8 minute read

SECTION 3 | EUROPE

EUROPE’S VC ECOSYSTEM BLOOMS

Billion-dollar start-ups are spreading across Europe at a rapid rate. US VC firms have taken notice. But do hubs in London and Paris really have an advantage over Silicon Valley?

Once considered a frontier market by VCs in Silicon Valley, Europe has developed a network which currently leads the industry by several measures.

Of the total number of unicorns created there – start-ups valued at $1 billion or above – more than half were created last year alone.

Though they still only represent a slice of last year’s global total (14%, according to Crunchbase), the high number of births seems unlikely to fade, even as start-up funding is squeezed elsewhere.

Globally, Europe saw the smallest regional drop in start-up funding in Q2, down 13%, compared to a 25% fall in the US and Asia. Even if it lags the US decline, the long-term outlook for the region remains positive.

“Historically, there has been a valuation arbitrage opportunity in Europe [for global VC funds] – companies have probably been on average more attractively priced,” says Dan Aylott at Cambridge Associates, “but the outstanding performance here up until

SAM PERRY,

DIRECTOR OF STRATEGIC ALLIANCES – PRIVATE EQUITY & VENTURE CAPITAL AT GLOBALISATION PARTNERS

VC-backed start-ups expanding beyond their home market typically need to spend both time and money carrying out due diligence on new markets they plan to enter. This is especially true for smaller, less experienced portfolio companies that lack the processes, procedures and knowhow needed to scale internationally. But due diligence is just the beginning, as these start-ups move on to building a legal and HR infrastructure. During a process which can take at least six months and cost tens of thousands of pounds, most start-ups will also make their first hire in the new territory. If a hiring decision does not work out, there can be huge costs associated with exiting that country and as a result of local labour laws, a start-up could also be left with human capital in the market. Delivering the agility start-ups need to identify and fast-track the onboarding of strategic hires, a global employment platform can often accelerate how they navigate international markets to scale up. As they expand, VC-backed start-ups also need to address compliance. Ensuring that they remain compliant with local employment and privacy laws when hiring talent in multiple jurisdictions can be complicated. As an example, the US and France both have complex and challenging labour laws and failure to adhere to these laws could cause serious problems and incur unplanned costs. Remaining compliant is a high priority for both the start-up and the VC investor, as failure to meet local compliance requirements could prevent them getting their next round of investment or achieving the correct market valuation. An established and experienced Employer of Record will help ensure they remain compliant in every country in which they operate.

last year has fueled further interest. I don’t see the European opportunity going away anytime soon. In fact, I see it continuing to evolve and expand.”

US-based VC firms including Bessemer Venture Partners, Lightspeed Venture Partners and General Catalyst have all recently hired or added to their teams in London and Europe to better access the region. Last year, Sequoia Capital opened its first permanent London office, more than 10 years after first investing in Europe, through Swedish fintech Klarna.

In a sign of closer ties between the US and Europe’s VC markets, the EU will open a new outpost in Silicon Valley this month.

“Originally there was a bit of a scouting mentality with US VC firms seeking investment opportunities here,” says a Parisbased VC source, “but that has gone out of vogue... it’s probably proved less efficient and there were a lot of raw deals.”

Despite potential language barriers across the continent, start-ups in the region are learning to leapfrog between emerging VC hubs to access talent, investors and broaden their customer base.

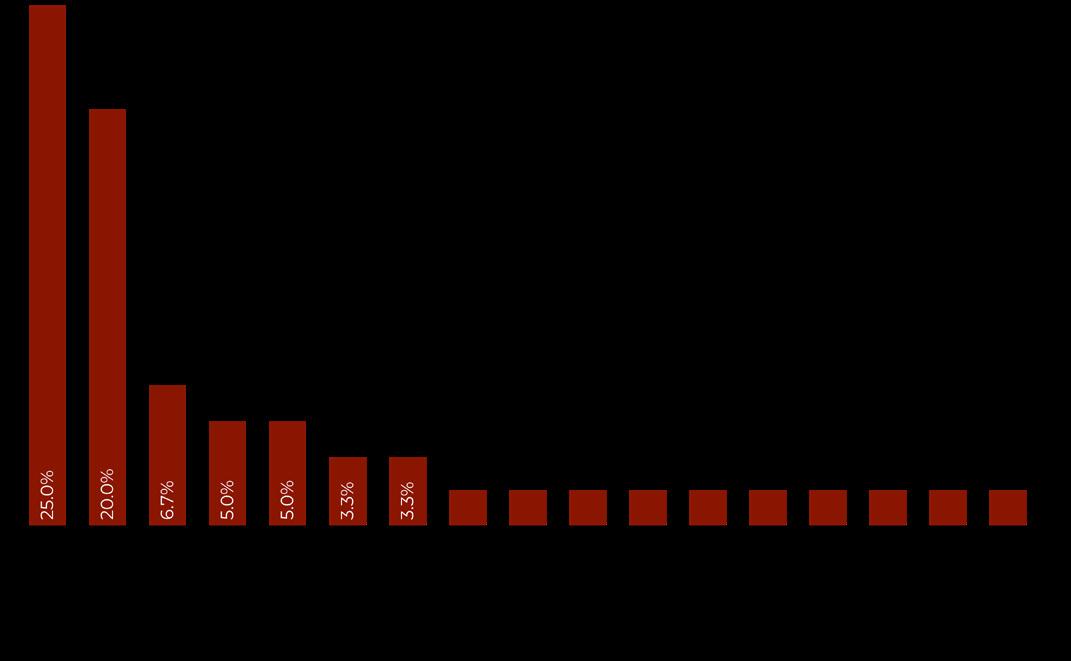

To reach its goal of 500 employees, Estonian online-identification start-up Veriff opened an office in Barcelona last year, saying it has “some of the best product and Figure 3.1: Industry was asked ‘In Europe, which one region do you expect to see the most interesting investment opportunities over the next 12 months?’

Source: Private Equity Wire survey, August 2022

engineering talent in the world”.

With a presence already in New York and London, such geographic diversification can offer resilience in a down market, say sources.

“If you build a company in Milan, in Copenhagen, in Dusseldorf, in Madrid... as long as the technology is world class, as long as you build it in a global way, it should be like any of the companies from Silicon Valley or Boston,” says Antoine Papiernik at Sofinnova Partners. “Europe’s problem in the past has been translating science and innovation into companies and ultimately the winners of tomorrow, so it has been the little brother of Silicon Valley for a long time.”

A strong university network is fostering much of this innovation, with Paris-based business school Insead and HEC Paris in France, Cambridge University and London’s LSE in the UK, and Stockholm’s main university and institute of technology in Sweden responsible for a large proportion of Europe’s recent unicorn founders.

A handful of cities in northern Europe dominate investment: London, Berlin, Stockholm, Munich, and Paris are home to start-ups which represented more than half Europe’s total VC funding last year.

In a survey by Private Equity Wire, respondents were asked which region in Europe will see the most interesting investment opportunities over the next 12 months. The UK was the most selected, with 25%, followed by Germany (20%).

A source at an investment bank which serves the VC market claims much of the new activity is coming from “the beer drinking countries, rather than the wine-drinking countries [of Europe]”. Even if there’s some truth to this, it may not be the case for long.

Flywheel spins

“The locations where big tech companies are built tend to generate an enormous amount of activity and creativity,” says Ed Knight at Antler, “they become a magnet for talent, and you get a flywheel spinning. Cloud computing now means that businesses can be built from anywhere, meaning that entrepreneurship is no longer limited to just Silicon Valley.”

According to Alex Ferrara, who leads VC giant Bessemer’s European efforts from London, the shift to remote working means European start-up founders no longer need to move to the Bay Area early on, and this is drawing VC investors more into the region.

Knight’s Antler started investing in the UK in 2019 and closed a new seed fund last year to help develop 70 UK tech startups in the country. It’s easy to see why: London attracted more than double the amount of VC funding in 2022 than Paris and Berlin and ranks third only behind New York and Silicon Valley. Funding rounds this year

Without one major hub, I think one of the biggest challenges is figuring out the coverage model for Europe

Figure 3.2: Global unicorn births by region, Q2 2022

Source: CB Insights, State of Venture Q2 2022

ALEX FERRARA,

PARTNER, BESSEMER VENTURE PARTNERS

A lot of the local and regional European consumer internet companies and online retail are facing headwinds as they’ve started to realize that there are minimal advantages of scale and brand across regions. A brand like Uber is powerful because consumers know that wherever they travel around the world there is a good chance they can use the Uber app to book a car. This creates some nice global network effects. However, that doesn’t really exist for categories like grocery or food delivery. A consumer in the UK is never going to need to use a grocery delivery or food delivery service in France or Germany, and so there really isn’t much benefit to operating in multiple countries. I think a lot of these companies have realized this, have begun to retrench, and are now contending with the reality that the market size for their service is smaller than they originally anticipated. I think cybersecurity will remain an attractive area given how much of the global economy has shifted from physical manufacturing to digital software and services over the past two decades and the need to protect this relatively new attack surface. If you look at the public market comps, the cyber sector has been more insulated from the meltdown than other areas. We expect spending for cybersecurity software, especially cloud security, will remain strong. Capital was basically free for the past few years but that’s no longer the case and so there’s now more of an emphasis on scaling with efficiency. I think that’s one reason why we’re seeing so much talk of product-led growth and bottomup customer acquisition models. I think this is one area where Europe has an advantage. We’ve generally found European SaaS companies to be more efficient than those in the US, which puts them at an advantage when it comes to fundraising. have included digital payments business GoCardless and software payments provider Paddle. In July, London’s Deputy Mayor for Business crowned the city the “fintech capital of the world” claiming it was home to more fintech companies than any other city globally. But in the same breath he also warned of a problem facing all of Europe’s VC hubs as they expand: the race for talent between them, and with VC hubs in the US, will only intensify.

“I think one of the biggest challenges is figuring out the coverage model for Europe,” says Ferrara. “Unlike the Bay Area or Israel, Europe doesn’t have any one major hub. You can find great founders and companies in many different cities across Europe. Figuring out how to best cover so many regions is one of the bigger challenges.”

KEY TAKEAWAY – SERVICE PROVIDERS

Europe is generating increasing interest from VC firms but many will need support to co-ordinate their business across the various hubs of London, Berlin and Paris