15 minute read

Mining

The global economy is demanding new minerals, and Africa has them. Mining

The richness of Africa’s mineral resource is extraordinary. In several categories, Africa is either the global leader or it has the second-biggest reserve. These include cobalt, phosphate rocks, bauxite, industrial diamonds, platinum-group metals (PGMs), zirconium and vermiculite.

Advertisement

Iron ore, copper, nickel, zinc, uranium, manganese, vanadium, ilmenite and gold, the continent’s biggest resource, are also found in large quantities.

The mining sector is responsible for 90% of the exports of the Democratic Republic of Congo (DRC) and the figure is about 80% for countries such as Botswana (which has gold, nickel, copper and soda ash in addition to its rich diamond resource), Guinea (gold, diamonds, alumina and bauxite), Senegal (phosphate and diamonds) and Sierra Leone (diamonds).

Africa features prominently on most lists of global mineral resources. One Botswana diamond mine produces about quarter of the world’s annual diamond supply by value and the continent has recently moved close to 75% of global production of diamonds. Mining and quarrying is the largest contributor to GDP in Africa.

Africa’s first lithium-ion factory has been launched. Sector Insight

Ghana exported gold to the value of $8.3-billion in 2017, which was just less than half of the total value of exports, including crude petroleum. South Africa’s top three exports (out of a total of $108-billion) were gold ($16.9-billion), diamonds ($9.8-billion) and platinum ($9-billion) (OEC).

Foreign interest in African mining is intense. Chinese companies are active in every part of the continent, including Ghana, in support of bauxite exploration and Zambia, as a partner in copper companies. More than 150 Australian companies operate in Africa and Japan is active through the Japan Oil, Gas and Metals National Corporation (JOGMEC) and several other companies such as Toyota Tshusho Corp, which is a minority partner in a Moroccan tin project.

The merger of Randgold and Barrack in 2018 created a gold mining company with a market capitalisation of $19.4-billion. The new company is likely to increase its activity in West Africa where Gold Fields Ltd, Newmont Mining Company and AngloGold Ashanti have operations.

R eliance on a single mineral creates an exposure

to price fluctuations that c a n t r i g g e r r e c e s s i o n s . O ther problems include political instability (although the outlook has improved recently), poor logistics, unreliable power supply and unpredic table regulator y regimes. This can include demands that local companies be included in transactions and variable tax and royalty c o n d i t i o n s . T h e A f r i c a n Development Bank (AfDB) reports that mining royalties as applied in 2016 in Africa’s 21 gold-mining countries, ranged from 2% to 12%.

The Economic Community of West African States (ECOWAS) stated in 2000 that it intended to align countries’ tax and customs regimes and to create mining codes that did not differ sharply from one another. The code was not implemented but there is an increasing awareness of the importance of regional (and continental) consistency on this score.

Another aspect that needs the attention for African mining to reach its full potential is geodata. There are very few places that have good systems in place to assist exploration efforts with reliable and detailed data.

Minerals for the new age

New finds of “old” minerals are happening across Africa: gold miners are very bullish in West Africa and Vedanta Zinc International is developing a huge mine in South Africa, but the big story is in minerals relevant to the new economy.

The announcement by the AfDB that it was “getting out of coal” in 2019 was a clear signal that the move away from fossil fuels is gathering speed. The bank has created a $500-million green baseload scheme to assist African countries to transition from coal-fired power plants to renewable sources. The bank expects the fund to yield up to $5-billion in investments.

The most important minerals in the age of computers and electric vehicles are cobalt, platinum, lithium, graphite, vanadium and manganese. Africa is a global leader in these minerals too. The DRC has more than 60% of the world’s cobalt resource.

The critical metals in new battery production are lithium, graphite, cobalt and nickel. A research body estimates that the global lithium-ion battery market could be worth as much as $77-billion by 2024 ( Transparency Market Research). Beyond the DRC, countries such as Madagascar, Morocco, Mozambique, Namibia, Zambia and Zimbabwe stand to benefit from this boom.

The Global Battery Alliance claims that lithium-ion batteries can significantly reduce emissions in the power and transport sectors. At the 2019 Batteries and Electric Vehicle Conference, the MegaMillion Energy Company launched Africa’s first lithium-ion factory. The company will operate out of the Coega Industrial Development Zone in Port Elizabeth, South Africa.

Also in South Africa, Thakadu Battery Materials is building a plant to beneficiate impure nickel to produce high-purity battery-grade nickel sulphate for the lithium-ion battery market.

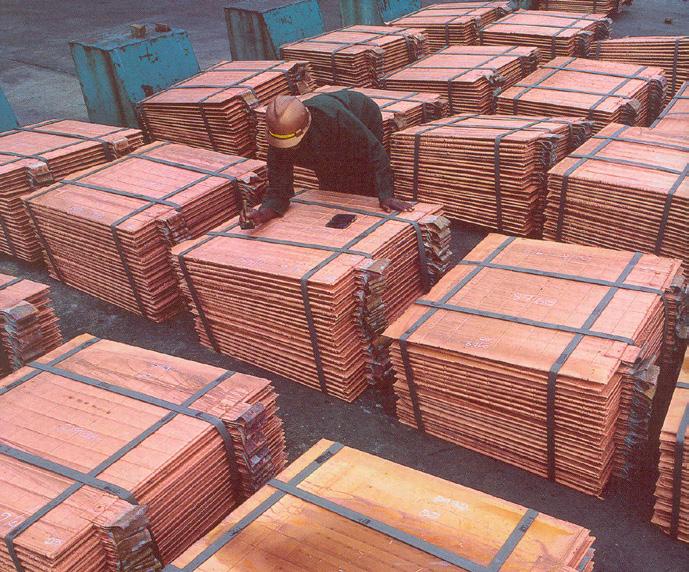

Copper and copper alloys are also important for electric vehicles, smartphones and computers. The Central African Copperbelt (encompassing parts of the DRC and Zambia) increased mined volumes to 2.2-million tons in 2018, more than twice the 800 000 tons mined in 2008.

Platinum’s role in the creation of hydrogen makes it a vital component for the fuel cell industry. South Africa, which produces more platinum than all the other countries in the world combined, is investing in research into new uses of platinum. Zimbabwe also produces platinum. ■

Africa Mining Vision: www.africaminingvision.org Ecowas Federation of Chambers of Mines: www.efedcom.org Global Battery Alliance: www.weforum.org International Association for Engineering Geology and the Environment: www.iaeg.info Investing in African Mining Indaba: www.miningindaba.com Mining Industries Association of Southern Africa: www.miasa.org.za Online Resources

Palabora Mining Company

A tale of a Chinese-owned mine that sparkles with hope.

Palabora Copper (PC), also known as Palabora Mining Company (PMC), celebrates 64 years of operation this year (2020) – making it one of the oldest mining operations in South Africa. Since its incorporation in 1956, PC has been South Africa’s sole producer of refined copper, although the mine has other by-products such as magnetite, vermiculite, sulphuric acid, anode slimes and nickel sulphate. Despite its age, the mine still promises a prosperous future.

Rio Tinto owned PMC, a PC mother-company, until 2013. When Rio Tinto left, PC was protected from potential jeopardy by the South African Industrial Development Corporation (IDC) and in the majority, the Chinese Consortium, which is made up of HBIS, Tewoo, General Nice and the China-Africa Development Fund, which got involved through Smart Union Resources South Africa. This resulted in the Chinese Consortium owning 74% and the South African government owning 26%, jointly through the Industrial Development Corporation, the Black Empowerment Consortium and PMC employees and local communities. The new owners continue to maintain the mine’s compliance with South Africa’s regulatory requirements.

When the Chinese Consortium acquired PC in 2013, PC was facing two ostensible scenarios: (a) culmination of the life of mine, and (b)

no overhauling of the smelter, which was outdated and facing shutdown. Occurrence of the first scenario would have resulted in the loss of employment for more than 3 700 employees (direct and indirect) while the second scenario would have lead to the loss of employment of more than 700 employees off-stream (smelter). Soon after the sale transaction, the new owners fostered partnerships between PC, Chinese and other international and South African companies in various areas such as economic development, trade, skills and technology transfers to achieve ground-breaking and substantive results in extending the life of mine, refurbishing the

smelter and building a floatation plant. The investment entails the development of a new underground block cave mining area known as Lift II together with supporting underground infrastructure and a large-scale new ventilation shaft.

At the time of the acquisition, PC was already a wellestablished underground mine, having transitioned from an open-pit operation in 2002. The mine has maintained an average production (as per

Senior Manager for Ore Extraction and Processing, Expect Ntsepe.

Lift I – Palabora Copper’s mine that sustains its sparkle

PC acknowledges that for it to continue being efficient, profitable and at the forefront of employment practices in the local mining industry, it needs solid leaders supported by unyielding and competent teams to safely extract and process its minerals.

its design capacity) of around 45 000 tons per annum (tpa) of copper rod (beneficiated from 0.55% copper). The entirety of this production is generated from the Lift I block cave mine situated around 400m below the open pit. After conducting the necessary studies, it was determined that the establishment of a new block cave mine – Lift II – would be feasible in extending PC’s life of mine to around 2033.

PC employs an average of 3 700 employees (Lift I and II) and seeks to remain industry competitive through its favorable conditions of employment and socio-economic development initiatives. The fact that the company regards this as important is reflected by the manner in which the safety and health of employees is observed, and in the investment made into socio-economic development initiatives in the Ba-Phalaborwa Municipal area.

In the copper stream, in the Lift 1 block cave mine, an experienced strategist and collaborative technical miner who is an inspirational rock in his own right leads the team. This strategist is Expect Simlindile Ntsepe, a Senior Manager for Ore Extraction and Processing. Expect leads a great team and pushes it to safely extract copper from PC’s underground resource for the benefit of downstream performance, ultimately ensuring that copper is available for sale to PC customers.

Expect is also PC’s 3.1(A) Appointee, meaning, he is a qualified and competent custodian of PC’s employees’ health and safety in terms of the South African law (Mine Health Safety Act, 29 of 1996).

A tested Mining Engineer with a BTech in Mining Engineering and a Higher National Diploma in Metalliferous Mining, both from the former Technikon Witwatersrand, Expect rose through the ranks in the mining industry over more than 17 years. He held a number of technical, supervisory and managerial positions before becoming a Senior Manager for the Mining and Concentrator Division and PC Executive Committee (EXCO) member. His experience embraces practical mining operations, planning and designing of underground

infrastructure, process analysis, optimisation, improvement, strategic development and implementation, leadership and management, and budget projection and management. Expect was PC’s Manager for Mining Operations for more than five years before earning his current position. Expect brings many attributes to the PC copper bench, including Blasting and Mine Overseer Certificates as well as Mine Managers Certificate of Competency (MMCC).

A relentless cooperative technical strategist, Expect is a national Council member of the Association of Mine Managers of South Africa (AMMSA) and the chairperson of PC AMMSA branch. In addition to his mining and leadership attributes, Expect is a sharp communicator who appreciates engaging stakeholders to ensure reaching amicable consensus. He constantly engages the Department of Mineral Resources (DMR) on issues related to mining to ensure alignment and compliance. In 2017, Expect and his Mining team won two awards from MineSAFE for Best Safety Performance in Class and Best Safety Performance in Copper Recovery.

Expect’s lengthy experience, coupled with his suitable qualifications, is an assurance that PC will continue to be at the forefront of mining copper and meeting specifications and needs of its copper customers.

Lift II – Palabora Copper Mine’s shared and sustainable future

Shaft Sinking Project Manager, Thabo Mokoena.

Lift II refers to the construction project of new declines underground which will connect the old mine (Lift I) and the new (Lift II). The project began in 2013. This is similar to constructing a new mine and so requires installing new infrastructure such as crushers, conveyor belt and ventilation shaft which is pictured on the next page. The new mine (Lift II) is situated 400m below the old mine (Lift I) and is being constructed by a consortium of international and local contractors including the Australian Downer Group (Integrated Services Company) a n d t h e S o u t h A f r i c a n Mvusuludzo Projects which is a 100% black-owned and Level 1 B-BBEE emerging mine contracting and development company.

The shaft-sinking company, Murray & Roberts Cementation (SA), is responsible for sinking the ventilation shaft for Lift II project. The ventilation shaft-sinking project commenced in February 2019 and is expected to be completed in mid-2022. The initial phases of the project involved drilling and reviewing of holes to determine the best location to sink the shaft. The new ventilation shaft will be much larger at 8.5m finished diameter, and will extend 1 200m in depth.

To ensure safety, Murray & Roberts Cementation (SA) deploys a sinking method, which entails using a four-deck sinking stage (for main shaft sinking comprising the top, electrical, working and observation decks). This gives personnel the ability to conduct various tasks simultaneously without compromising anyone’s safety at the bottom of the shaft. A shaft-sinking charging unit comprising emulsion tanks and pumps has been designed to facilitate shaft blasts safely and accurately with the maximum distance allowed for the stage above bottom not exceeding 70m.

To achieve success and fulfilment in virtually all the endeavours of the shaft-sinking project, the Shaft Sinking Project Manager, Thabo Daniel Mokoena, is an allrounder who understands that definite actions stem from positive thoughts, collaboration, passion, skills and continuous learning to stimulate power and purpose for one, the team and Palabora Copper. A skilful Mining Engineer with a BTech and a National Diploma in Mining Engineering from University of Johannesburg and Technikon Witwatersrand, coupled with more than 18 years’ experience in mining and shaft-sinking project management, Thabo personifies the idea that learning comes through accumulated studying and skilfulness through experience. Thabo, something of a mining and leadership scholar, has also acquired Mine Managers, Mine Overseers and Blasting Certificates from the Department of Mineral Resources as well as qualifications in Senior Management Development from the University of Stellenbosch and an Advanced Project Management Certificate from the University of Cape Town.

Thabo started his career as a Process Controller at Anglo Platinum Precious Metals Refinery and ascended through the ranks to Mining Engineering Trainee, Miner, Senior Shifts Supervisor, Study Mine

Overseer, Mining Engineer, Superintendent, Project Manager in numerous mines including various operations of Anglo Platinum, Murray & Roberts and Palabora Copper. He joined Palabora Copper as a Superintendent for Underground Mining and ascended to the position of a Project Manager for Lift II project, until he moved to his current position of a Project Manager for Lift II Shaft Sinking Project in January 2019.

Thabo has fulfilled the expectation of the most effective miner of beneficial engagement, when he became the Chairperson and EXCO member of the Limpopo Region’s Mine Health and Safety Tripartite Forum in 2019, a position he will hold until the next election. Thabo’s obligation in the same Forum started in 2015 as the Deputy Chairperson, a position he held until 2018. Thabo is also a member of South African Institute of Mining and Metallurgy (SAIMM) and Associate member of Association of Mine Managers South Africa (AMMSA).

PMC Vermiculite Business – a story of sustainability, resilience and agility

Senior Manager for Vermiculite and EXCO member, John Makgatho.

Palabora Copper (PC) is known for its copper, but the mine has also been mining vermiculite in a separate open pit since the early 1900s. The Vermiculite deposit is located within the Palabora Igneous Complex adjacent to the Kruger National Park, and one of the largest phosphate rock producers, the Foskor Mine. The crude vermiculite mineral is a magnesium, aluminium and iron silicate in a flaky form with a yellowish-to-brown colour. Vermiculite has a remarkable ability to expand significantly when heated at high temperatures (above 850 degrees Celsius). Vermiculite is clean, non-toxic, non-combustible and insoluble in water or organic solvents and is an excellent insulator for thermal and auditory applications. It is used in the horticulture, agriculture, fertiliser, manufacturing and construction industries as a friction lining. PMC continues to be one of the largest producers of vermiculite in the world.

PMC sells its vermiculite concentrate to local and international markets. Local markets access the products directly from the mine and international buyers from PMC subsidiaries located in Singapore, the United Kingdom and the United States of America. In 2011, the PMC Verimiculite Business was reconfigured to align the production with market needs and stabilise the supply to various global markets. Post 2011, the current Senior Manager for Vermiculite and PMC EXCO member, John Makgatho, headed the turnaround strategy to ensure that the Vermiculite Business continues to be sustainable, resilient and agile amid market challenges and changes.

“Crucial to the success of PMC Vermiculite Business are our

subsidiaries, PMC Vermiculite team and the broad PMC team as well as the leadership of PMC. Our vermiculite mine has been in existence for more than 65 years and continues to be amongst the largest producers of vermiculite in the world. We intend to capitalise on this experience of more than 65 years to continue operating into the future,” says John.

The SAMI SHE Awards, formerly known as MineSAFE, have recognised the PMC Vermiculite Mine as “Best-inClass” in the quarry business in South Africa for two consecutive years since 2018. The 2019 award included an input on “the most improved safety performance” and the Vermiculite Business scooped the award on 25 October 2019 at Emperors Palace in Gauteng for the period 2018/19.

The vermiculite team collaborates with the PMC Asset Management Division to coordinate the PMC Energy Management Programme. Because of energy-saving programmes by the Vermiculite Business, Productivity South Africa nominated PMC as a finalist for its Energy Saving Management Programme and termed it one of the best sustainable projects in the mining industry in South Africa.