The year 2023 has not been a kind one for the banking sector. We have three prominent American lending institutions, First Republic, Silicon Valley Bank and Signature Bank, all falling one by one, like a pack of cards. To make the matter worse, on March 19, global banking major Credit Suisse had to be rescued from going extinct by its Swiss rival UBS in a rushed deal. The bond category called AT1 has come under the focus now as UBS' takeover has wiped out some $17 billion worth of bonds of Credit Suisse.

Talking about the banking sector, COVID has set the financial sector on the path of digitisation and banks have been introducing fintech elements like instant and personalised customer services, apart from investing in AI and data analytics, to streamline their decision-making. The year 2023 will see this transformation accelerating further.

Shifting our attention away from the banking sector, let’s talk about the United Kingdom's mortgage market. The European giant, whose inflation figure now stands at 10.1%, is well far from the Bank of England's target of 2%, so expect the institution to keep on tightening its monetary policy. As per the experts, the country's mortgage market will feel the heat, as two million British homeowners are having variable rate deals, whose monthly interest rates will follow a higher trajectory every time BoE tightens its monetary policy.

While this April-June 2023 edition of the magazine revolves around these issues, its cover story will focus on Microsoft rolling out 'Security Copilot', a security analysis tool on the generative AI technology, amid the security concerns over ChatGPT.

Thomas Kranjec Editor

Director & Publisher

Krushikesh Raju

Editor

Thomas Kranjec

Production & Design

Brian Williams

David Brenton

Ian Hutchinson

Shankara Prasad

Editorial Stanley Rogers

Rachel Taylor, Lucas Cooper

Alice Parker, Tom Hardy

Business Analysts

Bindu P, David Pereira, Felicia Barbara Salt, Priscilla Dorothea Salt, Sneha Shet, Stella Thomas

Head of Operations

Mike Lloyd

Business Development Manager

Benjamin Clive

Marketing

Danish Ali

Research Analysts

Richard Sam, Sophia Keller

Accounts Manager

Edyth Taylor

Press & Media Contact

Craig Penn

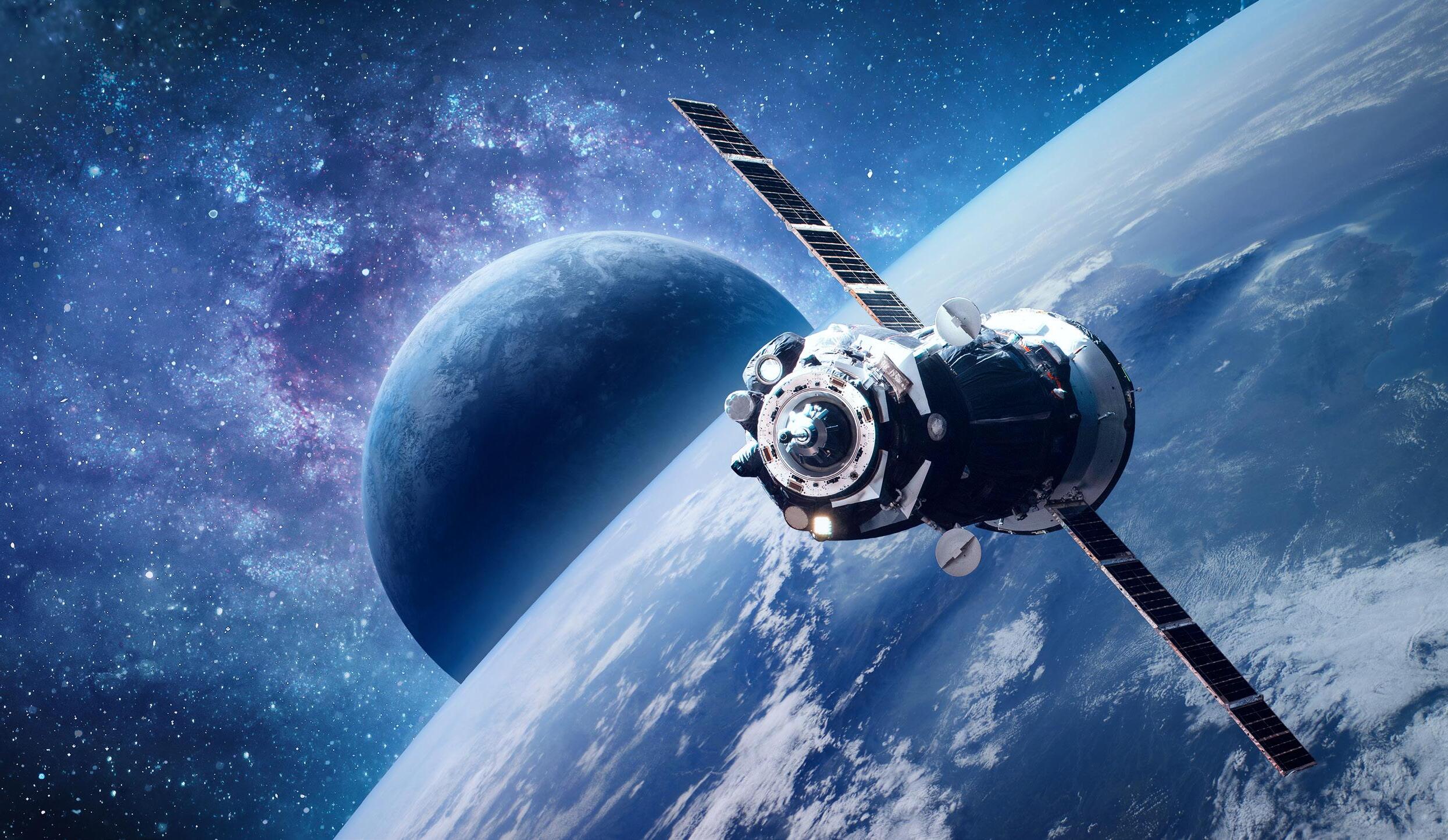

According to The Space Report 2022 by the Space Foundation, the space economy had a value of $469 billion in 2021, up 9% from 2020

Humanity is evolving in the 21st century, dominated by an accelerated series of technological progress. AI is making most of our work easy and occupations redundant. Medical marvels are slowly increasing life expectancies, and blockchain technology is making everything transparent, decentralised and democratised. Neurology, machine learning and psychology are deciphering the secrets of our brain. Humankind is also making giant strides in uncovering another mystery called space.

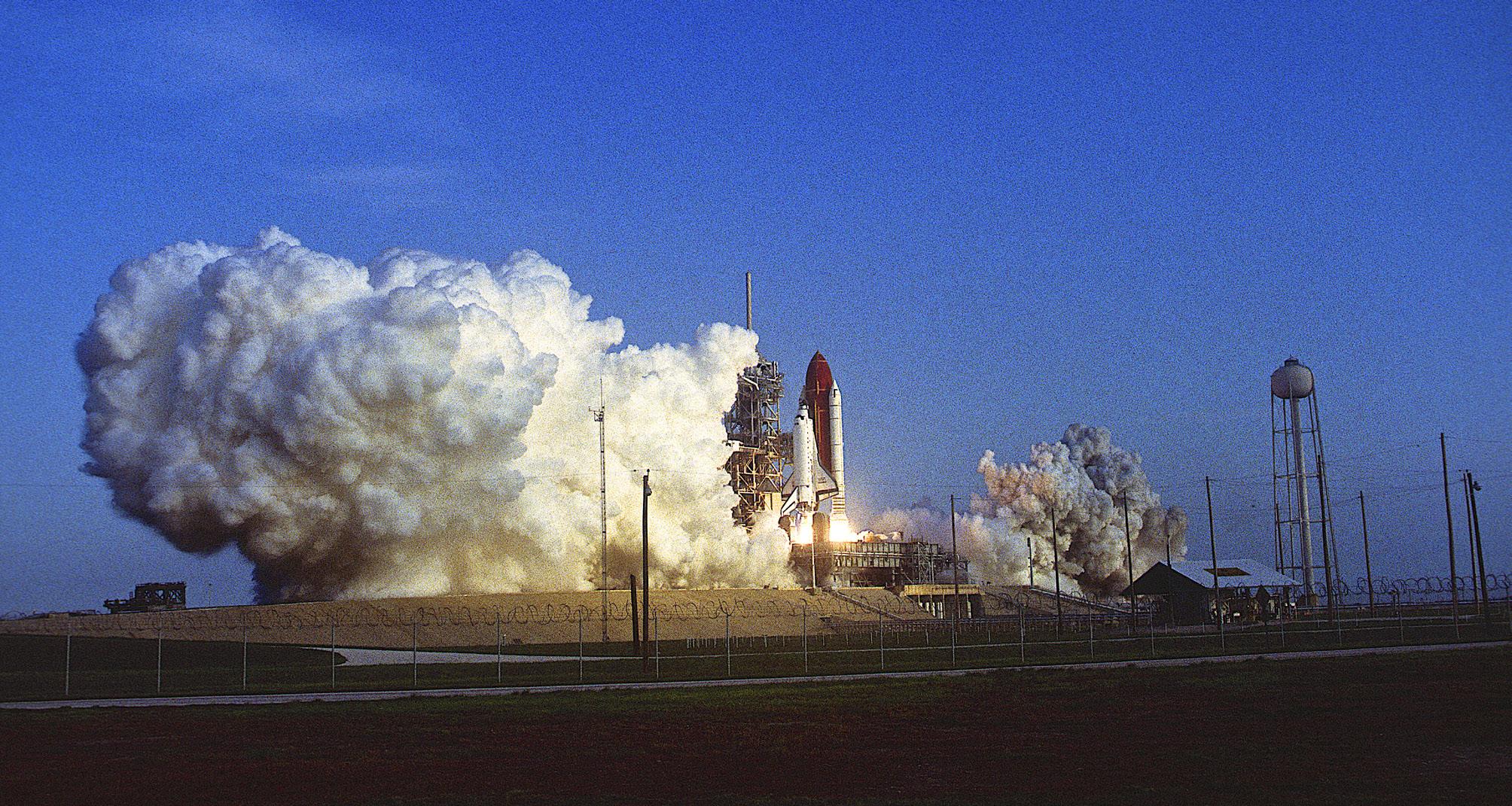

The rivalry between Elon Musk's Space X and Jeff Bezos's Blue Origin is a much-hyped one, so much so, that it parallels the space race between the United States and the erstwhile Soviet Union from 1955-1975.

Since the first successful manned mission on the moon in 1969, costs have decreased to the point where even private ventures can launch space missions. Numerous such corporations now fund space programs. According to estimates, today's space business includes over 10,000 companies and about 5,000 investors.

According to the Space Report 2022 by the Space Foundation, the space economy had a value of $469 billion in 2021, up 9% from 2020.

According to the European Space Agency, the deployment of new space infrastructure has benefited several sectors, including meteorology, energy, telecommunications, insurance, transport, maritime, aviation, and urban development.

The analysis estimates that more than $224 billion was made from

products and services provided by space enterprises, with the private sector accounting for most of this money.

According to the Space Foundation research, there has also been an increase in state-backed funding for space initiatives worldwide. Government spending on military and civilian space projects increased by 19% in 2021. China increased its investment by 23%, India increased spending by 36%, and the US added another 18% to space-related projects.

They call it a "space renaissance" when technical advancement drastically cuts prices and generates new capabilities.

Will Marshall, the CEO of Planet Labs, stated during the World Economic Forum's annual meeting in Davos in 2022 that the cost of rockets had decreased fourfold since 2012. Due to the availability of less expensive components, businesses that previously may have had to pay hundreds of thousands of dollars to launch a satellite may now do so for a fraction of that cost.

According to Will Marshall, “This indicates that we are creating ten times as much Earth imaging by area as we were five years ago and that the bandwidth of communications being transferred around the planet has increased by 10.”

Furthermore, he claimed that improved imaging is raising accountability. For instance, commercial satellite data gives

the world a bird's-eye perspective of the Ukraine situation, enabling people to observe and document events.

According to Will Marshall, satellite photography may also help governments check CO2 emissions, businesses track their environmental, social, and governance performance, and farmers monitor their crops.

Over 9,000 tons of equipment sent into orbit are causing severe issues. According to NASA, around 100 million particles of space debris orbiting the Earth are at least one millimetre in size.

Debris from previous missions, abandoned machinery, and malfunctioning spacecraft can all be included in this category. Even a tiny piece of junk, which is moving at rates of up to 17,500 mph (28,160 kph), can harm a satellite or spacecraft.

According to NASA, over the past 50 years, one piece of debris has returned to Earth on average every day. However, none has caused substantial harm, as most of these objects land in remote areas.

The cost-performance of satellites has improved 1,000 times over the past decade, and artificial intelligence (AI) is making it possible to effectively extract crucial data from these

databases. These are just a few of the significant technological breakthroughs that are causing this renaissance.

These developments are interacting with one another, releasing new applications, users, and functionalities from our space assets.

The data revolution comprises the core of the 21st-century space renaissance. We are producing ten times as much Earth imaging by area, and communications bandwidth is being transported throughout the planet by ten times as much. This is significantly impacting three key sectors:

The economy is one. There are currently two trillion-dollar-scale changes in the global economy. The first is the digitalisation of industries, which makes it possible for entire industries to function much more effectively thanks to big data and AI. Also, satellite data can speed up this transition. Farmers, for example, can use satellite photography to monitor their fields, identify issues early, and optimise inputs, thus lowering expenses and boosting both productivity and income.

The second scenario is the shift to a sustainable economy. Here, businesses track their environmental, social, and governance (ESG) goals, and governments do the same with their emissions. All of this begins with measuring. The sustainability transition depends on satellite data because it allows us to track changes in natural capital and consider them when making policies. For instance, 64 tropical countries' forestry ministries are using Earth observation data to stop deforestation in a partnership with Norway's Ministry of Climate and Environment (NICFI).

The third one is the tranquillity and safety. A more transparent society is being created through daily imaging, a technology that promotes accountability by illuminating global happenings. This has never been more evident than during the conflict in Ukraine. An overhead picture of the battle is being provided by commercial satellite data, which is altering the equation. Satellite data provides a new degree of global transparency by allowing people to

track change worldwide and shed light on international events. This is done by enabling the world to see and understand the difference in unprecedented detail, both in time and space. This responsibility is a powerful force for good.

As entertaining as it is to see the billionaires and new rockets in space, the data revolution driving sustainability and digital transformations—the two most significant economic shifts of our time—is a far more substantial opportunity for the space renaissance. It brings us new transparency, significantly impacting geopolitics and security, and removing the cover from actions that harm humanity. This is the accurate tale of the space renaissance and has profound implications for life on Earth.

The expansion of activities from different parties beyond the Earth's atmosphere is starting to outstrip governance, technological advancement is bringing costs down, commercial finance is at an all-time high, and more nations and businesses are clamouring to be involved. Although it already contributes to advancing international security and environmental goals, space has far more potential. But achieving it hangs in the balance, and all parties involved can make the industry more successful.

Space technology has advanced over the last ten years, making it more accessible to more participants, unlocking new use cases, and positioning space to help with global concerns. Throughout it all, despite geopolitical separation, there has been cross-sector and international cooperation in several areas.

Yet, due to the accelerating growth and complex geopolitical dynamics, the

The costperformance of satellites has improved 1,000 times over the past decade, and artificial intelligence (AI) is making it possible to effectively extract crucial data from these databases. These are just a few of the significant technological breakthroughs that are causing this renaissanceTechnology Space Economy

ecosystem's ability to advance industrially and sustain international cooperation is at risk. As a result, the international community will undoubtedly need to think rapidly about keeping space as a place for collaboration to fully reap its benefits.

A research that was influenced by the opinions of almost 100 business leaders outlines various futures for space. To fully achieve the societal and economic benefits of the space economy, it identifies five steps that could catalyse good governance.

According to interviews, industry leaders have identified four possible futures for space, which vary depending on the creation of commercial value and the degree of collaborative governance implemented in the sector:

In the best-case scenarios, there are a lot of opportunities, including tracking emissions on Earth to promote climate accountability and mitigation, early wildfire detection and forecasting to give people more time to prepare and evacuate, commercial space habitat construction in low Earth orbit (LEO) and on the moon where people could one day live and work, and robotic satellite maintenance to extend the life of space assets.

Industry leaders have come up with five high-priority steps to move the space

economy toward access and self-sufficiency: Develop and implement a practical framework for space governance involving all stakeholders' input. Leaders listed the following issues like ethical conduct in space, outlining the ownership, access, and usage rights to property, creating and enforcing uniform standards for hardware and software and preserving the environment, infrastructure, and human life as the ones that needed to be resolved.

These leaders are also batting for spending money and time on developing technologies and skills that will help, such as better propulsion, re-entry capabilities, cheaper ways to get different materials into space, robots, artificial intelligence, and machine learning. They also support the idea of encouraging cross-national, cross-sector, and cross-industry cooperation. Actors have a unique, if occasionally challenging, method of working together in space. Various approaches should be adopted to foster and promote deeper collaboration as activity increases. For example, space could become an increasingly important sector for businesses outside of aerospace and defence. In the majority of cases, the companies would then work closely together. Another concern area is the support of a self-sustaining industrial base by giving industry-specific government support, investing in go-to-market capabilities, encouraging communication with end users, and attracting a wide range of top talent.

Space technology has advanced over the last ten years, making it more accessible to more participants, unlocking new use cases, and positioning space to help with global concerns

Most people are not very familiar with the concept of artificial intelligence (AI). As an example, when 1,500 senior corporate leaders in the United States were questioned about artificial intelligence in 2017, only 17% of them said they were familiar with the term. Many of them had no idea what it was or how it would impact their specific businesses. They understood there was considerable potential for altering business processes, but they were unsure of how AI could be used within their own organizations. Despite a widespread lack of familiarity, artificial intelligence is a technology that is revolutionizing all aspects of life. Experts say it is a versatile tool that helps individuals to combine information, evaluate data, and use the insights

Despite the fact that there is no universally accepted definition, AI generally refers to a "machine that responds to stimulus consistent with traditional responses from humans, given the human ability for deliberation, judgement, and intention."

Researchers claim that these software programmes "make decisions which ordinarily demand a human degree of skill" and assist users in foreseeing challenges or resolving them when they arise. As a result, the user acts in an intentional, intelligent, and adaptive manner.

Algorithms for artificial intelligence are created to make judgements, often using real-time data. AI differs from passive machines, which can only make mechanical or preset decisions. They differ

from passive machines, which can only make mechanical or predetermined decisions.

Artificial intelligence combines data from numerous sources, instantaneously assess the information using sensors, digital data, or remote inputs, and then takes action based on the findings they draw from the data. Artificial intelligence is capable of making decisions with a high level of sophistication thanks to significant advancements in storage systems, computing speeds, and analytical approaches.

Machine learning and data analytics are typically used in AI projects. Data is analysed by machine learning to find underlying trends. Software developers can utilize this information to investigate certain problems if it identifies anything that is pertinent to a realworld situation.

Machine learning and data analytics are typically used in AI projects. Data is analysed by machine learning to find underlying trends. Software developers can utilize this information to investigate certain problems if it identifies anything that is pertinent to a real-world situation.

All that artificial intelligence need is data that has strong algorithms to recognize valuable patterns. Some examples of data are digital information, satellite images, visual information, text, and unstructured data.

Artificial intelligence decision-making systems have the capacity to learn and adapt. For instance, Semi-autonomous vehicles have features that alert drivers and other vehicles about impeding traffic jams, potholes, highway construction, or other potential roadblocks. AI advanced algorithms, sensors, and cameras combine dashboards and visual displays that show information in real-time so that human drivers can comprehend changing traffic and vehicle circumstances.

Applications in diverse sectors

Experts say, AI is not a futuristic concept, but it is a reality that is being implemented in a number of industries today. Finance, national security, healthcare, criminal justice, transportation, and smart cities are a few examples of these. There are several instances when AI is already changing the world and significantly enhancing human capabilities. The enormous prospects for economic growth that AI offers are one of the factors contributing to its expanding role in society. Artificial intelligence technology "may enhance global GDP by $15.7 by 2030," according to a PriceWaterhouseCoopers report. For example, advancements of $7 trillion have been made in China, $3.7 trillion in North America, $1.8 trillion in Northern Europe, $1.2 trillion in Africa and Oceania, $0.9 trillion in the rest of Asia excluding China, $0.7 trillion in Southern Europe, and $0.5 trillion in Latin America. China

Number of artificial intelligence investments by investors worldwide in 2022 (In Million Dollars)

Intel Capital

51

NEA

45

Y Combinator

31 Battery Ventures

32

Madrona Venture Groups

27

Accel

25

Bloomberg Beta

24

Source: Statista

is advancing quickly because it has declared a national objective to invest $150 billion in AI and take the lead globally by 2030.

A study conducted by the McKinsey Global Institute on China revealed that, "AI-led automation can offer the Chinese economy a productivity injection that would add 0.8 to 1.4 percentage points to GDP growth yearly."

The sheer size of China's AI market offers those country significant prospects for pilot testing and future advancement; even though their experts claim that the country is lagging behind the United States and the United Kingdom in AI adoption.

American investments in financial AI increased three times 2013-2014, reaching $12.2 billion. According to analysts in that industry, "Decisions about loans are now being made by software that can take into account a variety of finely parsed data about a borrower, rather than just a credit score and a background check."

The use of stockbrokers and financial advisers is eliminated by so-called roboadvisers, who "build tailored investment portfolios." The goal of these developments is to remove emotion from investing so that judgements may be made quickly and solely on analytical factors.

A prominent example of this is taking place in stock exchanges, where highfrequency trading by machines has largely supplanted human decision-making. People submit buy and sell orders, and computers instantly match them without any human involvement. On a very small scale, machines can identify trading inefficiencies or market disparities and carry out trades in accordance with investor instructions. Powered in some places by advanced computing, these tools have much greater capacities for storing information because of their emphasis not on a zero or a one, but on “quantum bits” that can store multiple values in each location. That dramatically

Artificial intelligence has a significant impact on national security. The American military is using AI as part of Project Maven

“to sift through the massive troves of data and video captured by surveillance and then alert human analysts of patterns or when there is abnormal or suspicious activity”

increases storage capacity and decreases processing times. This significantly shortens processing times and boosts storage capacity.

Another way artificial intelligence benefits financial systems is in fraud detection. In huge businesses, it can be challenging to spot fraudulent activity, but AI can spot anomalies, outliers, or incidents that call for further inquiry. This aids managers in identifying issues early on in the cycle, before they spiral out of control.

Artificial intelligence has a significant impact on national security. The American military is using AI as part of Project Maven “to sift through the massive troves of data and video captured by surveillance and then alert human analysts of patterns or when there is abnormal or suspicious activity.” According to Deputy Secretary of Defense Patrick Shanahan, the objective of developing technologies in this field is "to meet our warfighters' needs and to boost the speed and agility of technology development and procurement."

As huge amounts of data are sorted in almost real-time, the big data analytics associated with AI will significantly change intelligence analysis, giving commanders and their staffs a degree of intelligence analysis and productivity previously unseen. Command and control will also be impacted as human commanders outsource mundane and, in some cases, crucial choices to artificial intelligence platforms, drastically cutting the time between the decision and the action that follows.

Experts say, in the end, combat is a race against time, with the winner typically being the side that can make a decision and carry it out the quickest. In fact, artificial intelligence-enhanced command and control systems can move decision support and decision-making at a speed that is noticeably faster than that of conventional methods of fighting wars.

A new term, hyper war, has been established explicitly to embrace the pace at which war will be fought to describe how quickly this process will proceed, especially if it is combined with automatic decisions to deploy artificially intelligent autonomous weapons systems capable of devastating effects.

Artificial intelligence tools are helping designers improve computational sophistication in health care. For instance, the German business Merantix uses deep learning to solve medical problems. It can be used to "identify lymph nodes in the human body in Computer Tomography (CT) pictures" in the field of medical imaging.

The trick, according to the system's creators, is marking the nodes and spotting any potential troublesome lesions or growths. Although radiologists may only be able to carefully read four photos in an hour and charge $100 per hour. This method would cost $250,000 if there were 10,000 photos, which is too expensive to be completed by humans.

Deep learning can be used in this case to teach computers how to distinguish between lymph nodes that appear normal and those that do not. Radiological imaging specialists can apply this knowledge to actual patients and ascertain the degree to which someone is at risk of malignant lymph nodes after practising labelling accuracy through imaging exercises. It is an issue of determining the unhealthy versus healthy node because only a small percentage of samples are likely to test positive. Congestive heart failure, which affects 10% of senior individuals and costs the $35 billion annually, has also been the subject of AI research.

Artificial intelligence tools are helpful because they predict in advance potential issues and allocate resources to patient education, sensing, and proactive interventions that keep patients out of the hospital.

Merantix uses deep learning to solve medical problems. It can be used to "identify lymph nodes in the human body in Computer Tomography (CT) pictures" in the field of medical imaging

Recently, reports surfaced about Samsung employees leaking sensitive data to ChatGPT

The year 2023 has been all about the revolution brought by Artificial Intelligence, as Microsoft-backed OpenAI, whose ChatGPT (AIpowered natural language processing tool which initiates human-like conversations and assists its users to compose emails, essays, and to do coding jobs) was launched in the fag end of 2022, has now emerged as a disruptive force in the tech sector.

In March 2023, Microsoft rolled out an AI-powered security analysis tool to automate incident response and threat-hunting tasks, showcasing a security use case for the ChatGPT. The new tool, called Microsoft Security Copilot, is powered by OpenAI’s newest GPT-4 model and will be trained on data from Redmond’s massive trove of telemetry signals from enterprise deployments and Windows endpoints.

The world of cybersecurity has already been using generative AI chatbots to simplify and enhance software development, reverse engineering and malware analysis tasks and Microsoft’s latest move emboldens the approach further. The Satya Nadella-led tech giant is already making some $20 billion a year from the sale of cybersecurity products and the latest push into AI automation will further create new revenue streams for Microsoft. Also, analysts believe that the move will start the innovation race among cybersecurity start-ups.

The 'Security Copilot' chatbot will work seamlessly with security teams to allow cyber defenders to predict and analyse new challenges in their environment, learn from existing intelligence, correlate threat activities, and make better decisions at machine speed.

The chatbot has been designed to identify an ongoing cyberattack, assess its scale, and get instructions to begin remediation based on proven tactics from real-world security incidents, claimed Microsoft.

The 'Security Copilot' will also help in determining whether an organization is susceptible to known cybersecurity vulnerabilities, while assisting the businesses to examine the overall threat environment by the one asset-at-a-time approach. In short, the system will summarize the events of the data leak in a few minutes and prepare information in a ready-to-share, customizable report. The 'Security Copilot' will come integrated with Microsoft products like Sentinel, Defender and Intune to provide an “end-to-end experience across their entire security program.”

'Help Net Security' reported on how

Sophos X-Ops researchers have been working on three prototype projects that demonstrate the potential of GPT-3 as an assistant to cybersecurity defenders. These projects are using a technique called “few-shot learning” to train the AI model with just a few data samples, thus reducing the need to collect a large volume of pre-classified data.

The first application Sophos' research team tested with the few-shot learning method was a natural language query interface for sifting through malicious activity in security software telemetry. The model was tested against its endpoint detection and response product.

"With this interface, defenders can filter through the telemetry with basic English commands, removing the need for defenders to understand SQL or a database’s underlying structure. Next, Sophos tested a new spam filter using ChatGPT and found that, when compared to other machine learning models for spam filtering, the filter using GPT-3 was significantly more accurate," stated the 'Help Net Security' report.

"Finally, Sophos researchers were able to create a program to simplify the process for reverse-engineering the command lines of LOLBins. Such reverse-engineering is notoriously difficult, but also critical for understanding LOLBins’ behaviour—and putting a stop to those types of attacks in the future," the report concluded.

“One of the growing concerns within security operation centres is the sheer amount of ‘noise’ coming in. There are just too many notifications and detections to sort through, and many companies are dealing with limited resources. We’ve proved that, with something like GPT-3, we can simplify certain labour-intensive processes and give back valuable time to defenders. We are already working on incorporating some of the prototypes above into our products, and we’ve made the results

of our efforts available on our GitHub for those interested in testing GPT-3 in their own analysis environments. In the future, we believe that GPT-3 may very well become a standard co-pilot for security experts,” Sophos' principal threat researcher Sean Gallagher said.

We all know how the academic circle reacted to ChatGPT clearing exams (including difficult ones such as MBA, law and medical licensing ones).

Educational institutes around the world have taken the 'ban' route to prevent the student community from using the AIpowered chatbot, while completing their assignments or writing tests.

Now ChatGPT faces one more ban threat. The European Data Protection Board has expressed its intention to facilitate the coordination of member states' actions with regard to the OpenAI-developed AI chatbot, especially after Italy banned the chatbot

The 'Security Copilot' chatbot will work seamlessly with security teams to allow cyber defenders to predict and analyse new challenges in their environment

due to concerns over privacy violations. Spain's data protection agency, AEPD, has initiated an investigation into OpenAI, with the argument that AI development should not infringe on individuals' personal rights and freedoms. Germany too is mulling following a similar suit.

CNIL, the French regulatory authority, has already started a probe into ChatGPT following five complaints it received about the chatbot. One of the complainants was Eric Bothorel, a Member of Parliament, who alleged that the chatbot created false information about him. Bothorel is not alone here, as US law scholar Jonathan Turley too revealed that ChatGPT had invented a news article accusing him of sexual harassment of students during an 'Alaska trip'.

OpenAI has been given a deadline of April 30 by the Italian authorities to comply with specific privacy requirements, and even if the Sam Altman-led venture meets the criteria,

to come back online in the European country, ChatGPT and GPT-4, which reportedly “exhibits human-level performance on various professional and academic benchmarks,” have to meet the standards of GDPR, the EU's data protection legislation, which mandates that online services must furnish precise personal information.

On March 20, 2023, a Redis client opensource library bug led to a ChatGPT outage and data leak, with instances leading to the users seeing each other’s personal information and chat queries. These chat queries are basically records of past queries one has made in the sidebar (in simple terms, similar to Google search history). The feature also allows the users to click on one and regenerate a response from the chatbot.

The whole problem led to ChatGPT being taken offline by OpenAI. The

company's analysis of the issues revealed that chat queries and the personal information of approximately 1.2% of ChatGPT Plus subscribers were exposed in the incident. The information included subscribers' names, email and payment addresses, and the last four digits of their credit card numbers and expiration dates.

Then in April 2023, reports surfaced about Samsung employees leaking sensitive data to ChatGPT. After the South Korean tech giant's semiconductor division allowed its engineers to use ChatGPT, workers leaked secret information to the chatbot on at least three occasions. While one employee asked the chatbot to check sensitive database source code for errors, another solicited code optimization and a third fed a recorded meeting into ChatGPT and asked it to generate minutes. And all these incidents led to data security breaches, forcing Samsung to restrict the length of employees' ChatGPT prompts

to a kilobyte, or 1024 characters of text, apart from building its own chatbot.

OpenAI too has urged ChatGPT users not to share secret information with the AI tool during conversations as the latter is “not able to delete specific prompts from your history.”

The news of Microsoft launching 'Security Copilot', using the ChatGPT ecosystem, has excited the tech geeks about the endless possibilities the innovation brings, in terms of dealing with the new and dynamic challenges in the field of cybersecurity. However, the updates of the chatbot facing legal heat in Europe over data protection concerns has turned out to be a mood dampener, followed by the fiascos on March 20 and the data leaks by the Samsung staffers.

Should we trust ChatGPT and AI solutions as trusted cyber warriors? Or are these very tools themselves becoming cybersecurity threats? To get the answers, Global Business Outlook caught up with Harsh Suresh Bharwani, CEO and MD of Jetking Infotrain.

Harsh Suresh Bharwani spearheads the International Business, Dedicated Services, and Employability initiatives at Jetking. In the past decade, he has trained over 40,000 students on success, confidence, social skills, leadership, business, health, and finance. With 17 years of solid experience behind him, he is a Certified NLP Trainer & Certified Business Coach. Over the years, he has donned various hats and has excelled in various departments of the business. Accounting, Counselling and sales, HR management, channel management, International operations, placement, and marketing are some of the areas Harsh Suresh Bharwani has worked on during his journey with Jetking. In addition to being a par excellence leader, he is known for his innovation, empathy, understanding, connecting with employees, and multitasking. Here is the

excerpts from the interview:

GBO: Microsoft introduced ChatGPT capabilities to its cybersecurity business. How do you read this development?

Harsh Suresh Bharwani: Microsoft has been actively working on enhancing its cybersecurity solutions, and the introduction of ChatGPT capabilities is a significant step towards achieving this goal. ChatGPT's ability to process natural language queries and generate contextual responses makes it a valuable tool for threat detection, incident response, and other security-related tasks. By integrating ChatGPT into its security offerings, Microsoft can improve its threat intelligence capabilities and provide more comprehensive security solutions to its customers.

With the domain of cybersecurity facing new threats regularly, what are the chances for Microsoft's AI-backed solution to succeed?

The cybersecurity domain is constantly evolving, and new threats emerge every day. AI-powered solutions like ChatGPT can help organizations stay ahead of these threats by detecting and responding to them quickly and efficiently. The success of Microsoft's AI-backed solution will depend on several factors, including the effectiveness of the underlying algorithms, the quality of data used to train the model, and the ability to integrate the solution seamlessly into existing security workflows. If Microsoft can address these challenges effectively, its AI-backed cybersecurity solution could prove to be a gamechanger in the industry.

The banking and health sectors have been frequently targeted by cyber attackers. Will Microsoft Security

Copilot be a solution for such attacks?

The banking and healthcare sectors are among the most targeted industries by cyber attackers. Microsoft Security Copilot, a security automation solution that leverages ChatGPT, could be a game-changer for these industries. The solution's ability to automate security workflows, detect and respond to threats quickly, and generate contextual responses can help organizations in these sectors enhance their cybersecurity posture significantly. However, it's worth noting that no cybersecurity solution is foolproof, and organizations must adopt a comprehensive approach to cybersecurity that includes people, processes, and technology.

How generative AI-based tools will affect the cybersecurity market?

Generative AI-based tools like ChatGPT can have a significant impact on the cybersecurity market. These tools can automate several security-related tasks, including threat detection, incident

While the potential benefits of AI in cybersecurity are significant, companies must take a proactive approach to manage these risks to ensure that sensitive data remains secure

response, and vulnerability assessment, thereby freeing up valuable resources for security teams. Additionally, generative AI can help security teams make betterinformed decisions by providing realtime insights and actionable intelligence. However, it's essential to note that these tools are not a replacement for human expertise and must be used in conjunction with human intelligence to achieve optimal results.

ChatGPT has been banned in Italy due to its massive storage of personal data. Is the OpenAI product itself a data security concern?

ChatGPT has faced scrutiny for its data storage practices, particularly in regions with strict data privacy regulations like the European Union. In Italy, the product was banned due to concerns over its massive storage of personal data. While ChatGPT's data storage practices may raise concerns, it's worth noting that OpenAI has taken several steps to address these concerns. For example, OpenAI has implemented

strict access controls and encryption protocols to safeguard user data. Additionally, OpenAI has collaborated with privacy experts and regulators to ensure compliance with data protection regulations.

When Samsung staff entered the company's semiconductor-related information into ChatGPT, data leaks happened. What is your take on this?

The incident at Samsung involved a data leak related to the company's semiconductor business. The details of the leak are not publicly known, but reports suggest that Samsung staff had entered sensitive information into ChatGPT and that this information was later accessed by unauthorized parties. This incident highlights the importance of properly securing data when using AI systems like ChatGPT.

One possible explanation for the data leak at Samsung is that employees may have inadvertently disclosed sensitive information by inputting it into the AI

model without fully understanding the risks involved. This underscores the need for companies to provide adequate training and education to employees who have access to sensitive information.

Another possibility is that the ChatGPT system itself was vulnerable to attack, perhaps due to inadequate security measures. This is a concern not only for ChatGPT but for any AIbased system that handles sensitive data. Companies must take appropriate measures to secure their systems, including conducting regular security audits and implementing robust authentication and access controls.

The incident at Samsung is a reminder that the use of AI systems like ChatGPT can introduce new security risks that must be carefully managed. While the potential benefits of AI in cybersecurity are significant, companies must take a proactive approach to manage these risks to ensure that sensitive data remains secure.

What are your thoughts about it?

As with any technology, there is always a risk of security threats when using ChatGPT. However, the risks associated with ChatGPT are not unique to the technology itself. Rather, the security of ChatGPT depends on how it is implemented and the measures put in place to protect it from attacks. Like any other AI system, ChatGPT must be carefully monitored and secured to prevent unauthorized access or malicious use. It is important for organizations to take appropriate steps to secure their systems, including regularly updating software and implementing robust authentication and access controls. Ultimately, the success of ChatGPT in the cybersecurity market will depend on how effectively it can be secured and integrated into existing security systems.

In the early 2010s, Mohit Lad and Ricardo Oliveira were working late into the night in their startup's initial office in San Francisco office, developing the internet monitoring software called ThousandEyes. San Francisco is so energy conscious that the light in the building will go off after 6 pm in the evening, and it will take a phone call and passcode to get things back on running. Ricardo Oliveira had enough of this, and created a script using Twilio's APIs (Application Programming Interfaces) which allow users to call and message anyone, globally.

The script that Ricardo Oliveira created worked for a week until the lights started to go out again. He discovered that the script is perfect after frantically debugging it in the dark. The issue is that a storm has shut down an Amazon Web Services (AWS) data centre that houses Twilio on the other side of the country.

Mohit Lad believes this was a foreshadowing moment to depict how the internet functions today. He said in an interview given to Techradar that, “Every time there’s an Amazon outage, something breaks because the way applications are being built right now, there’s a lot more API calls than ever before. Previously, you would see - 10 years ago, 20 years ago - when you were building applications, you would include the code inside through libraries. Now you do an API call. An API call means you insert a dependency into some provider that may be sitting somewhere you don’t know."

“So as things get concentrated, if there are outages in parts of Amazon's environment, what happens is even things you don't anticipate breaking will break, like your doorbell cam may

not work because they have an API call were on Amazon. And I think one pattern you will start to find is that there's more and more unpredictability that will come through in terms of ripple effects. When large networks or large hosting providers, cloud providers go down," he added.

According to Mohit Lad, the best illustration of how the internet has changed is the switch from data being stored on a business' own premises to trusting cloud service providers, like AWS, Google Drive, and Microsoft Azure, with the data, usually as a cost-cutting measure. The most obvious advantages are that and a familiar interface, but even those have a cost.

Mohit Lad said, "Companies used to put everything in their own data center. Now they are going into the cloud, they do not control it. They used to build their applications on their own premises, like a CRM, or HR application. And even that is now done on Salesforce, Workday, or Office 365. We are using Teams, right? Teams are hosted in the cloud. The single thing that connects all of this together is the internet. And if it does not work, or portions of it do not work, then it

severely impacts user experience. The whole concept of ThousandEyes was started because we believe that the quality of the internet impacts quality of life.”

The fact that makes ThousandEyes indispensable to over 170 Fortune 500 companies, the top ten banks in the US, and customers such as Mastercard, Volvo, and HP, is that it maps paths between crucial firm infrastructure and the cloud providers hosting.

Mohit Lad said, “Think about Google Maps, or Waze. It is all about providing a visual around what’s happening between point A and point B, so you can make the right decision. That sort of end-to-end view of what the journey is between your end users and application, which is missing in the current market world.”

According to Mohit Lad, ThousandEyes continues to be an essential tool because of how the internet functions. In addition, he added that "the internet is essentially a collection of different networks. What ThousandEyes is doing is providing a view showing that journey and highlighting if

there is an outage somewhere, and that gives you the ability to route around it.”

As an example, Mohit Lad refers to "the 30,000 feet perspective" from the ThousandEyes programme, which gives a comprehensive overview of internet outages together with an interactive map showing their approximate regional impact. Another example of ThousandEyes special is it provides its capacity to pinpoint the precise location of an outage inside a network. He picks up an ongoing random outage -- a US provider is down, impacting traffic coming from Australia, via Cloudflare.

"So if we drill down, it shows up as Sydney, and you can look at specific parts of this network in Sydney, where the outages are," he explains.

He further said, “And knowing this, if you’re using this provider and you have critical customers in Australia, you actually know there’s an outage going on in that part of the environment. You can avoid this network, and make sure your users have a consistent experience and be able to help them out of a blind spot.”

Mohit Lad claims that since the company began about ten years ago, this conviction has only grown in significance. It turns out that the journey to where he and ThousandEyes are now was challenging. Mohit Lad's ambitions to enroll at the University of California, Los Angeles (UCLA) for the academic study were derailed, and his US visa was about to expire. Mohit Lad started working at an internet company in July 2008, but after just two months he received word that he was being fired due to layoffs brought on by the financial crisis. He said this incident opened his eyes. His UCLA lab partner Ricardo Oliveira had been urging him to launch a business with him, but he wasn't interested. Mohit Lad claims that redundancy ultimately led him to decide to take a risk even if it initially looked implausible.

“Nobody was willing to fund ThousandEye. A lot of people didn’t think the internet was going to be important enough to be monitored. We ended up raising money from the National Science Foundation, from the US government. That initial grant of $150,000 built the first version of ThousandEyes, but Mohit Lad is quick to point out that, in practice, it wasn’t a life-changing sum of money. ThousandEyes’ first data center was built in a garage with servers that had been thrown out into the street. One of the things that came out of (the financial crisis) was a lot of equipment being put in recycle bins outside companies in the Bay Area. Even today, we have the first server we put in place in our office", he added.

According to Mohit Lad, the current funding situation for technology entrepreneurs isn't quite as dire.

An enthusiastic Mohit Lad said, "The Year 2021 was quite crazy. Everybody was throwing a lot of money. I think

in 2022 investors are more disciplined around fundamentals, and are being pretty selective about where they invest and how they invest. And sometimes these market shifts are a good opportunity to really understand where to focus. Take ThousandEyes as an example. If we had gotten a lot of money from day one, we would have gone and tried all these different things to build a product and probably failed. The fact that we had very little money meant that we had to really focus on the one thing we could sell. And sometimes I feel like over-funded companies are essentially writing their own failure when they raise too much money and try to grow faster.”

“There’s still a lot of investor money. There are other government programmes in different countries, and I would definitely encourage people to leverage them. Sometimes these programmes won’t give you quick money spread out over increments every three months. But it does help you, and puts more discipline in how you operate. So, I think: look for alternative ways. My recommendation to entrepreneurs building software companies is to focus on getting early customers. That’s the best way to build the company, validate the product," he said.

Mohit Lad thinks for the internet there are challenges that are coming but he says it is equally to celebrate. He said, “There is not one thing I would say that’s going to change. I just feel connectivity is so critical that people live their lives around just being able to connect to something really quickly. It’s also the devices that are becoming increasingly internet connected. That’s also going to challenge how the internet is evolving and how it needs to support all these billions of billions of devices that are coming online.”

“The last thing I would add is that there’s a large population of the world that is still not online. And there are areas, especially in Africa, and parts of Asia and India, where people are connected through their cell phones. And I do think, in those markets, in particular, the ecosystem is evolving around that lifecycle versus building things for desktops and laptops," Mohit Lad concluded.

ThousandEyes

Meanwhile, Cisco has made measures to include ThousandEyes into its Predictive Networks Vision, where the solution may now optimise SD-WAN performance, in an effort to converge its range of solutions.

"As they are adopting that SD-WAN deployment, they’re also taking an increased dependency on the internet. We know that the internet is really predictably unpredictable, right? It is not controlled. You are really working across the same networks that consumers are accessing YouTube videos on. So when you are accessing an internet environment for key applications and key traffic across your SQL, insights will be announced," Joe Vaccaro, VP of Products of ThousandEyes said.

With the help of the solution, partners will be able to foresee problems in the IT environments of their clients before they arise and take immediate action to fix them. The solution is used by ThousandEyes partner NTT, which collaborated with Cisco for five years prior to Cisco's acquisition of ThousandEyes, to fulfil its clients' needs for hybrid work solutions.

"What we’re seeing in the market is that our clients and our customers are moving to SDWAN very aggressively and they’re treating the internet a bit like a black box. In other words, they don‘t understand that there are potentially optimal paths for their traffic," said Joe Maissel, practice director of observability and AI operations for NTT.

“There is not one thing I would say that’s going to change. I just feel connectivity is so critical that people live their lives around just being able to connect to something really quickly"

- Mohit Lad

Google has started taking pre-orders for its first foldable phone, with a goal of shipping the device in June 2023. The Pixel Fold sells for $1,799, the same price as its main competitor, the Samsung Galaxy Fold 4. Google is late to the foldable market, though not as late as Apple, which doesn't have a foldable device yet, it’s taking advantage of its timing by targeting some of the perceived deficiencies of the Galaxy Fold. Google's folding phone, for example, is thinner and has a wider body for easier handling. The wider body also allows for a better aspect ratio for viewing the OLED displays on the front and inside.

Brad Akyuz, a mobile industry analyst with Circana, a global market research firm said, "The Pixel stands out by having a wider aspect

ratio. That is ideal for content consumption. The Samsung Fold has more of a square screen, so you get black bars when you are watching content on it."

"When closed, the Pixel matches the dimensions of a regular phone with the benefit of the fold. The Samsung is a little taller and skinnier," Bob O’Donnell, founder and chief analyst with Technalysis Research said.

The United Kingdom announced up to £1 billion ($1.24 billion) in support for its semiconductor industry to boost its domestic chip-making capacity and prevent further supply disruptions, after the bosses of some of the country's leading companies called

for help. The investment is part of a 20-year semiconductor strategy that has faced long delays and sets out the UK's plan to secure its chip supply and guard against national security risks.

The strategy sets out a range of intended actions to expand the

UK's domestic chip sector, mitigate the risk of supply chain disruptions and protect national security. As part of its strategy, the UK will seek to increase cooperation with international partners. Recently in Hiroshima, Britain reached an agreement with Japan to strengthen cooperation in defence and semiconductors. The government will initially invest up to £200 million from 2023 to 2025 before expanding its commitment to up to £1 billion over the next decade, the government said. Funds will be used to improve the talent pool and access to prototyping, tools and business support.

"Semiconductors underpin the devices we use every day and will be crucial to advancing the technologies of tomorrow," British PM Rishi Sunak said.

Bloomberg reported that Apple's headset project has suffered from CEO Tim Cook's distance approach and at times lacked the confidence of key company executives. The augmented reality headset has been in the works for years but has reportedly been hampered by Cook's relative non-participation. The headset project has cost over $1 billion dollars annually and has changed direction significantly since work began.

Cook's relatively straightforward approach to a major project is in stark contrast to his predecessor, the late Apple founder Steve Jobs, who was known for his obsessive focus on even the smallest details of a project, Jobs worked closely with his top design manager Jony Ive. In 2019, Ive departed from Apple, but was involved in a headset development project.

Cook's approach is very different. "He's the complete opposite of Steve when it comes to having a clear opinion on the details," a source told Bloomberg. Cook isn't the only one keeping his distance. Top executives, including Apple software chief Craig Federighi and hardware executive Johny Srouji, both expressed concern about the project. Federighi seemed “wary” and kept his distance, citing people familiar, and Srouji compared the headset effort to a “science project.”

Netflix stock rose up more than 9%, shortly after revealing details about its new ad-supported tier that indicated the business model is starting to pay off. The streaming service said that it has five million monthly active users for its cheaper ad-supported option, and 25% of its new subscribers signed up for the tier in areas where it's available. The update came at Netflix's first pitch to advertisers, the first time Netflix has attended the industry's so-called upfront presentations.

This year, leading media companies, including Comcast's NBCUniversal and Warner Bros.Discovery, highlighted ad-supported streaming options in their presentations. Netflix rolled out its ad-based option in late 2022 after quarters of flat subscriber growth caused the stock to plummet. The company released mixed

financial results last quarter but said it added 1.75 million subscribers. Netflix is also preparing to roll out its crackdown on password sharing more widely, another move to drive revenue growth.

Media companies that were once focused on getting subscribers for their fledgling streaming services have now turned their attention to making their businesses profitable. To achieve this, some have reduced the cost of content spend and relied on advertising models.

Netflix is also preparing to roll out its crackdown on password sharing more widely, another move to drive revenue growth

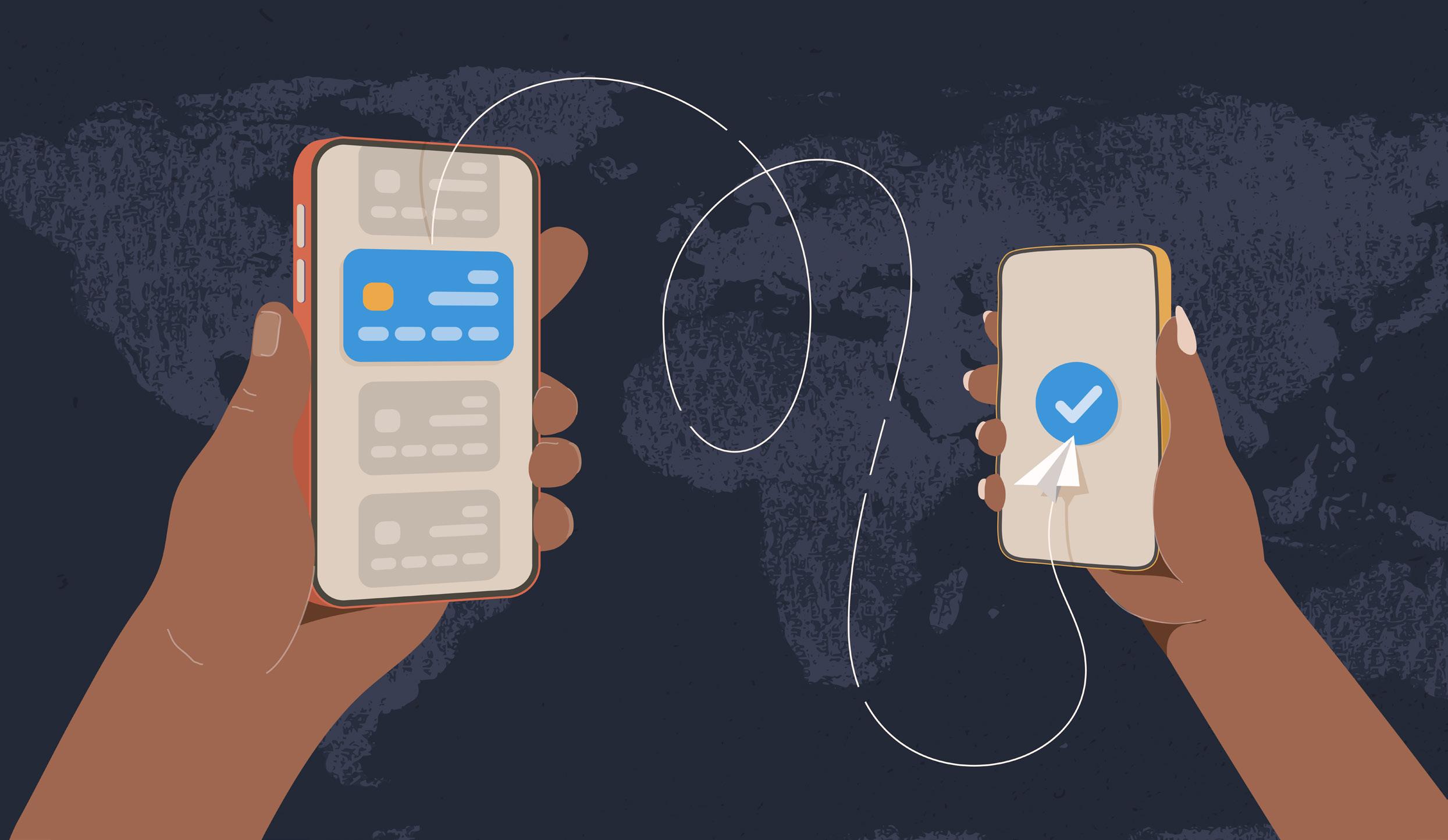

A study has revealed that 57% of lenders have adopted the Open Banking method since the COVID outbreak

Post-2015, “Open Banking” has become one of the major driving factors behind fintech sector growth. The term usually involves the usage of Application Programming Interfaces (APIs) which help third-party developers to build products and services. They also provide the customers with transparency options ranging from open to private data. In 2016, the United Kingdom Competition and Markets Authority (CMA) asked the banking biggies such as HSBC, Barclays, RBS, Santander, Nationwide, and Bank of Ireland, to allow the fintech start-ups to start working towards the “Open Banking” concept and let these players access the banking transaction data.

In 2018, “Open Banking Limited” came into existence, adding more muscles to the sector. While the Competition and Markets Authority and Financial Conduct Authority look into the regulation-related matters, as of now, there are some 202 service providers in this sector catering to the customers’ needs.

Apart from the United Kingdom and the EU countries, Open Banking is expanding its wings in the United States as well, where Financial Data Exchange (FDX), came into existence in 2018 and now consists of the country's premier financial institutions. FDX has the goal of establishing a common, shared Open Banking via a market-driven method, where the institutions will engage with the financial market players via a consortium approach.

While COVID saw a massive jump in digital banking since 2020, the number of customers ready to share their data via Open Banking has tripled in the same period of time. As per Experian stats, data-sharing requests reached 188 million in

February 2021 from 47 million in February 2020. The study also said that 57% of lenders have adopted the Open Banking method since the COVID outbreak.

In the United Kingdom itself, Open Banking has seen successes in the mortgage market and now eyeing the letting industry as well (a sector that deals in forming agreements between landlords and tenants ahead of residential property sales). Now Open Banking is even streamlining the referencing process for the tenants, thus allowing them to use online banking sans daily manual process payments.

Now we will discuss how Open Banking is proving itself as a game-changer in the property market.

Right now the United Kingdom property market is going through some tumultuous times, due to COVID, Brexit, inflation, and the cost of living crisis. Thanks to the ‘Zero Stump Duty’ reforms, the sector is witnessing volatility in the form of rising mortgage rates. While the market predictions are not putting out a rosy picture for the £1.4 trillion worth sector, the situation looks ripe for the fraudsters to do their things. Recent media reports have spoken about a massive hike in fraudulent applications for rental properties. This is also known as tenancy fraud, where these scammers will put up false IDs, income

statements and employer references. This type of incident has increased by 71% in the last two years.

Here comes the crucial role of open banking. Rental technology platform Goodlord has reported that in 2022, it identified one in five applicants as fraudulent ones through its specialist team. The whole process has saved the United Kingdom landlords some £1 million. The estate agents can also verify the applicants’ income records and earlier rent payment stats through Open Banking. Not only are the agents getting quick, transparent data about the renter’s income, but the tenants can also complete the referencing process on short notice, without massive volumes of paperwork, which in a normal method, stretches to several months, as the customers have to provide bank statements, reference letters from past employers and landlords.

Open Banking generally uses Application Programming Interfaces (APIs) for fast, yet secure data transfers. These APIs even allow the users to regulate the shared data they share, without password sharing. Data transfer can only happen once the customer gives his/her consent. The businesses wanting to connect with their customers through Open Banking must have UK FCA authorisation, which in turn requires these players to meet a number of technical

prerequisites, apart from submitting regular audit reports.

As per the latest data, there are some 15 million renters in the United Kingdom who move from one property to another every 12-18 months.

While they do this, the process also involves a lengthy period of submitting bank statements, payslips, utility bills, credit card bills and many other details, while applying for mortgages, followed by a thorough customer reference and background checks from the bank’s part.

What Open Banking does is that it cuts short that tedious process. The banks can approve the loans in minutes and seconds without getting indulged in heavy paperwork. The mortgage applicant needs to connect Open Banking platforms to his/her online bank accounts, so that these tools, with user permission, can access the data and pass them to the financial institutions within a few minutes. Real estate agents and property landlords can also enjoy the benefits of automated and real-time payment management through open banking.

In Open Banking, lending institutions can share customer data with estate agents. It also streamlines ad automates mortgage-related paperwork. It’s all about giving customers the hassle-free services they deserve. Things like verifying the mortgage seeker’s previous rent payment records or whether the submitted reference papers are genuine or not require a lot of time in the traditional banking methods, as the staffers have to perform a massive amount of paperwork, making calls and sending faxes. What open banking does is automate this mundane process, as the computers take over the job of cross-verifying the home buyers’ details, finding anomalies in the papers and data submitted by the mortgage applicant.

A recent study report from Tata Consultancy Services laid out the roadmap for Open Banking. While it identified that Open Banking is cultivating unconventional

data sources for full proof of customer creditworthiness before proceeding with the loan approval process, the report also suggested that lenders use consumer information like social data, utility payment records, e-commerce transactions, and conventional credit repository report to not only get understanding about customers' creditworthiness but also to know about his/her consumer behaviour.

The study even pointed out that Open Banking is helpful when it comes to verifying customer income data and completing other KYC procedures. The APIs can contribute to this process by indulging in cross-checking employment records, title and appraisal details and credit history. While the paperwork gets eliminated here, the above-mentioned APIenabled verification processes can simplify the months-long mortgage approval procedure as something which can be completed in just a few minutes. TCS also predicted that the mortgage application and approval cycle will be reduced to a four-step mechanism in the near future (property search and finalize consent, settlement, and possession).

However, the report said that most mortgage companies are still using old, outdated paperwork methods. While it batted for heavy investment in the area of data collection and storage for an effective Open Banking solution, it also pitched for more attention in the API area.

"Data recipients need to connect to different API sources while collecting data from any data holder, making it readily available for the lenders. The faster and more reliable these APIs deliver the data, the better the user experience. For this, the APIs related to all banking segments like retail, corporate, and wealth and products such as banking, loans, insurance, and investments need to be extended to the entire mortgage and housing ecosystem,"

the report observed.

"We recommend super apps to act as a one-stop solution for property search, home insurance, title verification, valuation companies, credit repositories, mortgages, and mortgage insurance. These super apps can cater to the broader ecosystem by integrating an end-to-end value chain into the home buying process. However, building and implementing the new technology required to comply with data holder obligations would be crucial. Data recipients also need to keep upgrading and building their platforms – an ongoing developmental activity for data holders, recipients, and lenders," it added further.

The above-mentioned TCS report shows the future for the mortgage lending industry, i.e. embracing Open Banking as soon as possible. Apart from cutting the costs down on the paperwork field, this method will also help a mortgage company to stand tall above its competitors, in terms of offering customers a hassle-free loan approval mechanism.

As per ResearchAndMarkets.com, European countries like Germany, France, Sweden, and the Netherlands are making progress on the open banking front. In Germany, the foundation has been laid to develop a strong open banking ecosystem, with the country having the second-highest number of home-regulated third-party providers as of June 2022.

"The number of passport third-party providers in Germany reached a tripledigit count during the same period. As of 2021, a majority of the third-party providers in Germany offered both account information and payment initiation service, with this share being higher compared to the entire EEA region. Furthermore, the share of countries in the European Economic Area (EEA) that are approved to

provide third-party services in Germany also saw a slight increase from 2019 to 2021," the study remarked.

"The number of third-party providers in Germany reached a triple-digit value as of June 2022, thereby reducing the gap between the EEA and Germany. More than three-quarters of countries in the EEA have the authority to provide third-party services in Germany, with Lithuania at the top of the list, followed by France and the Netherlands. One challenge that remains is providing stable and standard APIs," it stated further.

In the region of Asia-Pacific, countries such as Australia, Hong Kong, and Singapore have been the early adopters of open banking.

"In 2022, Australia aims to implement consumer data rights for the energy sector that will ensure further growth of open banking in the country. Singapore has robust and dynamic legislation in place for the development of open banking. New Zealand also plans to launch a similar consumer data rights initiative in Australia by the end of 2022. Moreover, countries such as Indonesia and the Philippines are also making progress in the development of open banking initiatives," stated ResearchAndMarkets.com.

The open banking industry will continue to gain traction in 2023 as well as more solutions are adopted by the sectors like financial services, healthcare, retail, insurance, and education. The growing use of digital payments and mobile wallets, along with increased consumer awareness, will drive the market growth of open banking. However, the sector needs to be careful against online fraud and data breaches.

Banking crises are typically followed by slow credit expansion and GDP increases

Inflation seemed to be driven by an unusual mix of supply shocks associated with the pandemic and later Russia’s invasion of Ukraine, and it was expected to decline rapidly once these pressures eased. Central banks in major economies are susceptible to bank crises if the situation is not normalized. The Federal Reserve, Bank of Canada, and Bank of England have raised interest rates in order to manage the heat of the bank crisis.

What is the bank crisis?

Banks are susceptible to a range of risks. These include credit risk (loans and other assets turn bad and cease to perform), liquidity risk (withdrawals exceed the available funds), and interest rate risk (rising interest rates reduce the value of bonds held by the bank, and force the bank to pay relatively more on its deposits than it receives on its loans).

A decline in the value of banks' assets is frequently the cause of financial issues. For instance, a decline in real estate values or a rise in non-financial sector bankruptcies might both result in a decline in asset values.

Or, if a government ceases meeting its obligations, this may cause the value of the bonds that banks hold in their portfolios to drop significantly. A bank may have obligations that are greater than its assets as a result of a significant decline in asset values, which would indicate that the bank has negative capital or is "insolvent." Or, the bank may still have capital, just not to the minimal level required by law (this is also referred to as 'technical insolvency').

If a bank has too many liabilities that are due and is short on cash (or other assets that can be quickly converted to cash), this can also cause or exacerbate financial troubles. This may occur, for instance, if numerous depositors request withdrawals of deposits at the same time (depositors run on the bank). It might also occur if the bank's borrowers need their money but there isn't enough cash on hand. The bank can lose liquidity. Liquidity and insolvency are two different concepts that must be understood. A bank might be solvent but liquid, for instance (that is, it can have enough capital but not enough liquidity on its hands). However, insolvency and liquidity frequently go hand in hand. Depositors and other bank borrowers frequently start to feel nervous and demand their money when there is a significant decrease in asset values, which exacerbates the bank's problems.

A (systemic) banking crisis happens when numerous banks in a nation experience severe solvency or liquidity issues all at once, either as a result of being hit by the same external shock or as a result of one bank or a group of banks' failure spreading to other banks in the system. A systemic banking crisis, in more precise terms, occurs when there are several defaults in a nation's corporate and financial sectors and when financial institutions and corporations have significant trouble meeting their contractual obligations on time. The net capital of the entire banking sector is depleted as a result of the high increase in non-performing loans. Depressed asset prices (including equity and real estate prices) following run-ups prior to the crisis,

substantial increases in real interest rates, and a slowdown or reversal in capital flows may all be present in this scenario. The crisis is occasionally brought on by bank depositor runs, but more often than not, it is recognized that systemically important financial institutions are in trouble.

Bank systemic crises can have serious consequences. They frequently cause severe current account reversals and deep recessions in the impacted economies. Some crises proved to be contagious, quickly spreading to other nations with no obvious weak points. Unsustainable macroeconomic policies, including large current account deficits and unsustainable public debt, excessive credit booms, significant capital inflows, and balance sheet fragility, along with policy paralysis brought on by a number of political and economic constraints, have been among the many causes of banking crises. Currency and maturity mismatches were a key aspect of many financial crises, while off-balance sheet activities of the banking industry predominated in others.

Caprio and Klingebiel created the first global database on banking crises (1996). The most recent database version is accessible as Laeven and Valencia, which has been updated to reflect the most recent global financial crisis (2012). It lists 147 systemic banking crises between 1970 and 2011 (of which 13 are borderline occurrences). Additionally, it provides information on 66 sovereign debt crises (defined as a government defaulting on its debt to private creditors) and 218 currency crises (defined as a nominal depreciation of the currency relative to the US dollar of at least 30% and at least 10% higher than the rate of depreciation in the year prior). The database contains thorough details regarding the various governments' crisis management strategies. According to analyses based on the dataset, there are several characteristics (such as those reflecting high leverage and rapid credit expansion) that imply a greater chance of a crisis. However, consistently predicting banking crises is very difficult.

The database of banking crises created by

Bank systemic crises can have serious consequences. They frequently cause severe current account reversals and deep recessions in the impacted economies. Some crises proved to be contagious, quickly spreading to other nations with no obvious weak pointsBanking & Finance Banking Crisis

Laeven and Valencia (2012) is in the Global Financial Development Report to examine what works (and what doesn't) in banking supervision and regulation. The report and supporting papers compare nations that experienced banking crises with those that were able to avoid them using data from the Banking Regulation and Supervision Survey conducted by the World Bank to accompany the Global Financial Development Report.

According to the report and paper, countries affected by the crisis had less strict and more complicated definitions of the minimum capital requirements, lower actual capitalization rates, less stringent regulatory policies regarding bad loans and loan losses, and fewer restrictions on non-bank activities. Although there were lower incentives for the private sector to monitor bank risks, they had stricter disclosure obligations. Overall, the global financial crisis has only, at most, caused incremental reforms in regulation and oversight. Some adjustments, like raising capital requirements and tightening resolution procedures, have moved regulation in crisis countries closer to regulation in non-crisis countries in the right direction, but some of the crisis's policy interventions have also reduced the incentives for the private sector to keep an eye on banks' risks. The analysis reveals room for improving legislation, oversight, and the incentives for the private sector to keep an eye on risk-taking.

Banking crises are typically followed by slow credit expansion and GDP increases. But the question remains is this due to the fact that crises frequently occur during economic downturns, or do issues with the banking sector have separate detrimental real effects?

According to Jerome H. Powell, Governors of the Federal Reserve System says, "sectors that are more dependent on outside financing should perform comparatively worse during banking crises if banking crises exogenous impair real activity". In developing nations, in nations with less access to international

finance, and in nations where banking crises were more severe, the differential effects across sectors are larger. Controlling for recessions, currency crises, and alternative proxies for bank dependency are some robustness assessments.

In the short term, it will be a difficult effort to stop the banking system from collapsing and restore its functionality. Starting to develop the regulations for a new banking system is equally crucial. There are two directions one can take. The Basel approach is one, while the Glass-Steagall method is the other. The Basel approach states that banks will continue to function as universal banks, carrying out both conventional and investment bank activities. The next step in this strategy is to establish and put into place regulations that set limits on the risks that these universal banks can accept. Its guiding principle is that determining the necessary capital to be utilized as a buffer against future shocks in credit risk may be done through an appropriate study of the risk profile of the banks' asset portfolios. Once these minimum capital ratios are in place, credit risk accidents can be absorbed by the existing equity, preventing banks from going broke and thereby avoiding the devilish spillovers from solvency problems into liquidity problems. This approach has completely failed. As was argued earlier, it was first implemented in the Basel first approach, but was massively circumvented by banks that profited from the loopholes in the system. Basel's second approach attempted to remedy this by allowing banks to use internal risk models to compute their minimum capital ratios. The underlying assumption was that scientific advances in risk analysis would make it possible to develop a reliable method of determining minimum capital ratios.

80% of individuals and UK customers and families have less than £500 pounds worth of savings

£2,595 average credit card debt per household

12.8 mn no. of households with no or less than £1,500 in savings

60,383 average total debt per household

476,588 average house price in London (highest in the UK)

Source: Money Charity

On March 19, 2023, came the biggest shocker from the world of banking as after lengthy negotiations with the Swiss government, UBS acquired the 167-year-old investment and financial services behemoth Credit Suisse for $3.25 billion in order to prevent the latter's collapse, after Saudi National Bank, Credit Suisse's largest investor, decided against providing more financial assistance to the crisis-hit Swiss financial major.

Credit Suisse’s monetary outflows topped 10 billion Swiss francs after March 15, 2023, when the bank’s share price dropped by nearly 25%. Saudi National Bank's announcement only resulted in the market price of the bank’s unsecured bonds, set for a 2027 maturity, dropping to a low of 33% of their par value these bonds ere valued at 90% at the beginning of March 2023. The Swiss government had no other option but to jump into the fray and hastily arrange the Credit Suisse takeover deal with UBS.

The takeover entails "a huge amount of risk," UBS’ Chair Colm Kelleher has warned already, as the concerned shareholders will have their eyes dead fixed on the road ahead, as the survival of both the Swiss and global banking ecosystems will depend on how the deal works in coming months.

The year 2023 has already seen the downfall of the US-based Silicon Valley Bank and Signature Bank, thus giving us the uncomfortable flashback of the 2007-08 financial crises, an event marked by the bankruptcy of Lehman Brothers.

As banks across the world are on the customer reassuring drive, the bond category called additional tier one (AT1) has come under focus now as the UBS' takeover has wiped out some $17 billion worth of bonds of Credit Suisse. The bond owners now stare at the scenario of not receiving a single penny in the payout.

AT1 bonds came into being in the wake of the 2008 financial crisis

"The extraordinary government support will trigger a complete write-down of the nominal value of all AT1 shares of Credit Suisse in the amount of around 16 billion Swiss francs," the Swiss Financial Market Supervisory Authority said in its statement, a statement which has now spooked investors about the future of their AT1 holdings in other banks.

AT1 bonds are unsecured, perpetual bonds that banks issue to improve their core capital base. The money raised through these bonds is also used as a shock absorber option by the bank, during crisis moments. If these banks sense trouble, they can convert AT1 bonds to equity or write them down.