5 minute read

TOKENOMICS: INITIAL COIN OFFERING 12

01 Introduction

Advertisement

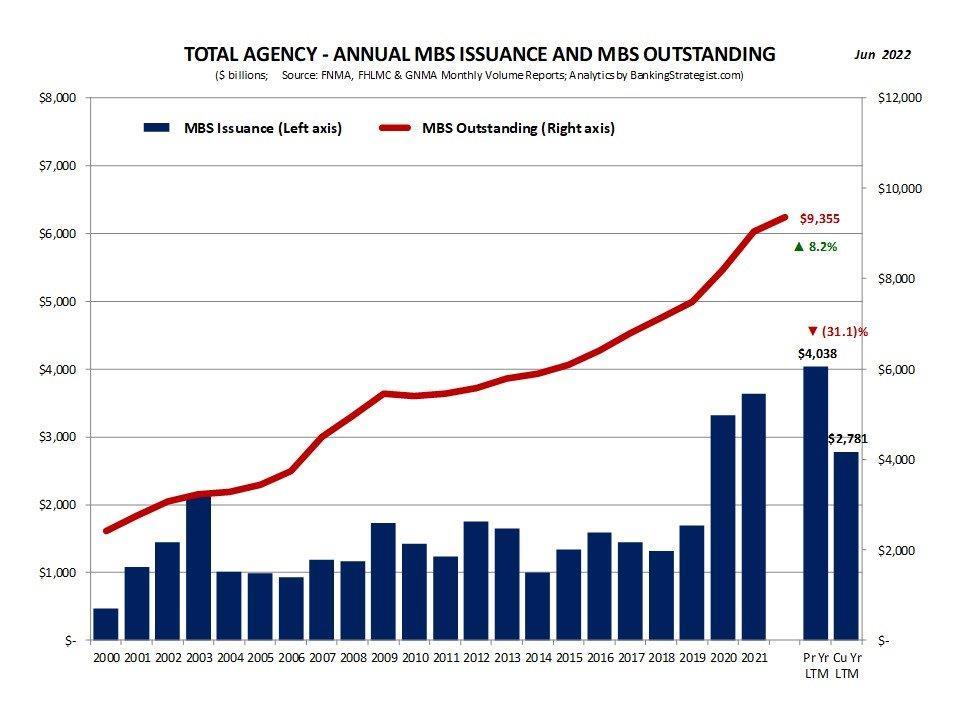

Mortgage-backed securities (“MBS”) are bonds secured by home and other real estate loans.1 Investors face two primary problems when they decide to purchase MBSs. MBS bonds are created and sold through a complex network of banks, federal government agencies, government sponsored enterprises, securities firms, and brokers. The first mortgage-backed security (MBS) was issued in 1968. The MBS market grew rapidly with outstanding issuances exceeding $9 trillion by 2010.2 The process for creating an MBS starts when banks group home and real estate loans together in pools comprising loans with similar characteristics. These pooled loans are then sold to a federal government agency like Ginne Mae, to government sponsored enterprises Fannie Mae or Freddie Mac, or to securities firms to be included in new MBSs. Finally, the MBSs are sold to investors in a highly centralized way through banks or brokers. MBS Investors then receive monthly disbursements collected from the interest and principal payments from the pooled MBS loans. It is time to provide a secure and decentralized alternative to this antiquated system.

Assets backed by loans including home or real estate loans are not easily accessible to U.S. investors in a decentralized and efficient way. Investors may face one or more problems when they decide to purchase MBSs. One problem faced by investors who wish to purchase MBSs is high minimum investments. Investors can pay more than $25,000 USD to invest in MBSs.3 MBSs are traded within the secondary mortgage market. The secondary mortgage market is a marketplace where investors buy and sell mortgages packaged into bundles with many individual loans. Lenders originate loans then place them for sale on the secondary market. Investors who purchase those loans receive the right to collect the money owed.4 High minimum investments are a barrier to entry for many investors. The U.S. secondary mortgage market is comprised of MBSs and is valued at over approximately $9.4 trillion MBS outstanding MBSs.5 The volume of outstanding MBSs continue to grow. Another problem that may be faced by investors who wish to purchase MBSs is accessibility friction caused by requirement of broker involvement in the MBS purchase. An MBS investor may likely even have to make an appointment to physically meet with a broker to purchase MBSs. MBSs may also suffer from security weaknesses due to confirmation of individual transactions occurring on one or a few centralized computers.

01.2 The History of Cryptocurrencies: The Problem

Cryptocurrency is decentralized digital money that’s based on blockchain technology. A blockchain is an open, distributed ledger that records transactions in code.6 In 2008, a pseudonymous programmer named Satoshi Nakamoto published a 9-page document outlining the first cryptocurrency, Bitcoin. Bitcoin is the world’s first successful decentralized cryptocurrency and payment system. Anyone with electricity, access to Internet, and a device can connect to Bitcoin.7 The Ethereum network is a blockchain network platform that followed the creation of Bitcoin. Ethereum is the second most popular cryptocurrency, right after Bitcoin. However, unlike Bitcoin, Ethereum isn’t designed to be just a store of value or a medium of exchange. Ethereum is meant to be a decentralized computing network that is based on blockchain technology.8

Cryptocurrencies are revolutionary; however, they also face problems. One such problem faced by cryptocurrencies is extreme market price volatility. The market price of many cryptocurrencies faces extreme volatility because most are not backed by traditionally accepted assets such as gold, properties, stocks, or bonds. Between April and June of 2022, Bitcoin’s value more than halved, from just over $45,000 to around $20,000; other coins have fallen even more so. The Terra-UST ecosystem, which paired a crypto coin with one designed to be pegged to the U.S. dollar, collapsed in May 2022. This collapse wiped out $60 billion worth of value and lead to cascading failures among crypto lenders.9

The solution for problems associated with both MBSs and cryptocurrencies is mortgage-backed cryptocurrencies (“MBC”)(Patent Pending). An MBC is created by backing cryptocurrency digital assets such as cryptocurrency coins (“CC”) and cryptocurrency tokens (“CT”) with more traditionally accepted home and real estate loan assets. Backing a cryptocurrency means that something is provided as collateral. Home and real estate loans are used as collateral for MBCs.

MBCs resolve the deficiencies of both traditional MBSs and cryptocurrencies by making assets backed by home or real estate loans more decentralized and easily accessible to users and by reducing extreme market price volatility. MBCs make assets backed by physical home or real estate loans more easily accessible to average investors in a decentralized and efficient way by removing the sizeable minimum investment requirements, and, by eliminating the friction caused by the need to purchase the security from a separate broker. In some implementations, an MBC investor can purchase MBCs with just a few clicks on their mobile device or computer connected to the internet.

MBCs solve the problem of extreme market price volatility faced by many cryptocurrencies because MBCs are backed by traditionally accepted home and real estate loans. Cryptocurrencies aren’t intrinsically valuable. There isn’t gold or diamonds or anything backing up crypto’s value. For example, Bitcoin’s value dropped by 30 percent in just one day.10 Unlike most cryptocurrencies, MBC are backed by tangible, physical assets.

Additionally, the centralized computers used to perform and confirm MBS transactions and/or payouts are vulnerable to bad actors seeking to perform counterfeit transactions, fraudulent payouts, or even to erase records associated with authentic investments. Centralized networks are more vulnerable to attacks because hackers only need to target one central point to gain access to the entire system. Decentralized networks are more secure because even if one node is compromised, the other nodes are not affected.11 A node is one of the computers that run a given blockchain network’s software to validate and store the complete history of transactions on that network.12 MBCs may also include one or both of one or more coins or one or more tokens. A given coin of the cryptocurrency may include a representation of digital value that is stored on a given blockchain or cryptocurrency network.