11 minute read

business again

AFTER FALLING BACK IN IMPORTANCE, SURVEY RESPONDENTS BROUGHT THE TOPIC OF RELATIONSHIPS BACK TO WHERE IT USED TO BE // BY ADAM

MALIK

It has been said over and over again that the automotive aftermarket is a relationship-based industry. And the importance of relationships is coming back into focus as availability and inventory issues seem to ease.

The relationship a shop has with its jobber has generally been an important consideration when deciding from whom to order parts. It took a back seat last year but jumped up several spots and back to a familiar ranking in the Jobber News Annual Shop Survey. It’s now back to being the second most important factor when thinking about whom to call when in need of a part.

When shops were polled this year about how important a number of factors are in terms of their decision to make a jobber their first call, 62 per cent included ‘relationship’ on their list. That’s up eight percentage points from last year and nearly back in line with 2018 results where 65 per cent of respondents had it on their list.

Readers of Jobber News’ sister publication CARS were invited via newsletter, eblast and social media to share their thoughts on several areas of their relationship with jobbers, as well as their insights on industry trends and issues. About 100 responses were received.

While part availability/inventory has been top of mind for many editions of this survey, it’s noteworthy that there was a significant drop in those who listed it as an important consideration when deciding which jobber is their first call.

While generally picked by 93 and 94 per cent of respondents in the two most recent surveys, this year’s result came out visibly different at 85 per cent.

The two most significant changes may be linked. As part availability has become less of a concern, shops are going back to those with whom they have a better relationship.

Relationships were strained as supply issues grew and not just between shops and jobbers. Distributors were leaning on suppliers to get product. But suppliers were handcuffed due to logistics issues. Those relationships have “significantly” improved, according to the MEMA Aftermarket Suppliers group.

“We're hearing that from customers and hearing it from suppliers, versus where we were at the depths of the crisis,” Paul McCarthy, the group's president and chief executive officer. “And I think our big message is we need to keep that up.”

And it showed in the comments. When asked to expand on their answers, more leaned toward the relationship aspect.

“If I can trust and depend on my supplier for product and support, it makes my decision very easy,” one respondent wrote.

One pointed out that “relationship is the deal-breaker,” when choosing which jobber to call.

“Service is key,” said another. “Knowing that you can depend on them to supply quality parts and that they will take care of any issues you may have.”

Another noted just how far relationships go in business. “If we are loyal to a specific supplier, then we know we can count on them when we need, whether it be for warranty or getting us the correct parts in a timely manner. We need to work together,” they wrote.

“Have the parts on hand or overnight is the most important,” one comment said. “Price is really not a biggie. Our customers want their vehicles ASAP as most use them for work.”

Still, that’s not to take away from the importance of availability. No matter how good the relationship is, if the parts aren’t in stock, then no business can be conducted.

“If the parts aren’t available, none of the other questions matter,” a comment said.

“I hate having to hunt for parts,” wrote one respondent. “I like dealing with suppliers that have a wide range of parts in stock or in their network.”

We asked:

If you could give any piece of advice to aftermarket jobbers about how to keep you, their customer, happy, what would it be? What can jobbers do to make sure they are delivering what you need? How are they or are not meeting your needs?

They said:

Weekly check-ins make a huge impact; it shows that the jobber cares and helps resolve issues quickly before they become a problem. It also gives the jobber the opportunity to advise on new products, services or changes that are coming up.

Hire quality reps, empower them and build relationships.

Cheap offshore parts have increased in price dramatically to the point where, in many cases, the prices are extremely comparable to the good stuff. Get rid of the garbage and fill the shelves with a better selection of quality items.

Maintain a good inventory. Offer a decent reward program that has things shops could use. Offer tech training programs. Have fast delivery times. Have a decent labour warranty program supported by the parts manufacturers since they boast about their product quality and offer a lifetime warranty on premium parts.

Please show respect in not giving the person who walks off the street the same price as an automotive shop or high-value customer. Makes us look terrible.

Time is money, which makes availability the top choice, said another. “so many parts delays make timely repairs difficult.”

Some needed parts may not be discovered until the part is on the hoist, making quick delivery of the utmost importance. “we need the parts now, not in two days,” one person said. “We appreciate a jobber that is honest and will bend over backwards to make this happen.”

Dealers

Jobbers should be aware: More shops are turning to dealers to get the parts they need — and they’re doing it more frequently.

Almost half (49 per cent) said they’re buying more from dealers. Last year, about a third (34 per cent) said they were going to the dealer more for parts.

Furthermore, a larger share of the parts shops are acquiring are coming from dealers: In 2022, 58 per cent said less than 10 per cent of their products came from dealers. This year, just 46 per cent reported that little amount of dealer product. The drop here shows that shops are increasing their percentage of dealer purchases.

While 34 per cent last year said they bought between 11-24 per cent, that number is now 38 per cent. The 25-49 per cent group grew two percentage points, now at 8 per cent. Five per cent said the majority of their parts come from dealers, up from 2 per cent the year before.

Why is this happening? The comments don’t indicate an availability issue. Quality and fit were most commonly referred to as the main reasons, along with price.

“The quality of aftermarket parts has slipped (mainly chassis) forcing us to buy from dealers,” one respondent said.

“The changes in my business require more electronic parts that are of high quality,” said another. “Possibly 5 per cent increase to dealerships due to major companies buying out aftermarket companies and reducing quality. The jobber has his hands tied because of buying group policies.”

One said they won’t “install electronic or emission parts from aftermarket suppliers,” over quality issues.

One noted that, as a European specialist, finding parts in the traditional aftermarket is difficult. “We deal with mostly European product, with an emphasis on OE parts, primarily due to the correct fit and finish every time. Secondary is the general lack of quality availability of European parts,” they wrote.

Getting the right fit and finish was also mentioned a few times among respondents.

“Many parts offered by jobbers have a high failure rate or simply will not work with the OEM computers/ systems,” noted a respondent.

“The aftermarket parts at times do not fit properly or do not even work right out of the box,” echoed another.

Another comment pointed to the fact that most customers will choose the aftermarket because of the price difference between dealers and independent shops. But, “jobber pricing is creeping up,” they said. “The gap is narrowing.”

It can also hurt customer loyalty, one pointed out. “Jobber pricing getting beat by dealers. And when they don't have the part, then loyalty is challenged.”

What percentage of products you purchase from your first-call jobber versus other sources (other jobbers, car dealers, other sources? ) 26.5% 12.2% 9.2% Other

16.3%

What percentage of products do you purchase from new car dealers?

On a percentage basis, how many products do you order online?

9.2%

17.3%

Online ordering

In the past, more shops placed their orders online. Now, more jobbers are placing virtually all of their orders online.

When we asked, “On a percentage basis, how many products do you order online?” a third of respondents said they were putting at least 90 per cent through in this manner. That’s up from not even a quarter (24 per cent) last year.

More shops are choosing to place the majority of their orders through an online system — 71 per cent of this year’s respondents said at least half of the products they order are online. That’s up two percentage points from last year.

“We have increased online ordering over last year,” one person commented. “Habits have changed in the shop with new software systems that were implemented, as well as training. Some of the online systems are cumbersome, not intuitive, don't have clear parts descriptions, poor sorting options. The best part is being able to see availability quickly, as well as part pictures.”

Challenges around the supply chain have changed habits for some. “Supply issues are constantly affecting our business,” a respondent wrote. “Some vehicles have to stay here for weeks until a part becomes available. Our online ordering is fine when the parts are in stock. It is not the jobber that is the issue; it is the manufacturer that supplies to the jobber.”

Indeed, some did express frustration when placing an online only to find out that the product was actually out of stock.

“Accuracy of parts in stock causes issues if you cannot speak with someone,” one commented.

For one who did increase their online ordering, they were driven by supply issues as well. And they’re a proponent of the ability. “Online order is efficient. No need to be on the phone to check if parts are available, fewer wrong parts,” they added. “Jobbers need to keep online orders easy to use and always up to date to increase sales.”

Some shops noted the ease in finding what they need, rather than having to talk someone through what they were looking for.

“Online ordering, frees up talking to people — click on part and order,” one person wrote.

“Online ordering helps take [out] some of the guesswork, back and forth asking, answering pertinent questions,” said another. “Also, ability to check inventory from one supplier/DC to another simplifies the ordering process.”

And they feel if they’re picking the part themselves, mistakes are reduced. “Online ordering is the only way to go, minimizing time on the phone and getting the wrong part,” said one response. “You can see what you are ordering. My supplier also has a phone app that I can use anywhere for ordering by scanning vehicle VIN. Big plus.”

Still, a good counterperson can do wonders. “Online ordering is great for most parts but has its limitations. A good counter person is invaluable,” praised a commenter. But, they added, improvements can still be made. “We need more and better photos of the parts and good descriptions.”

Supply, inflation impact

Between supply constraints and inflation raising their costs, challenges have been high for shops. It would, however, appear that they’re managing change in their business rather well. This is, in part, thanks to an understanding customer base that realizes this industry isn’t immune from the same problems hitting others.

“Businesswise, business has been relatively steady. Versus last year, parts availability has improved, but the price increases are being felt. Our clientele is aware of this, so not too much complaining,” said a respondent.

“It’s almost normal now for customers [to] expect a price increase from worldly situations. Wait times are getting to be normal as well, depending on vehicle make and model,” said another.

“We have had an issue with pricing. Most customers understood the problems. Parts availability was an issue up to last summer. Did lose a few customers to the dealers thinking that they could be quicker. A few came back,” another commented.

Availability seems to have subsided, some have noted. But not entirely. Some shops are proactive in letting customers know.

“[We] warn customer immediately on drop off that parts shortage may result in the car being down for a day or two [and] explain that, unfortunately, pricing is up just like everything else. Still dealing with shortages on common items,” one commented.

“The availability of parts caused delays in repairs, but we did not see an increase in lost sales due to parts availability,” a respondent said.

“Supply chain issues are still present but shifting within different

Which to stay current and safe is increasing by the day,” one said.

“We are seeing more and more electric vehicles in our area. Until they start needing repairs, the cost of necessary tools and equipment, Insurance costs, building upgrades, etc. isn't feasible,” another said.

With the growing popularity of EVs, one said “We need to be on the forefront of this emerging business to be competitive.”

One respondent had an idea for attracting business. “To help the EV/hybrid situation, I am considering installing charging stations to attract more vehicle traffic which will bring more work,” they wrote.

For another, ADAS was most important to them. “Recalibrations for suspension replacement, etc. and educating the customer on the extra charges and time, etc.,” the respondent said. “The EV/hybrid is something seen more and more as you drive around town and notice the different options — learning curve and acceptance to this major change.”

With these changes, there are concerns around the ability to deal with the new technologies as physical footprint presents a challenge.

“Our shop is not equipped properly for the upgrades needed and it's not feasible to relocate or build new,” a commenter wrote.

Many recognize that adapting to the incoming technology trends is essential to their long-term success.

Has product lines. You never know about product availability until you call the jobber,” another said.

Biggest impact

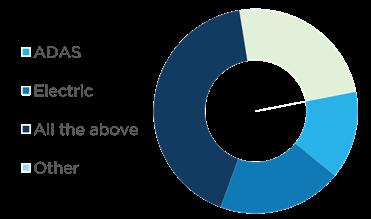

More than two-thirds believe their business over the next year will be most impacted by a combination of hybrid vehicles, electric vehicles and advanced driver assistance systems.

Another 17 per cent said only electrics, 12 per cent only picked ADAS and 10 per cent picked hybrids as the only development to impact them.

“All of the listed systems require new tooling, training and updates,” a respondent observed.

And that comes with a cost, said others. “The training and equipment requirements are becoming a major expense for the business, as well as the requirement of ongoing information updates

“We expect future technologies to help maintain or improve our current level of business by making sure we are able to properly service newer vehicles that are now entering the marketplace,” a respondent wrote.

It’s all part of continued industry change, some observed.

“Technology, as long as we keep up with it, will keep us progressing and we will prosper if we embrace change,” one said.

“Our industry has always adapted (sometimes slowly) to technology change,” another noted. “Cars will always need servicing. I expect [an] increase in my shop as long that I’m keeping updated.”

One respondent is taking it all in stride. “Forty years in for me, technology is, and always has been, constantly evolving with rapid changes and trends. Embrace and deal with it as it rolls down on you, just like every other year,” they advised.

And staying up to date is essential, many commented. Training is an important focus for them.

“Sending techs for training is becoming more essential. We will need a lot of training, which has a cost. I believe we are in for a major very costly change in our industry, that most aftermarket shops will not be able to survive [and] everyone will be forced back to dealerships,” one warned, adding that people, training, low wages and lack of pension are just some of the pressing issues that will only grow over time.

But this is, of course, costly. “It will be more costly to be in this service sector due to equipment costs and training costs. Vehicle parts prices are increasing steadily and only going to get worse given the complexity of new vehicles,” one observed.

And are they being helped by their jobber partner? Responses jumped all over the spectrum.

“No help whatsoever at his point. I would like to see a group approach to access manufacturers' information and diagnostic tools so that it is more affordable for us,” one said.

“They are doing an adequate job, more could we done with training and introducing product offerings for equipment,” observed another.

“Top notch,” a comment praised. “That being said, slow on supply of EV tooling and parts stocking.”