The Durban Chamber of Commerce and Industry offers a wide variety of services to members, debates current issues through Standing Forums and advocates for business in the appropriate forums.

The Durban Chamber of Commerce and Industry NPC assists you in expanding your business globally by connecting you with international chambers around the world. This means that our members have complete access to international chambers of commerce and embassies, thus opening a world of possibilities and business opportunities internationally.

Through our International Business Unit, we produce Certificates of Origin (CO). A CO is a document required for all export processes to prove that the goods are from South Africa, the country of origin. We pride ourselves on being a reputable organisation that is respected in industry. Our CO business is governed by strict compliance guidelines and principles which ensure that every CO produced by the chamber for your product will be 100% vetted and compliant.

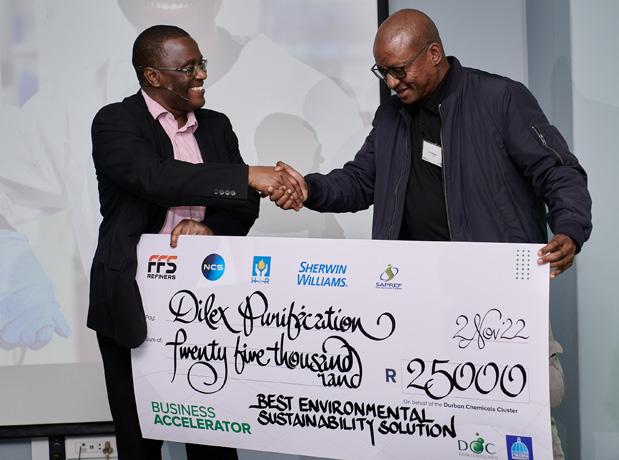

Through the Business Development division, the Durban Chamber of Commerce and Industry aims to support and transform small, medium and micro enterprises (SMMEs), including informal businesses in the Durban area, into sustainable businesses ready to do business with large entities. We offer non-financial assistance such as skills development, mentorship, networking workshops and oneon-one consultations.

Durban Chamber has been trusted by CIPC to be the agency that does most of the business legalities in KwaZulu-Natal such as company registrations, CIPC annual returns, name

changing, company amendments, directors’ amendments and company name reservations.

The Durban Chamber has more than 54 000 informal traders who receive assistance with their business needs through the associations they belong into. These businesses have a special membership package which is discounted to accommodate them. Just like SMMEs, they receive nonfinancial support such as skills development, mentorship, networking workshops and one-on-one consultations.

We continue to add value for our members through our robust interactions and partnerships with both the private and public sectors. These initiatives are over and above the numerous value-adding services offered by the chamber and our system of Standing Forums, which meet regularly to consider and debate relevant issues within the sectors that they represent. Our policy a nd advocacy initiatives ensure that we are constantly:

• Identifying government policies relevant to business in Durban and KwaZulu-Natal

• Informing, through research and giving a broader perspective and on such policies

• Liaising with relevant institutional structures to enhance robust collaboration

• Amplifying core issues that impact business with short, medium and long-term perspectives

• Promoting an appreciation of broad-based economic, social and environmental sustainability

• Advocating good practices to our members and enabling policy for the city, province and state

• Assisting in promoting partnership approaches to complex problematic issues affecting business

The Ethekwini Presidential Working Group has been established after a meeting between the Durban Chamber Of Commerce and Industry NPC and President Ramaphosa and five cabinet ministers.

As organised business, we remain committed to working with the government to rebuild Durban and create a favourable business environment. Our business is to serve the business community through advocacy and lobbying and to protect and promote the interests of the eThekwini business community.

The Durban Chamber of Commerce and Industry NPC, together with the KZN Growth Coalition, hosted President Cyril Ramaphosa on 23 February 2024 to discuss the issues affecting businesses in Durban and KwaZulu-Natal. The President was accompanied by a ministerial delegation comprising Ministers Gordhan, Cele, Mchunu, Ramokgopa and Zikalala. At the engagement business leaders discussed Durban’s dysfunctional infrastructure, tourism, promoting KZN as an investment hub and safety and security.

As an organisation, we believe this Working Group will provide an opportunity for the public and private sectors to engage. It is the first time since democracy that Durban business leaders have a direct line to the Office of the President. The Office of the President revealed that eThekwini Municipality accounts for 6.8% (the third-largest metropolitan municipality in South Africa) of the national population, 60.99% of the KwaZulu-Natal GDP and 9.7% of the national GDP.

We believe this is sufficient evidence that eThekwini Municipality is a significant economic contributor and critical metro for South Africa and therefore requires urgent attention. For the eThekwini Presidential Working Group to work and achieve its desired outcomes

business needs to be allowed to lead in the following areas: infrastructure (water, sanitation, and energy distribution), safety and security, investment and tourism. These areas have been identified by the Durban Chamber of Commerce and Industry NPC as key pillars to help turn around eThekwini Municipality.

It is time for government and businesses to work together to solve Durban’s most pressing issues. If we do not address the challenges immediately, we can expect to see many businesses disinvesting from Durban and opting for alternative and more lucrative investment destinations. We need to save our city, and we need to do it now!

The Durban Chamber of Commerce and Industry NPC holds the distinction of being the oldest and largest metropolitan chamber in Africa, having been established in 1856. Our primary objective is to serve the business community in eThekwini by advocating and lobbying for their interests. Our organisation has a member-focused approach, ensuring that their needs are prioritised. We take pride in our brand, which is built on strong values, trust and integrity, making us the preferred choice of chamber for our members.

As the oldest metropolitan chamber in Africa, we are committed to delivering exceptional value to our members through our dynamic collaborations with the private and public sectors. Our efforts go beyond the vast array of value-added services that we provide. We have established a network of 20 Standing Forums that convene frequently to discuss and deliberate on pertinent matters within

their respective industries. By doing so, we ensure that our members are wellinformed and equipped to navigate the ever-evolving business landscape.

The Durban Chamber also offers membership. We believe in MEMBERSHIP THROUGH FELLOWSHIP and CREATING PARTNERSHIPS. Therefore RELATIONSHIPS are the true currency of commerce. The Durban Chamber facilitates our members’ development of business relationships with one another, as well as with other key stakeholders to promote economic growth.

The first shipment of goods under the under the African Continental Free Trade Area (AfCFTA) from the Port of Durban brought into sharp focus the urgent need for the province – and the country – to upgrade its ports and logistics infrastructure.

South African estates are offering more affordable properties, greener surroundings and a broader range of services and amenities.

A unique guide to business and investment in KwaZulu-Natal.

Publishing director: Chris Whales

Editor: John Young

Managing director: Clive During

Online editor: Christoff Scholtz

Designer: Tyra Martin

Production:

Sharon Angus-Leppan

Project manager:

Chris Hoffman

Ad sales:

Shepherd Mugero

Sadiyah February

Dwaine Rigby

Gabriel Venter

Tahlia Wyngaard

Administration & accounts:

Charlene Steynberg

Kathy Wootton

Distribution and circulation manager: Edward MacDonald

Printing: FA Print

The 2024/25 edition of KwaZulu-Natal Business is the 16th issue of this highly successful publication that, since its launch in 2008, has established itself as the premier business and investment guide for the KwaZulu-Natal Province.

A special feature on the state of the estate market in South Africa notes some features beyond the obvious attractions such as security and coastal living. New factors in the growth of the estate living market include a focus on conservation and nature, developers offering a broader (and lower) price range for buyers of homes and residential estates now becoming part of bigger “precincts” offering other zones such as retail and commercial. Examples from KwaZulu-Natal are cited regarding these new trends.

The province’s ports, including the inland Dube TradePort situated at the King Shaka International Airport, were firmly in the spotlight as the first-ever shipment was made out of South Africa in terms of the African Continental Free Trade Area (AfCFTA). If the country is to take full advantage of the agreement then its logistics infrastructure has to run efficiently.

To complement the extensive local, national and international distribution of the print edition, the full content can also be viewed online at www.globalafricanetwork.com under ebooks. Updated information on KwaZulu-Natal is also available through our monthly e-newsletter, which you can subscribe to online at www.gan.co.za, in addition to our complementary business-to-business titles that cover all nine provinces, our flagship South African Business title and the latest addition to our list of publications, The Journal of African Business, which was launched in 2020. ■

Chris Whales Publisher, Global Africa Network Media

|

Email: chris@gan.co.za

KwaZulu-Natal Business is distributed internationally on outgoing and incoming trade missions, through trade and investment agencies; to foreign offices in South Africa’s main trading partners around the world; at top national and international events; through the offices of foreign representatives in South Africa; as well as nationally and regionally via chambers of commerce, tourism offices, airport lounges, provincial government departments, municipalities and companies.

Member of the Audit Bureau of Circulations

COPYRIGHT | KwaZulu-Natal Business is an independent publication published by Global Africa Network Media (Pty) Ltd. Full copyright to the publication vests with Global Africa Network Media (Pty) Ltd. No part of the publication may be reproduced in any form without the written permission of Global Africa Network Media (Pty) Ltd.

PHOTO CREDITS | AES; Afrimat; Bel Adone/Wikimedia Commons; Bell Equipment; Coastlands Hotels and Resorts; Dube TradePort; Durban Chemicals Cluster; GCIS; Mondi; Old Mutual; Renishaw Coastal Precinct; Riverside Precinct; St Francis Links Villas; SAPREF; SCTIE;

Global Africa Network Media (Pty) Ltd

Company Registration No: 2004/004982/07

Directors: Clive During, Chris Whales

Physical address: 28 Main Road, Rondebosch 7700

Postal address: PO Box 292, Newlands 7701

Tel: +27 21 657 6200 | Fax: +27 21 674 6943

Email: info@gan.co.za | Website: www.gan.co.za

Estate.

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd, has used all reasonable efforts to ensure that the information contained in KwaZulu-Natal Business is accurate and up-to-date, the publishers make no representations as to the accuracy, quality, timeliness, or completeness of the information. Global Africa Network will not accept responsibility for any loss or damage suffered as a result of the use of or any reliance placed on such information.

The first shipment of goods under the under the African Continental Free Trade Area (AfCFTA) from the Port of Durban brought into sharp focus the urgent need for the province – and the country – to upgrade its ports and logistics infrastructure.

By John Young

In January 2024 President Cyril Ramaphosa was on hand to oversee the first goods leave South Africa from the Port of Durban under the African Continental Free Trade Area (AfCFTA), the agreement whereby most African countries will trade with one another with greater freedom.

Unlike other continents where intra-continental trade has boosted economic growth, exports between African countries is at about 16%. Asia is 55%, North America 49% and the EU 63%.

The first steps in a move by national government to partner with the private sector in boosting efficiency at ports were taken in 2022: deals were signed at the Port of Durban and at Richards Bay.

In 2023, these first steps became a giant leap when International Container Terminal Services

Inc (ICTSI), a Philippines-based port operator, was announced as the preferred partner for a joint venture (JV) to run the Durban Container Terminal with Transnet. Getting the deal over the line might take longer as logistics giant Maersk has lodged objections over the process.

ICTSI operates in 20 countries and employs more than 11 000 people. Transnet will hold 50% plus one share in the JV for 25 years, with an option to extend to 30 years. From the initial list of 17 potential partners, ICTSA was eventually chosen from a shortlist of six. Part of the plan for Durban Container Terminal Pier 2 is to increase traffic in such a way that it will be able to increase its handling capacity from the present 2.9-million TEUs (twomillion 20-foot equivalent units) to 11-million TEUs by 2032.

PHOTO: GCIS

The 2022 deal involving a 15-year concession for the loading of grain at one of Durban’s agricultural terminals was won by Afgri, one of South Africa’s biggest agricultural firms. Afgri will deal with the operation and maintenance of all landside operations, and the deal includes a similar arrangement at East London. The other two terminals in Durban are operated by SA Bulk Terminals and Bidvest Bulk Terminals.

At the event, pictured, President Ramaphosa commented, “Industrial development is core to Africa’s integration. It builds Africa’s productive capacities, adds greater value to our products and diversifies trade beyond the traditional commodities. We have already seen the potential of greater cross-border collaboration.

“South African automotive companies source leather car seats from a factory in Lesotho employing close to a thousand workers and wiring harnesses from Botswana at two plants employing several thousand workers.” He further noted that copper wire is sourced from Zambia, rubber from Cote d’Ivoire, Nigeria, Malawi, Ghana and Cameroon, and steering wheel components from Tunisia.

Ramaphosa’s attendance at another event signalled that there is sincere interest in the upgrading of logistics infrastructure. The President returned to Durban in April 2024 to officially launch the Newlyn PX Bayhead rail terminal. The multimodal hub will handle, store and make possible the loading and movement of many kinds of cargo, including containers. The facility is adjacent to the Port of Durban.

KwaZulu-Natal’s two big original equipment manufacturers (OEMs), Toyota South Africa and Bell Equipment, are among the province’s biggest exporters. From its factory south of Durban Toyota exported 71 014 Hilux vehicles in 2023, to go with the 37 382 units of the same model that it sold locally.

About 40% of Bell Equipment’s South African turnover is accounted for by exports, which are sent to more than 80 countries. The company has a large plant in Richards Bay as well as a facility in Germany. Bell was the first winner, in 2019, of the Exporter of the Year Awards for capital equipment

Bell Equipment has launched a new division, Bell Heavy Industries.

manufacturers offered by the South African Capital Equipment Export Council (SACEEC).

In 2023, Bell launched a new division, Bell Heavy Industries. Project engineering and contract manufacturing will be the focus of the division, which builds on seven decades of experience in complex engineering, heavy fabrication, and machining for its own range of material handling equipment. In 2024, the company welcomed a new Group CEO. Having previously worked at the company his grandfather Irvine Bell founded in 1954, Ashley Bell co-founded Matriarch Equipment with his brother, Justin Bell, in 2009, and continued to act as a director of Bell from 2015. One of the first tasks of the new CEO was to announce that a new Bell Motor Grader would be manufactured at the Richards Bay plant from 2025.

The Provincial Government of KwaZulu-Natal has created a KZN Energy War Room. Over and above the interventions into energy efficiency of government buildings and investments in things like solar panels, and plans to continue rolling out electricity connections to previously unserviced households, the administration intends turning Richards Bay into an energy hub.

This ambition received a boost in 2023 with the decision by the National Energy Regulator of South Africa to approve Eskom’s application to build a 3 000MW gas power station at Richards Bay.

Battery storage has made a debut in the province as well. South Korean firm Hyosung Heavy Industries has signed on to implement the Eskom project to create a battery energy storage system, in this instance in the uMgungundlovu District Municipality.

PHOTO: Bell Group

Every kind of business is turning to renewables. The Creighton Valley Cheese Company has been solar-powered since 2020.

In 2023, Premier Nomusa Dube-Ncube said that, in addition to the R97-billion Eskom project, the following facilities would be established at the deepsea port:

• Mabasa Energy and Fuels, R10-billion

• NFE BGE Gas Supply, R25-billion

• Phakwe RBGP, R34-billion

An earlier announcement on the energy front by President Ramaphosa that private investors could generate up to 100MW without having to go through a tangled web of licence procedures was a boon for the province’s larger companies. The likes of Sappi and Mondi produce great quantities of biomass waste and all of the province’s sugar producers are potentially generators of electricity.

Many of them already are producing power for their own use, now they can sell it to the grid.

The signing of a long-term contract for energy supply by Eskom and South32 for its Hillside Aluminium smelter was another very welcome step in the energy field. The deal expires in 2031.

In the oil and gas sector, the big issue of SAPREF, South Africa’s largest crude oil refinery which suspended operations in 2022, has been solved in the sense that the Central Energy Fund has purchased it. However, whether it will return to refining oil is an open question.

The province’s existing infrastructure, good soils and fine weather provide a solid base for a varied economy. KwaZulu-Natal has significant capacity in heavy and light manufacturing, agro-processing and mineral beneficiation, all of which is supported by South Africa’s two busiest ports (Richards Bay and Durban), the country’s most active highway (the N3), a modern international airport and pipelines that carry liquids of all types to and from the economic powerhouse of the country around Johannesburg in the interior.

Mondi and Sappi, two global giants in forestry, paper and packaging, have a significant presence in KwaZulu-Natal.

Tourism is a key sector in the KwaZulu-Natal economy and provides livelihoods to many thousands of families in urban and rural areas. The closing of borders brought real hardship to many areas.

A number of flights have been resumed to King Shaka International Airport by the likes of Turkish Airlines and a new flight has been inaugurated by SA Airlink, connecting the province to Zimbabwe.

The provincial government is working on an investment pipeline, through the Special Economic Zones (SEZs), of R22-billion. The SEZs at Richards Bay and King Shaka International Airport (the Dube TradePort) are key components of the strategy and are now well-established nodes of investment.

Milestones have been reached in the plan for creating further SEZs to focus on leather and textiles. A business case has been completed by units within the provincial government and land at Ezakheni (Ladysmith) in the uThukela District has been identified and secured. Dube TradePort will be the SEZ operator and R780-million in investments has been pledged by companies keen to relocate to the SEZ. To spread the benefits of the SEZ, the concept of “The Textile Belt” will be followed. The corridor approach will leverage comparative advantages of various regions in the clothing and textile value chain. ■

MIYELANI MKHABELA

Group Chief execu.ve

: +27 61 443 3199

Service excellence and class-leading brands – exceeding expectations.

: www.antswisa.co.za

: The Firs of Rosebank, Biermann Ave, Rosebank, Johannesburg, Gauteng 2196

Sir/Madam,

DATE:

Develop Office is a wholly owned dealership distributor of leading stationery brands. Our diverse range of quality products enables us to service all related such as the office, schools, homes and corporates within and beyond our borders. Our national sales and distribution network is supported by in Johannesburg, Durban, Cape Town and East London as sales branch in Polokwane and Nelspruit. These hubs cover all regions and regional centres across the and beyond our borders into Africa. Our experienced team is dedicated to service excellence and to long term relationships with our customers.

Antswisa Develop Office, we are extremely proud of the class-leading international brands for which we have distribution rights. Our wholesale dealership brands include: Croxley, Dahle, Durable, Dymo, Esselte, Jovi, Leeho, Leitz, Lion Brand, Maped, Papermate, Parker, Pendaflex, Penguin, Rapid, Rolodex, Rotring, Talens, Sellotape, Sharpie, Stabilo, Twinlock, Thrass, UHU, Konica Minolta Printing Machines and Waterman.

means continuous improvement and innovation in retail markets, and We remain committed to our of providing world class product at competitive prices with a focus on customer service excellence.

AAntswisa Develop Office we measure ourselves on our ability to deliver a service level that meets and exceeds expectations. In the recent months we have invested great amounts of time and resource in improving our and processes We always welcome any input to improve our service to you.

committed to our promise of providing world-class product at competitive price with a focus on customer service excellence.

you for your continued support and looking forward to a mutually beneficial relationship into the future.

ntswisa Develop Office, a wholly owned subsidiary of Antswisa Group, is a wholesale dealership and distributor of leading stationery brands.

Our diverse range of quality products enables us to service all related markets such as the office, schools, homes and corporates within and beyond our borders.

Our national sales and distribution network is supported by regional hubs in Johannesburg, Durban, Cape Town and East London as well as sales branches Polokwane and Nelspruit. These hubs cover all regions and regional centres across the country and beyond our borders into Africa.

+27 61 443 3199

miyelani.antswisa@icloud.com

Our experienced team is dedicated to service excellence and to building long-term relationship with our customers.

www.antswisa.co.za

At Antswisa Develop Office we measure ourselves on our ability to deliver a service level that meets and exceeds your expectations. In recent months we have invested great amounts of time and resources in improving our systems and processes.

We always welcome any input to improve our service to you.

BIZHUB 550I

Simple, Connected and Safe

The Firs of Rosebank, Biermann Ave, Rosebank, Johannesburg, Gauteng 2196

At Antswisa Develop Office, we are extremely proud of the class-leading international brands for which we have exclusive distribution rights.

Our wholesale dealership brands include Croxley, Dahle, Durable, Dymo, Esselte, Helix, Jovi, Leeho, Leitz, Lion Brand Maped, Papermate, Parker, Pendflex, Penguin, Rapid, Rolodex, Rotring, Royal Talens, Sellotape, Shapie, Stabilo, Twinlock, Tharss, UHU, Konica Minolta printing machines and Waterman.

Antswisa means continuous improvement and innovation in the retail markets, and we remain

• Black & white A4/a3:55/27 ppm

• Paper formats: A6-SRA3, custom formats banner format up to 1.2 metres

• 10.1-inch colour panel with multi-touch support and dedicated mobile touch area provides more convenience and flexibility

• Reduced environmental impact thanks to state-of-the-art technology that ensures competitively low energy consumption, which also saves money

• Highest data security with various security functionalities including state-of-the-art antivirus technology that reduces the risk of data loss and keeps confidential data safe!

South African estates are offering more affordable properties, greener surroundings and a broader range of services and amenities.

Estate living continues to grow as a trend, but estates themselves are changing.

A Pam Golding Properties analyst told Property24 in 2023 that 16.4% of all residential sales in South Africa in the previous year were for properties in estates. The figure for 2010 was 13.1%.

Property research company Lightstone has put the number of estates in South Africa at 5 000, encompassing about 440 000 properties. This is only 7% of the country’s property portfolio but represents about 17% of the total market value of residential property.

The Covid-19 epidemic is part of the reason for the uptick in numbers and the rise in remote working is a related factor but there are other considerations: increasing demand for security and the attractions of a coastal lifestyle compared to inland living among them.

Three other shifts are noticeable:

• the importance of wildlife and nature in new estates

• the broader scope of affordable options available

• the widening of the concept of estate living to include “precincts”

New World Wealth’s analysis of trends in estates in 2021 noted a “general movement away from traditional golf estates and towards wildlife and parkland estates” and stated that clustering of housing was becoming commonplace in order to allow for more open space on the estate as a whole.

Something else noted by this survey was that the percentage of millionaires living in (or having a second home on) estates was on the rise, up from 30% in 2010 to 48% at the time of the survey, June 2021.

Adrian Gardiner, founder of the Mantis Collection, says of the St Francis Links estate, inside of which his company has recently developed the St Francis Links Villas, “The birdlife and the wildlife make St Francis unique.”

The first page of the website of KwaZuluNatal’s Zimbali Estate references a “natural and contemporary coastal forest estate”, “eco-friendly”, “caring for the environment” and “our wildlife, our birdlife and our incredible flora”.

Excellent

Lightstone regularly releases graphs showing trends in the property market. The average price for an estate property in 2003 was close to R3-million. That figure averaged just less than R2-million in the four years to 2022.

The St Francis Links Villas in the Eastern Cape is a typical new development in that it includes free-standing houses but also one-bedroom and two-bedroom apartments.

Newer estates are also allowing for smaller plots and greater mix of more affordable houses to be built. This might be within a particular section or “suburb” of the estate, as with the St Francis Links Villas option, which is a development within the estate. Residents of the Villas have some of their own amenities (like healthcare) but they also have access to the clubhouse and gym of the main estate.

A new trend in estate living is the move to precincts. Essentially this is the extension of the concept of a secure estate to encompass more elements: residential, commercial, educational, medical and recreational. In short, a town within a city with the residential estate occurring within the precinct.

An established practice is to have hotels or lodges within the estate, as is the case at Zimbali. The idea of a precinct goes beyond holidaying and recreation to encompass work and play.

Gideon van der Vyver, the developer of the Riverfields Precinct in Gauteng, says that the focus is on safety, sustainability and community. Calling the new entities “managed precincts”, Van der Vyver points to the success of the Umhlanga Urban Improvement Precinct (UUIP) which was established in 2015. He credits the UIP with

reducing crime, improving street cleanliness and creating a more welcoming environment. Other examples he cites from around South Africa are Waterfall City (between Johannesburg and Pretoria), Melrose Arch and Steyn City in Johannesburg, the V&A Waterfront and Century City in Cape Town and Menlyn Maine in Pretoria.

Riverfields, which is near the OR Tambo International Airport, has so far delivered more than 1 000 residential units, a retail node is functioning and a number of logistics and distribution centres have been created in the light industrial zone.

While the KwaZulu-Natal North Coast has long been a site for golf and residential estates, many destinations south of Durban are proving attractive destinations for people choosing estate living.

One of the most ambitious of these is the 1 300-acre Renishaw Coastal Precinct on the Mid-South Coast near Scottburgh. The development is backed by Renishaw Property Developments, a subsidiary of the JSE-listed Crookes Brothers Limited, and its property partner, Crocker Properties.

At Renishaw Hills, an established retirement estate which is the first node to be completed, every property has been positioned to maximise the views of the surrounding coastal forest and Indian Ocean.

The precinct will eventually comprise zones for residential, retail, educational and healthcare. In keeping with the latest trend, the developers will build on just 20% of the land, creating a conservation area of real substance.

Van der Vyver sums up the positive impact a managed precinct can have as follows: “They attract businesses, tourism and investment, which leads to job creation and increased economic activity. The presence of commercial spaces and retail outlets also generates revenue for the local government through taxes and fees.” ■

Renishaw Managing Director Barto van der Merwe believes that his company’s latest all-inclusive offering for residents and investors will enhance the attractiveness of the KwaZulu-Natal Mid-South Coast.

Renishaw Managing Director

Barto van der Merwe.

Barto van der Merwe is an accomplished Managing Director with extensive experience in the construction industry. He holds a Bachelor of Engineering in Structural Engineering from Technological University Dublin and is recognised as a Chartered Engineer in Ireland and a Professional Engineer in South Africa. Skilled in structural and building engineering management and in corporate leadership, Barto is also a strong community and socialservices professional, bringing a wealth of knowledge and leadership to his role.

Where is the Renishaw Coastal Precinct?

The 1 300ha Renishaw Coastal Precinct falls within two municipalities: eThekwini in the north and Umdoni in the south. It’s located in the KwaZulu-Natal Mid-South Coast on prime land adjacent to the ocean, just 45 minutes from King Shaka International Airport and with access to the N2.

What is your vision for Renishaw Coastal Precinct?

Our vision is to enhance the Mid-South Coast through strategic land sales that provide essential community facilities such as hospitals, schools and shopping centres. Our focus is community development over profit, which means creating symbiosis with the existing community. Our pending donation of 142ha of adjacent land to the community of Amandawe under the KwaCele Tribal Council (KTC) and the 10% stake in the development company will be acquired by the KTC through a buy-out process to ensure community inclusivity and prosperity.

How is Renishaw Coastal Precinct different from other developments?

At Renishaw Property Developments, a proud subsidiary of the JSE-listed Crookes Brothers Limited, we prioritise the conservation of the region’s natural beauty. Our development spans an impressive 1 300ha, but unlike other projects that cram as many units as possible into small spaces, we are dedicated to preserving the land.

Only 20% of our property will be developed, with the remaining 80% transformed into a stunning conservation area. This approach creates one of South Africa’s largest and most unique developments, offering a harmonious blend of modern living and nature. With our deep historical ties to the region, we’re committed to building a community that embodies sustainable luxury and unparalleled quality.

Our vision is to create a self-reliant, sustainable commuter development that offers significant investor advantages. With a prime location, subtropical climate, competitive property prices, secure water provision and sanitation, on-site healthcare and education and comprehensive zoning, we’re attracting investors who share our vision for inclusive community development.

Why was Renishaw Hills mentioned at the 5th South Africa Investment Conference (SAIC) in 2023?

Renishaw Hills, a mature lifestyle estate and the first development within the Renishaw Coastal Precinct, represents R500-million of an anticipated R15-billion investment. As part of Node 1 in a five-node precinct, it promises significant socio-economic benefits. With 2 500 residential opportunities for 7 500 people and thousands of jobs, the precinct was recognised by President Cyril Ramaphosa for its investment pledge at the 2023 South Africa Investment Conference.

Is Renishaw Hills sold out or are stands available?

Phase 5 is completely sold out and the most recent section, Phase 6, is already 70% sold out, with its highend free-standing units and maisonettes in demand. The highly anticipated apartments are launching in 2024, with Phase 7 set to dazzle in 2025, providing further investment opportunities in this quality estate for those over 50. We encourage interested parties to visit www.renishawhills.co.za to book a tour now.

Who is attracted to Renishaw Coastal Precinct?

The semigration trend has seen residents from KwaZulu-Natal and Gauteng investing in Renishaw Hills, with ex-pats returning to the region to take advantage of the affordability, quality lifestyle, subtropical climate and high-end amenities. The buyto-rent market is also strong with younger investors buying in Renishaw Hills enjoying great rentals with a long-term vision of living here. The precinct is attracting interest from reputable organisations, who

share our vision for a development that enhances the entire KZN Mid-South Coast. This includes a local company building the filling station, a respected school group that will establish the region’s first private school, a renowned hotel chain and developers of a shopping centre that have invested, with a wellknown church group currently finalising a deal.

What are the key attractions of the area?

The KZN Mid-South Coast is renowned for its laidback outdoor lifestyle and boasts several seaside attractions. Scottburgh Beach is ideal for swimming, surfing and sunbathing and there are world-class dive sites – the nearby Aliwal Shoal and further south, Protea Banks. There are many great golf courses, hiking and biking trails, nature reserves as well as community events that take place throughout the year. ■

Your endless holiday at Renishaw Hills

Welcome to Renishaw Hills, the over-50s oasis by the sea. Set in KwaZulu-Natal’s Mid-South Coast town of Scottburgh, the estate provides community, security, superior healthcare and affordability.

Renishaw Hills is a prime investment destination, offering discerning buyers high-quality properties at competitive prices. This prestigious 25-hectare lifestyle estate has delivered exceptional investment returns. In just six years, property values have soared by 60%, with demand for these upscale units continuing to rise.

Renishaw Hills is part of Renishaw Property Developments, a subsidiary of the JSE-listed Crookes Brothers Limited. It’s the first development in the expansive 1 300-hectare Renishaw Coastal Precinct, with R500-million already invested and an estimated R15-billion likely to be achieved upon completion. As the pioneering project among five interconnected nodes in this mixed-use, self-sustaining precinct, Renishaw Hills is setting a new standard. Its remarkable contribution to investment has even garnered special mention from President Cyril Ramaphosa at the 5th South Africa Investment Conference.

More than 200 residential units have been sold in Renishaw Hills, with an ambitious vision to offer 2 500 residential opportunities across the entire Renishaw Coastal Precinct, ultimately providing homes for around 7 500 people. Development opportunities have been sold to renowned organisations, with deals for a shopping centre and filling station already

finalised while agreements for the first private school, hospital, church and hotel are on the horizon.

Community development lies at the heart of this visionary project and all investors are reputable and aligned with this ethos. The result is a thriving, vibrant precinct setting a new benchmark for lifestyle living on the Mid-South Coast.

A deep commitment to nature lies at the heart of Renishaw Hills, with extensive land, including a vibrant wetland, undergoing remarkable rehabilitation. Residents revel in the natural beauty and year-round subtropical climate as they explore hiking and biking trails with breathtaking ocean views. This passion for nature extends throughout the Renishaw Coastal Precinct, where 80% of the land is being preserved for conservation, creating an unparalleled coastal haven.

Investors in Renishaw Hills become part of an allinclusive estate that provides peace of mind with cutting-edge security. An electric perimeter fence, camera surveillance, access control and 24/7 guarding and patrols ensure residents’ safety while remaining

unobtrusive. Here, you can truly relax and embrace the good life, knowing that you’re protected by the best security measures available.

Residents enjoy the freedom to indulge in the estate’s countless social activities and top-class facilities. Enjoy a dip in the heated swimming pool, stay fit in the gym or relax in the library. Join in on boules, archery, snooker, art, dancing, darts, mah-jong, canasta, cycling, walking, bridge, the book club, the camera club, table tennis… and so much more! The list is virtually endless!

Renishaw Hills champions physical well-being through its vibrant, active outdoor lifestyle, but the estate also boasts on-site healthcare to meet every resident’s health needs. The Renishaw Hills Estate Medical Service, operated by Senior-Care, provides a dedicated, 24-hour medical response as well as a telephonic advisory service. Residents can also enjoy home-based care, which offers personalised assistance in the comfort of their own homes, an internationally preferred method of senior care.

Residents of this pet-friendly estate enjoy uninterrupted water supply thanks to borehole water treated on-site to SANS 241 standards. Each Renishaw Hills unit is equipped with solar geysers, inverters, prepaid meters and premium fittings like SMEG gas hobs and electric ovens. It’s a perfect blend of sustainability, luxury and style.

Renishaw Hills’ Reversionary Transfer Obligation (RTO) units offer a unique investment model similar to life rights. You gain secure, lifelong occupancy at a much lower market price and at this attractive price point they are sold very quickly which means getting in early.

The estate offers exceptional value for money with affordable levies starting at just R2 340 for apartments. This all-inclusive fee covers everything: exterior maintenance and insurance, garden services, refuse collection, postal services, fibre-optic WiFi, security, healthcare options and access to communal facilities. Homeowners can enjoy a worry-free lifestyle with all the essentials taken care of!

At Renishaw Hills, no corners have been cut. The estate was crafted using only the finest building materials and by partnering with renowned architects and accredited construction companies. By prioritising impeccable quality and design, contractors have won multiple Excellence in Construction awards. Investors can rest easy, knowing their homes are built to last, free from the worry of unforeseen and costly repairs.

Nestled in the vibrant coastal town of Scottburgh, Renishaw Hills offers easy access to shopping centres, restaurants, golf courses, stunning conservation areas and warm beaches. Just a stone’s throw away is the renowned Aliwal Shoal, a Marine Protected Area and one of the world’s top dive sites, teeming with marine life and underwater adventure.

The warm climate supports an outdoor lifestyle, with magnificent trails for avid runners and cyclists. Renishaw Hills has everything a mature resident needs to fully embrace this lifestyle. Birdwatching is a delight with countless bird species waiting to be sighted!

Each Renishaw home features a professionally installed indigenous garden worth in the order of R200 000, designed by renowned botanist Elsa Pooley. This tranquil retreat lets you relax, unwind, and connect with nature without ever leaving home. Visit

Secure your slice of paradise today!

Renishaw Hills offers freestanding units, maisonettes and apartments with stunning ocean and forest views. Apartment prices start at just R1 595 000, 2-bedroom maisonettes from R2 050 000 and 2-3 bedroom houses begin from only R2 280 000 – all with no transfer duties payable.

Growing middle class, affluent consumer base, excellent returns on investment.

SA is the location of choice of multinationals in Africa. Global corporates reap the benefits of doing business in SA, which has a supportive and growing ecosystem as a hub for innovation, technology and fintech.

South Africa (SA) has the most industrialised economy in Africa. It is the region’s principal manufacturing hub and a leading services destination.

SA has a progressive Constitution and an independent judiciary. The country has a mature and accessible legal system, providing certainty and respect for the rule of law. It is ranked number one in Africa for the protection of investments and minority investors.

The African Continental Free Trade Area will boost intra-African trade and create a market of over one billion people and a combined gross domestic product (GDP) of USD2.2-trillion that will unlock industrial development. SA has several trade agreements in place as an export platform into global markets.

SA has a sophisticated banking sector with a major footprint in Africa. It is the continent’s financial hub, with the JSE being Africa’s largest stock exchange by market capitalisation.

SA is endowed with an abundance of natural resources. It is the leading producer of platinum-group metals (PGMs) globally. Numerous listed mining companies operate in SA, which also has world-renowned underground mining expertise.

A massive governmental investment programme in infrastructure development has been under way for several years. SA has the largest air, ports and logistics networks in Africa, and is ranked number one in Africa in the World Bank’s Logistics Performance Index.

SA has a number of world-class universities and colleges producing a skilled, talented and capable workforce. It boasts a diversified skills set, emerging talent, a large pool of prospective workers and government support for training and skills development.

SA offers a favourable cost of living, with a diversified cultural, cuisine and sports offering all year round and a world-renowned hospitality sector.

Covering all aspects of facilities management services, the company has quickly gained a reputation for competent technical skills and experience. Founded in 2021, we provide bespoke solutions via a comprehensive integrated facilities-management solution.

The Technical Services Division of the company has four components, namely: Technical Services; Soft Services; Business Support Services; Elevators.

Antswisa Facilities Management website: www.antswisaFMS.co.za | email: Antswisa@antswisafms.co.za

Technical Services

• Building and Maintenance

• Mechanical Services

• Electrical Services

• Utility Management Services

Soft Services

• Cleaning, Hygiene and Pest Control

• Security and Guarding Services

• Waste Management Services

• Utility Management Services

• Landscaping and Horticulture Services

• Catering Services

Elevators and Escalators

• Installation

• Maintenance

• Modernisation

Antswisa Tile South Africa

Antswisa Tile South Africa, a wholly owned subsidiary of Antswisa Group, is a wholesale dealership and distributor of leading tiles and cement brands.

MIYELANI MKHABELA

Group Chief executive

PHONE

WEB

ADDR : +27 61 443 3199

: www.antswisa.co.za

: The Firs of Rosebank, Biermann Ave, Rosebank, Johannesburg, Gauteng 2196

Our diverse range of quality products enables us to service all related markets such as the residential and commercial developments, developers, retailers, resellers, municipalities, departments, homes and corporates within and beyond our borders. Our national sales and distribution network is supported by regional hubs in Johannesburg, Durban, Cape Town and East London as well as sales branches in Polokwane and Nelspruit, and beyond our borders into Africa. Our experienced team is dedicated to service excellence and to building long-term relationships with our customers.

Dear Sir/Madam

Create the home or a development of your dreams with Antswisa Tile South Africa as your partner. We offer a vast selection of top-quality tiles for all your flooring, wall, bathroom and kitchen needs.

Antswisa Tile South Africa is a wholly owned subsidiary of Antswisa Group, is a wholesale dealership leading tiles and cement brands. Our diverse range of quality products enables us to service all the residential and commercial developments, Developers, Retailers, resellers, municipalities, and corporates within and beyond our borders. Our national sales and distribution network is hubs in Johannesburg, Durban, Cape Town and East London as well as a sales branch in Polokwane These hubs cover all regions and regional centres across the country and beyond our borders into experienced team is dedicated to service excellence and to building long term relationships with

Our tiles are not only beautiful but also durable, ensuring that your space remains stylish for years to come. Choose from a wide range which will remain stylish for years to come.

Create the home or a development of your dreams with Antswisa Tile South Africa as your partner. selection of top-quality tiles for all your flooring, wall, bathroom, kitchen needs and cement. Our beautiful but also durable, ensuring that your space remains stylish for years to come. Choose options, including floor tiles, bathroom tiles, wall tiles, and kitchen tiles, and transform your space functional living environment.

At our home or office, your home or office is our top priority. That's why we offer expert advice DIY projects to help you achieve the look and feel you want. Whether you're looking to buy tiles need some inspiration, we are here to help. Trust us to guide you through the entire process and the results you want.

So why wait? Create your dream development today with us.

MIYELANI MKHABELA Group Chief executive

purpose is to refresh our country and make it a better place for all

Sustainable solutions through collaboration and co-creation.

Coca-Cola Beverages South Africa (CCBSA) is a proud industry leader in developing increasingly sustainable ways to manufacture, distribute and sell its products. It uses its industry leadership to be part of the solution to achieve positive change in the world and to build a more sustainable future for the planet.

Its aim is to create greater shared opportunity for the business and the communities the company serves across the value chain. Opportunity is more than just money, it’s about a better future for people and communities everywhere in South Africa.

CCBSA believes in growing its business the right way, not just the easy way. This helps create inclusive growth opportunities for linked communities, women and youth, customers, its employees and shareholders, for a better shared future.

CCBSA is committed to building economic inclusion and sustainability solutions that benefit its stakeholders, in particular, the communities in which the company is invested. It does this through collaboration and co-creation of sustainable solutions.

CCBSA has an important relationship with water. Tell us more...

Water is a priority for the Coca-Cola system because it is essential to life, our beverages and the communities the company serves.

The Coca-Cola Company’s 2030 Water Security Strategy focuses on increasing water security by investing in water initiatives that benefit nature and communities.

This includes projects that provide benefits to local watersheds that supply water for drinking, agriculture and manufacturing, restore and conserve habitats for plants and animals, and offer opportunities for local economic development.

CCBSA is focused on accelerating the actions needed to increase water security where it operates, sources ingredients and touches people’s lives. It does that by contributing toward sustainable, clean water access that improves livelihoods and wellbeing while protecting against water-related disasters.

As part of the Coca-Cola system, it has set three key goals designed to achieve its vision:

• Achieve 100% regenerative water use across our facilities in areas identified as facing high

levels of water stress by 2030

• Improve the health of watersheds identified as most critical for our operations and agricultural supply chain by 2030

• Continue to return water to nature and communities. Ensuring the health of watersheds is a major part of this.

In parts of the Eastern Cape Province in South Africa, CCBSA launched an ambitious project to work with the local municipality and other key stakeholders to assist vulnerable and distressed communities. CCBSA deployed off-grid, solar-powered groundwater harvesting and treatment projects called Cokevilles in the region. Late last year, it unveiled a R12-million groundwater harvesting Cokeville project, to supply the entire town of Graaff Reinet in the Eastern Cape with potable water.

CCBSA seeks to drive a circular economy for its packaging because this helps to reduce waste and carbon emissions.

The company is working to use more recycled content in our packaging, to expand its use of returnable bottles, and to collect packaging for recycling through The Coca-Cola Company’s World Without Waste initiative.

To galvanise collective action, it invests in solutions and partnerships across industry, governments and society. This includes companies within key industry sectors that can help drive the transition to a circular economy.

The Coca-Cola Company and its bottling partners, including Coca-Cola Beverages South Africa, are leading the industry in making our value chain increasingly sustainable in the way that it produces and package its products.

As a system, it has the following global goals:

• Help collect a bottle or can for every one it sells by 2030

• Focus on making all its packaging 100% recyclable by 2025

• Have 50% recycled content in our packaging by 2030

• Make 25% of its packaging reusable (returnable) by 2030

Furthermore, the company is working to use more recycled content in its bottles and has expanded the use of clear and returnable bottles. This includes the introduction and rollout of returnable 2L plastic bottles in South Africa.

According to CCBSA: “People matter. Our planet matters. We believe in doing business the right way by following our values and working toward solutions that benefit us all.” ■

“Together, we co-create solutions that address systemic climate challenges and drive transformative change.” – Dr Shingirirai Savious

Mutanga

Unprecedented environmental challenges have positioned my research group, CSIR Climate Services, as a forerunner of innovation and leadership in climate change research. Our mission transcends mere scientific inquiry; it is a commitment to forging pathways that empower industries across Southern Africa to thrive in a low-carbon, resilient future.

At the core of our vision lies the transformative power of knowledge. Through advanced modelling and cutting-edge decision-support tools, we empower stakeholders to navigate complex climate landscapes with precision and foresight. By delivering actionable insights, we enable proactive adaptation strategies that not only mitigate risks but also foster sustainable growth and resilience in the face of climate uncertainty.

By developing transparent greenhouse gases (GHG) inventories and robust carbon-modelling frameworks, we enable businesses and governments to pioneer carbon-neutral strategies and meet global sustainability standards. Our focus on co-benefits ensures that every action taken contributes not only to environmental sustainability but also to enhancing livelihoods and fostering inclusive growth. Twinned with the Climate Modelling Research Group, which provides seamless projections and downscaling of

future climate through seasonal and near-term time scales, we can build climate risk resilience across all sectors of the economy.

We partner with industry leaders, policymakers and academia to harness collective expertise and resources. Together, we co-create solutions that address systemic climate challenges and drive transformative change. Our global engagements through platforms like COP28 and regional alliances within BRICS and SADC amplify our impact, positioning us at the forefront of shaping sustainable development agendas.

As pioneers in climate services, we catalyse critical mass. Through initiatives like the water-energy-food nexus and landscape restoration, we champion nature-based solutions that enhance resilience and preserve biodiversity. Our robust monitoring and reporting frameworks ensure accountability and drive continuous improvement, aligning with global commitments such as the Paris Agreement.

At the CSIR Climate Services Research Group, we lead with purpose and conviction. We are not just envisioning a sustainable future; we are actively shaping it. At the heart of our value proposition lies the ability to translate complex climate data into actionable

intelligence. By enabling proactive adaptation strategies, we empower our partners to build resilience and sustain growth in a changing climate landscape.

Join us in redefining what climate services can achieve – where innovation meets resilience and every decision today secures a prosperous tomorrow for generations to come.

The research group has produced several key outputs, including but not limited to the following:

Project 1: The research group has led the development of a monitoring and evaluation system for multi-hazard early warning systems and losses and damages under the auspice of the Initiative for Climate Action Transparency (ICAT)

Project 2: Business case development for sector job resilience planning in support of Just Transition

Dr Shingirirai Savious Mutanga is the Research Group Leader for the Council for Scientific and Industrial Research’s (CSIR) Climate Services Research Group, responsible for strategic investment goal setting, leadership provision to a multi-disciplinary team and the implementation of the research, development and innovation strategy. He holds a PhD in industrial systems engineering from the University of Pretoria and an MSc in geoinformation science and earth observation for environmental modelling and management, obtained from a consortium of four universities: the University of Southampton in the United Kingdom, Lund University in Sweden, the University of Warsaw in Poland and the International Institute for Geo-Information Science and Earth Observation (ITC) in the Netherlands. His work experience spans the government to the private sector, academic research, think tanks and consulting. He has served on the Special T20 Africa Standing Group for the G20, BRICS and the Southern African Steering Committee, for Future Earth, a subregional investment forum and is a member of the Southern African Vulnerability Assessment Committee. He has published

in South Africa with UK PACT (Mpumalanga)

Project 3: The Third National Communication on Climate Change and South Africa’s Third Biennial Update Report, which were submitted to the UNFCCC

Project 4: Scenario building for future water management in the Limpopo province, South Africa, in collaboration with the University of Limpopo and South African Weather Services (SAWS)

The group also played a key role in South Africa’s Nationally Determined Contributions reports (DFFE) and the latest National Food and Nutrition Security Survey, funded by the Department of Agriculture, Land Reform and Rural Development (DALLRD).

extensively in both national and international accredited journals, policy analysis reports, books and conference proceedings. Among his publications are the edited books Africa in a Changing Global Environment, Management and Mitigation of Acid Mine Drainage (AMD) in South Africa: Input for Mineral Beneficiation in Africa and Africa at Crossroads. His research interest is modelling a wide range of global environmental issues, particularly energy, water, food security and climate change. Within the climate change domain, apart from his technical competence, he has a great interest in advancing climate education. He is a senior research associate with the University of Johannesburg (UJ), the University of the Free State (UFS), the University of Limpopo (UL) and the University of Pretoria (UP), where he is supervising master’s and doctoral students.

Many incentives are available to support small businesses and startups throughout South Africa across a wide range of sectors. Established businesses are also encouraged to support smaller entities along their supply chain.

Funding from the Manufacturing Competitiveness Enhancement Programme (MCEP) helped Glenart Trading move to bigger premises, which has enabled the company to increase Christmas cracker production, among other items, and employ more people.

South Africa wishes to diversify its economy and incentives are an important part of the strategy to attract investors to the country.

The Department of Trade, Industry and Competition (the dtic) is the lead agency in the incentives programme, which aims to encourage local and foreign investment into targeted economic sectors, but the Industrial Development Corporation (IDC) is the most influential funder of projects across South Africa.

There are a variety of incentives available and these incentives can broadly be categorised according to the stage of project development:

• Conceptualisation of the project – including feasibility studies and research and development (grants for R&D and feasibility studies, THRIP, Stp, etc)

• Capital expenditure – involving the creation or expansion of the productive capacity of businesses (MCEP, EIP, CIP, FIG, etc)

• Competitiveness enhancement – involving the introduction of efficiencies and whetting the competitive edge of established companies and commercial or industrial sectors (BBSDP, EMIA, CTCIP, etc)

• Some of the incentives are sector-specific, for example the Aquaculture Development and Enhancement Programme (ADEP), Clothing and Textile Competitiveness Improvement Programme (CTCIP) and the Tourism Support Programme (TSP).

The South African government, particularly the Department of Trade, Industry and Competition, has a range of incentives available to investors, existing companies, entrepreneurs and co-operatives across many sectors.

Key components of the incentive programme are the Manufacturing Incentive Programme (MIP) and the Manufacturing Competitiveness Enhancement Programme (MCEP). The initial MCEP, launched in 2012, was so successful that it was oversubscribed with almost 890 businesses receiving funding.

A second phase of the programme was launched in 2016. The grants are not handouts as the funding covers a maximum of 50% of the cost of the investment, with the remainder to be sourced elsewhere.

The Enterprise Investment Programme (EIP) makes targeted grants to stimulate and promote investment, BEE and employment creation in the manufacturing and tourism sectors. Aimed at smaller companies, the maximum grant is R30-million.

PSN Travel Frenzy is a Richards Bay small business that has grown after being supported by SEDA. Walking tours and game reserve visits are part of the company’s extended tourism offering.

Specific tax deductions are permissible for larger companies investing in the manufacturing sector under Section 12i of the Income Tax Act.

Other incentives available to investors and existing businesses in more than one sector include the:

• Technology and Human Resources for Industry Programme (THRIP)

• Support Programme for Industrial Innovation (SPII)

• Black Business Supplier Development Programme (BBSDP), which is a cost-sharing grant offered to black-owned small enterprises

• Critical Infrastructure Programme (CIP) that covers between 10% and 30% of the total development costs of qualifying infrastructure

• Co-operative Incentive Scheme, which is a 90:10 matching cash grant for registered primary co-operatives

• Sector Specific Assistance Scheme, which is a reimbursable 80:20 cost-sharing grant that can be applied for by export councils, joint action groups and industry associations.

A lot of emphasis is placed on the potential role of small, medium and micro enterprises in job creation and a number of incentives are designed to promote the growth of these businesses. These include:

• Small Medium Enterprise Development Programme (SMEDP)

• Isivande Women’s Fund

• Seda Technology Programme (Stp)

Seda is the Small Enterprise Development Agency an agency of the Department of Small Busine ss Development that exists to promote SMMEs.

The Export Marketing and Investment Assistance (EMIA) Scheme includes support for local businesses that wish to market their businesses internationally to potential importers and investors. The scheme offers financial assistance to South Africans travelling or exhibiting abroad as well as for inbound potential buyers of South African goods. ■

Department of Trade, Industry and Competition: www.thedtic.gov.za

Industrial Development Corporation: www.idc.co.za

Invest Durban: www.invest.durban

Manufacturing Competitiveness Enhancement Programme (MCEP): www.mcep.co.za/

South African government incentive schemes: www.investmentincentives.co.za

Trade & Investment KwaZulu-Natal: www.tikzn.co.za

Macadamia nuts are spreading.

Macadamia nuts have been trending in South Africa for nearly a decade, but the focus has been on the fertile growing areas of Limpopo and Mpumalanga provinces. No longer.

The hot subtropical climate of the KwaZulu-Natal South Coast is perfect for the cultivation of macadamias and farmers in the area are increasingly starting to switch from bananas.

The Kwa-Natal Banana company, which counts among its members farmers responsible for 80% of banana production by volume on the KZN South Coast, reports that most farmers have planted at least part of their farms with macadamias. The chairman of the company, James Miller, has converted half his farm to the nut.

Fertiliser costs for bananas have risen because of Russia’s war with Ukraine and there is increasing competition from countries like Mozambique and Swaziland. Although macadamias are not as labour intensive, they do require a higher level of skill among the workforce.

The global market for macadamias, which is expected to keep growing at an annual compound growth rate of 11.2% to 2032, was valued at R28.7-billion in 2022 (International Nut and Dried Fruit Council).

The South Coast Tourism and Investment Enterprise (SCTIE), with a head office in Port Shepstone, has been formed to attract investment and position the KZN South Coast region as a prime tourism destination.

SECTOR INSIGHT

Tongaat Hulett’s business rescue process continues.

Regarding macadamias, Phelisa Mangcu, CEO of SCTIE, says, “The area is already renowned for its banana production and the growth of the macadamia nut sector is bringing with it job creation and investment opportunities, with the domestic and international export markets primed for these quality-grown products.”

Of KwaZulu-Natal’s 6.5-million hectares of agricultural land, 18% is arable and the balance is suitable for the rearing of livestock. The province’s forests occur mostly in the southern and northern edges of the province.

The coastal areas lend themselves to sugar production and fruit, with the north being particularly well suited to subtropical fruits. KwaZulu-Natal produces 7% of South Africa’s citrus fruit.

The Coastal Farmers Cooperative represents 1 400 farmers. TWK is a R6-billion operation that originated in forestry but which is now a diverse agricultural company with seven operating divisions. It has 19 trade outlets in the province and 21 in Swaziland

and Mpumalanga.

Beef originates mainly in the Highveld and Midlands areas, with dairy production being undertaken in the Midlands and south. The province produces 18% of South Africa’s milk.

KwaZulu-Natal’s subsistence farmers hold 1.5-million cattle, which represents 55% of the provincial beef herd, and their goat herds account for 74% of the province’s stock.

The Midlands is also home to some of the country’s finest racehorse stud farms. The area around Camperdown is one of the country’s most important areas for pig farming. Vegetables grow well in most areas, and some maize is grown in the north-west.

Enterprise iLembe, the development arm of the iLembe District Municipality, is looking for investors to further develop an agro-processing hub near the King Shaka International Airport and Dube TradePort.

SA Canegrowers Association (SACA) has announced a five-year, R1billion, commitment to the funding of transformation initiatives.

There are approximately 21 000 small-scale farmers in the province, many of whom are involved in programmes with the bigger production companies or are affiliated to SACA. In January 2024, SACA paid out about R175-million for the benefit of smallscale farmers. SA Canegrowers represents 23 866 growers and is responsible for the production of 18.9-million cane tons.

In the same month, the creditors of the troubled Tongaat Hulett Limited agreed to the business rescue plan put forward by the Vision Consortium. With the group’s CFO, Rob Aitken, appointed as interim CEO and a clear plan for the future, hopes were raised that the huge company that has played a major role in sugar industry for more than 100 years would soon be back on its feet. But then an urgent court

Milk Producers Organisation: www.mpo.co.za

SA Canegrowers Association: www.sacanegrowers.co.za

South African Sugar Association: www.sasa.org.za

South Coast Tourism and Investment Enterprise: www.investkznsouthcoast.co.

application was brought against the plan and a court also found that the company was liable for its commitments under the Sugar Act and the Sugar Industry Agreement. This included fees owed to the South African Sugar Association (SASA).

In 2022 seven former Tongaat Hulett senior executives appeared in court on charges of fraud for allegedly backdating sales agreements of the company’s property division to score better bonuses.

The sugar industry itself faces many challenges, not least the imposition of a sugar tax and imports from countries such as Brazil, India and Thailand. Diversification is vital for the future and power generation will be an important part of that. Neither of the Big Two companies relies exclusively on South African sugar earnings: the troubled Tongaat Hulett has a big property portfolio and Illovo draws most of its profit from operations elsewhere in Africa.

A start has been made on tackling the many challenges faced by the sugar industry: the Sugarcane Value Chain Master Plan 2030 has been signed by two national government ministers and various sector participants. Of the 10 443 farmers who supply Tongaat Hulett, 94% are smallscale farmers. The Illovo SmallScale Grower Cane Development Project used 119 local contractors to develop the fields of 1 630 new growers on 3 000ha.

The Sugar Terminal at Maydon Wharf, Durban, serves 11 mills and can store more than half-a-million tons of sugar. It also has a molasses mixing plant. ■

Optimising energy in paper and pulp.

Alot of energy is needed to create paper and pulp and companies are looking for better ways of doing things. Many companies are working to improve efficiencies in their production processes but a focus on steamgeneration efficiencies and optimisation is the speciality of Associated Energy Services (AES), which operates and maintains equipment in the steam and boiler sector.

In the South Durban Basin where there are several large paper companies, emissions regulations put in place by the eThekwini Municipality are having an effect on pollution levels. As Dennis Williams, Commercial Director at AES explains, “The municipality understood that, with an economic incentive, this becomes a selfregulating mechanism. They stipulated that, when applying for licences for new boilers, facilities had to be operated by a specialist energy plant operator.”

AES is investigating the uses to which a range of by-products, pictured, can be put. A particular by-product of the tissue production process, high in both moisture and fibre, has been identified as having energy value.

One of the most important drivers of the packaging industry is the growth of online shopping. Mondi, a global packaging and paper company with a significant presence in KwaZulu-Natal, has released its “Fifth Annual Mondi eCommerce Report”.

Among the findings of this global report are that a quarter of shoppers are buying online at least once a week and fashion is still number one for online purchases. Importantly for packaging companies, 88% of the 6 000 people surveyed said they valued protective packaging and many considered recyclability important. Almost half of the audience said they would not shop again with a brand if the packaging did not meet expectations.

Investments by Mondi into its Richards Bay mill have expanded the number of products that it can offer and also improved environmental outcomes. The two main products are Baycel, a premier grade bleached hardwood pulp made from 100% eucalyptus fibre, and Baywhite, a white top kraft linerboard. Both originate from certified responsibly managed forests. Mondi’s Merebank Mill produces a range of office paper products including the well-known brand, Mondi Rotatrim.

Customers want sustainability in packaging.

Nampak produces crêpe paper at Verulam and Rafalo produces tissue paper. SA Paper Mills is another paper producer. Mpact has plastics and paper operations and does a lot of recycling.

ONLINE RESOURCES

Forestry South Africa: www.forestry.co.za

Paper Manufacturers Association of South Africa (PAMSA): www.thepaperstory.co.za

South African Institute of Forestry: www.saif.org.za

Sappi has 19 production facilities on three continents. The Sappi Saiccor mill 50km south of Durban is the world’s biggest manufacturer of dissolving wood pulp. Typek office paper is made at Sappi’s Stanger Mill. Sappi Southern Africa has concluded a 175GWh per annum renewable energy Power Purchase Agreement (PPA) with Enpower Trading. ■

According to Statistics SA’s 2021 report on food security and hunger, out of almost 17,9 million households in South Africa, almost 80% reported inadequate access to food, and 15% and 6% reported inadequate and severe access to food, respectively. The country’s unemployment rate was recorded at 32,9% in the first quarter of 2023, one of the highest unemployment rates in the world. During the COVID-19 pandemic, unemployment peaked at 35,3%.

To alleviate these challenges, in 2020, Mondi Zimele established an Agriculture SMME programmme as part of a broader initiative that provides technical and business support to emerging farmers in communities where Mondi and SiyaQhubeka Forests (SQF) operate in Zululand, northern KwaZulu-Natal.

Mondi Zimele thus supplies farmers with technical farming support, including seedlings in the early stages of the programme, business support and financial management training. The programme has been implemented in Zululand, but expansion to other close-by communities is planned.

Mondi Zimele’s Agricultural SMME Programme has supported 122 farmers, which includes 17 SMMEs constituted by 11 co-operatives and six individual farmers since it was established. Over 1 098 households have benefitted. About 320 permanent and seasonal jobs have been created, and approximately R2 million in revenue has been generated since the programme’s launch.

The critical success factor has been the facilitation of formal markets, with exceptional support from local retailers, fresh produce markets, and a vision of formalising supply partnerships with food manufacturers. All the farmers have grown exponentially and are given equal opportunity to supply some of the biggest retailers in South Africa.

Bongile Bho of Bongile Bho

Trading and Projects said that Mondi Zimele has become like family to her. “My journey wasn’t easy. Mondi Zimele helped me with knowledge to be the independent farmer I am today.”

Bongile began by selling her produce at the local bus stations; now she supplies Spar and Food Lovers Market.

Eva Biyela of Imahlobo Co-

operative in Nzalabantu Reserve said that Mondi Zimele has provided them with business, sales, financial and farming support. “They have been instrumental in teaching us the financial and business side of farming; to record everything that coming in and what’s spent on business needs like chemicals and seeds, so we know how much profit we make individually.”

Mtubatuba-based Lizwi Dube of Ezemvelo Fresh Produce said: “The training sharpened us more than I can express, especially in communicating with retailers and selecting the best produce to send to market. We are supposed to control the market by supplying the best quality in and out of season. Mondi Zimele provides us with the technical know-how.”Dokodweni Farming’s Sifiso Nkwanyana said that Mondi Zimele helped him install a borehole for his farm, which now supplies fresh produce to Spar and Pick ’n Pay.

The Fakude Family owns and runs the Mtolo Farming and Produce in KwaMthethwa. They would like to thank Mondi and Mondi Zimele for extending their possibilities. “Before we started this business, we didn’t have any networking programmes or training. Mondi Zimele helped us when we wanted to expand and obtain necessary information and knowledge to help maintain our business and ensure it supplies what customers need.

Emerging Zululand farmers who want to join can send their proposals, with pictures of their current operations, to their local traditional authority, which sits on the Mondi Liaising Forum. After a comprehensive assessment, the chiefs submit them to Mondi’s Land Department to determine if they are at the subsistence or semicommercial phase. If all criteria are met, Mondi Zimele will get on board and support them accordingly.

Afrimat has acquired Lafarge.

In April 2024 Afrimat’s acquisition of Lafarge finally won the approval of the Competition Tribunal.

Afrimat has been following a diversification strategy in recent years, especially into mining, but the Lafarge transaction is something of a return to its roots, which lie in quarrying and aggregates. Both companies have a strong KwaZulu-Natal presence.

The fly-ash and grinding plants of Lafarge give Afrimat access to more downstream operations while the cement kilns provide another income stream. The assets will be housed within Afrimat’s Construction Materials division.

Although mining has been pursued in South Africa for many years, there are some experts who feel that the country’s potential has only begun to be tapped. In order to provide better and more detailed data about what lies beneath the surface, the Council for Geoscience (CGS) has embarked on a multi-year Integrated and Multidisciplinary Geoscience Mapping Programme (IMMP) of the country.

The process is not only about finding new mineral resources but preliminary findings, especially in the kind of minerals that the world needs to help it switch to cleaner energy processes, have been encouraging and a stated goal is to secure a minimum of 5% of the global exploration expenditure. The multidisciplinary onshore geoscience mapping is being done at 1:50 000 scale and is providing data on groundwater, geo-environmental matters and geohazards. KwaZulu-Natal has had more than its fair share of floods and land washed away in recent times, so the research is relevant.

A project to extend the life-of-mine of an anthracite coal mine in a rural community north of Richards Bay will go ahead after several visits to high courts.

Council for Geoscience: www.geoscience.org.za

National Department of Mineral Resources: www.dmr.gov.za

SECTOR INSIGHT

Detailed mapping is revealing new resources.

Richards Bay Minerals (RBM), a subsidiary of the Rio Tinto Group, has resumed operations at its mineral sands plant and refinery but has not yet committed to continuing to invest in a major mine-life extension. The main products of the RBM mine are zircon, rutile, titania slag, titanium dioxide feedstock and high-purity iron.