24 minute read

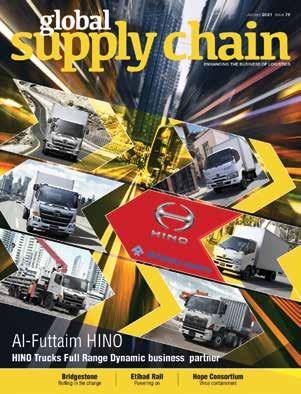

RAFED-ADP

Rafed an Abu Dhabi Ports collaborate on UAE’s Cold Store Distribution Centre

Centre is the UAE’s largest Health & Medical Supplies facility

Rafed, the recently established healthcare procurement company, and Abu Dhabi Ports, the region’s premier facilitator of logistics, transport, and trade, have signed a collaboration agreement to jointly launch the largest healthcare and medical supplies cold store distribution centre in the UAE.

Under the strategic collaboration agreement, Abu Dhabi Ports will deliver a state-of-the-art warehouse and inventory management solution for upstream, midstream and downstream operations as Rafed’s fourth-party logistics service provider.

Both Abu Dhabi Ports Group and Rafed are members of the Hope Consortium launched last week. Spearheaded by the Department of Health Abu Dhabi, the consortium represented a public-private partnership and offers a complete supply chain solution to address vaccine transport, demand planning, sourcing, training, and digital technology infrastructure, and facilitate vaccine availability across the world, it was revealed in a press communiqué.

Technologically advanced

The new distribution centre will be the largest, most technologically advanced centre in the UAE. The partnership will provide stakeholders with streamlined services and synergies across multiple business areas, specifically enabling them to deliver pharmaceuticals, medical equipment and consumables across the local and regional supply chains.

Both Abu Dhabi Ports Group and Rafed are members of the Hope Consortium launched last week. Spearheaded by the Department of Health Abu Dhabi, the consortium represents a public-private partnership and offers a complete supply chain solution to address vaccine transport, demand planning, sourcing, training,

Rafed and ADP collaborate to store and transport the pandemic vaccines.

and digital technology infrastructure, and facilitate vaccine availability across the world.

“As part of our strategy, we are creating a new business model that enhances the procurement process of the healthcare sector that is primed for future growth and deliver exceptional value, efficiency and quality,” commented Rashed Saif Al Qubaisi, CEO, Rafed.

“Rafed’s agreement with Abu Dhabi Ports as their sole provider of logistics services is a testament to our capabilities and expertise in efficiently managing end-to-end supply chain and associated value added services to support the healthcare sector across the country,” remarked Robert Sutton, Head of Logistics Cluster, Abu Dhabi Ports.

Enhanced logistics capabilities

Abu Dhabi Ports recently announced its enhanced logistics capabilities for the storage and distribution of more than 70mn Covid-19 vaccines at its dedicated 19,000sqm temperature-controlled warehouse facility in Khalifa Industrial Zone Abu Dhabi (KIZAD).

The technologically advanced facility is equipped to store vaccines and other pharmaceutical products at a temperature range of 2 to 8 degrees as well as the more extreme range of -80 degrees. The facility is equipped with temperature and humidity systems monitored digitally via a control dashboard.

Ensuring availability and quality

Rafed aims to ensure the availability and quality of essential goods and services for Abu Dhabi’s healthcare sector, which include pharmaceuticals, equipment, diagnostics and consumables, and to reduce operating costs for healthcare providers.

As a Group Purchasing Organization (GPO), Rafed specialises primarily in healthcare procurement which includes supplier sourcing and contract management, procurement ordering services, warehousing, and distribution.

Rafed was developed by and is part of ADQ, one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi’s diversified economy

SAL unveils new timely tailored infrastructure to streamline vaccines distribution

Saudi Arabian Logistics Company (SAL), the Kingdom’s leading cargo ground handler and logistics provider, recently announced the unveiling of its new pharma and perishable facilities at the Cargo Village in Riyadh, including the much-awaited Covid-19 vaccines soon to be rolled out worldwide.

The Saudi Arabian Minister of Transport Eng. Saleh bin Nasser Al-Jasser inaugurated SAL’s new facilities at the country’s main gateway, King Khalid International Airport in Riyadh, Saudi Arabia. SAL, a subsidiary of the Saudi Arabian Airlines Corporation, that is tasked to complement the nation’s goal of creating a global logistics hub.

With 5,000sqm of storage, the pharma and perishable facilities combined can adequately handle up to 365,000 tons of cargo a year. SAL’s partnership with other stakeholders including the Saudi Customs and Saudi Food and Drug Authority has made clearance of shipments easier and faster.

A section of SAL Pharma officials pose for a picture.

Sophisticated operations

The new facilities have four docks for loading refrigerated containers. The project, which started its operations, also has twelve warehouses with different temperatures ranging from minus 20 degrees Celsius to 25 degrees Celsius to suit the nature and type of cargo to be stored. In addition, within the facility, there is a special storage dedicated for flower cargo.

“The launch of the Riyadh Cold Storage facilities comes at a historic moment that coincides with the world’s anticipation for the delivery of the Covid-19 vaccine. This urgency makes us harness the capabilities of the operation capacity of our pharmaceutical facility and be fully prepared to receive and handle the new vaccines in coordination with the health authorities,” asserted Omar Hariri, CEO, SAL.

The new project, he added, will enhance SAL’s handling and storage services for medical and pharmaceuticals in line with

SAL Pharma officials at a facility.

the highest quality standards approved by appropriate EU regulators.

The opening of the facilities ushers in a new and advanced phase for handling sensitive cargoes including foodstuffs that require special care. Within the facilities, there are divisions run by the Saudi Food and Drug Authority and the Saudi Customs to inspect and expedite the cargo handling process to avoid an unbreakable cool chain.

Temperature regulation

The new facilities also feature a 650sqm temperature control breakdown area. There’s also an area for shipping refrigerated containers enough for 20 active containers. It is also equipped with a thermal isolation area.

Last May, SAL started its operations at its new facilities in the Riyadh-based King Khalid International Airport’s Cargo Village. The total area of the facilities is 42,000sqm while its operation capacity reaches 450,000 tons a year including cargoes and goods handled.

SAL aims to contribute to the Saudi Vision 2030 objectives and turn the Kingdom into a global logistics hub and invest in its strategic geographical location connecting three continents.

The Saudi Ministry of Transport assured the country’s transport infrastructure and facilities, particularly air cargo and logistics, are fully prepared to handle Covid-19 vaccines once it is ready for distribution.

Subscribe today

PLEASE FILL IN ALL FIELDS IN BLOCK CAPITALS

Name: Company Name:

Position: PO Box: City: Country:

Telephone: Mobile: E-mail:

Annual Subscription in the UAE (US$ 30.00) Annual Subscription in the GCC (US$ 65.00) Annual Subscription outside GCC (US$ 100.00)

P. O. Box 49784, Dubai, UAE, Tel: 04 3795678 Email: info@signaturemediame.com

The pandemic has thrown much of the Supply Chain mechanism and ecosystem into disruption and disarray. The search is now on for the new normal and the new paradigm writes Tom Craig President LTD Management, Pennsylvania, USA, a leading authority and professional consultant on logistics and supply chain management and regular contributor to Global Supply Chain— Editor.

Firstly, I’d like to put a disclaimer. I did not predict a global pandemic and the impact it would have on businesses, supply chains, logistics, and transportation. Supply shocks. Demand shocks.

Amazing front line efforts rife across supply chains, transportation, and logistics. As a note, much of what you may read for 2021 is a continuation of what is happening and what is accelerating in the e-commerce, technology, investors, retail domains.

So I am going to take a different approach. It will not be predictions and forecasts. It will not revisit what happened and what will continue to happen. Besides what is happening—let us talk about what should be happening—the new normal, pandemic takeaways. Some of the content reflects what supply chain management was supposed to be when the term took hold and before it became about costs.

Validation In search of the new normal for Supply Chain Management

Coupled with that is the recognition of the end-to-end supply chain. That is a different take from the pro-Covid when it was just SCM.

Supply chains manned the front line in keeping companies and therefore economies going. That recognition had begun earlier with e-commerce, Amazon, and how they used a new supply chain management to drive its order delivery / click-to-door times. Supply chains also show in discussions about global trade and onshore / nearshore.

So here are ideas on changes to supply chain management as part of the new normal. There is a slant on operations which is important and is and was with coronavirus: Organization: It is time to move away from the transportation, warehouse, logistics approach. Define instead as upstream and downstream. So that- • Mirrors and aligns with how the business operates and the supply and demand shocks with Covid. • Recognize upstream chaos with suppliers and import transportation. Container

lines, ports, upstream complexity, size, nonlinearity, and supply chains within supply chains. It also brings procurement / purchasing and inbound transportation/ logistics into this segment. • Delineate downstream and all the transportation problems. • Enforces SCM’s strategic and critical importance. • Break from costs and cost centers view.

That obsession has held back supply chain management development. • Move from nodes (stop) and links (start) to a flow of materials, parts, components, and finished goods. Think of the inventory turn speed and financial benefit. • Operate supply chains with the end-toend scope. • Bring focus on resilience. • Enhances planning and operations.

Role of transportation and logistics: Tied to the organization is how transportation and logistics fit into this supply chain. Their importance is unquestioned, and I am not diminishing it. Covid taught us that.

However, with an end-to-end supply chain, then how to position them is a discussion that needs to be had. They should be defined in terms of the supply chain, both upstream and downstream and then blended accordingly. I see them in a type of matrix management across the supply chain organization for operations, negotiations, and performance/relationships management.

Also, there are 3PL providers. With the emphasis on the supply chain, they should transition to 3PSCM or SCMaaS, which brings in some of the technology that is discussed below. Otherwise, the logistics focus of these outside firms can clash with the supply chain focus of the company.

Borrowing from the original 3PLs which were freight forwarders with staffing inside the customer, I think this would create a continuous collaboration among the buyer and seller. That would be a unique relationship with great upside for all.

Technology, Resilience, Blockchain,

Visibility: Technology and investors have gotten much attention. And I expect they will be, both for predictions/trends and accelerated usage for 2021.

To me, tech options are for supply chain operations and planning. They are not an option. The question is which you need most.

First, part of the company tech group should be imbedded in supply chain management. This would improve understanding of needs, operation detail, any vendor selection and implementation.

TMS (transportation management system) and ERP (enterprise resource planning) are two technologies that have been around for a while. This section is about ‘new’ ones.

Much of the tech push comes down to resilience and the need for it. Some see resilient supply chains meaning technology, which cannot catch diseases, replaces humans. Others see the improvement to operations or planning. Warehouse robotics for order picking and storage and autonomous/driverless vehicles meet both needs.

Digitization can meet both with providing data that can be used with analytics and artificial intelligence. Move away from documents. Much in supply chain management is not digitized.

Nevertheless, digitization is a BOPIS vs Click-toDelivery. It is about order picking performance and costs and last-mile delivery cost. There should be nothing in the analysis as to an allocation of store overhead/fixed costs.

requirement of what must be done. This can be seen with international and all the parties involved in each transaction. So this area is one that needs attention.

Some automation is in the hyped stage. Blockchain is an example. It is supposed to build supply chain visibility and chain of custody. That has not been established and, at times, seems to be about cryptocurrency than supply chain management.

Visibility is much needed. It should be end-to-end, upstream and downstream. It also ties to the chain of custody. Two points here. One is the recognition of the number of stakeholders and participants involved. Think of all the suppliers, their suppliers, various transportation modes and providers, warehouses, customs and where they are located.

A good example is with an import order and shipment. The players you see and do not see. That reach and scope is a weakness in present visibility and blockchain, activities that are missed.

The other point is this is really about your purchase orders and your customers’ orders. It starts with your purchase order and your supplier’s performance and your performance with a customer order. The perfect order—delivered complete, accurate, and on time.

The need is for an integrated view. Where is my purchase order? Will it arrive as planned? That is the starting point—at the supplier. Same with what you do with the customer order. The other point is misdirection. Is not only about transportation and a track and trace of a shipment. Where is your end-to-end inventory and that includes in-transit? Is it in the correct positions? Transport is a secondary means to all that.

Some of the technologies require spending and resource capabilities that not all firms have. For them, assessment and increased focus must be used to improve supply chain management.

E-commerce: Many retailers were closed during the pandemic. That and public health concerns made shoppers go online. E-commerce growth surged. Big time. Retailers who were already positioned with their supply chains to drive the online customer experience are doing well.

It would be interesting to see costs for two retail fulfillment options of in-store versus warehouse. Fulfillment—in-store vs warehouse. Or for BOPIS vs Clickto-Delivery. It is about order picking performance and costs and last-mile delivery cost. There should be nothing in the analysis as to an allocation of store overhead/fixed costs. If there is, then perhaps there should be recognition of the cost for customers to pick up orders instead of having them delivered. The point is to have apples with apples, and not mixed fruit salad.

Manufacturing should gear up for its customers wanting fast order delivery. E-commerce is more than customers sending online orders. It is about those orders and delivering them as specified by customers.

Tied with the retail and manufacturing online business are the supply chains for e-commerce as compared to traditional business. How many warehouses should there be to provide needed order delivery speed? Will firms use the standard vertical warehouses designed for pallets of products instead of the horizontal for online? The volume of orders is a factor here as is the shipping of cases or pallet loads. Conclusion: The pandemic is changing how and what business is done and what customers are doing. This means both now and post-pandemic—the new normal. It is a matter of what should be with supply chain management versus what will be.

Infor’s top technology predictions for 2021

Soma Somasundaram, Chief Technology Officer & President-Products, and Rod Johnson, Global President and Chief Revenue Officer, Infor, offer their predictions on cloud, AI and supply chain developments in 2021—Editor.

Cloud and AI - Soma Somasundaram

Cloud technology will reinvent event experiences

After the US Open tennis tournament successfully pivoted to cloud and AI this year to enhance the virtual experience for fans who could not attend the physical event, we will see an uptick in physical events leveraging cloud technology to give viewers tailored experiences.

With 2021 primed to grip the world’s attention with several major events, such as the Summer Olympics in Tokyo and the Wimbledon Championship, cloud technology is poised to completely reinvent what we know about fan experiences today.

The potential for using cloud technology to transform events is enormous — think real-time crowd excitement analysis to optimize highlights and advertisements, extremely low-latency live feeds, and moderated crowd interaction – all hosted on robust cloud platforms.

Multi-tenant cloud architectures will be the new gold standard Using multi-tenant cloud solutions means companies are automatically kept up-to-date with the most cutting-edge technology, without having to worry about manual updates or replacing hardware.

As we move into a new year that likely will bring more uncertainty, multitenant cloud solutions will become critical technology differentiators, helping businesses remain agile and innovative, while also reducing their e-waste footprints and helping them move closer to their sustainability targets.

AI will transform the hiring process

In the unpredictable job market of 2021, it will be critical for organizations to leverage AI to ensure they find the right candidate for the job. AI will enable HR departments to become more proactive in their hiring and help them determine a candidate’s cultural fit by using data to measure the quality of a hire.

Innovations such as intelligent screening software that automates resume screening, recruiter chatbots that engage candidates in real-time, and digitized interviews that help assess a candidate’s fit, will start becoming commonplace in HR departments.

AI also holds great promise for creating more diverse and inclusive workplaces, given its ability to reduce biases and add objectivity into employment decisionmaking through AI-powered algorithms that will identify the unique qualities of candidates.

AI in healthcare will become mission critical

Over the next year, we will see the accelerated adoption of AI across many areas of healthcare.

By applying machine learning to real-time global data sets, healthcare professionals can more accurately track contact between staff and infected patients, enable accurate diagnoses, utilize predictive analytics to track personal protective equipment (PPE), optimize workforce allocations, and develop more effective and lasting vaccinations.

Supply Chain - Rod Johnson Supply Chains will rapidly become digital

As a direct result of Covid-19, we are going to see the acceleration of digital supply chains in 2021. While supply chain leaders have traditionally viewed digital transformation in the context of efficiency and cost, the focus will now be on agility and resiliency. That’s where digital technology comes in.

A multi-enterprise, digital supply chain enables better end-to-end visibility, better predictive analytics, and better and smarter automation. Leaders will be able to customize and flex their supply chains based on market demand and make better use of ecosystem partners.

These digital tools are as far ranging as artificial intelligence, augmented reality, and robotic process automation and are expected to shift early promises to impactful value propositions.

Artificial intelligence will be critical for real-time supply and demand matching

As the incredible supply chain disruptions of 2020 unfolded, it became clear that managing real-time supply and demand matching and forecasting were no longer tasks humans can take on alone.

It’s no longer reasonable to expect a supply chain leader to predict when one country’s market will suddenly close and another’s will open, or account for evershifting materials and costs — especially as government restrictions on transportation and travel change rapidly.

In 2021, we will see supply chain managers accelerating their adoption of AI to augment workers’ instincts and experiences and provide them with intelligent insights into changing market conditions, letting them accurately forecast supply and demand in real-time.

2021 Forecast for trade and investment in the Middle East

Joe Hepworth, the Dubai-based Director, OCO Global, and Founder, The British Centres for Business (BCB), examines his crystal ball to predict 2021 trends for FDIs in the region against the backdrop of the ubiquitous though unwelcome Coronavirus that has dominated the world for all of 2020.

For all the challenges that currently exist in making predictions for the year ahead, I don’t envy those who were doing the same exercise a year ago, given what’s transpired since (much as they’d have been able to claim force majeure-unforeseeable circumstances that prevent someone from fulfilling a contract).

Based on where we are now, in the latter stages of the whole Covid-19 episode and with the signal advances in vaccination progress in November and December however, I do think that we can make some relatively confident calls on the year ahead in terms of the foreign direct investment and international trade landscape for the Middle East.

The first and most obvious thing to suggest is that it will be a good year, taken in isolation. The effect of Covid-19 in 2020 and the impact it has had on trade and investment (estimated to be down by 40% versus 2019) was such that even very modest growth would look good in relative terms.

As such, don’t be fooled by year-on-year figures. For anyone who’s reporting them in 2021, a more accurate benchmark would be 2019 or 2018 figures, but do expect a return to growth, albeit from a much lower base.

Surging UAE-Israel ties

The flurry of activity between the UAE and Israel that’s marked the last few months looks set to continue into 2021. It’s likely to change in nature however, with more substance replacing the initial excitement, as tangible deals start to be struck.

Based on the work we’ve been doing with Israeli companies, the main focus at this stage looks to be on establishing trade links–finding agents, distributors & commercial partners – ahead of potential inward FDI projects over the next few years once the market has been proven.

Should other GCC countries beyond Bahrain and the UAE also agree peace terms with Israel, a similar commercial dividend would be reaped across the whole region. The UAE would stand to benefit the most from this as it would bring its regional hub status into full play for Israeli companies, and this in turn would be a significant stimulus for inward investment from Israel.

Of course, geopolitics continues to have a massive impact on trade and investment, and the thawing of other regional relationships would have a similar impact, whilst we also wait to see how the new rulers of Kuwait and Oman will shape their respective national approaches post-Covid.

International politics also has a large influence and all eyes are on the new Biden administration in the USA to see how it will engage with the Middle East, and Iran in particular.

The China factor

The United States’ relationship with China is very likely to impact the region. As a result of Covid, we are already seeing multinational companies look at reshoring or near-shoring key supply chain nodes to reduce the reliance on China.

We see the Middle East as a likely winner from this pattern with its relative proximity to key demand markets in India, Africa and Europe. Add in the continued USA-China tensions – and we don’t expect a material thaw under President-elect Joe Biden in the short term – and the Middle East looks to

Joe Hepworth

Director, OCO Global, and Founder, The British Centres for Business (BCB)

With responsibilities across all market sectors and multiple regional countries, Joe oversees trade and export support projects across the region and is responsible for delivering the company’s investment attraction services in the region. He also leads the company’s economic development consulting team for the GCC.

As part of Joe’s work with OCO, he holds a number of other important client representational roles in the Middle East. He is Director for Missouri Department of Economic Development in the Middle East; Regional Director for IDA Ireland; Middle East Director for the Connected Places Catapult and has managed the UK’s Department of International Trade regional delivery contract since 2013. play an important role as a ‘neutral’ region relatively unscathed by bilateral trade wars, which is obviously positive for trade and investment here.

The region also stands to benefit from continued disruption of the uncertainties around the Brexit trade deal, with UK companies in particular looking for benign regions to trade with. The recent raft of new laws announced in the UAE regarding both corporate legislation such as 100% ownership and more; social and liberal changes for expats, further enhances the UAE’s position as the ‘go to’ MENA location for foreign companies looking to establish a regional presence.

Related to this, one of the biggest trends for 2021, in the UAE in particular, is likely to be wholesale corporate restructuring amongst multi-nationals already present here as they look to realign and take advantage of the new rules emerging in the first quarter.

Consolidation inclination

Expo 2020, the ultimate forum for countries to showcase their best technology, culture, innovation, and more

with the winners being those jurisdictions – emirates or free zones – who appreciate this and can offer something more than an office or warehouse lease.

A look at 2021 wouldn’t be complete without considering the importance of Expo 2020 Dubai as a vital celebration of the UAE in its golden jubilee year. The Middle East’s first ever mega-event moment in the sun and, by October 2021 I hope, the global lodestar for post-Covid 19 recovery.

Whilst Expo isn’t a trade show, it’s still the ultimate forum for countries to showcase their best features–technology, culture, innovation, ecology and more -so expect this to be done with fervent pride, and for the UAE to benefit as the host of an event that’s now even more important than was originally intended.

Organic wholesaler doubles output with AutoStore empowered by Swisslog

The leading wholesaler in the Swiss organic market, Bio Partner, has doubled its output following the implementation of innovative robotic logistics from Swisslog at its facility in Aargau, Switzerland.

Bio Partner, the leading service provider and wholesaler for the Swiss organic specialist market, supplies business customers in the organic specialist trade as well as the rest of the retail and food industry from its location in Seon.

As a result of the merger with Somona, the warehouse reached its performance and capacity limits, and the wholesaler turned to a local partner with a global footprint to deliver an automated storage system.

The 12,200m2 warehouse handles 10,000+ products, a process now optimized thanks to the high-performance AutoStore storage solution, delivered by global warehouse automation specialist, Swisslog, a member of the KUKA group.

“Companies with large warehouses have to constantly work on increasing efficiency and our robot systems work flawlessly around the clock,” commented Dr. Christian Baur, CEO, Swisslog. The aim of this new system from Swisslog is to automate the storage and picking of the dry assortment and to compress it in terms of volume.

Consistently high performance

The new AutoStore system at Bio Partner has 44 robots with the ability to handle 25,000 containers and at least 6,000 products completely autonomously. “The high-tech robots create a volume of 900 containers per hour and, depending on the development, this system can still be expanded considerably,” continued Dr. Baur.

The orders are automatically transmitted to the AutoStore system and processed in accordance with parallel processes, which are a huge advantage in large warehouses. This means that higher volumes can be made available in a shorter time. Picking errors cost time and money, and robots don’t make mistakes since the hardware and software work together perfectly.

Modular Warehouse Management

Bio Partner relies on the modular warehouse management software SynQ from Swisslog to orchestrate the warehouse and picking processes based on data-based insights.

“Our company relies on long-term, sustainable partnerships. With Swisslog, we found a strong local partner and the system installation was quick and easy,” remarked Lukas Mettler, Head, Warehouse Logistics, Bio Partner.

As a leading global integrator with over 200 realized projects, this is just one example of many projects which showcase the wide implementation spectrum of AutoStore empowered by Swisslog.

Swisslog provides data-driven and robotic solutions for logistics automation alongside reliable, modular service concepts.