A truly smart city, Durban, KZN, South Africa seamlessly combines an innovative business environment with an exciting, contemporary lifestyle.

Connecting continents, here you will find Africa’s busiest port, the top ranking conferencing city and the home to the continent’s very first Aerotropolis. Boasting world-class infrastructure, manufacturing and industrial concentration that is constantly evolving, isn’t it time to join this progressive society rich in investment opportunities?

…We can help you make it happen, now. web: invest.durban

Tel: +27 31 311 4227 Email: invest@durban.gov.za

Foreword 5

A unique guide to business and investment in South Africa.

An economic overview of South Africa 8

South Africa has the minerals that the green economy needs.

Provinces of South Africa 12

A snapshot of South Africa’s nine provinces.

Partnerships show the way for Special Economic Zones 18

Collaboration between the private sector and government and its agencies is paying off in eight provinces.

Citrus exports have finally made it to China.

Mining 46

Platinum’s role in green hydrogen is a boon for miners.

Infrastructure for carrying newly-generated power is a priority.

The Central Energy Fund has become a shareholder in a Free State gas project.

South Africa is investigating how best to use its groundwater.

A huge bridge in the Eastern Cape is an engineering challenge.

52

62

64

The Durban International Convention Centre (Durban ICC) prides itself on being leading venue for meetings, business events, conferences and exhibitions on the African continent. However, this is not their own opinion, but rather the overwhelming feedback received from their clients who have voted it in the top 1% of Convention Centres worldwide, as well as “Africa’s Leading Meetings and Convention Centre” no fewer than 17 times!

The Durban ICC is a versatile venue of enormous dimensions, flexible enough to meet any need, no matter how extraordinary. The Centre offers the largest column-free, multipurpose event space on the African continent. International and national conventions, exhibitions, sporting events, concerts and special occasions of every kind can be accommodated. Flexibility and versatility are key factors in the design of this state-of-the-art, technologydriven Centre. The Centre also offers a range of innovative solutions such as Live-streaming events, Remotepresentation events, Hybrid events, and Video-on-Demand.

The Durban ICC’s highly experienced and friendly team will ensure that your event is seamlessly executed giving you complete peace of mind. Providing exceptional customer service remains the heartbeat of the Durban ICC, striving to ensure that every delegate who walks through

the five-star facility has a memorable experience.

Delegates visiting the Centre can look forward to superb standards of culinary excellence and hospitality. As part of the Durban ICC’s gourmet evolution over the past decades in the industry, they are completely reinventing their culinary offering in order to showcase some of Durban’s authentic African Cuisines. Furthermore a wide range of new innovative packages have been designed to meet the unique needs of each target market, at the best possible rates.

Demonstrating its commitment to quality, the Durban ICC is five-star graded by the Tourism Grading Council of South Africa and maintains its ISO9001, ISO14001 and ISO22000 certifications ensuring the highest international standards in Quality Management, Environmental Responsibility, Food Safety and Health and Safety.

The DURBAN ICC offers you first-world convenience and a proudly African meetings experience. The Centre is fully Wi-Fi enabled and connectivity is complimentary to its delegates and guests.

• Located in Durban, known as South Africa’s entertainment “playground”.

• Durban International Convention Centre (Durban ICC) comprised of the Durban ICC Arena and the Durban Exhibition Centre.

• Voted “Africa’s Leading Meetings and Conference Centre” by the World Travel Awards no fewer than 17 times and continuously strives to deliver excellent service

• Largest flat floor, column-free multi-purpose event space in Africa.

• Ranked in the world’s Top 15 Convention Centres by the International Association of Congress Centres (AIPC).

• The Centre is located 30-minutes from the King Shaka International Airport and over 3,600 Hotel rooms are within a 10-minute walk of the Centre.

Manufacturing 66

Innovation and expansion are happening in textiles.

Construction and property 69 The renewable energy sector has opened up new work workstreams.

Transport and logistics 70 The value of goods transported along the N3 continues to grow.

Tourism 72 Swiss investment may underpin expansion.

ICT 74 Government’s latest mobile contract is shared by four companies.

Banking and financial services 75 African Bank is on the acquisition trail.

Development finance and SMME support 76 Expanding small business has become big business.

ABOUT THE COVER: Main picture: Sasol’s octene plant at Secunda is a major contributor to the chemical sector, Sasol. Bottom left and then left to right: Renergen has started delivering the country’s first liquified natural gas (LNG) to Ardagh Glass Packaging & Ceramic Industries, Renergen; The Tsitsikamma Community Wind Farm is one of many such facilities in the Eastern Cape, Cennergi; The Kruger National Park is a superb tourism asset, Ugurhan/iStock by Getty Images; Anglo American unveiled a huge truck powered by a hybrid hydrogen fuel cell in 2022, Anglo American; Impala Platinum is a major producer and refiner of platinum group metals with operations in two South African provinces and two other countries, Implats.

A unique guide to business and investment in South Africa.

Welcome to the 11th edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by an e-book edition at www. southafricanbusiness.co.za.

A special feature in this journal focusses on the importance of partnerships as the way forward for the country’s growing number of Special Economic Zones. There are now SEZs in eight provinces and collaboration between the private sector and government and its agencies is proving a crucial element in pursuing the goal of industrialising the South African economy. These zones intended as catalysts for economic growth in established sectors and in stimulating new industries.

Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provinces. The fact that South Africa’s law-enforcement agencies are arresting people alleged to have been involved in state capture and the Reserve Bank has started freezing assets in other matters leads the national overview because business can’t function properly without the rule of law.

South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. The e-book editions can be viewed online at www. globalafricanetwork.com. These unique titles are supported by a monthly business e-newsletter with a circulation of over 35 000. Journal of African Business joined the Global African Network stable of publications as an annual in 2020 and is now published quarterly. ■

South African Business is distributed internationally on outgoing and incoming trade missions, through trade and investment agencies; to foreign offices in South Africa’s main trading partners around the world; at top national and international events; through the offices of foreign representatives in South Africa; as well as nationally and regionally via chambers of commerce, tourism offices, airport lounges, provincial government departments, municipalities and companies.

Member of the Audit Bureau of Circulations

COPYRIGHT | South African Business is an independent publication published by Global Africa Network Media (Pty) Ltd. Full copyright to the publication vests with Global Africa Network Media (Pty) Ltd. No part of the publication may be reproduced in any form without the written permission of Global Africa Network Media (Pty) Ltd.

PHOTO CREDITS | Air Liquide; Atlantis SEZ; Caspir Camille Ruben on Unsplash; Cennergi Services; Concor; Citrus Growers’ Association of South Africa; CSIR; De Beers; Defy; Department of Trade, Industry and Competition (the dtic); Dipuno Fund; Heineken; Lanzerac Hotel;

Global Africa Network Media (Pty) Ltd

Company Registration No: 2004/004982/07

Directors: Clive During, Chris Whales

Physical address: 28 Main Road, Rondebosch 7700

Postal address: PO Box 292, Newlands 7701

Tel: +27 21 657 6200 | Fax: +27 21 674 6943

Email: info@gan.co.za | Website: www.gan.co.za

ISSN 2221-4194

Mercedes-Benz SA; Raubex; Renergen; SA Investment Conference; Sappi; Sun International; Stadio; Tetra Pak; Ubank; Kevin Wright/Vedanta Zinc International; John Young.

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd, has used all reasonable efforts to ensure that the information contained in South African Business is accurate and up-to-date, the publishers make no representations as to the accuracy, quality, timeliness, or completeness of the information. Global Africa Network will not accept responsibility for any loss or damage suffered as a result of the use of or any reliance placed on such information.

South Africa (SA) has the most industrialised economy in Africa. It is the region’s principal manufacturing hub and a leading services destination.

SA is the location of choice of multinationals in Africa. Global corporates reap the benefits of doing business in SA, which has a supportive and growing ecosystem as a hub for innovation, technology and fintech.

SA has a progressive Constitution and an independent judiciary. The country has a mature and accessible legal system, providing certainty and respect for the rule of law. It is ranked number one in Africa for the protection of investments and minority investors.

The African Continental Free Trade Area will boost intra-African trade and create a market of over one billion people and a combined gross domestic product (GDP) of USD2.2-trillion that will unlock industrial development. SA has several trade agreements in place as an export platform into global markets.

SA is endowed with an abundance of natural resources. It is the leading producer of platinum-group metals (PGMs) globally. Numerous listed mining companies operate in SA, which also has world-renowned underground mining expertise.

SA has a sophisticated banking sector with a major footprint in Africa. It is the continent’s financial hub, with the JSE being Africa’s largest stock exchange by market capitalisation.

A massive governmental investment programme in infrastructure development has been under way for several years. SA has the largest air, ports and logistics networks in Africa, and is ranked number one in Africa in the World Bank’s Logistics Performance Index.

SA has a number of world-class universities and colleges producing a skilled, talented and capable workforce. It boasts a diversified skills set, emerging talent, a large pool of prospective workers and government support for training and skills development.

SA offers a favourable cost of living, with a diversified cultural, cuisine and sports offering all year round and a world-renowned hospitality sector.

The appearance of alleged fraudsters in court bodes well for the rule of law, a prerequisite for attracting investment. South Africa has the minerals that the green economy needs.

By John YoungWhen the accused in the Transnet fraud and corruption case appeared in a specialised commercial crimes court in October 2022, there was not enough room in the dock for the 11 accused. The first row of the public benches had to be used to fit the former staff members and their alleged accomplices to face more than 50 counts of fraud and corruption.

In the same month, the South African Reserve Bank seized what it understood to be former Steinhoff CEO Markus Jooste’s assets, including his house in Hermanus and the Stellenbosch wine estate and hotel, Lanzerac. Given the nature of these things, the ownership of the hotel is not entirely clear (it involves entities registered in the British Virgin Islands) but the broad strokes of the bank’s actions are clear – it intends getting to the bottom of the accounting scandal that led to losses for investors which may amount to R200-billion.

In 2021 ex-president Zuma’s refusal to appear before the Zondo (state capture) commission led to him spending time in jail. His trial on substantive corruption charges lies ahead.

For the chances of a South African economic recovery, these events are seminal. The era of state capture will take time and forensic effort to unravel, but the fact that trials are happening – and that two of the Gupta brothers were arrested and denied bail in Dubai – means that the country’s National Prosecuting Authority seems to be on track again after itself being buffeted by disruptive forces.

That the Reserve Bank is doing its bit to rein in the private sector must also be welcomed by businesses and investors who know that economies can only grow if there is trust and respect for the rule of law.

Dutch brewing giant Heineken has signalled some confidence in the South African economy

with its decision to purchase Distell for a reported R38.4-billion. Heineken already runs (and has expanded) the Sedibeng brewery in southern Gauteng and announced its intention to take a majority share in its regional partner, Namibia Breweries.

Distell brands such as Savanna, Three Ships Whisky, Klipdrift and Amarula will give the expanded company a much more diverse portfolio and position it for a drive into other African markets.

Speaking to the Sunday Times after the release of Distell’s annual results in August 2022, Distell CEO Richard Ruston highlighted the economic factors that the country has to get right for the economy to thrive: “macroeconomic stability, policy certainty and the big infrastructure and energy initiatives”.

One institution that the state-capture plotters never succeeding in getting their hands on was the state Treasury, although there was one fraught weekend in December 2015 when it was touch-and-go.

With the Reserve Bank also having managed to preserve its independence (and now showing some muscle in the Jooste saga), the first two items highlighted by the Distell CEO –macroeconomic stability and policy certainty –at least have a solid basis on which economic planners and politicians can build.

And a very positive element is that virtually everyone agrees that big infrastructure and energy initiatives are what the country needs. Quite what, how and when are still being debated, but at least the need is agreed on.

From government’s side, there is an initiative to coordinate efforts with regard to infrastructure. In 2020, Infrastructure South Africa (ISA), a programme within the Ministry of Public Works and Infrastructure, was established.

ISA is headed by Dr Kgosientsho Ramokgopa and it reports to the Presidential Infrastructure Coordinating Commission (PICC) Council, chaired by President Cyril Ramaphosa. The body is intended as the single point of entry for accelerated infrastructure investment, with a

Dutch brewer Heineken, which runs a brewery in Sedibeng, has bought Distell. Credit: Heineken

particular focus on both public and private sector social and economic infrastructure projects.

An excellent programme exists to procure the energy that South Africa needs to expand the economy, the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). The programme has suffered one unwarranted interruption since its introduction in 2012, but generally it has delivered what it was intended to deliver, cheaper, greener power.

In Round Five of the REIPPPP, the cheapest solar generation cost was 37.5c/kWh while the best wind cost was 34.4c/kWh. These represent remarkably low costs and are lower by an order of magnitude than the prices that were quoted when the programme began a decade ago.

When President Ramaphosa announced that private power investors could create up to 100MW of power without having to wait for licensing, he potentially opened up a path to growth, a path that has been constrained for some time by the limitations of the national utility, Eskom.

Eskom’s inability to provide enough electricity to power the economy (and its huge debt) rank as the biggest risks to the South African economy. Opportunities for private consortiums are expanding and every window of the REIPPPP

has been oversubscribed so there is an appetite to enter the South African energy market.

Eskom’s unbundling will be another spur to growth. The legal separation of transmission is the first step, with the other two elements, generation and distribution, to follow. The idea is not to privatise the entities but to find private partners and to allow for competition within the various fields.

The R130-billion pledged at COP26 by the EU, the US, Germany, France and the UK to assist South Africa’s transition from oil and coal to greener technologies is not straightforward; it comes as a mixture of grants, risk-sharing instruments and concessional finance but it will allow South Africa to fund projects that will help the country to move away from fossil fuels without further stretching Eskom’s precarious finances.

The mining sector is also paying close attention to the world’s shifting priorities in terms of how to power the economy: commodities attracting the most attention are those which have the potential to power the green economy, platinum group metals (PGMs) and chrome among them. In August 2021, South African mineral exports were 44% higher than the year before. Covid obviously had a lot to do with that figure, but R166.5-billion still represented a good return.

Although gold mining is declining in volumes (even while prices rise), the major investment of Vedanta Zinc International in a project in the Northern Cape and Sibanye-Stillwater’s

acquisition drive in the PGM sector are significant economic drivers. De Beers’ investment in its Limpopo diamond mine, Venetia, will significantly expand that facility’s life.

Coal and iron ore continue to be exported in large volumes through the Richards Bay Coal Terminal on the east coast and the Port of Saldanha on the west coast.

The agricultural sector fared fairly well during the Covid-19 lockdown. Although sectors like wine suffered badly, a reported increase in maize exports, as well as greater international demand for citrus fruits and pecan nuts, helped the industry expand by 15% (StatsSA). However, since Covid, there has been the Russian invasion of Ukraine, which has not only disrupted markets for South African produce but upset logistics chains.

Grain crops such as maize, wheat, barley and soya beans are among the county’s most important crops. Only rice is imported. Wine, corn and sugar are other major exports.

Basing economic growth on a devaluing currency is not always the best long-term method of boosting economic growth, but high-value agricultural exports and increased numbers of high-spending international tourists hold some promise for helping to get the South African economy back on a growth path. Horticulture in particular is seen as holding great potential not only for increased earnings, but for creating jobs. South Africa’s traditional strength in minerals still holds good. ■

Travellers should prepare to be astounded by the natural attractions and experiences that are on offer in Mpumalanga. It is South Africa’s most easterly province, endowed with an extraordinary richness of natural beauty from canyons and waterfalls and with scope for a huge diversity of adventures and experiences ranging from encounter-rich game drives to paragliding. Mpumalanga offers a wide array of activities for the active tourist, ranging from abseiling to white-water-river rafting, with fly-fishing, paragliding, mountain biking, bungee jumping, hiking, 4x4 trails and many outdoor adventure activities in between.

Mpumalanga is undoubtedly the ultimate destination in terms of wildlife experience. The Kruger National Park, Manyeleti, Loskop Dam and numerous private game reserves dotted throughout the region offer an exhilarating experience that brings visitors closer to nature. Mpumalanga boasts a conservancy area that is rich with diverse flora and fauna.

The Panorama Route offers spectacular landscapes with attractions like the Blyde River Canyon (third-largest in the world and known as a “green canyon” because of its subtropical vegetation, pictured). The province also boasts majestic waterfalls and high-altitude scenic drives leading to attractions like God’s Window, Bourke’s Luck Potholes and the Three Rondavels.

Mpumalanga’s rich heritage is still largely unexplored but more and more visitors are being exposed to fascinating

history. The many heritage sites in the area include the Samora Machel monument near Mbuzini and the Barberton Makhonjwa Mountains World Heritage Site (pictured), boasting rock formations dating back more than 3.5-billion years. Other sites not to be missed are the mining village of Pilgrim’s Rest, the Highveld Heritage Route (which abounds with adventurous tales from history), the stone circles of Mpumalanga and Goliath’s footprint to name just a few. Mpumalanga is rich in culture and boasts the Swazi, Ndebele and Shangaan people with icons like Dr Esther Mahlangu who has managed to preserve, package and export the vibrant geometric art of the Ndebele globally.

Bird watchers can have a glimpse of more than 500 different birds endemic to the Kruger National Park or the town of Chrissiesmeer, the centre of South Africa’s own Lake District where four river systems start their journeys across the country. The small tourist town of Dullstroom is referred to as South Africa’s trout-fishing mecca. Mpumalanga is an ideal sporting destination with several world-class golf courses and the Mbombela Stadium that was built for the FIFA World Cup in 2010 and has subsequently hosted international football and rugby matches. Get off the beaten track and explore the many other tourism offerings of the Mpumalanga Province.

For more information:

Email: info@mtpa.co.za and reservations@mtpa.co.za Website: www.mpumalanga.com

Facebook: Mpumalanga Tourism and Parks Agency | Twitter: @Mtpatourism | Instagram: @mpumalangatourism

A South African province that has everything a tourist could want.

A South African province that has everything a tourist could want.

Capital: Kimberley

Capital: Cape Town

Capital: Kimberley

Main towns: Douglas, Upington, De Aar, Port Nolloth, Colesberg

Main towns: Douglas, Upington, De Aar, Port Nolloth, Colesberg

Population: 1 185 600 (2015) Area: 372 889km² (30.5% of South Africa)

Population: 1 185 600 (2015) Area: 372 889km² (30.5% of South Africa)

Premier: Dr Zamani Saul (ANC)

Premier: Dr Zamani Saul (ANC)

Key sectors: Agriculture, mining, renewable energy, astronomy.

Key sectors: Agriculture, mining, renewable energy, astronomy.

Infrastructure: Upington Industrial Park, Sol Plaatje University, Vaalharts Irrigation Scheme, Square Kilometre Array telescope project, Namakwa Special Economic Zone.

Notable tourism assets: Six national parks including the Kgalagadi Transfrontier Park, Orange River, spring flower displays, diamond routes.

Infrastructure: Upington Special Economic Zone, Sol Plaatje University, Vaalharts Irrigation Scheme. Notable tourism assets: Six national parks including the Kgalagadi Transfrontier Park, Orange River, spring flower displays, diamond routes.

Capital: Mahikeng

Main towns: Klerksdorp, Rustenburg, Brits, Potchefstroom

Main towns: Klerksdorp, Rustenburg, Brits, Potchefstroom

Population: 3 707 000 (2015) Area: 104 882km² (8.6% of South Africa)

Population: 3 707 000 (2015) Area: 104 882km² (8.6% of South Africa)

Premier: Bushy Maape (ANC)

Premier: Professor Tebogo Job Mokgoro (ANC)

Key sectors: Mining, agriculture, agri-processing, automotive components.

Key sectors: Mining, agriculture, agri-processing, automotive components.

Infrastructure: Hartbeespoort Dam, Pelindaba nuclear research unit, North-West University, Bakwena Platinum Highway.

Infrastructure: Hartbeespoort Dam, Pelindaba nuclear research unit, North West University, Bakwena Platinum Highway.

Notable tourism assets: Sun City, Mmbatho Palms Hotel Casino Convention Resort, Pilanesberg National Park, 18 luxury lodges in Madikwe Game Reserve.

Notable tourism assets: Sun City, Mmbatho Palms Hotel Casino Convention Resort, Pilanesberg National Park, 18 luxury lodges in Madikwe Game Reserve.

Main towns: Stellenbosch, George, Plettenberg Bay, Beaufort West, Oudtshoorn, Worcester, Malmesbury

Capital: Cape Town

Main towns: Stellenbosch, George, Plettenberg Bay, Beaufort West, Oudtshoorn, Worcester, Malmesbury

Population: 6 200 100 (2015) Area: 129 462km² (10.6% of South Africa)

Population: 6 200 100 (2015) Area: 129 462km² (10.6% of South Africa)

Premier: Alan Winde (DA)

Premier: Alan Winde (DA)

Key sectors: Agriculture, agriprocessing, wine and grapes, financial services, manufacturing, tourism, oil and gas, boatbuilding. Infrastructure: Ports of Cape Town, Saldanha and Mossel Bay, Mossgas oil-to-gas refinery, Cape Town International Airport, Cape Town International Convention Centre, Koeberg nuclear power station.

Key sectors: Agriculture, agriprocessing, wine and grapes, financial services, manufacturing, tourism, oil and gas, boatbuilding. Infrastructure: Ports of Cape Town, Saldanha and Mossel Bay, Mossgas oil-to-gas refinery, Cape Town International Airport, Cape Town International Convention Centre, Koeberg nuclear power station.

Notable tourism assets: Table Mountain, Garden Route National Park, Karoo National Park, West Coast National Park, Kirstenbosch Botanical Gardens, Cape Point, V&A Waterfront, Plettenberg Bay, Route 62, Zeitz Museum of Contemporary Art.

Provincial government website: www.northern-cape.gov.za Department of Economic Development and Tourism: www.northern-cape.gov.za/dedat

Provincial government website: www.northern-cape.gov.za Department of Economic Development and Tourism: www.northern-cape.gov.za/dedat

Provincial government website: www.nwpg.gov.za North West Development Corporation: www.nwdc.co.za

Provincial government website: www.nwpg.gov.za North West Development Corporation: www.nwdc.co.za

Notable tourism assets: Table Mountain, Garden Route National Park, Karoo National Park, West Coast National Park, Kirstenbosch Botanical Gardens, Cape Point, V&A Waterfront, Plettenberg Bay, Route 62, Zeitz Museum of Contemporary Art.

Provincial government website: www.westerncape.gov.za Wesgro: www.wesgro.co.za

Provincial government website: www.westerncape.gov.za Wesgro: www.wesgro.co.za

A wide variety of investments are available.

Gauteng:

• Financial and business services

• Information and communications technology

• Transport and logistics

• Basic iron and steel, steel products

• Fabricated metal products

• Motor vehicles, parts and accessories

• Appliances

• Machinery and equipment

• Chemical products, pharmaceuticals

• Agro-processing

North West:

• Mining

• Agriculture and agro-processing

• Tourism

• Metal products

• Machinery and equipment

• Renewable energy (solar)

Northern Cape:

• Mining

• Agriculture and agro-processing

• Fisheries and aquaculture

• Renewable energy (solar, wind)

• Jewellery manufacturing

Western Cape:

• Tourism

• Financial and business services

• Transport and logistics

• ICT

• Agriculture and agro-processing

• Fisheries and aquaculture

• Petrochemicals

• Basic iron and steel

• Clothing and textiles

• Renewable energy (solar, wind)

Free State:

Limpopo:

• Mining

• Fertilisers

• Tourism

• Agriculture

• Agro-processing

• Energy, including renewables (solar)

Mpumalanga:

• Mining

• Tourism

• Forestry, paper and paper products, wood and wood products

• Agriculture and agroprocessing

• Metal products

Eastern Cape:

KwaZulu-Natal:

• Transport and logistics

• Tourism

• Motor vehicles, parts and accessories

• Petrochemicals

• Aluminium

• Clothing and textiles

• Machinery and equipment

• Agriculture and agroprocessing

• Forestry, pulp and paper, wood and wood products

• Motor vehicles, parts and accessories

• Forestry, wood and wood products

• Clothing and textiles

• Pharmaceuticals

• Agriculture and agro-processing

• Mining

• Petrochemicals

• Machinery and equipment

• Tourism

• Leather and leather products

• Tourism

• Renewable energy (wind)

Source: Industrial Development Corporation (IDC); The Case for Investing in South Africa, Executive Summary (South African Investment Conference, 2018).

Source: Industrial Development Corporation (IDC)

SOUTH AFRICAN

SOUTH AFRICAN BUSINESS

The decision by TotalEnergies to submit a production plan for their recent discoveries off the coast of Mossel Bay coincided with the beginning of commercial operations of Tetra4’s natural gas project in the north-eastern Free State. These two events prove that investors can see that the South African resources equation adds up to something worthwhile.

These are exciting times for exploration in South Africa. Both of these projects came about through the licensing authority of Petroleum Agency South Africa (PASA), the agency of national government which reports to the Minister of Mineral Resources and Energy (DMRE). PASA regulates and monitors exploration and production activities and is the custodian of the national exploration and production database for petroleum. Its role was statutorily endorsed in June 2004 in terms of the Mineral and Petroleum Resources Development Act of 2002.

In terms of strategy, the agency actively seeks out technically competent and financially sound clients to whom it markets acreage, while ensuring that all prospecting and mining leases

are for the long-term economic benefit of South Africa. As custodian, PASA ensures that companies applying for gas rights are vetted to make sure they are financially qualified and technically capable, as well having a good track record in terms of environmental responsibility. Oil and gas exploration requires enormous capital outlay and can represent a risk to workers, communities and the environment. Applicants are therefore required to prove their capabilities and safety record and must carry insurance for environmental rehabilitation.

As part of a drive to create certainty for investors, a new bill has been introduced to replace old legislation. The Upstream Petroleum Resources Development (UPRD) Bill provides for greater certainty in terms of security of tenure by combining the rights for the exploration, development and production phase under one permit.

The draft bill was first published in June 2021 and discussions with industry stakeholders are ongoing. Organisations such as the South African Oil and Gas Alliance (SAOGA) will be coordinating responses to present to parliament. Objectives of the bill include:

• expanding black participation

• promoting local employment and skills development

• creating an enabling environment to accelerate exploration and production of South Africa’s petroleum resources.

Sustainable development: balancing development with environmental protection

South Africa has vast gas and oil resources and exploration and the exploitation of these resources has barely scratched the surface. Having to import oil and gas has a serious impact on the country’s balance of payments.

This makes it more difficult to industrialise the country. For the 2021/22 financial year about 50 applications for exploration and production were received but only about 10% of that number were approved.

This is because of very stringent licensing and environmental regulations which must be followed. As PASA CEO Dr Phindile Masangane explains, “We assure South Africans that the slow pace is because we have to make sure that we have a robust system that incorporates all the aspects of licensing but importantly, that the environmental impact assessment is thoroughly undertaken.”

Despite this, planned seismic surveys were halted after opponents of the process went to court in 2021 and 2022. Proponents of continued exploration argue that the seismic process being followed is no

different to that which has been followed in the past, and which is employed all over the world.

Dr Masangane told Bloomberg in August 2022: “As the Petroleum Agency, we acknowledge that South Africa’s upstream oil and gas industry has become litigious.” She noted that local consultation standards are going to be evaluated and improved if necessary. This aspect of the process has been the subject of criticism in the court cases.

Investors are still very interested in the South African proposition, as the TotalEnergies offshore and the Free State project prove. Most offshore project exploration interest tends to come from foreign investors because of the high costs but within South Africa, there is a growing number of local participants. A women and black-owned company, Imbokodo, is making a name for itself as a participant as a shareholder in a number of licensing rounds.

Revised draft regulations related to hydraulic fracking in the gas-rich Karoo region were published by the Department of Forestry, Fisheries and the Environment (DFFE) in July 2022 for public comment. Fracking is a drilling technique that is widely used in other jurisdictions such as the United States, but environmental concerns have been raised. Dr Masangane further told Bloomberg that groundwater and geological studies are being conducted in the biodiversity-rich areas of the Karoo and that once regulations have been finalised, seismic activity will be undertaken to establish which blocks to license.

As part of an attempt to engage in a broader discussion on policy issues, a joint colloquium was held in 2022 on the subject of how to balance South Africa’s energy needs with the country’s climate change commitments. The colloquium, and several online events which prepared for and anticipated the main event, was jointly hosted by the DMRE, the DFFE and PASA.

Dr Masangane is convinced that a balance can be achieved between developing renewables and continuing to exploit the country’s (and the continent’s) oil and gas reserves. She points out that the use of certain fuels for cooking leads to deforestation: “If they were to use gas, whether it is LPG or natural gas for cooking that in itself is decarbonisation because then you arrest the negative impact of deforestation. We must not buy into a false narrative and a false choice. It is possible that we can have a dual strategy.” ■

The goal of industrialising the South African economy is a major objective of the Special Economic Zone programme. These zones (which include Industrial Parks) are intended as catalysts for economic growth in established sectors and in stimulating new industries.

Collaboration between national government (through the Department of Trade, Industry and Competition, the dtic, which oversees the programme), provincial departments and municipalities, economic development agencies and private companies in key sectors is a vital component in making Special Economic Zones work.

As defined by the dtic, Special Economic Zones (SEZs) are geographically designated areas set aside for specifically-targeted economic activities, supported through special arrangements (laws, tax rebates) and systems that are often different from those that apply in the rest of the country.

South Africa’s Industrial Policy Action Plan (IPAP) identifies SEZs as growth engines towards government’s strategic objectives of industrialisation, regional development and employment creation.

The purpose of the SEZ programme is to: expand the industrialisation focus to cover diverse regional development needs; provide a clear, predictable and systemic planning framework

for the development of a wider array of SEZs to support industrial policy objectives; clarify and strengthen governance arrangements, expand the range and quality of support measure beyond provision of infrastructure; and provide a framework for a predictable financing framework to enable long-term planning.

In some parts of the country, an anchor tenant is central to the concept of the approved or proposed SEZ.

In East London, the presence of MercedesBenz South Africa makes the clustering of automotive suppliers in the East London IDZ both logical and cost-effective. The Northern Cape’s proposed Namakwa SEZ is predicated on the huge operations of the existing Gamsberg Zinc Mine (pictured) and the proposed smelter to be built by international investor Vedanta Zinc International.

In eastern Limpopo, the Mining Supplier Park run by mining company Glencore is forming the core around which the Fetakgomo-Tubatse SEZ is being created. Local and district municipalities are investing in basic infrastructure, while the provincial government has allocated staff from its Department for Economic Development, Environment and Tourism to drive the process. The same provincial department has created a stateowned-company to run the Musina-Makhado SEZ in the northern part of the province.

Collaboration between the private sector and government and its agencies is paying off in eight provinces.

The country’s biggest diamond miner, De Beers, is partnering with the local tertiary college, the Venda TVET College, by offering engineering graduates a chance to gain practical experience at its Musina operations. The decision by the college to locate its engineering facility within the SEZ is another example of collaboration.

Part of the value proposition of the Upington Industrial Park is based on the plans of Airports Company South Africa to develop the local airport as a base for storage of aircraft and for maintenance and repairs. The fact that major automotive manufacturers test their cars in the Northern Cape on a regular basis is something that the Northern Cape Economic Development Agency (NCEDA) is promoting as an opportunity for investors.

Mining is at the heart of another planned Northern Cape project, the Kathu IDZ. Big companies such as Sishen Iron Ore Company, Kumba, Assmang and South32 have expressed support and the project has been submitted by the NCEDA to Infrastructure South Africa to be registered as a catalytic project.

The OR Tambo International SEZ (Gauteng IDZ) leverages the advantages of being located at a major transport hub for access to African and international markets. The SEZ’s location within the Ekurhuleni Metropolitan Municipality means that there are also many opportunities for tie-ups with a huge variety of manufacturing enterprises – Ekurhuleni has the country’s densest

concentration of manufacturing operations. An interesting example of inter-government partnership came about in December 2020 when the City of Cape Town transferred general industrial-zoned properties worth R56.5-million to the Atlantis Special Economic Zone Company (SOC) Ltd. In return, the City became a shareholder in the company.

An earlier cooperative agreement between the City of Cape Town and the Western Cape Provincial Government had set out the terms for the transaction once the Atlantis SEZ Company was registered.

The signing of this land agreement meant the ASEZ Company assumed responsibility for the usage, administration and control of the property. The total area of proclaimed land is 118 hectares, of which 25ha has already been developed by five investors. The difficulty was that the other 94ha of land belonged to the City of Cape Town and was subject to various conditions about the rate at which it could be rented out or sold. By incorporating the City of Cape Town as a shareholder, the land was unlocked and the SEZ was in a position to expand.

A few kilometres north of Atlantis, the Saldanha Bay Industrial Development Zone (SBIDZ) has to work hand-in-hand with the Saldanha Bay Municipality (SBM) and the Transnet National Port Authority (TNPA) as it defines its role and expands its offering. As an example of the level of cooperation envisaged for SEZ development, the R3.5-billion first phase of the expansion of the Port of Saldanha is described in an SBIDZ press release as being understood as “a long-term partnership between the government, its institutions and the private sector”.

The press release further explains how the process fits into the national context:

“This transaction model has proven the best way to fund long-term assets in a competitive environment. The SBIDZ has begun the formal process of submitting this project to the Investment and Infrastructure Office in the Office of the Presidency, supported by the National Treasury, for inclusion in the Sustainable Infrastructure Development Symposium (SIDS).” ■

SEZs are located in areas with particular resources and historical sectoral strengths. The relevant SEZ is geared to serve, support and encourage development of those resources and sectors. There are currently 15 Special Economic Zones in eight provinces. Some of the zones are in the process of being officially proclaimed as SEZs.

Province: Limpopo

Name: Musina-Makhado SEZ

SEZ status: Approved

Focus: Light industrial, agroprocessing, metallurgical, mineral beneficiation, solar power

Province: Limpopo

Name: Fetakgomo-Tubatse SEZ SEZ status: Focus: Green energy, hydrogen, mining inputs, mineral beneficiation

Province: Gauteng

Name: Vaal SEZ SEZ status: Focus: Logistics, agriculture and agro-processing, tourism, alternate energy (solar, battery storage, hydrogen)

Province: Gauteng

Name: OR Tambo International Airport (Gauteng IDZ) SEZ status: Focus: Beneficiation of precious metals and minerals sector, light, high-margin, export-oriented manufacturing

Province: Gauteng

Name: Tshwane Automotive SEZ SEZ status: Focus: Automotive, automotive components, manufacturing, export manufacturing

Name: Nkomazi SEZ

SEZ Status: Approved

Focus: Strategic location on Maputo Corridor is major selling point; logistics, agro-processing, manufacturing, nutraceuticals, fertiliser products

Province: Eastern Cape

Name: Coega SEZ

SEZ status: Approved

Focus: Automotive, agroprocessing, aquaculture, energy, metals, logistics and business process services (BPO)

Province: Western Cape

The Musina-Makhado Special Economic Zone is ideally placed to bolster national plans, says CEO Lehlogonolo Masoga, while carrying out an inspiring vision for the region’s economy and people.

Please explain the rationale behind Special Economic Zones. Special Economic Zones (SEZs) are growth engines towards government’s strategic objectives of industrialisation, regional development, employment creation, the improvement of existing infrastructure, skills development and technology transfer by attracting foreign direct investment and strengthening the export of value-added commodities. SEZs are geographically-designated areas set aside for targeted economic and sector-focused activities, supported through special arrangements (that may include laws) and systems that are often different from those that apply in the rest of the country. This is a strategic phenomenon which has transformed economies across the globe by developing major industrial development zones with ripple effects such as the development of new towns and smart cities.

How do SEZs fit into national plans such as the Industrial Policy Action Plan (IPAP)?

Lehlogonolo Masoga has more than 20 years of experience as an administrator and public servant, most recently as Deputy Speaker of the Limpopo Provincial Legislature and MEC for Roads and Transport. He served as the spokesperson for the former LEDET MEC and Minister of Public Administration, the late Mr Collins Chabane. Lehlogonolo holds three Master’s degrees: Governance and Public Leadership (Wits), Development Studies (Limpopo) and an MSc in Leadership and Change (Leeds Beckett University, UK). He has B-Tech HRM from UNISA and a professional diploma in Humanitarian Assistance from the Liverpool School of Tropical Medicine (UK) and is currently a registered PhD candidate in Public Administration.

IPAP recognises the role of industrial parks and Special Economic Zones as strategic vehicles for industrial activities which promote beneficiation and manufacturing. The support which is provided to SEZs in terms of infrastructure, regulatory framework and incentive schemes provides a conducive environment to bolster industrialisation. The IPAP classifies Special Economic Zones into key categories which include Industrial Development Zones, Free Ports, Free Trade Zones and Sector Development Zones.

How does the MMSEZ fit into regional and provincial planning initiatives?

The priorities of the Limpopo Development Plan 2020-2025 and the Medium-Term Strategic Framework include the following:

• Transformation and modernisation of the provincial economy

• Integrated and sustainable socio-economic infrastructure development

• Spatial transformation for integrated socio-economic development

• Economic transformation and job creation through regional integration

These policy priorities reinforce the business case of the MusinaMakhado Special Economic Zone in line with the vision of the provincial

administration. A successful MMSEZ will result in South Africa’s active participation and leadership in the African Continental Free Trade Area (AfCFTA) and the industrialisation strategy of SADC.

The Limpopo Development Plan articulates an inspirational vision about the future as follows: The Limpopo Province of the future will create an environment that is mutually beneficial, where rural living and smart cities coexist in harmony, adopting the future without losing touch with our heritage. The new Limpopo Province will:

• Develop new smart green cities with integrated transport systems.

• Embrace renewable energy to reduce the reliance on fossil fuels.

• Develop and implement new 4IR education systems that can inspire and prepare the youth and adults for the future.

• Evolve businesses to embrace the 4IR and be globally competitive.

• Evolve the provincial economy from being mostly dependent on the primary sectors, to a diverse and inclusive economy, with growth potential to reduce unemployment significantly.

• Have happy, prosperous and connected communities.

• Have new economic infrastructure that can enable Limpopo to leap into the future, such as drone airports to assist in delivering packages to rural areas.

What underpins the geographic spread of SEZs?

During the early 2000s, government adopted the Industrial Development Zones, which were mainly concentrated in the historical economic hubs and coastal regions. The SEZ model recognised a need to harness the country’s economic competitive advantages across the value chains. Our economy boasts various competitive advantages which span across various provinces. This new approach has created an unprecedented opportunity for rural provinces such as Limpopo to participate in this magnificent programme.

What measures are undertaken to encourage investments in SEZs?

The success of a Special Economic Zone is dependent on its capacity to attract and retain

both domestic and foreign direct investment. The secret to unlocking investment lies in the readiness of the infrastructure, packaging of a solid business case, project preparation, marketing and investment promotion strategies.

What collaborations is the MMSEZ engaged in?

When the MMSEZ was officially designated in 2017, among the things that the provincial government had to start preparing for was skills development among the youth who will require new and advanced skills to work in the project. An idea to establish the Vhembe TVET College Musina Satellite Campus was mooted and with the support of Venetia Mine, a start was made. When the college management were looking for a new piece of land to build a proper campus around Musina, an opportunity was identified to relocate the campus into the North Site of the MMSEZ. The beauty of the MMSEZ-VTVET partnership lies in the fusing of skills development and industrial platforms within the same zone. We are pleased with the support provided to this pioneering initiative by both the provincial and national government. This initiative will also form part of the foundation and a seed for the development of a new smart city in Musina.

What is the MMSEZ strategy on SMMEs?

Small, micro and medium-sized enterprises are the lifeblood of any economy to facilitate economic empowerment and job creation. Economic transformation through the empowerment of SMMEs and historicallydisadvantaged individuals has undergone several policy setbacks that threatened the country’s path for economic transformation. Among the first steps undertaken by the MMSEZ SOC to level the playing field for the empowerment of local enterprise and entrepreneurs was the development of an Enterprise Development Strategy, through which local enterprises and entrepreneurs will be prioritised in terms of opportunities presented by the SEZ. They will also receive the necessary support for them to reach their full potential and become the integral part of the MMSEZ ecosystem. ■

Both private and public institutions have committed funds and a mining company is engaged in a partnership.

The M usina-Makhado SEZ (MMSEZ) is intended as a catalyst for massive future investment in the region and support of industrialisation and economic growth.

The MMSEZ has already attracted significant investment from public and private investors and a strong pipeline of further investment is envisaged.

Major investments in infrastructure are being provided by the Provincial Government of Limpopo through the Limpopo Department of Economic Development, Environment and Tourism (LEDET). Of R600-billion pledged to develop infrastructure for the North Site of the MMSEZ over the mediumterm expenditure framework (MTEF), some R39million has been spent to date on engineering work and the 2022/23 financial year will see a further allocation of R200-million for items such as security, water and electricity infrastructure.

The entity which has been created to run the SEZ, the MMSEZ state-owned-company (MMSEZ SOC), is responsible for coordinating investments and guiding the process towards the realisation and functioning of the Special Economic Zone.

The local Technical Vocational and Educational and Training college, Vhembe TVET College, is

investing in establishing a campus in Musina to complement the development of the SEZ.

A satellite campus was originally established but through a partnership between the MMSEZ SOC and Vhembe TVET the engineering campus will relocate to a site within the SEZ site. De Beers will support the graduates with on-thejob training.

The SEZ will thus be supporting the skills profile of the district and combining skills development and industrial development. Additional investments in student accommodation and retail outlets to support the student population will further enhance the diverse offering within the SEZ.

Having a tertiary college located within the SEZ will form an important first building block towards creating a Smart City in Musina.

The investment value of the 1 000MW Solar Power Plan to be constructed in the SEZ is valued by the provincial government at US$1.5-billion. The project is being undertaken by Huadian Hong Kong Ltd, the company that has signed a Memorandum of Understanding (MoU) with LEDET.

Eskom has started with the inception and scoping report for bulk electricity infrastructure of the MMSEZ, which will connect the power plant to the grid. ■

What is the Musina-Makhado Special Economic Zone?

The MMSEZ is a flagship initiative of the Limpopo Provincial Government. The North Site is wholly owned and operated by the MMSEZ SOC. The South Site is operated by the MMSEZ SOC in partnership with a Chinese operator, Shenzhen Hoi Mor Resources Holding Company Ltd.

The Musina-Makhado SEZ is a flagship initiative of the Limpopo Provincial Government implemented through the Musina-Makhado SEZ SOC in partnership with a Chinese Operator, Shenzhen Hoi Mor Resources Holding Company Ltd. The MMSEZ as an economic development tool aims to promote national economic growth and exports by using support measures in order to attract targeted foreign and domestic investments, research and development (R&D) and technology transfer.

The MMSEZ is a flagship initiative of the Limpopo Provincial Government implemented through the MMSEZ SOC, in partnership with a Chinese Operator, Shenzhen Hoi Mor Resources Holding Company Ltd.

Musina-Makhado SEZ is flagship initiative of the Limpopo Provincial Government implemented through the Musina-Makhado SEZ MMSEZ SOC in partnership with a Chinese Operator, Shenzhen Hoi Mor Resources Holding Company Ltd. The MMSEZ as an economic development tool aims to promote national economic growth and exports by using support measures in order to attract targeted foreign and domestic investments, research and development.

Metallurgy •

The MMSEZ is an economic tool that aims to promote national economic growth and exports by using support measures in order to attract targeted foreign and domestic investments, research and development.

Where is the MMSEZ located?

Limpopo Provincial Government implemented through the Musina-Makhado SEZ SOC in partnership with a Chinese Operator, Shenzhen Hoi Mor Resources Holding Company Ltd. The MMSEZ as an economic development tool aims to promote national economic growth and exports by using support measures in order to attract targeted foreign and domestic investments, research and development. Investment

• Preferential corporate tax

• Building allowance and tax relief

• Employment tax incentive

zone:

•

Investment opportunities outside the zones:

• Real estate

• Retail and hotels

• Schools and airport

•

• Health

• Entertainment

• Musina Dam

The Musina-Makhado SEZ is located in the vicinity of the Beit Bridge Border Post which is one of the busiest ports of entry in SA and an undisputable gateway to the South African Development Community (SADC) countries. The MMSEZ has the potential to become an inland intermodal terminal, facilitated by its anchor along the North-South Corridor, and directly connecting to the country’s major ports through both N1 road and the JohannesburgMusina railway line, for the trans-shipment of sea cargo and manufactured goods to inland destinations and the SADC markets.

• Customs-controlled area tax relief

• Rental space discounts

• Readily available infrastructure

• Sufficient land for greenfield projects

• Access to agricultural and mineral resources

• Easy access to the up-north (SADC) market

• Accessible logistics support for the movement of goods

Stainless Steel Plant

Contact details

Musina-Makhado SEZ SOC 67 411 9192

Musina Makhado SEZ SOC

93 Biccard Street, Polokwane,

Mr Richard Zitha, Executive Investment Promotion

71 391 8188

Cell: +27 71 391 8188

Mr Richard Zitha, Project Executive Cell: +27 071 391 8188 Email: R.Zitha@mmsez.co.za

Email: R.Zitha@mmsez.co.za

Anew Smart City is taking shape in Limpopo Province. It is catalysed by the economic stimulus of the MusinaMakhado Special Economic Zone (MMSEZ). The new Smart City will integrate the towns of Musina and Makhado to become the pre-eminent trade and industrial centre of Southern Africa.

The new Smart City will reignite the rich civilisational heritage of the Great Mapungubwe, Thulamela and Zimbabwe Kingdoms which at their height in 1000AD produced artifacts in gold and traded globally as far as Arabia, India and China. This region will once again rise and become a modernised industrial and global trade hub, building on its heritage and embracing the technology revolution.

The geographic location of the Smart City in the northern part of South Africa bordering Zimbabwe and connecting into the rest of Africa gives it a critical comparative advantage, together with the natural endowments within the surrounds of Musina and Makhado which include high-value agricultural land, mineral resources and functional spatial relationships. If harnessed fully these will help to create a competitive regional economy for South Africa and the continent.

The advantage of the MMSEZ is that it is part of a national economic programme, located within the National Transformation Corridor that links Gauteng with its dynamic economy to the Beitbridge Border Post, one of the busiest ports in Africa.

The goal of the Smart City is transformational. People’s needs and aspirations are at the centre of planning. The foundations are proper sanitation and waste management, 24-hour electricity and water supply, efficient mobility and public transport with a network of wellconnected roads and access to reliable and high-speed telecommunications. The circular and green economy based on reuse, recycle, share, low/zero-carbon footprint meets with the concept of the Smart City. The MMSEZ, working together with all three spheres of government and stakeholders, aims to develop the designated MMSEZ as a catalytic driver for a Smart City which is envisioned to be:

A leading innovative, sustainable and inclusive high-tech Africa gateway city, driven by residents and visionary investment within a prosperous rural-urban integrated region and operating as a highly connected – freight/warehousing/ logistics/transport/retail/ manufacturing – industrial hub supporting the SEZ within a superefficient Gauteng-Limpopo-Zimbabwe economic corridor.

“A leading innovative, sustainable and inclusive high-tech Africa gateway city”

A leading innovative, sustainable and inclusive high-tech Africa gateway cityA Smart City programme is envisaged for northern Limpopo Province, catalysed by the development of

themulti-sector Musina-Makhado Special Economic Zone.

The Board of Directors of Musina-Makhado Special Economic Zone (MMSEZ) recognises and appreciates the immensity of the challenges and attractive opportunities that come with the MMSEZ. We understand the mutual and interdependent relationship between a successful SEZ and our envisaged Smart City. We also acknowledge that the long-term nature of this project and its intergenerational characteristics require long-range planning and short-term execution. It requires human and capital resources that are committed in the long term and resilient enough to withstand the turbulences inherent in these types of projects.

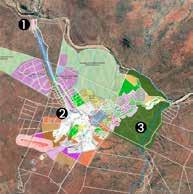

The core triangle of Beitbridge, Musina CBD and Antonvilla (Northern SEZ) will catalyse a region of smartness and development with upgrades to roads and connectivity that will create the Musina-Makhado corridor.

This core triangle will catalyse a region of smartness and development with upgrades to roads and connectivity that will make the Musina-Makhado corridor

As a long-term developmental approach, this will result in a transformed, competitive and spatially integrated regional economy and this will lead to the upliftment and well-being of people living in Vhembe, its neighbouring districts and the Province of Limpopo at large.

The development of the Smart City starts with the Northern SEZ Site of the MMSEZ as a smart precinct, together with the upgrading of the Beitbridge border post and the town of Musina to become an integrated core of the new Smart City. This core triangle will catalyse a region of smartness and development with upgrades to roads and connectivity that will make the MusinaMakhado corridor the fastest-developing area in Limpopo, South Africa and Southern Africa.

The Northern Site of the MMSEZ in Antonvilla will be the first smart precinct in the smart city that will improve the economy and create jobs.

A green industrial estate where one can live, work, play.

Investments into light manufacturing, retail, trade, freight and logistics warehousing, and agro-processing will be sought.

Innovation and incubation of new businesses to work on latest technology in electronics and other industries will be promoted.

The buildings and management of the precinct will use solar energy and conversion of waste to energy to ensure sustainability.

The Smart City Model will be implemented incrementally:

• First step: integrate the Northern Site of the MMSEZ, the Beitbridge border and the Musina town to form the Smart City.

• Second step: upgrade the N1 between Makhado and Beitbridge as part of the Smart City Corridor.

• Third step: promote strategic developments along the N1 Musina-Makhado Smart City corridor.

• Fourth step: renew and regenerate the towns of Musina and Makhado.

• Fifth step: implement the corridors, ensuring connectivity to villages and promote agriculture and tourism, activating the Smart Region.

• Parallel steps: development of roads for connectivity; work on telecommunication coverage; training of communities to use technology in partnership with the institutions of higher learning and through schools; building awareness on zero waste and low-carbon living. The work on the metallurgy complex at the Southern SEZ site will also be undertaken in parallel.

A vibrant partnership with the University of Venda in co-creating the Smart City was launched on 16 September 2021, when the model was unveiled. The next step will be to develop the supply of skills needed for a Smart City and the ongoing operation of the SEZ.

A vision of the emergence of a Smart City in the land between Musina and Makhado energises the directors and staff of the MMSEZ company to perform to the best of their abilities from day to day and from year to year. It is this vision that shines a light on our path to build a platform from which the next generation will derive optimal economic benefits. We continue the relentless pursuit of this vision, while keeping our promise to do all we can to maintain an environment that our children and their children will happily inherit from us. What will emerge between these two northern-most towns of Limpopo province is a Smart City that will offer endless opportunities for all our people. It is a Smart City that will offer business, job, skill development and entertainment opportunities for the people of the Vhembe region, Limpopo Province and the nation. This will be a Smart City we will all be proud of.

Beitbridge border

Musina CBD

Antonvilla (Northern SEZ)

The Northern Site of the MMSEZ in Antonvilla will be the first smart precinct in the Smart City that will improve the economy and create jobs. A green industrial estate where one can live, work, play. Investments into light manufacturing, retail, trade, freight and logistics, warehousing and agro-processing will be sought. Innovation and incubation of new businesses to work on latest technology in electronics and other industries will be promoted. The buildings and management of the precinct will use solar energy and conversion of waste to energy to ensure sustainability.

Mr

Tel: +27 66 174 0798 | 93 Biccard

The Vaal Special Economic Zone (Vaal SEZ) is intended as a catalytic project to boost economic growth and create jobs in the Vaal region.

Heidelberg is the seat of the municipality. Emfuleni in the west is home to the towns synonymous with steel, Vanderbijlpark and Vereeniging and the Sasol Petrochemical complex to the south of Sedibeng in the Free State Province.

By 2030, an industrialised, globally competitive, export-driven regional economy.

Our Mission is our tagline: To Reignite the Birthplace of Industrialisation in South Africa.

The Sedibeng District, host of the proposed Vaal SEZ, comprises three local municipalities and is strategically located both in terms of highways and railways and in relation to three economically-powerful metropolitan municipalities, Johannesburg, Ekurhuleni and Tshwane.

Aconsiderable amount of planning has already gone into the concept which ties in to development goals and frameworks at local, regional and national level.

The three local municipalities which make up the Sedibeng District Municipality are predominantly rural. Midvaal is the most rural of the three local municipalities, with urban development concentrated along routes R59 and R82 in the north-western parts of the municipal area. Midvaal has strong regional linkages to major economic cores.

Lesedi is also primarily rural, with the major urban concentration located in Heidelberg/Ratanda nodes, along the N3 freeway at its intersection with Provincial Route R42, east of the Suikerbosrand Nature Reserve.

• The Vaal SEZ will leverage existing assets and infrastructure

• It will pursue opportunities in the green economy, decarbonisation, hydrogen and net-zero emission sectors

• To become the go-to investment destination

• To be a multi-tier (multiple sites, multiple sectors), anchor SEZ hub, spatially dispersed within the region

• To achieve a seamless, integrated, socially-cohesive society, with sustained economic growth and quality jobs for the people of the Vaal region.

The Vaal SEZ Master Plan was completed at the end of June 2022. Site analyses of secured sites has been completed.

A pipeline of firm investment commitments is being established. Township establishment processes will be initiated for land parcels to service current highpriority investors.

The SEZ designation application will be submitted by the end of October 2022.

Enabling framework

Strong government support, robust legal and regulatory framework. Strong commercial and significant economic and social returns, including incentives and rebates.

Locational benefit

South Africa’s economic hub, sound logistics networks and infrastructure.

Infrastructure services

One-stop shop services and the Vaal SEZ’s Shared Services and investor access to serviced land and funding options.

Management capability

Independent management body, cooperation between dedicated bodies, local, regional and national government.

Sedibeng District Municipality is traversed by extensive national and provincial major railway and road mobility infrastructure: Route N1: the major national north/south freeway linking Musina at the northern border of South Africa to Cape Town in the south Route N3: the major transport link between Gauteng Province and eThekwini, passes through Sedibeng District’s Lesedi Municipality Route N17: the main link between Johannesburg, Secunda, eSwatini and the Richards Bay harbour Route R103: the old Johannesburg-Durban road runs parallel to Route N3

Two land parcels earmarked by the municipality for SEZ development (one of 20ha and another of 149ha). Access to the N3 to allow good connections to Johannesburg and KwaZuluNatal. Three-way collaboration between the Municipality, MTP Aviation Solutions and the Vaal SEZ to widen the SEZ area to include parts of the Heidelberg Aerodrome.

Land has been secured adjacent to the Klipriver Business Park (500ha) with access to the R59 via the R550. Also, 100ha secured next to SA Steel Mill off the Pierneef Road offramp, as well as 9ha in DeDeur, zoned for agricultural purposes and earmarked for agro-procressing. Council has approved the land classification.

The Emfuleni Local Municipality Council has resolved to make two adjoining land parcels available, totalling 697ha. The site is bordered by the N1 highway and is close to the ArcelorMittal factory. This site is also earmarked for the development of a Hydrogen Valley Concept.

Vaal SEZ aims to build on region’s strengths to create sustainable businesses

The Vaal SEZ is to be created within the Sedibeng District Municipality, which already has several attractive assets for would-be investors:

• An existing manufacturing base (eg, Heineken, ArcelorMittal, SASOL, SA Steel Mills) and a history of industrial activity

• Agricultural land available for development

• affordable industrial and commercial land earmarked for development

• Vaal River, tourism

• Vaal Dam, tourism

• Existing university and graduates

• Young population with huge potential

• Skilled artisans

• Excellent rail and road connections

• Proximity to three of South Africa’s largest metropolitan markets, namely Johannesburg, Ekurhuleni and Tshwane

The Vaal region is a historic cluster of capital-intensive and heavilyindustrialised manufacturing which was underpinned by a globally-competitive mining and iron and steel sector.

These experienced a marked decline from the 1990s, but plans are underway to revive the region, using the tried and tested method of creating a Special Economic Zone (SEZ) as a hub for business activity. Where the Vaal SEZ is unique is that various satellite hubs will work out from a central hub like spokes in a wheel, thus exploiting the existing strengths of particular sites and spreading economic benefits across the area more widely.

The Vaal region presents a compellingly unique value proposition of a thriving regional value-adding industrial economy which effectively leverages its comparative locational attributes and resource endowments. In addition to spearheading the revival of the existing industrial manufacturing base, it will also facilitate the creation of new growth and differentiation opportunities which include low-carbon manufacturing, energy, agriculture and agro-processing.

Despite the ongoing challenges that have faced Vaal businesses over the years, it has been found that existing businesses have continued to support communities and explore ways to be more sustainable. Significant investment continues to be made by existing businesses and this bodes well for how the region is viewed by its residents – a vote for the future.

There is a strong case for investors to join and benefit from a green energy-fuelled reindustrialisation of the Vaal region. This will transform this industrial basin into the country’s preeminent hub for low-carbon manufacturing and renewable energy production.

The Vaal SEZ is connected to other national and provincial initiatives in Gauteng. This regional development aims to create linkages and the integration of the host province’s growth strategies with the local economic development strategies of the host municipalities to national economic initiatives.

• High-impact investments into the food, agriculture and agro-industries value chain

• Investment in gateway logistics (air, road, rail, river) to exploit the locational advantages of the Sedibeng District

• Investment in the Blue Economy and the Tourism Sector using the advantages of the Vaal River

• Building a Smart City along the Vaal River to enable SEZ development and to drive urban regeneration

• Building strong local linkages between township/rural economies with the value chains that the Vaal SEZ will develop and strengthen

The cannabis economy is projected to grow quickly.

Land is available for future development.

Land is affordable

Solar and battery storage

The circular economy

The hydrogen economy: aim to be South Africa’s preeminent hub for the hydrogen economy

• Food, beverages, agro-processing and agribusiness

• Agro-processing – plant products and value chains

• Agro-processing – livestock and value chains

• Warehousing and storage – packaging

• Expansion of gateway logistics and infrastructure

• Logistics – exploiting locational advantages

• Formalised relationship with tertiary educational institutions

• Development with a purpose

• Pool of skilled resources for industry

• Training for future skills

• Maintenance of existing assets

• Creating new and sustainable infrastructure to support targeted industrial activities

• The Vaal Dam is a significant asset

Excellent location, resources and incentives combine to make South Africa’s most central province an attractive investment proposition for businesses of all sorts.

Situated in the heart of South Africa and sharing borders with Lesotho and six other provinces, the Free State’s location provides easy access to the main ports of Durban, East London and Gqeberha and is therefore ideal for logistics, manufacturing and agro-processing operations.

The main economic sectors are agriculture, mining and manufacturing. The concentration of large chemical companies in the town of Sasolburg is testimony to the influence of global chemicals and energy company Sasol.

Companies relocating not only enjoy the opportunity to source inputs at competitive prices, but also to benefit from domestic, regional and international markets for their products and services.

There are industrial parks and a Special Economic Zone (SEZ) that are supported by the Department of Trade, Industry and Competition. Industrial parks are situated in Maluti-A-Phofung, Botshabelo and Thaba Nchu.

The Free State’s strengths for inward investment are boosted by:

• openness to business, trade and investment

• abundance of natural resources

• low factory rentals

• Africa’s leading telecommunications network

• incentive packages uniquely developed for Special Economic Zones and industrial parks

• Free State Development Corporation (FDC) support services for priority sectors such as agro-processing and manufacturing

• a large labour pool

• diverse cultures

• competitive land and building costs.

Select investment opportunities include: agriculture and agro-processing; tourism and property development; medical and pharmaceutical

production and distribution; manufacturing; renewable and clean energy and medical tourism.

The Free State Development Corporation (FDC) contributes to the Free State’s economic development through four service delivery pillars: SMME/co-operative funding and support; export-related services; property management; investor services.

FDC services to investors and business include:

• Project appraisal and packaging.

• Promotion and facilitation of investment projects and facilitation of access to finance.

• Providing access to business and government networks and assistance with business retention and expansion.

• Information on statutory requirements, investment advice and assistance with investment incentive applications and business permits.

• • Assisting with the development of local and international markets and facilitating joint ventures/equity partnerships through identification of local partners.

The FDC ovesees 253 commercial properties and 290 industrial sites, which it uses to:

• Facilitate commercial and industrial activity

• Assist new investors looking for suitable premises

• Facilitate SMME development, particularly in rural areas

The substantial property portfolio makes FDC one of the biggest property owners in the province with industrial, residential and commercial properties in excess of 900 000m² situated in the Mangaung Metro and Thabo Mafutsanyana District.

FDC industrial properties are located in

• Thaba Nchu

• Botshabelo

• Industriqwa – Harrismith

• Phuthadithjaba

The main objective of the MAP SEZ is to attract foreign and direct investment and to stimulate the local economy as well as to create meaningful work opportunities for people of the Free State as a whole and in particular the Maluti-A-Phofung region.

The MAP SEZ is nestled on 1 038ha of land which is divided into four precincts that include the crossdocking and container-terminal precincts. The MAP SEZ is a multi-sector processing, manufacturing, engineering, logistics services and transport complex, serving the needs of the upstream value-adding, beneficiation, processing and production service companies operating across sectors and geographic areas in Southern Africa.

A number of incentives are available to ensure MAP SEZ’s growth, revenue generation and international competitiveness. These incentives include:

• 15% corporate tax instead of 28% corporate tax

• Building allowance tax

• Employment incentive tax

Free State Province Center yourself in the heart of South Africa

Free State Province Center yourself in the heart of South Africa

Free State Province Center yourself in the heart of South Africa

Free State Province

Center yourself in the heart of South Africa

From the impressive rock formations of the Golden Gate Highlands National Park to the country’s biggest dam, Gariep Dam, with cultural, historical and adventure experiences in between, the Free State caters to every tourist’s taste.

There are also multiple investment opportunities. The Free State Gambling, Liquor and Tourism Authority (FSGLTA) is doubling up on efforts to attract international tourists and to create new markets domestically through programmes such as “Travelling Differently”.

Tourism infrastructure is being enhanced and new skills taught to prospective employees in the sector. Bloemfontein’s newest investment is the R95-million Premier Splendid Inn.

All of the major hotel brands have a presence in the Free State. Protea Hotels has properties in Bloemfontein, Harrismith and the popular resort town of Clarens while Sun International, the Tsogo Group and City Lodge are well represented. ■ Free