3 minute read

Road to Recovery

Road to Recovery: 2020 E-commerce in Asia Pacific

The Asia-Pacific (APAC) region alone will account for 63% of total e-commerce sales worldwide and Chinese consumers, making up the majority of APAC, will spend US$2.1 trillion online in 2020, an increase of 16%, says a research.

he ‘Road to Recovery: T 2020 e-Commerce in Asia-Pacific’ research by Rakuten Advertising, uncovered insights into consumer buying behaviour and preferences, accompanied with actionable strategies to help brands navigate through regional nuances and seamlessly integrate into the APAC market.

More than 5,000 consumers across Australia, China, Hong Kong, India, Japan, Malaysia, New Zealand, Singapore, South Korea and Taiwan were surveyed.

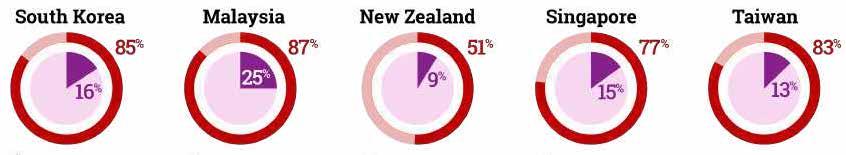

A majority of Asia-Pacific consumers (72%) also closely follow influencers and bloggers, with shoppers from Malaysia (87%), China and India stating that they are highly likely to be influenced by these content creators.

The research says that about 1/3 of Malaysian consumers find out about new retailers through bloggers and influencers, with 25% stating that influencers play an important role when it comes to discovering new products.

To reach these customers, it suggested that brands consider implementing a multi-touch commissioning strategy in their affiliate program to efficiently reward online content publishers or influencers and strengthen their partnerships.

Additionally, brands can reach highly engaged cashback shoppers and at the same time align commissions to business objectives through dynamic commissioning which allows brands to commission differently based on business objectives such as new vs. existing customers or specific products. By doing so, online content publishers have greater insight into what’s important to a brand and can align campaigns accordingly.

Rakuten Advertising’s Senior Vice President of Asia-Pacific, Stuart McLennan, commented on how retailers can identify the opportunities to enable them to ride out the challenges brought about as a result of Covid-19.

“Whilst the pandemic has unfortunately resulted in more

Over Half Of Consumers Engage With Brands Via Social Media The APAC social media ecosystem is diverse, with consumers choosing to engage via different local platforms.

72% of APAC Consumers Follow Influencers Influencers and bloggers play an important role in the discovery of new products, particularly in India, China and Malaysia.

Top Influencer Type

APAC

37%

92%

82% 91% 39%

85% 87% 51%

77% 83%

consumers being confined to their homes or geographical locations, online services such as food and grocery delivery, ‘buy online pick-up in-store’ and video-on-demand (VOD) have, undoubtedly, gained popularity, with consumers showing that these new habits are likely here to stay.”

He said that retailers should ensure they are complementing their online presence with a strong and tailored digital strategy to enable brand discovery and encourage conversion. “Understanding the consumer behaviour of Asia-Pacific shoppers, addressing the nuances of each market and adapting for the online and mobile experience will be key to success.”

Additionally, as e-commerce continues to blur the line between international borders, it is more important than ever for brands to tailor their marketing messages and shopping experience to each market and look to reach consumers through the right channels and partners.

The Malaysian Shopper

Indoleads

Involve Asia

ShopBack

*Please contact us for list of local publishers a full

Some Key Findings

• 66% of consumers across APAC have made an online purchase from an international retailer this year. • 64% of APAC consumers discover new brands through online search, followed by paid social, and recommendations from friends and family. Influencers and bloggers also play an important role in the discovery of new products. • On average, 3 out of 4 consumers agree that brands should offer benefits to frontline health workers. At the same time, 73% prefer retailers to include information on how they are responding to Covid-19 and communicate with compassion and empathy. • Consumers in Asia Pacific want to see empathy from brands and support for frontline workers during the Covid-19 pandemic. 75% of consumers say they prefer brands that offer discounts and benefits to frontline health workers, and 73% stated they want brands to communicate with compassion and empathy during this time.