8 minute read

Cutting Edge

by Frank Legato

Property-Wide Cashless

Advertisement

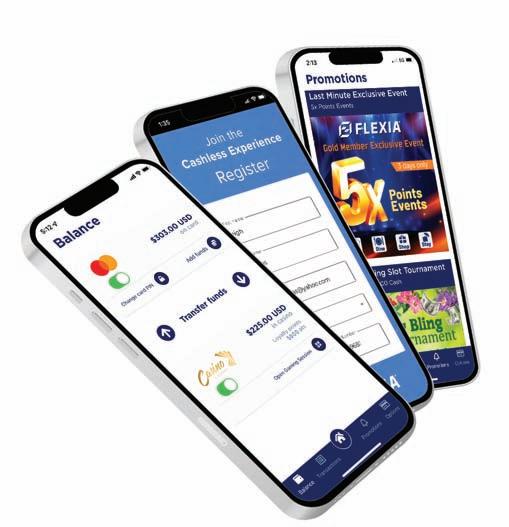

PRODUCT: Flexia Cashless Gaming Solution

MANUFACTURER: Flexia Payments LLC

The Flexia Cashless Solution is driving an enhanced customer experience by facilitating a single digital wallet that may be utilized property-wide for gaming, retail, F&B, hotel and other amenities throughout the casino resort. Providing convenience, speed and integration with multiple systems and partners, Flexia enhances the bottom line and improves customer satisfaction.

Flexia’s go-to-market strategy is to develop strategic partnerships and close collaboration with the leading casino management system providers, including Aristocrat, Axes, CasinoTrac and Win Systems, as well as two more significant partnerships currently in the final stage of negotiations.

Coupled with the flexibility and technical innovations of the Flexia platform, these alliances reduce implementation time by providing a solution already tailored to the requirements of each CMS, allowing Flexia to focus on the specific needs of the casino—as the preferred cashless solution of the CMS rather than as competition.

Consumers demand convenience and ease when they create their new cashless accounts, while operators want a process which leverages existing relationship data to streamline the flow across all customer touchpoints. Flexia’s InstaPlay Registration module solves both challenges by enabling real-time player enrollment in its cashless solution while simultaneously and seamlessly onboarding players across multiple casino platforms in a single, automated process. Players scan a QR code to complete a simple online registration process. InstaPlay collects the customer data, performs instant KYC and fraud checks, and populates the casino’s CMS and loyalty system with the customer’s data. InstaPlay also issues a cobranded multi-account Flexia Prepaid MasterCard as a virtual (in app) and/or physical card, enabling players to use funds in their Flexia MasterCard account outside of the casino.

Players can easily load funds to the Flexia App from bank accounts, credit cards and debit cards, and transfer funds among the Flexia MasterCard account, casino wagering accounts and their favorite games. They can also view transactions, manage their profile, and receive in-app promotions and communications.

The Flexia solution helps operators drive additional player engagement and incentivize loyalty. Linking the Flexia MasterCard account to the casino’s loyalty system lets players earn casino loyalty points, and real-time tracking of player spend—both inside and outside the casino—provides valuable data on player preferences to the marketing team, which can be used for targeted, in-app promotions.

For more information, visit flexiapayments.com.

Processing Power

PRODUCT: DPX-S451 Gaming Platform

MANUFACTURER: Advantech-Innocore

Advantech-Innocore, a global leader in gaming systems, has released the DPX-S451 gaming platform, the latest in the line of the DPX-S Series range of gaming platforms. The DPXS451 is the 12th generation of the S series product range, and continues the field-proven design evolution to enhance the performance and output options for slot machines, casino games and betting terminal vendors.

Using the AMD Ryzen Embedded R2000 processor, which combines the “Zen+” x86 core architecture with high-performance AMD Radeon graphics, the DPX-S451 platform provides enhanced and optimized computing power, unrivaled graphical performance and an overall increase of performance measures of over 33 percent against previous generations based on AMD R2000 Embedded Processors.

The system provides ECC and non-ECC RAM up to 32GB DDR4-3200, support of up to four displays, and a PCIe x16 v3.0 slot to support an additional graphic card. A full set of I/O designed specifically for gaming devices is included, and the system is compatible with Advantech-Innocore’s software solutions for security, media validation, SAS and diagnostics.

The DPX-S451 is also backwards-compatible with other S series products, and is backed by the reliability, longevity and support that Advantech-Innocore is known for. The DPX-S451 is a high-performance board, featuring enhanced processing power and supporting best-in-class integrated GPU, but priced at a cost-effective level.

The DPX-S Series products provide highly integrated industrial singleboard computers and systems with an unrivaled performance range, scalability, long life cycle and low power. Both AMD and Intel platforms are offered, and each one features a full set of I/O, COMs, and security, developed specifically to meet the requirements of the regulated gaming industry.

For more information, visit advantech-innocore.com/hardware/dpx-s.

APOLLO LIQUIDATES PlayAGS STAKE

Apollo Global Management, the private equity firm that was formerly the parent company of gaming supplier PlayAGS, has liquidated its 22 percent stake in the now-public supplier, commonly referred to as AGS.

Apollo was the largest shareholder in AGS, which has grown to one of the industry’s major suppliers of slots and table-game technology.

AGS announced on November 14 that it was selling the 8.2 million shares controlled by Apollo, with the proceeds to go to the equity firm. It did not provide a reason. The following day, AGS shares plunged by 13.39 percent on volume that was more than 20 times the daily average.

“The announcement follows a Q3 earnings report that, while seemingly right down the middle, was met with a 21 percent decline in the shares the following day,” wrote Stifel analyst Jeffrey Stantial in a report to clients. “AGS has partially recovered, though still -11 percent,” said Stantial. “We have yet to hear of anything credible justifying the sell-off from a fundamentals perspective, though the timing of the secondary sale shortly thereafter could potentially draw scrutiny.”

Stantial did, however, note Apollo’s sale removes a “longstanding overhang” from AGS stock, which often traded at deep discounts relative to peers due to the private equity firm’s position in the shares. The analyst added Apollo’s sale was likely more “mechanical” than anything else, as the financial company has been involved with AGS for a decade and its remaining stake was small.

Apollo previously owned Caesars Entertainment but sold the holdings in 2019. Apollo paid $2.25 billion for the operations of the Venetian, Palazzo and Venetian Expo in February as part of a $6.25 billion purchase from Las Vegas Sands Corp. Real estate investment trust VICI paid $4 billion for the land and buildings.

KONAMI APP WINS GOLD AWARD

In December, Konami Gaming announced that its Konetic mobile app has been honored for excellence in digital media. A Gold Winner at this year’s MarCom Awards, it was chosen from a pool of 6,000 entries across 43 countries.

Powered by Konami’s award-winning Synkros casino management system, Konetic gives teams a robust mobile tool to perform a variety of job tasks on the gaming floor including dispatching, jackpot processing, ticket-in/ticket-out (TITO) redemptions, progressive sign monitoring and more.

Konetic is currently live at initial launch locations, with expanding installations having been scheduled through the end of the year.

“Konetic equips casino floor personnel and technicians with rapid mobile alerts from anywhere on the property, so teams have comprehensive ability to respond, with full benefit of managed assignments, status updates, and reporting,” said Tom Jingoli, Konami executive vice president and chief operating officer.

Backed by near real-time communication with Synkros, Konetic drives data to and from casino staff in moments, so they can respond to on-thefloor needs with optimal service and efficiency. The app is available for iOS and Android, and leverages a mobile device’s built-in camera for all barcode and ticket scanning.

Casino properties have the option to enable and disable differing app modules according to their business needs.

AGENCY RECEIVES GRANT FROM BetMGM TO STUDY PROBLEM GAMBLING

Art Paikowsky

BetMGM donated a $180,000 grant to the International Center for Responsible Gambling. The grant, announced November 22, is earmarked to study the relationship between advertising and problem gambling.

“Findings from this evidence-based research study will allow us to better identify potential risks and guide best practices for the gaming industry,” said ICRG President Arthur Paikowsky in a statement.

BetMGM Senior Manager of Responsible Gaming Richard Taylor said such analysis is important in an effort to create programs to deal with such problems, according to CDC Gaming Reports.

“This groundbreaking research will not only provide valuable learnings to BetMGM but will also serve as a guide for the industry and key stakeholders,” Taylor said.

Since its inception in 1996, the ICRG has overseen or published a number of studies on problem gambling.

RESORTS WORLD VEGAS, SIGHTLINE LAUNCH NEXT-GEN CASHLESS

Resorts World Las Vegas

Resorts World Las Vegas and Sightline have launched second-generation cashless technology at the multibillion-dollar complex. Resorts World, a Genting property, opened in June 2021, the first allnew resort to open on the Strip since the Cosmopolitan, more than a decade earlier.

The update includes remote identity verification and enrollment for loyalty and payments, biometric authentication and a single “digital wallet” user experience.

Before remote identity verification, in Nevada a patron could not use his or her account for cashless gaming until an ID was verified on property by a resort staff member. Resorts World Las Vegas is the first casino in Nevada to enable its guests to enroll, verify and fund from anywhere around the world in as little as a few minutes.

The ability for gaming operators to utilize remote identity verification was spearheaded by Sightline after it successfully petitioned the Nevada Gaming Commission to change the state’s gaming regulations.

Resorts World Las Vegas made history when it first opened in June 2021 as the Las Vegas Strip’s first casino to enable its guests to pay for anything onsite through their mobile device, including slot machines, table games, retail shops and entertainment.