43 minute read

POLITICS PAGE

from Issue #1290

Georgia and Its Main Strategic Partner: Marking New Principles in Relations? Part 1

ANALYSIS BY VICTOR KIPIANI, CHAIRMAN, GEOCASE

Advertisement

Enough time has elapsed since the inauguration of President Joe Biden in the United States to express certain opinions. Clearly, these views cannot be categorical. The reasons for such caution in assessments can be split into two: fi rst, a period of several months is not a suffi cient basis for drawing conclusions; and second, a radical change in the foreign policy of a country like the United States requires much more time and even more effort (not to mention the objective or subjective constraints that hinder noticeable changes or make them almost impossible).

We have already extensively discussed the possibility of a qualitative realignment of the foreign policy vector by the new White House Administration in previous publications. Thus, a reader can learn about our views on those issues in those articles if interested.

Despite the above, virtually every newly elected ruling power in every country, within a few months of coming to power, is characterized by its own signature. It is exactly during this period that the old domestic and foreign policy agendas are revised, new ones are brought forward, and practical steps are planned. Planning, for the most part, manifests itself in the recruitment of new staff from various parts of the executive branch, which also gives some insight into future actions. Furthermore – especially in the case of the United States – several statements are made selectively, a specially prepared word is uttered, and the socalled Policy Paper is published, which provides additional information on the attitude of the new government towards on-going issues.

A REMINDER OF WHAT WE ALREADY SEEM TO KNOW

There are several countries in the world today whose study of foreign policy documents or other materials should be a constant priority for us. However, it is unfortunate that not all are given equal attention in this regard, and some may indeed fi nd themselves beyond how much they should get. For example, we rarely come across a qualifi ed assessment of such topical Russian issues. However, perhaps this is not at all so surprising bearing in mind the stigma attached to any interest towards Russia in the community and the threats posed by that interest at one time in the past. Also, the depth of research on the current processes in the Middle East leaves the impression of insuffi ciency in this regard, which raises questions considering that the region is in Georgia's immediate neighborhood, with more geopolitical infl uence than many Georgians can imagine.

This list can be expanded, however, in our opinion, virtually all signifi cant political spaces are connected together by a single shortcoming: The inadequate attitude towards in-depth study and analysis by the offi cial and, in some cases, civil analytical circles of Georgia. In this respect, the public sector is probably relatively proactive, although this relative advantage is immediately nullifi ed as soon as the "self-isolation" of offi cial channels occurs and they display inadmissibility of the opinions or evaluations generated beyond them. Eventually, the process of conceptualization is slowed down, the quality of analytics falls, the decision-making process is damaged, and, consequently, the state interest of Georgia is also damaged. In general, this problem needs to be discussed in more detail, especially concerning the example of very specifi c state institutions. However, we should not get carried away and for now return to the main point of this article.

Vice President Mike Pence in Tbilisi, in 2017. Offi cial White House photo by D. Myles Cullen

WHAT WE SHOULD EXPECT

We mentioned above the need to observe the countries that are particularly important for Georgia's foreign and domestic positioning. We noted the necessity for timely, correct processing of the information obtained as a result of these observations and fi ltered evaluations through the "oven" of decisions. Reconciling all levels of this unifi ed technology of intellect and politics is especially important when any mistake or misinterpretation can have dire or even irreparable consequences for your homeland. Therefore, it is perfectly natural for the US domestic political current or its entrances to the global arena to attract the special attention of offi cial and public circles in Georgia.

Since the independence of Georgia, the United States has made a special contribution to the development and prosperity of the Georgian state, and it continues to do so in present days. Moreover, the role of the United States, recognized by us as a key strategic partner and ally, will remain so in the foreseeable future. Clearly, the content of the relationship may change under the infl uence of a global and regional context. But, also, in practice, there is no doubt that in the face of the next few decades, our bilateral relationship must be fi lled with new elements. It should be fi lled provided that the parties have a real will and the resources to develop a partnership with both changing realities and changing circumstances while maintaining their ability to adapt adequately.

The past few years have completely changed the foreign policy, geo-economic, and security dynamics. At the same time, it is noteworthy that even this period allows the distinction of individual stages within itself. One such undeniable milestone was Donald Trump's presidency, during which a number of global challenges were assessed quite differently – in some cases the assessments were fair and, in some others, quite arguable. However, the fact is that several politically and intellectually unresolved issues have been stirred up, their re-evaluation has begun, and several problems have paved the path for quite different resolutions.

Trump's presidency is over (although, Trumpism is not over yet), and the new White House resident, while still campaigning, outlined several aspects of US foreign policy that are directly related to Georgia's future and can directly shape the regional picture.

During the election, the marked novelties got way more highlighted fi rst during President Biden's visit to the State Department and then during his speech at the recent Munich Security Conference. These two events logically attracted the attention of the Georgian audience to get a more accurate answer to two very specifi c questions: First, what would be the position of the Biden Administration towards the Black Sea region and, presumably, Georgia? And second, how should we act to further deepen American interest in the Georgian agenda?

Bringing more clarity to these issues became even more urgent when Trump's approach was replaced by Biden's, and any gains from the past Georgian-American partnership required a new guide. Such novelty was led by the coincidence of several key elements, namely the current dramatic social process in the US, the need to redefi ne the Western security model, and the growing active interest of several regional leaders at the expense of Western interests in the Black and Caspian Sea macro-regions. We are facing a regional situation, which as per one of the top offi cials of the US State Department, is practically equivalent to a "geopolitical earthquake". Irrespective of whether this comparison is correct or not, it is a fact that the regional dynamics of recent years have not changed for the benefi t of Georgia and its key strategic partner. This requires a joint, decisive, and timely effort to overcome the status quo that has already been created – as well as to deal with the (inevitable?) future “aftershocks”, which are typical for earthquakes.

From this perspective (and in view of the historical crossroads so relevant for Georgians), it is necessary to know what the guiding principles of the foreign policy of our main strategic partner and ally are and what conceptual and strategic implications on which the White House Administration and its State Department will rely. It is essential to have an answer to the question we have already raised: What should we expect from the West in this diffi cult region and what might be the concrete result of this expectation? It is quite understandable that this and other related issues are not just in the fi eld of intellectual exercise. The answers to them and the response based on the answers are directly related to the coherency of Georgia as an international legal entity, its functionality, and the future perspective of Georgian statehood.

To raise a certain awareness around emerging issues, we will use two documents: one is US Secretary of State Anthony Blinken's, A Foreign Policy for the American People, and the other is the White House Interim National Security Strategic Guidance, both dated March 3 this year. In order to better summarize them, we decided to merge the content of both documents. This way we can better comment on specifi c aspects. This approach in terms of apprehension is more acceptable to the reader as well. In addition, this assessment of the State Department and White House will allow us to see the picture from the Georgian side better and to analyze it rationally. This approach will be at least an initial attempt for further, more extensive analysis and implementation of theoretical theses in practice. Most importantly, such observation or analysis should become a constant objective for the relevant services and research circles in Georgia. It must also build a credible bridge to translate analytical assessments and conclusions into qualifi ed policy decisions.

WITH OR WITHOUT A "GRAND STRATEGY"?

We do not formulate the question in this way by chance. We have already noticed that the era of linear and strictly regimented "strategy" is a thing of the past and it has been replaced by a more fl exible, dynamic, so-called emerging strategy. The reason for this is on the surface: A rapidly changing world where the depth, pace, and content of change in most cases cannot be predicted. Hence, the so-called hard big strategies have lost their purpose, the practical value of which was more suited to the static confrontation between the two opposite camps during the Cold War. In the modern world, in the face of the need for leader states to adapt to rapidly changing circumstances without ideology, the attachment of the executive branch to the policy document of the "Grand Strategy" can turn out to be counterproductive only. Thus, the space for operative response to events is limited, the decision-making and implementation quality decreases, and the management of national policy becomes constrained.

At this stage, the document prepared by the White House was called “interim”. This is quite understandable as the fi nal document is still being prepared. However, it is likely that the fi nal strategic document will retain the same, high degree of fl exibility (some may even disapprove its "amorphousness"). In practical terms, this may prove that modern foreign policy, at the expense of shifting away from "values", further emphasizes pragmatic interests. In addition, the deviation from moral principles in the geopolitical line of any country can further be explained by "technical considerations" for protection of national and strategic interests. In the face of such reasoning, we inadvertently recall the words of Lord Palmerston: “We have no eternal allies, and we have no perpetual enemies. Our interests are eternal and perpetual, and those interests it is our duty to follow”. Consequently, such a blatant change in the rules of the game in the foreign arena should mean only one thing for Tbilisi: constant psychological readiness for change and the maximum concentration of political or other resources to respond to them properly. The world politics of such an environment does not need to be evaluated from the point of view of excessive morality. It is simply a matter of looking through the prism of your own national interests and devoting as much time and energy as possible for the systematic and rational – not “doctrinal” – pursuit of those interests.

This is the reality the modern geopolitical landscape offers and we and our partners must face it.

5 Taking Stock of Recent Developments in the South Caucasus. Part 2

ANALYSIS BY EMIL AVDALIANI

Following the Second Karabakh War, there are ongoing talks about restoring the Soviet-era railways from Azerbaijan to Armenia, from Armenia to Azerbaijan’s Nakhchivan. Those links will allow Russia and Iran to have a direct link to each other. Turkey pursues its own railway project to Azerbaijan’s exclave. Still Iran is interested in a faster direction to Russia. The line from Iran to Russia via Azerbaijan could serve this purpose, but it is still under development. The second option for Iran is a northward route to Armenia and Georgia, which could lead to potential resumption of talks on the Abkhazian railway section. However, economic sustainability of and legal problems related to this project remain highly divisive subjects questioning the prospects of the projects. Within the light of changing connectivity lines, the growth of Russian and Turkish power in the South Caucasus, it is interesting how the US reacts to this new geopolitical context. With Georgia, the United States has an important partner in the region. This is underlined not only by the pro-Western nature of the country, but also by the fact that the location of Georgia is such that it allows the United States to reach out to the Caspian basin. In other words, Washington understands that without Georgia, America will practically lose its ability infl uence the heart of Eurasia.

At the same time, Georgia's role in US foreign policy has not yet been made a top priority.

This was seen in the way the US reacted to the Second Karabakh War. The confl ict showed that the collective West needs to be more active in its positioning towards the region overall, and Georgia in particular. Indeed, there were reasons for the Western procrastination, with the confl ict coincided with the US presidential election and subsequent change of administration. The signals coming from Washington at the moment are different from what we had during Trump's presidency: in the coming years, Georgia will perhaps be seen more often as a part of the political game between Russia and the United States.

Biden's government will be much more principled towards Russia. This will be expressed primarily by raising the issue of the liberation of the occupied territories of Georgia. Attempts to establish closer military and economic contacts between Washington and Tbilisi may also be expected.

However, to avoid unnecessary overexpectations, it must be said that, like under Trump, Biden's foreign policy will be more focused on China. Russia's role in this global confl ict will be also signifi cant as both powers, China and the United States, will try to "dissuade" Moscow from joining either of the other sides. This explains Moscow’s decadelong desire to pursue a multi-vector foreign policy. Against this background, it is in the US interest to weaken the burgeoning Sino-Russian rapprochement, which could potentially be done by fi nding common ground with Russia on a variety of issues. The point is that in the longer term, American politicians could be in favor of reaching a certain rapprochement with Russia to limit the latter’s tilt towards China. Perhaps some inspiration could be drawn from the model used by Henry Kissinger in the 1970s to break up the Sino-USSR nominal alliance.

And this is where the issue of Georgia is important. Could Georgia be part of a great geopolitical trade-off between larger powers? Of course, there are many fundamental differences between the US and Russia today that cast doubt on even limited rapprochement between the two countries. But in analytics, we have to try and re-try all possible trends, even if at this particular moment changes seem unlikely.

Looking ahead, it is possible that the US will not try to further strain relations with Russia by advancing Georgia's membership hopes in NATO. Instead, however, it would be considered as substantial progress if the US concludes a free trade agreement with Georgia, and strengthens military ties through exercises and the transfer of critical military equipment for defense. Joint work on advancing Georgia’s air-defense sector could be yet another sphere for bilateral cooperation.

China will be another important component of the US policy towards Georgia. In recent years, Georgia has been increasingly viewed by Washington in the context of a global competition with China. Washington will try to minimize China's attempts to wedge itself into Georgia's infrastructure, be it in ports or railways. The recent US-Georgia memorandum of understanding on deployment of 5G internet is one example of how the US attaches larger geopolitical importance to Georgia in its global contest with China.

Image source: nonproliferation.org

Emil Avdaliani is professor at European University and the director of Middle East Studies at Georgian think tank, Geocase.

“Maskirovka”: Mercenaries in the Russian Hybrid Warfare Model

Image source: Reuters/Maxim Zmeyev

ANALYSIS BY MICHAEL GODWIN

Many Georgians still have the images of Russian soldiers burned into their memories from 2008. However, it’s likely that not all of those witnessed were actually serving members of the Russian Armed Forces. The use of irregular and militia-style units in combat operations by Russian sympathizers dates back to the myriad of Eastern European confl icts in the 1990s. With the combat experience in these wars, in Georgia, and Moldova, they were used as shock troops in Ukraine. Now, with deployments ranging from Tskhinvali to Venezuela, these groups have become a hallmark of Russian aggression, and will likely be increasingly common nearby. First, it helps to defi ne the term “hybrid warfare,” as it has taken on several different defi nitions in security and defense communities. For the purposes of this analysis, this type is the combined use of government regular soldiers, irregular paramilitary and local militia units folded into service, and private military company (PMC) employees hired in offensive, defensive, and more recently in Abkhazia and South Ossetia- occupation duties. The use of these unoffi cial units provides several key benefi ts for the Kremlin: • Budget - Depending on the specifi c PMC, many of these employees make below-average to average working wages, but already have the training and equipment since they are usually preyed upon for recruitment shortly after they leave regular military service. These men are typically from low-income homes and with only a military service record to show their station, and chances of landing any considerable career are slim. • Deniability - As we’ve seen time and time again from the Kremlin, the existence of mercenary units being used in Georgia, Ukraine, Syria, and recently Nagorno-Karabakh have been denied vehemently. By burying the papertrail so deep in Russia’s already widely corrupt hierarchy, it’s virtually impossible to connect all the dots defi nitely. Because of this, it’s too easy to simply shrug and deny any knowledge of their existence, as well as not face the public when the inevitable death toll comes in. • Flexibility - Because their existence can be denied, legal responsibility is almost impossible to pin down. Just as they rise and commit their deeds, they can just as easily fade into the sand. As most of these units are raised and formed only temporarily, there is no Public Relations Offi cer or Commandant to bring before a court, let alone a press corps.

With these combined, they are able to operate effectively and with total impunity, and since their shadowy leadership is often so well connected to Putin’s inner circle, there’s little hope of exposing them. In fact, since the actual operation of a PMC is illegal in the blackand-white of Russian law, it’s almost certain to rule out any competition and keep the profi ts centered around the gilded elite in Moscow.

This profi t incentive lies at the core of the use of these companies, some of which have recently begun to become more infamous; ENOT, Cossacks, and the most famous by now, Wagner Group. Putin and his circles of oligarchs need more foreign money sources, since Russia is not exactly known for its overly robust and healthy domestic economy. Some of this comes in the form of oil, such as the Nord Stream 2 project, and seizure of oil fi elds and their profi ts in Syria. However, in order to diversify and expand, they have found other cash avenues in the PMC markets. The deployment and management of mercenaries in Syria was largely overseen by Evgeny Prigozhin, one of Putin's closest associates. Prior to his role in command, he was the head of Concord Management and Catering companies, providing the majority of the food and clothing services to the Kremlin as well as the Russian Armed Forces. While it’s largely unknown how much exactly he has profi ted from these combat operations in Syria, it's certain to say it’s no small fi gure. A new project, reportedly named “Patriot” has focused on using the survivors of these PMC units devastated in Georgia, Ukraine, and Syria, as well as some of the more trusted special operations team members, to focus more on modern objectives. Reports are already coming in about their use in Africa, Southeast Asia, and South America.

With this force conveniently masked by an ever-shifting identity, and money fl owing favorably, it’s becoming apparent that they can begin to emulate their Russian Army counterparts. Armored vehicles, advanced anti-tank and anti-air weaponry, uniforms and equipment to help further mask their organizations, and the fi nancial backing to achieve any nefarious goals are only the beginning. It’s not out of the realm of expectations that naval and air assets will follow.

In addition to this, these units also act as a front for international crime, facilitating arms traffi cking and provoking regional security incidents in favor of their masters. It’s not outside the realm of possibility that their operations also involve border incidents near Abkhazia and South Ossetia. With a shadow budget that is estimated at almost 65% of the national defense spending of the Russian Federation, these PMCs are largely operating unchecked. Like a mold that continues to grow back, the only way to effectively eliminate this threat is to attack the fi nancial roots of these elements. In addition, Georgia and her allies that have borne the brunt of their cruelty needs to call on the international community to bring more action against the use of these organizations. Proper PMC regulation, licensing, or formal thirdparty inspection to ensure compliance and transparency is adhered to, particularly with respect to foreign operations. With this, it is imperative for Georgian security services and military forces to bear this threat in mind. Because these PMC units operate somewhat autonomously from their regional Russian Army partner forces, the tactics and techniques used in the fi eld will not be so easily identifi able by traditional means. As Georgia is such a key strategic partner in the defense of the Black Sea, the jewel of Putin's eye, appropriate countermeasures, both militarily and legislative, should be assessed and implemented. To prevent these shadow actors from interfering with the current and fl uid political situation, Georgia should be a leader in these initiatives at PMC reform aimed at Russia.

ISET Agri Review | March 2021: Sector at a Glance

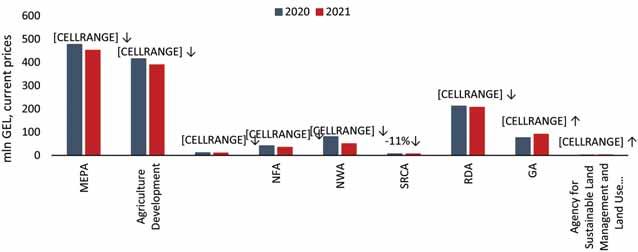

Figure 1. State budget 2021 allocations

Source: Source: Ministry of Finance, 2021

On 29 December 2020, the Parliament of Georgia approved the state budget for 2021, which includes allocations of around 18.3 billion GEL, from which the Ministry of Environmental Protection and Agriculture (MEPA) will receive 451.6 million (2.5% of the total budget allocation). The MEPA will direct 10 mln. GEL towards the Environmental Protection and Agriculture Development Program (2.2% of MEPA’s total budget), with around 389.6 mln. (86.3% of MEPA’s total budget) to be allocated to agricultural development, and approximately 51.9 mln. GEL (11.5%) to be spent on environmental protection.

Compared to 2020, the budget for agricultural development will decrease by around 6.3%. Though, additional state funds will be allocated to the newly established agency for sustainable land management and land use monitoring, by 85.8% and by 19.8% for Georgian Amelioration (GA). The budget for the National Wine Agency (NWA) and the National Food Agency (NFA) will decline by 37.7% and 15.2%, respectively. While the Scientifi c-Research Center of Agriculture (SRCA) budget will decrease by 11%, and the Rural Development Agency (RDA) will lose 2.4%. MEPA will also be directing less spending towards the joint Environmental Protection and Agriculture Development Program than in 2020 (-9.9%) (Figure 1).

Although the redistribution of funds has changed slightly, as in previous years, the biggest share of MEPA’s funds will further support the RDA (53%), GA (23.3%), and the NWA (12.8%). The RDA will continue fi nancing around 16 programs; including their “Preferential Agrocredit project”, with the highest budget of 115 mln. (55% of their total budget), and 18 mln. (8.7%) and 12 mln. GEL (5.8%) will be directed towards “Plant the Future” and “Co-fi nancing Processing and Storage Enterprises”, respectively.

The State Budget for 2021 identifi es the main priorities for Georgian agricultural development as: • Supporting domestic production and improving the quality of locally produced agricultural goods; • Improving access to financial resources for farmers and agricultural enterprises; • Supporting the development of climate-smart agriculture.

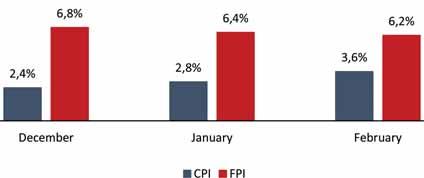

Figure 2. Annual changes in prices PRICE HIGHLIGHTS

On a monthly basis, the country’s price levels were stable between December 2020 - February 2021. In December 2020, the Consumer Price Index (CPI) decreased by 1.0% from November 2020. In January and February 2021, the monthover-month infl ation rate remained at 1.1%. Meanwhile, food and non-alcoholic beverages prices increased during the period.

Interestingly, the monthly food price infl ation rate exhibited a downward trend. In December 2020, food prices, measured by the Food Price Index (FPI), increased by 2.1% from November 2020, while the corresponding month-overmonth price changes in January and February 2021 were 2.0% and 1.1%, respectively.

From an annual perspective, the CPI continued to increase between December 2020 - February 2021. In December 2020, the CPI rose by 2.4% on an annual basis. Within the period, annual infl ation marked its highest level in February 2021 at 3.6% (Figure 2).

In February 2021, year-over-year prices for food and non-alcoholic beverages increased signifi cantly, by 6.2%, contributing 2.03 percentage points to the change in total CPI. The main drivers were price fl uctuations in the following sub-groups: oils and fats (+34.3%), sugar, jam, honey, chocolate, and confectionery (+14.1%) and coffee, tea, and cocoa (+12.4%).

Over the last year, prices for food and non-alcoholic beverages have been increasing; mainly due to disruptions in food supply chains and pandemicrelated restrictions. Depreciation of the Georgian lari has forced additional upward pressure on food prices. In February 2021, the FPI increased by 6.2% compared February 2020. Prices increased the most for the following categories:

Oils and fats – In this category, the price of sunfl ower oil exhibited the largest increase of 62% in February 2021, in comparison to the previous year. Such sharp increases in sunfl ower oil prices were driven by trends on the Russian markets (Georgia imports around 90% of the oil from Russia). Increased production costs, due to depreciation of the national currency and a poor harvest due to unfavorable summer weather conditions, drove Russian sunfl ower oil prices up. This rise in the Russian market thus contributed to the spike in Georgian prices for sunfl ower oil.

Sugar, jam, honey, chocolate, and confectionery – In this category, sugar prices increased the most on an annual basis, by 36.7%, in February 2021. Given that Georgia is a net sugar importer, international trends infl uence sugar prices.

According to the Food and Agriculture Organization (FAO), international prices of sugar exhibit an upward trend; refl ecting concerns over tighter global supplies due to falling production in key producing countries.

Coffee, tea, and cocoa – In this category, prices for ground coffee increased the most (14% in February on an annual basis), refl ecting recent trends on international markets. According to Forbes, international coffee prices are close to the highest levels since 2020; signaling weather concerns and expectations of reduced Brazilian coffee production.

As to international prices, during December 2020 - February 2021, international prices exhibited an upward trend on both a monthly and annual basis. In February 2021, the Food Price Index, measured by the Food and Agriculture Organization (FAO), increased sharply, by 16.7% compared to February 2020, and marked the highest level since July 2014. The February increase in the FPI was driven by strong gains in the vegetable oils (51%), cereals (26.5%), and sugar (9.5%) sub-indices. Such a sharp increase in vegetable oil price was driven by increases in the price of palm oil, due to concerns over dwindling inventories in the chief exporting countries. Cereal prices rose due to increased demand from China, while increases in sugar were heightened by falling production in major producing countries.

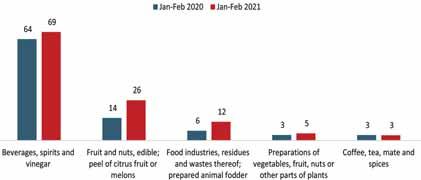

TRADE HIGHLIGHTS

Total Georgian exports in January-February of 2021 amounted to 495 mln. USD, which is 7% lower than the same indicator in 2020 (531 mln. USD). Whereas agricultural exports expanded by a signifi cant 20%, from 112 mln. in 2020 to 134 mln. USD in 2021.

Considering imports, the total decreased by 14%, from 1,349 to 1,159 mln. USD. A similar trend can be observed in agricultural imports, which decreased by 13%, from 165 to 143 mln. USD during the fi rst two months of 2021. Given that the COVID 19 pandemic negatively affected incomes all over the world and caused trade restrictions, the reduction in international trade is not surprising. The depreciation of the Georgian lari puts an additional pressure on imports.

Interestingly, the fi rst two months of 2021 are marked by an increase in agricultural exports, which if sustained in the long-run is obviously a positive development for Georgia’s international trade.

A closer look at the drivers of increased agricultural exports shows that the highest export values in Jan-Feb 2021 compared to the same period of 2020 are observed for the following commodities: • Beverages, spirits and vinegar (HS code 22); • Fruit and nuts, edible; peel of citrus fruit or melons (HS code 08); • Food industries, residues and wastes thereof; prepared animal fodder (HS code 23); • Preparations of vegetables, fruit, nuts, or other parts of plants (HS code 20); • Coffee, tea, mate, and spices (HS code 09).

Exports of beverages increased by 7%, from 64 to 69 mln. USD. For edible fruits and nuts the same indicator was 79%, where the export value from this category increased from 14 to 26 mln. USD, highlighting signifi cant, almost double, growth. An even greater increase can be observed in the exports of animal fodder, which rose by 92%, from 6 to 11 mln. USD, on an annual basis. For vegetables (HS code 20) and for coffee, tea, mate, and spice (HS code 09), the respective percentage changes in export value are 29% and -3% (Figure 3).

POLICY WATCH

Export quotas on wheat have entered into force in Russia

On 15 February 2021, export quotas on wheat, rye, maize, and barley came to force in Russia; where customs tariffs and prohibitive duty, amounting to 50% of customs, were also imposed.

For more information see the following link: https://iset-pi.ge/index.php/ ka/iset-economist-blog/entry/khorblisbazari-sakartveloshi

Agro-startup fi nancing project

Within the framework of an innovative product created to support agribusinesses, TBC has implemented an agro-startup project. This agribusiness start-up support program provides for a long-term grace period over the principal amount, dependent on the specifics of the fi nancing activity, of up to a maximum of fi ve years.

For more information see the following link: https://georgiatoday.ge/tbcinvests-more-than-gel-70-million-insupport-of-agribusinesses/

The EU and FAO support the Georgian government in enhancing climate-smart agriculture practices

With the support of the European Union (EU) and the Food and Agriculture Organization of the United Nations (FAO), the Ministry of Environment Protection and Agriculture of Georgia (MEPA) has established a Climate Agriculture Working Group, which conducts regular online sessions to address the challenges of climate change in the country.

For more information see the following link: http://www.fao.org/georgia/ news/detail-events/en/c/1375656/

Figure 3. Top fi ve agricultural export commodities by value

7 Company Law Reform in Georgia - New Rules on Incorporation

Through the contribution of partners Archil Giorgadze and Nicola Mariani, joined by senior associates Ana Kochiashvili, Tamar Jikia, associate Mariam Kalandadze, junior associates Ana Jikia, Lasha Machavariani and Nino Sakvarelidze, MG Law Offi ce is partnering with GEORGIA TODAY to provide updated information regarding signifi cant legal changes and developments in Georgia. In particular, we highlight signifi cant issues which may impact businesses operating in Georgia.

On 9 February 2021, a new draft of the Law of Georgia on Entrepreneurs (the Draft Law) was initiated in the Parliament of Georgia. The Draft Law is intended to replace the Law of Georgia on Entrepreneurs which was enacted in 1994 (the Law on Entrepreneurs). Almost twice as extensive as the current Law on Entrepreneurs, the Draft Law brought further clarifi cations to questions like the governance and set-up of the company, its incorporation, operation, and reorganization.

In particular, the Draft Law aims to create a uniform and transparent legal framework for corporations, their shareholders, directors, creditors and other stakeholders. The new rules will be adapted to requirements of modern corporate relations. They will further improve the business climate and continue promoting entrepreneurial freedom. In addition, the Draft Law will bring the Georgian legislation closer to the European standards which will in turn facilitate closer business relations with Europe and create comfortable and familiar legal framework for foreign investors.

Apart from harmonizing the Georgian legislation with that of EU, the Draft Law seeks to achieve multiple objectives. With the view of strengthening shareholder rights and by offering detailed default rules, the Draft Law aims to modernize the Georgian corporate governance. These default rules can be revised and further refi ned by agreement between the shareholders. However, these rules will apply if the agreement cannot be reached on specifi c regulations of various issues in the company’s constitutional documents.

Considering that the Draft Law has recently been initiated and presented to the public by the Parliament of Georgia, it has not yet been voted in. However, we expect that the Draft Law will enter into force in 2021.

As the Draft Law reforms the Georgian corporate law in many areas and with the view of keeping the businesses informed and up-to-date about the new rules and amendments in corporate legal framework, MG Law has begun publishing series of articles reviewing key aspects of the Draft Law.

In this segment, we will discuss issues involving the formation and incorporation of companies and foreign branches in Georgia.

The series of our articles will additionally cover new rules for capital formation, including minimum capital requirements, duties of corporate managers and their liability, as well as shareholder rights and obligations, with a specifi c focus on derivative suits and piercing of corporate veil.

Image source: EU Internal Market, Industry, Entrepreneurship & SMEs

INCORPORATION AND REGISTRATION OF A COMPANY

The Draft Law refl ects most of the existing rules for incorporation of legal entities and offers several new requirements to be observed by founding shareholders. The National Agency of Public Registry of Ministry of Justice of Georgia (the Registry) will continue to manage and oversee the company registrations.

DOCUMENTS NEEDED FOR THE COMPANY INCORPORATION

Registration of a company will generally require submission of a written incorporation agreement duly signed by all founding shareholders.

The incorporation agreement shall consist of the following: a. Company’s charter (can be standardized as well as personalized); b. Company name; c. Legal address of the company; d. Identifi cation details of founding shareholders: • In case of natural persons – personal identifi cation number, name and last name, place of residence; • In case of legal persons – copy of the certifi cate of incorporation noting e.g., company name, legal address and the identifi cation number. e. Identifi cation details of a company director and of an authorized person as well as the details and term of offi ce of supervisory board members if applicable (similar to the current law, the Draft Law does not envisage citizenship requirements, any person is permitted to act as a director of a Georgian company). f. Power of Attorney (POA) – in case the company is incorporated by an authorized representative of an interested party.

The Draft Law aims to maintain ease of starting up and doing business in Georgia. Foreign shareholders or directors can manage the registration procedures remotely by appointing an authorized representative. The authorized representative will act through a power of attorney and will be able to incorporate a legal entity in Georgia, approve its charter, select the company name and legal address, appoint directors. In terms of formal requirements existing notarization/legalization rules will still apply to documents issued and certifi ed outside of Georgia.

Notably, the Draft Law does not impose any limitations on directors or company shareholders with respect to their citizenship or place of incorporation. Any natural or legal person can be a shareholder or a director in a Georgian company. A procedural prerequisite is to submit a copy of their passport or incorporation certifi cate to the Registry.

The Draft Law envisages additional requirements for specifi c legal entities: • The incorporation agreement of a limited partnership needs to specify members that are limited partners; • The incorporation agreement of a limited liability company needs to specify amount of subscribed shares and information on the number of shares that each partner holds (in the form of percentage of total shares); • In joint stock companies (JSC) the incorporation agreement has to indicate both subscribed capital and authorized capital. In addition, a JSC may issue shares with nominal value and shall indicate such nominal value in the incorporation agreement. As incorporation of the JSC may entail certain expenditures, the Draft Law requires for all costs associated with the incorporation (e.g., license, permits, remuneration of individuals in connection with the incorporation process) to be recorded; • In the incorporation agreement of a cooperative, nominal value of the units has to be specifi ed.

PM Meets with Members of Business Associations amid World Bank Projections of Slow Recovery

BY KETEVAN SKHIRTLADZE

Ameeting between the Prime Minister of Georgia Irakli Garibashvili and members of business associations took place on Wednesday, his first such meeting since being appointed Prime Minister.

The depreciation of the Lari, deteriorating macroeconomic indicators, the trend of economic downturn, and the lack of foreign investment are the challenges being faced by businesses today.

The meeting came the same day the World Bank released a report projecting that the Georgian economy is unlikely to recover to pre-COVID levels until late 2022.

“Emerging and developing economies in the Europe and Central Asia region are expected to grow by 3.6% this year, as a recovery in exports and stabilizing industrial commodity prices partly offset a resurgence of the pandemic late in 2020 and a recent fl areup in new cases,” says the latest edition of the World Bank’s Economic Update for the region. “Hardest hit are economies that are heavily dependent on services and tourism since social distancing measures and mobility restrictions led to sustained weaknesses,” it notes. (See more on this on georgiatoday.ge)

“This is the fi rst meeting with the new Prime Minister,” President of the Business Association, Soso Pkhakadze said on Wednesday. “We’ll be mainly focusing on macroeconomic issues. Then format will then be expanded. Our association represents all sectors of the economy in the country. Other companies will also be involved in this process.

“We all know we’re facing a severe economic crisis, and we see the many challenges. We want to look at these problems together. We always aim to raise issues professionally, academically, and objectively, and this meeting will be no different,” Pkhakadze told journalists.

Prime Minister Garibashvili reaffi rmed his support for the business sector, along MANDATING RULES FOR OFFICIAL CORRESPONDENCE

In terms of additional novelties, limited partnerships, joint stock companies and limited liability companies may be required to make changes to the design of their offi cial documents or offi cial websites. Namely, companies will have to include the company name, its legal address and identifi cation number in every business correspondence (including electronic ones). Additionally, if the company is undergoing liquidation, rehabilitation or any other similar procedure, it will be required to make a note of it both on its written documents and on its website.

REQUIREMENTS RELATING TO THE CHARTER

The Ministry of Justice of Georgia (the Ministry) will prepare several standardized charter forms designed to be adopted and used by various business entities. The standardized charters will be periodically updated by the Ministry in light of ongoing statutory amendments. Provision of standardized charters (e.g., Model Articles adopted in the United Kingdom) is a common occurrence in different jurisdictions.

Pursuant to the Draft Law, the company charter will regulate issues envisaged by the shareholders. In addition, it has to specify (i) legal form of a business entity; and (ii) economic activity of a company (both general and specifi c activities can be indicated).

CHOOSING THE COMPANY NAME

Even though the Law on Entrepreneurs envisages provisions relating to selection of the name of the company, the Draft Law provides more specifi c regulations spread over at least ten different provisions. Primary considerations that shareholders have to keep in mind are intellectual property rights, use of the company business forms in its names, caution towards restricted phrases (entailing racism, sexism, enticing violence etc.). INCORPORATING THE BRANCH OF THE COMPANY

The Draft Law specifi es incorporation procedure of the company branch and makes a distinction between registering a branch of a Georgian company (which does not require a formal registration process) and an incorporation of a branch of a foreign based company that envisages a similar registration process to that of the company registration. In addition, the registration of a branch of a foreign company requires the details of the parent company to be duly indicated (its applicable jurisdiction, relevant registry’s details, fi nancial statements of the parent company, economic activity etc.). All relevant documents will have to be notarized, legalized or apostilled as required.

PRE-ENTREPRENEURIAL ENTITY AND THE QUESTION OF LIABILITY

The company is deemed to be established upon its registration at the Registry, however, both the Law on Entrepreneurs and the Draft Law acknowledge an existence of a pre-entrepreneurial entity prior to completion of offi cial registration process. Even though the notion of a pre-entrepreneurial entity does not currently bear much practical utilization due to the pace and simplicity of the registration process, notable changes have been made in the Draft Law in this regard. The Law on Entrepreneurs merely specifi es direct and an unlimited personal liability for any actions of those directly involved in the activities that have occurred on behalf of the pre-entrepreneurial entity and its director. In comparison, the Draft Law allows those acting on behalf of the company and creditors to agree on an alternative distribution of the liability. Further, it explicitly allows a transfer of the personal liability to the company upon its registration and company’s approval of the transactions that have occurred in its name before the offi cial registration.

Source of photo: commersant.ge with a readiness to work closely with its representatives. He stated that it is his “priority to have as few barriers to the performance of the private sector as possible, both at the central and regional levels, because business plays a special role in the development of the economy, employment, and real advancement.”

The meeting focused on the 10-Year Development Plan of the country, which is being developed under the initiative and leadership of the PM, along with the importance of active involvement of businesses in this process. It was stressed that it is important to intensify vaccination in this process in order to set the business and economy in motion in real terms.

USAID YES-GEORGIA Program Presents Women Entrepreneurs from Mountainous Georgia

USAID’s program ‘Supporting Youth and Women Entrepreneurship in Georgia’ (YES-Georgia) continues its mission uninterrupted. Aiming to support Georgia’s economic development, the program offers signifi cant support to aspiring as well as established female entrepreneurs to advance their business skills and ability to secure funding for their businesses.

The program is implemented by Crystal Fund with the fi nancial support of USAID, the Women’s Global Development and Prosperity (W-GDP) Initiative, and JSC MFO Crystal.

The benefi ciaries of the program include women from the mountainous regions of Georgia who, in the face of harsh climates, limited livelihood and job opportunities, put immense effort into advancing their entrepreneurial potency. These women have made notable contributions to Georgia’s rural development by bringing in employment and skill training facilities to small villages. In this process, USAID YES-Georgia stands by them every step of the way, facilitating their access to practical knowledge, providing mentorship, effective development tools, as well as access to legal and accounting services.

Here are three stories of success, perseverance, and much more from Georgia's small villages.

Gvantsa Chabukiani, a 22-year-old entrepreneur from Lechkhumi, is an energetic woman with zeal and hope to address the needs of her community. After graduating from university, Gvantsa returned to her native village Dekhviri to start working as a primary school teacher. In parallel, Gvantsa produces natural bee products and is preparing to turn her childhood passion into business through printing her label: "Honey from Lechkhumi". In the near future, Gvantsa plans to establish a social enterprise devoted to the development of beekeeping in the region. All interested persons shall have the opportunity to study beekeeping. Gvantsa’s participation in the USAID YES-Georgia program helped her acquire the due knowledge and skills to turn her ideas into reality. 33-year-old Nestan Chkhvimiani lives in the village of Chrebalo, Ambrolauri Municipality. Nestan taught herself how to turn wood into beautiful pieces of art. Determined to be independent fi nancially, she steadily gained pace. Her activities include the production of a variety of wooden, environmentally friendly toys. After winning GEL 5,000 in a grant competition from the Czech organization Caritas, she upgraded her equipment and started exploiting new opportunities. Apart from toys, Nestan creates wooden souvenirs and various themed items for educational institutions. The family also produces traditional Rachuli wine Khvanchkara. Nestan is an active participant in this side of the family business, helping her husband and creating beautiful wooden boxes for the wine bottles. Nestan has made sure to leave the middlemen out of her business and do everything, from ideas to manufacturing and selling from scratch. After completing her master's degree, 28-year-old Asmat Bolkvadze decided to return to Adjara’s Khulo municipality and pursue valuable work in her hometown. She discovered her passion for agriculture early in life and worked with enthusiasm towards her goal. In 2013, within the framework of the Adjara Agriculture Project, Asmat established the fi rst Chandler Walnut Demonstration Garden in highland Adjara. Chandler is the most preferred walnut variety for new orchards due to its productivity and excellent nut quality. To turn all this into a successful business, Asmat intends to make good use of the skills gained through the USAID YES-Georgia program.

Going forward, YES-Georgia will continue to learn from the above-mentioned success stories, empowering more women entrepreneurs to increase their selfeffi cacy, confi dence, and skills to follow in the footsteps of other successful women. By early 2024, YES-Georgia aims to provide business management training, legal and accounting services, mentoring, and networking opportunities to over 2,500 women.

Asmat Bolkvadze

Nestan Chkhvimiani Gvantsa Chabukiani

SOCIETY Only Half of Domestic Violence Victims Call Police for Help, Study Says

As the world sees an increase in domestic and genderbased violence amid the pandemic, the United Nations Development Program (UNDP) and the UK Government are working with the Ministry of Internal Affairs in Georgia to assess the effectiveness of state services provided to victims.

“Human rights protection is our priority, supported by the ongoing reforms in the Ministry of Internal Affairs and the measures undertaken during the pandemic,” said Deputy Minister of Internal Affairs Aleksandre Darakhvelidze. “We are working with public agencies and international partners to ensure effi cient response to domestic violence in pandemic conditions.”

Research carried out by the Georgian non-governmental organization “Sapari” in March-June 2020 suggests that nearly half of all victims of domestic violence refrained from seeking help from the police.

The quantitative part of the research was based on phone interviews with 76 women victims of domestic violence from Tbilisi and the regions. Respondents were selected randomly from a database maintained by civil society organizations. The qualitative part of the research draws on focus group discussions with ten lawyers and ten police offi cers, and 15 in-depth interviews with benefi ciaries of three NGOs: Sapari, the Anti-Violence Network and the Georgian Young Lawyers’ Association.

Among the main fi ndings: > Only 44% of victims used the 112 emergency number to call the patrol police. > Of those who called 112, 71% were dissatisfied with the service they received. > 56 percent of victims opted not to call 112, but only 10% went to a police station. > 27% of victims said they preferred to consult with NGOs rather than contact authorities.

Those who did not call 112 cited a variety of reasons: lack of trust (35%), lack of awareness (30%); and long wait times (18%). The slow response times reported in the survey may stem from use of the 112 emergency number as a COVID-19 hotline. The survey was conducted before additional 112 extensions were added in November 2020 for urgent medical assistance (112); fi re and rescue (112/1), which covers assistance to victims of domestic violence; and COVID19 support (112/2), which may have reduced wait times.

Of those who called the patrol police, 42% say it took 10-15 minutes for police to arrive and 58% said it took longer. 39% observed that police offi cers were not considerate to the victims, with some quoted as saying that “the pandemic situation is not the right time to worry about domestic violence.”

Half of all respondents thought that pandemic lockdowns had a negative impact on police operations. Many cited diffi culties in getting to the police station owing to limits on public transportation imposed to control the virus. 88% of all respondents were convinced that police do not provide online investigative services – something that the MIA noted was impossible given current regulations governing the collection of evidence.

“Around the world we are seeing that gender-based violence is a shadow pandemic,” said UNDP Head Louisa Vinton. “Our research is designed to help the responsible authorities identify and remedy weaknesses in the systems set up to prevent violence, assist survivors and prosecute offenders, despite pandemic limitations.”

The Ministry of Internal Affairs reports that the number of restraining orders issued to protect victims of domestic violence increased from 5,521 in February-July 2019 to 5,699 in the same period of 2020. 85% of survey respondents who requested restraining orders against perpetrators said they were granted.

“The UK is proud to be supporting work to improve services for victims of domestic abuse. The nature of the pandemic has created particular challenges to ensuring widespread awareness of and access to confi dential support, advice and refuge,” said British Ambassador Mark Clayton. “I am pleased to see that the Ministry of Internal Affairs and the CSO Sapari collaborated effectively on this research. The evidence provided from the research should help policymakers design improved services for victims of domestic violence.”

A Rapid Gender Assessment of the COVID-19 situation in Georgia conducted last year by UNDP in partnership with UNFPA and UN Women showed that awareness of survivors regarding available support services is low.

Research on police effectiveness in providing services to victims of domestic violence is part of a broader UKfunded programm supporting public administration reform in Georgia that UNDP implements in partnership with the Government and public agencies.