About Us 2 TABLE OF CONTENTS 12 Focus Areas 56 Tax Credits 48 Budget 72 Commissions, Boards & Committees 88 Statute Content Locator

ABOUT

Introduction & About Us 5 Executive Director’s Message 6 Vision, Mission, & Strategic Plan 8 Teams 11

US

Introduction

The Utah Governor’s Office of Economic Opportunity prepares an annual report for the Utah Legislature and the public. The report — published annually on October 1 for the previous fiscal year — details the programs, initiatives, and events for which the office is responsible. The 2022 Annual Report represents the period from July 2021 to June 2022, known as Fiscal Year (FY) 2022.

4

About Us

Under Gov. Spencer J. Cox’s direction, the Governor’s Office of Economic Opportunity (Go Utah) provides resources and support for business creation, growth, and recruitment. It also drives increased tourism and film production in Utah. As stewards of Utah’s economy and quality of life, Go Utah utilizes federal, state, and private sector resources to administer programs in areas demonstrating the highest potential for economic development and the most opportunity for Utahns.

5

Dan Hemmert Executive Director

Utah Governor’s Office of Economic Opportunity

801-538-8769

danhemmert@utah.gov

Executive Director’s Message

I’m pleased to report that Utah’s economy continues to garner accolades. Perhaps most notably, in April 2022, The Wall Street Journal ranked Utah as the country’s number one state for COVID-19 performance based upon a combined economy, education, and mortality ranking.

The Governor’s Office of Economic Opportunity (Go Utah) is committed to supporting the state’s positive momentum in all areas. We emerged from the 2022 legislative session with several new initiatives and some new team members. The past year’s noteworthy changes include:

• Coordination by the Unified Economic Opportunity Commission, which resulted in more than 30 policy initiatives developed with hundreds of stakeholders

• A more strategic tax credit program, commonly referred to as EDTIF or REDTIF in rural Utah, where new commercial projects must be in a targeted industry cluster (unless unique economic circumstances apply)

• Hiring our first director of immigration and New American integration in the Utah Immigration Assistance Center, who coordinates with state and federal government partners to facilitate the successful use of foreign labor programs on behalf of businesses

• The Legislature created the Utah Office of Regulatory Relief in 2001 to administer a regulatory sandbox — which is now up and running — that may allow businesses to experiment with products, methods, or services by temporarily waiving state regulatory laws

6

• Renaming the Utah Office of Outdoor Recreation to the Utah Division of Recreation and moving it to the Utah Department of Natural Resources (effective July 1, 2022)

• Moving Talent Ready Utah to the Utah System of Higher Education (effective July 1, 2022)

• Moving the Pete Suazo Utah Athletic Commission to the Utah Department of Cultural & Community Engagement (effective July 1, 2022)

The Governor’s Office of Economic Opportunity provides economic opportunities for all Utahns. We claim to be stewards of the world’s best economy and quality of life and take that stewardship seriously.

Thank you to the 90+ Go Utah employees who give their all to ensure Utah’s economy remains the nation’s envy. And thank you to the Legislature for entrusting our team with the care of the state’s economy — one of Utah’s most valuable and treasured assets.

Sincerely,

Dan Hemmert

Vision & Mission

HOW WE ACCOMPLISH OUR VISION & MISSION

What we do and the Go Utah teams and initiatives involved in the work

What We Do

Support innovation, entrepreneurship, and small business creation and growth

Promote a business-friendly environment that enables the private sector to create high-paying jobs

Facilitate alignment between industry and education to train a world-class workforce

Engage with industry to build strategies that maintain a diversified economy and strengthen the business supply chain

Utilize sustainable incentives to address challenges in affordable housing, the environment, and transportation, and provide public benefits like infrastructure and workforce development

Encourage collaboration and partnerships between state and local government, nonprofits, and the private sector

Provide economic opportunities to support a robust quality of life for all Utahns

Expand the tourist experience of Utah’s natural and cultural wonders and promote film production

Ensure every Utahn can access and pursue outdoor recreation opportunities

Maintain a database for community reinvestment agencies to track projects and taxing entities

Regulate professional unarmed combat sports, including boxing, kickboxing, and mixed martial arts

8

VISION

We’re stewards of the world’s best economy and quality of life.

MISSION

We foster quality economic growth.

* These teams moved to new agencies/ departments on July 1, 2022:

• Pete Suazo Utah Athletic Commission moved to the Utah Department of Cultural & Community Engagement

• Talent Ready Utah moved to the Utah System of Higher Education

• Office of Outdoor Recreation moved to the Utah Department of Natural Resources to form a new Division of Recreation

Teams & Initiatives

CENTER FOR RURAL DEVELOPMENT

CORPORATE RETENTION & RECRUITMENT

INTERNATIONAL TRADE, DIPLOMACY & PROTOCOL

ONE UTAH SUMMIT – STARTUP PITCH

PETE SUAZO UTAH ATHLETIC COMMISSION*

PROCUREMENT TECHNICAL ASSISTANCE CENTER

TALENT READY UTAH*

TARGETED INDUSTRIES

UNIFIED ECONOMIC OPPORTUNITY COMMISSION

UTAH BROADBAND CENTER

UTAH FILM COMMISSION

UTAH IMMIGRATION ASSISTANCE CENTER

UTAH INNOVATION CENTER

UTAH OFFICE OF OUTDOOR RECREATION*

UTAH OFFICE OF REGULATORY RELIEF

UTAH OFFICE OF TOURISM

UTAH REDEVELOPMENT AGENCY DATABASE

9

Strategic Plan

UNIFIED ECONOMIC OPPORTUNITY COMMISSION

The Unified Economic Opportunity Commission develops, directs, and coordinates Utah’s statewide and regional economic development strategies. It informs policy decisions and builds consensus.

Gov. Spencer J. Cox chairs the commission. It includes senior-level managers from government offices and departments, education officials, state legislative leaders, and representatives focused on housing, cities, and rural counties, as well as several subject matter experts and non-voting members.

10-YEAR STRATEGIC PLAN

Go Utah published its Utah Economic Vision 2030 plan in September 2021. It outlines economic development strategies in the following areas:

• Education and the talent pipeline

• Community growth and economic planning alignment

• Economic opportunity for all

• Low regulations/taxes

• Strong targeted industries

• Startup state

• Rural affairs

• International connections

The plan concedes:

Accommodating growth will remain the state’s most pressing economic issue for the foreseeable future. The way Utah coordinates and manages its growth over the next decade will set a pattern and standard for the next century of economic and community planning. In planning for 2030 and beyond, the state’s primary challenge – and opportunity – will be how Utah leaders harness the momentum of America’s fastest-growing economy without overburdening the state’s communities.

10

This table represents full-time Go Utah employees — not part-time or intern team members — as of June 30, 2022.

* Moving to Utah Department of Cultural & Community Engagement (effective July 1, 2022)

† Moving to the Utah System of Higher Education (effective July 1, 2022)

‡ Moving to the Utah Division of Recreation's Department of Natural Resources (effective July 1, 2022)

11 Teams

CONTACT INFO

team headshots,

access email,

LinkedIn

our staff directory

go-utah.fyi/directory EMPLOYEES Executive Leadership 6 Business Services 21 Center for Rural Development International Trade, Diplomacy & Protocol Procurement Technical Assistance Center Utah Broadband Center Utah Immigration Assistance Center Utah Innovation Center Utah Main Street Program * Corporate Retention & Recruitment 10 Talent Ready Utah † Targeted Industries Unified Economic Opportunity Commission Economic Development Tax Increment Financing Communications 4 Operations 19 Administration Business Intelligence Compliance Contracts & Policies Finance Utah Office of Regulatory Relief Pete Suazo Utah Athletic Commission * 1 Utah Office of Outdoor Recreation ‡ 4 Utah Office of Tourism 27 Utah Film Commission Total Go Utah Employees 92

See what programs and initiatives Go Utah employees cover, view

and

phone, and

profiles from

available at

Supporting Utah Entrepreneurs & Businesses 14 Rural Utah Support 18 Workforce Initiatives & Training 26 Innovation 30 Broadband 31 Corporate Retention & Recruitment 32 International Trade & Diplomacy 34 Targeted Industries 35 Tourism 36 Film Production 40 Regulatory Relief 42 Immigration Assistance 43 Outdoor Recreation 44 Unarmed Combat Sports Management 45 Utah Redevelopment Agency Portal 47 Contract Compliance 47

FOCUS AREAS

Supporting Utah Entrepreneurs & Businesses

In Utah, we’re focused on supporting small business owners and entrepreneurs. That’s why the Office of Economic Opportunity offers many programs and services that provide resources to help small businesses launch, grow, and mature.

The Business Services team fosters partnerships with the U.S. Small Business Administration, Suazo Business Center, Women’s Business Center of Utah, and many others to support Utah small businesses through every stage of their business development. Resources include consulting, training, financing options, and other tools to help them succeed.

Go Utah also offers programs and services directly to small businesses, including:

CENTER FOR RURAL DEVELOPMENT

The center works with businesses in Utah’s rural counties, providing resources and programs to sustain business and improve employment opportunities. It collaborates with local governments and other development partners to support rural economic growth.

CORPORATE RETENTION & RECRUITMENT

This team manages Go Utah’s financial incentives for local and out-of-state companies seeking to expand or relocate to Utah. Incentives are available to select companies creating new, high-paying jobs that improve quality of life, increase the tax base, and diversify the economy. Incentives are post-performance and awarded as a tax credit, rebate, or grant.

14

INTERNATIONAL TRADE & DIPLOMACY

As Gov. Cox’s international outreach team, this group manages diplomatic meetings in Utah and internationally. They partner with World Trade Center Utah to promote the Utah business community and recruit foreign direct investment.

PROCUREMENT TECHNICAL ASSISTANCE CENTER

The center helps Utah businesses find, bid on, and win procurement opportunities with federal, state, and local government entities. PTAC educates and assists Utah businesses to compete more effectively in the government marketplace through one-on-one and group mentoring.

In FY 22, PTAC accomplished the following statewide:

• Completed 2,283 hours of counseling

• Counseled 566 new clients

• Helped Utah companies win $825 million in federal contract awards

• Hosted 86 in-person and virtual events, including the PTAC Symposium (250 attendees) and the PTAC/Go Utah Aerospace and Defense Industry Event (350 attendees)

UTAH BROADBAND CENTER

This initiative advances economic opportunity, energy efficiency, telecommuting, education, and telehealth services that rely on broadband infrastructure. The Go Utah office works with broadband providers, local, state, and federal policymakers, consumers, community institutions, and other stakeholders to support broadband deployment throughout the state, improve efficiencies, and expand statewide access and usage.

15

UTAH FILM COMMISSION

The Film Commission supports Utah businesses involved in film, television, and commercial production, from caterers to equipment rental, by promoting and incentivizing film production around the state.

UTAH IMMIGRATION ASSISTANCE CENTER

This newly formed office is a one-stop resource for individuals and businesses seeking immigration guidance and information on Utah’s foreign labor rules and regulations. It coordinates with state and federal government partners to facilitate the successful use of foreign labor programs and coordinates with other entities engaged in international recruitment efforts. It also manages the New American Task Force in a statewide effort to promote the integration and inclusion of Utah's immigrant communities.

UTAH INNOVATION CENTER

This center supports several of Utah’s targeted industries. It assists Utah innovators in winning federal research and development dollars through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. It’s a catalyst for technology innovation in the state and helps small businesses compete successfully and win nondilutive research and development funding.

UTAH MAIN STREET PROGRAM

This program helps Utah communities revitalize their economy, appearance, and the image of their downtown commercial districts. (Note: This program was transferred to the Utah Department of Cultural & Community Engagement on July 1, 2022.)

16

Salsa Queen is one of our Inspire In Utah stories. The campaign supports women in business in Utah. Learn more at inutah.org

UTAH OFFICE OF OUTDOOR RECREATION

The team advocates for outdoor recreation services, guides, and products supporting businesses across the state that help people experience uniquely Utah activities. (Note: This office moved to the Utah Department of Natural Resources on July 1, 2022.)

UTAH OFFICE OF TOURISM

Utah experiences are big business, and the Office of Tourism supports Utah entrepreneurs by marketing and promoting the Utah tourist experience. The Red Emerald Strategic plan guides the office's efforts. The plan focuses on deeper engagement with local communities, attracting quality visitation to promote longer stays and increased spending, and dispersed visitation statewide.

UTAH OFFICE OF REGULATORY RELIEF

This new initiative temporarily allows businesses to experiment with products, production methods, or services. It allows entrepreneurs to see if their products work and are valued by customers even when they don’t fit within the state’s current regulatory framework. The office also provides valuable information to policymakers about the appropriate scope and scale of regulation for new products, production methods, or services.

17

Rural Utah Support

Residents and businesses in rural Utah are vital to the state’s healthy and diverse economy. Go Utah provides tax credit incentives, grants, and other resources to help these local governments and businesses grow and prosper through the Center for Rural Development.

Examples of Center for Rural Development programs that served rural Utah in FY 2022 include the following:

PROCUREMENT TECHNICAL ASSISTANCE CENTER (PTAC)

U.C.A. 63N-13-101

The PTAC program helps Utah businesses compete in the government marketplace by providing counseling, workshops, webinars, and various networking opportunities.

In FY 22, in rural Utah, PTAC has:

• Counseled 162 new clients in rural Utah (30% of all new clients)

• Helped Utah companies receive $70 million in federal contract awards

• Held 28 events in rural Utah (33% of PTAC events this year occurred in rural Utah)

Some events from this fiscal year include the Roosevelt Business Alliance Meeting, Associated General Contractors Exhibitors Showcase, and presenting at the Rural Chamber Coalition conference. PTAC is engaged in the newly created BIG (Beaver, Iron, and Garfield counties) Chamber of Commerce. Team members regularly travel to these counties to meet with rural small businesses and community members.

18

RURAL COUNTY GRANT PROGRAM

U.C.A. 17-54-101

The Utah Governor’s Office of Economic Opportunity administers the Rural County Grant Program through its Center for Rural Development. Utah rural counties of the third, fourth, fifth, or sixth class are eligible to apply for the Rural County Grant.

This program places the responsibility and opportunity for economic development decision-making into the hands of rural county leadership to direct their unique planning and implementation. The grant addresses the economic development needs of rural counties, including:

• Business recruitment, development, and expansion

• Workforce training and development

• Infrastructure and capital facilities improvements for business development

Challenges & Achievements

Rural County Grant Parts A and B were issued in FY 2022. All 24 rural counties received $200,000 each. Total funding of $4.8 million was distributed through Part A.

Part B of the grant was launched for the first time in FY 2022. In total, there were 11 applicants for the competitive grant, and 11

awards were given. Allocated funding ranged from $42,000 to $300,000, for a total of $1,750,000. Each award was contracted for up to two years on a 75/25% basis, meaning 75% of the awarded funds are delivered upon award approval. The remaining 25% will be issued when the approved project and activities are completed.

Outcomes

Economic development projects and activities addressed by Rural County Grant Part A and Part B included:

• Sub-grants to businesses for capital investments and job retention

• Funding economic development professional positions

• Addressing affordable housing challenges

• Event amenities and venue improvements

• Infrastructure improvements for downtown place-making

• Buy-local sales promotions

• Owner and manager training in practical business skills and customer service

• Rebranding, marketing, and advertising support

• Business leadership and training academies

• Market research and feasibility studies

19

RURAL COWORKING AND INNOVATION CENTER GRANT

U.C.A. 63N-4-503

The Rural Coworking and Innovation Center Grant assists in creating facilities designed to provide individuals working within designated rural areas with the infrastructure and equipment needed to participate in today’s online workforce.

The state has allocated $750,000 per fiscal year for this grant. An advisory committee, known as the Rural Online Working Hubs Grant Advisory Committee, comprises seven members representing diverse workforce and industry sectors. The committee reviews and scores applications, advises the Go Utah office, and makes recommendations regarding grant awards.

Qualifying activities of this grant are:

• Construction or renovation of a facility to create a coworking center

• Extending or improving utilities and broadband service connections to a coworking center

• Purchasing equipment, furniture, and security systems for a coworking center

Challenges & Achievements

In FY 2022, Go Utah received five applications; four applicants were awarded grants. The advisory committee’s engagement in application review and scoring helped ensure the best applications were accepted.

Outcomes

A total of $768,856 was awarded and allocated in FY 2022 to rural coworking projects. The grant program included carryover funds that went unawarded in the previous year. Coworking and Innovation Centers are now open in:

• Blanding, San Juan County

• Cedar City, Iron County

• Green River, Emery County

• Hanksville, Wayne County

• Moab, Grand County

• Orangeville, Emery County

• Panguitch, Garfield County

• Price, Carbon County

• Vernal, Uintah County

Other coworking centers are in development in:

• Brigham City, Box Elder County

• Fountain Green City, Sanpete County

• Junction Town, Piute County

• Monticello, San Juan County

• Roosevelt City, Duchesne County

As the program is post-performance, reimbursement is made upon completion or partial completion of a project. In FY 2022, $497,534 was paid out to grant awardees.

20

RURAL ECONOMIC DEVELOPMENT TAX

INCREMENT FINANCING (REDTIF)

U.C.A. 63N-2-106(2)

The rural-Utah-focused change to the Economic Development Tax Increment Financing program is known as REDTIF. In FY 2022, the Go Utah Board identified a REDTIF tax credit of no more than $275 million for 15 companies. These benefits were provided to companies in eight rural counties. Since then, 47% of those companies have entered into contracts with Go Utah. The office expects to review the first REDTIF claims in the summer of 2023 and 2024 for qualification to provide a tax credit, validate job creation, and report new state revenue in rural Utah.

RURAL SPECULATIVE INDUSTRIAL BUILDING PROGRAM

U.C.A. 63N-4-704

The Legislature removed this program's funding in the 2020 5th special session, and the statute was repealed in July 2022. Therefore, Go Utah did not launch this program.

21

RURAL EMPLOYMENT EXPANSION PROGRAM

U.C.A. 63N-4-401

The Rural Employment Expansion Program supports businesses that create new highpaying jobs in qualifying rural Utah counties. These jobs can be remote, online, in a satellite hub/office space, or physically located in the same county as the business. For each new position, businesses receive $4,000 to $6,000 based on the employee’s location.

Challenges & Achievements

In FY 2022, most companies experienced constraints due to the availability of material inputs, labor, and distribution. Increasing costs associated with inflation also impeded plans for business expansion. Despite challenges, many businesses remained resilient and were optimistic about future opportunities.

Outcomes

In FY 2022, 28 applications were received. Of those, 17 contracts have been executed, with an additional nine agreements under negotiation. The Rural Employment Expansion Program currently has obligations of $1,174,000 and projects the creation of 306 new jobs in rural communities.

Applications were received from businesses in the following rural counties:

• Box Elder

• Carbon

• Grand

• Iron

• Juab

• Sanpete

• San Juan

• Sevier

• Wasatch

Since the program is post-performance, reimbursement is made upon verification of new hires and the annual gross wage of the position at the end of 12 consecutive months. For FY 2022, $192,000 has been paid out to grant awardees creating 33 new high-salaried jobs paying at least 110% of the county’s average wage.

22

RURAL FAST TRACK GRANT PROGRAM

U.C.A. 63N-3-104

The Rural Fast Track grant program supported small companies in rural Utah by awarding post-performance matching grants for investments directed toward improved production and the creation of high-paying jobs. The program identified and supported eligible businesses ready to grow in rural Utah.

In FY 2022, Go Utah reimbursed $392,561 on nine grants totaling $1,655,438 in private capital investment and created nine new fulltime, high-paying jobs.

The program is now closed. One contract remains for reimbursement evaluation, and no future contracts will be issued.

TARGETED BUSINESS INCOME TAX CREDIT

U.C.A. 63N-2-301

The Targeted Business Income Tax Credit program encourages private investment and new job creation in rural Utah counties with fewer than 25,000 residents. The program offers up to $300,000 annually to businesses with eligible Community Investment Projects. The awards to qualifying businesses are refundable tax credits up to $100,000 per company. Qualifying businesses receive this post-performance tax credit after achieving contracted benchmarks and commitments.

Challenges & Achievements

This program has faced challenges in recent years, the largest of which is contract fulfillment. Unpredictable market shifts caused by COVID-19, supply chain issues, and construction costs have made it difficult for companies to complete their projects within post-performance contract terms.

Outcomes

In FY 2022, the Legislature did not renew the program during the standard three-year sunset review process. As a result, Go Utah did not enter into additional contracts but allowed three companies in their period of performance to complete their scope of work and potentially claim an award.

23

UTAH MAIN STREET PROGRAM

U.C.A. 63N-3-601

The Utah Main Street Program (UMSP) adheres to the Main Street America Approach, developed by the National Main Street Center. This unique preservation-based economic development tool enables communities to revitalize downtown and neighborhood business districts by leveraging local assets.

Challenges & Achievements

For FY 2022, the Utah State Legislature appropriated $355,000 in ongoing funding for the UMSP. As a new program to the state, a concerted effort was made by the Center for Rural Development to launch the program, which included program design, marketing, and applications for area designations and downtown enhancement grants. As a result, 16 area designations were established in communities — nine at a Tier 1 level and seven at a Tier 2 level — setting the stage for tremendous program growth and opening the door for many future designations across the state.

Outcomes

The Utah Main Street Program (UMSP) Advisory Committee announced the communities that received its Downtown Enhancement Grant. Seven designated Tier 2 communities received awards totaling $190,000. The seven communities include:

• Brigham City

• Cedar City

• Helper

• Mount Pleasant

• Ogden

• Price

• Tooele

Projects include establishing community main street groups, identifying downtown revitalization priorities, facade grants for downtown businesses and buildings, wayfinding signage, information kiosks, lighting, and many more community-building projects. Success metrics will include new businesses opened, new jobs created, private and public investment, number of rehabilitated buildings, retention and growth for businesses and jobs, and hosted events.

(Note: The Utah Main Street Program was transferred to the Utah Department of Cultural & Community Engagement on July 1, 2022.)

OTHER RURAL EFFORTS

Go Utah considers all its programs and initiatives crucial to supporting Utah’s small businesses in rural Utah. A few examples include:

• Utah Office of Tourism promotes visitation, tourism, and uniquely Utah experiences across the state

• Utah Office of Outdoor Recreation manages initiatives and grant programs supporting enhanced quality of life for all Utahns

• Utah Film Commission supports and advances film production throughout the state

• Utah Innovation Center helps small technology businesses secure nondilutive research and development funding

• Talent Ready Utah’s workforce training programs help Utahns retrain and reskill for enhanced economic prosperity

• Procurement Technical Assistance Center’s regional offices support Utah small businesses seeking government contracts

• Utah Broadband Center works to ensure broadband+ internet speeds throughout the state

• Corporate retention and recruitment, especially the state’s tax credit REDTIF program, support rural Utah businesses and companies located in rural Utah

• Opportunity Zones located throughout rural Utah encourage investment in economic revitalization

Rural Spotlight ONE UTAH SUMMIT

Produced by the Office of Economic Opportunity and Southern Utah University, in cooperation with other partner organizations, the governor’s One Utah Summit (formerly known as the Utah Rural Summit) is the premier gathering conference for Utah’s top leaders and decision-makers to discuss rural Utah challenges and opportunities.

Hosted in Cedar City, the summit supports Gov. Cox’s One Utah Roadmap initiative and addresses critical policy and infrastructure needs.

To learn more, visit oneutahsummit.com or check out One Utah Summit on social media.

Gov. Spencer J. Cox presents a governor's award at the May 10, 2022, One Utah Summit in Salt Lake City.

Workforce Initiatives & Training

The Talent Ready Utah team supports education and industry partnerships and works to build a highly skilled workforce while providing students with increased career and education opportunities. Programs designed to support the Talent Ready Utah mission include Learn & Work In Utah, Utah Works, the Talent Ready Connections Grant (which drives the state's apprenticeships), and the work-based learning expansion initiative. Talent Ready Utah's also heavily involved in creating pathways programs with targeted industry clusters and the Utah State Board of Education to offer high-quality career exploration and work-based learning opportunities to high school students.

26

HIGHLIGHTS & RETURN ON INVESTMENT

APPRENTICESHIPS AND WORK-BASED LEARNING

63N-1b-306 (new code - HB 333; 53B-33-107)

In the fall of 2021, Talent Ready Utah established a request for proposal and application process for higher education institutions and local education authorities to submit applications for creating or expanding work-based learning and apprenticeship programs. A grant scoring committee composed of Talent Ready Utah, the Utah System of Higher Education, Department of Workforce Services, and employers vetted applications and applied scoring rubrics and criteria. The committee then recommended funding requests voted on by the Talent, Education, and Industry Alignment Board. Applications that showed regional workforce alignment, proved program demand, and demonstrated employer engagement for hiring completers received a recommendation for funding. This funding was also utilized to hire three Talent Ready Utah regional coordinators in the Southwest Region (Utah Tech), Central Region (Snow College), and Wasatch South (SLCC) to work with regional employers and education partners to grow apprenticeship programs.

Institutions were awarded the following dollar amounts and are in the process of creating and expanding their programs. Some institutions have already seen enrollments for their program expansions. New students will begin enrollment in fall 2022.

Snow College

• Awarded: $411,983.40

• Awaiting fall 2022 enrollment information

Dixie State

• Awarded: $235,778

• Awaiting fall 2022 enrollment information

Provo School District

• Awarded: $125,000

• Students enrolled: 109

• Students Completed: 109

• Students Placed: 0

Salt Lake Community College

• Awarded: $560,870.25

• Students enrolled: 52

• Students Completed: 52

• Students Placed: 52

Mountainland Technical College

• Awarded: $210,000

• Awaiting fall 2022 enrollment information

Bridgerland Technical College

• Awarded: $455,000

• Awaiting fall 2022 enrollment information

27

UTAH WORKS

63N-1b-307 (new code: HB 333; 53B-33-108)

Utah Works grant proposals submitted to Talent Ready Utah are scored and validated by a committee, which recommends funding to the Talent Board to determine which institutions of higher education shall receive financial grants. Proposals must show an immediate regional employment need, strong partnerships between the institution and industry, and a direct link to employment for program completers through these partnerships.

Talent Ready Utah’s marketing efforts include:

• LaunchMyCareer.org (managed by Davis Tech College) and cards containing QR codes distributed to prospective students and employers.

• One-page flyers issued to prospective students, participating companies, and institutions; participating companies perform outreach with new employees.

• Participating institutions market Utah Works on their websites.

LEARN & WORK IN UTAH

$15 million awarded across the state

14 163 Institutions funded Programs funded

Funding allocated $2,261,892.18

Funding spent $351,662.92

367 students trained

367 students completed training

4,598

Total students enrolled as of May 2022

2,217

Total number of students who completed Learn & Work in Utah programs as of May 2022

1,047 Participants placed in jobs as of May 2022

28

Innovation

The Utah Innovation Center supports innovators across the state by connecting them with a broad range of assets and resources, including the chance to apply for equity-free research and development funding through the federal Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs.

The Utah Innovation Center is proud to have facilitated Utah small businesses receiving over $50 million in direct funding and $100 million in follow-on funding. In addition, the Innovation Center team promotes Technology-Based Economic Development (TBED) efforts by connecting and collaborating with members of Utah’s world-class industry, higher education, and entrepreneurship support organizations.

The team offers its services statewide, free of charge, giving Utah’s technology-oriented companies a distinct advantage in today’s competitive environment.

$50 million in direct funding

UTAH SMALL BUSINESSES RECEIVED MORE THAN $100 million in follow-on funding

30

Broadband

The Utah Broadband Center, housed within the Governor’s Office of Economic Opportunity, is integral to ensuring all Utahns have access to reliable internet service. The Center is a resource for the state’s broadband plan, which addresses infrastructure deployment, bandwidth, adoption, digital inclusion, and literacy across the state.

The Utah Broadband Center:

• Facilitates the Utah Broadband Alliance

• Facilitates the Utah Broadband Center Advisory Commission

• Maintains the statewide broadband availability map

• Administers the Broadband Access Grant program

• Develops a statewide Digital Connectivity Plan

During the 2021 legislative session, the Legislature approved resources for the state’s first broadband grant. This funding opportunity will connect rural, unserved and underserved households that would not otherwise have access to high-speed internet. The grant launched in October with over $23 million in requests. Five applicants were awarded a total of $9.8 million to bring high-speed internet to over 4,100 locations in 12 communities, including households and businesses in the Navajo Nation.

$23 million + in requests $9.8 million awarded

4,100 LOCATIONS

12 COMMUNITIES + NAVAJO NATION

The Utah Broadband Center Advisory Commission was established in the 2022 legislative general session. Composed of legislators and state representatives, the commission launched its mission by approving the Digital Equity funding opportunity to provide high-speed broadband access to every Utah household. Facilitated by the center, the commission will also gather stakeholder input supporting the center’s administration of the federal broadband funds as part of the Infrastructure Investment and Jobs Act.

31

Corporate Retention & Recruitment

The Governor's Office of Economic Opportunity's Corporate Retention and Recruitment team helps accelerate business growth and job creation through sustainable, targeted expansions and relocations. Financial incentives are available for select companies that:

• Create new, high-paying jobs

• Help improve the standard of living

• Increase the tax base

• Attract and retain top-level management

• Diversify the state's economy

The team's primary economic development tool is the state's Economic Development Tax Increment Financing (EDTIF) program.

The office’s Corporate Retention and Recruitment team recommends financial incentives for local and out-of-state companies seeking to expand or relocate to Utah. The Go Utah Board votes on all proposed incentives in a public meeting. The office’s executive director provides the final sign-off on all awarded incentives.

Incentives are available to select companies creating new, high-paying jobs that improve quality of life, increase the tax base, and help diversify state and local economies.

Incentives are offered as tax credits or grants. They’re disbursed only after the company has met contractual performance benchmarks, including job creation, capital expenditure, and payment of new state taxes.

Since its 2005 inception, approximately twothirds of the companies participating in the state’s tax credit incentive program are Utahbased companies.

Two-thirds of EDTIF participants are Utah-based companies.

FY 22 EDTIF HIGHLIGHTS

Projections based on this fiscal year’s EDTIF/REDTIF approvals

27 Participating companies

$1.97 billion + in projected capital investment [OVER 50% WILL OCCUR IN RURAL UTAH]

20,478 Projected new jobs

$942 million + in projected new state revenue $12.7 billion + in projected new state wages in the coming years

One trend this fiscal year was an uptick in advanced manufacturing projects. Of the 27 projects passed, 15 projects included manufacturing elements.

Thanks to modifications to the EDTIF program for rural areas, Utah also passed a record number of projects in rural communities, with 13 of the 27 projects choosing a rural site. Other figures in rural Utah were even more impressive. For example, the projected capital investment in rural Utah from announced projects in FY 22 is approximately $1.2 billion, which is more than double the capital investment rural Utah has seen from state incentives in the past five years combined.

The year’s successes are made possible by an entire team, not all of which reside within Go Utah. The office’s partnership with the Economic Development Corporation of Utah remains critical for managing the state’s new project funnel, coordinating outreach, and working with local entities.

International Trade & Diplomacy

Go Utah’s International Trade and Diplomacy team partners with international organizations in Utah, including World Trade Center Utah (WTCU), to coordinate the state’s international business promotion activities, including trade missions, trade shows, and business workshops. Last year, Go Utah and WTCU hosted and organized events with more than 70 dignitaries and international representatives.

The team works to increase exports from Utah to foreign customers and increase foreign direct investment in Utah.

Gov. Cox’s diplomacy team communicates and coordinates with foreign government agencies to establish lasting relationships between the state of Utah and foreign governments, international organizations, and agencies. The group regularly hosts dignitaries and delegations, including ministers, ambassadors, consuls general, and consuls worldwide.

34

Targeted Industries

Utah works to create sustainable advantages around emerging and mature workforce sectors by convening constituents and organizing strategies to support and build specific industries in its robust, diverse economy. Utah has five targeted industries selected for their current and potential contributions to the state’s growing economy.

Advanced Manufacturing

Utah’s advanced manufacturing industry includes cutting-edge companies dedicated to expanding the advanced materials, manufacturing, technology development, and design sectors. Manufacturing is one of Utah’s largest industries, making significant GDP contributions to the state. In 2021, the industry:

• Provided 4% of total employment

• Paid 5.7% of total earnings

• Produced 6.2% of Utah’s gross

• domestic product

• Employed more than 17,000 Utahns

Aerospace & Defense

The aerospace and defense industry in Utah includes many widely-known companies. It also includes specialized companies contributing to the commercial and defense supply chains. Utah’s aerospace industry accounts for over 1,500 companies and organizations, 43,000+ jobs, and is projected to see more than 15% growth in the next decade.

Financial Services

Utah’s financial services industry and workforce are well-known for strength and excellence. This sector includes commercial and industrial banks, credit unions, fintech businesses, insurance organizations, and other financial services enterprises, with employment growth of 18.2% over the past five years. Utah’s 16 industrial banks held $171 billion in assets in 2020.

Life Sciences & Healthcare

Some of Utah’s largest employers are healthcare companies, such as Intermountain Healthcare and University of Utah Health. Utah’s life sciences industry develops, manufactures, and distributes the pharmaceuticals and medical devices that make modern healthcare possible, generating more than $9.6 billion in annual sales.

Software & Information Technology

Since the 1980s, Utah has been home to cutting-edge information technology and software companies. Today, Silicon Slopes is a household name. Utah’s tech industry serves as an economic driver, with over 9,500 IT-related establishments that call Utah home and job growth averaging 4.7% per year (2011 to 2021). In 2021, tech jobs in Utah grew by 7.2%, equating to more than 14,000 people employed in the industry.

Through a competitive bid process, Go

Utah and Layton-based LSI are working together to assist Utah industries with ecosystem-strengthening grant proposals for available grants within the state's strategically targeted industries. Utah will continue to submit competitive grant proposals for the battery and advanced materials industries, along with others, utilizing this grant-writing resource.

Tourism

The Utah Office of Tourism (UOT) plays an integral role in the success of the Governor’s Office of Economic Opportunity by stimulating traveler spending in Utah and helping destinations around the state manage and responsibly grow their tourism infrastructure and economies.

In addition to generating income for the state, the UOT inspires positive perceptions of Utah by promoting the Life Elevated® brand through marketing campaigns that include public relations, social media, digital advertising, content marketing, and more.

As stewards of a healthy and sustainable tourism economy, the Office of Tourism advances its Red Emerald Strategic Plan to responsibly grow Utah’s tourism industry while maintaining a high-quality experience for visitors and Utah residents. The plan prioritizes quality visitation over quantity of visitors, distributing visitation, continuing powerful branding, enabling community-led visitor readiness, and improving organizational effectiveness.

Tourism’s fiscal year 2022 marketing campaigns were aligned to meet the strategic plan imperatives. In addition to generating beneficial economic impacts, UOT’s campaigns delivered travelers willing to spend more money, learn about Utah, and participate in more activities while visiting. Visitors were informed about how to travel responsibly and engage in the communities they visited.

The FY 2022 Southern Utah+ advertising campaign led to more active, better trips with higher average visitor spending and more social media advocacy. Advertising influenced approximately 850,000 Utah leisure trips and about $1.35 billion in visitor spending.

The FY 2022 winter campaign also produced results aligned with the Red Emerald Strategic Plan. Travelers who saw ads were more likely to spend more money, participate in more activities, share information about their trip on social media, and ultimately rated trip satisfaction more favorably than others. The average length of stay for travelers increased to 4.1 nights. Advertising influenced about 345,000 trips and resulted in approximately $900 million in visitor spending.

UOT advertising and marketing direct potential visitors to the VisitUtah.com website. In the past year, VisitUtah.com has made great strides to grow the diversity of editorial contributors, including Black, Shoshone, Navajo, and Latinx writers and photographers. UOT also featured work by adaptive recreators and members of the LGBTQ+ community. The office plans to continue offering a platform for diverse voices to share their Utah stories.

The website also encourages responsible travel behavior. Between January 2021 and June 2022, “Responsible Travel” informational content on VisitUtah.com received more than 861,000 visits with an average time on page of 2:31 minutes. VisitUtah.com received the

36

National Council of State Tourism Directors’ Mercury Award from U.S. Travel Association, recognizing the site for promoting thoughtful and responsible travel through humancentered web design.

Award-winning videos also played a key role in promoting the state. The office commissioned a long-form video entitled “A Table for All,” featuring refugees who have established eateries and contributed to the diversity of Utah’s foodie scene. The video won a platinum Adrian Award from Hospitality Sales and Marketing Association International. Additionally, Google studied YouTube travel ads from 2021 and found that UOT’s video, created in partnership with More Than Just Forests and featuring the Manti-La Sal National Forest, was the best performing travel video that year.

Public relations was also an effective way to promote the state. During FY 2022, the office’s domestic PR efforts generated 1.6 billion total print, online, social, and broadcast impressions. The coverage included targeted regional or national publications and media outlets such as Good Morning America, The Boston Globe,

Robb Report, Parents magazine, AARP, and Cosmopolitan

UOT partnered with Salt Lake City International Airport supporting international visitor recovery by launching Utah’s first ever leisure-based international direct flight, Eurowings Discover, from Frankfurt to Salt Lake City. In addition, other direct international flights that resumed included the Air Canada Toronto flight, and Delta transatlantic flights to and from Paris, London, and Amsterdam. The office hosted a press conference with more than 100 international journalists, telling the story of Utah’s commitment to and leadership on sustainable and responsible travel, Forever Mighty® principles, Utah’s heritage cuisine, and dark skies initiatives. International media and tour operators were hosted throughout the state, resulting in Utah stories being told in their origin countries.

In FY 2022, UOT engaged in several industry and destination development projects. With the support of the Destination Development co-op program, the office assisted Visit Park City in its sustainable tourism plan, supported

37

a community assessment of Kearns/Magna, and helped develop a tourism marketing/ branding plan for Salt Lake County Arts and Culture.

In partnership with the Institute of Outdoor Recreation and Tourism at Utah State University, UOT launched the Red Emerald Resilience industry webinar series. The office also created two industry toolkits: a refreshed Utah Dark Skies resource alongside an April Utah Dark Sky Month declaration, and a firstever Agritourism toolkit and industry guide in partnership with Utah’s Own. Approximately 30 partnerships were created under the Forever Mighty responsible tourism initiative, including nonprofits (such as Leave No Trace and Tread Lightly), DMO partners, and state agencies. The office also recently reactivated the State Scenic Byway Committee to utilize federal funding to support local and statewide scenic byway programs.

The office completed a statewide resident sentiment survey conducted by the Kem C. Gardner Policy Institute to gauge resident attitudes regarding travel and tourism. Most Utah residents have favorable views of tourism, but there are concerns about congestion and quality of life in some gateway communities. The office will continue to collaborate closely with local elected officials and stakeholders in FY 2023 as it continues marketing, stewardship, and development efforts as part of Utah tourism’s Red Emerald Strategic Plan. ■

38

Film Production

The Utah Film Commission plays a vital role in the success of the Governor’s Office of Economic Opportunity by promoting the state as a destination for film, television, and commercial production. Film production creates jobs in the creative sector while supporting local businesses and encouraging tourism across the state.

In March 2022, the Legislature amended the current Utah Motion Picture Incentive Program (MPIP). This revised program is designed to attract higher-impact film and television productions to Utah’s rural communities, adding additional tax credits available for productions that shoot at least 75% of their production days

in a rural county. The rural component of the MPIP will allocate an additional $12 million in tax credits each year for the next two years.

The focus on film production in rural Utah is already demonstrating success. In June 2022, the Go Utah Board approved 13 productions for film incentives, six filming exclusively in rural Utah, with an overall estimated economic impact of $142.5 million.

Film production continues to be a reliable economic driver that impacts the entire state. In the last five years, Utah’s film incentive generated $614 million in net output. Nearly

40

Yellowstone Season 1 (2018), Paramount Network

half (49%) was from direct spending in the industry, while a further $143 million was created in the supply chain and $170 million through the subsequent wage effects. A 2021 study from Olsberg SPI commissioned by the Motion Picture Association of Utah revealed and outlined how valuable Utah film production has been to the state. The study found that for each tax dollar spent on the tax credit, Utah’s economy receives $7.

The Utah Film Commission also serves as a liaison to the broader entertainment industry by supporting local film events and working with higher education to create workforce training opportunities around the state.

ACHIEVEMENTS

• $4.8 million in state film incentives was awarded during the past 12 months to 13 productions shooting in Utah, including a mix of local and out-of-state feature films and TV series, yielding a total estimated spend of $32.8 million.

• 44% of all state filming locations are in rural counties.

• Six Utah communities are certified as Film Ready Utah to support film productions and enable economic impact across communities, including Cedar City, Kanab/ Kane County, Moab to Monument Valley, Ogden, Park City, and Utah Valley.

• Over 150 people participated in workshops and educational programming supporting Utah crews’ workforce development.

• A 2021 SMARI study estimated $600 million per year in film-motivated tourist spending in Utah over 10 years, with 30% of visitors indicating that a film or television series was among the primary motivators for visiting a particular destination in the state.

41

High School Musical (2006), Disney Channel

Regulatory Relief

Go Utah’s Office of Regulatory Relief administers a general regulatory sandbox created by the Legislature in 2021. A regulatory sandbox creates a safe space for businesses to experiment with new and innovative ideas in the market, without the burden of regulatory barriers, for one year with a possible one-year extension. Companies with products, services, or business models that don’t neatly fit into the state’s current regulatory framework can submit ideas they’d like to test in the sandbox to the Office of Regulatory Relief.

As a sandbox participant tests its idea, state regulators collect data about how well the business and idea work without burdensome regulations. At the end of the predetermined period, regulators evaluate the experiment’s results. Once regulators have gathered all the facts, they provide them to the Legislature.

The office has entered into two agreements this fiscal year:

An agreement with Homie Title that suspended the requirement under Utah Code Ann. § 31A-23a-1003(1)(b) that at least 30% of Homie Title’s annual title insurance business comes from an unaffiliated business as that term is defined in Utah Code Ann. § 31A-23a-1001(1).

An agreement with TowPro under which the fee TowPro charges per dispatch may be passed to the vehicle owner by waiving:

• Utah Code Ann. § 72-9-603 (16) and any related administrative rule that regulates a tow truck motor carrier’s ability to charge a fee to a vehicle owner or pass along a fee to a vehicle owner when that fee is charged in response to (A) a peace officer dispatch call; (B) a motor vehicle division call; or (C) any other call or request where the owner of the vehicle, vessel or outboard motor has not consented to the removal.

• Utah Code Ann. § 72-9-604, which prohibits political subdivisions from charging fees related to dispatch costs associated with towing rotation.

The Regulatory Relief office also invites residents and businesses to make suggestions regarding laws and regulations that could be modified or eliminated to reduce their regulatory burden. Please send feedback and suggestions to regrelief@utah.gov

42

Immigration Assistance AND NEW AMERICANS IN UTAH

In March of 2022, Go Utah hired a director for its newly-formed Utah Immigration Assistance Center. As director of immigration and New American integration, the center’s director helps advance economic opportunities for immigrants in Utah.

The Utah Immigration Assistance Center was created by the Legislature during its 2021 general session, with the passage of H.B. 404. The center is a resource to help individuals and businesses recruit and retain international workers. The center also engages with state and federal government partners to facilitate the successful use of employment visa programs and coordinates with other entities involved in global immigration efforts.

New Americans, or foreign-born individuals, represented 8.4% of Utah’s population in 2019. They play a vital role in the state’s robust economy, help fill critical positions in fastgrowing industries, and add to the fabric of diverse communities around the state.

One of the center’s initiatives is the state’s New Americans Taskforce. It’s a statewide effort to develop a comprehensive strategy that maximizes economic opportunities, social inclusion, and civic potential for New Americans while reinforcing an environment of belonging in Utah.

Since hiring the director, the Utah Immigration Assistance Center has provided resources to nine individual businesses, participated in presentations reaching 16 additional companies, and hosted a roundtable

discussion with 28 organizations on specific employment-based visa pathways.

The number of individuals who were able to work in the state as a result of this assistance is not known at the time of this report, as the foreign labor process is lengthy. However, we'll share this data in subsequent annual reports.

The Utah Immigration Assistance Center recommends the Legislature update the center's statute to include a focus on New American integration.

43

Outdoor Recreation

The Utah Office of Outdoor Recreation embodies the state’s ongoing commitment to outdoor recreation as an economic driver and a way of life. It plays a crucial role in the exceptional quality of life that’s enjoyed by both locals and visitors.

The Outdoor Recreation team works to ensure Utahns live healthy and active lifestyles through outdoor recreation. It actively promotes recreational opportunities, educating partners and the public on recreational best practices, and providing resources to support outdoor infrastructure projects.

• Outdoor recreation initiatives include:

• Utah Outdoor Recreation Grant

• Utah Outdoor Recreation Summit

• Every Kid Outdoors Initiative

• Utah Trails Forum

Support for corporate recruitment efforts in the outdoor recreation industry that help existing

Utah-based companies and attract new businesses and industry events.

In 2022, the Utah Outdoor Recreation Grant funded $11 million to 85 outdoor recreation infrastructure projects across the state, with 23 different counties receiving funds and 53.5% of funding going to rural Utah. The team received requests for $17.5 million in outdoor recreation infrastructure project funding. The total value of the projects the UORG supported was $90 million.

The office continued its annual Outdoor Recreation Summit in various locations throughout the state and presented nearly 50 Summit Speaker Series and Summit Meetup Series events.On July 1, 2022, the Utah Office of Outdoor Recreation will move from the Governor’s Office of Economic Opportunity to join the Utah Department of Natural Resources within the newly-created Division of Outdoor Recreation.

44

Unarmed Combat Sports Management

Housed within the Utah Governor’s Office of Economic Opportunity, the Pete Suazo Utah Athletic Commission regulates unarmed combat sports across the state.

The commission facilitates a safe, healthy environment for boxers, kickboxers, and mixed martial artists in Utah by actively pursuing ongoing training and updated technology to ensure efficient and effective administration of the sport’s unified rules.

The Pete Suazo Utah Athletic Commission also aims to continue growing the number of events and participating athletes in Utah.

On July 1, 2022, the Pete Suazo Utah Athletic Commission will move from the Governor’s Office of Economic Opportunity to join the Utah Department of Cultural & Community Engagement.

45

Utah Redevelopment Agency Portal

As outlined by the Legislature, Go Utah maintains a database for community reinvestment agencies to track the financial details for each project area and the taxing entities with which they partner.

The Utah Redevelopment Agency database is available at goedcommunity.utah.gov/RDA/s

Contract Compliance

The Go Utah compliance team reasonably assures companies receiving a tax credit or cash payment have met legislative, regulatory, and contractual requirements before receiving tax incentives.

The compliance team includes members with accounting, finance, and business economics training and experience. It uses best practices to collect, verify, and store statutorily-required performance metrics. The team strives to ensure the proper use of taxpayer funds.

Go Utah manages and executes tax incentives, pass-through appropriations, and various other economic incentive contracts. With assistance from the office of the State Attorney General, Go Utah ensures that agreements capture legislative direction and intent and are legally sound.

Go Utah awards are post-performance and require each company’s participation through accurate reporting, assisted by data-sharing agreements with the Utah Department of Workforce Services and the Utah State Tax Commission.

Go Utah utilizes the Salesforce platform to create contracts, collect electronic signatures, and retain relevant documents. Depending on legislative activity, the office generates an average of 200 to 300 arrangements per year.

However, the COVID-19 pandemic has exponentially increased the number of contracts managed by Go Utah. The office managed over 1,500 contracts during FY 2020. During FY 2021, the office processed approximately 350 contracts. And during FY 2022, the office handled approximately 470 contracts.

47

FY 2022 Operations Budget 50 FY 2022 Funds Budget 51 FY 2022 Program Expenses 52 Industrial Assistance Account 54

BUDGET

FY 2022 Operations Budget

Includes one time and nonlapsing/carryforward balances Restricted fund balances reported separately (see FY 2022 Funds Budget) Other includes CARES Act Funding

50

BUDGET ITEM GENERAL FUND GENERAL FUND ONE TIME* GF RESTRICTED DEDICATED CREDIT TRANSPORTATION OR EDUCATION FEDERAL TOTAL BUDGET** PETE SUAZO ATHLETIC COMMISSION $176,200 $71,000 — $54,600 — — $301,800 OUTDOOR RECREATION $338,700 $63,700 — — — — $402,400 FILM $827,800 $197,800 $8,200 — — — $1,033,800 TOURISM $3,551,300 $1,307,200 — $285,600 $118,000 — $5,262,100 CORPORATE RECRUITMENT AND BUSINESS SERVICES $4,158,100 $2,005,700 $260,600 $65,000 — $1,362,900 $7,852,300 POINT OF THE MOUNTAIN $1,750,100 $6,500,000 — — — — $8,250,100 ADMINISTRATION $2,890,400 $4,055,900 — $2,917,800 — — $9,864,100 INLAND PORT $3,049,400 $6,900,000 — — — — $9,949,400 URBAN AND RURAL BUSINESS SERVICES $3,801,000 $7,610,700 — $179,500 — $654,500 $12,245,700 RURAL DEVELOPMENT $10,016,900 $3,156,000 — $7,200 — $24,000 $13,204,100 TALENT READY UTAH $1,427,900 $6,786,900 — — — $14,988,600 $23,203,400 PASS THRU $11,377,900 $59,480,400 $10,000,000 $11,000,000 — — $91,858,300 OTHER*** — — — $30,000 — — $30,000 GO UTAH BUDGET $43,365,700 $98,135,300 $10,268,800 $14,539,700 $118,000 $17,030,000 $183,457,500 OTHER 1% ADMINISTRATION 5% PASS THRU 50% TOURISM 3% FILM 1% TALENT READY UTAH 12% URBAN AND RURAL BUSINESS SERVICES 6% UTAH INLAND PORT AUTHORITY 5% OUTDOOR RECREATION 1% POINT OF THE MOUNTAIN 4% PETE SUAZO UTAH ATHLETIC COMMISSION 1% RURAL DEVELOPMENT 7% CORPORATE RECRUITMENT & BUSINESS SERVICES 4%

* ** ***

FY 2022 Funds Budget

51

BUDGET ITEM GENERAL FUND GENERAL FUND ONE TIME* GF RESTRICTED DEDICATED CREDIT TRANSPORTATION OR EDUCATION FEDERAL TOTAL BUDGET** MOTION PICTURE INCENTIVE — $1,435,500 $1,432,000 — — — $2,867,500 OUTDOOR REC INCENTIVE — $14,379,800 — $7,761,900 — — $22,141,700 TOURISM MARKETING — $5,886,200 $22,822,800 — — — $28,709,000 GO UTAH BUDGET — $21,701,500 $24,254,800 $7,761,900 — — $53,718,200 TOURISM MARKETING 54% OUTDOOR REC INCENTIVE 41% MOTION PICTURE INCENTIVE 5% Includes one time and nonlapsing/carryforward balances Operational fund balances reported separately (see FY 2022 Operations Budget) * **

FY 2022 Program Expenses

52 BUDGET ITEM PERSONNEL TRAVEL CURRENT EXPENSE* DATA PROCESSING DTS GRANTS/ PASS THROUGH NONLAPSING TOTAL EXPENSE** PETE SUAZO ATHLETIC COMMISSION $136,200 $11,300 $36,900 $9,400 — $108,000 $301,800 FILM $610,300 $8,500 $142,200 $79,700 $2,615,800 $444,800 $3,901,300 CORPORATE RECRUITMENT AND BUSINESS SERVICES $1,360,500 $32,900 $2,460,500 $339,200 $325,400 $3,333,800 $7,852,300 POINT OF THE MOUNTAIN — — — — $8,250,100 — $8,250,100 ADMINISTRATION $1,902,400 $15,900 $1,067,200 $147,400 $2,955,300 $3,775,900 $9,864,100 INLAND PORT — — — — $9,949,400 — $9,949,400 URBAN AND RURAL BUSINESS SERVICES $2,017,300 $77,400 $1,249,600 $177,700 $5,585,100 $3,138,600 $12,245,700 RURAL DEVELOPMENT $735,900 $11,000 $68,100 $13,600 $6,723,600 $5,651,900 $13,204,100 OUTDOOR RECREATION $385,700 $11,000 $52,200 $26,400 $4,896,000 $17,172,800 $22,544,100 TALENT READY UTAH $398,600 $17,500 $416,100 $10,000 $15,315,300 $7,045,900 $23,203,400 TOURISM $2,433,100 $129,800 $17,320,800 $209,800 $6,540,400 $7,337,200 $33,971,100 PASS THRU — — — — $78,948,700 $12,909,600 $91,858,300 OTHER — — — — $30,000 — $30,000 GO UTAH BUDGET $9,980,000 $315,300 $22,813,600 $1,013,200 $142,135,100 $60,918,500 $237,175,700

OTHER 1% URBAN AND RURAL BUSINESS SERVICES 5% PASS THRU 39% CORPORATE RECRUITMENT & BUSINESS SERVICES 3% POINT OF THE MOUNTAIN 3% TOURISM 14% OUTDOOR RECREATION 9% RURAL DEVELOPMENT 5% FILM 2% UTAH INLAND PORT AUTHORITY 4% PETE SUAZO UTAH ATHLETIC COMMISSION 1% TALENT READY UTAH 10% ADMINISTRATION 4%

Current Expense includes 1x Capital Expense Total expense includes operations and fund budgets * **

FY 2022 Industrial Assistance Account

Go Utah manages the Legislature-funded Industrial Assistance Account. It has three purposes:

1. Provide grants and loans to entities that provide a unique economic opportunity and contribute to the state’s financial well-being. The unique opportunity must be in concert with other state, federal, or local agencies’ economic benefits and act in concert with free-market principles.

2. Allocate funds to reimburse for-profit businesses for the costs incurred to recruit, hire, train, and hire employees in a newly created job.

3. And, beginning June 1, 2022, it can grant funds to an entity offering technical assistance to a municipality in connection with housing, transportation, and growth planning.

Go Utah entered into the following contracts with Utah Companies during FY 2022 with funding from the Industrial Assistance Account.

The office will report these contracts' economic outcomes and benefits as information becomes available at a future time.

COMPANY NAME PURPOSE AMOUNT Hexcel Corporation Infrastructure Improvement $200,000 American Packaging Corporation Infrastructure Improvement $75,000 Wasatch Business Finance Economic Opportunity $300,000 Vitalpax, Inc Infrastructure Improvement $100,000

FY 2022 INDUSTRIAL ASSISTANCE ACCOUNT CHANGE IN POSITION

FY 2021 EXPENDITURE SUMMARY

FY 2022 EXPENDITURE SUMMARY

FUND CHANGE IN POSITION

NOTES

• We've corrected the name to Industrial Assistance Account (IAA) rather than Industrial Assistance Fund (IAF)

• IAA expense is shown on a cash basis from July 1 to June 30 each year

• FY 22 received $21.3 million of replenishment from GS2022, including $5M for a DNR project

• FY 22 received a single $10 million appropriation for the Utah Lake Clean Waterway project

• In FY 21, we made the final BEAR program payment, so there's no remaining encumbrance for FY 22

• In FY 22, the RFT program closed with only a few remaining contracts for FY 23

• We changed the FY 22 division of funding to put the remaining funds available towards economic opportunities

55 IAA ALLOCATIONS BUDGET EXPENDED ENCUMBERED AVAILABLE BALANCE Economic Opportunities $3,345,710 $101,225 $3,065,215 $179,270 Rural Fast Track $5,347,876 $679,129 $1,310,275 $3,358,472 BEAR Funding $1,087,312 $63,687 — $1,023,625 Smart Schools - iSchools — — — — Post-Performance Grants $10,886,467 $400,000 $1,100,000 $9,386,467 ALLOCATIONS SUBTOTAL $20,667,365 $1,244,041.00 $5,475,490.00 $13,947,834.00 IAA ALLOCATIONS BUDGET EXPENDED ENCUMBERED AVAILABLE BALANCE Economic Opportunities $49,011,099 $6,744,021 $15,196,194 $27,070,884 Rural Fast Track $668,061 $392,561 $275,500 — BEAR Funding — — — — Smart Schools - iSchools — — — — Post-Performance Grants $1,100,000 $300,000 $800,000 — ALLOCATIONS SUBTOTAL $50,779,160 $7,436,582.03 $16,271,693.57 $27,070,883.98 IAA ALLOCATIONS BUDGET EXPENDED ENCUMBERED AVAILABLE BALANCE Economic Opportunities $45,665,389 $6,642,796 $12,130,979 $26,891,614 Rural Fast Track ($4,679,815) ($286,568) ($1,034,775) ($3,358,472) BEAR Funding ($1,087,312) ($63,687) — ($1,023,625) Smart Schools - iSchools — — — — Post-Performance Grants ($9,786,467) ($100,000) ($300,000) ($9,386,467) ALLOCATIONS SUBTOTAL $30,111,795 $6,192,541.03 $10,796,203.57 $13,123,049.98

Economic Development Tax Increment Financing 58 Enterprise Zone Tax Credit 63 Hotel Convention Tax Credit 64 Technology & Life Science Economic Development Act 65 Motion Picture Tax Credit 66 New Market Tax Credit 67 Targeted Business Income Tax Credit 68 Utah Rural Jobs Act 70 TAX

CREDITS

Economic Development Tax Increment Financing

U.C.A. 63N-2-1

The Economic Development Tax Increment Financing (EDTIF) program helps foster and develop key industry sectors in Utah, provides additional employment opportunities, and improves the state’s economy.

The state uses the EDTIF program for corporate retention and recruitment. The program offers a tax rebate of up to 30% in urban areas and 50% for specific rural areas of new state taxes paid for up to 20 years to companies that create at least 50 jobs that pay wages of 110% of the county average for urban areas and 100% in rural areas.

EDTIF contracts are post-performance, only providing a state tax credit if the company meets its promised obligations.

This fiscal year, the number of approved incentives for the EDTIF program set new records in every category. In FY 2022, 27 companies received approval from the Go Utah Board to participate in the EDTIF program.

The EDTIF participants this fiscal year are collectively projected over the next 20 years to create:

20,478 High-paying jobs

$1,972,878,630 Capital investment

$942,401,100 State tax revenue

$12,734,493,371 In-state wages

The Rural Economic Development Tax Increment Financing (REDTIF) tax credit program is new this fiscal year. REDTIF refers to rural modifications of the EDTIF program that allow projects located in rural areas to qualify for more significant incentives. With this tool, the state has seen unprecedented economic opportunities flow to its more rural communities.

For example, the projected capital investment in rural Utah from announced projects in FY 22 amounts to more than $1.2 billion, more than double the capital investment rural Utah has seen from state incentives in the past five years combined.

58

Companies offered an incentive under the EDTIF program may enter into a contract to provide a report of employees and state taxes paid. These reports are reviewed annually by our office before the issuance of a tax credit. These post-performance reviews are called assessments. Assessments typically lag calendar years by two years to allow time for corporate filings and tax reporting. Completion of an assessment is contingent on the time and accuracy of the companyprovided data. An assessment's completion date may impact data reported by the program in year-over-year comparisons.

During the last reporting period of the calendar year 2020, the program completed 30 current year assessments, 27 prior year assessments, and two previous year adjustments. Unique to the 2020 year, the Go Utah Board offered an option for companies who have entered into an agreement to forgo providing an annual report in 2020 in exchange for adding an additional year. This is called the 2020 Accommodation, and at the time of the annual report, 21 companies exercised the option.

Since the EDTIF program’s 2005 inception, Go Utah’s Compliance team has assessed 135 companies and verified the creation of 35,275 new full-time jobs.

59

ASSESSMENT STATUS, CY 2020 CHART In-Process 10 Awaiting Additional Information 4 Assessed for a tax credit 30 Deferred 2020 Accommodation 21 Companies in information technology and financial services lead the types of companies assessed during this period.

Information Technology Cluster 30% Financial Services Cluster 17% Life Sciences Cluster 7% Outdoor Recreation Cluster 7% Aerospace Cluster 6% Energy And Natural Resources Cluster 3% Other 30%

OUTCOMES

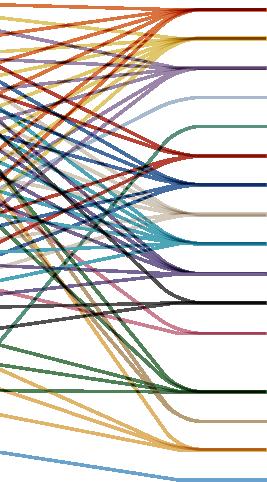

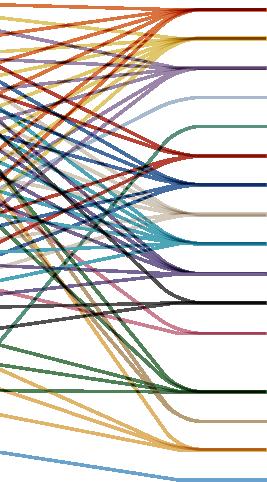

ANNUAL INCREMENTAL INCREASE IN JOBS

35,275 total jobs created as of 2020

For companies that did not have an audit year assessment, we assume there was no increase or decrease in employee count for reporting purposes. This data represents annual incremental increases or decreases; we can add the years together to create the total cumulative job count.

For assessment completed for CY 2020, new high-paid employees that received a paycheck above 110% of the county average wage were identified across all areas of the economy.

HIGH-PAYING JOBS BY TARGET INDUSTRY

Number of Jobs and Average Wage CY 2020

60 0 5000 10000 15000 20000 25000 30000 35000 40000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

TARGET INDUSTRY JOBS AVERAGE SALARY Aerospace Cluster 729 $97,344 Energy and Natural Resources Cluster 540 $111,787 Financial Services Cluster 680 $119,916 Information Technology Cluster 4,346 $128,939 Life Sciences Cluster 617 $112,044 Outdoor Recreation Cluster 128 $84,677 Other 873 $103,585 Grand Total: 7,913 Grand Average: $113,074

REVENUE

Compliance receives a growing number of requests to calculate new state revenue for companies with an EDTIF award. We calculate new state revenue using paid and remitted employee withholdings, sales and use tax, and corporate tax that has increased from the time of Board approval, as verified using information from the Utah State Tax Commission.

A percentage of these new state revenues can be credited to the EDTIF program if the company meets its contractually defined number of new, high-paying jobs. The chart below shows the percentage by type of cumulative new state revenue and new state revenue for CY 2020.

CUMULATIVE NEW STATE REVENUE CY 2000–2020

The difference in these two amounts represents tax credits that have been awarded by the percentage of new state revenue incentivized by the EDTIF program of $222.8 million. The award percentage has been set in statute not to exceed 30% for urban counties and 50% for rural counties.

NEW STATE REVENUE CY 2020

NEW STATE REVENUE CY 2020

Over the program’s history, EDTIF-assessed companies have created $846.9 million in new state revenue and $624.2 million in new state revenue after tax credits.

61

Witholding $492,633,938 Sales and Use $137,449,605 Corporate $235,512,955

Witholding $52,150,248 Sales and Use $4,204,424 Corporate $15,567,410

YEAR REBATE NEW STATE REVENUE NEW STATE REVENUE AFTER REBATE 2004 $52,367 $96,975 $44,608 2005 $236,746 $438,418 $201,672 2006 $1,952,651 $4,590,428 $2,637,777 2007 $5,537,467 $15,435,264 $9,897,797 2008 $7,853,120 $23,683,804 $15,830,684 2009 $6,725,684 $21,551,550 $14,825,866 2010 $10,846,194 $36,834,767 $25,988,573 2011 $11,767,769 $45,384,076 $33,616,307 2012 $15,207,871 $49,714,555 $34,506,684 2013 $15,681,109 $53,131,241 $37,450,131 2014 $17,620,965 $60,512,550 $42,891,585 2015 $19,504,481 $69,431,582 $49,927,101 2016 $18,187,727 $71,382,954 $53,195,227 2017 $20,811,974 $85,334,973 $64,522,999 2018 $24,123,692 $106,766,606 $82,642,914 2019 $32,707,175 $131,890,915 $99,183,740 2020 $13,965,011 $70,784,350 $56,819,340 $222,782,003 $846,965,007 $624,183,004

Enterprise Zone Tax Credit

U.C.A. 63N-2-3

Enterprise Zones are economic areas designated by local governments and approved by Go Utah. Eligible businesses within Enterprise Zones can apply for state income tax credits to invest in depreciable assets, including machinery and equipment; create new, above-average wage jobs; and rehabilitate older facilities.

INITIATIVES

The Center for Rural Development works with the Go Utah compliance team to review and approve business applicant claims for Enterprise Zone Tax Credit certificates. The center and compliance team also cooperates with the Automated Geographic Reference Center to update and refine all Enterprise Zone designation maps throughout the year.

CHALLENGES & ACHIEVEMENTS

The program is actively issuing tax credits incentivizing private investment, but activity in FY 2022 is slightly lower than in FY 2021. The lower activity could be attributed to legislative adjustments to the program starting in FY 2021. The tax credit percentage rate was reduced from 10% to 5% on qualified depreciable assets, and entities whose primary business is residential rental property are no longer eligible for tax credits. Additionally, no new Enterprise Zone designation applications were accepted after Dec. 31, 2020, ultimately leading to the program’s sunset.

OUTCOMES

947 Enterprise Zone Tax Credits were issued in FY 2022, compared with 1,091 issued in FY 2021. Applications are made available every January for the previous three calendar years. Go Utah provides eligible entities with a tax credit for the calendar year the depreciable asset(s) were placed into service, as reported in the table below.

YEAR NO. OF COMPANIES DISBURSEMENT PROPERTY INVESTMENT REHABILITATION EXPENDITURE NEW FTE ($750 CREDIT PER FTE) 2017 896 $10,516,876 $171,253,089 $354,932 139 2018 1132 $11,969,949 $164,169,021 $323,927 126 2019 1105 $11,677,790 $169,985,044 $79,934 60 2020 877 $6,252,716 $145,316,000 $442,123 64 2021 658 $4,797,633 $99,159,420 $638,011 22 TOTALS 4,668 $45,214,964 $749,882,573 $1,838,926 411

Hotel Convention Tax Credit

U.C.A. 63N-2-501

The Hotel Convention Tax Incentive encourages the development of co-located hotels and convention spaces in Utah. It provides a post-performance tax rebate of up to $75 million for up to 20 years.

In October 2018, the Go Utah Board approved the developer, Salt Lake City CH, to receive a post-performance tax credit to build a new Salt Palace Convention Center hotel in Salt Lake City. The hotel broke ground in the spring of 2020. When completed in the fall of 2022, it will provide approximately 700 rooms and add 62,000 square feet of meeting space to attract larger conferences, meetings, and conventions.

With the assistance of a third-party auditor, Go Utah and the Utah State Tax Commission are actively validating and transferring the rates of state, county, and local sales taxes paid on the materials used in the hotel’s construction to the Convention Incentive Fund. Go Utah and the Utah State Tax Commission will have to successfully validate and process $3.8 million in sales tax for the hotel to receive an incentive.

After that amount is reached, the hotel will receive an incentive of 95% of sales tax paid, with 5% going to the Stay Another Day and Bounce Back funds.

Go Utah and the Tax Commission have processed sales tax claims for six quarters, ranging from 1st Quarter CY 2020 to 2nd Quarter CY 2021. These claims total $1,768,700.

In FY 2023, Go Utah will work with potential applicants to start administering the Hotel Mitigation Fund. This fund will allow affected hotels to claim up to $2.1 million annually for the first four years following the Salt Palace Convention Center hotel’s opening. Any additional funds not claimed in this annual process, and 5% of sales tax revenue generated from the hotel, will go toward the Stay Another Day and Bounce Back funds to pay for the state’s tourism advertising, marketing, and branding. Salt Lake County is responsible for replenishing this account to a $2.1 million balance by providing supplemental funding in years two, three, and four.

64

Technology & Life Science Economic Development Act