4 minute read

The Orphan Drug Outlook

Orphan drugs are going through an interesting era. Although they are intended to treat rare conditions – orphan diseases that affect less than 200,000 persons in the US – this area has taken on a special importance in recent years.

For one thing, the investigation of orphan drugs often leads to medical breakthroughs that might not otherwise have been achieved, sometimes for populations facing life-threatening conditions. It’s also usually easier to gain both government support and marketing approval for an orphan drug, in order to offset the eventuality that the drug may not be profitable in the short run (even though the market cost of these drugs has been rising steadily). And those medications, once in the marketplace, may lead to further indications down the road. In 2019, nearly half – 21 of 48 – novel drugs approved by the FDA in the U.S. were for rare or orphan diseases. The companies producing them often get longer exclusivity periods, tax credits and lower regulatory fees. This encourages them to take on what would otherwise be risky research studies. It also helps them conduct clinical trials, which are more difficult and costly with smaller populations of potential trial participants (the Clinicaltrials.gov website reports that 32% of uncompleted rare disease trials cited lack of available patients as the reason for their failure). Clinical trial design is more difficult for uncommon diseases, but this can lead to innovation in trial design that will help other companies in the future. Lavinia Meloni, spokeswoman for the European Federation of Pharmaceutical Industries and Associations, says that “The use of real-world data (RWD) can also be particularly useful in rare disease trials, for example by utilizing the information in patient registries for patient stratification and sometimes replacing one study arm with information from RWD and even in some cases replacing the traditional clinical trial when the population is too low to run a randomized trial.”

Advertisement

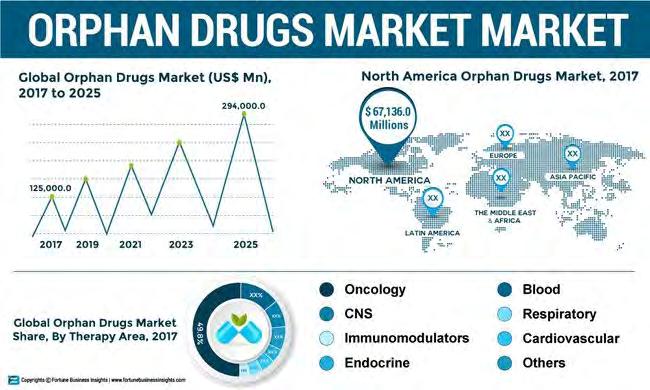

North America is expected to remain dominant in the global orphan drugs market between 2018 and 2025, according to Fortune Business Insights, “Orphan Drugs Market: Global Market Analysis, Insights and Forecast, 2018-2025,” from June 2020. According to the report, the global orphan drugs market was valued at $125B in 2017 and is anticipated to reach $294B by 2025. The report also stated that the market will exhibit a remarkable CAGR of 11.4% during the forecast period. Fortune also anticipates – as many do – a significant expansion of the oncology segment in orphan drugs, based on the rising incidence of the disease, and the growing number of rare cancers identified. It’s expected to represent

Figure 1

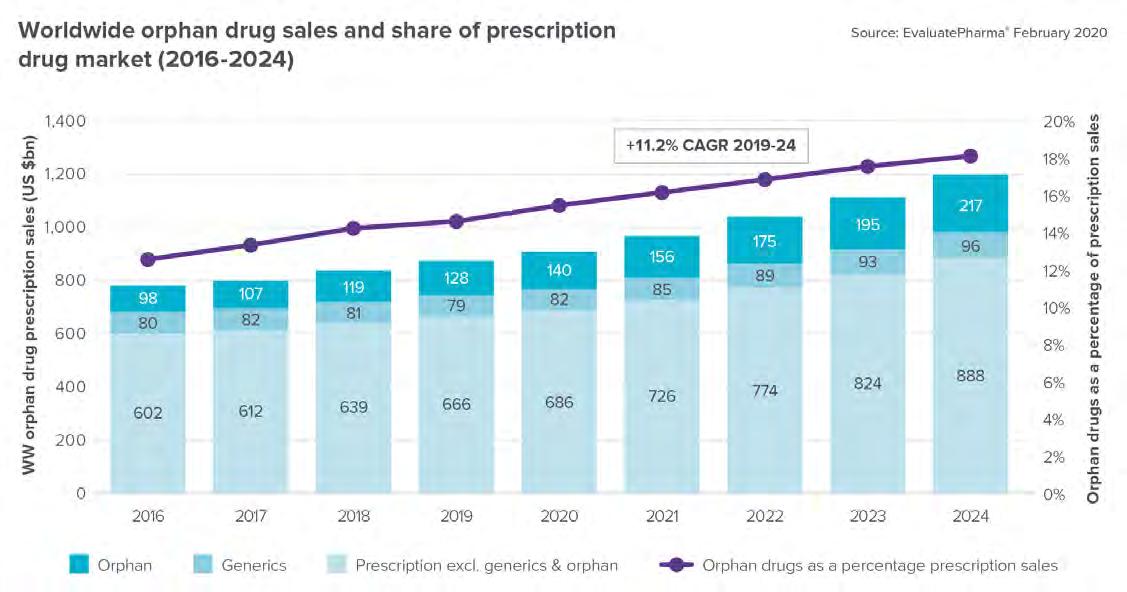

nearly half the share of orphan drugs globally. (Figure 1) Source: Fortune Business Insights, June 2020, Orphan Drugs Market Size, Share and Global Industry Trend Forecast till 2025 The most comprehensive analysis of the market comes from EvaluatePharma’s Orphan Drug Report 2020. It says that “Four decades ago, patients with rare diseases had very few treatment options. The 1983 Orphan Drug Act changed everything by providing substantial tax incentives for pharmaceutical companies to invest in rare conditions. With an estimated 7,000 orphan diseases, 1 out of every 10 Americans lives with a rare condition.” (Figure 2) Source: EvaluatePharma’s Orphan Drug Report 2020

EvaluatePharma’s prediction is a little more cautious than that of Fortune. They believe the market will generate $217B in 2024, which would still be over 18% of overall prescription sales. And the value created by orphan R&D drugs, based on consensus forecasts, is 20 percentage points higher than non-orphan drugs.

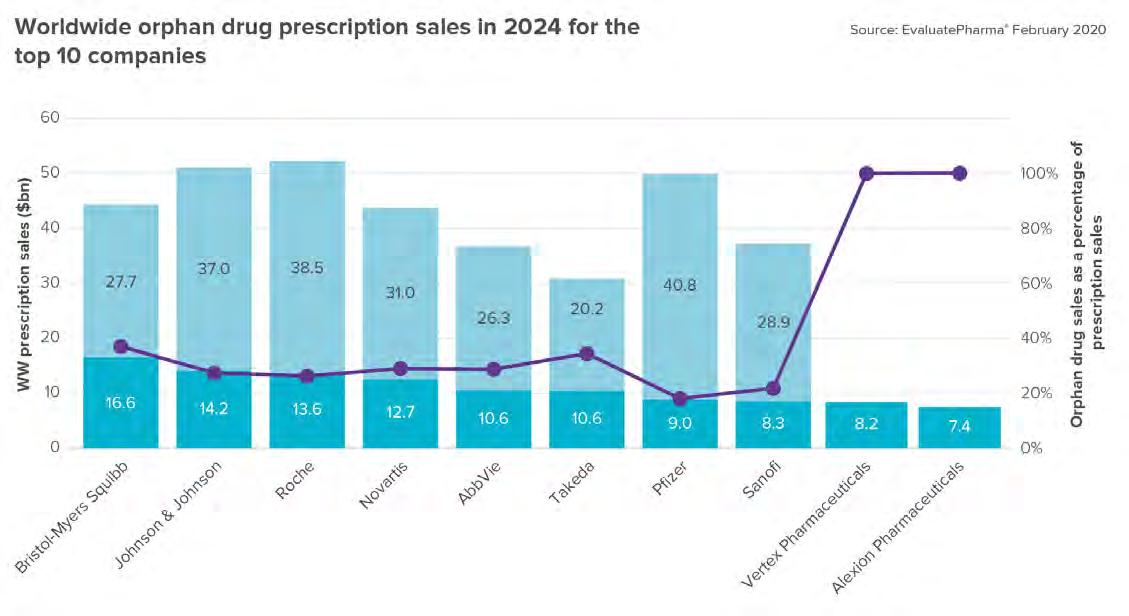

THE ORPHAN DRUG LANDSCAPE IN 2024 There are objections to pharmaceutical companies benefiting from the regulatory and tax benefits meant for orphan drug developers. Big pharma is forecast to make up 8 of the top 10 orphan drug companies in 2024. (Figure 3) Source: EvaluatePharma’s Orphan Drug Report 2020

Figure 2

Figure 3

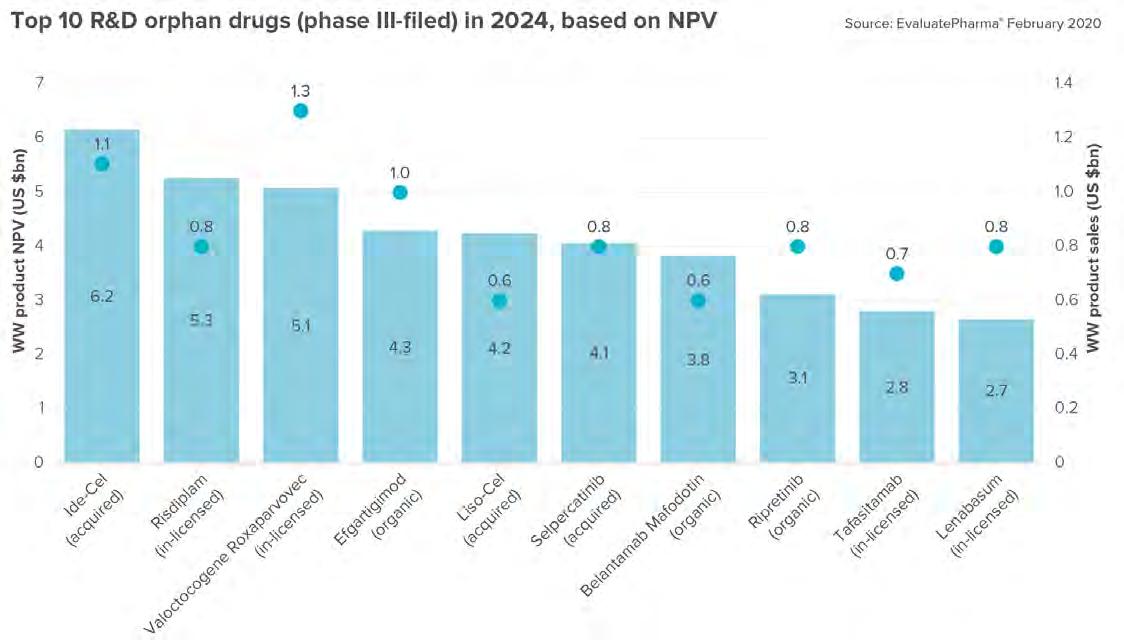

Bristol-Myers Squibb and Takeda have the highest forecast CAGR between 2018 and 2024 — 28% and 20% respectively, largely as a result of acquiring orphan drug companies. $5.5B of Vertex Pharmaceuticals orphan sales forecast in 2024 come from Trikafta alone, the FDA’s fastest novel drug approval of 2019. (Figure 4) Source: EvaluatePharma’s Orphan Drug Report 2020 After oncology, other large orphan drug categories are rare genetic diseases, blood disorders and central nervous system diseases. Biogen’s Spinraza and Alexion’s Soliris were the first to market for their respective indications, spinal muscular atrophy and paroxysmal nocturnal hemoglobinuria. And more recently, strong sales for

Figure 4

Roche’s hemophilia A treatment Hemlibra and Pfizer’s rare cardiomyopathy treatment Vyndaqel have helped solidify these two big pharma companies as leading players.

THE ORPHAN DRUG PIPELINE A greater range of genetic disease orphan drugs is on the horizon. Pipeline products in 2024 include two CAR-T therapies acquired by Bristol-Myers Squibb via its Celgene takeover: Ide-Cel and Liso-Cel. Both these CAR-T therapies are forecast to be in the top 10 selling R&D drugs – those currently in phase III or filed – in 2024. (Figure 5) Source: EvaluatePharma’s Orphan Drug Report 2020

Also in the top 10 is BioMarin Pharmaceutical’s Valrox, which is filed for hemophilia A. Its forecast for sales of $1.3B in 2024. There’s also blockbuster Hemlibra’s $4.3B. (Figure 6) EvaluatePharma says “As awareness of rare diseases continues to grow, more and more patients will be diagnosed, broadening the potential patient population and driving even greater sales projections.” •

Figure 6

COMMENT