Global Gaming Business Magazine GGB December 2022 • Vol. 21 • No. 12 • $10 All or Nothing Bally’s quest to dominate the omnichannel universe REGULATING REGULATORS AINSWORTH’S HARALD NEUMANN MARKETING: THINK SMALL PLAYER PAYMENT PROTECTIONS Association of Gaming Equipment Manufacturers DOING THE NUMBERS Why slot math is often the margin for success FINALLY, Europe’s First IR And more 10 trends for 2023

Trending for 2023

Our annual rundown of the Top 10 trends for the coming year reflects an industry fully emerged from the Covid-19 crisis and ready for growth, with opportunities ranging from integrated resorts in Europe and the Philippines to potentially lucrative new jurisdictions like Texas, and challenges like California sports betting.

By Julia Carcamo, Roger Gros, Suzanne Perilloux Leckert, Frank Legato, Glenn Light, Jess Marquez, Patrick Roberts, Richard Schuetz, and Michael Zhu

FEATURES

14 Math Rules

Creative slot game design can only be brought to the finish line by effective program math, which is why mathematicians are essential to the development process.

By Frank Legato

By Frank Legato

On the cover: Melco Resorts & Entertainment’s City of Dreams Mediterranean

38 Watching the Detectives

With some jurisdictions appointing gaming regulators who know nothing about the industry, and a few using gaming commissions as patronage dumping grounds, many ask who is regulating the regulators.

By

Marjorie Preston

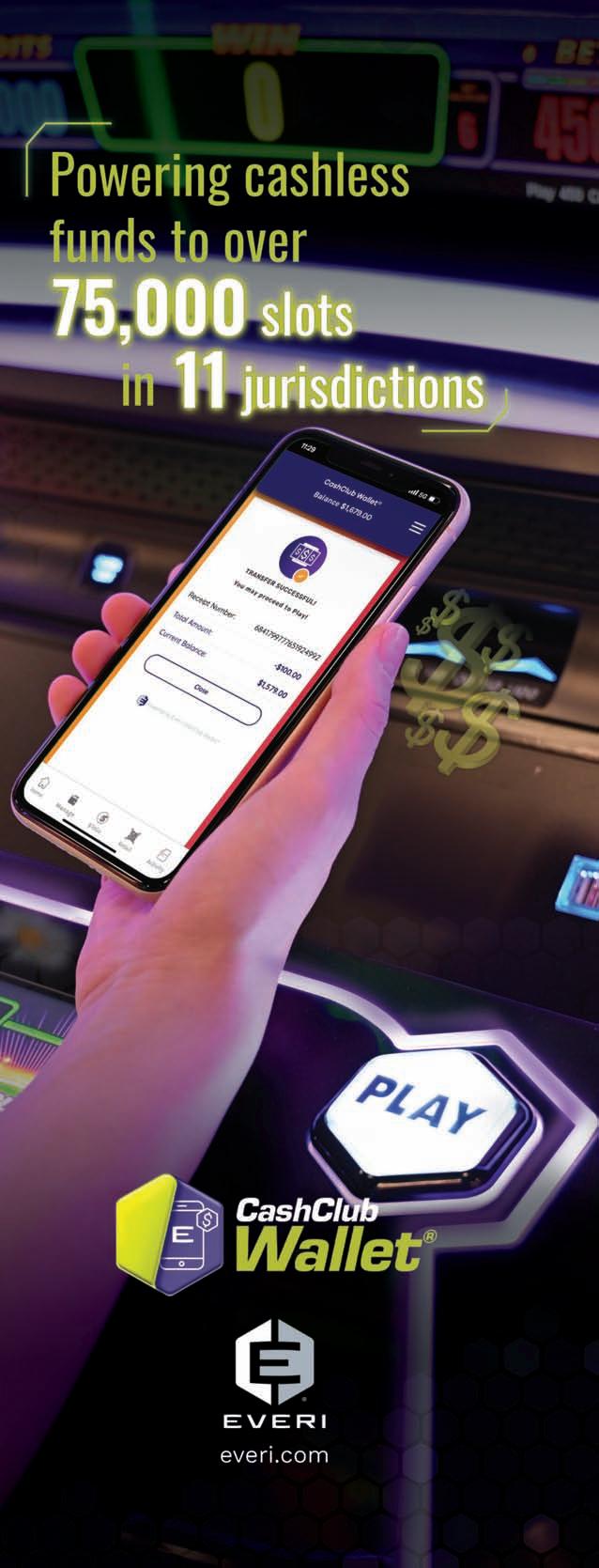

42 Payment Evolution

As the industry sorts through a potpourri of cashless payment options, the worlds of gaming and fintech continue to converge.

By Dave Bontempo

32 Bally’s Bounce

Since its acquisition of Bally’s Atlantic City and subsequent rebranding from Twin River, Bally’s Corporation has grown into an omnichannel powerhouse, and the growth is by no means complete.

By Roger

Gros

Vol. 21 • No. 12 COLUMNS CONTENTS 10 AGA Records Fall Anton Severin 12 Fantini’s Finance Opportunities and Challenges Frank Fantini 35 Marketing How to Win in 2023: Think Small Rich Sullivan 4 The Agenda 6 By the Numbers 8 5 Questions 13 AGEM 36 Emerging Leaders With the AGA’s Cait DeBaun, the New Jersey DGE’s Jamie McKelvey, and Pechanga Resort’s Agata Maher 46 New Game Review 50 Frankly Speaking 51 Cutting Edge 52 Goods & Services 53 People 54 Casino Communications With Simon Thomas, CEO, Hippodrome Casino DEPARTMENTS

DECEMBER 2022 www.ggbmagazine.com december

Global Gaming Business Magazine 18 COVER STORY

3

My Macau

By Roger Gros, Publisher

Granted, I was far from the first gaming industry journalist to visit Macau when the Venetian Macao opened in August 2007. I had heard so much about the “capital of gaming” because even 15 years ago, the revenues it achieved far outpaced any other gaming jurisdiction in the world, including Las Vegas. I had a good frame of reference for the opening of the Venetian since I had spent so much time in the Las Vegas version of the same property. But the Macau version just seemed bigger and better—and certainly more crowded. And I was immediately hooked.

As a former dealer, I relished a casino floor comprised largely of baccarat tables, my favorite game to deal. Those pesky slot machines were limited to the margins of the casino floors, and, at that time, weren’t very popular.

I returned to Macau every year until 2017 because I had been a consultant to G2E Asia, helping them set up the conference program at the event. Every year I’d return, there would be a spectacular new property, whether it was an expansion of the Las Vegas Sands footprint, the amazing Galaxy project, which will debut Phase IV in 2023, Melco’s City of Dreams integrated resort with several different fabulous hotel brands and spectacular architecture, the two other U.S. entries, Wynn Resorts and MGM Resorts, each of which had familiar, yet Asian-focused properties, and of course the original SJM, Stanley Ho’s family flagship, Lisboa.

I came to look forward to my trips each year, not only for the amazing facilities that were going up but also for the incredible executives who were truly making it the world capital of gaming. Of course it all started with Mr. Ho, but it truly broke out with the vision of Sheldon Adelson, who saw gold in a wet, reedy marsh separating two neighborhoods in Macau. Adelson, along with Bill Weidner, Brad Stone and Rob Goldstein, transformed that marsh in what we know as the Cotai region today, home to almost a dozen integrated resorts, with thousands of hotel rooms, many hectares of meeting space, non-gaming attractions and restaurants that will satisfy any taste bud. I’d start to list the executives in Macau that I was most impressed with but I’m sure I’d leave out someone important, but it’s safe to say that they were some of the most talented and innovative people that I’ve met in my 40-plus years in gaming.

Since I haven’t been back since 2017, it’s almost inconceivable to me that those casino floors that were

once packed from morning to night with players wagering side by side and over the shoulders should be sparse and empty. The pandemic has almost been a death knell for the gaming industry in Macau. The companies have poured millions of dollars into the maintenance of their properties and the well-being of their workforce, with little in return. The “zero tolerance” policy of mainland China seems to be insane given how the rest of the world has recovered from the Covid situation. Yes, there are still cases popping up all over the world, but their severity is much diminished. And to sacrifice the gaming industry at that altar seems to be short-sighted.

And then we’ve got the situation with the VIP operators, the junket guys. When I was helping to put together the G2E Asia conference program, we always tried to include a panel of experts to talk about that market, which contributed around 70 percent of gaming revenue in those days. The VIP market was not the players on the main casino floor. They all had special rooms that they had built inside the casinos to host their players in the luxury—and privacy—they desired.

So it wasn’t always easy to get them to participate. But one year we had a panel consisting of some of the most powerful junket operators in town, and someone asked a question about the amount of money gambled on the tables—and beneath them, in the form of illegal bets. There was no hesitation when the operator answered there was 10 to 20 times more money bet under the tables than on them. There was an audible gasp throughout the room, but I saw the fellow panelists all nodding their heads.

With the recent crackdown on these VIP companies, that situation is over. The casino companies are now focusing on what they call the “premium mass,” that is, the good players but not the “whales” of the VIP market. For sure, those whales will return, but it will be under the strict rules of the Chinese government.

So the “good old days” of the “Wild West” Macau are clearly over. When—and if—the Chinese government reopens the borders, satisfied they stamped out every last case of Covid, Macau still won’t be the same. It will no longer be the sole capital of gaming. It will still be a great market, but one that will compete with many great markets in Asia.

I’ll miss the old Macau, but look forward to its bright new future.

Vol. 21 • No. 12 • DECEMBER 2022

Roger Gros, Publisher | rgros@ggbmagazine.com twitter: @GlobalGamingBiz

Frank Legato, Editor | flegato@ggbmagazine.com twitter: @FranklySpeakn

Jess Marquez, Managing Editor jmarquez@ggbmagazine.com

Monica Cooley, Art Director mcooley@ggbmagazine.com

Terri Brady, Sales & Marketing Director tbrady@ggbmagazine.com

Becky Kingman-Gros, Chief Operating Officer bkingros@ggbmagazine.com

Lisa Johnson, Communications Advisor lisa@lisajohnsoncommunications.com twitter: @LisaJohnsonPR

Columnists

Frank Fantini | Anton Severin | Rich Sullivan

Contributing Editors

Dave Bontempo twitter: @bontempomedia | Julia Carcamo Keli Elkins | Suzanne Perilloux Leckert

Glenn Light | Allison McCoy | Marjorie Preston Patrick Roberts | Richard Schuetz

Bill Sokolic twitter: @downbeachfilm | Michael Zhu

EDITORIAL ADVISORY BOARD

Rino Armeni, President, Armeni Enterprises

•

Mark A. Birtha, Senior Vice President & General Manager, Hard Rock International

•

Julie Brinkerhoff-Jacobs, President, Lifescapes International

• Nicholas Casiello Jr., Shareholder, Fox Rothschild

• Jeffrey Compton, Publisher, CDC E-Reports twitter: @CDCNewswire

• Dean Macomber, President, Macomber International, Inc.

• Stephen Martino, Vice President & Chief Compliance Officer, MGM Resorts International, twitter: @stephenmartino

• Jim Rafferty, President, Rafferty & Associates

•

Thomas Reilly, Vice President Systems Sales, Scientific Games

• Michael Soll, President, The Innovation Group

• Katherine Spilde, Executive Director, Sycuan Gaming Institute, San Diego State University, twitter: @kspilde

•

Ernie Stevens, Jr., Chairman, National Indian Gaming Association twitter: @NIGA1985

• Roy Student, President, Applied Management Strategies

• David D. Waddell, Partner

Regulatory Management Counselors PC

Casino Connection International LLC. 1000 Nevada Way • Suite 204 • Boulder City, NV 89005 702-248-1565 • 702-248-1567 (fax) www.ggbmagazine.com

The views and opinions expressed by the writers and columnists of GLOBAL GAMING BUSINESS are not necessarily the views of the publisher or editor.

Copyright 2022 Global Gaming Business LLC. Boulder City, NV 89005

GLOBAL GAMING BUSINESS is published monthly by Casino Connection International, LLC. Printed in Nevada, USA.

Postmaster: Send Change of Address forms to: 1000 Nevada Way, Suite 204, Boulder City, NV 89005

4

Official Publication

THE AGENDA

Global Gaming Business DECEMBER 2022 GGB

TRIbal EConomIC DIvERsITy

most financial experts agree that tribes that depend solely upon gaming revenues need to diversify their economy if they want the “seven generations” that they say they are protecting to thrive. A report prepared by Wells Fargo Bank and Boston Consulting Group spells out solutions for economic self-sufficiency for the 574 federally recognized tribes—gaming and in the U.S.

“Tribal communities have been impacted by economic events over the last 20-plus years: 9/11, the great financial crisis, and Covid,” Dawson Her Many Horses, the lead researcher for Wells Fargo, said. “This report was born out of that, reflecting on those experiences and our desire to support our clients and stakeholders in a way that’s meaningful and reflects our expertise in the market.”

One of the major problems for tribes of all sizes is the lack of access to capital. The chart at right demonstrates the few resources tribes can access.

The report provides tribal leaders a framework to think about other economic development opportunities with the profits they make from the casinos.

“It helps them think about other ways they can leverage their assets, to help them withstand the next economic downturn,” Her Many Horses said. “It’s a big report, but we think there’s a lot in it that folks will find useful.”

He hopes private investors will take a look at tribal communities.

“When we look at the banking landscape available for

online measures

online gaming is only legal in six U.S. jurisdictions, but in 2021 it produced more than $3.8 billion in gross gaming revenues. So Eilers & Krejcik launched its Online Game Performance Report, in which it evaluates 29 online gaming sites with a total of 1,780 unique game themes, with 36,565 games tracked each month in five of those states—New Jersey, Pennsylvania, West Virginia, Connecticut and Michigan—representing almost 60 percent of the active market. The chart at right gives a breakdown of the games that are offered by 22 companies across those online casinos. Evolution, which specializes in “live” gaming, has the lead by far, accounting for 27 percent of the total GGR in October 2022. Most of the other major game suppliers come next, and then some online-games-only companies making some progress. To obtain a copy of any Eilers & Krejcik reports, contact Rick Eckert at reckert@ekgamingllc.com.

Capital landscape differs by type, investment range and volume of capital

tribal communities, what we see is that a lot of the financial institutions that are available in mainstream America don’t necessarily go into or have exposure to Native America: venture capital, private equity, regional banks, national banks. You know, there are a lot of banks that just haven’t done much or may not know about opportunities in tribal communities,” Her Many Horses said.

To download a copy of the report, visit wellsfargo.com/com/focus/tribal-economic-report.

Key Insights—GGR & Games Tracked

6 Global Gaming Business DECEMBER 2022

BY THE NUMBERS

WHERE WE’RE GOING, WE DON’T NEED CASH. TO BOLDLY ANALYZE WHERE NO ONE HAS ANALYZED BEFORE THE BONUSING FORCE IS STRONG WITH THIS ONE. I’M SORRY DAVE, I’M AFRAID I CAN DO THAT. TODAY! For more information visit www.acresmanufacturing.com For a personal demonstration, please email tricia.lee@acresmanufacturing.com

Questions

Harald Neumann

“They Said It”

“It’s very simple for me—it’s about building a sustainable business. We don’t want customers for 10 minutes; we want them for 10 years. No one wants to benefit from others’ misfortune.”

Executive Officer, Ainsworth Game Technology

Chief

Conor Grant, chief executive for the U.K. and Irish Division of Flutter Entertainment, on why the subsidiary Paddy Power is spending more than €100 million annually on safer gaming measures

I

ndustry veteran Harald Neumann was named chief executive officer at Ainsworth Game Technology in September 2021, following a five-year tenure in the same position at Novomatic, Ainsworth’s majority shareholder. Since his appointment, Neumann has been focused on growing the North and Latin American markets, and the company’s historical horse racing (HHR) revolution has been a big part of that growth. Neumann spoke with GGB Editor Frank Legato at the Ainsworth booth at the G2E trade show in October. To hear and view a full podcast version of this interview, visit GGBMagazine.com.

GGB: Let’s start with some of the results—your earnings for fiscal year 2022 are up 38 percent, net income up to $11.8 million. What were the most critical contributors to these results? Neumann: Well, the most critical was that the world recovered from Covid—I think that was the most important one. And of course, our U.S. piece has contributed more than 50 percent of our success; Latin America has recovered, Australia is becoming better and better, so in total, the recovery from Covid and of course our HHR business in the U.S., which also contributed a lot to our profitability.

How important are the Americas for Ainsworth, and what do you do to maintain growth in these markets?

We have defined three key markets for us: No. 1, U.S.; No. 2, Latin America; and No. 3, Australia. So you can see U.S. and Latin America are the first two. The U.S. is the biggest market by far in the casino area—we are quite successful already in the high-denomination area, and we want to increase our installed bases in the low-denomination area, and of course HHR should increase. Latin America is important for us, even though there are always some challenges, like in Mexico with the recent tax increase and smoking ban. But nevertheless, these markets are very important.

How has your commitment to R&D expanded and improved your product roadmap?

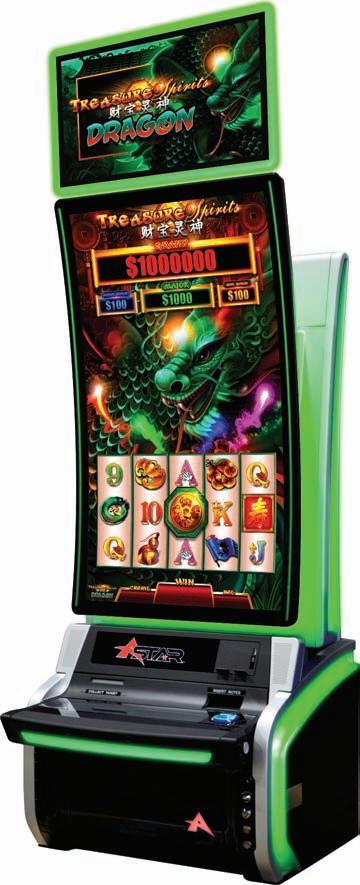

When I joined the company, this was priority No. 1, because the company will only survive if we are providing the right games to our clients. We hired a new CTO, David Bollesen, and we have two new studio heads in Vegas and in Australia. All of them are already contributing to our success. We debuted three games at G2E, Treasure Spirits, Ca$h Stacks Gold and Ultra Shot Gold, which are already indicative of the direction Ainsworth is going.

What have been the initial results back from the low-denomination additions? We have already launched the games I mentioned in Sydney, and they are showing quite good results at the Star Sydney. We have had the experience that there’s a high probability that games which are successful in Australia will be successful in the U.S. We’ve really gotten quite positive feedback about the performance of our games, so I believe that we are going in the right direction.

Of course, we have to talk about HHR, where you’ve dominated the space. How have you been able to implement HHR development alongside your traditional offerings?

It’s a new game style in the U.S. which is really performing, and we recently announced an agreement for expansion to Kentucky Downs. Our improved performance in game development will, of course, also have an impact on our HHR games. So, everything is connected together, and as we are not co-developing a game just for HHR or just for Class III, this is connecting the features for both markets. This also brings an added revenue stream because we’re connecting games from Aristocrat, IGT, Konami and so on to our system, which generates added revenue and profitability.

CALENDAR

December 5-7: Global Symposium on Racing, Loews Ventana Canyon Resort, Tucson, Arizona. Produced by the Race Track Industry Program, University of Arizona. For more information, visit rtip.arizona.edu/symposium.

February 7-9: ICE London, ExCeL, London, U.K. Produced by Clarion Gaming. For more information, visit ICELondon.UK.com.

February 28-March 1: Casino & Esports Conference, Alexis Park Hotel, Las Vegas. Produced by Gameacon Events. For more information, visit casinoesportconf.com.

March 7-8: iGaming Next: New York, The Convene-Midtown Manhattan, New York City. Produced by iGaming Next. For more information, visit iGamingNext.com.

March 27-30: Indian Gaming 2023, San Diego Convention Center, San Diego, California. Produced by the Indian Gaming Association. For more information, visit IndianGamingTradeshow.com.

March 29-30: Prague Gaming & TECH Summit ’23, Vienna House Andel’s Prague, Prague, Czech Republic. Produced by Hipther. For more information, visit Hipther.com.

April 19-20: SAGSE LATAM 2023, Buenos Aires Hilton, Buenos Aires, Argentina. Produced by Mongraphie. For more information, visit SAGSELATAM.com.

May 9-11: SBC Summit North America, Meadowlands Exposition Center, East Rutherford, New Jersey. Produced by SBC. For more information, visit SBCEvents.com.

5

8 Global Gaming Business DECEMBER 2022

2

NUTSHELL

1 3 4

5

BLUBERI CLASS OF 2022

JUST WAIT UNTIL NEXT YEAR! FOR MORE INFORMATION VISIT WWW.BLUBERI.COM

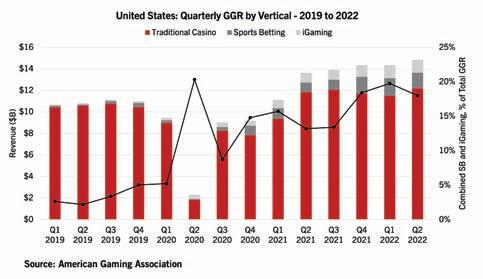

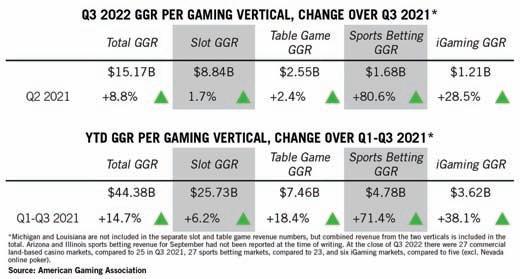

Records Fall

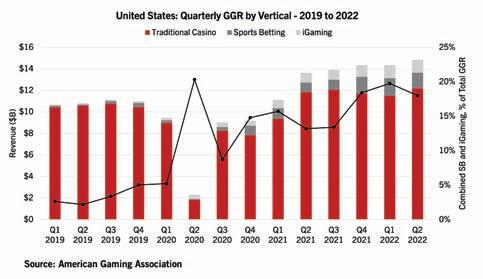

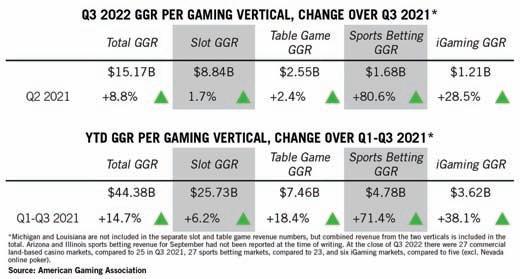

As 2022 draws to a close, the gaming industry’s hot streak is showing no signs of slowing down, with annual commercial gaming revenue set to shatter 2021’s record for the highest-grossing year in industry history. Through the first nine months of the year, the industry has generated more than $44 billion in revenue, up nearly 15 percent year-over-year.

What is driving this impressive run in the face of persistent concerns about the health of U.S. consumer budgets? The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker examines industry trends to answer just that question.

Here are the lessons we learned from our Q3 2022 report.

Record-Breaking Third Quarter

Q3 2022 commercial gaming revenue from brick-and-mortar casino games, sports betting and iGaming set a new single-quarter record, reaching $15.7 billion and topping $15 billion for the first time ever. While the broader U.S. economy expanded at an annual rate of 2.6 percent, gaming revenue accelerated 8.8 percent compared to the same quarter in 2021.

Land-Based Gaming Reaches New Highs

When the factors driving gaming’s record revenue are examined, the spotlight is often directed to the rapid rises of sports betting and iGaming, exciting gaming verticals that are still in their infancy across most of the country.

While sportsbook revenue jumped 80.6 percent year-over-year to a record $1.68 billion and iGaming revenue nearly matched its Q2 2022 record of $1.21 billion, it is still land-based casinos that are driving overall gaming revenue. In the third quarter, land-based casino slot and table games generated an alltime quarterly high of $12.27 billion in revenue, up 1.8 percent year-over-year.

By Anton Severin

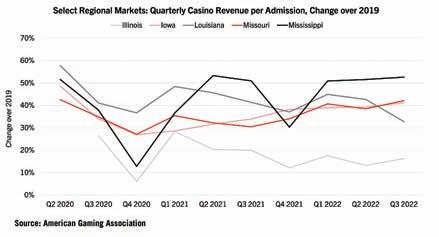

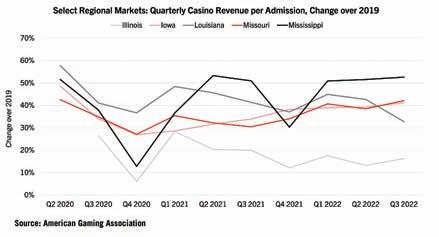

Casino-Goers are Spending More

Americans have yet to return to casinos in the same numbers as before the pandemic, with recent AGA polling indicating that 34 percent of adults visited a casino in the past year (versus 44 percent in 2019 and 28 percent in 2021), but patrons continue to make up the difference through markedly higher spending. In Q3 2022, revenue per casino admission remained well above pre-pandemic levels (37 percent on average) in the states that publish admissions data.

This trend has been a constant over the past two years, as casino-goers, on average, are higher income earners than before the pandemic. According to AGA survey data, 52 percent of past-year casino visitors reported a household income of more than $60,000, compared to 42 percent of all Americans. In 2019, these figures were 42 percent and 38 percent respectively.

Casino Gaming Continues to Expand

Third quarter-land-based gaming revenue was further boosted by the launch of commercial casino gaming in two new states, reflecting strong interest for inperson gaming in new geographies.

On July 8, Virginia became America’s 26th state to launch land-based casino gaming when Hard Rock Bristol opened its doors to the public. The state’s first temporary location grossed $40.3 million in its inaugural quarter of partial operations, outperforming several similarly sized properties in nearby Maryland, Pennsylvania and West Virginia. Subsequently, Nebraska became the 27th state with commercial land-based casino gaming when WarHorse Casino debuted slot gaming on September 24.

Taken together, AGA’s Commercial Gaming Revenue Tracker showcases the continued resiliency of both the U.S. commercial gaming industry and Americans’ demand for gaming. This resiliency will continue to be challenged by future economic headwinds, but what is clear is that the industry is as healthy today as ever.

Anton Severin is director of research for the American Gaming Association. AGA’s Commercial Gaming Revenue Tracker will continue to report on the industry’s performance on a monthly and quarterly basis.

10 Global Gaming Business DECEMBER 2022 AMERICAN GAMING ASSOCIATION

Revenue keeps flowing in to U.S. commercial casinos, but what did we learn?

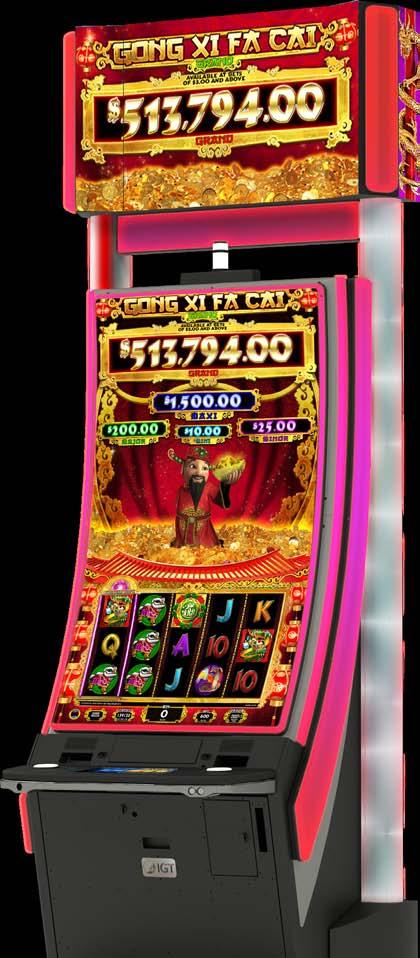

MAKE THE BIGGEST IMPRESSION EILER’S RANKED #1 LARGE FORM FACTOR CABINET © 2022 IGT. All other trademarks used herein are owned by IGT or its affiliates, may not be used without permission, and where indicated with a ®, are registered in the U.S. Patent and Trademark Office. IGT is committed to socially responsible gaming. Our business solutions empower customers to choose parameters and practices that become the foundation of their Responsible Gaming programs. Scan to learn more about the Peak65™ Gaming Machine *EILERS-FANTINI Cabinet Performance Report. Oct. 2022

Opportunities and Challenges

Two diametrically opposed realities confronted casino operators in the third quarter

By

Two themes dominated company comments during the third-quarter earnings report season:

1. Business at casinos is strong and older players, international players and conventions are returning, all boding well for the near-term future.

2. Inflation is starting to have its effects driving up the cost of food and utilities and other expenses, chipping away at the big EBITDA margins that casino companies have so proudly achieved.

Related to those are that games and technology companies continue to enjoy strong support from casino operators, are benefiting from strengthening of their balance sheets and are seeing improvements in supply chains.

However, hovering over these conflicting trends is a Federal Reserve Board of Governors determined to put the brakes on inflation even at the cost of recession.

Casino companies have considerable underlying strengths. They have cut costs. Balance sheets have been strengthened and will be strengthened further. There is plenty of room for revenue growth, whether through existing operations or geographic or physical plant expansions.

But for the foreseeable future, there remains that risk of a Fed-induced recession to worry investors.

And the worry is setting in. Even though stocks ran up fast and far after the latest inflation reports showed modest improvements in trends, both absolute stock prices and valuations are below levels. Whether we are in a bear market punctuated by rallies or whether the worst is behind and it’s upwards from here are arguments for bulls and bears. But the reality is that stock prices as of this writing are still double-digits below their highs.

Regardless of short-term market moves, it is safe to say that if the Fed continues raising rates and scaring off investors and a recession ensues, you can say goodbye to all the sanguine talk about consumers continuing to spend. They won’t. Even without recession, there is mounting evidence that the cash hordes consumers built with Covid relief money are finally nearing depletion and will not be there to finance gambling jaunts.

Sprinkle in higher prices and less discretionary

income and the outlook for entertainment companies dims into a world of stagflation. Go past stagflation to full recession and the result for consumer discretionary companies is the same.

And weaker economic conditions will bring lower earnings followed, of course, by lower stock prices likely compounded by tumbling valuations.

If that scenario comes to pass it will spell for long-term investors two enticing words: buying opportunity.

could finally say debt ratios are under control. They and Aristocrat could point to continuing improvement in their business fundamentals. Everi and Inspired Entertainment continued to develop in ways that promise to deliver impressive compounded profitable growth, each with its own special kicker, cashless gaming for Everi and virtual sports for Inspired. All are growing their digital businesses as they develop from casino suppliers into cross-platform games providers.

So, while casinos and sports betting companies grab the attention, investors might do well to look at the engines under the industry’s hood that make it all go.

Now, Macau

Readers of this space are accustomed to my warnings about investing in Macau casino operators. And, for those keeping score, my bearish stance has proven correct, big time.

But conditions change, and now is the time to consider buying the stocks, and especially those of the U.S. listed companies—Las Vegas Sands, Melco Entertainment, MGM Resorts and Wynn.

The underlying strengths of today’s casino companies and their still-to-fulfill business opportunities will remain regardless of inflation, recession or bear markets.

And if history repeats, the road back to higher stock prices will begin before the economy recovers, so any investors waiting for the all-clear signal will miss the big upturn.

In short, now and the near future should be good times for long-term gaming investors to be buyers.

Supplying Optimism

Casino companies make the headlines in the financial press. Everyone can visualize the main floor of a casino, a table game pit, the crowds and bright lights of the Las Vegas Strip.

But the real story of gaming in 2022 might be the health and prospects of the supplier companies.

Everyone, it seems, had a positive tale to tell in their third-quarter announcements.

Big players from IGT to little guys like AGS beat expectations. Companies such as Light & Wonder

Macau casinos may never return to the revenue levels of several years ago. In fact, I doubt that they will, given the Chinese Communist Party’s antipathy towards gambling.

But the national Chinese government also is not about to crush Macau’s economy and, for the foreseeable future, that economy depends on the health of its casino industry.

Travel will soon resume to Macau from mainland China and revenues should grow substantially over the next year, taking stock prices with them. That should present a significant trading opportunity. Note, I said trading opportunity, not investment opportunity. Those believing the long-term bullish story for Macau gambling risk being burned by that Communist antipathy.

Of course, this depends on one big caveat—the renewal of gaming concessions. We’ll know the answer to that soon enough, with current betting that they will be renewed.

Frank Fantini is principal at Fantini Advisors, investors and consultants with a focus on gaming.

12 Global Gaming Business DECEMBER 2022

FANTINI’S FINANCE

Frank Fantini

It is safe to say that if the Fed continues raising rates and scaring off investors and a recession ensues, you can say goodbye to all the sanguine talk about consumers continuing to spend.

”

“

AGEM update

AGEM Member Profiles

Silver Member Profile Zitro globalzitro.com

Zitro’s strong focus on research, development and innovation of products has led the company to become a global leading supplier of video slot and video bingo games in addition to its commitment to give greater prominence to the online market.

Bronze Member Profile Competition Interactive competitioninteractive.com

Competition Interactive is a licensed gaming manufacturer born from the love of game design and the passion of evolving the casino gaming experience. Their strong team brings years of experience to provide the gaming industry with next-gen fun and engaging casino and iGaming products.

Associate Member Profile Butler Snow LLP butlersnow.com

AGEM November 2022 Meeting Recap

• AGEM will host Nevada Gaming Control Board member Brittnie Watkins and Technology Division Chief Jim Barbee at the next monthly gathering on December 13. In addition to a discussion with GCB Technology on general industry issues, this will also be prior to the Nevada Gaming Commission agenda on December 22, where proposed Regulation 5 provisions surrounding cybersecurity will be discussed and considered. AGEM, through its Compliance Committee and outside counsel, is preparing a response and comments on the proposed regulations. Members are also invited to provide additional information that may assist with AGEM’s response to ensure that supplier considerations are identified and considered.

• G2E 2022 was recently completed and deemed to be a successful show by exhibitors and visitors alike. Korbi Carrison, G2E event director, gave a recap of the show at the recent monthly meeting. Total attendance is thought to be 25,000, a number which is just shy of 2019 figures; however, the data is still being analyzed with final figures not yet verified. The G2E educational panels were particularly well attended with higher-than-expected numbers and in some cases, all seats taken with standing room only. The focus now is to build on the success of this year’s show by evaluating all the feedback to determine what worked, what didn’t, and how they can continue to improve to make G2E the best show.

• For the past few months, the AGEM Compliance Committee has been putting together information to present to the Pennsylvania Gaming Control Board to improve the process of game/product approvals. Currently, some of the processes through the lab are quite cumbersome due to the regulations not keeping up with the fast pace of technology progress. AGEM members have been invited to provide information highlighting some of the more common issues that can be presented to the agency for discussion in hopes of finding a more efficient process for all parties.

Forthcoming Events

• AGEM is supporting the National Black Caucus of State Legislators Conference November 30December 3 in Las Vegas by sponsoring a cocktail reception during the event.

• The AGEM McMonigle Cup Golf Tournament takes place at Bear’s Best Las Vegas on December

6. Open to all members, the event will consist of 20 two-person teams and will conclude with a barbecue lunch and prize-giving.

• The National Conference of Legislators from Gaming States Winter Meeting takes place December 8-11 in Las Vegas. AGEM will be a sponsor of this important legislator event with Executive Director Daron Dorsey and Director of Responsible Gaming Connie Jones taking part in various events and panels during the conference.

• The next AGEM Board of Directors/Voting Member meeting will be held on December 15.

AGEM index

Butler Snow LLP is a full-service law firm with a network of attorneys, advisers and staff collaborating across a network of more than 25 offices in the United States, Europe and Asia, allowing clients to benefit from strategic counsel, efficient execution and innovative solutions to complex challenges.

AGEM is an international trade association representing manufacturers of electronic gaming devices, systems, lotteries and components for the gaming industry. The association works to further the interests of gaming equipment manufacturers throughout the world. Through political action, trade show partnerships, information dissemination and good corporate citizenship, the members of AGEM work together to create benefits for every company within the organization. Together, AGEM and its member organizations have assisted regulatory commissions and participated in the legislative process to solve problems and create a positive business environment.

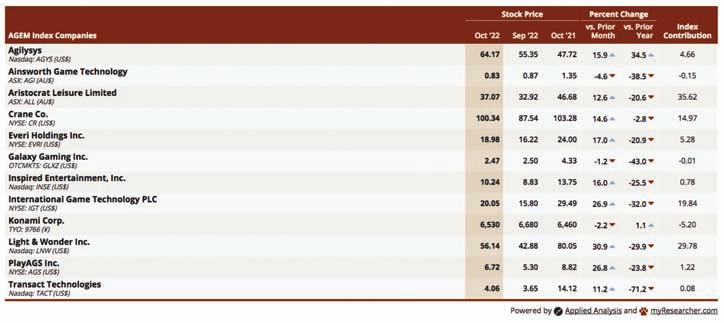

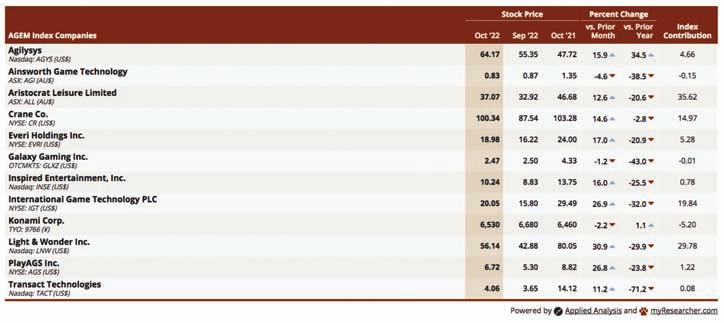

The AGEM Index increased by 106.87 points in October 2022 to 846.64, a 14.4 percent improvement from the prior month. Compared to one year ago, the index was down 231.28 points, or 21.5 percent. The latest period marked the first month-over-month increase following a two-consecutive-month skid. During the latest month, nine of the 12 AGEM Index companies reported stock price increases, resulting in nine positive contributions to the AGEM Index and three negative contributions. The largest positive contributor to the monthly index was Aristocrat Leisure Limited (ASX: ALL), whose 12.6 percent increase in stock price led to a 35.62-point gain to the index. Light & Wonder Inc. (Nasdaq: LNW) contributed a 29.78-point increase to the index as the result of a 30.9 percent increase in its stock price. The largest negative contribution to the index was sourced to Konami Corp. (TYO: 9766), whose 2.3 percent decrease in stock price resulted in a 5.2-point loss for the AGEM Index. All three major U.S. stock indices saw month-over-month increases in October 2022. The Dow Jones Industrial Average increased by 13.9 percent from September, while the S&P 500 grew by 8 percent. Meanwhile, the NASDAQ rose 3.9 percent over the month.

DECEMBER 2022 www.ggbmagazine.com 13

Doing the Math

By Frank Legato

what keeps players at the game—the program math

Fifty years ago, the math of the slot machine was a simple proposition. Three reels, 64 stops per reel, and no special features outside of perhaps a wild symbol. The functions of game design and program math were usually relegated to one person.

The virtual reel system that came in the 1980s changed everything, of course, with an unlimited number of virtual stops at the game designer’s fingertips. Still, things remained relatively simple, at least until Australian-style multi-line games and bonus features debuted in the mid-1990s. With more possible outcomes to every spin, program math gained an importance it did not previously have.

These days, mathematicians are essential to game design. They take creative concepts that present a multitude of outcomes, and features from holdand-re-spin to wheel bonuses to multiple progressive jackpots, and weave them into game programs that keep players playing while making money for the casinos.

“Math is critical,” says Michael Brennan, chief product officer for slot supplier Bluberi. “In the simplest terms, the old adage of ‘the art gets the player to stop and try your game, but the math keeps them there (and keeps them coming back)’ really does ring true today more than ever.”

“Game math is the foundation of the game,” notes Gerard Crosby, senior vice president and chief games product officer for Konami Gaming. “The game designer works closely with the mathematician creating a compelling math model, then works with a small team of artists, engineers and composers, developing the game vision, ensuring the player chases are transparent and fun to play.”

Other suppliers sing a similar tune when it comes to the importance of math in the game design equation. “The combination of math and art is extremely important to any slot product,” says Ainsworth’s Andrew DuBose, a game designer who also holds an M.S. in mathematics. “We are always trying to meet the players’ needs and expectations

during game play.”

Ainsworth Lead Game Designer Terry Daly, a 30-year veteran of the craft, digs down deeper, noting that math is what governs the game style. “A gambler-style game will have a low win frequency, but higher pays,” he says. “An entertainment-style game will have more frequent bonuses, but lower pays. It’s important to determine what you are trying to accomplish with each game. You are really trying to reach two audiences. There are players who have more time than money and other players who have more money than time. We need to appeal to both on casino floors.”

“Konami’s math is targeted toward the gambler player type, and game themes tend toward the styles sought out by that type of gambler,” says Ian Arrowsmith, senior director of game development for Konami Gaming. Michael Mastropietro, senior vice president of game development for Light & Wonder, says, “To achieve successful game design, mathematicians, game companies and designers must embrace the idea that math is the soul of the game. The experience of the game and the excitement behind each moment is driven by math. When you mesh these two elements together—creativity and mathematical function—you achieve a balance that not only is functional for the casino but is also excitable for the player.”

14 Global Gaming Business DECEMBER 2022

“You are really trying to reach two audiences. There are players who have more time than money and other players who have more money than time. We need to appeal to both on casino floors.”

—Terry Daly, Lead Game Designer, Ainsworth

Anthony Baerlocher, vice president, innovation and mechanical reels for IGT, puts it succinctly: “To me, the math is the personality of a game,” he says. “Different people are attracted to different types of games and game math. The math itself is complicated, but it is a science. It is true, it is accurate. But there is an infinite number of permutations on how to get to a 95 percent payout. That’s where the creative process comes in—building the pay loading, the frequencies, how much goes into a bonus that creates that game’s unique personality.”

Signature Style

Those “unique personalities” of games have allowed each supplier to develop a signature style—game characteristics that players recognize as the product of a particular manufacturer.

“We do think we’re evolving a signature Bluberi approach,” comments Brennan. “Can we take the final game math and simply re-present key events and mechanics to the player to add variety, depth, and re-playability without affecting the core math pillars?

“For example, if you spin a wheel to win a multiplier, why not, for a less frequent subset of this occurrence, present the multiplier first then recreate the wheel spin experience? This is a method we used to great success in Devil’s Lock and are repeating with upcoming releases.”

“Ainsworth’s high-denom math models have been some of Ainsworth’s signature game styles,” says Daly. “That’s a much different math style than a traditional three-reel game or a five-reel low-denom game. It’s all about appealing to different players.”

“All mathematicians have what we’d consider a style or fingerprint to the designs we put out,” says L&W’s Mastropietro. “This signature fingerprint is woven consistently throughout studio outputs.”

Tweaking the math while keeping a signature style is particularly important in the case of recurring game themes. “When it comes to building game families, you typically have math models that stay consistent and then iterate the creative,” says Mark DeDeaux, general manager and senior vice president, slots for AGS. “As an example, with the game Rakin’ Bacon!, we have certain standards within the game to make sure they are always present. When we make sequels, there are certain items we never want to depart too far away from, like the base mechanics, because players have certain expectations of the game.”

“For game families, we try to keep jackpot and feature hit rates the same,” says Ainsworth’s DuBose. “On all our three-reel games the jackpot

frequency will be similar. The math changes may be more subtle in line pays or adjusting other frequencies of events that players will want to chase.”

“Thinking back to many of our game families,” says Mastropietro at L&W, “you’ll see various iterations of the game, and with each new addition to the family, there’s something that makes it more compelling for the player. We look to take the fun parts of the game that really draw in the attention span and excitement and give them a plus-up.

“For example, our Dancing Drums began with the feature play of drums growing up to six stacked, but when we released Dancing Drums Explosion, we thought, ‘OK, how can we one-up this for the player?’ and that’s where we decided the drums now would grow to stack eight high.”

One theme that has maintained its signature style throughout the past 25 years and scores of individual titles is the Wheel of Fortune franchise from IGT.

“There are certain functionalities that are combined with the wheel and frequency of the wheel that have fulfilled play expectations over so many years,” says Dubravka Burda, senior vice president, global studios for IGT. “We evolved the math over the years, but the functionality, the color, and the parts in the game are very consistent. This is something that is definitely IGT’s signature.”

The Basic Process

As more and more diverse game features have been added, game design has become more complex over the years, as all those features and outcomes must be woven into an effective math program. However, the basic process of game development has remained as a joint effort of creative design and mathematics.

“Essentially the whole process hasn’t changed at all in the fact that you’re aiming to create an experience that is going to get the player excited to pursue a win and want to play the game each time they visit a casino,” says Ainsworth’s Daly. “What has changed is the technology. The math is much more complex. We can really drill down into how players interact with the game.

“Additionally, the math modeling is much more flexible. In older games, especially old mechanical games, you could get very limited in what

DECEMBER 2022 www.ggbmagazine.com 15

“Game math is the foundation of the game. The game designer works closely with the mathematician creating a compelling math model, then works with a small team of artists, engineers and composers, developing the game vision, ensuring the player chases are transparent and fun to play.”

—Gerard Crosby, Senior Vice President and Chief Games Product Officer, Konami Gaming

you were able to execute. To put it simply, the power of microprocessors today is infinitely more powerful than anything that was available in the past. The ability to use graphics to reflect the math has obvious changed significantly over the years. You can do things today that would have been unfathomable 20 years ago.”

“Great game ideas come in all different shapes and forms,” says DeDeaux at AGS. “Sometimes it’s iterating off of mechanics we are familiar with in the market and building math models that accentuate the game. It starts with the concept of a game and simultaneously, graphics, art and math come together to complement it. We identify what we want to achieve and have ongoing development and iterations of it to get there.”

“Concept first, then we assign a math model,” explains Martin Blais, mathematician manager for Bluberi. “And it all has to gel, following our cornerstone design principle of ensuring everything is ‘where it matters.’ Big animations should coincide with significant math contributions, for example.”

DuBose at Ainsworth comments that effective game design is a process that can take many forms. “In the recently released Grand Legacy and Royal Legacy, we thought we had a good game theme and wanted to incorporate some ideas like larger multipliers and the chance to win multiple jackpots on a single spin,” he says. “We sat on it for bit until we were able to come up with the right math for the game.”

“Konami’s R&D works closely with product management to determine the business and market needs with respect to all the different types of games required,” says Arrowsmith. “The game designer usually has an idea of the type of game they want to make. They then work with both math and art to come up with an initial concept, with the math and art complementing each other, to produce an awesome game.”

What has changed in this process is the complexity of the games themselves, according to Konami’s Crosby. “The games have become more complex as more and more exciting new free game and bonus features are included,” Crosby says, “and thus, product technical documents have grown to be the size of a large novel, and simulations of the math models have become a critical part of the math design process.

“Also, the design of the math model is much more collaborative between mathematician and game designer to ensure the best playing experience is achieved. Wizard Strike is a perfect example of this, where mathematician

and designer worked hand-in-hand to produce this compelling model.”

“Games used to be pretty simple, but they’ve grown significantly in complexity,” says Blais at Bluberi. “The role of a mathematician has also evolved, where today a strong mathematician needs to be versatile—he or she has to know some programming, for example.”

“Back in the day when it was three reel, one-line stepper, it was here’s a math idea first,” says IGT’s Baerlocher. “That’s inverted in today’s world. It’s really more about coming up with the concept and then making sure that the math fits. And then what we see happening is the math actually adapts to the original concept. If we find it doesn’t play the way it was originally envisioned, we make modifications so that the concept and the math work hand in hand.”

“Game math is fairly finite,” says DeDeaux at AGS. “You may have a game concept that is creative in the types of bonuses you want to do, but adapting the game math to the game is challenging, and takes a lot of creativity and finesse to have the exact outcome mathematically in the bonus, features, and base game. It requires a lot of art, science, and being creative in solving challenges.”

Into the Future

Those challenges will no doubt increase as the creative teams at the slot suppliers come up with more innovative concepts and new ways to play.

“One thing that is certain is that games will become more complex in the future,” says DeDeaux at AGS. “As an industry, we will face the challenge of entertaining and capturing the younger demographic. When you look at how tech has evolved, and the types of entertainment experiences offered on cellphones, we will need to think about how we can compete with future technology, in general, to continue moving forward as an industry.”

IGT’s Baerlocher sees the challenges of game design evolving as more information becomes available on player preferences. “The big thing I see changing in the industry is the availability of data,” he says. “It used to be really hard to get any type of information out of the casino industry on how games were performing, but in the past four or five years, operators are being more open to sharing data because they realize that by giving the suppliers some insights, they’re going to get a better product.

“With information like the Eilers report and ReelMetrics that shows which games are the top earners, you can spend more time studying those games and learning from them... using data to help our creativity.”

“I like to use the analogy that building a game is like building a great (music) album,” says DeDeaux at AGS. “You need lyrics, your music, and all the different elements to create one. But it’s the combination of all these things working harmoniously together that makes it great.

“Math is like the heartbeat of a game, similar to how the rhythm is the heartbeat of a song—and it is critical to the overall success of the game.”

16 Global Gaming Business DECEMBER 2022

“The combination of math and art is extremely important to any slot product.”

—Andrew DuBose, Game Designer, Ainsworth

Back to Basics

pandemic

Last year, the top trend identified by the editorial advisory board of GGB was the recovery from the pandemic. Yes, following the shutdowns of 2020, 2021 was an improvement, but in 2022 the pandemic was clearly in our rearview mirror. The gaming industry produced record revenues in 2022 as players relieved that pent-up demand that had been building up since the introduction of Covid. So things were good.

Now, 2023 will certainly have its challenges, most notably the soaring inflation and economic malaise that has already begun in the second half of 2022. But the overhang of Covid is gone, at least in most of the world outside of southeast Asia. The Chinese zeroCovid policies are affecting all the jurisdictions that depend on Chinese travelers, so there’s no telling when or if that policy will be relaxed.

But for the rest of us? It’s back to “normal,” or whatever that is in the wake of the pandemic. But possibly because of the clouds that hang over the general economy, the trends for ’23 weren’t that clear. Is sports betting really doing the most it can for the gaming business? If so, what happened in California? Can I bet on the next pitch? How is casino marketing changing now that the next generation is in play? If Macau is hurting, who’s getting that business and why? How is slot theory evolving for new players? Esports betting getting closer? What’s so great about sustainability? And when it comes to new venues, when can we look to Texas? If it’s taken years to get over the hurdles in Japan and Brazil, what makes us think that it will be easier in Europe?

So learn what to look for in 2023, but you’d better look fast. It may not last long.

1

Island Fever

Europe’s first integrated resort will open in 2023 and may spur a quickening of the pace for others

The Cordish Companies are part of a massive development in the town of Torres de Alameda near Madrid

Integrated resorts are a proven success wherever they are built. The U.S., Australia, and many countries in Asia can attest to their ability to create employment, generate massive tax revenues and increase tourism in quantity and quality. Why, then, have there been no IRs built in Europe, a continent that could surely appreciate those benefits? There have been no shortage of proposals, with many European countries floating the idea, but it has never come to fruition.

Why? The answer is often convoluted and includes politics, corruption, tradition, and often a lack of commitment to the process.

But all that is about to change in 2023. The first European IR will open in Cyprus. It’s been a fiveyear effort, and the Asian gaming company, Melco Resorts & Entertainment, is poised to open City of Dreams Mediterranean in the second quarter of the year.

Even before opening, COD Mediterranean seems to have reawoken interest in IRs in other countries. In Greece, a plan to create a master community at the former Hellinikon airport that includes an in-

City of Dreams Mediterranean

Total size of site:

• 36.7 hectares (88 acres)

• 86,000 square meters (282,000 square feet)

• A 14-story hotel tower with 500 guest rooms and exclusive suites

• 9 world-class restaurants and bars

• Retail area inspired by the streetscape of the old Nicosia

• 7,500-square-meter gaming area with over 100 tables and 1,000 state-of-the-art slot machines

• Over 9,600 square meters of expo, ballroom, convention, meeting and pre-function areas

• Spa and fitness facilities

• Sports and leisure facilities, including a seven-a-side football pitch, tennis court, squash court and jogging trails

• Indoor and outdoor swimming pools and landscape gardens

• 200-seat amphitheater and terraced lawn for live outdoor entertainment

• A family adventure park

18 Global Gaming Business DECEMBER 2022

Location: Zakaki, Western Limassol

The 10 Trends for 2023 do NOT start with the recovery from the

tegrated resort appears to be moving forward. Hard Rock International is the partner (replacing Mohegan Sun) with the GEK TERNA Group and construction is under way for a possible 2026 opening. The property promises a five-star hotel, premier convention and meeting space, a large entertainment component, world-class food and beverage and unique outdoor spaces.

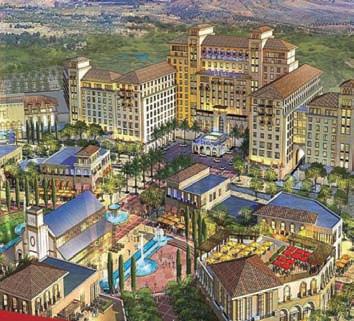

In Spain, the Cordish Companies, known for its “Live!” gaming and nongaming developments in the U.S., has reached an agreement with the small town of Torres de Alameda, east of Madrid.

The mayor of Torres de Alameda, Carlos Sáez, is fully behind the project, which will feature a variety of attractions including several smaller casinos, hotels, shopping areas, meeting and convention space, restaurants and much more. Sáez insists that Cordish is “in love” with the town and fully committed to the project.

But it will take more than the approval of the mayor of Torres de Alameda; it will require the OK from the Community of Madrid, a regional organization that rejected the first Cordish proposal for “EuroVegas” in 2017 because it was too “American” and failed to promote the Spanish culture. Cordish is hoping this time will be different with one of the attractions being the world’s largest flamenco table. The project will cost an estimated $2.36 billion with profits of over $4 billion projected within the first five years.

But with no timeline, the Melco project will get a long head start.

Grant Johnson, the property general manager for City of Dreams Mediterranean and Cyprus Casinos, tells GGB he thinks the company’s relations with the Cyprus government was the reason Melco was chosen.

“It takes a unique set of circumstances to make an integrated resort happen,” Johnson says. “Melco is always looking for growth opportunities, and I think in Cyprus, we finally found an opportunity where it was a destination that had a good base of tourism with a good location and potential to grow that tourism number. And more importantly, Cyprus was a government that seemed very interested to bring an integrated resort to the market.

“Europe is a complicated place with lengthy and complex regulatory processes, and it was a long time coming for this type of integrated resort, but it was a good match between our objectives and Cyprus.”

Johnson explains that Cyprus was looking to upgrade and increase its visibility by approving an IR.

“Cyprus has a small population of 900,000 and competes with the tourism offerings of the Mediterranean—Greece and the islands off Greece, Southern France and Italy, and other places,” he says. “I think Cyprus is under-recognized. So they were looking to put themselves on the map a bit more for its blue water, beautiful beaches, 320 days of sun, and a mix of various cultures. There are Roman, Greek and Turkish influences. So it’s a unique place, and I think they were looking for new ways to help market themselves. And the integrated

resort will do that.”

One of the issues Cyprus wanted to address was an expansion of the season, according to Johnson.

“It’s very much a summer market,” he says, “a seasonal market. So they were really looking to make us a year-round destination. With an integrated resort, you bring in the MICE business in the winter, alternative entertainment, and we’ll fill this place with content. It just enhances the offering.”

Four years ago, Melco began to open satellite casinos across the Republic of Cyprus, and four are open today. Johnson says they’re typical “locals” casinos.

“It’s a very much core local clientele of repeat visitation,” he says, “a nice base of business that we can start with here, but we need to grow that international space as we go. There were no casinos here prior to us operating in the Republic of Cyprus. There’s some in the north of Turkish-occupied Cyprus, but we had to basically build up a local casino operation team. We hired almost all of our dealers locally and trained locally. They will move up to supervisors when COD Mediterranean opens.”

As for that international visitation, Johnson says it will rely heavily on Israel and the surrounding Gulf states.

“In the summers there are 30 flights a week from Israel,” he says. “And that drops down to about 10 per week in the winter months. And then you go to the Gulf countries, which are also big for us. So the Gulf countries, and then Pan Europe and sprinkle a little bit of North Africa in there as well. And then we’ll see what happens with the conflict in Ukraine. Russia used to account for about 20 percent of the visitation to Cyprus. Not so much anymore, but longer term as Russia comes back, I think that will be in the mix as well.”

Another target for Melco is the tour operators who run excursions throughout the Greek Islands over the summer season. Johnson says extending these relationships is a priority for COD Mediterranean.

“We hope to work with over 90 tour operators by the time we open; we’re slowly starting to sign contracts,” he says. “There’s an existing tour operator business that now we’re tapping into. We think our product adds to this. We’re now going back and having to be a bit more aggressive with our partnerships and to push a little bit more on the off season, because that’s something where traditionally the tour operators haven’t come to Cyprus. So that’s where the Ministry ofTourism gets involved, and it’s working with the airlines together with tour operators and trying to develop off-season content.”

Melco made a commitment to the government to first hire Cyprus citizens, and Johnson says they are fulfilling that commitment. But he also notes that they’ve had to reach farther afield to fill some positions.

“We have 700 colleagues now that are employed through our satellite operations but we’re hiring another 1,800 as we get to COD Mediterranean,” he explains. “And we’re struggling, to be honest, to find enough locals within Cyprus, which is our priority. So we’re looking now across Europe and even non-EU countries.”

Johnson is confident not only that they’ll be well staffed for the opening, but that the Melco corporate culture will keep them engaged.

“As you know, that’s in our DNA, and it starts with (CEO Lawrence Ho) and then trickles down to all of us. Melco has always been a global leader in hospitality with service, and we just moved it to Cyprus and applied it here. There are some adjustments, of course, as you get into a local market because you want to adapt to the local culture. But that’s really our strength as we come in, because there are probably hundreds of hotels throughout Cyprus, but what we’re bringing is the Melco global standard of hospitality.

“We’ve got 96 Forbes stars, and I forget how many Michelin stars we have now, but they are special here, and that’s actually helping us recruit.”

—Roger Gros

DECEMBER 2022 www.ggbmagazine.com 19

The Hard-Rock Hotel Casino Hellinikon Athens

The Philippine Casino Gaming Market

An exemplary case of competitive factors driving market recovery and growth in a post-Covid era

While the profound impacts of the Covid-19 pandemic continue to linger in many Asia Pacific gaming markets, the Philippine casino industry has been leading the region’s recovery and displaying signs of growth. The following examines how diversification and other key market advantages provides an exemplary case for post-Covid era gaming across Asia.

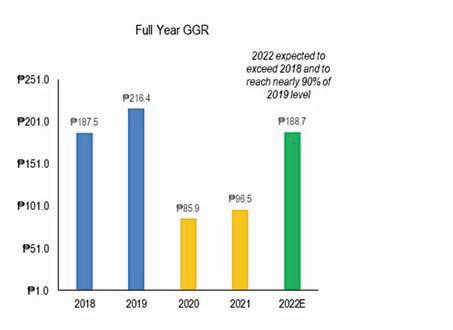

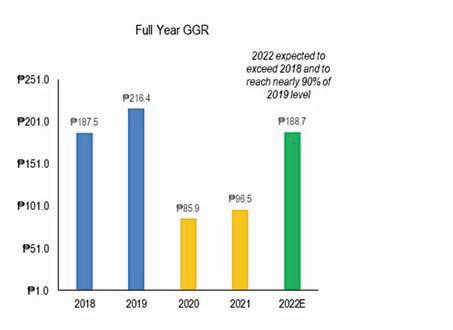

Land-based casino gaming in the Philippines was legalized in 1976. Since then, the industry has grown steadily over the past few decades (except during the pandemic-affected years) and has successfully secured its position among the top three gaming markets in Asia. From 2012 to 2019, the market’s gross gaming revenue (GGR) grew at a compound annual growth rate (CAGR) of more than 17 percent to achieve a record GGR of PHP 216.4 billion in 2019, more than three times the GGR in 2012.

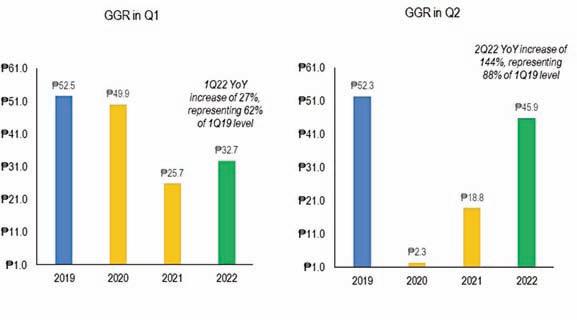

Casino Gaming GGR in the Philippines (PHP in billions)

What is fueling the recovery and growth of the Philippine casino market? Our analysis indicates that the critical drivers include diversified product offerings, well-balanced market segments, expanding and enhanced capacity, an advantageous gaming tax regime, a solid workforce available at competitive costs, and the agglomeration of high-quality integrated resorts (IRs) in the country.

Diversification

The Entertainment City district in Metro Manila, the pride of the country, is a truly remarkable example of casino gaming and diversified leisure activities. Home to a number of prominent world-class resort complexes, the area provides a wide range of lodging, gaming, and other entertainment offerings. Moreover, Entertainment City arguably represents one of the world’s top IR clusters, along with the Las Vegas Strip and the Cotai Strip in Macau.

While these destinations have varying degrees of dependency on gambling, the agglomeration of casino facilities has undoubtedly shaped all three into top tourist destinations. The resulting “cluster effect” is expected to drive a strong and sustainable increase in future gaming and tourism demand.

The country’s anchor destination, Entertainment City, is complemented by other notable casino resort areas in Cebu and Clark. Cebu, a significant tourism destination and the second largest metropolitan area (after Metro Manila) in the Philippines, recently welcomed a new five-star IR, NUSTAR Resort and Casino, with Emerald Bay Resort and Casino expected to open next year.

The Clark Freeport Zone, a redevelopment of the former U.S. air base about 50 miles north of Metro Manila, is home to multiple high-quality gaming and hospitality properties. The upward dynamics in these markets unequivocally endorse the importance of diversification in terms of product offerings, source markets and beyond, which had been emphasized by many before the pandemic and have become even more critical in the post-Covid era.

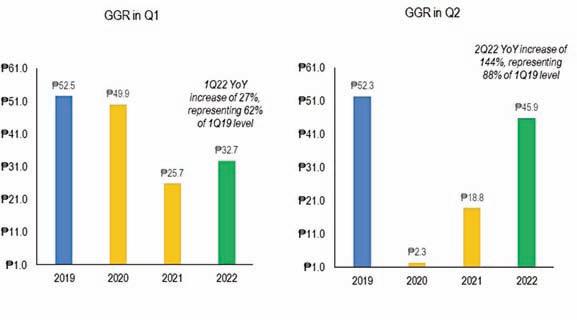

During 2020 and 2021, the market was severely impacted by protective measures instituted to curb the global pandemic, including closures, lockdowns, capacity limits and other restrictions. Nevertheless, the Philippine market’s GGR in the first half of 2022 has demonstrated a strong rebound with the recovery pace expected to accelerate—the 2022 total GGR estimate is anticipated to exceed the 2018 level and to reach nearly 90 percent of the 2019 level.

Visitation

Fueled by solid local market segments and gradually increasing international visitation, the Philippine gaming market has been able to achieve substantial progress since early 2022. Within the current Asian gaming landscape, one of the most noticeable ongoing changes is the shift of junket-channeled VIP play

Solid Recovery Beginning in Q2 2022 (PHP in billions)

20 Global Gaming Business DECEMBER 2022

2

Source: PAGCOR, The Innovation Group

Source: Philippine Amusement and Gaming Corporation (PAGCOR)

to mass-oriented business. While it is true that mass gaming tends to yield a relatively higher profit margin than VIP business, it is important to not overlook the infrastructure and capacity required to handle the volume of mass visitation necessary to offset the decrease in premium business and achieve future growth. The Philippine market fills another exemplary role in this context.

Infrastructure improvements in the Philippines, ranging from enhanced connectivity between Manila and the neighboring regions to the newly added terminals at airports in Clark and Cebu, are expected to facilitate rapid recovery and further growth of the country’s gaming industry. The Clark International Airport’s new 10,000-square-meter terminal can accommodate approximately 8 million additional passengers per year. In addition to providing a more efficient gateway into Clark, it also is intended to ease air traffic congestion at Manila’s Ninoy Aquino International Airport.

Workforce

Further to above, one challenge that surfaced during the pandemic and continues to linger is the availability of a quality workforce. Shortages in skilled labor have hindered recovery and growth pace of economic activities around the world, and have been especially challenging for service industries like gaming. Mass gaming requires a larger workforce of quality, skill and reliability, which is likely to challenge many operators in the region’s gaming markets.

The Philippines possess another competitive advantage in this area. The local workforce tends to be comprised of fast learners who have the passion to work in most entertainment and hospitality settings. Meanwhile, labor costs in the Philippines remain among the most competitive in the ASEAN countries, at-

tracting foreign investments and new operations to the country.

Taxation

Gaming tax rates and structure can have a significant impact on the potential success of an IR development and the acceptable return on private investment. Implementing a tax structure that attracts optimal capital investment while still deriving adequate revenue through taxes and providing ample funding for tourism promotion, regulatory oversight, and other associated social needs is critical.

The Philippines’ gaming tax regime remains commercially competitive in the Asia Pacific region, which represents a solid competitive advantage of the market, as operators can allocate more financial resources towards customer acquisition and/or capital improvements that result in greater prospective revenues.

While macroeconomic conditions and geopolitics between the Philippines and its key feeder markets may impose challenges in the years ahead, on balance, the Philippines gaming market is expected to grow in a sustainable manner thanks to its major business drivers and competitive advantages. The Philippine market already has set an exemplary case for the industry in the Asia Pacific region to evolve in a post-Covid era and will continue to build on that by capitalizing on the booming, and increasingly wealthy, middle class in the region, and better stimulating tourism and related economic impacts that benefit the country. —Michael Zhu is senior vice president, international operations planning and analysis for The Innovation Group.

The Holy Grail

Microbetting will produce more revenue for sportsbooks, but how will it be promoted?

Critical mass has always been the key to success for sports betting. If you can only make a few wagers on the results of the entire game/match, you might as well be betting the horses. And we know that horse racing is a dying sport for that exact reason. They haven’t figured out how to allow betting at the quarter pole or any other length of the race, or even of the margin of victory, so the win-place-show and all the attendant parlays is about it.

While sports betting has a few more results-driven wagers available, the real prize is figuring out how to bet in-game or in-running, whatever it’s called. When you could predict whether the next pitch will be a strike or a ball, or even a fastball versus a curveball, you’ve drilled down. When you have analytics to place accurate odds on whether the next play will be a run or a pass, you’ve got something. Or if you could take a flyer on whether the basketball team will run a play resulting in a layup or a 3-point shot, you might be building something strong.

So far, in-game wagering hasn’t taken off in the U.S. Much of it could be the result of lagging technology. Either the operator doesn’t trust the technology to offer in-game betting or the player gets frustrated with the lag time between deciding to make the bet and actually pulling the trigger. Seems that more often than not, the odds change dramatically in the other direction or the bet gets taken off the board. It’s frustrating for both parties.

In addition, in-gaming betting is largely limited to the shifting odds on the results of the entire game. For example, in soccer, if a team that started the game at +200 scores the first goal, the odds of them winning the game probably drops to even money or even -120, given the paucity of scoring in many soccer matches. But try to find a bet that predicts which team will make the next turnover. In most cases, the U.S. for sure, it won’t be there.

But there are dozens of companies in pursuit of the “holy grail,” and the ones that succeed will do very well. SimpleBet is a company that is a contender. Mark Nerenberg, the company’s chief commercial officer, explains why it’s important to understand the dynamics between this “micro time frame in-play betting.” While he says that this kind of wagering hasn’t been that prominent in the European sports betting community, he believes it will be different in the U.S. “because of the cadence of the U.S. sports and the significance of these micro events within the sports.”

The microbettor will have a chance to wager whether Aaron Judge will hit a home run while he’s in the on-deck circle, or even when he’s down 0-2, when the odds will soar against him hitting it out

He says that there is always significant time to place bets on these micro events, and that those events are already highly recognized by fans.

“They have opinions on whether one team is going to stop the other on third-and-one, or whether the next hitter will be able to deliver in the clutch,” he says. “Those things are already ingrained in the U.S. sports.”

Nerenberg says the technical expertise compiled by SimpleBet over the past three years has made a huge difference.

“When you’re taking these microbets, you have to know the exact state of the game at all times,” he says. “We got very good at defensive logic, where we identified all these situations that we know would be wrong. Then the other challenge was marrying that with fully powered machine learning models that could work with that defensive logic to reprice the market. Dozens of markets are being created with every pitch, every play, and we’ve gotten really good at the machine learning engineering aspect of microbetting.”

The benefits of microbetting are many, according to Nerenberg.

“Starting with the users,” he says, “it’s that short interlude and ondemand. That’s where the internet is going now. Instead of just waiting for a three-hour game to be over for a result, they can jump in and out and make bets the entire game. For the users, it’s a higher level of engagement.

“For the operators, it’s high turnover, good monetization, similar to iGaming. But this is built on underlying entertainment that people are already engaged with. For example, if Aaron Judge is on deck, will he hit a home run when he gets up? Or even better, if he’s down 0-2 in the count, the odds just got more attractive for a huge payout for the bettor.”

While the U.S. sports seem to be more suited for microbetting, similar situations exist in such games as golf and cricket. And as the technology improves, and bettors aren’t shut out of bets that have a rapid resolution, microbetting should thrive.

—Patrick Roberts

22 Global Gaming Business DECEMBER 2022

3

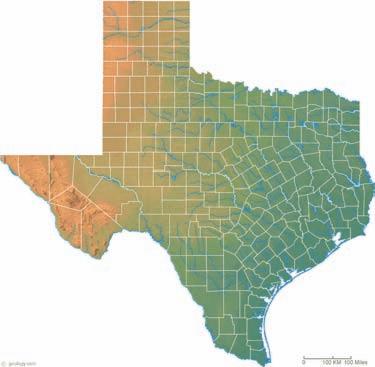

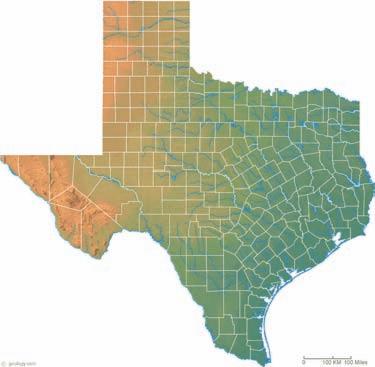

Texas Teases

The rumors have been going around for quite some time—2023 could be the year that Texas passes casino gaming legislation. Full disclosure, I was born in Texas and lived my formative high school years in Southeast Texas, only a 30-minute drive from Louisiana’s Delta Downs racino and an hour from the casinos in Lake Charles. I want Texas to get this right. And with Texas’ status as a top state for business and quality of life, I have every belief that they will.

Texas is home to the fourth and fifth most populous metropolitan statistical areas (MSAs) in the country—Dallas-Fort Worth and Houston (7.7 million and 7.2 million people, respectively); San Antonio and Austin are both in the top 30 most populous MSAs. Each of these massive MSAs with their existing tourism infrastructure and their growing wealth should be able to support a first-class destination resort casino. In fact, of the top 30 MSAs in the U.S. that permit gaming, each hosts multiple casino gaming facilities within their markets.

However, even with the recent proliferation of skill-based gaming machines and social poker clubs in the state, casino gaming and sports betting are prohibited in the Texas Constitution. That constitution can only be amended through a two-thirds vote of the legislature, followed by voter approval. November 14 was the first day that legislators could file bills for the 88th Legislature, which convenes on January 10, 2023 and closes on May 29. In November Senator Carol Alvarado (D-Houston) introduced a bill that would legalize sports betting and casino gaming in Texas, but that bill has a long way to go.

So what will the final casino legislation look like? During the 2021 session, Rep. John Kuempel (R-Seguin) and Alvarado filed legislation to permit four destination resort casinos in the state’s four largest metro areas: DallasFort Worth, Houston, San Antonio, and Austin. The bill sought to create a Texas Gaming Commission, would have imposed a 10 percent tax on table games and 25 percent on slots, permit the state’s federally recognized Native American tribes to offer full-scale casino gaming, permit horse and greyhound tracks to offer gaming, and would have also legalized sports betting.

In that same session, Rep. Joe Deshotel (D-Beaumont) filed a bill which provided for nine casino licenses to all be located within 200 miles of the Gulf of Mexico, including licenses for existing parimutuel licensees, all under the Texas Lottery. Levying an 18 percent tax rate on GGR, the funds were to pro-

vide funding for coastal protection and assistance for communities hit by catastrophic flooding. That bill received tacit backing of Speaker of the House Dade Phelan (R-Beaumont), whose district has been hard-hit by hurricanes in recent years. Both 2021 bills died, and everyone has since had the chance to regroup.

Governor Greg Abbott’s pre-election announcement that he would consider “a very professional entertainment option” signaled that the issue is on the table. Deshotel is retiring, to be replaced by his former chief of staff Christian “Manuel” Hayes. Will the newly elected Rep. Hayes carry on his former boss’ casino efforts and goal of helping disaster-ridden communities?

Speaker Phelan hasn’t made any public comments on the issue of late, but last December issued a statement saying, “These issues are best viewed through the prism of being long-term commitments rather than short-term revenue sources, and (he) believes they warrant a broader discussion on the economic impact that large entertainment investments can have on a community.”

Lieutenant Governor Dan Patrick has a track record of supporting job creation and economic development, and in February 2021 said in an interview on The Chad Hasty Show that “if you want to pitch your casinos or you pitch your sportsbooks, talk about jobs, talk about tourism.” Could we now see passage of casino bills which incorporate pieces of the previous ones? Or something different entirely?

However this turns out in 2023, I believe the legislature will continue to engage stakeholders and do its homework. I’ve spent the last nearly two decades working in the gaming industry and have seen both great successes and myriad mistakes made by well-meaning government entities. Success will be maximized by logical, forward-thinking vision that views resort casinos as major economic engines.

Small thinking and piecemeal legislation will result in undesirable projects with limited economic impacts. A thriving industry which creates good-paying jobs and spinoff benefits in the economy, contributes to communities, and helps the state and localities to meet funding goals is possible, and should be the only acceptable outcome. I am hopeful that this message is being heard in Austin, and that Texas can show the rest of the country how it’s done.

—Suzanne Perilloux Leckert is managing partner with the Convergence Strategy Group (convergencestrat.com) and can be reached at spleckert@ convergencestrat.com.

DECEMBER 2022 www.ggbmagazine.com 23

Will the Lone Star State join the gaming community?

4

Texas Governor Greg Abbott did an about-face before the 2022 midterm elections by saying he would consider legalizing “a very professional entertainment option”

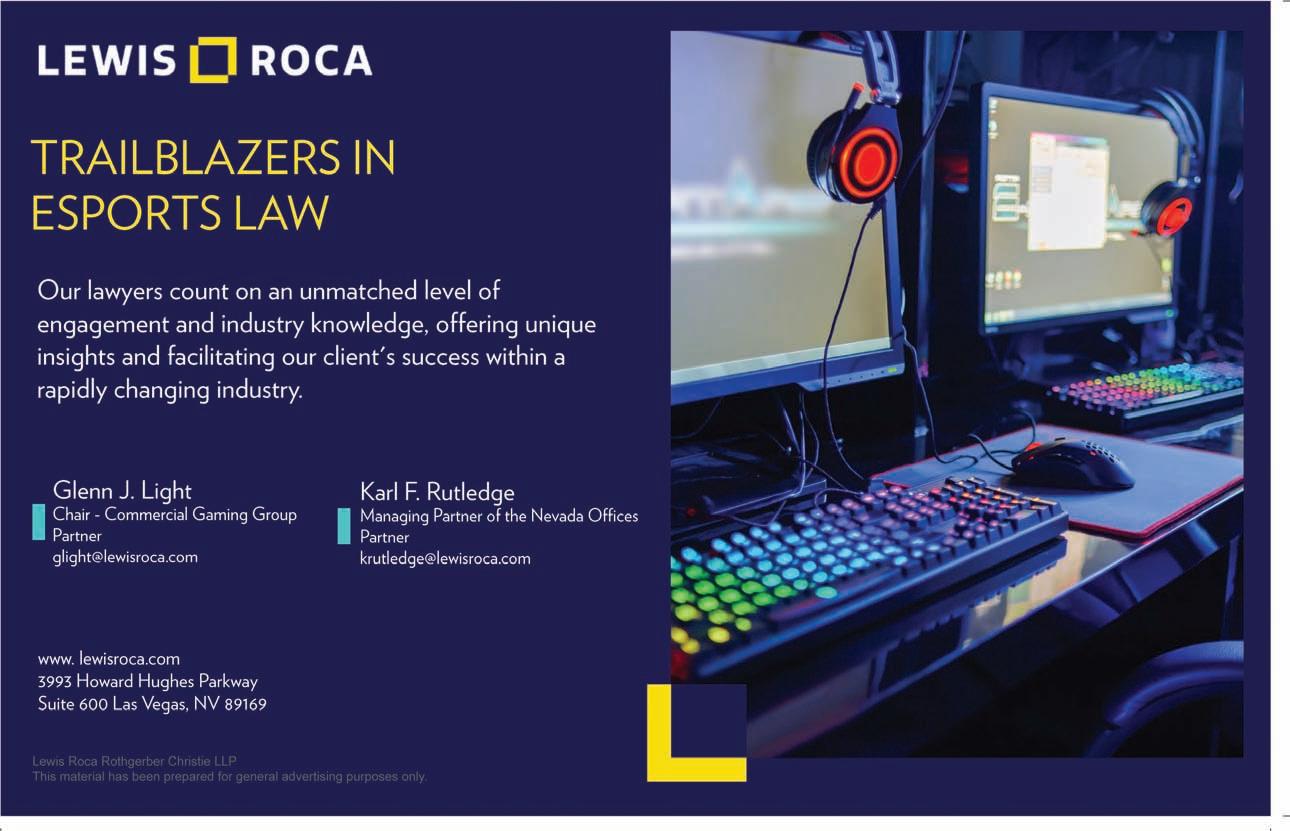

5The Rise of Third-Party Esports Wagering

Nevada and New Jersey are the leaders in developing regulations

Aconstant in the gambling industry is that it is always evolving and seeking new revenue growth streams. One of the newest and groundbreaking opportunities comes in the way of third-party, electronic sports (esports) betting.