with strong growth prospects and an exciting future as a standalone business”.

Unilever CEO Hein Schumacher added: “Under the Growth Action Plan we have committed to do fewer things, better, and with greater impact. The changes we are announcing today will help us accelerate that plan, focusing our business and our resources on global or scalable brands where we can apply our leading innovation, technology and go-to-market capabilities across complementary operating models”.

The spin-off is expected to be completed by the end of 2025.

By: Innovation Editor – Europe

Source: / image source: Unilever

INDIA: NESTLE AND DR REDDY’S ANNOUNCE

The Indian arm of consumer goods giant Nestle and Indian multinational pharmaceutical company Dr Reddy’s have formed a joint venture to offer

new nutraceutical brands to consumers in India and other agreed territories.

The joint venture will establish its headquarters in Hyderabad, and select brands will be licenced by both parties. Nestle Group will license brands such us Nature’s Bounty, Osteo BiFlex, Ester-C, Resource High Protein, Optifast, Resource Diabetic, Peptamen, Resource Renal & Resource Dialysis, while Dr. Reddy’s will licence Rebalanz, Celevida, Antoxid, Kidrich-D3 and Becozinc in the nutrition, and OTC segments.

Commenting on the move, Nestle India chairman and

managing director Suresh Narayanan commented: “This joint venture [will allow] us to bring our science-backed nutritional solutions to more people across the country. Dr. Reddy’s is a trusted name in the pharmaceutical space and shares our commitment to provide access to high quality products. This joint venture will enable us to build a robust retail and distribution network to take our brands closer to consumers and making a meaningful difference to improve the quality of life”.

The company is expected to start operations in the second quarter of 2025.

Source: Nestle /Dr Reddy’s

Image Source: Nestle / Dr Reddy’s(montage)

By: InnovationEditor–Asia Pacific

Mars affiliate company Royal Canin has announced the opening of India’s first and Asia’s second-largest packaging plant for pet food products in Bhiwandi, Maharashtra, with an investment of R$100 crore ($13.5million).

The state-of-the-art packaging centre reportedly features an automatic packing machine and relevant utilities, facilitating the effective conversion of bulk goods into retailpacks.

Royal Canin global president Cecile Coutens said: “India is one of the fastest-growing Petcare market withCAGRof ~15percent. Today, pet owners are becoming increasingly attentive to their pets’ health and well-being and wishto provide the highestquality of nutrition and care. […] The opening of our new Packaging Center Operations in Bhiwandi willenableustosupportpetowners in India further, helping them provide precise “Health Through Nutrition” solutions for their belovedpets”.

Royal Canin India general manager Satinder Singh added: “The new setup is part of our consumer experience, enabling us to bring our high-quality nutrition to serve more cats and dogs. Equipped with cutting-

edge facilities, the new Packaging Center operations reflects our commitment to providing Indian pet parents with premium products that meet the unique nutritional needs of their beloved pets”.

Source: Pro MFGMedia

Image Source: RoyalCanin

By: InnovationEditor –Asia Pacific

Italian dairy firms Latteria Soresina and Zanetti have announced the acquisition of 100% of the shares in Saviola, an Italian manufacturer of Protected Designation of Origin (PDO) cheeses including parmigiano reggiano and grana padano.

With turnover in 2023 of €518 million ($555 million), Latteria Soresina is best known for producing milk, butter and Italian cheeses such as gorgonzola and parmigiano reggiano.

Zanetti is a leading distributor of parmigiano reggiano, grana padano and other hard cheeses, turning over €690 million ($739 million) in 2023, with 70% of total sales coming from internationalmarkets.

The agreement is aimed at bolstering Latteria Soresina’s presence in local and foreign markets, and at promoting dairy products made ofItalianmilk. Commenting on the move, Latteria Soresina president Tiziano Fusar Poli said: “Addressing markets that are becoming more and more concentrated requires investments in innovation, sustainability and efficiency. […] The assets we are acquiring from Saviola will be very important to pursue our missionand our strategy”.

Source: Latteria Soresina

Image Source: Latteria Soresina /Zanetti(montage)

By: InnovationEditor –Europe

NigerianBreweries,Nigeria’sleading beermaker and subsidiary of global brewing giant Heineken, has announced plans to temporarily pause operations at two of its nine breweries and optimise production capacity at the other sevenbreweries,aspartofaBusinessRecoveryPlan.

In a statement, the firm said the move, which also includes a Rights Issue, was essential to improve its operational efficiency and financial stability and enable a return of the business to profitability, in the face of “the persistently challenging business environment”.

Commenting on the decision, Nigerian Breweries managing director / CEO Hans Essaadi described the business recovery

Aldi, the German retail giant, has announced it plans to add 800 new stores to its US network by 2028 through a combination of new store openings and store conversions.

The retailer is aiming to increase its presence in the Northeast and Midwest, adding nearly 300 stores in both regionsbyendof2028. IntheWestregion,itislookingto increase its store count in Southern California and Arizona,aswellasenteringnewcitiessuchasLasVegas.

Commenting on the move, Aldi CEO Jason Hart said: “Our growth is fuelled by our customers, and they are asking for more Aldi stores in their neighbourhoods

planasstrategicandvitalforbusiness continuity: “The tough business landscape characterised by double-digit inflation rates, naira devaluation, FX challenges and diminished consumer spend has taken its toll on many businesses, includingours”.

“Thisiswhywehavetakenthedecision to further consolidate our business operations for efficient cost management and optimal useofourresourcesforfuturesustainablegrowth”,headded.

Source / image source: NigerianBreweries

By: InnovationEditor–Middle East& Africa

USA: DAISY BRAND TO BUILD $627 MILLION FACILITY IN IOWA

Daisy Brand, a leading manufacturer of dairy-based products, has announced plans to

nationwide. […] While price is important, we earn their loyalty by stocking our shelves with only the best products and offering a quicker, easier, and more enjoyable shopping experience”.

The expansion includes 400 Winn-Dixie and Harveys stores in Alabama, Florida, Georgia, Louisiana and Mississippi which the retailer acquired from Southeastern Grocers, in adeal announced in August last year.

By: Innovation Editor – North America

Source: ESM

Image source: Aldi

invest $627 million to build a new processing plant in Boone, IA to meet increased demand.

Spanning an area of 750,000 square feet, the facility will be the company’s fourth and is expected to create 255 jobs for the region once fully operational. The company also has manufacturing sites in Garland (TX), Casa Grande (AZ) and Wooster (OH).

Founded in 1917, Daisy Brand is a fifth-generation family-owned company that claims to be a market leader in sour cream and cottage cheese, with distribution in all 50 states. Recently the firm, which uses the strapline “Pure & Natural”, also started selling flavoured dips with a sour creambase.

Source: Food Processing / AOL /Daisy Brand

Image Source: Daisy Brand

By: InnovationEditor –North America

Palermo Villa, a leading US manufacturer of branded and private label frozen pizza, has announced plans to build a 200,000 sq ft production facility inWestMilwaukee, WI.

Founded in 1964, Palermo Villa has a brand portfolio that includes Palermo’s Pizza, Screamin’ Sicilian, Urban Pie Pizza Co., Surfer Boy, Connie’s Pizza, and Funky Fresh Spring Rolls.

Commenting on the move, Palermo chief executive officer Giacomo Fallucca said: “Our priority is to keep market competitive jobs local and that means growth at our company headquarters on Canal Street in Milwaukee, continuing to increase capacity at our recently added Jefferson, Wis., facility, and now the development in WestMilwaukee”.

Demands in the marketplace and increasing headcount necessitated the new facility, the company said.

Construction is scheduled to begin in August and is expected to be completed in June 2025.

Source / image source: Palermo Villa

By: InnovationEditor –North America

Mission Foods, a subsidiary of bakery firm Gruma, has announced plans to spend M$792 million ($46.3 million) over the next five years to build a new plant in Puebla and expand its existing Huejotzingo plant that makes tortilla, toast and fried food.

The company said the investment would meet increasing demand in Mexico’s Central, Bajio, and Southern regions. The plant will have capacity for 70,200 tonnes and create 440 directjobs.

Rubicon Bakers, a portfolio company of Trive Capital specialising in baked goods, has announced the acquisition of Lucky Spoon Bakery, a maker of gluten-free cakes and biscuits headquartered in Salt Lake City (UT). Founded in 2010, Lucky Spoon is described as a manufacturer of cakes, cupcakes, biscuits, and brownies.

Source: Rubicon Bakers (via PRNewswire)

William Jackson Food Group (WJFG), a leading UK food supplier, has announced the acquisition of Lottie Shaw’s, a Yorkshire-based

Commenting on the move, Mission Foods Mexico director Nader Badii Gonzalez said: “In 2016, Mission’s successful incursion into Puebla began and since then we have generated more than 500 jobs, of which 60% have been for women. Now with these new construction projects and expansion of our facilities, Mission Mexico reaffirms and strengthens its productive commitment with the state of Puebla”.

This marks Gruma’s second investment of 2024, with the company having earlier invested $87.3 million to build a new plantinHunucma, Yucatan.

Source: Food Business News

Image Source: MissionFoods By: InnovationEditor –North America

Cafe Spice, a leadingUSprocessor of Indian meals, has opened

bakery business, via its subsidiary Jackson’s of Yorkshire. Lottie Shaw’s is described as a manufacturer of biscuits, parkin, confectionery, gingerbread, cakes, tarts and vegan baked treats.

Source: WJFG / Feast Magazine

Simply Good Foods, a US-based manufacturer and distributor of nutritional foods and snacks, has announced it has bought Only What You Need (OWYN), a 100% plant-based ready-todrink protein shake brand and portfolio company of Purchase Capital. OWYN is said to be a leading shake brand offering products that are high in protein but low in carbohydrates. Source: Simply Good Foods

a new 70,000 sq ft processing plant in Beacon, NY to boost production capacity and improveefficiency.

The state-of-the-art plant reportedly features advanced batch cooking kettles and a continuous chilling and stabilization process utilisingspiralchillers.

Commenting on the news, Cafe Spice CEO and co-founder Sameer Malhotra said: “This is a momentous achievement for Cafe Spice that we’re very proud of. The addition of this facility will allow us to scale our procedures and expand on innovationefficiently”.

Giovanni Gomez, Cafe Spice VP of food safety and quality assurance, added: “We ensure full traceability and accountability throughout our process,withfullycodedandtrackable materials used fromstart to finish. Remote temperature monitoring further enhances our ability to maintainoptimalconditions”.

The company, which also announced the addition of Butter Paneer and Chicken Cashew Korma meals to its range, said that it would continue operations at its existing 50,000 sq ft processing plant in New Windsor, NY, which is situated just a fewmiles from the new facility.

Source: FoodDive /FoodProcessing/Cafe Spice

Image Source: Café Spice

By: InnovationEditor–North America

Bridor, a bakery company owned by Le Duff, has announced the acquisition of Pandriks, a compa-

ny that produces organic and artisan-inspiredbakeryproducts.

Established in 2012 in the Netherlands, Pandriks is described as a manufacturer of traditional bakery products and organic bread under private label and through its own brand SlooOW. It operates productionfacilitiesinMeppel,Netherlands, and Fulda, Germany, supplying products both to European retail chainsandcustomersoverseas.

Commentingonthemove,Bridor Worldwide CEO Philippe Morin said: “The acquisition of Pandriks is consistent with Bridor’s strategy. It gives us the opportunity to take a leading position on key markets such as the Netherlands andGermany.Thisacquisitionwill also strengthen our teams with the highly experienced, qualified and motivated people from Pandriks joining Bridor. Pandriks will bring to life the Bridor purpose: ‘Share the bakery cultures of the world’”.

Pandriks CEO Peter van den Berg added: “Pandriks has grown significantly in recent years and wants to invest in further expansion to optimally serve our clients. With LE DUFF Group as our new shareholder, we believe that it is possible to achieve our goals while preserving our unique identity, philosophy and strategy”.

The acquisition will reportedly strengthen Bridor’s foothold in northwest Europe, increase production capacity, and expand its organic baked goods

portfolio. Financial terms were notdisclosed.

Source: Pandriks

Image Source: Bridor

By: InnovationEditor –Europe

Leading Swiss dairy company Emmi has announced the acquisition of a majority shareholding in Verde Campo, a Brazilian maker of yoghurt, milk drinks and other dairy products from soft drinks major CocaCola via its Brazilian subsidiary Laticinios PortoAlegre.

Verde Campo is described as a “pioneer in protein” and is claimed to be particularly popular among consumers in the large Brazilian cities, who place a high value on health and functionality.

Commenting on the move, Emmi Group CEO Ricarda Demarmels said: “The shareholding in Verde Campo will allow us to improve our position on the strategically importantBrazilian market while reinforcing the value of our portfolio with a strong brand and a focus on functional premium dairy products. We are confident that by joining forces with Verde Campo’s former founding team, we can take the brand to profitable growth”.

How should food companies ensure success in the face of global political insecurity, price inflation and supply chain challenges?

The socio-economic context of recent years has left us facing situations of extreme complexity – ones which have required us to make great efforts to address. At Noel, thanks to our strong commitment to investment, we have been able to rely on the manufacturing muscle and robustness needed to meet market demand and continue to grow. We have gained efficiencies and optimized our business model, allowing us to overcome obstacles such as higher raw material and energy costs, as well as the higher cost of production.

What major trends do you expect to shape food innovation in 2024 and beyond?

Health-oriented products, products with extra-high protein, plant -based options made from vegetables that emulate fish and meat, locally-sourced products, and manufacturing processes that minimize environmental impact: these are some of the principal trends that are setting the direction of travel in the food industry.

What strategic steps is Noel Alimentaria taking to meet

Gama spoke to Anna Bosch Güell, Director General, Noel

these challenges and grasp these opportunities?

" We have gained efficiencies and optimized our business model, allowing us to overcome higher raw material and energy costs "

Innovation is one of the fundamental pillars for our company and has allowed us to evolve our most traditional ranges, in addition to driving our other brands and business on a path to diversification. A notable example is the relaunch of our chacuterie brand Delizias, where we have improved a number of recipes and expanded the range. We have also just launched the new DeliPro line of extra-high protein products and are making a signficant investment in other categories such as plant-based, as well as premium products, including hand-made croquettes and filled pasta in partnership with renowned Catalan chef Nandu Jubany.

How is the way food companies are looking to reach and engage with consumers changing?

One of Noel’s defining characteristics has been its ability to actively listed to the needs of consumers and respond in an agile fashion, without compromising on quality or food safety. All the products we launch to the market fulfill four fundamental criteria that resonate with consumers: taste, to provide the best experience; health, through clean label recipes and high quality ingredients; convenience, adapting to the needs and occasions of distinct consumer groups; and sustainability, generating the lowest possible impact on theenvironment.

" We are making a significant investment in plant-based and premium products "

The acquisition of Verde Campo will speed up the transformation of Emmi’s portfolio through the addition of innovative brands and differentiated premium concepts, the company added.

The transaction is subject to regulatory approvals. Financial terms were notdisclosed.

Source / image source: Emmi

By: InnovationEditor –Latin America

UK food manufacturer Samworth Brothers has announced it has completed the acquisition of Real Wrap Co, a producer of ready-made sandwiches and wraps.

The Ginsters brand owner had previously acquired a minority stake inthe business.

Founded in 2010, Real Wrap Co. is described as a manufacturer of chilled and ready-to-heat sandwiches, wraps, salads and fruit and granola pots, as well distributing the Pollen + Grace and Flawsome brandranges.

Commenting on the move, Samworth Brothers’ chief executive Hugo Mahoney said: “Food to go has been a tremendous success story for Samworth Brothers in recent years, and we believe the category is well-positioned forgrowth.”

“The Real Wrap Co has great future potential, and the capability and scale of Samworth Brothers will help support fur-

ther development for The Real Wrap Co business”, he added.

Real Wrap Co founders Jason Howell and Philippe Gill added: “We are really excited about developing The Real Wrap Co business in the coming years and we are delighted to be supported by a like-minded partner in Samworth Brothers, to help us continue to do an amazing job for our customers, our people andour planet”.

Financial terms were not disclosed.

Source: Just Food /Food Manufacture

Image Source: Samworth Brothers

By: InnovationEditor –Europe

South African consumer goods firm Tiger Brands has announced the opening of a 300 million ZAR ($15.8 million) peanut butter manufacturing facility in the city of Johannesburg, SouthAfrica.

The company described the move as one of its largest capital investments for a single project. The new facility aims to modernise operations, providing increased in-house flexibility for faster innovation and newproductlaunches.

Black Cat is claimed to be one of the leading brands in the 1.7 bil-

lion ZAR ($89 million) South African peanut butter category, with annualsalesof5millionkg.

Commenting on the news, Tiger Brands CEO Tjaart Kruger, said: “Consumers are looking for affordable and healthier food options. Peanut butter is an important staple in the South African diet, and we expect strong growthinthiscategory”.

“This new facility will introduce flexibility, improved efficiencies and reduce our cost profile, allowing us to retain our prominent position in the market and respond to consumer needs”, he added.

Source / image source: Tiger Brands

By: InnovationEditor –Middle East& Africa

Potato and frozen food specialist McCain has announced it has bought the outstanding shares in Strong Roots, a plantbased frozen food company based in Ireland, to fully acquire the company.

McCain had previously invested $55 million to acquire a minority stake inStrongRoots in2021. Commenting on the acquisition, McCain chief growth and strategy officer Peter Dawe said: “Since 2021, our partnership with Strong Roots has re-

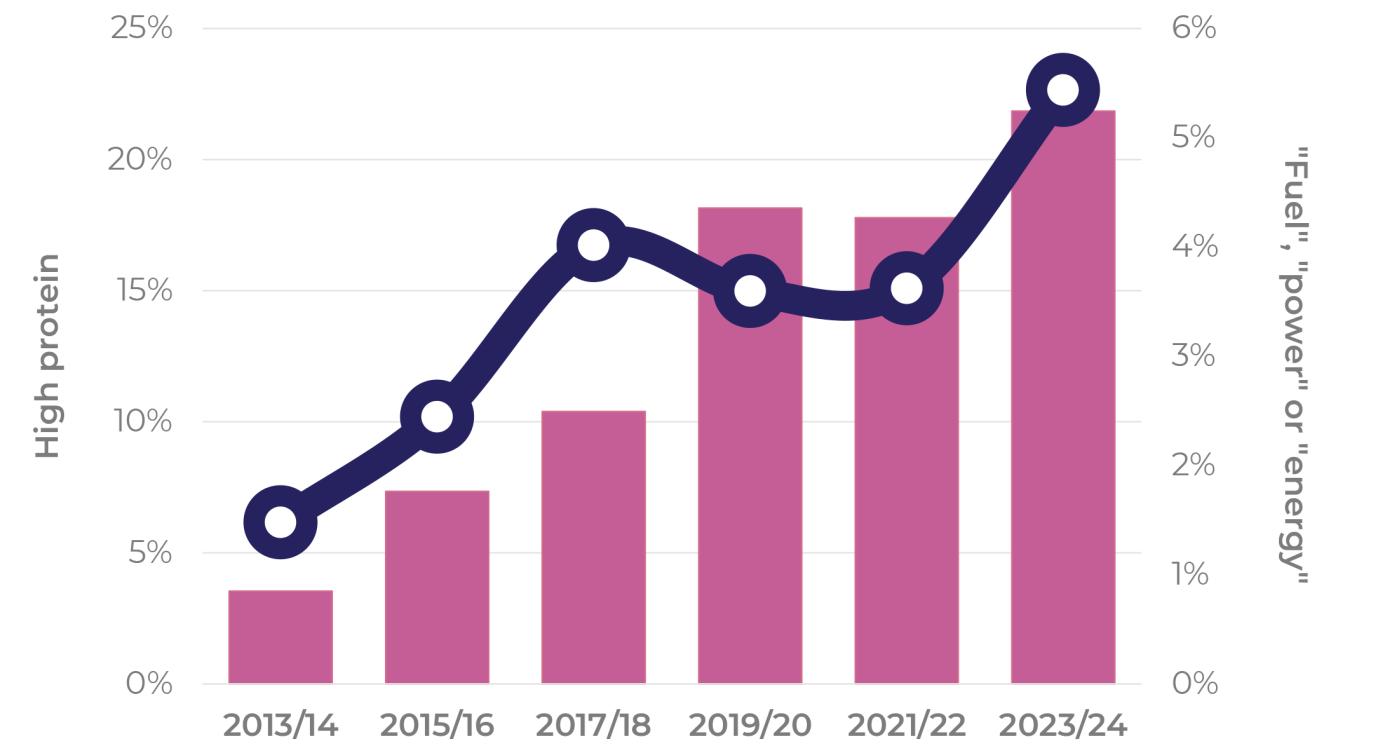

The notion of ‘food as fuel’ (especially via protein enhancement) is accelerating in consumer goods innovation, the latest Insight by Gama Compass can reveal. This all fits within a wider trend for positioning that targets ‘performance’ and the ‘everyday athlete’, as the distinction between food and supplements becomes ever more blurred. Meat and dairy (not to mention meat and dairy alternatives), together with pasta and bakery, are some of the categories that have been driving this trend since 2023.

The trend for protein enhancement is long established in FMCG – predating, for instance, other long standing megatrends such as plant-based foods. As Gama explored as far back as 2016, interest in protein content was in large part driven by in-vogue dietary trends such as paleo and the Atkin’s diet which espoused the benefits of protein over carbohydrates, as well as embodying the ‘snackification’ of food and drink that mirrored consumers’ increas-

ingly informal eating habits and less regimented lifestyles. Especially at the breakfast occasion, health-forward, on-the-go products which provided ‘fuel for the day’ developed as an important segment in their own right.

Interestingly, a spike of popularity (in product innovation terms) in ‘food as fuel’ and protein enhancement around 2019 / 20 was followed by a brief lull in 2021 / 2022, perhaps in the context of the Covid

-19 pandemic and other health concerns coming more to the fore. 2023 / 2024 though, has seen renewed interest in protein benefits, although more so in food categories than in non-alcoholic drinks. Featuring on nearly 22% of launches, the high protein claim has climbed to third in the ranking for food products, behind only no gluten and vegan; in 2016, when we first reported on the trend, it was much less mainstream, coming in at only eighth place overall.

The higher prevalence of high protein claims is echoed in the rise of their associated slogans, with the proportion of new launches offering “performance”, “energy” or “fuel” stepping up from 3.6% in 2021/22 to 5.4% in 2023/24. Indeed more than a quarter of all launches since 2013 bearing a high protein claim have also touted “performance”, “energy”, “power” or “fuel”, underlining the direct association in the mind of the consumer between protein and physical stamina or mental alertness. This is ultimately a little surprising given that, from a conventional nutrition point of view, ‘energy’ is strictly speaking provided by calories or carbohydrates rather than protein, even if protein can legitimately claim other tangible health effects, such as satiety or building muscle mass.

Underscoring the extent of this protein frenzy is the fact that even nat-

urally high-protein products such as meat, fish & poultry, as well as dairy, are now leading the charge in respect of protein claims and enhanced protein content. This can, to a certain extent, be explained by the fact that meat and dairy substitutes now comprise a significant proportion of launches within the wider meat, fish and dairy space: to compete with animal-based products in nutrition terms, many brands may feel the need to overtly tout their protein benefits. However with even traditional meat and dairy now also joining the party (38% of conventional meat, fish and poultry launches, and 45% of conventional dairy launches making high protein claims in 2023/24), it is apparent that protein-based marketing and formulation is impacting all categories. This is leading to surprising ‘superprotein’ concepts in the meat and dairy space, such as last year’s ElPozo’s Bien Star +Proteinas range of cold meats in Spain, containing added protein concentrate and with “28g protein” prominently emblazoned across packs.

" Even naturally high protein products such as meat, fish & poultry, as well as dairy, are now leading the charge in respect of protein claims "

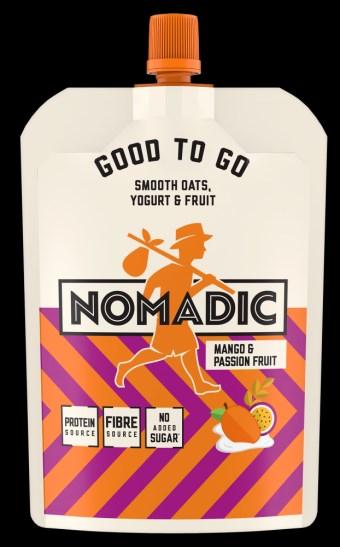

Another aspect of the high protein surge worth noting is the close parallel with other health claims, most notably the recent uptick in products boasting high fibre and gluten free benefits. This is evident not only in more obvious categories such as breakfast cereal, especially porridge and granola products enhanced with seeds and ancient grains, but even in dairy and meat, fish and poultry. Again,thismayhavesomethingtodo with the rise of meat and dairy alternatives that allow for more ‘clean eating’ positioning, but also points to the growing popularity of combinations of meat and yoghurt with grains, cereals and pulses. For instance last year, Nomadic Dairy and The Collective in the UK both launched flavoured yoghurt smoothies blended with oats, positioned as a high protein, high fibre snack and sold in on thegopouches.

The intensification of the high protein and ‘food as fuel’ trend can be seen in the context of wider concerns around health & wellbeing, accentuated by the Covid-19 pandemic, where the boundary be-

tween food and supplements becomes less distinct, and foods are more and more required to take on almost medicinal properties. At the same time, the demands of a modern world that for some can feel fraught, challenging and uncertain act as a driver for preoccupation with ‘performance’ and self care. Increasingly, it seems, food and drink innovation will need not only to deliver on taste and nutrition, but also chime with these more complex and multi-faceted attitudes to both mental and physical wellbeing.

Yoghurtandoatblendsarebeing positionedasahigh-fibre, highproteinsnack

Source: Gama Compass

Image Source: El Pozo / The Collective / Nomadic Dairy

Formoreinformationabout GamaCompass,pleasecontactusat info@gamaconsumer.com

With sustainability continuing to embed itself as a mainstream concern within fast moving consumer goods (FMCG), London’s Natural & Organic Products Expo (NOPEX) once again proved a major draw for industry professionals keen to explore the latest in eco-friendly product innovation and the hottest purpose-led trends.

With some 6,210 delegates and 600 exhibitors congregating inside ExCel’s showgrounds, the mood was characteristically engaged but relaxed. While visitor numbers were down 15% on the previous year, show organisers flagged that this was due to

" NOPEX showed off a 'vibrant new look' as the pavilions were divided into three distinct areas "

tightened vetting procedures for prospective attendees, in pursuit of a ‘quality over quantity’ strategy, to enhance the interactions for those exhibiting.

Broadening the experience for visitors was a diverse seminar programme, alongside two innovation showcases highlighting the very latest breakthroughs in natural-focused innovation. 2024 also saw NOPEX show off a “vibrant new look” as the pavilions were divided into three distinct areas focused, respectively, on Natural Health, Natural Food Expo and Natural Beauty.

Elsewhere, in what was billed as an integral part of NOPEX, Vegan World returned to showcase the most recent innovations in the rapidly-evolving plant-based category Other features included Launchpad Zones for beauty and food, spotlighting startups and challenger brands making waves in the natural and organic industry, and the Indie Focus Programme for independent retailers, including a curated seminar schedule and dedicated onsite networking opportunities.

" Within the functional space, mood and cognitive enhancement was a standout trend"

A sweep of the exhibition stands revealed product innovation continuing to be oriented around hot topics, with functionality once again among the most predominant themes on display. Within the functional space, mood and cognitive enhancement was a standout trend, emphasising the value consumers now place on mental as well as physical wellbeing. Elsewhere, closely-defined demographic targeting was apparent, evidenced, for instance, by innovations for women experiencing the menopause.

Natural & Organic Products Expo returns to ExCeL London on 11th to 12th May 2025.

Image Source: Gama

flected our ambition to invest for the future, and to diversify our portfolio to ensure we continue to meet evolving consumer demands. We are excited to help further accelerate growth, bringing natural, simple meals and ingredients to even more customers in retail and foodservice markets”.

Strong Roots founder and CEO Samuel Dennigan said: “We have witnessed tremendous growth since partnering with McCain and this move will enable Strong Roots to maintain its focus on sustainability while propelling innovation to bring delicious, vegetable forward products to more consumers around the world”.

Strong Roots will continue to operate as an distinct business, with Samuel Dennigan supporting the team to advance portfolio innovation and brand growth, the company said.

Terms of the transaction were notdisclosed.

Source / image source: McCain

By: InnovationEditor–Europe

Brazilian personal hygiene, beauty and household care firm Flora has announced the opening of a new distribution centre in Bauru, SaoPaulostate.

According to sources, the 3,000 sq m centre is intended to be a hub for the company that will allow it to expand its presence to strategicregions.

Thiago Cardoso, distribution director at Flora, commented: “This investment complements our push to expand and facilitate our logistics operations, allowing for a more efficient process and ensuring excellent distribution for retailers in the

Asahi has announced plans to close a brewery in Greenwich, London that produces the Meantime and Dark Star beer ranges, with production transferred to the Fuller’s site in west London. According to reports, the Greenwich site will be retained but converted into a “standalone” consumer retail experience.

Source: The Drinks Business / Just Drinks

Nestle, the Swiss consumer goods giant, has announced an investment of A$32 million ($20.8 million) to upgrade its manufacturing

region. The interior of Sao Paulo is a very important hub and we are pleased to have this distributioncentre inBauru”.

Florahasbeenoperatingformore thanfourdecadesthroughbrands suchasMinuano,Francis,Neutrox, Albany,OXCosmeticosandPhytoderm. It has manufacturing units inGoias,SantaCatarinaandAlagoas and distribution centres in Goias, Minas Gerais, Santa Catarina, AlagoasandSaoPaulo.

Source: LogWeb

Image Source: Flora

By: InnovationEditor –Latin America

UK: MOLSON COORS INVESTS £100 MILLION

Molson Coors has announced an investment of £100 million ($124 million) in its UK business over the nextfive years.

line for powdered drink concentrates in Smithtown, Australia. The company said the investment would be used to introduce state-of -the-art manufacturing technology to the factory and support increased production capacity.

Source: Nestle / The Manufacturer

Consumer goods major Unilever has announced plans to invest $80 million to expand its facility in Jefferson City, MO for the manufacture of the functional powder mix Liquid IV. Liquid IV was bought by Unilever in 2020 and is said to be now four times larger than it was in the period near acquisition.

Source: Unilever / Missouri Department of Economic Development

Fermentation and ‘non-animal dairy’ remain two of the hottest trends in the food industry. Our latest Innovation Insight focuses on a novel fungi-based dairy analogue that sees these two trends collide – Nature’s Fynd Dairy-Free Yoghurt.

Boasting “all the creaminess” of a conventional yoghurt, Nature’s Fynd Dairy-Free Yoghurt from The Fynder Group takes a novel approach to dairy alternatives by harnessing the power of fermentation, specifically the company’s Fy Protein technology. According to the makers, the technique involves combining a strain of fungi and a blend of nutrients inside a liquid-air interface to trigger high protein fermentation. The fungi is then transformed using “simple food production steps” and blended to create the final yoghurt, which is claimed not to be affected by the “grittiness” often associated with high protein and plant-based yoghurts.

Nature’s Fynd Dairy-Free Yogurt demonstrates that as developments in meat and dairy alternatives continue apace, hightechnology approaches based on culturing and fermenting methods may win out, especially if they can most closely match the taste and mouthfeel of conventional dairy, and at a competitve price point. And while the fermented / cultured dairy alternative segment may remain in its infancy, the technology is undoubtedly garnering attention, and seems ripe for commercial scaling, especially as the regulatory environment becomes more favourable. What may aid fer-

mentation technologies in this respect is the rise in popularity of fermented and pickled foods (fermented cabbage dishes such as kimchi and sauerkraut, and fermented tea drinks such as kombucha being among the most notable examples), which could allow for positioning of such technologies as a ‘natural’ process. This may help to overcome the typical ‘frankenstein foods’ objections to novel food technologies in general, and biotechnologies in particular.

Looking ahead, as boundaries continue to be pushed in pursuit of lucrative new opportunities in dairy alternatives, culturing and fermentation technologies of the kind pioneered by the Fynder Group seem set to play a decisive role. As such technologies mature and come ever closer to mimicking the taste and texture of dairy, and providing produc-

" Fermented / cultured dairy alternatives seem ripe for commercial scaling, especially as the regulatory environment becomes more favourable "

tion at scale is successful at lowering cost, persuading consumers that ingredients based on these technologies are as ‘real’ and ‘natural’ as conventional dairy is likely to be key to unlocking their mainstream adoption.

Image source: Nature's Fynd

In a statement, the company said the decision would allow it to increase its brewing and packaging capabilities at its largest UK facilities in Burtonon-Trent and Tadcaster, which supply the UK and Western Europe markets.

Commenting on the move, FraserThomson,MolsonCoorschief supply chain officer for Western Europe, said: “This plan is an investment in our future, giving our people and our brands the tools to fulfil our potential in the U.K. market while making strong progress against our sustainabilitytargets”.

Besides improving capabilities and making operations more efficient, the investment will also contribute to the firm’s commitment to reduce direct carbon emissions to net zero in the UK by 2035, the company said.

Source / image source: Molson Coors

By: InnovationEditor–Europe

PepsiCo, the global snacks and drinks giant, has announced plans to invest 1,266 crore INR ($154 million) to set up a flavour manufacturing facility for beverages in Ujjain, in India’s Madhya Pradeshstate.

The plant, spanning an area of approximately 22 acres, is expected to enhance PepsiCo’s beverage production capacity and create more employment opportunities, the company said ina statement.

The company added it would enable them to manufacture beverageflavours“inIndia,forIndia”.

Commenting on the move, PepsiCo India senior vice president, beverages George Kovoor said: “We are excited to announce the setting-up of our second flavour manufacturing facility in India, a significant testament to PepsiCo’s unwavering commitmentto the region”.

“This strategic investment not only strengthens our dedication to providing the highest quality beverages to our consumers but also reinforces our responsibility to drive sustainable practices across our operations”, he added.

Construction is expected to begin this year, and the plant is projected to be operational in the firstquarter of 2026.

Source / image source: PepsiCo

By: InnovationEditor –Asia Pacific

St. Paul, a leadingDutch cheese processor, has announced the acquisition of Koninklijke ERU, an independent Dutch cheese dairy, to create an alliance for the production of a wide range of processedcheese products.

Foundedin1824,KoninklijkeERUis known for brands such as Balans,

Goudkuipje and Prestige, with a product range that includes both spreadable and American-style single-slicecheese.

Commenting on the acquisition, St. Paul CEO Dieter Kuijl said: “With this historic step, St. Paul becomes the largest (melted) cheese producer in the Benelux. We are determined to further develop and expand our diverse range of high-quality (melted) cheese products, meeting the diverse needs of consumers, out-ofhome, and the food industry”.

In June 2023, Koninklijke ERU joined forces with St. Paul to acquire the processed cheese business of Kasi Food, formerly under the Lekkerkerker Food Group inLopik.

Financial terms of the transaction were not disclosed. The deal is subject to approval by the Dutchmarketauthority.

Source: Koninklijke ERU /St. Paul

Image Source: St. Paul

By: InnovationEditor –Europe

Uncle Matt’s Organic, a producer of organic beverages, has opened a new 75,000 sq ft manufacturing plant in the US state of Texas, to the west of Dallas and FortWorth.

The facility will reportedly take charge of 100% of Uncle Matt’s chilled juice production.

Commenting on the move, Uncle Matt’s Organic founder and chief executive officer Matt McLean said: “Having doubled in size since acquiring the brand back in 2020, this move reflects Uncle Matt’s Organic commitment to being consistently great with every bottle produced. Centralizing production allows us to streamline operations, reduce costs, and improvequality”.

“This newfound flexibility accelerates innovation and new product launches”, he added. “Coupled with our state-of-theart equipment and high-quality control standards, we’re thrilled to see the impact on Uncle Matt’s Organic finished product. We are fanatics about flavor and maintaining great taste withevery case sold”.

Source: Food Business News

Image Source: Uncle Matt's Organic By: InnovationEditor – North America

North American rice and pasta specialist Riviana Foods has announced it has completed the firstphase of a$80.6million investment in a start-of-the-art processing and packaging plantinMemphis, Tennessee.

In a press release, the Ebro Foods subsidiary said the first phase of the project upgraded approximately 20,000 sq ft of thefacilitytodoublecapacityfor Minuteready-to-servericecups.

Commenting on the investment, Riviana Foods president

and CEO Enrique Zaragoza said: “The substantial increase in the plant’s capacity to produce ready-to-serve cups has placed Riviana in a stronger position to meet the growing demand of our customers for high quality, flavorful and convenient food options. Along those same lines, we look forward to completing the second phase of our investment in the plant, which will add new capacity to produce our ready-toserve rice pouch products for the US and Canadianmarkets”.

The second phase of the project began earlier this year and is projected to be completed in early 2025. It will add approximately 65,000 sq ft of new production capacity for ready-toserve pouch products under the Tilda, Carolina and Mahatma rice brands.

Source / image source: Riviana Foods

By: InnovationEditor – North America

Innohas, a South Korean food maker, has announced the opening of a manufacturing site which is claimed to be the largest fully plant-based food facility anywhere inthe world.

SitedinJecheon,SouthKorea,the newfacilitywillreportedlyproduce Korean-style plant-based foods under Innohas’s Sunlit Foods brand to cater to increased demandforKoreancuisine.

Established in 2001, Innohas operates under a namesake brand in Asia, but the Sunlit brand in

the Americas and Europe. Its product range includes bulgogi, vegetable kimbap, bulgogi japchae,andbibimbap.

The new facility reportedly features South Korea’s largest frozen kimbap production line, dedicated plant-based barbecue and deep-frying lines, and an exclusive oven line for plantbasedproducts.

The company is quoted as saying it intends to spearhead the plant-based trend in a country that traditionally has a strong meat-eatingculture.

Source: The PlantBase / Innohas

Image Source: Innohas

By: InnovationEditor –Asia Pacific

USsnackmanufacturerJ&J Snack Foodshasannouncedtheacquisition of the Thinsters biscuit brand fromHainCelestial,anorganicand naturalproductscompany.

Thinsters are described as thin, bite-size cookies that are oven-baked with real butter and real sugar.

The Hain Celestial Group, which itself acquired Thinsters in 2021 along with That’s How We Roll brands and ParmCrisps, said the decision would optimize its better-for-you portfolio and reduce debts.

Commenting on the move, J&J Snack Foods president and

US retail giant Walmarthas announced thelaunch ofBetterGoods, anew brand thatis claimed to mark the company’s largestprivate-brandfoodlaunchin20years.

According to Walmart, the range features 300 products, including frozen, dairy, snacks, beverages, pasta, soups, coffee, chocolate and more. BetterGoods products will also fall within three “category pillars”, namely “culinary experiences” (such as specialty salts, jarred soups and premium pasta), “plant-based” (including dairy-free desserts and cheese), and“madewithout”(featuringproductsvariouslyfreefromgluten,artificialflavours,coloursandaddedsugars).

Walmart senior vice president, private brands, food and consumables Scott Morris said: “Bettergoods is [...] a commitmenttoourcustomersthattheycanenjoyuniqueculinaryflavorsattheincrediblevalueWalmartdelivers”.

Source / image Source: Walmart

Spinneys,theUnitedArabEmirates(UAE)basedretailchain,hasannouncedplanstoopenitsfirststoresinSaudiArabia asitseekstoexpanditspresenceintheGulfCooperationCouncil(GCC)region.

SpinneyspresentlyhasstoresinEgypt,Qatar,Lebanon,Oman,PakistanandAfghanistanaswellastheUAE.

ThenewSpinneysstoriesinSaudiArabiawillbeopenedbyAlbwardyInvestment,theUAE-basedholdingcompanythat ownsthefranchiseandisthelargestshareholderinSpinneys.Thecompanyreportedlyplanstoopenits firststoreinthe first semester of 2024 and three more by the end of the year, with the first openings being in Jeddah and the capital Riyadh.

As many as four Spinneys stores per year could be added in Saudi Arabia over the next five to ten years, according to sources.

Source: Spinneys / Trend Type Image Source: Spinneys

Leading supermarket chain Rewe has announced it has opened Voll Pflanzlich, its first store entirely dedicated to vegan and plant-based products, located in the Friedrichshain district of the German capital Berlin.

Claimed to offer over 2,700 products – twice as many as a typical Rewe supermarket, the new 212 sq m concept store lists 300 different brands, including the own label Rewe Bio + vegan, Rewe Bio, Rewe Beste Wahl and Vivess, and big brands such as Rugenwalder, Oatly and Alpro. The product range is said to include snacks, drinks, fruit, sushi, bakery products, sandwiches, drugstore items, and self-service dairy-free ice cream.

Commenting on the opening, Rewe Group CEO Peter Maly said: “With REWE voll pflanzlich, we are showcasing the extent and variety of vegan products. We have been recognised several times already as a vegan pioneer in the food industry, and we have been encouraged by the positive response from our customers”.

Source / image Source: Rewe

CEO Dan Fachner said: “We are thrilled to add Thinsters to our growing portfolio of fun brands. This acquisition is a natural fit for us, complementing our already vast offering of cookies and baked goods. Thinsters’ dedication to using highquality, wholesome ingredients resonates perfectly with our growingcustomer base”.

Hain Celestial president and CEO Wendy Davidson added: “Divesting Thinsters further streamlines our supply chain network and strengthens our ability to focus our efforts on driving greater reach and scale of our core better-for-you brands across our categories of focus. We are pleased to reach this agreement with J&J Snack Foods and are confident that the business will thrive under their leadership”.

Terms of the transaction were notdisclosed.

Source: J&J SnackFoods(via PRNewswire) /HainCelestial

Image Source: J&J Snack Foods

By: InnovationEditor –North America

PepsiCo, the US-based food and drinks business, has announced the closure of the Quaker facility it operates in Danville, in the US stateofIllinois.

The decision is said to follow a recall of granola-based snacks madeatthefactoryduetopotentialsalmonellacontamination.

“After a detailed review, we determined that meeting our future manufacturing needs would require an extended closure for enhancements and modernisation”, a PepsiCo spokesperson is quoted as saying. “In order to continue the timely delivery of Quaker products trusted by consumers since 1877, we determined production would need to perma-

Kerry, a leading food and food ingredients company, has announced a “category-first” range of products made from a blend of oat milk and dairy milk, branded as Smug Dairy. The new range, which launched in UK stores at the end of March, includes analogues to cheddar cheese, milk, butter and butter spread and is claimed to be lower in saturated fat than traditional dairy. Source: FoodBev / Just Food

Labatt Breweries, a leading Canadian drinks company, has announced the entry of the

nently shift to other facilities”. The plant opened in 1969 and in recent years has focused on making Quaker Oats granola bars, although it has previously also manufactured cereal and pancake mix. The shutdown is said to affect more than 500 employees.

Source: JustFood /IPMNews

Image Source: PepsiCo By: InnovationEditor –North America

Australian company Vitality Brands has entered into an agreement to acquire Essano, a New Zealand-based beauty brand, for anundisclosedsum.

7UP soft drinks brand into the alcoholic drinks space with the launch of SVNS Hard 7UP. The ready-to-drink cocktail combines the lemon-lime flavour of PepsiCo’s 7Up with vodka -based alcohol. Source: Labatt Breweries (via Cision NewsWire)

Kraft Heinz Not Company, the joint venture between Kraft Heinz and TheNotCompany, has announced the launch of NotHotDogs and NotSausages, the first plant-based offerings under the Oscar Mayer brand. According to the company, the new meat substitutes offer a smoky, savoury taste, meaty colour, and thick, juicy bite. Source: Kraft Heinz

Hailedasthe“busiest”editionto date, the 2024 edition of Food & Drink Expo (and its co-located events) yet again emerged as a significant showcase of the latest in food and drinks innovation in theUK and beyond.

Absorbing much of the Birmingham NEC’s extensive showgrounds for three days between 29th April and 1st May, Food & Drink Expo saw around 1,200 exhibitors pack the pavilions to show off the latest products and concepts from across the grocery, specialist retail, wholesale, foodservice and hospitality sectors. Away from the exhibition stands, a major draw for the thousands of visitors that flocked to the event was a diverse programme of presentations, debates and other events spread across five different stages, as

well as awards in categories such as Product and Retailer of the Year Award.

Co-located events included the National Convenience Show (in turn incorporating The Forecourt Show), The Restaurant Show and the Farm Shop & Deli Show, while dedicated zones for “plantbased” and “healthy & natural” products were testament to continued interest in the vegan and ‘clean eating’ trends.

Out on the show floor, the nicotine category was making its presence felt, with what appeared to be greater representation than in previous editions. A notable trend among e-cigarette brands was the promotion of rechargeable devices with refillable containers, apparently developed in response to the recent UK ban on disposable vapes.

Among the food and drink exhibits, health and wellbeing demonstrated its continuing allure, with high protein products (especially in categories such as bakery and snacks) and energising drinks in particular evidencing the current popularity of products geared towards the fitness enthusiast. Meanwhile, in the field of technology, one energy drink brand in particular was trialling a more automated approach to product and packaging design, with both the can and the flavours of the drink reportedly developed using artificial intelligence.

The next edition of Food & Drink Expo will start in Birmingham on 7th April 2025.

Image Source: Gama

play dairy

firm, how is Groupe Bel adapting to ensure the sustainability of the businessinthelongterm?

We have a growth model that has two pillars – profitability and responsibility–becauseweknowthat if we want to remain relevant for the next 150 years we have to be bothprofitableandresponsible.

" At Bel we believe that if we transition to more sustainable agriculture we can all benefit, because by curing the soil we can cure the climate"

Over the last 20 years, Bel has been extremely committed to corporate social responsibility (CSR), with ambitions including ensuring that 100% of our packaging is recyclable and reducing our carbon footprint. We have also expanded our range to include fruit-based and plantbasedproducts.

Gama spoke to Paula Amaral, Head of Sustainability, Innovation and Strategy at Groupe Bel PAULA AMARAL

Becoming a mission-led company by law reflects our commitment to a model that benefits all our stakeholders, while embodying our core values of economic, societal and environmental responsibility. With our purpose now integrated in our corporate status, Bel is bringing to fruition over 20 years of engagement and action. It marks a significant step forward and cements our engagement over the long term to providing healthier and more sustainablefood.

Why is Bel taking a particular interestinregenerativeagriculture?

It is well known that modern agriculture, in particular in the aftermath of Word War II, was developedinordertofeedtheworld,and not to benefit the soil. Undoubtedly that was a great ambition at the time, but we also know that this type of intensive agriculture, which relies on spraying the soil with chemicals, is eliminating the microorganisms that extract carbon. At Bel we believe that if we transition to aformofagriculture thatis more sustainable we can all benefit, because by curing the soil we can cure the climate. That’s why in 2023 Bel Group launched an alliance for regenerative agriculture enlisting diverse stakeholders to bring about that change together. In Portugal we have two pilot regenerative agriculture projects – one on the

mainland, and one in the Azores. We are working together with NGOs on the best way to feed our cattle herds in order to improve the health of the soil. By 2030, all of our milk and apples will come from regenerativeagriculturepractices.

What other steps is Groupe Bel taking to reduce the carbon footprintofitsoperations?

As a player in the food system, we know we are partly responsible for the 30% of total greenhouse gases emissions that the sector contributes. This is why we developed a simple data analytics tool to measure the carbon footprint of our products from farm to fork. Thanks to this tool, we can calculate the carbon footprint of each one of our products and look atchangingrecipes, packaging or logistics to lower our planetary impact. We also invited some of our retail customers to visit our farms and learn about our sustainability efforts, and these visits are already bringing about some greatresults.

This deal will bring opportunities to expand its portfolio of established brands including Essano, Cancer Council Sunscreen, Epzen, Dominate, Shockwaves and Tribe Skincare inglobalmarkets.

“The partnership will propel Vitality Brands’ international growth strategy by introducing Essano to Vitality Brands’ vast distribution network across Australia and Asia while leveraging Essano’s growing presence in the United States to bolster Vitality Brands’ portfolio in this market significantly”, said Vitality Brands co-founder and MDRichard Meyrick.

Essano co-founder Shane Young addd: “In addition to our companies’ shared values and commitment to delivering the highest quality, valuefor-money products for our loyal customers, along with our strong trans-Tasman sense of family means that as a combined operation, we can make further inroads in the beauty sector globally”.

The transaction is expected to closebytheendofMarch,subject tocustomaryclosingconditions.

Source: Inside FMCG /Business News Australia

Image Source: Vitality Brands By: InnovationEditor–Asia Pacific USA: MARS INVESTS $70 MILLION IN NEW JERSEY FACILITY

FMCG giant Mars has announced a $70 million investment in R&D and food manufacturing at its site in Hackettstown, NewJersey.

In a press release, Mars said the upgraded New Jersey site would include a new prototyping kitchen, packaging lab, and collaboration space with the intent of increasing innovation and development to meet consumer preferences. The capabilities in the Innovation Studio will support the production of Mars Wrigley products produced in the US, whilst the updated packaging studio will be used to test sustainable packagingsolutions.

Anton Vincent, president of Mars Wrigley North America and Global Ice Cream, commented: “At Mars, our commitment to quality and innovation has been at the centre of our business for more than a century. The continued investment in our Hackettstown site reaffirms our commitment to innovation in New Jersey and upskilling our Associates with best -in-class facilities to create more moments of everyday happiness forour consumers”.

The opening of the New Jersey Innovation Studio follows the recent opening of a snacking R&D hub in Chicago, designed for “ground-breaking research and snackinginnovation”.

Source / image source: Mars By: InnovationEditor –North America

BRAZIL: TIROLEZ OPENS NEW PLA

Brazilian dairy firm Tirolez has announced the opening of a new manufacturing plant in Santa Catarina, Brazil.

According to sources, the company invested R$150 million ($30.1 million) in the manufacturing unit in Caxambu do Sul, with the aim of expanding production capacity and strengtheningits productportfolio.

The unit will have the capacity to process up to 1.2 million litres of milk per day and increase production of mozzarella to 6,000 tons per month. In addition, the facility will produce other varieties of cheese that are already part of the company’s portfolio.

Source: PP Comunica

Image Source: Tirolez

By: InnovationEditor –Latin America

Spanish retailer Dia has announced plans to close 343 stores and three warehouses in Brazil as part of a strategic review of its business in the country, accordingto anESMreport. The closures would affect more than half of the roughly 600 stores Dia operates in the country. In a statement, the company said it planned to concentrate its efforts the Sao Paulo region, where its store count is currently 244, with the aim of achieving higher profitability and cost reduction by leveraging store concentration and its logistics network.

The decision comes after Dia reported a loss of €154 million ( $175million) inBrazilin 2023.

In a filing to the Spanish stock market regulator CNMV, the retailer said it now aimed to direct its resources towards markets offering better growth prospects and increased profitability,suchasSpainandArgentina.

Last August, the retailer also announced it would be exiting Portugal by the beginning of this year, selling nearly 500 supermarketstoAuchanPortugal.

Source: ESM

Image Source: Dia By: InnovationEditor –Latin America

Valeo Foods, the diversified food company, has announced plans tocloseafacilityintheUKcityof Liverpool that manufactures confectioneryproducts.

First acquired by the company in 2018, the factory employs 100 staff and is dedicated to the manufacture of the Taveners brand range of products, which includes traditional sweets such as caramels, mallows, gums and jelly.

Valeo Foods UK supply chain director Lee Nicholls is reported as saying that the closure was “essential for the future success of the Valeo Confectionery businesses here inthe UK”.

The decision was taken “in face of significant market challenges, changing demand and consumer preferences, as well as growing cost pressures”, according to further quotes attributed to the company.

The factory is expected to shut its doors withina year, although no precise date has been given for its closure.

Next Century Spirits, a US-based distilled spirits and marketing firm, has announced the acquisition of a majority stake in the brand assets of Texas-based peer Southwest Spirits & Wine. Next Century Spirits said the deal included the Nue Vodka brand, which has an approximate annual volume of 220,000 9 litre cases across 29 states. Source: Next Century Spirits

Pladis, the global snacks firm, has announced it has completed the integration of chocolate firm Godiva Chocolatier into its product port-

Source: JustFood /Liverpool Echo

Image Source: Valeo Foods By: InnovationEditor –Europe

USA: SAZERAC ACQUIRES COCKTAIL BRAND BUZZBALLZ

Global spirits company Sazerac has announced it has signed an agreement to acquire BuzzBallz, a US ready-to-drink cocktail brand,foranundisclosedsum.

Founded in 2009 by Merilee Kick, BuzzBallz is described as a woman-led and familyoperated distillery, winery and brewery, renowned for its spherically-shaped RTD cocktails. BuzzBallz’s portfolio also includes includes brands such

folio, alongside established brands such as Ulker and BN, and well-known British biscuit brands McVitie’s, Carr’s and Jacob’s. The strategic step will strengthen Pladis’s £3 billion ($4.05 billion) pre-Godiva annual net revenue, the company said. Source: Pladis

Borough Broth, a UK-based bone broth manufacturer, has announced the acquisition of SpiceBox, a food brand inspired by Indian cuisine, for an undisclosed sum. Following the acquisition, Borough Broth’s facilities in West London are set to become the primary manufacturing centre for the SpiceBox product range, which includes curry, ready-made dhal and sauces. Source: Just Food

as BIGGIES, Uptown Cocktails, Sip Sip Hoorayand TexasCraft.

Commenting on the move, Sazerac CEO and president Jake Wenz said: “Merrilee and the team at BuzzBallz have created incredible brands and we are both honored & excited to partner together to take them to the next level. Merrilee’s creativity, commitment to quality and drive is inspiring. BuzzBallz is truly one-of-a-kind and we can’t wait to help spread the products to more consumersall over the world”.

BuzzBallz CEO Merrilee Kick added: “[Sazerac is] a partner we can continue to grow with internationally, as well as expand our existing distribution footprint in the USA. We are excited about our future growth opportunities from the synergies we will createtogether”.

The transaction is subject to customary closing conditions, including receipt of regulatory approvals.

Source: Sazerac(via PR Newswire)

Image Source: Sazerac By: InnovationEditor–North America

The retailer said it intended to initially close 600 Family Dollar stores, with a further 370 Family Dollar outlets and 30 Dollar Tree stores also expected to be shuttered over the coming years at theendoftheirleaseterm.

“During the fourth quarter of fiscal 2023, the Company announced that it had initiated a comprehensive store portfolio optimization review which involved identifying stores for closure, relocation, or re-bannering based on an evaluation of current market conditions and individual store performance, among other factors”, Dollar Tree said in a statement announcing its latest financial results. “As a result of this review, weplanonclosingapproximately 600 Family Dollar stores inthe firsthalfoffiscal2024”.

Despite the impending closures, the company also said it had opened 219 new stores in the fourth quarter, bringing full-year newstoreopeningsto641.

Commenting on the decision, Dollar Tree chief executive Richard Dreiling said: “We took a thoughtful and deliberate approach to address underperforming stores by considering each individual store’s performance, local operating environment, and our broader need for scale and operating efficiencies across the portfolio”.

Source: Dollar Tree / WashingtonPost

Image Source: Dollar Tree

Dollar Tree, the largest discount retailer in the US, has announced plans to close nearly 1,000 stores, following a “a store portfolioreview”.

By: InnovationEditor –North America

sector in Ecuador through a deal with Gloria Foods, a subsidiary of the Peruvian business conglomerate Gloria Group, for Ecuajugos.

According to Gloria Foods, the deal includes a factory and distribution centre in Cayambe, the local brands La Vaquita, Yogu Yogu, Natura, Cereavena and Huesitos, and the licensing of the international brands La Lechera and Svelty.

Commenting on the move, Nestle Ecuador executive president Josue De La Maza said: “It is worth noting that in 2018 we acquired Terrafertil, an Ecuadorian company that has grown throughout Latin America with a leading portfolio in the plant-based category, which strengthens our product offering to Ecuadorian consumers. We are confident that Gloria Foods will continue to develop the dairy business in Ecuador based on its regional trajectory”.

Nestle, the Swiss consumer goods giant, has announced plans to exit the dairy and juice

Gloria Foods president Claudio Rodriguez added: “With this purchase, we are renewing our commitment to the Ecuadorian market as a significant player in the food sector, and we welcome with enthusiasm the excellent team and the major brands that the acquisition brings with it. We are confident that this transaction will strengthen our portfolio in Latin America and allow us to continue bringing our quality and

Mid-May saw Birmingham’s NEC once again become a focal point for the newest developments in consumer goods, as the latest edition of The Vaper Expo UK, a twice-yearly event for the global e-cigarette industry, took centre stage.

A typically lively and colourful affair, The Vaper Expo UK welcomed as many as 300 exhibitors, as well as around 20,000 delegates, reflecting the now-established position of vaping within the broader tobacco and nicotine industry landscape. The presence of food trucks, a lounge area and live entertainment leant something of a carnival feel to proceedings, even amid the serious business of networking and deal-making. Separate days for consumer and trade visitors gave exhibitors the opportunity not only to make new professional connections but also to stress test their latest ideas on existingandprospectivecustomers.

A tour of the showgrounds revealed an obvious emphasis on concerns such as value-formoney, longevity and sustainability, no doubt in part responding to the recently-announced UK government ban on disposable vaping products. This was evidenced by an apparent ‘arms race’ in the number of ‘puffs’ being offered per device (with one brand touting as many as 22,000), and claims being made in respect of enhanced battery life. Elsewhere, brands were offering e-liquid pods that could be refilled so they could be used multiple times rather than discarded.

" Food trucks, a lounge area and live entertainment leant something of a carnival feel to proceedings "

A second major theme of the show, meanwhile, was customisation, with a number of companies touting devices that could hold multiple flavours at once – in one case as many as five in the same e-cigarette. Twisting the end of the device allowed the user to switch from one flavour to

another with no need to replace the refill.

" A tour of the showgrounds revealed an obvious emphasis on concerns such as value-formoney, longevity and sustainability "

Other notable innovations were technology oriented, such as one brand offering wireless charging, and another that combined vaping with functionality to monitor heart rateandbloodoxygenlevels.

The second 2024 edition of The Vaper Expo UK is scheduled to begin on 25th October.

Image Source: Gama

expertise to the countries where we are present”.

The transaction is subject to approvalfromantitrustauthorities.

Source: Ecuador Times / FoodBev

Image Source: Nestle /Gloria Group By: InnovationEditor–Europe

Indian dairy giant Mother Dairy has announced plans to invest 750 crore INR ($90.36 million) to enhance dairy, fruit, and vegetable processing capacity across keylocations.

In a statement, the company said the investment would be used to establish a dairy plant in Nagpur, Maharashtra, with an investment of around 525 crore INR ($63.25 million), and the development of a new fruit processing plant inKarnataka.

Commenting on the move, Mother Dairy MD Manish Bandlish said: “In our endeavour to expand our distribution and reach to our consumers, we have earmarked a capital expenditure (capex) outlay of over INR 750 crore to enhance our dairy and F&V (fruits and vegetables) processing capacities across key locations”.

“In addition to these new greenfield plants, we are also strengthening our capacities in our existing facilities with an

outlay of around INR 100 crore”, he added.

The newplants are scheduled to becompletedwithintwoyears.

Source: EconomicTimes / Business Standard

Image Source: Mother Dairy By: InnovationEditor –Asia Pacific

Australian poultry supplier Inghams Group has announced plans to buy Bostocks Brothers (BBL), a New Zealand producer of organic poultry, in a deal worth 35.3 million NZD ($21.8 million).

The acquisition is said to include the brand, three freehold farming sites and the main processingplant.

Founded in 2014, BBL has its primary operations in Hastings, onNewZealand’sNorthIsland.

Commenting on the move, Inghams Group CEO and managing director Andrew Reeves said: “With the strong recovery in operational and financial performance of our New Zealand business, this acquisition represents a unique opportunity to further enhance our capabilities, extend our range and advance ourplansforthebusiness”.

The deal is expected to be closedbytheendofSeptember.

Source: JustFood /Food Processing

Image Source: Inghams Group By: InnovationEditor –Asia Pacific

Sugar Foods, a manufacturer of toppings, croutons, beverage ingredients and pizza toppings owned by Pritzker Private Capital, has announced the acquisition of Concord Foods, a leading US provider of retail foods and bespoke ingredients.

Previously owned by Arbor Investments, Concord Foods is described as a premier supplier of custom ingredients and retail food products, catering to nationally-recognized supermarkets, foodservice operators and foodmanufacturers.

The acquisition is set to include Concord’s 255,000 sq ft facility in Brockton, MA, along with brands like Concord Fresh Success, Simply Concord, Italia Garden, Oringer and RedEMade, broadening Sugar Foods’ North Americanoperationalfootprint.

Commenting on the acquisition, Sugar Foods president Andrea Brule said: “Concord and Sugar Foods share a long and successful history of customer-led innovation and service, and, with our complementary capabilities, I am confident that, together, we will maximize customer value and unlock new growth oppor-

tunities. This transaction combines the best of both organizations, and I look forward to welcoming the talented Brockton teamtoourSugarFoodsfamily”.

Terms of the acquisition were notdisclosed.

Source / image source: PritzkerPrivateCapital

By: InnovationEditor–North America

The bottles utilize Frugalpac’s Frugal Bottles technology, described as being produced from 94% recycled paperboard with a food-grade pouch housing the wine. The packaging is said to be fully recyclable and to weigh five times less than a standard glassbottle.

Frugalpac reported that substituting glass bottles with cardboard would allow Aldi to reduceitscarbonfootprintequivalenttodrivingaroundthe planet nearlysixtimes.

Commenting on the launch, Julie Ashfield, managing director of buying at Aldi UK, said: “Shoppers are striving to become more sustainable in their everyday lives, looking for small ways to make a big difference forourplanet”.

“Our Buying Teams are continuously thinking of how we can evolve our ranges to offer greater value and greener choices”, she added. “We are proud to be the first supermarket to launch an own-brand paper bottle, helping todrivesustainablechange”

The line comprises two South African wines, one a white made from Sauvignon Blanc grapes and the second a red Shiraz, bothonsalefor£7.99($10.19).

The newpackwill be available in stores from Global Recycling Day(18thMarch).

Source: Aldi/Frugalpac

Image Source: Aldi

By: InnovationEditor–Europe

Multinational tobacco and nicotine products manufacturer British American Tobacco (BAT) has announced the openingof a £30 million ($38 million) “stateof-the-art” innovation centre in Southampton,ontheUK’ssouth coast, to accelerate developmentofsmokelessproducts.

In a press release, the firm said it was committed to investing £300 million ($384 million) yearly in the development of new non-combustible products with a view to becoming a “smokeless” business by2035.

The new centre will employ 400 highly-specialised engineers and scientists, working in nine technical spaces and labs.

Last year, the company also announced the opening of an inno-

vation hub in Trieste, Italy focusingon“newcategory”products.

Commenting on the move, James Murphy, research and science director at BAT, said: “The opening of this new facility marks an important milestone in BAT’s transformation and will play a key role in making a smokeless future a reality. Evidence provided by objective world-class science is essential to facilitate the migration of adult smokers to smokeless products and support public healthobjectives”.

BAT currently has a threestrong portfolio of global “smokeless” brands: Vuse vapour products, Glo tobacco heating products and Velo nicotine pouches

Source / image source: BAT By: InnovationEditor – Europe

Scandza, a diversified Norwaybased food and drink firm, has announced it is selling Bisca, a Danish biscuit and cake manufacturer, to Danish privateequity group Erhvervsinvest Management for an undisclosed sum.

Established in 1890, Bisca produces goods such as Danish butter cookies, brownie bites, digestive biscuits, oat and wholegrain biscuits, and crackers, and has a production facility inStege.

Commenting on the move, Bisca CEO Kristian Walsoe said: “We have seen significant

HKTDC FOOD EXPO 2024

WHAT? Mid-August will see the Hong Kong Convention and Exhibition Centre play host to the latest edition of the HKTDC Food Expo. Last year's event attracted more than 700 exhibitors.

WHERE? Hong Kong, China

WHEN? 15th to 19th August 2024

ANUGA SELECT INDIA 2024

WHAT? This offshoot of the flagship German tradeshow "celebrating India's culinary treasures" is set to welcome some 20,000 visitors, and over 250 exhibitors representing 10 different sectors, to the Bombay Exhibition Centre in Mumbai this August

WHERE? Mumbai, India

WHEN? 28th to 30th August 2024

WORLDFOOD ISTANBUL 2024

WHAT? WorldFood Istanbul is promoted as "the international meeting point of the Turkish food industry" and is expected to attract more than 1,000 brands to showcase when the event returns this September.

WHERE? Istanbul, Turkey

WHEN? 3rd to 6th September 2024

LUNCH! SEPTEMBER 2024

WHAT? Advertised as "the definitive café, coffee shop and food-to-go event", Lunch! is a twice-yearly gathering welcoming over 300 suppliers to London's Excel. Co-located with Casual Dining.

WHERE? London, UK

WHEN? 18th to 19th September 2024

EXPOALIMENTARIA 2024

WHAT? Over 500 exhibitors are due to set up their stall for the latest edition of Expoalimentaria, billed as Latin America's premier trade event for the food and drink industry.

WHERE? Lima, Peru

WHEN? 27th to 29th September 2024

2024 WHERE?

London, UK

WHEN?

10th to 11th September 2024

What are your expectations for this year's Speciality & Fine Food Fair? How will you be celebrating the landmark 25th edition?

We’re really excited for this year’s event! It’s amazing to think how the speciality food & drink industry has evolved since 1999 and this year we’ll be celebrating both that incredible past and the industry’s bright future.

In June we’ll be launching two new initiatives ahead of the Fair in September. Our 25th anniversary documentary will be taking some of the Fair’s most important ambassadors, partners and advocates and asking them to reflect on the past 25 years.

Plus, our new Rising Stars initiative will be celebrating 25 upand-coming food & drink founders who are blazing a trail, inspiring their peers and developing fantastic brands.

Amid ongoing cost-of-living pressures, how will artisan food and drink brands be primed to succeed in 2024/2025?

Artisan food & drink has an incredibly important role to play amidst the cost-of-living crisis, as do independent retailers, delis and farm shops. When consumers are looking for a treat, an opportunity to try something new or a brand with strong sustainability credentials and quality ingredients, this is where our industry comes into its own.

Slightly higher RRP needs to be balanced with authentic messag-

" Premium, chefmade ready meals are a growing presence "

ing, transparent product provenance and a strong commitment to people and planet. Plus, of course, great taste needs to be at the heart of a successful artisan product.

We’d advise working closely with retailers to ensure their teams know recommended pairings and understand what makes the product unique.

What trends are you seeing picking up in the speciality food and drink space this year?

Premium, chef-made ready meals are a growing presence in the food & drink space, part of an exciting period of growth and changing consumer perceptions for the frozen food market.

The fermented food & drink market is continuing to evolve and meet the needs of healthconscious consumers, with continued popularity of products such as kimchi, kombucha, miso and tempeh.