16 minute read

Go It Alone or Partner? The Emerging Pharmaco Choice

By Ester Oben Etah, Principal, Launch Excellence, QuintilesIMS and Bill McClellan, Principal, Launch Excellence, QuintilesIMS

The emerging pharmaceutical and biotech industry is thriving. But precommercial companies must make a fundamental decision at some point in the drug development process: take the product to market on our own or to partner with an established large pharmaceutical company? This decision is typically made as developers approach the end of Phase II clinical trials, but can take place at any time—even after the drug has launched.

Advertisement

QuintilesIMS analyzed the approaches of companies that launched products for the first time between 2006 and 2015 to understand their funding/commercialization strategies. 1 Here are the results of this analysis and the implications for the three types of players involved: the research companies, their potential large pharma commercialization partners, and venture capitalists. The Nature of First -Time Products In recent years, there’s been a shift in the market towards more innovative, premium-priced specialty drugs. The share of biologics among all FDA-approved New Molecular Entities (NMEs) increased from 14 percent in 2004 to 27 percent in 2015, and the share of orphan drugs increased from 29 percent in 2010 to 47 percent in 2015. If venture-funding trends are an indication of what is to come, the shift towards biologics and orphan drugs is likely to continue. The share of investment in biologics increased from 27 percent in 2004 to 50 percent in 2013, reaching $38 billion. Interestingly, the rate of first-time launches is increasing. From 2006 to 2015, 105 companies launched a product for the first time. How

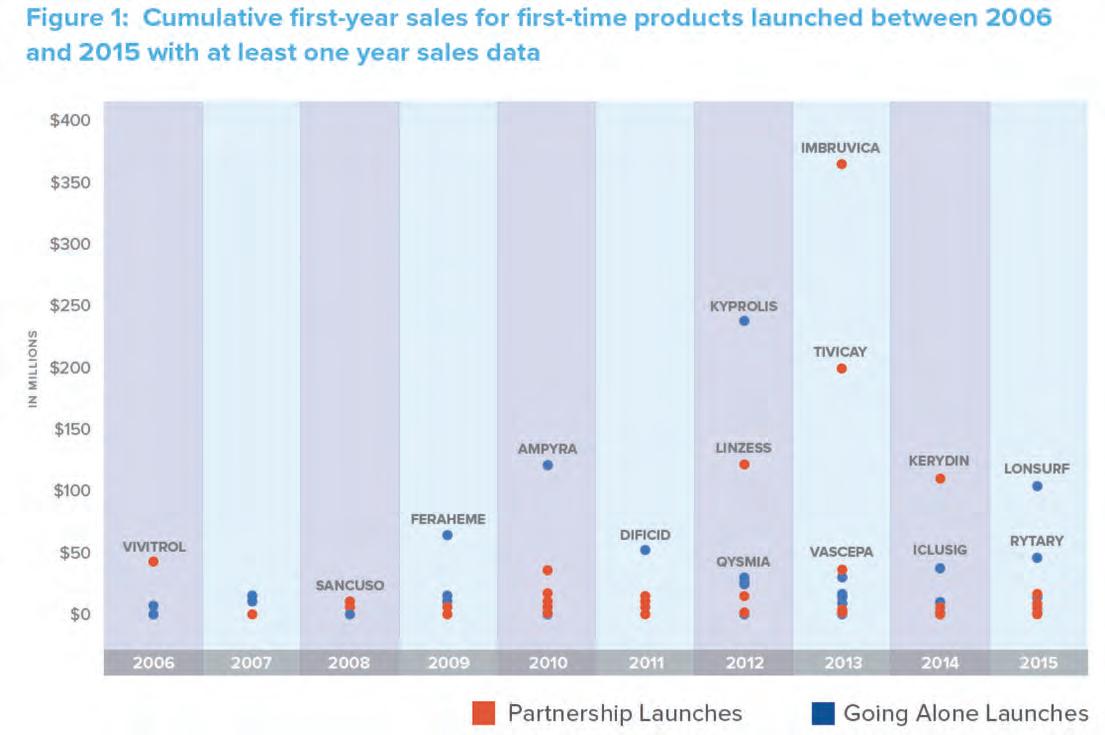

ever, two-thirds of those products were launched between 2011 and 2015. It also appears that the potential of first-time launches to generate high revenue is improving; between 2011 and 2015, seven products (Imbruvica®, Incivek®, Kerydin®, Kyprolis®, Linzess®, Lonsurf®, and Tivicay®) achieved over $100 million in first year sales, whereas only one product (Ampyra®) had done so between 2006 and 2010. 2 (See Figure 1) The Launch Challenge Whether for a small or large company, launching a drug successfully is a colossal undertaking. According to PhRMA, on average it takes about 10 years and up to $2.6 billion to bring a product to market. And the risk of failure is infamously high; the probability that a drug entering clinical studies will actually make it to market is less than 12 percent. 3 The costs and risks of late-phase development and commercialization are tied to several industry trends: • The legal and regulatory hurdles to approval are constantly changing—in particular, regulators tend to be requiring more extensive clinical trials, often with commitments for post-marketing surveillance. • The marketplace is ever more competitive and the expectations of stakeholders such as regulators, payers, providers, patients and patient advocacy groups are ever higher. There is an increasing trend towards patient-focused drug development which requires a better understanding of how a disease impacts the quality of life (QOL) and survival of a patient. Stakeholders are requiring more real-world evidence on how new drugs and technologies impact patients’ QOL and survival rates in the real world settings and not only data from clinical trials. • Regulators need this data to understand safety of a new product when it becomes widely available, typically through post marketing surveillance. • Payers need this data to determine the clinical value of a new product, its cost effectiveness and ultimately its optimal formulary placement.

• Providers use this data to improve the quality and medical care of their patients, reduce overall costs and improve outcomes of treatment and patient care. It provides information on how best to incorporate new therapies and technologies into everyday clinical practice. • Patients and patient advocacy groups are empowered by such information which enable them to make informed decisions and ensure that the voice of the patient is heard and understood across every stage of drug development from R&D to commercialization and postmarketing surveillance. The result is that real-world evidence is now included earlier in the drug research and development phase and collected all the way through commercialization as well as post-marketing. The inclusion of real-world evidence increases the cost, complexity and time line of the drug development process and the risk of failure. Success, then, requires a rigorous R&D process, extensive regulatory expertise, a well-developed infrastructure and deep experience to support commercialization, and immense financial resources. These requisites, of course, are far more difficult—although not impossible—for first-time launchers to attain.

C ommon Funding Models The sources of funding for precommercial companies are different by phase of development.

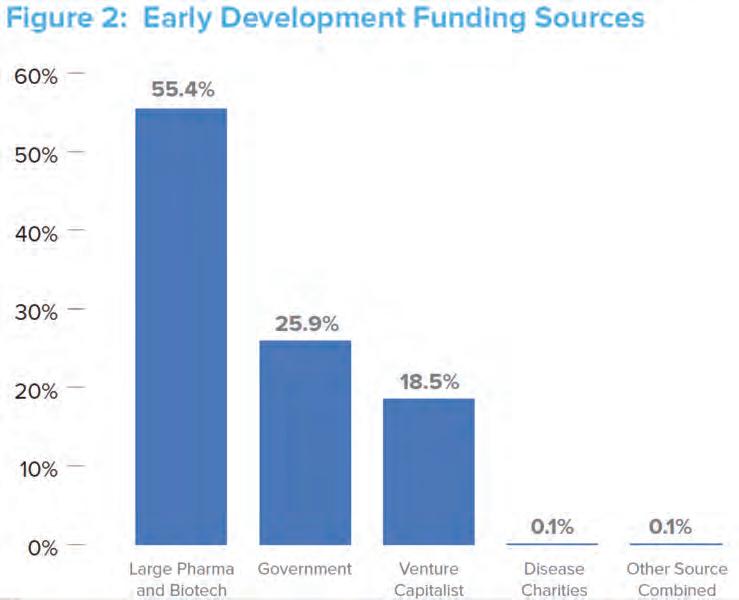

Source: Who’s Going to Pay for Future Drug Development—(Part 1 & 2), Stewart Lyman In the high-risk, early phases of development (through Phase II clinical trials), emerging companies receive funding from a variety of sources. (See Figure 2.) The fact that over half of earlystage funding comes from large pharma represents a new trend; in the past, the risk associated with highly innovative drugs was largely borne by academia, small biotech firms, and venture capitalists. So collaboration is increasing between pharma and academic institutions. Today, it seems that virtually every large pharmaceutical company has some kind of collaborative agreement with academia and small biotech firms as a way of bolstering their dwindling pipelines while keeping their overhead costs low.

A R ange of L aunch S cenarios Going it Alone: about 60% of companies • Develop and commercialize own product • In-license and commercialize the product • Acquire a company and commercialize its product Partnership: about 40% • Agreement with another company for commercialization • Company develops the product in collaboration with another company • Develop the product and then sell it to another company • Company A develops the product acquired/licensed from another

Company B; Company A eventually acquired by Company C

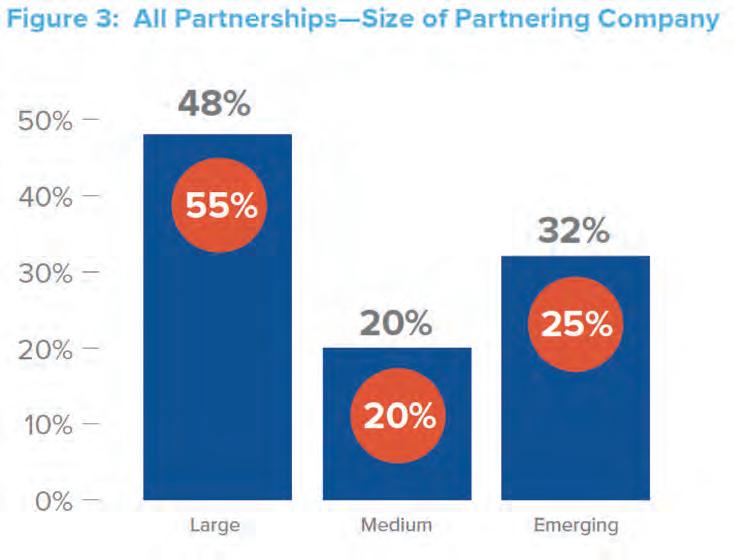

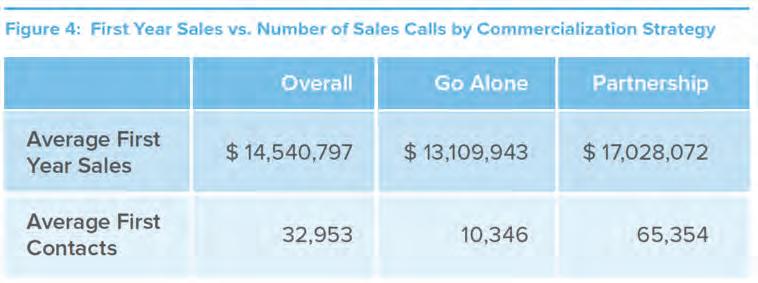

Weighing the Options for L ate - Phase D evelopment To further explain the partnership arrangements above, more than half (55 percent) of co-promotion deals are with large partners. (See Figure 3.) First-time launch companies attempting to bring a product to market on their own face a multitude of challenges, including the need to raise sufficient capital to fund Phase III trials and to either hire in or outsource the talent to manage the clinical trials, prepare regulatory submissions, gain access, and market and sell the approved product. But, if they can do that, the rewards are high. Going it Alone produces twice as many

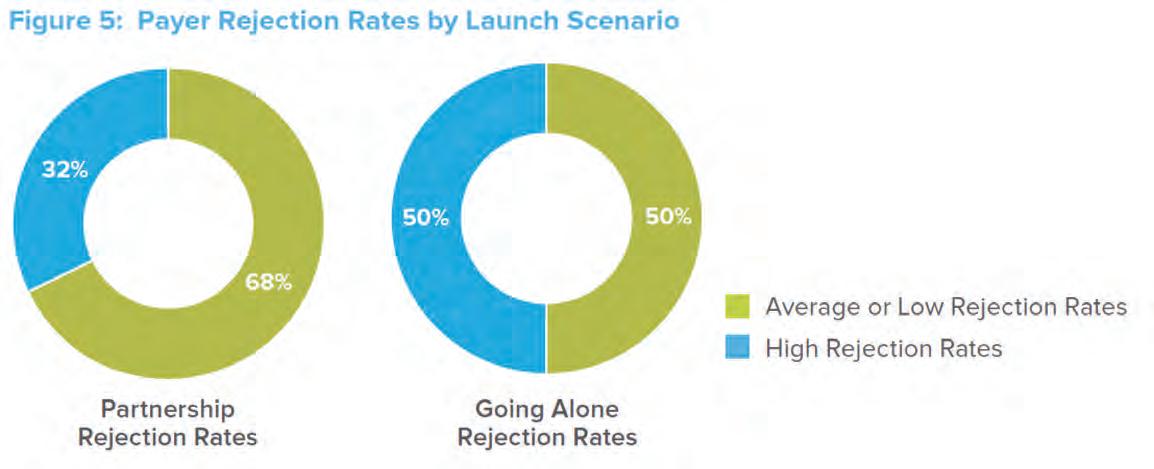

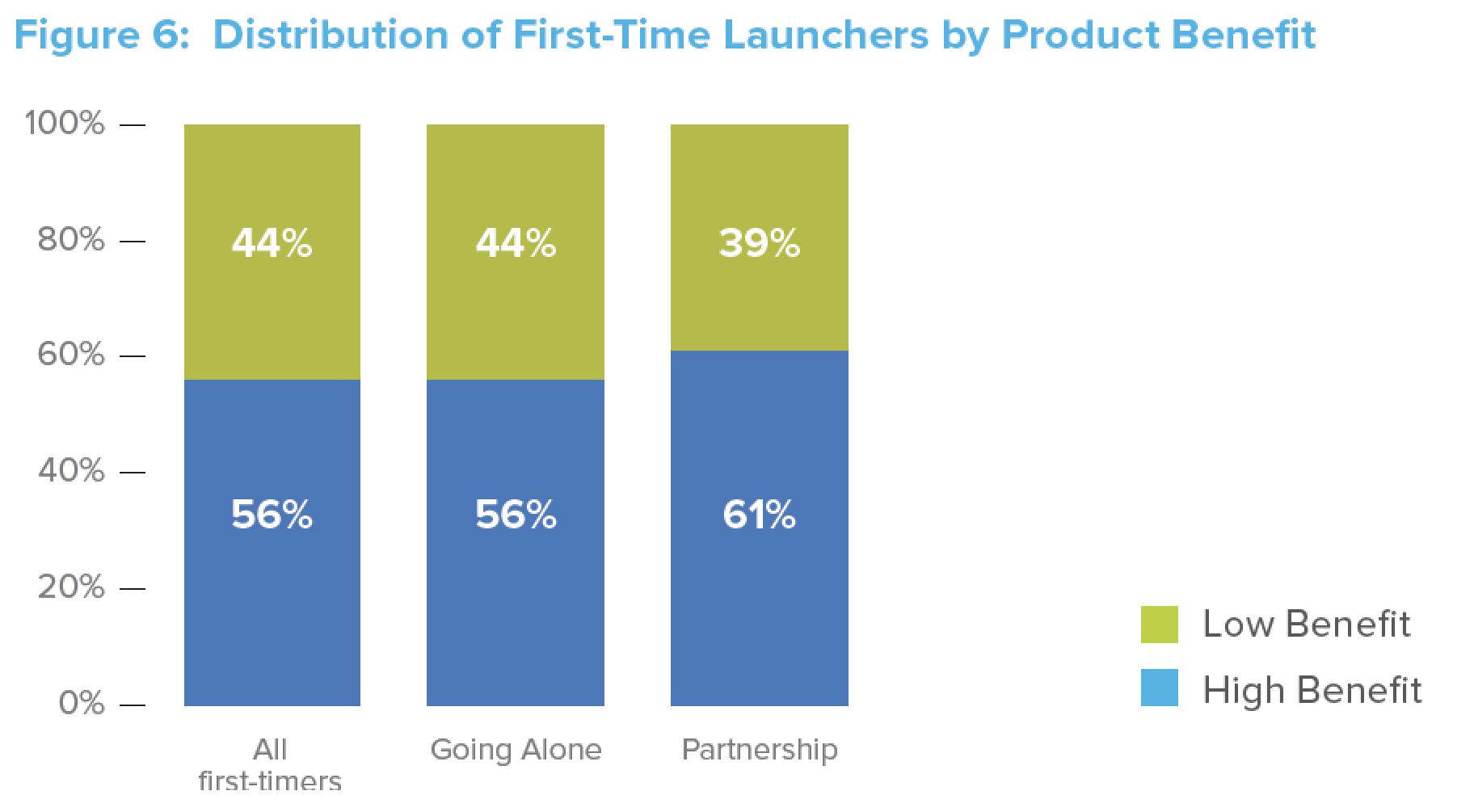

medium-sized companies (those with first-year sales of $101-500 million) than does partnering. Figure 4 illustrates that even though emerging companies have far less “promotional muscle” when they enter the market on their own, their first-year revenues are not dramatically less than if they had entered into a partnership. Going it Alone, however, appears to be riskier when it comes to negotiating with payers. Of those launches that faced high payer rejection rates, a larger percentage (50 versus 32) were introduced by companies Going it Alone than by those in partnerships. 4 (See Figure 5.) This could either reflect the fact that partners have more leverage

and/or experience when negotiating with payers (given the other products in their portfolio) or the fact that partners tend to be involved with products that have high revenue-generating potential that payers tend to receive well. About two-thirds (61%) of the partnership deals involve such high-potential products. (See Figure 6.)

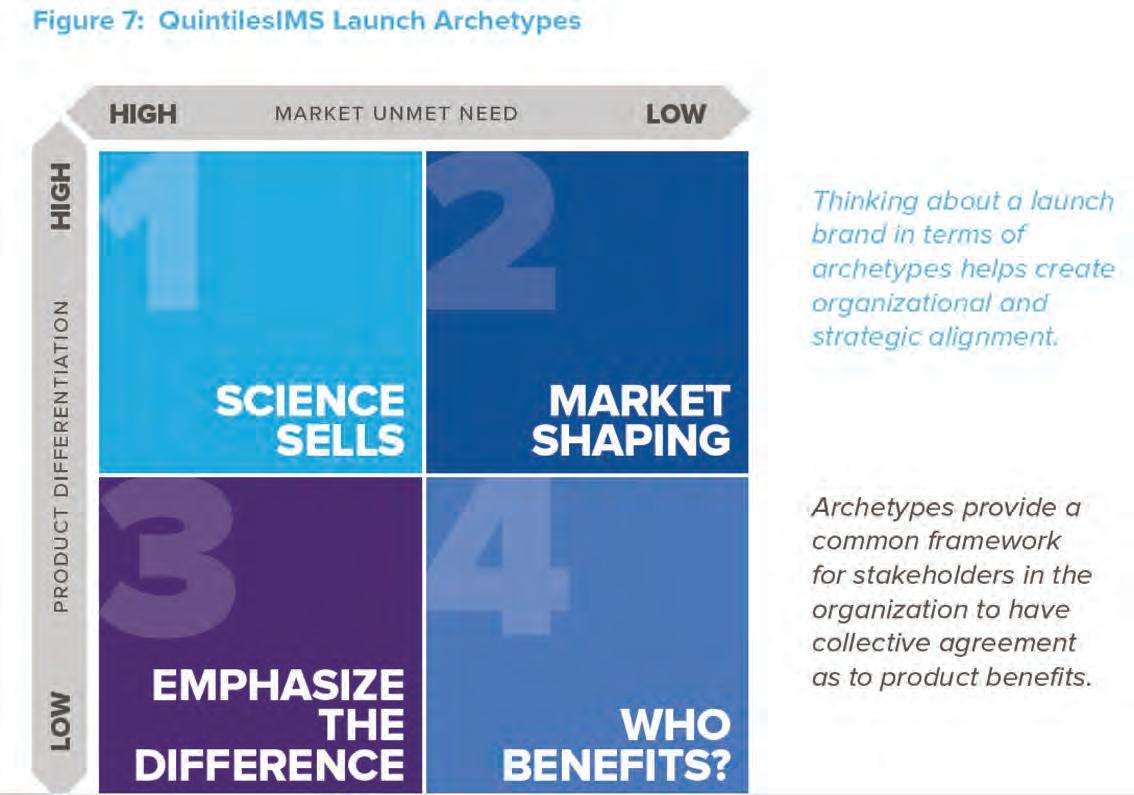

T he Four Launch Archet ypes Any new product launch can be characterized by the degree to which the product is differentiated from the competition and the amount of unmet need in the market. QuintilesIMS describes every launch as falling into one quadrant of a grid, as shown in Figure 7. A different strategy is then applicable to the archetype within each quadrant. Specifically: • Science Sells: Highly differentiated products entering a market with high unmet need can focus on the science; • Market Shaping: Highly differentiated products entering a

market with low unmet need must shape the market;

• Emphasize the Difference:

Poorly differentiated products entering a market with high unmet need must emphasize what makes them different; and • Who Benefits?: Poorly differentiated products entering a market with low unmet need must focus on highlighting who will benefit from the product. First-time launches of the past 10 years are apportioned across the four archetypes as shown in Figure 8.

Research Conclusions Th e analysis reveals some interesting findings on the choices that emerging companies are making— and the results they are seeing. QuintilesIMS concluded that: • The funding models for earlyvs. late-phase research/commercialization are different. Venture capitalists generally exit deals at the end of Phase II, leaving emerging companies with the

need to find new sources of funding. • For commercialization, more emerging companies opt to go it alone than to partner with a large pharmaceutical company. The split is approximately 60/40 between Going it Alone and partnering. • In terms of first-year sales, Going it Alone appears to be more profitable for the originator than partnering. Going it Alone produces twice as many medium-sized companies in the first year than does partnering. This is true despite the emerging company’s smaller promotional capabilities. • One of the main short-term benefits of partnering may be in negotiating with payers. Companies Going it Alone are more likely to face payer high rejection rates than those in partnerships. • The long-term benefits of partnering were not explored in this research, but logic suggests that they might include support with subsequent launches, ongoing leverage with stakeholders, and greater promotional muscle. • Success for first-time launchers hinges on having a high-value product and access to capital. To be successful, new products have to offer patients better outcomes, either in terms of fewer side effects, fewer hospitalizations, improved Quality of Life, increased productivity, or longer survival. There are ample examples of successful launches under both models—Going it Alone and partnering. In general, successful first-time launches are highvalue products that fall into the QuintilesIMS Archetypes: Science Sells, Market Shaping and Emphasize the Difference. • The distribution of launches across the four QuintilesIMS archetypes was similar for Going it Alone companies and those with partners, with high-benefit products accounting for about 60 percent of launches. This

suggests that regardless of their funding structure or commercialization strategy, first-launch companies are generating greater innovation. This could also be driven in part by what earlystage funders such as venture capitalists are willing to invest in. (Venture funding by therapeutic area closely mirrors first-time launch products by therapeutic area over the last decade.)

TWO CASE HISTORIES

A Partnership among Three Parties Launched Incivek® and Achieved First-Year Sales of $1.4 billion.

Vertex Pharmaceuticals developed Incivek®, a novel treatment for Hepatitis C, in collaboration with Mitsubishi Tanabe Pharmaceutical Corporation and Tibotec BVBA (Janssen). Vertex drew upon

Tibotec’s experience in infectious diseases and in conducting largescale, late-stage clinical trials. Incivek launched in 2011, with Vertex retaining marketing rights in the US, and assigning them to Janssen outside of the US and to Mitsubishi Tanabe in Japan. The product was highly differentiated; its new mechanism of action offered significant improvement over the standard of care. In fact, it was designated as a breakthrough therapy. It launched into a market of high unmet need and fell into the “Science Sells” archetype.

Kyprolis® Successfully Braved the Market Alone And Garnered $237M in First Year Sales

Onyx Pharmaceuticals developed Kyprolis and launched it in the US in 2012, after raising $32.1 million in an Initial Public Offering (IPO) in 1996. Other public offerings followed, and the company was later acquired by Amgen for the $9.7 billion in late 2013. Kyprolis is indicated for the treatment of multiple myeloma in patients who have received at least two prior therapies. There is still a high rate of relapse in this rare disease, so there is a high unmet need in the market, and Kyprolis was designated as an orphan drug. However, the product is not very differentiated, as it is a proteasome inhibitor like Velcade®, and it received a standard FDA review, rather than the priority review typical of orphan drugs. Kyprolis fits the “Emphasize the Difference” archetype.

Far -Reaching Implications of the Decision

For Emerging Companies

It is clear that Going it Alone delivers higher first-year returns, but what about into the future? Partnering with a large pharmaceutical company may provide worthwhile long-term benefits with subsequent products (although this analysis did not attempt to address that hypothesis). Emerging companies also need to weigh the other benefits of partnering—capital, expertise, relationships with stakeholders, and leverage in the market—against the downside—loss of control.

This can be difficult for entrepreneurs to accept, especially as it may extend to the very direction into which the compound is taken. Emerging companies that choose to work with partners should enter negotiations with a strong position and a full understanding of the deal’s implications. Companies that elect to go through the late stages of development, regulatory approval, and commercialization without a partner obviously need expertise to raise the necessary capital and then must decide how best to staff the required functions. Today, there are operations and consulting partners that allow emerging companies that choose Going it Alone to invest less to stand up operations. When looking for a commercial outsourcing solutions partner, a proven track record within healthcare information, analytics and technology along with deep therapeutic expertise, including field based teams and back office support should be prerequisites. For emerging global biopharmaceutical companies seeking to optimize their new product’s commercial value, an outsource partner can minimize operational risk, lower the cost of their commercial operation, and increase speed to insight, all while maintaining long term corporate flexibility.

For Large Pharmaceutical Companies

The fact that so many emerging companies are finding that Going it Alone is a viable option has ramifications for the large pharmaceutical companies that rely on the innovation of emerging companies to augment their pipelines. Competition for deals is intensifying, and large companies must be proactive in making partnership with emerging companies earlier in the game. The last decade has seen a trend towards increased collaboration between large pharma and biotech companies and emerging companies in early drug development. These deals, which include acquisitions and joint ventures, eventually provide large companies with greater stakes in the outcome of successful and viable new companies. The arrangement ensures that the emerging companies have the cash flow earlier on to pursue innovative research and that the large pharmacos and biotechs are given first rights to new products to bolster their pipelines.

However, this practice may be affected by the fact that some of the traditional funders of earlyphase research are changing their investment models; they’re moving away from funding emerging companies. Instead, in an attempt to reduce their risk, they are focusing on funding drug development from early discovery through to commercialization for already existing companies. This is beginning to create a funding gap that could impact creativity and innovation… which would ultimately be felt by large companies. We have seen an increasing number of interest groups and disease foundations trying to raise money to bridge the funding gap for research and development particularly in rare diseases and areas of high-unmet need.

For Venture Capitalists

Over the last five years, the number and value of the first-time launches we assessed increased, and this trend is likely to continue into the future. As a result, there will be more opportunities for investors to fund emerging companies as they transition from mainly research and development companies to full-fledged small pharma or biotech companies with R&D as well as commercialization functions. Investor companies need to look at their funding models to determine if they are positioned to make the most of these opportunities as they present themselves. In the past, investors involved in early-phase drug development tended to exit somewhere around Phase II, forcing emerging companies to find alternative sources of funding or to partner with larger companies that could support continued development from Phase III through commercialization. Given the success of the first-time launches and the value they are bringing into the market, investors need to reconsider their exit strategies. They should determine if it is perhaps more meaningful to build on the relationship that they already have with emerging companies and continue their fund-

ing up to commercialization. Indeed, some venture firms such as venBio have started shifting their funding model, and an increasing number of them are also funding Phase III through to commercialization. For investors, given the success of the first-time launches, it seems that engaging early and becoming the funder of choice for emerging companies will be even more rewarding in the future. Should this become commonplace, emerging companies would be able to retain their autonomy and culture of innovation. In sum, the analysis of companies that launched a product for the first time between 2006 and 2015 revealed that companies can rely on several different funding models and employ a variety of strategies. There are successful examples of each approach, but there are many considerations that should go into the decision, including a company’s short- and long-term goals, the degree of control it wants to retain, and its ability to rely on outsourcing partners, to name a few. Large pharmaceutical companies and venture capitalists should recognize the options—and success—that emerging companies are having and revisit their own business strategies accordingly. •

1 There were 22 more launches in 2016, which can be seen here: https://igeahub.com/2017/01/31/all-the-22-drugsapproved-by-fda-in-2016-and-all-the-new-launches/ 2 All trademarks, trade names and product names contained herein are the property of their respective owners. The use or display of other parties’ trademarks, trade names and product names is not intended to imply, and should not be construed to imply, a relationship with, or endorsement or sponsorship of QuintilesIMS Incorporated or its subsidiaries by such other party. 3 “Biopharmaceutical Research & Development: The Process Behind New Medicines,” PhRMA, August 20, 2015. 4 This analysis covers only those companies (whether Going it Alone or in Partnerships) that actually launched products. Companies whose launches failed were not analyzed. Ester Oben Etah Principal, Launch Excellence, QuintilesIMS Ester has over 20 years of experience working in the pharmaceutical and biotechnology space both in the US and Internationally. With her medical and scientific background, she brings a lot of therapeutic area expertise as well as an in-depth understanding of the rapidly changing dynamics of the industry. While at QuintilesIMS, Ester developed experience in market assessment & forecasting and patient level data analysis. In addition, Ester has experience in product portfolio valuation & decision analysis, product licensing & deal valuation, mergers & acquisition analysis and life cycle management.

Bill McClellan Principal, Launch Excellence, QuintilesIMS Bill is an expert in the field of pharmaceutical launch excellence with over 20 years of experience. He leads the Launch Center of Excellence for the US at QuintilesIMS where he focuses on launch readiness, tracking and performance diagnostics utilizing patient data, statistical modeling, qualitative and quantitative research. Bill leads a team of professionals responsible for developing thought leadership to provide innovative approaches for launching a brand. The research focuses on patient acquisition and prescriber adoption and productivity. The group has examined how launch success varies by market need and product differentiation creating launch archetypes. Findings have fueled offerings that focus on launch strategy, commercialization tactics and performance monitoring.