Birmingham Economic Review 2022

Chapter 1: Economy: Crises and Resilience

Connect. Support. Grow.

IntroductionThe annual Birmingham Economic Review is produced by the University of Birmingham’s City REDI and the Greater Birmingham Chambers of Commerce. It is an in depth exploration of the economy of England’s second city and a high quality resource for informing research, policy and investment decisions.

This year’s report provides comprehensive analysis and expert commentary on the state of the city’s economy as it emerges from disruption caused by the pandemic into a new period of high inflation and uncertainty. The Birmingham Economic Review assesses the resilience of the city, its businesses and its people to the set of challenges stemming from the UK’s vote to leave the EU, the coronavirus pandemic and now the energy crisis. It includes an update on the development of the region’s infrastructure and highlights opportunities for growth, building on existing strengths and assets.

The most recently available datasets as of 30th September 2022 have been used. In many circumstances there is a significant lag between available data and the current period. Contributions from experts in academia, business and policy have been included to provide timely insight into the status of the Greater Birmingham economy.

Report Geography

The report focuses on the ‘Greater Birmingham city region’ defined by the boundaries of the Greater Birmingham and Solihull Local Enterprise Partnership (GBS LEP). The GBS LEP area consists of the following local authorities: Birmingham, Solihull, Bromsgrove, Cannock Chase, East Staffordshire, Lichfield, Redditch, Tamworth, Wyre Forest.

References to the ‘West Midlands region’, or ‘West Midlands (ITL1)’, are to the large scale region at International Territorial Level 1 (ITL1). There are nine ITL1 regions in England: North East, North West, Yorkshire & The Humber, East Midlands, West Midlands, East of England, London, South East and South West in addition to Scotland, Northern Ireland and Wales. Note that ITL recently replaced the EU’s Nomenclature of Units for Territorial Statistics (NUTS). Geographies of ITL and NUTS territories generally correspond except for minor differences at local authority level outside the Midlands.

References to the ‘West Midlands metropolitan area’ are to the West Midlands county comprising seven metropolitan districts (WM 7M): Birmingham, Solihull, Coventry and Dudley, Sandwell, Walsall, Wolverhampton.

References to the ‘West Midlands Combined Authority (WMCA) area’ are to that administered by the Combined Authority.

Note that figures may not always total exactly due to rounding differences. Figures in some tables may be undisclosed due to statistical or confidentiality reasons.

1

Foreword and Welcome

Chapter 1. Economy: Crises and Resilience

Chapter 2. Business: Disrupted Markets

Chapter 3. People: Challenging Times

Chapter 4. Place: Connecting Sustainable Communities

Chapter 5. Opportunity: Building on Strengths

2 Index

Economy: Crises and Resilience

The national economy has been dealing with a series of shocks and crises arguably since the global financial crisis in 2008, followed by the Brexit referendum in 2016, the coronavirus pandemic in 2020 and now the energy crisis precipitated by Russia’s invasion of Ukraine in February of this year.

Despite the headwinds of austerity and Brexit, the UK economy grew at an annual rate of 2.1% in the decade between 2009 and 2019. The Greater Birmingham economy grew at a slightly faster pace of 2.3% and was closing the gap on skills and employment. However, the region was continuing to fall behind London and the South East on other key measures including labour productivity, pay and health, pointing to the need for investment and levelling up action.

Although the coronavirus pandemic brought severe disruption to the national and global order, the health and economic crisis was felt more acutely in the West Midlands due to the structure of the regional economy and weaknesses relating to health and poverty.

A strong economic recovery, combined with global supply chain disruption from the ongoing impacts of the pandemic, has created inflationary pressures in the world economy. Added to this has been the inflationary impact of the energy crisis as the flow of natural gas and other major commodities from both Russia and Ukraine have been disrupted due to the present conflict.

As it stands the global, national and regional economies are facing turbulent and uncertain times which look set to remain for at least the short term. Resilience continues to be a key factor in the long term success of the region and its ability to not only weather the current storms, but emerge stronger, capable of levelling up and still able to compete on the world stage. Much of this year’s Economic Review highlights the current challenges and risks but there are also genuine reasons for optimism about the future.

This chapter takes a comprehensive look at the city region’s economy within the context of the recent series of global and national crises. Headline indicators including productivity, business activity, trade and investment are charted whilst key risks are outlined.

Macroeconomic Context

The UK economy bounced back sharply last year as the country reopened following a series of national and local lockdowns throughout 2020 and early 2021. Revised figures from the Office for National Statistics (ONS) show the UK economy fell by a record 11.0% in 2020, more than previously thought. That was followed by a 7.5% rebound in 2021, although growth has since slowed in response to inflationary pressures and a worsening national and global outlook. As of Q2 2022 the national economy was still 0.2% smaller than pre pandemic (Q4 2019) despite earlier estimations that it had already recovered.

It should be noted that the UK was hit harder by the pandemic than the average across G7, OECD and EU27 countries and has been slower to recover. It was the only G7 country not to have recovered to its pre pandemic level as of Q2 2022.

3

Source:OECDQuarterlyGDPvolumeindex TheindexhasbeenrebasedsothatQuarter42019=100.

In August, the Bank of England projected UK GDP growth to average 3.5% in 2022 although signalled potential for a recession starting in late 2022 and lasting until late 2024.1 Projections released in August were for negative growth of 1.5% in 2023 and 0.25% in 2024, although it should be noted that this was prior to the announcement of the government’s Growth Plan on 23rd September.

Whilst the Bank signalled the UK economy may have already been in recession at its Monetary Policy Committee in September2, revised growth figures released by ONS at the end of that month showed that Quarter 2 grew by 0.2% rather than contracted by 0.1% as previously thought.3

The Bank’s expectations (as of August) for the Euro area were for 1% decline in 2023 before returning to slight growth in 2024. The USA was projected to grow by 1.5% in 2023 and 1.75% in 2024. World GDP was projected to average approximately 3% growth.

Inflation rates are far higher than central bank targets, driven by strong post lockdown demand combined with pandemic induced supply chain constraints and supply side shocks to commodities, particularly energy, following Russia’s invasion of Ukraine.

The Consumer Prices Index (CPI) rose by 9.9% in the 12 months to August 2022, following a new 40 year high reached in July 2022. The Bank of England is expecting inflation to peak at almost 11% in October, revised down from previous estimates of 13% due to the introduction of the energy support package for domestic and non domestic customers. Inflation is projected to gradually fall back to the 2% target by 2024 although could be affected by actions in the Growth Plan.

The Bank’s Monetary Policy Committee voted to increase the current bank rate of interest to 2.25% in September, the highest rate for 14 years. Further rate rises are anticipated over the coming months, as seen with the United States’ Federal Reserve and other central banks, as it attempts to tame inflation.

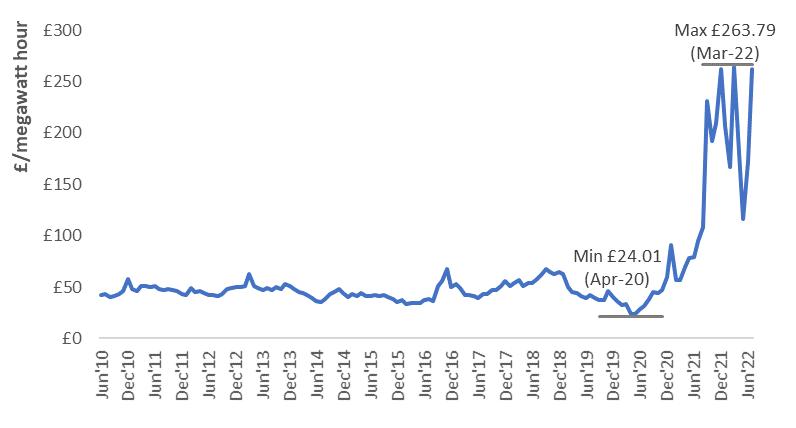

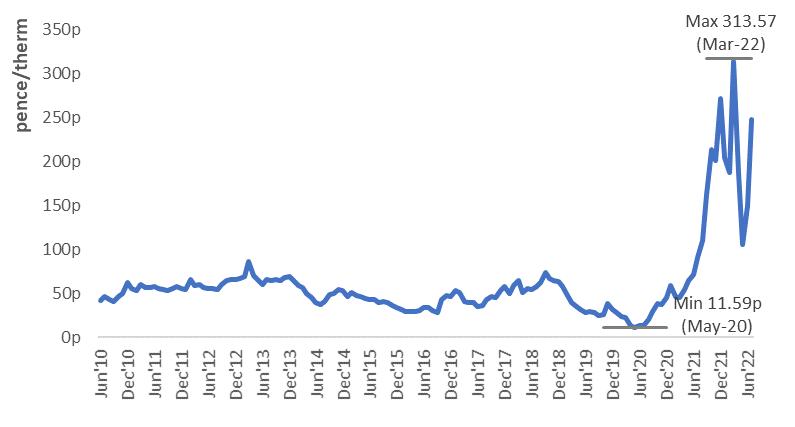

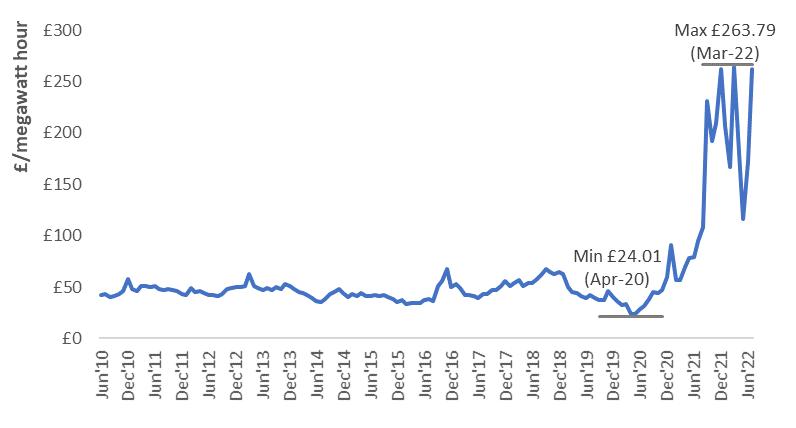

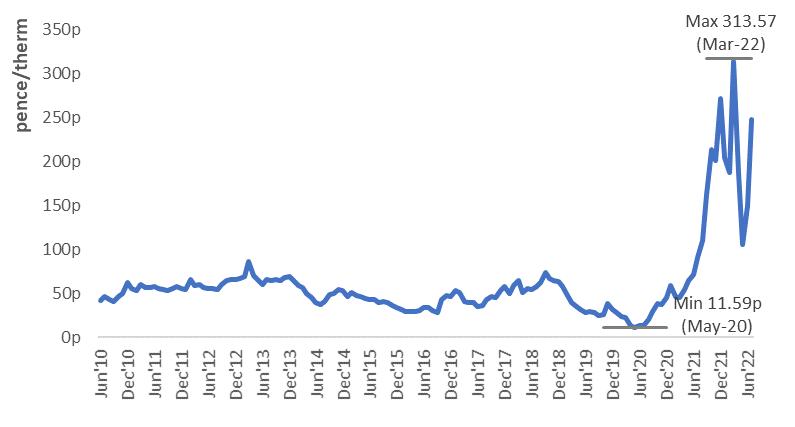

Energy prices are a major driver of inflationary pressure and are anticipated to directly contribute 4% to overall inflation in Q4 2022. Wholesale gas and electricity prices rose extremely quickly early this year following Russia’s invasion of Ukraine. The invasion caused

Bank of England, Monetary Policy Report: August 2022

Bank of England, Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 21 September 2022

ONS, GDP quarterly national accounts, UK: April to June 2022

4 UK and international volume indexed GDP

1

2

3

severe disruption to gas supplies to Europe which was already struggling with shortages. Consequently, wholesale day ahead gas prices jumped from 11.6 pence per therm in May 2020 to 313.6 pence in March 2022. Electricity prices, which are linked to those of gas, jumped from £24.01 per MWh to £263.79 over a similar timeframe.

Wholesale day ahead gas prices

Domestic and non domestic customers had been facing the prospect of colossal increases in energy costs over the 2022/23 winter, threatening to put huge strain on cash flows and financial stability. In September, the new Truss government announced details of an energy support package for households and businesses. An Energy Price Guarantee will cap unit rates for gas and electricity so that the typical household energy bill will cost around £2,500 a year for the next two years. This is in addition to the Energy Bills Support Scheme announced by the Johnson government earlier in the year. A similar Energy Bill Relief Scheme is in place for non domestic consumers for six months from October with plans to review the scheme beyond its current timeframe.4

Faced with the spectre of recession amid slowing global growth and persistently low UK productivity, the new British Prime Minister and her Chancellor published The Growth Plan on 23rd September. The bold Plan announced a raft of tax cuts and supply side reforms intended to

[accessed September 2022]

5

Source:Ofgem,WholesaleDayAheadContractsPriceTrends Wholesale day ahead electricity prices

Source:Ofgem,WholesaleDayAheadContractsPriceTrends

4 BEIS, Energy bills support factsheet

raise UK trend growth to 2.5%.5 The uncosted Plan caused serious concern amongst the global investor community, sparking a run on the pound and pushing up gilt yields such that the Bank of England intervened with emergency action. The Institute for Fiscal Studies estimated that the Plan could push borrowing to £190bn this financial year inclusive of the energy support package, and £100bn a year once energy support is removed.6

The UK’s economic and fiscal outlook remained uncertain and challenging at the time of writing.

Regional Output

Latest available figures from the ONS show that Greater Birmingham contributed an estimated £52.6bn in gross value added (GVA) to the national economy in 2020, accounting for 3.1% of England’s total.

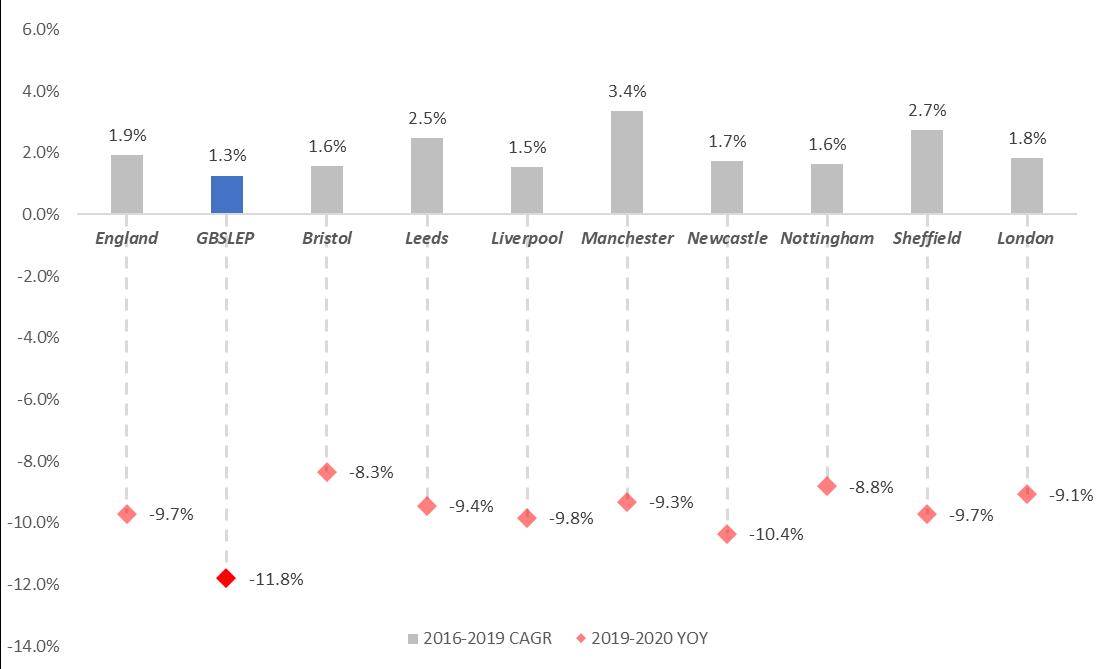

The city region’s economy was hit hard in 2020, suffering an 11.8% decline in GVA as challenges and restrictions brought on by the pandemic significantly impacted activity. This was a greater contraction than the average for England (9.7%). Within the region, Solihull fared particularly badly and saw a 14.4% decline. This was a reversal of the previous three year trend which saw Solihull grow by an average of 3.2% per year against 1.9% for England and 0.9% for Birmingham. Gross value added

GVA 2020 Annual growth 2016 2019*^ YoY growth 2019 2020*

Birmingham £27.9bn 0.9% 9.8% Solihull £9.3bn 3.2% 14.4%

GBSLEP £52.6bn 1.3% 11.8% England £1,682.8bn 1.9% 9.7%

Greater Birmingham suffered a greater fall in economic output than any of the other English core cities and London. It is also notable that the city region was also growing at a slower rate than all other core cities over the three years prior to the pandemic. Several of the core cities in the North of England were growing at a faster rate than the national average, including Greater Manchester.

6

Source:ONS,Regionalgrossvalueadded(balanced)byindustry:ITLregions&cityand

enterpriseregions.

*adjustedtoexcludetheeffectofinflation. ^3yearcompoundannualgrowthrate(CAGR).

5 HMT, The Growth Plan 2022 [accessed September 2022] 6 Institute for Fiscal Studies, 2022, Mini Budget response

Labour productivity growth index for England’s core cities

Source:ONS,Subregionalproductivityforenterpriseregions. GVAperhourworked,atcurrentprices,smoothed,indexedto2011.

8

Rebecca Riley, Associate Professor for Enterprise, Engagement and Impact, City REDI, University of Birmingham

The pandemic and exiting the EU have hit Birmingham hard since 2020 and we have seen this presented in real time data over the last 2 and a half years, such as footfall, job vacancies and impacts on the certain communities, occupations, and sectors. Lagging economic data is now being published for the years affected by the pandemic such as GVA, which is giving us a better indication of the impacts at the height of the pandemic. Forecasters are now producing predictions based on this latest data. More real time rapid economic and social indicators have also worsened since last year this has a knock on effect to the short and long term forecast globally, nationally, and regionally.

In the Midlands the WMCA, Midlands Engine and Midlands Connect collaborated to purchase a version of the Oxford Economics forecasting model in order to create a consistent baseline down to Local Authority level. A single version of a baseline with the ability to create scenarios at a local level enables partners to share a single version of a baseline forecast. These forecasts are based on a trend and all things being equal and are inclusive of any policy or investment already announced, but exclusive of any new policy or investments in the future.

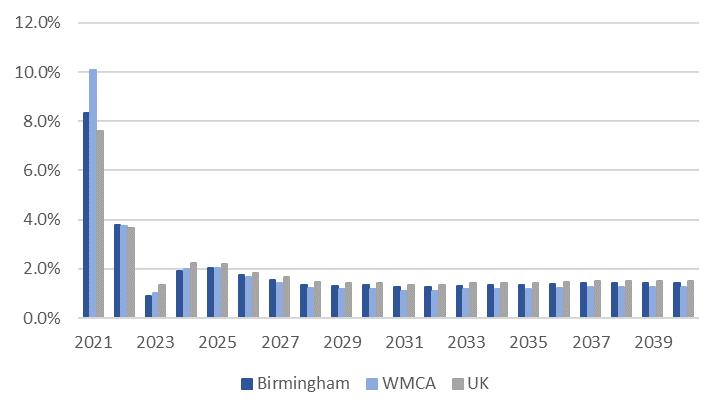

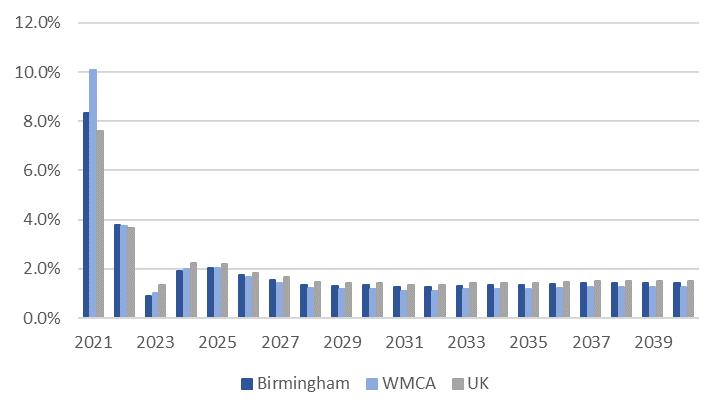

Oxford Economics (OE)8 have updated this forecast for the partners, one of the principal components of the forecast is the population, which is set to grow to 1.22m by 2040, a 7% growth and the city is a major attractor of people from the surrounding areas.

The forecast predicts significant GVA growth in the longer term. They have also revised up last year’s growth as performance has been better than expected. Birmingham will bounce back, but like many global cities in the near term the predications for 2023 are still low, but longer term there will be recovery:

• Total GVA in 2020 for the Birmingham was £25.8 billion

• The projected GVA in 2040 is £37.4 billion an additional £11.6 billion

• This is an increase of 45%, with an average annual yearly growth rate of 1.89%, slightly below the UK rate 1.96%

Rate of growth in GVA

9

Source:OxfordEconomics

8 Oxford Economic Forecasting, Midlands Forecasting model June 2022

In terms of other measures of productivity, the baseline scenario forecasts the Birmingham GVA per job to grow to £64,923 by 2040 from £49,874 in 2020 an average annual yearly growth rate of 1.33%, compared to the UK at 1.60%. The Birmingham GVA per head is predicted to grow to £30,605 by 2040 from £22,583 an average annual yearly growth rate of 1.54%, compared to the UK at 1.87%. It is worthwhile noting the UK figures are significantly affected by the London performance.

The impact of the pandemic and EU Exit on the sectors in Birmingham continues to shift reflecting the waves of different impacts the economy has suffered. The declines predicted last year in manufacturing employment however have been revised and aren’t as severe as predicted. In terms of employment growth, this again reflects the shifts in the economy from manufacturing (currently employees 37,996, meaning the industry will see a loss of 14,696 employees) to the professional, scientific and health and social work, which are long term trends for the city accelerated by the pandemic either because of demand or because those occupations were more protected from the worst effects. Within the forecast, the city still has a strong employment performance in critical sectors, Professional, scientific, and technical (+31.2%) and Admin & Support (+28.9%), which have fuelled growth in the past and driven growth regionally. Overall total employment is set to increase by 10.9% between 2020 and 2040, whereas the UK will see a 6.7% increase. Construction is doing better than the UK reflecting the continued investment in the city, and this sector underpinned the accelerated growth at the end of the last decade, however regionally the sector has still not recovered.

Overall, this forecast from OE takes the view that the City will revert back to its long run performance and the gains in growth made in the run up to 2019 have been lost because of the impacts of the pandemic, specifically on trade and manufacturing.

This forecast performance for the city reflects the significant impacts places and people have faced but overall suggest the City will get back on track in the long term. In the short term though we can see that Birmingham, like many places globally, faces significant challenges as seen in the data and analysis provided in previous WMREDI monitors. However, this is a baseline and there are potential downsides, such as continued war in Ukraine and Covid waves affecting supply chains and trade, as well as staff sickness, but there also significant upsides, not least the longer term effects of investment from HS2 and Commonwealth Games, both of which have long term impacts difficult to predict. Both of these major investments change perception of place, an issue Birmingham has suffered from for many decades, and these upsides could kick start the previous accelerated growth seen in the latter end of the last decade. Attracting investment, skilled employment and new business that could change the fortunes of Birmingham capitalising on the international arena it finds itself on.

10

Erin Henwood, Policy Adviser, Greater Birmingham Chambers of Commerce

With inflation hitting new record highs, overheads spiralling, and a recession looming, the new Prime Minister would be easily forgiven for setting aside the Levelling Up Agenda to focus on tackling the current cost of living crisis.

The seismic challenges facing the country and the pervasive inequalities outlined in Boris Johnson’s flagship Levelling Up White Paper, however, demand attention as they further exacerbate the stark reality of our current economic situation. No sooner had the Government introduced commitments to boost pay and productivity and spread opportunities than the country lurched forwards into uncertain economic terrain.

Firms are feeling increasingly under pressure to raise prices to meet surging energy bills and skyrocketing overheads, whilst employees feel the burden of real pay falling at the sharpest rate ever recorded between April and June 2022. At the time the White Paper was launched in February, the West Midlands had the third highest unemployment rate in the country. This figure has since climbed even higher, with the region now sharing second place with London, just 0.5 per cent behind the North East.

With a deteriorating economic outlook, it would be prudent for the new Prime Minister to not lose sight of the intrinsic link between the cost of living crisis and levelling up. Any action taken to boost the economy in the short term must be reconciled with the long term aims of the Levelling Up Agenda. For example, proposals outlined in the White Paper relating to skills and recruitment including the £2.5 billion Skills Fund could not come at a better time: more than three quarters of firms in Greater Birmingham reported experiencing recruitment difficulties in the Greater Birmingham Chambers of Commerce’s Q2 Quarterly Business Report. Indeed, anecdotal evidence suggests that some small businesses have already been forced to shorten their operating hours to mitigate the impact of labour shortages on their business. Successfully addressing the region’s skills gap will not only improve prospects on an individual level, it will also ensure that firms can employ skilled workers to boost their output and help rebuild the economy.

Commitments to improving communities and wellbeing will certainly be welcomed by retailers and hospitality firms situated on local high streets, who have been at the mercy of waning consumer confidence and decreased footfall in town centres. Such businesses would have been pleased to see £328 million committed from the Levelling Up Fund to 15 towns across the region: in Wolverhampton, this funding will be used to build new community spaces and undertake high street and public realm improvements to regenerate the city centre and encourage business investment.

The Levelling Up White Paper has the potential to create significant improvements to the lives of the most disadvantaged across the country, who are already bearing the brunt of the cost of living crisis. If the new Government is serious about addressing the economic predicament now facing the country, it must ensure that Levelling Up remains firmly at the top of its list of priorities. Not doing so would risk leaving the most disadvantaged areas of the country behind, further exacerbating the inequalities pervading our society and limiting the country’s potential.

11

Business Activity

Following the outbreak of Covid 19 and the first national lockdown, the Natwest PMI Business Activity Index for the West Midlands collapsed to a low of 10.9 in April 2020. The Index measures changes in the output of goods and services, with a reading above 50 indicating growth and below indicating contraction.

The regional Index registered growth for all but two months since February 2021, although at a slowing pace. The most recent update saw the West Midlands reading slip from 50.3 in July to 49.3 in August. The slowdown in regional business activity is in line with the national trend. Nine of twelve UK regions posted readings below 50 in August, except London, North West and Yorkshire & Humber.

The New Business Activity Index for the West Midlands was 48.5 in August. However, this was a better reading than most other regions, with nine out of twelve below 50.

Concerns about inflation remain high with almost all regions posting record, or near record, increases in input and output prices in the spring although the pressures have since eased.

West Midlands Business Activity Index

12

Source:Natwest,RegionalPMI BusinessActivityIndex.

Beth Clewes, Insight and Intelligence Services Manager, Greater Birmingham Chambers of Commerce

Business Confidence is the expectations that firms have for their future, often based on their current financial and operational conditions as reported through self reported surveying. Data related to Business Confidence often fluctuates from quarter to quarter and is sensitive to regional and national political developments due to it being a reflection of where firms see themselves being in the next 12 months based on current economic conditions.

At GBCC, Business Confidence is measured through our Quarterly Business Report survey, looking in particular at firms’ expectations around profitability and turnover for the following 12 months. The Quarterly Business Report is the most comprehensive survey of its kind in the city region, which shines a spotlight on indicators such as domestic and overseas sales, business confidence and recruitment and price trends.

Over the past four quarters (Q4 2021 Q3 2022) the Greater Birmingham business community has seen a steady downturn in their turnover and profitability expectations, with manufacturers seeing more of a fluctuation than service firms for both measures. As Figures 1 and 2 show, manufacturing firms experienced an increase in business confidence in Q1 2022, but then decreased again to below their service sector counterparts in the following quarter and have continued to decline. In contrast, service firms have seen a steady decrease in confidence in the past year.

13

Figure1:Proportionoffirms(splitbysector)reportinganexpectedincreaseinturnoverover thenext12months,Q42021Q32022 0% 10% 20% 30% 40% 50% 60% 70% 80% Q4 2021 Q1 2022 Q2 2022 Q3 2022 Turnover by sector, Q4 2021 Q3 2022 All sectors Manufacturing Services

Figure2:Proportionoffirms(splitbysector)reportinganexpectedincreaseinprofitabilityover thenext12months,Q42021Q32022

As well as rising to the challenge of overcoming the twin headwinds of Covid 19 and Brexit recovery this year, firms are now facing a crisis around the cost of doing business, rising energy prices and record high levels of inflation. It is perhaps no surprise that confidence has taken a hit when 55% of firms are expecting to increase their prices over the next three months. Energy prices are a major concern for employers at present of those businesses that are expecting to increase their prices over the next 3 months, 31% cited rising utility costs as the primary factor behind the decision. Anecdotally, as a result of the rising costs of doing business, service firms have had to pass down cost increases to customers, which will have a broader impact on levels of consumer spending a key driver of economic growth in the UK. Concerns about inflation have also been growing over the past year, with a huge leap from being 19% of firms’ concerns in Q3 2021 to 40% in Q3 2022, the second highest figure on record

While the most recent data may currently paint a sombre picture, the Greater Birmingham business community has overcome such challenges in the past, with the historical data from the 2008 showing that the city region’s business confidence levels bounced back after the late 2000s recession.

Figure3:Proportionoffirms(allsectors)expectingturnoverandprofitabilitytoincreaseover thenext12months,Q12008toQ42010

The graph above shows that business confidence levels dropped when GDP began to fall in Q2 2008, prior to the technical onset of the recession (Q3 2008 was the second successive drop in GDP). At this point, the proportion of firms expecting an increase in profitability was at 54% and turnover at 56%. However, by the final quarter of the recession in Q2 2009, profitability

14

0% 10% 20% 30% 40% 50% 60% 70% Q4 2021 Q1 2022 Q2 2022 Q3 2022 Profitability by sector, Q4 2021 Q3 2022 All sectors Manufacturing Services 0 20 40 60 80 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Turnover and profitability (all sectors), Q1 2008 Q4 2010 Turnover Profitability

projections were almost restored to their pre recession level (with 63% of firms expecting it to increase) and the proportion of firms predicting an increase in turnover had doubled compared to Q1 of 2008 (to 60% of firms expecting an increase).

The fact that Business Confidence measures rely on firms predicting a future that may not happen, especially during periods of turmoil where the future looks particularly unclear, means that the current figures reveal more about the sentiments that the business community are feeling right now, rather than evidence that conditions will be worse for firms in the next 12 months. While confidence has been impacted, we are optimistic that this will rise again as economic conditions improve and the scope of government support to get businesses through this period become clearer.

The Greater Birmingham Chambers of Commerce is on hand to help businesses in the local community to connect, support and grow through these challenges, and the Quarterly Business Report is one of the key mechanisms we use to inform ourselves of what is happening on the ground. The sentiment we’ve gathered from local businesses over the past 25 years helps to direct our lobbying activity and gives us direction in terms of where to focus the support we offer as a Chamber. You can read more about the Quarterly Business Report and access previous publications here.

15

Consumer Spending

National data from ONS shows that domestic consumer spending remained 1.9% below pre pandemic (2019) levels for the first six months of this year, adjusted for inflation. Spending in certain categories has grown with communications being +12%; education +8%; furnishings, household equipment and house maintenance +6%; restaurants and hotels +6% and food and drink +5% over the same time period. Spending on transport has declined by 20% and health by 14%.

High inflation and a squeeze on household incomes are dampening consumer spending. The GfK Consumer Confidence Barometer decreased to a record low of 41 in June, with measures relating to personal finances and purchasing intentions worsening further. Indeed, consumer moods are now lower than at the start of the pandemic and during the 2008 financial crisis.9 The Bank of England stated at its September Monetary Policy Meeting that spending had already peaked.

International Trade

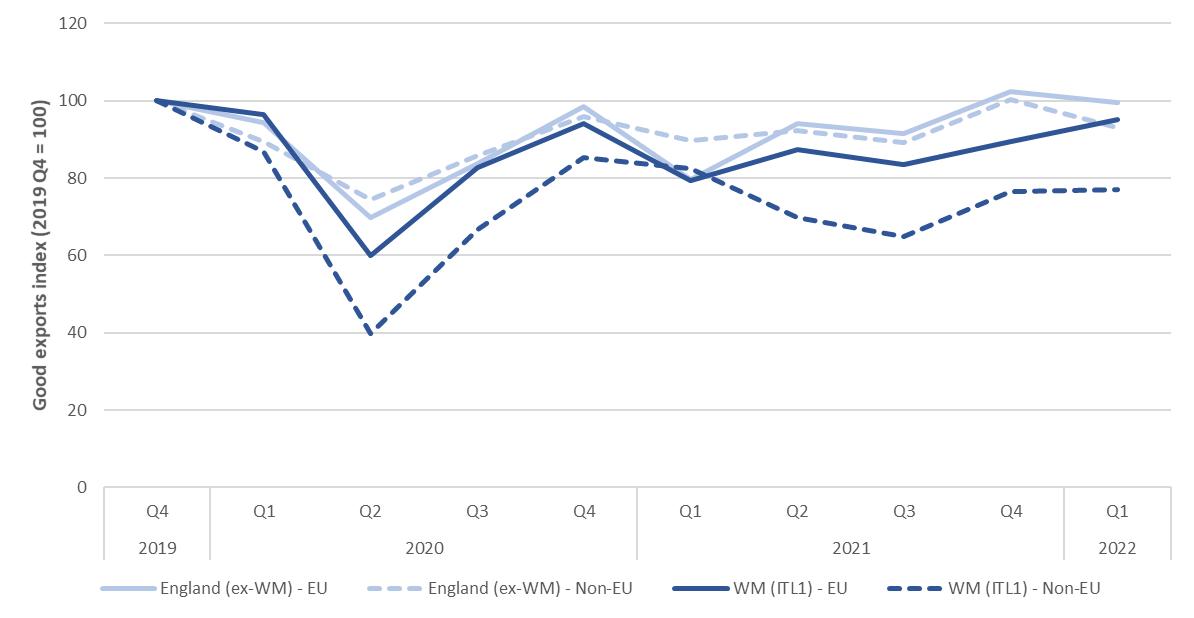

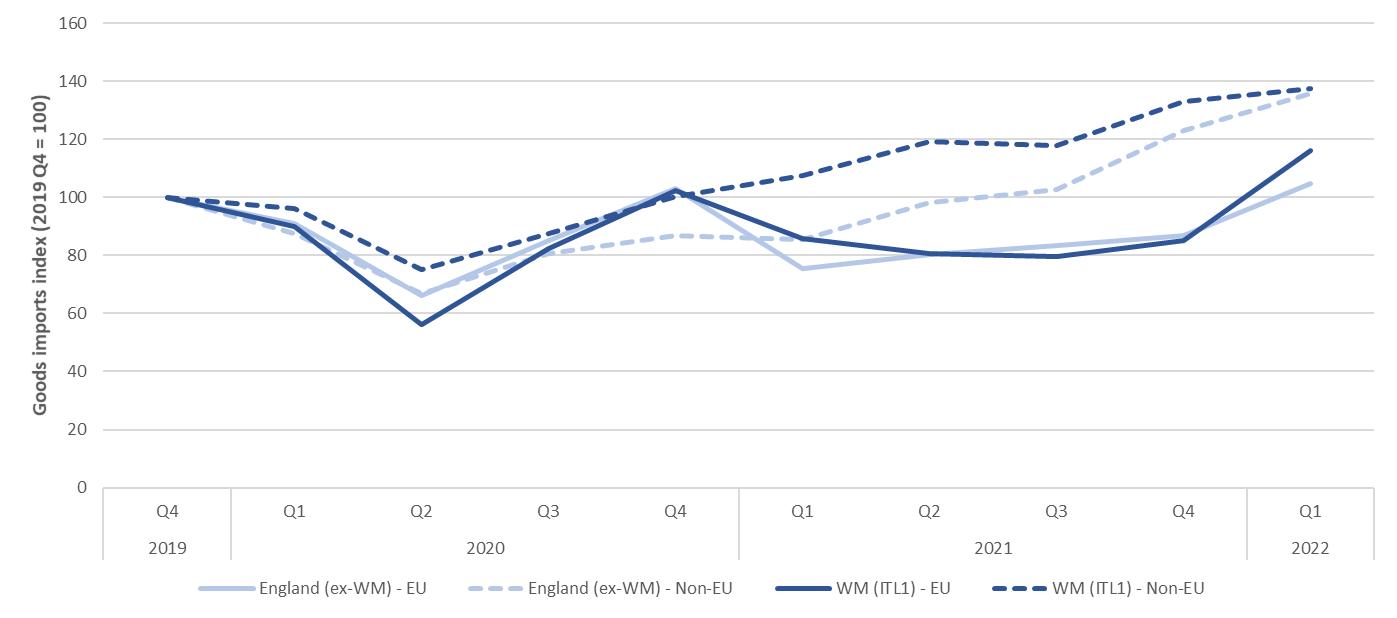

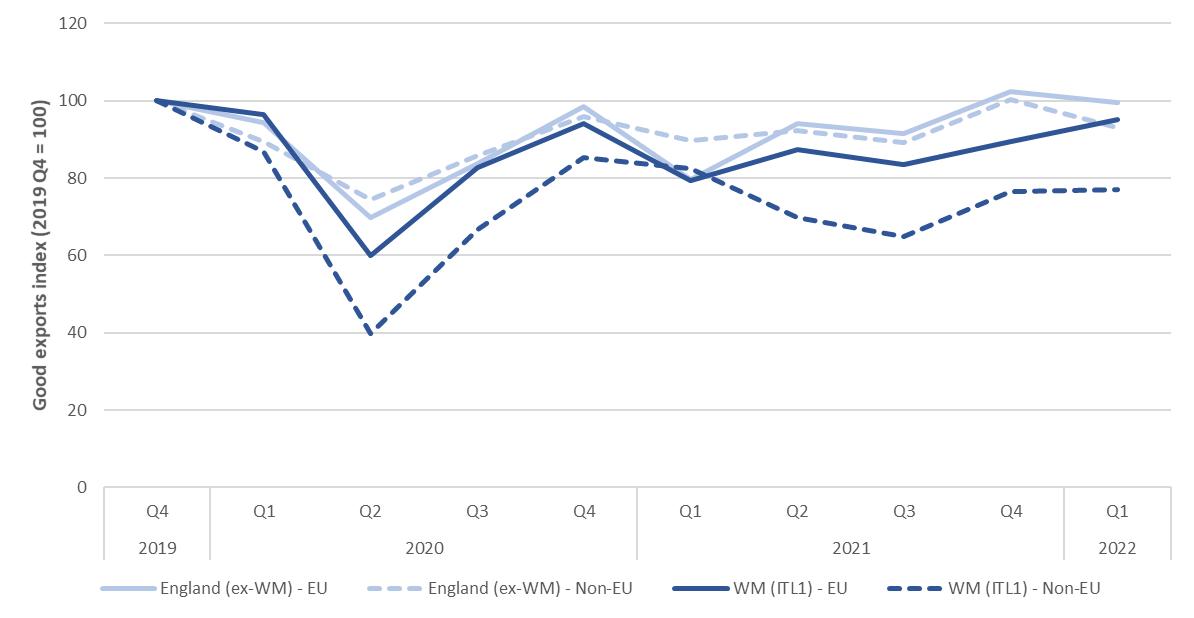

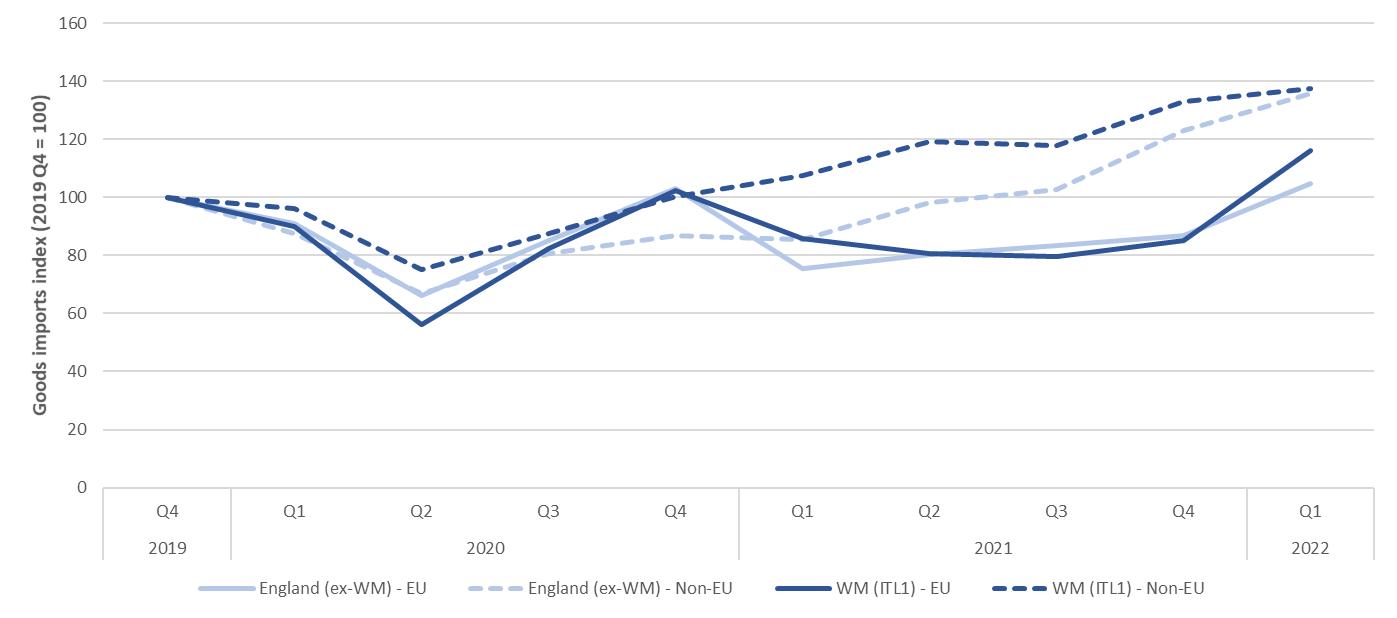

Regional trade partially recovered in 2021 with goods exports growing by 3.8% and imports by 13.2%, although remained a respective 19.3% and 7.5% below pre pandemic (2019) levels. Provisional HMRC data for Q1 2022 indicates a continued recovery and that goods imports are recovering more quickly than exports. However, the figures are subject to change and complicated by a new reporting methodology for EU trade which affects backwards comparability of the first quarter.10

The trade deficit on goods has widened over the past few years.

Total trade in goods for West Midlands (ITL1) and England (£ millions)

FULL YEAR

1st QUARTER ONLY*

2021 vs.2020 vs.2019 2022* vs.2021 vs.2020 vs.2019

WMExports 25,533 3.8% -19.3% 6,907 4.3% -6.8% -14.6%

WMImports 33,953 13.2% -7.5% 10,900 31.9% 34.4% 8.7%

WM Balance -8,420 56.2% 66.3% -3,993 142.9% 474.5% 105.8%

England Exports 226,292 6.5% -8.7% 59,204 12.5% 3.4% -7.8%

England Imports 358,920 8.9% -9.1% 117,012 46.6% 32.8% 11.2%

England Balance -132,628 13.2% -9.8% -57,808 112.7% 87.5% 40.9%

GfK, 2022, UK Confidence sinks to 41 in June to set new record low

Refer to ONS explainer on changes to UK trade figures with the EU

16

UK total domestic

consumer expenditure

(£billions)

Source:ONS,Annualconsumertrends,seasonallyadjusted Figuresbasedonchainedvolumemeasurestoremovetheeffectofinflation.

9

10

Source:HMRC,UKregionaltradeingoodsstatistics.

*AnewdatacollectionmethodwasintroducedinQ12022representingabreakinthetime series.Cautionshouldbeexercisedwhencomparingtopreviousquartersattheregionallevel.

Theamountofregionallyunallocatedtradehasincreasedduetothechange. Figuresfor2021and2022areprovisionalandsubjecttochange.

West Midlands’ goods exports were hit harder and are recovering more slowly than nationally. The region exported £25.5bn of goods in 2021 accounting for 11% England’s total, down from 13% in 2019.

Regional goods exports to the European Union (EU) are recovering at a faster rate than exports to non EU countries which were hit particularly hard. This differs to the rest of England where non EU goods exports were hit to a lesser extent and have almost recovered at a similar pace. Exports to North America were particularly affected and remained 29% below pre pandemic levels at the end of 2021. Although a smaller share of the total, exports to Middle East and North Africa remained 27.5% down.

Machinery and transport equipment accounted for 74% of the decline in exports to the EU and almost all of the decline to the rest of the world. The drastic decline is a result of pandemic related disruption to global supply chains and suppressed demand for automotive and aerospace vehicles.

Goods exports to EU and non EU destinations

Source:HMRC,UKregionaltradeingoodsstatistics.

*AnewdatacollectionmethodwasintroducedinQ12022representingabreakinthetime series seeabove.

Goods imports from EU countries fell by more in Q2 2020 than those from other countries of origin. Imports from non EU countries have recovered quickly and are now significantly higher than at the end of 2019, whilst imports from the EU have only recently surpassed this level, similar to nationally.

Reduced imports of machinery and transport equipment ( 11% in 2021 versus 2019) and miscellaneous manufactures ( 19%) were the most substantial in their contribution to the overall regional decline. Imports of manufactured goods fell by 22% in 2020 but have since recovered and are now 3.6% above their pre pandemic level. Imports from Asia and Oceania were 10% down in 2020 but are now 24% above their 2019 level.

17

Goods imports from EU and non EU origins

Source:HMRC,UKregionaltradeingoodsstatistics.

*AnewdatacollectionmethodwasintroducedinQ12022representingabreakinthetime series seeabove.

Turbulence in trade activity caused by the pandemic and its impact on global supply chains means it is difficult to attribute changes in EU trade flows directly to Brexit and the EU UK Trade and Cooperation Agreement. Analysis by the OBR forecasted a long term 15% decline in UK trade associated with Brexit11 whilst prior research by City REDI found that the West Midlands is more exposed than average to its effects, with manufacturing being the most exposed sector.12

The EU UK Trade and Cooperation Agreement has introduced barriers that have disproportionately affected small and medium sized businesses who are less likely to have the resources needed to navigate bureaucratic changes to trade effectively. The Greater Birmingham Chambers of Commerce, with the support of the West Midlands Combined Authority (WMCA), has spent the past several years working to inform businesses of the latest Brexit related developments. This year, the Chamber is delivering a range of activity including events, briefing resources, and expert videos to update local firms on ongoing Brexit related issues.

18

11 OBR, Economic and fiscal outlook October 2021 (p.58) 12 City REDI blog, Ortega Argiles, 2018, The Exposure of the West Midlands Region to Brexit

Jun Du, Professor of Economics, Aston Business School

The UK trade has experienced unprecedented disruptions and sharp decline episodes in recent years during the EU exit, the COVID pandemic, the global recession, supply chain bottlenecks, high energy price and inflation, as well as the Ukraine war. Compared to other developed economies, the UK had an underwhelming recovery. In 2022 the UK trades less than in 2019 with the EU, its largest trading partner, while over the same period, Germany and the Netherlands have grown trade within the EU by nearly a quarter, so has the US grown trade with the EU considerably.13

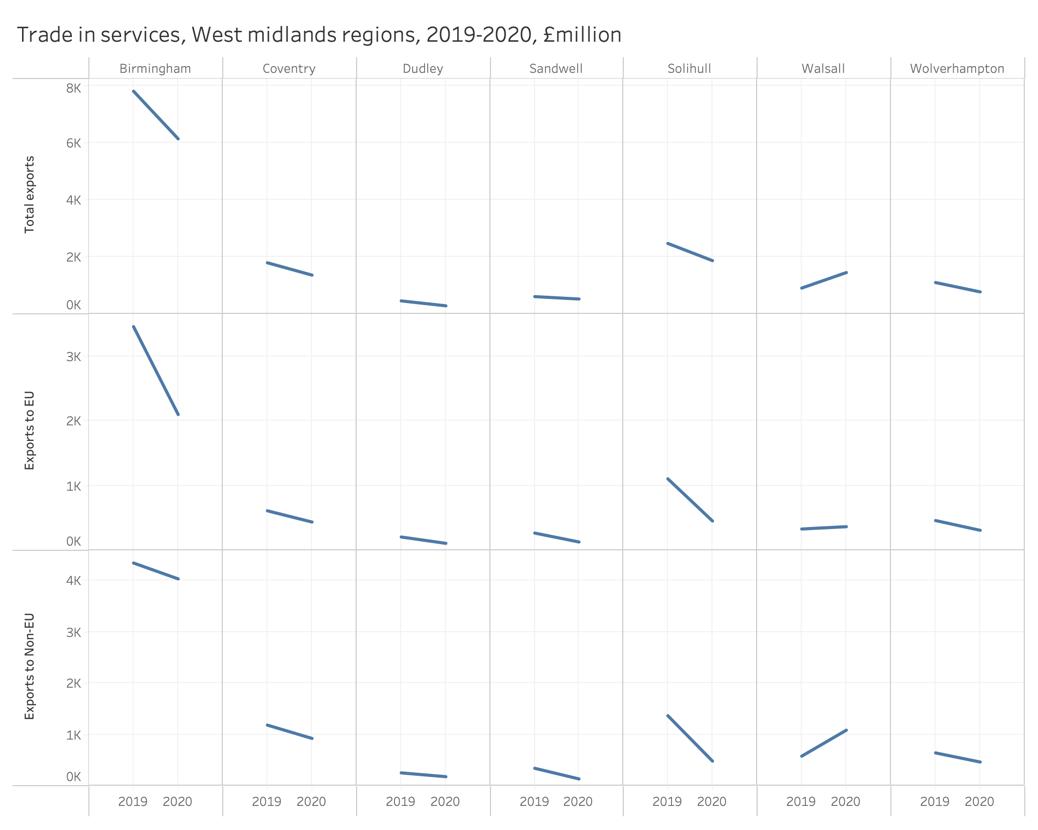

West Midlands have been among the hardest hit regions in trade terms in the UK throughout the recent crisis period. At the fourth place nationally in terms of total value of exports after South East, London and Scotland, West Midlands’ total exports in 2020 (£25 billions) was three quarter of that in 2019 (£33 billions), according to the latest ONS UK Trade subnational statistics [Exhibit 1]. Manufacturing sectors’ exports shrank by more than a quarter during the same period, the worst among all regions.

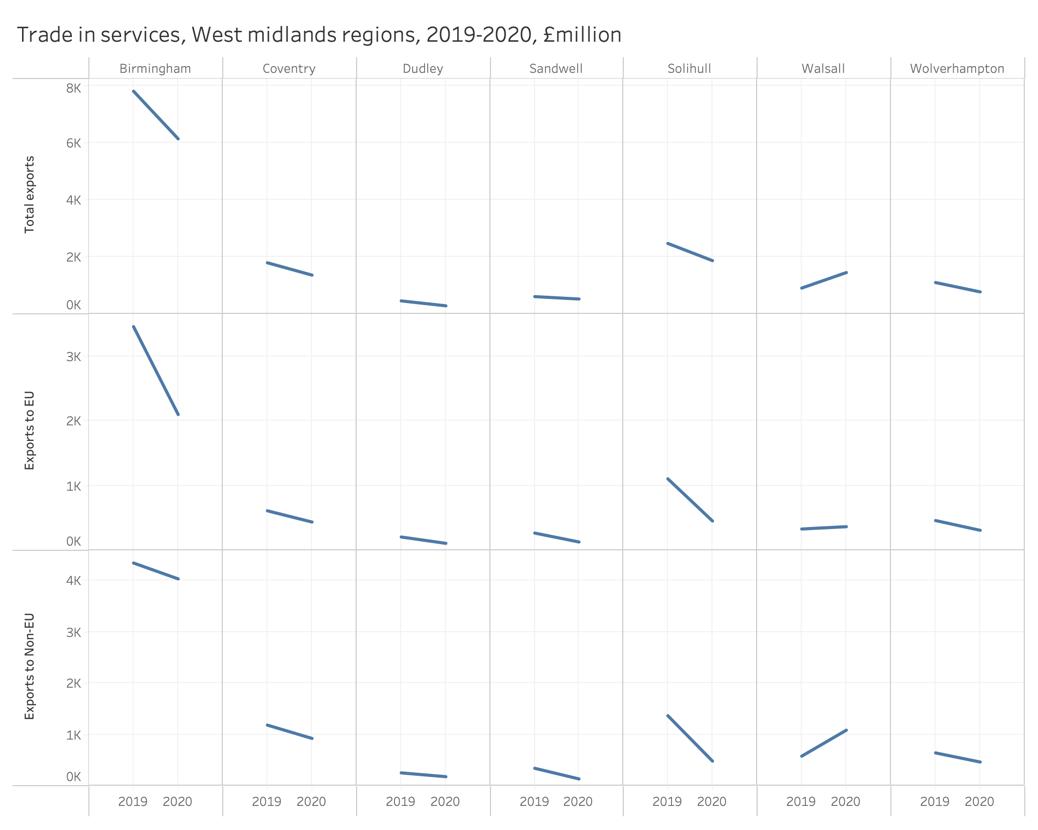

Similarly, exports in services of West Midlands also declined by more than a quarter of value in 2020 (£11 billions) compared to 2019 (£15 billions), the worst decline among UK regions [Exhibit 2]. West Midlands has slipped one place to the seventh in 2020 in the national rank of the total value of exported services. Birmingham as the top services exporter in West Midlands had sharpest decline in exporting to the EU in 2020, while its exports to the non EU countries has been remarkably resilient, maintaining 93% of the pre COVID level [Exhibit 3].

Emerging regional trade data for exports in goods in 2021 suggest that the recovery natured growth of Midlands area has been moderate, reflecting the post EU exit challenges. Nationally, our recent research on UK trade dynamics shows that despite of the tariff free terms of trade in goods set out in the EU UK Trade and Cooperation Agreement (TCA), UK exports experienced a large, negative, statistically significant decline at the end of transition after the TCA was put in force. Non tariff measures (NTMs) are responsible for the adverse TCA effect on UK trade with the EU and that the magnitude of loss was significant (Du and Shepotylo, 2022).14 We estimate that increased trade frictions due to sanitary and phytosanitary measures (SPS, particularly in Food and drink, Wood and Chemicals sectors) and technical barriers to trade measures (TBT, Metals, Equipment, Machines and Miscellaneous Industrial products) can explain 70% of the documented total reduction in the EU exports in the first six months period of 2021.

Evidence suggests that exporting to the EU has become much more costly, and for some exporters unviable. The export market dropping out is a key concern of losing the benefits of exporting and for the region’s future pipeline of export growth.

There has never been a better time to explore markets outside the EU, notably in the Commonwealth countries and emerging economies, as well as some under explored markets in North America. Our research finds that firms have increased activities in exploring these markets since the Brexit Referendum. Since 2021, while firms facing higher non tariff barriers in SPS measures have been more active in diverting exports towards the non EU destinations, firms facing higher TBT measures seemed less active in finding alternative markets. The manufacturing sectors in West midlands automotive, aerospace, pharmaceuticals and chemicals industries among others are more likely to be affected by TBT when trading with

13

14 See

paper “TCA, Non

Measures

UK Trade” for the Enterprise Research Centre at https://www.enterpriseresearch.ac.uk/wp content/uploads/2022/06/ERC ResPap98 TCA Non

Measures and UK Trade Du Shepotylo.pdf.

19

See further commentary at https://www.aston.ac.uk/latest news/eu uk trade and cooperation agreement costly what does uk need do aston angle

our new

tariff

and

tariff

the EU. This creates additional concerns about their post Brexit prospect, give their reliance on EU value chains.

In the short and medium term, supporting firms to export should be the priority, especially small and medium sized firms that are productive enough to have exported in the past but facing hurdles to continue exporting. These firms tend to be resource constrained but have the infrastructure and ambition to internationalise. Targeted supports for specific challenges could be fruitful. With strong expertise and experience, the UK Department for International Trade Midlands Export Support Service, Birmingham Chambers of Commerce, and West Midlands Growth Company and Growth hubs as well as experts in region’s universities all have a major role to play in helping firms to export.

Exhibit 1 Trade in goods, West Midlands In the UK

20

Trade in Services, West Midlands In the UK

21

Exhibit

2

Exhibit 3 Trade in Services, West Midlands regions

Mandy Haque, International Director, Greater Birmingham Chambers of Commerce

In writing this blog for the 2022 Birmingham Economic Review, my first thought was, “well what has changed since the last publication?”

Many of the challenges are still present: the complexities associated with Brexit compounded by the coronavirus pandemic; the global supply chain is still in a vulnerable position; the soaring costs of shipping and demand on transportation is causing businesses to review their suppliers and their finances. In addition, we have the difficulties of the cost of living crisis with businesses seemingly left out of support packages, the hike in energy costs, the government awaiting a new leader which has taken time and some might say focus away from issues that need addressing, as well as the impact of the war in Ukraine. These factors have all exacerbated an already difficult situation for businesses.

Nearly two years on after the UK left the EU there is still some uncertainty on the “real deal” and benefits for business. There is still the need to provide further documentation for European shipments and since travel corridors opened after the pandemic and the world has tried to return to a normality, further travel has seen further costs for those that may not have realised. As in person exhibitions, conferences and expos increase many firms are finding that they now need to submit documents to customs that they previously hadn’t needed to and many businesses have paid the price of not being prepared when presenting themselves to European customs authorities. That said, trade with Europe has increased in 2022 compared to last year and my recent meeting with His Majesty’s Trade Commissioner for Europe was enlightening on how government is trying to ease the challenges experienced by businesses whether exporting goods or services. In amongst all of this HMRC are changing their 30+ year old system for processing customs declarations and although the date of implementation is pushed back, it will soon come to be and operators need to be aware of the processing changes. For e commerce there are additional challenges, whether it is having the right labelling, packaging or representation in market, trade is a complex environment in which to operate.

The impact on currency exchange is also a deliberation where companies may not pre empt the drop of the value of the pound against other currencies and so have not hedged their funds by setting in a fixed exchange rate to help plan their finances. Foreign exchange companies can advise on this and whether it is the right approach for your business. Some countries may also go onto the banking high risk lists where banks may not be so accommodating to lend to business for international trade. As the political environment changes so do the high risk nations and this needs to be considered when embarking in contracts that may seem profitable at the time. Although international trade does find a way through the barriers, there are other considerations and sanctions and embargoes is an area where getting it wrong is not an option. With the rate of inflation rising, businesses may be inclined to stockpile goods, but this has its own issues with storage costs and storing goods that may have a shelf life or be seasonal.

So, after reading the above you may be thinking, “why do it at all if trading globally is deemed to be so challenging?” Well, as the old saying goes, “the benefits do outweigh the risks.” Those that embark on the global trade journey do so to see their businesses grow. According to ONS statistics, exports to Europe have increased this quarter compared to the same quarter last year and they are set to increase despite the challenges faced. Those that have exhausted the domestic market find a whole new enthusiasm to grow in other markets as well as their profile and become less vulnerable by growing their market share.

Help is at hand and that’s where Chambers can play their part. Many, like the Greater Birmingham Chambers of Commerce can provide support in areas such as providing trade documentation, translation, training the workforce in international trade complexities as well as provide support and signposting to those that need that help.

With trade negotiations continuing and many overseas markets having agreements in principle, there will still be some changes to trade anticipated, but it is important to realise that there is support for business to help navigate the complex trade journey. The international divisions at

22

the Greater Birmingham Chamber of Commerce are focused on bi lateral trade and have strong partnerships and overseas relationships to facilitate trade opportunities. The Greater Birmingham Commonwealth Chamber of Commerce supports bi lateral trade with Commonwealth nations, broadening businesses reach to new markets post Brexit as well as this year engaged with the Commonwealth Games Organising Committee for Birmingham 2022 and is committed to expanding on the business legacy from the games. The Greater Birmingham Transatlantic Chamber of Commerce is part of the British American Business Network, one of 21 chapters spanning the UK and North America and is also available to help support those transatlantic relationships. The year has been a reflective, challenging but exciting year in many respects for international trade and overseas engagement and whatever the situation, know that the Chamber can support your business to navigate the international trade challenges and opportunities ahead.

23

Foreign Direct Investment

Statistics from the Department for International Trade show that 62 inward investment projects to the Greater Birmingham area in 2021/22 both single and multi site created 2,063 new jobs and safeguarded 93 existing jobs. This was the fourth highest number of investment projects for a LEP area in the country after Greater Manchester (81), North East (72) and Leeds City Region (65). Figures for prior years are not available at the LEP level.

In the same year, the wider West Midlands (ITL1) region received a total of 143 inward investment projects, just two less than 2020/21 but 14 less than 2019/20. Nationally, there was a slight increase in the number of projects in spite of a steep decline to recover from in the previous year. Total job creation and safeguarding at the regional level has declined 11% over the past two years, despite increasing 42% nationally.

General trends indicate Biotech, Pharmaceuticals, Environment, Infrastructure and Transportation, and Renewable Energy are growth sectors, whilst investment into Advanced Engineering, Aerospace, Business and Consumer Services, and Creative Media has fallen. Inward Investment

GBSLEP

FDI projects 62 Total jobs 2,156 West Midlands (ITL1)

FDI projects 157 145 143

Total jobs 6,614 6,304 5,871

UK FDI projects 1,852 1,538 1,589

Total jobs 65,138 73,506

Sector Summary

The composition of Greater Birmingham’s economy changed in 2020 as disruption resulted in large changes to economic output, both positive and negative, in different sectors. The following figures are based on the most recent available regional data up to 2020 and national data up to Q2 2022 from ONS.

The Business, Professional & Financial Services sector remained the city region’s largest sector by some margin as measured by GVA. Previously the second largest sector, Advanced Manufacturing and Engineering suffered significant decline pushing it into fourth place. It was surpassed by the Public Sector (incl. Education) which increased in size in response to the crisis and Retail which declined but to a lesser extent. The strongest growth was seen in the Life Sciences & Healthcare sector, although Digital & Creative also saw some growth. Cultural & Sport, which includes Accommodation, Food and Arts & Entertainment industries, suffered a massive 43% decline given the challenges faced by the beleaguered sector. Discouragingly, the Low Carbon & Environmental Tech sector declined by 8% over the year although is difficult to measure using this methodology.

24

2019/20 2020/21 2021/22 YoY 20/21 YoY 21/22

8% 1%

5% 7%

17% 3%

92,524 13% 26% Source:DIT,Inwardinvestmentresults2021/22. FDIdatafortheGBSLEPareaisunavailablefor2019/20and2020/21.

GVA GVA

Sector Share Share YoY

Brexit Risk (2020) (2019) to Competitiveness Business, Professional & Financial Services £17.2bn 33% £17.8bn 32% -3.3% Medium

Public Sector incl. Education £6.9bn 13% £6.4bn 12% 7.9% Medium

Retail £5.9bn 11% £6.4bn 12% -6.6% High Advanced Manufacturing & Engineering £5.8bn 11% £7.0bn 13% -17.0% High

Life Sciences & Healthcare £5.4bn 10% £4.7bn 9% 13.4% Medium

Construction £4.0bn 8% £4.3bn 8% -5.1% Medium Digital & Creative £3.0bn 6% £2.9bn 5% 3.4% Medium Logistics & Transport £1.9bn 4% £2.2bn 4% -12.9% High

Cultural & Sport £1.5bn 3% £2.7bn 5% -43.1% High Low Carbon & Environmental Tech £0.8bn 1% £0.8bn 2% -8.0% Medium

TOTAL £52.6bn 100% £55.3bn 100% -4.9% -

Source:ONS,RegionalGVA(balanced)byindustry:city&enterpriseregions.

GVAbasedoncurrentpricessoyearoveryearchangeincludesimpactofprice changes/inflation.

An update on key sectors of the economy is provided below, drawing on national level statistics and other relevant research.

Business Services & Finance was less affected by the pandemic and made a relatively quick recovery. Sectoral GVA declined nationally by 8.3% in Q2 2020 but had made a full recovery by Q2 2021. As of Q2 2022 it was 4.6% above pre pandemic (Q4 2019), which is a positive for the city region given its high weighting as a share of overall GVA.

Retail was acutely impacted by protective measures introduced to control the spread of Covid 19, with the sector falling at a national level to 69% of 2019 output in Q2 2020 and struggling to recover since. New data from the ONS shows it remains 17.5% below its 2019 level as of Q2 2022, a bigger gap than previously thought. Bricks and mortar retail has been particularly hard hit whilst internet sales climbed from 19.2% of total sales in 2019 to 36% in Q1 2021. Online shopping as a share of total retail has since receded although remains well above pre pandemic levels as of Q2 2022 at 25.7%.15

The Centre for Retail Research claims that 2020 was likely the worst year for bricks & mortar retailers for 25 years. Nationally, over 180,000 jobs were lost and 16,000 shops closed in 2020, and 105,000 jobs lost and 11,500 closed in 2021. Two thirds of those closures were independent retailers. The sub sector is already under pressure from changing consumer trends, the shift to online retailing and punitive business rates.16

Construction was also badly impacted by the first national lockdown in March 2020, falling nationally to 63.4% of 2019 levels of output in that quarter. However, the sector has made a gradual recovery and was 2.9% above 2019 output as of Q2 2022. The sector has struggled with

25 Economic composition of Greater Birmingham (GBSLEP)

15 ONS, Internet sales as a percentage of total retail sales (ratio) (%) [accessed September 2022] 16 Centre for Retail Research, The Crisis in Retailing: Closures and Job Losses [accessed September 2022]

material shortages, input cost inflation, and skilled labour shortages partially related to the UK’s departure from the EU.17

Transport Storage & Communications was 1.8% above its pre pandemic level as of Q2 2022 at the national level. Strong take up of warehouse space led to record low vacancy rates of just 2.3% in the West Midlands earlier this year. As of July, vacancy rates stood at 2.8% and there was 2.2m sqft across ten units under development in the region.18

Accommodation & Food Services was the worst affected sector, with national output dropping to 15.3% of 2019 levels in Q2 2020, although had recovered to 106.8% by Q2 2022. In addition to social restrictions, the sector has also faced supply chain, cost and labour shortage challenges over the past two years forcing it to adapt. Hospitality businesses that survived the pandemic are in a precarious state as the energy crisis bites, which could see the loss of thousands of businesses and hundreds of thousands of jobs, including in the supply chain, across the UK.19

Manufacturing output at the national level recovered quickly and was strong throughout 2021. As of Q2 2022 the sector was 6% above its pre pandemic level. The sector is benefitting from reshoring activity as manufacturers look to increase the resilience of their operations and supply chains. A Make UK survey showed that 42% of manufacturers have increased their proportion of suppliers in Great Britain in the past two years.20

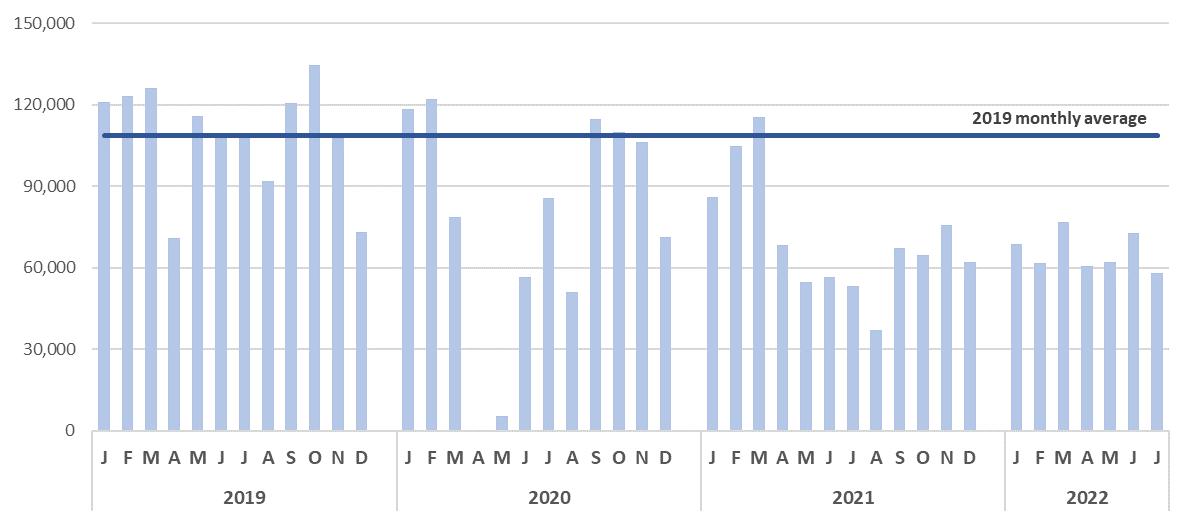

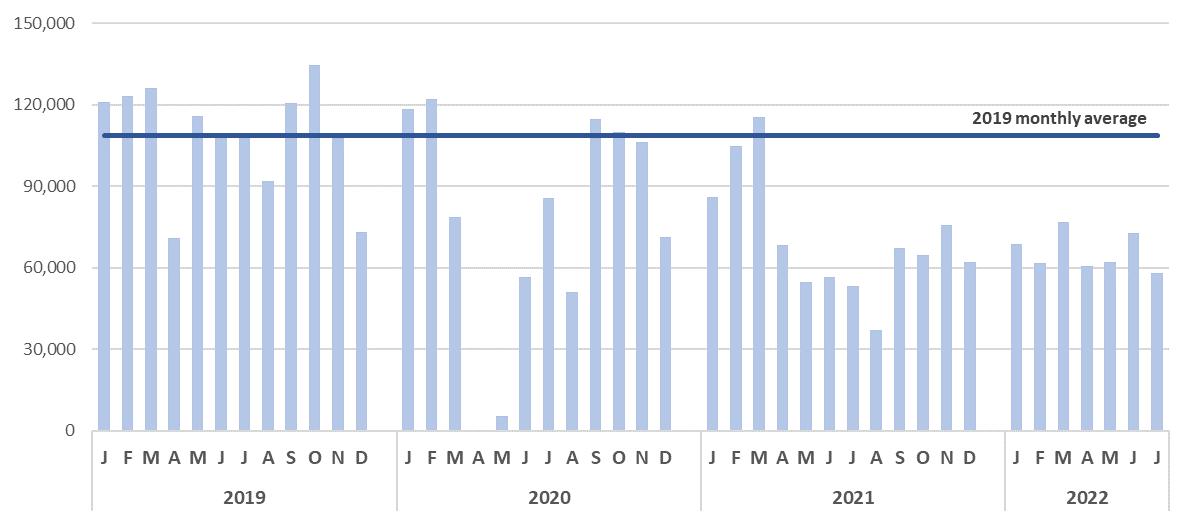

Automotive is a key component of the manufacturing sector and has been badly impacted by the pandemic. The West Midlands region accounts for 35% of all automotive employment and so what happens in the subsector greatly affects the region. Data from the Society of Motor Manufacturers and Traders (SMMT) shows that monthly output in 2021 remained almost 40% down on 2019 and was not showing signs of recovery.

Car manufacturing monthly output (UK)

Source:SMMT,Manufacturingdata carmanufacturing.

26

17 Construction News article, available here 18 Savills, The logistics market in the West Midlands (July 2022) 19 The Drinks Business article, available here 20 Make UK, 2022, Operating without Borders Building Global Resilient Supply Chains

Dr Matt Lyons, Research Fellow, City REDI, University of Birmingham and Dr Magda Cepeda Zorrilla, Research Fellow, City REDI, University of Birmingham

The automotive sector is important to the national economy estimated supporting 153,000 full time equivalent (FTE) jobs in 2019. The automotive sector is heavily clustered in the West Midlands, supporting 33% of UK automotive manufacturing employment (51,625 FTE). The region hosts 430 specialist automotive firms including market leaders, Jaguar Land Rover, and Aston Martin Lagonda. While these automotive firms are spread across the West Midlands Birmingham supports 8,000 FTE in automotive manufacturing, 5% of all national employment in the sector.

The economic benefits to the regional economy are multifaceted. The automotive sector is export intensive, and the West Midlands is the UK’s leading region making 40% of all cars exported from the UK. The sector supports a broad supply chain with strong linkages to metals, engineering, R&D and other advanced manufacturing sectors. Beyond this the sector is a key source of innovation and competitive advantage for the region.

However, the joint impacts of Brexit and Covid 19 have had a dramatic effect on the automotive sector in what we refer to as the ‘2020 shock’. Society of Motor Manufacturers and Traders (SMMT) figures show that new car production was down 29.3% in 2020 and 28.7% in 2021 compared to 2019 levels, representing the lowest levels of car production since 1984.

Analysis conducted by City REDI suggests that in the 2020 shock in the West Midlands automotive cluster would lead to 64,831 full time equivalent jobs £11.4 billion in output and £4 billion in GVA being lost throughout the national economy.

The analysis shows that the shock is not contained to the automotive sector but has significant knock on effects on other sectors including Manufacture of basic and fabricated metals, Professional Scientific and technical activities, wholesale and retail trade and repair of motor vehicles, Construction and Information and communication.

Our analysis shows the impacts across wages by occupation showing that on average all earners will see a fall in wages by 0.94% with the most significantly impacted occupations Elementary Trades and Related Occupations seeing a fall of 1.9% and Process plant and machine operatives a fall of 3.1%. When grouped by skill level it is noted that lower skilled occupations were the most significantly impacted seeing a percentage fall of 1.04% compared with medium skilled 0.98% and high skilled occupations 0.90%.

Due to policy interventions like furlough the simulated impacts listed here were somewhat mitigated. However, the analysis gives us an insight into how vulnerable the regional and national economies are to a shock in the automotive sector.

The three major considerations from the analysis are:

Uncertain recovery: The timeline for recovery is uncertain as supply chain issues persist, the cost of living crisis dampens demand and the long term impacts of Brexit on trade and production are still being worked through.

Future shocks: Diesel and petrol vehicles will be banned from sale in just 8 years. There are other signs that manufacturing employment is trending down in the Midlands with one forecast suggesting employment in manufacturing will be down 40% by 2040.

Regional resilience: One of the most significant conclusions from the analysis is how vulnerable the West Midlands economy is to shocks in the automotive and advanced manufacturing sector.

27

This will have important consequences for highly specialized regions like the West Midlands with a significant influx in unemployment in low skilled occupations Process plant and machine operatives and Elementary Trades and Related Occupations.

The Automotive sector is a source of innovation and competitive advantage for the West Midlands if this is in decline new areas need to be identified and supported to soften the landing of a shock in the sector.

Automation and electric vehicles are potential sources of growth for the region. However, it is likely that the skills lost to ICE automotive manufacturing decline might not be a close match to those in demand from these new industries. As such a long term view of the future skills required for the region should be taken to ensure a successful transition.

This article is linked to the academic paper Understanding the 2020 Shock in the UK’s Automotive Sector coauthoredbyMattLyons,MagdaCepedaZorrilla,RaquelOrtegaArgilés andDenizSevinc.

28

Paul Thandi CBE DL, Chief Executive Officer, The NEC Group

At this point last year, we had just progressed to Stage 4 of the Government’s roadmap, marking the long awaited return to full operations for our venues; The Ticket Factory, our ticketing business; and Amadeus, our award winning caterer. Cut to the present and we continue to operate under ‘normal’ conditions externally but recovery conditions in all of the markets we serve. We continue to face extreme challenges of price volatility, across power consumption and a high inflationary environment across all other costs, including the highest salary challenges I have seen in 30 years of leading businesses. However, the Group has an ambitious plan to return revenues, service offers and profitability back to pre pandemic levels. And as things currently stand, things are progressing well. The business has a strong pipeline of booked activity and prospects and we now have over 600 FTEs. Through the Group’s education programmes, we are back supporting future talent in the Midlands, developing their skills whilst showcasing the broad range of roles a career in live events offers.

The Birmingham 2022 Commonwealth Games has served the region well a global advocate for our arts, culture, and diversity. This has already provided us with the opportunity of huge legacy benefits as a business, primarily because of our Proud Host Venue status. Over 1.5 million tickets were purchased across the Games and over 1.5 billion people worldwide saw what our teams could deliver and how our venues can be transformed. It demonstrated why we are the perfect events destination; set in the heart of the UK, offering world class facilities, technical capabilities, and unrivalled connectivity by road, rail, and air.

Our businesses are already witnessing an influx of new enquiries, and most notably at the time of writing, a second stage bid invitation to host the Eurovision Song Contest 2023 at Resorts World Arena. Whether this will go in our favour is yet to be determined but even if we do not win the bid, Birmingham has been positioned very well as a major events destination, with all the critical infrastructure, connectivity, culture and people investments made which is crucial if we want to continue to be a global player in the events market.

As the NEC Group delivers its diversification strategy, it is apparent that there is still a desire for the ‘live’. The first quarter of this financial year has been The Ticket Factory’s best Q1 in terms of ticket sales for six years. There is a lot of product out there that we can utilise. Take Wireless Festival for example. The NEC hosted this in June, the first outdoor festival of its kind to be held on the Campus, with further interest from festival promoters as a result. Esports is an interesting genre which we’d like to develop further, having hosted the Commonwealth Esports Championships (ICC), previously ESL Dota 2 (Utilita Arena Birmingham) and also the filming location for the show opener to the 2021 League of Legends World Championship (NEC). The NEC Group has a growing affiliation with this event genre one that has made it big online and is gradually expanding its offline offer for fans as well.

There are opportunities aplenty for and within Birmingham. As with many arts, sports and cultural institutions across the city and wider region, the NEC Group is a strong, strategic economic asset that is part of an industry integral to long term economic recovery. While we still confront obstacles of yesteryear, there is a great buzz and momentum around Birmingham and the region now, which any business should try and capture.

29

Neelam Afzal, Partner and Solicitor, Wildings Solicitors and Committee Member, Asian Business Chamber of Commerce

In a 2021 report published by Diversity UK, it was reported that ethnic minority led businesses contributed a staggering £74 billion to the UK Economy, with 6 million businesses registered in the UK and employing 3 million people in 2019 20.

Research published by Aston University’s Centre for Research in Ethnic Minority Entrepreneurship (CRÈME) revealed:

• Ethnic minority led businesses are more innovative and more likely to export than non ethnic minority led businesses.

• Ethnic minority led businesses are often detached from mainstream business support, and struggle disproportionally when it comes to accessing finance.

• The impact of Covid 19 has bought structural inequalities in ethnic minority led businesses.

Ethnic minority led businesses in Birmingham have reported that they face their own unique challenges but are often overlooked by policymakers in the region or in central government.

The disproportionate challenges faced by ethnic minority led businesses have further been impacted by coronavirus crisis, inflation, energy prices and the Commonwealth Games.

National and regional evidence from aggregated data revealed that there was a higher and disproportionate number of Covid related deaths from ethnic minority communities, and a broad correlation between areas where there is social economic deprivation. A significant number of ethnic minority led businesses operate in the hospitality and retail sector, including high street, clothing and supermarkets businesses. Many of these businesses required their workers to be in close proximity with their customers. Research undertaken by the West Midlands Combined Authority (2020), has shown that a large number of ethnic minority groups faced losing their jobs and will have difficulties finding suitable alternative positions. During the pandemic, ethnic minority led businesses were often unable to access external funding, which was due to many factors, such as the lack of local businesses support, a need for assistance in completing applications, and language and technology barriers. There were several initiatives by the Birmingham Chamber of Commerce, Asian Business Chamber of Commerce and other business support groups to assist businesses in tackling language or technological barriers. Local businesses report that often they would learn about funding or support after the event, and there was no one single, clear conduit of delivering support and assistance.

Whilst some ethnic minority led businesses have closed, other ethnic minority led businesses have done well, through innovation. Some local Birmingham ethnic minority led businesses have developed innovative sanitising products and distributed PPE. Businesses have diversified their operations, to use technology (which for some ethnic minority led businesses has been a challenge) and they have changed their business models.

Nevertheless, the long term challenges of the pandemic have now been exacerbated by current issues, such as inflation, and grossly increased energy prices. It has been reported that sectors such as retail and manufacturing have particularly suffered, first during the pandemic, during which many were unable to source their products from existing suppliers from outside of the UK, and now with increasing energy prices. This is having a debilitating impact of the survival of these businesses. Ethnic minority led businesses in many sectors have been unable to pass on increasing costs to their customers.

The Commonwealth Games has had a positive impact ethnic minority led business in the region. The Birmingham Race Impact Group commissioned a panel of race and equality practitioners to consider inequality, particularly where diverse communities have felt ignored by the organisers of the Commonwealth Games in respect of legacy, community engagement and procurement. It is expected that in time, further data will emerge.

30

At a national level, there needs to be better quality data by the Government, which is collated and published, identifying better access to finance and support, implemented through coherent plans to support businesses, and a strategic approach to addressing the impact of economic factors which disproportionately affect ethnic minority led businesses. This must be addressed within the Government’s strategic plans for levelling up in the Midlands.

31

Risks

There a number of significant risks facing the national and regional economy at this time.

Inflation/Interest Rates persistent inflation is eroding purchasing power and there is evidence it is beginning to weigh down consumer spending. The Bank of England is widely expected to raise interest rates in the coming months in an attempt to reduce inflation back down to the 2% target, however this will increase borrowing costs on mortgage holders and other debt holders.

Energy Crisis excessively high energy prices pose a serious economic risk to the UK’s households and businesses. Whilst the government’s energy support scheme places a (temporary) cap on bills, energy costs are still a primary driver of inflation. There is also the possibility of rolling blackouts over the winter which could impact business operations and supply chains. The outcome of the war in Ukraine and the future of national energy resilience is not clear at this point.

Brexit the consequences of the UK’s formal departure from the EU are still being played out with retail, manufacturing, logistics & transport and culture & sport having been identified as most at risk from the break. The nature of the trading relationship with Northern Ireland remains contentious and without long term resolution. Beyond the immediate threat of trade disruption, the issue also threatens the stability of the UK’s political union, its relationship with the EU’s trading bloc, and the potential of a trade deal with the United States. Previous research by City REDI highlighted the Manufacturing, Retail, Logistics, Cultural and Sports sectors as being at highest risk of Brexit related disruption.21

Covid 19 although restrictions on daily activity have largely been removed for some time now, the infectious disease has not gone away and the threat of potentially more deadly or disruptive variants remains. Case rates were relatively low as of the end of September, although had shown early signs of increase.

Covid 19 daily new cases (GBSLEP)

Fiscal Stability uncertainty and concern about UK fiscal policy remains at the time of writing. The national debt stood at 99.6% of GDP at the end of Q1 2022 having reached its highest levels since the end of World War II over the course of the pandemic. Net borrowing for 2021 was 7.9% of GDP and although borrowing has fallen in 2022, it remains higher than pre pandemic.22

Concerns about fiscal policy announced in The Growth Plan sparked a weakening of the Pound and raised the cost of government borrowing, which in turn caused the Bank of England to warn of a material risk to UK financial stability in relation to pension funds. Uncertainty remains at the time of writing.

32

Source:UKHealthSecurityAgency,UKCoronavirusDashboard.[link]

21 Refer to City REDI publications and research on Brexit and the Midlands. 22 ONS, UK government debt and deficit: March 2022

Spatial Inequality the levelling up agenda acknowledges the differences that have opened up in the economic, social and environmental conditions and outcomes of different places in the United Kingdom. Failure to address these will result in a continuation of weak productivity and could lead to political instability.

Skills Shortages more than two thirds of UK leaders surveyed by Russell Reynolds stated that the availability of talent and skilled labour was the most pressing threat over the next 12 18 months.23

33

23 Russell

Reynolds Associates, 2022 Global Leadership Monitor [accessed September 2022]

Connect. Support. Grow. Contact Us: For queries related to the Birmingham Economic Review 2022 please contact: Emily Stubbs Senior Policy and Projects Manager Greater Birmingham Chambers of Commerce E.Stubbs@birmingham-chamber.com Kelvin Humphreys Policy and Data Analyst City-REDI, University of Birmingham K.Humphreys.1@bham.ac.uk Greater Birmingham Chambers of Commerce 75 Harborne Road Edgbaston Birmingham B15 3DH T: 0121 274 3262 E: policy@birmingham-chamber.com W: greaterbirminghamchambers.com