3 minute read

By the Numbers

Where There’s Smoke…

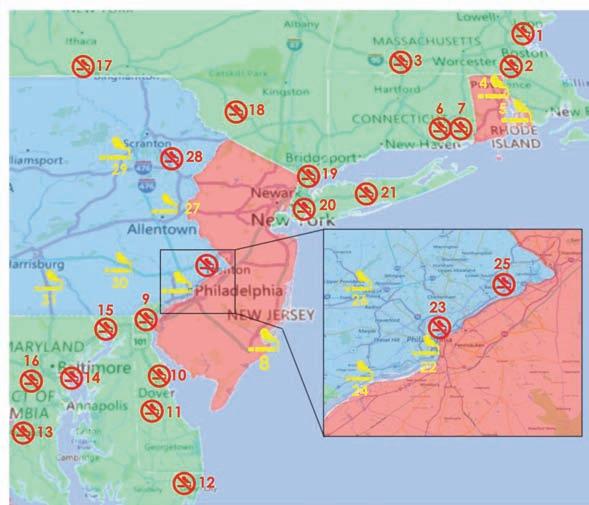

In June, C3 Gaming (Casino Consultants Consortium) issued a followup to a survey they did on the impact of smoking bans on casinos, and again came up with some quite interesting data. As the New Jersey legislature considers a bill that would ban smoking in Atlantic City casinos, the industry’s lobbying group, the Casino Association of New Jersey, commissioned a report from Spectrum Gaming that detailed lots of dire consequences should a ban go into effect that included the closing of at least two casinos and the loss of thousands of jobs.

Advertisement

In the new report, C3 points out that the data used by Spectrum is in most cases at least 10 years old, and presents updated revenue numbers that suggest that a smoking ban doesn’t harm gaming revenue, and in fact, can actually increase it, along with cost savings on cleaning, repairs and air handling. The report points out that 157 tribal casinos have banned smoking since the pandemic, and even some casinos in Pennsylvania, where smoking is allowed, have voluntarily banned smoking with no ill effects on gaming revenue.

In New Jersey, a majority of members in the state Assembly have signed on as sponsors of the smoking ban bill and Governor Phil Murphy has said he would sign any bill that arrived on his desk. Thus far, no hearings have been scheduled on the bill. New Jersey and Pennsylvania are the last holdouts in the northeastern U.S. to continue to allow smoking in casinos. The tribal casinos, Foxwoods and Mohegan Sun in Connecticut, have voluntarily imposed a smoking ban. To access the study, visit C3gaminggroup.com. Casino Smoking Bans in NE USA

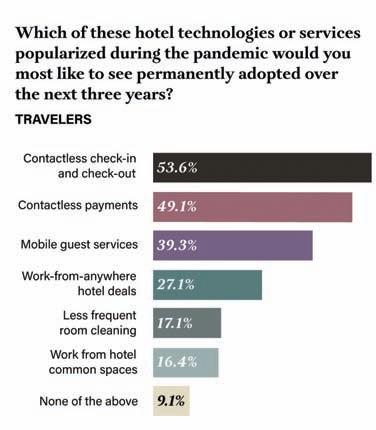

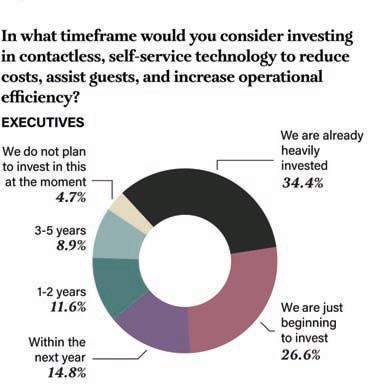

Fewer Touch Points

Every industry was impacted by the pandemic and the accompanying restrictions. The hospitality industry, which plays a big role in the gaming industry, was particularly hard hit, as guests became accustomed to the changes that were required. In a new study by Skift and Oracle Hospitality, “Hospitality in 2025: Automated, Intelligent... And More Personal,” guests and operators were asked a variety of questions about what changes caused by the pandemic they liked and wanted to become permanent. Respondents overwhelmingly liked contactless check-in and check-out, as well as contactless payments. And when operators were asked whether they were investing in these technologies, the response was clear. Those who have already invested or plan to invest within one or two years were more than 85 percent of the respondents. To obtain a copy of the report, visit Skift.com.