6 minute read

NICHE SPORTS GO PRO

Gaming America sits down with Pro League Network’s Co-Founders

Mike Salvaris and Bill Yucatonis to discuss the advent of niche sports betting.

How would you describe Pro League Network and its ambitions?

Pro League Network (PLN) is a portfolio of fun and bettable sports that we either own or have produced and licensed from third parties. What we are trying to do is use these sports as a way of capturing what we see as latent gambling dollars; events that are on at times in the betting calendar when there's not a lot else going on. So whether that is during the week or during the day, or some evenings when there are no other professional sports, we see these fun, casual, bettable sports as a way of appealing to bettors; when there are not a lot of other conventional sports to bet on.

How do you identify the niche sports you think a lot of people want to bet on?

I think there's a casual element to what we identify. You don't have to know the intricacies of the rules or anything; you just need to be able to look at the competitors and feel confident about wagering. We account for affinity to the sport, as everyone has had some experience with mini golf in their life. Additionally, we consider the professional athletes doing something that people do on the weekends as a driver of interest in the sport. It's a combination of science and art, but we feel very confident in the portfolio we have and the sports that are coming down the pipeline.

Can you tell us anything about what is in the pipeline for PLN?

We have a lot of sports in our portfolio, ranging from combat to derivatives of golf.

I think there’s a lot we could be doing in these kinds of areas. We're very interested in developing an affinity within specific categories of sports, as this helps build relationships with fans of one type of sport, as they are likely to be fans of other sports in our portfolio. For example, if a fan likes SlapFight, then they will also likely be a fan of Pillow Fight Championship or Carjitsu. There’s a lot of mutual reinforcement of the fanbase across the categories we’re working on. Carjitsu is Brazilian jiu jitsu rules in a car, and the judo community loves it because of how the confined space allows them to use different moves and leverage. We've also structured the sport to be an easy-to-digest, short-format that follows the rules and has good integrity, making it enjoyable to watch and easier to bet on.

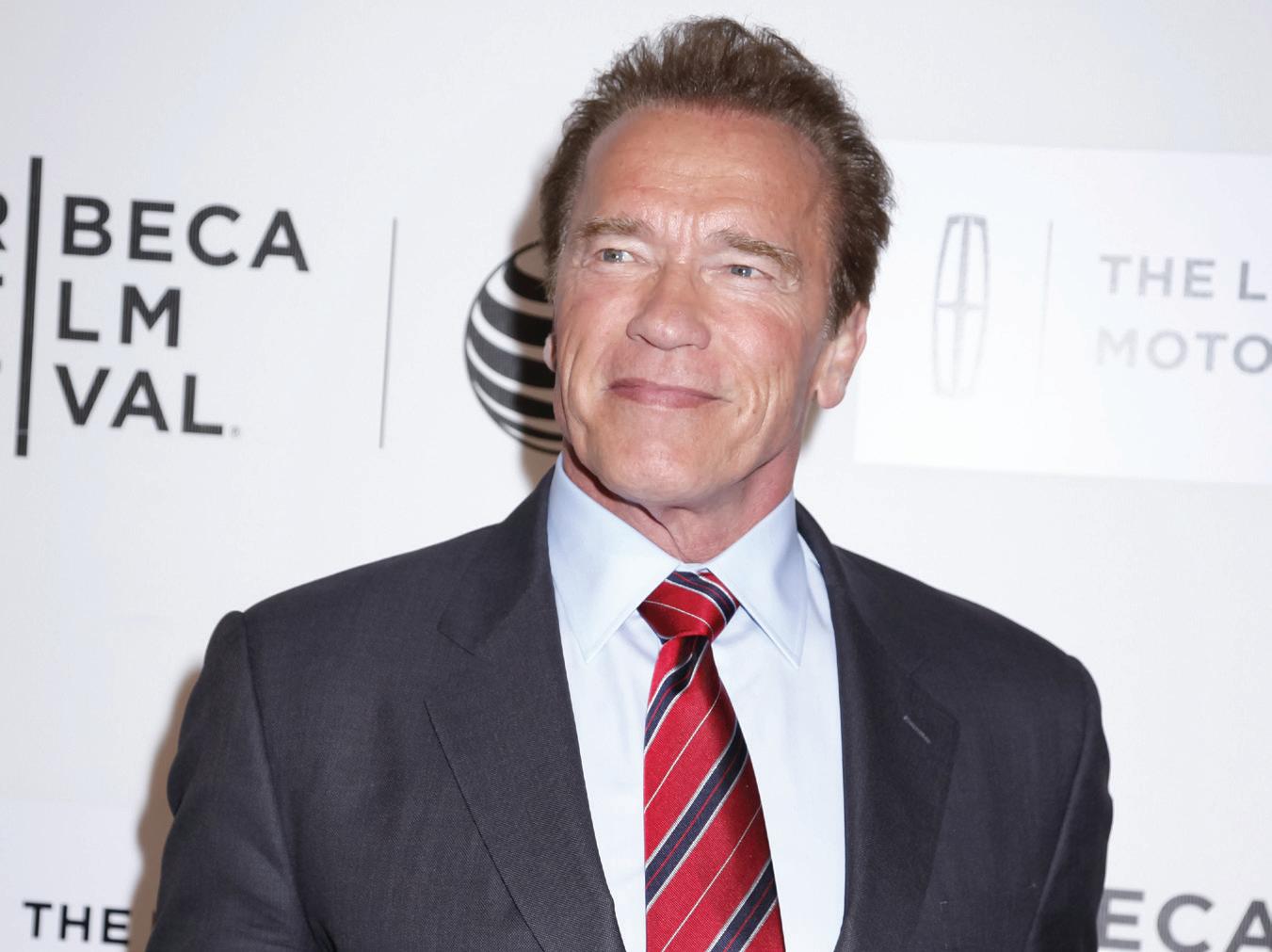

We saw that Arnold Schwarzenegger was a pundit on one of the SlapFight games and it obviously has a huge following. How does the betting action compare to a traditional sport such as baseball or tennis?

One factor that contributes to the popularity of the sport is the delivery of the content at the right times of the day, week and season. For example, we ran a two-day pro putting league last week. Day one was during the day on Monday and day two was at night, starting at 6:30PM (ET) on Tuesday. We noticed a totally different buzz for the event on Monday during the day compared to Tuesday night. It was more approachable because it was a casual type bet, and people were able to easily watch it while multitasking from their home office. It wasn’t competing with a college basketball game or a hockey match then. It’s not necessary for these sports to equal an NFL game in terms of popularity for us to have a successful business. I think the betting action for table tennis in Colorado, for example, was around $78m last year when you look at sports betting handle. We would love for our entire portfolio of sports to reach that level.

Did the Covid-19 pandemic and more people watching content from home affect the market for people watching niche sports?

The pandemic and more people watching content from home have certainly affected the market for niche sports. We didn't really appreciate this until we ran some sports during this time and saw the traffic coming from it. Another comparison point is urban racing, which was responsible for 60% of the handle in the US before the pandemic, due to its availability. It's not the Kentucky Derby or any other big events that are seeing the largest amount of success betting wise. Rather it’s the entry-level races because they are widely available to bet on. This helps substantiate the fact that delivery and time of day are both important factors when offering betting options to our customers.

Looking at customer acquisition, is your target market people who are already into these niche sports, or do you look at converting ‘conventional’ bettors?

You have a wide range of betting options and if there are a lot of live betting options, it will likely attract people who typically only bet on the NFL and other major leagues. There are also people who are fans of the sport that simply want to be able to bet on it and continue engaging with the sport they love. That would be "Bracket A;" "Bracket B" consists of those who find these niche sports approachable and instinctually bettable.

There is a huge growth audience of sports fans who want to find something enjoyable and entertaining. We are interested in live and in-play betting, and the variety of bets we have can draw in more people. For example, in golf, the most talked-about and engaged wager was the number of holes -in-one. We had two bets – one was an over/ under on the total number of holes-in-one for the round and the other was an over/ under on four specific holes. What was interesting was that the over/under on the fourth hole was set at 1.5 and people were fascinated by this. We heard about it in the punting and sports betting community, and saw different podcasts and videos about people playing. Since these sports are casual and accessible, people don't need to know the person playing to be able to bet.

These are professional putters who have been playing for decades, some of them even for 40-50 years, so there is a chance for them to become celebrities overnight due to their style and personality. These people are given celebrities overnight due to their style little nicknames and audiences had no idea who they were two weeks ago. That validates why we're doing this. You could one day see a SlapFights champion being a household name. This is more about creating an element of ‘celebrityism’ around these players, not necessarily making them into the new

Tiger Woods. The notion of short-format content and influencers around a sport and celebrities around the sport has shifted a lot over the last decade. I think what we're doing by enabling betting on niche sports is: we're inviting new people to step into that world. They have an interest because they are betting on it and I think, because they bet on it, they get to learn about the different personalities in that world, appreciating the skill and athleticism. It's a really cool way to expand the fanbase of any of these particular sports.

Where do you see Pro League Network in the next 18-24 months, particularly in regards to its US-facing operations?

We can look at it a couple of ways. Number one is that we see ourselves producing a lot of content in the next 18-24 months. In terms of hours of content per week from PLN on sports, we hope to have between 10 to 15 hours of content related to betting on US sportsbooks. This could be through all the sports within our portfolio. Number two, we have good relationships with sportsbooks. Right now we have lines offered on DraftKings and Betfred, but we certainly see ourselves expanding those relationships as we go on this year. That could be a way for us to work with different states to get approvals. We have a good solid base of early adopter states, with about six or seven state jurisdictions having some of our sports approved for betting. We’re in Colorado, Wyoming, Connecticut, Oregon, Ontario and Louisiania. We'd like to see that approval everywhere. It takes time for regulators to see these sports are being conducted at a professional level with the strictest integrity standards and that is what we are dead serious about; because that's what we're building our business on. there is no wagering, so we'd love to go on the sport. There is no specific another, it's just making sure we're able ensuring the fit is right for the audience our portfolio.

We see that certainly expanding as we look into the next 12 months, let alone the end of two years. The next big target is Louisiana. It really depends on the sport, because each sport has some states that have a larger Southern audience and some that are more popular with other audiences. We'd love to conduct a mini golf tournament in a state where wagering is live. We have just conducted our last event in South Carolina, where there is no wagering, so we'd love to go to a state where we are able to wager on the sport. There is no specific big state we're targeting more than another, it's just making sure we're able to enable wagering on sports when we're conducting the events. It’s also about ensuring the fit is right for the audience that's responsive to their specific sport in our portfolio.