7 minute read

Real Estate

HISTORIC FIRST HOME BUYER LAW PASSES PARLIAMENT

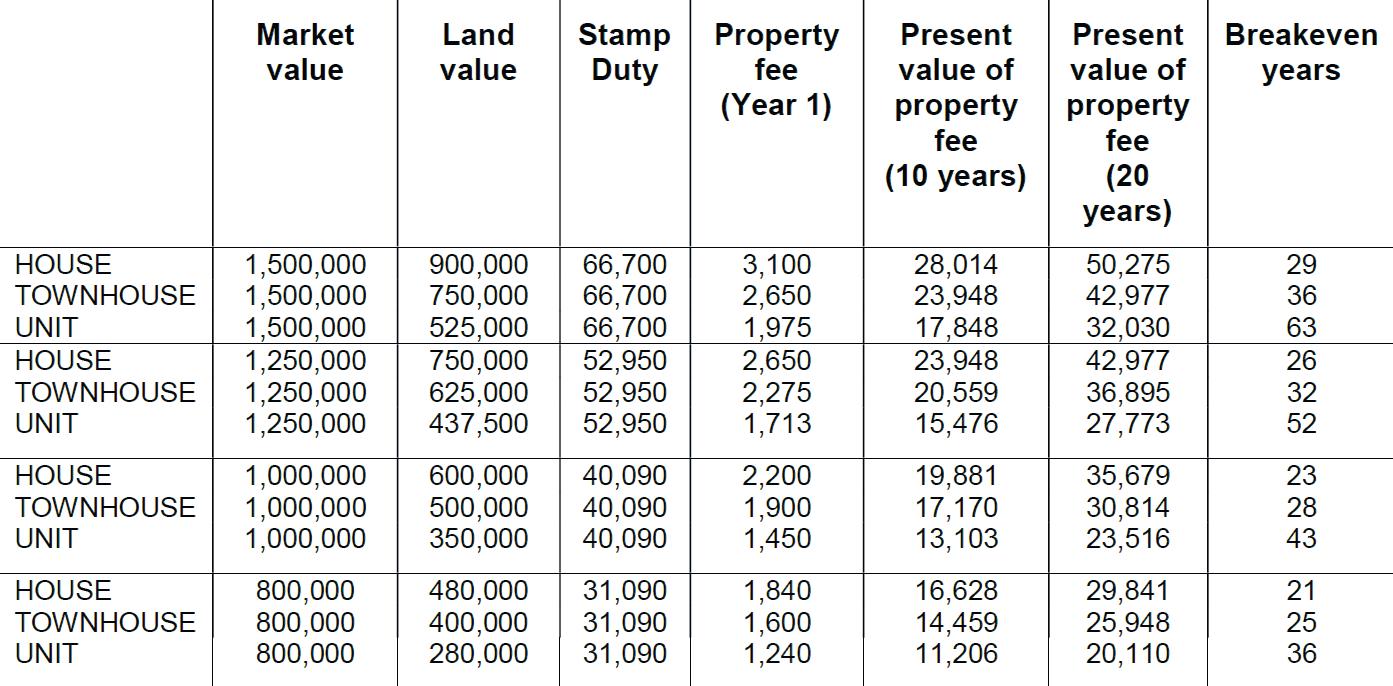

Stamp duty comparisons

Thousands of frst home buyers will now be able to unlock the dream of home ownership sooner following the successful passage of the Perrottet Government’s historic legislation in Parliament today.

For the frst time in Australia, frst home buyers will be given the choice between paying a smaller annual property fee or a large upfront stamp duty on their frst property.

Premier Dominic Perrottet said the First Home Buyer Choice would be a gamechanger for frst home buyers, helping families get the keys to their frst home sooner.

“The great Australian dream of home ownership just got much easier for a generation of young families,” Mr Perrottet said.

“For the frst time we will provide frst home buyers with a choice, helping thousands of people to shave around two years off the time needed to save for a deposit.

Treasurer Matt Kean said the new law would help more young people enjoy the fnancial security that comes with home ownership.

“First Home Buyer Choice will signifcantly reduce upfront costs, reduce the time needed to save for a deposit and will see the majority of eligible frst home buyers paying less tax overall,” Mr Kean said.

Eligible frst home buyers can access the scheme from Saturday 12 November.

These buyers will be required to pay stamp duty on purchases made until 15 January 2023, but then will be able to apply for a refund of their stamp duty if they choose to opt into the annual fee.

From 16 January 2023 purchasers can opt in to the annual fee directly and will not be required to pay stamp duty.

AUCTIONEERS I REAL ESTATE LIVESTOCK I PROPERTY MANAGEMENT TENTERFIELD...purchase the lifestyle! History I National Parks I Cool Climate Country Living 277 Rouse Street, Tenterfi eld P: 02 6736 3377 • STEVE 0428 100 328 E: general@alfordduff.com.au W: alfordduff.com.au

for dwellings costing up to $1.5 million. For the purchase of vacant land intended for the construction of a frst home, the price cap will be up to $800,000.

The program is uncapped and will be available for every eligible frst home buyer who wants to access it.

NSW Treasury data shows the breakeven period between upfront stamp duty and an annual property fee would be 36 years for an $800,000 apartment, 28 years for a $1 million townhouse, and 26 years for a $1.25 million house.

The same data shows that if a frst home buyer purchased a $1 million house and sold it 10 years later, which is around the median holding period, the annual property payments over the 10 years would total $19,881 in present value terms compared with $40,090 in upfront stamp duty - a saving of $20,209.

The NSW Government has allocated $728.6 million to First Home Buyer Choice over the next four years.

Housing Package announced at the 202223 NSW Budget that aligns with the Housing 2041 vision.

For more information on the First Home Buyer Choice, go to https://www.nsw.gov. au/initiative/frst-homebuyer-choice

HAVE YOUR SAY ON REVIEW OF NSW RETAIL LEASES ACT

The NSW Government has announced a review of the NSW Retail Leases Act 1994 (the Act), which impacts landlords, investors and retail tenants.

Minister for Small Business Victor Dominello said it was timely to review the Act to consider the impact of any changes in the retail landscape and broader leasing practices and requirements.

“The review will consider whether the Act continues to meet its policy objectives and whether any amendments should be made to improve certainty and the regulatory environment for retail landlords and tenants,” Mr Dominello said.

Mr Dominello said the effective operation of the Act was a key requirement for many businesses and investors and the review would help ensure the legislation remained effective and constructive.

“I look forward to the review identifying practical measures that will support business and the broader retail property industry,” Mr Dominello said.

An industry reference group will be established representing landlords, tenants and other key stakeholders to support the review and provide industry expertise. An inclusive public consultation process will also ensure other stakeholders are afforded the opportunity to have their say.

NSW Small Business Commissioner Chris Lamont, who will be conducting the review, said he expected it would provide a renewed focus on improving business relationships between retail leasing tenants and landlords.

“The Retail Leases Act should be clear, refect industry expectations and promote confdence across the business sector,” Mr Lamont said.

Stakeholders are encouraged to participate in the review and can review the Discussion Paper, Terms of Reference and complete the online survey by visiting https://www. haveyoursay.nsw.gov. au/retail-leases. The review is expected to be completed within nine months.

OPEN HOMES

ALSTONVILLE

ALSTONVILLE

1/13 Arrowsmith Avenue Saturday 10:00-10:30 am Troy MacRae 0414 867 035 or Tina Kelly 0421 183 222 Elders Real Estate Alstonville

ALSTONVILLE

ALSTONVILLE

36 Cooke Avenue Saturday 11:00-11:30 am Tina Kelly 0421 183 222 Elders Real Estate Alstonville

LENNOX HEAD

LYNWOOD

52 Dees Lane Saturday 11:00-11:30 am Troy MacRae 0414 867 035 Elders Real Estate Alstonville

FIRST HOME BUYERS RECEIVE POWER TO CHOOSE FROM THIS WEEKEND

First home buyers across NSW will have a spring in their step at auctions and open homes this weekend with the First Home Buyer Choice coming into effect.

For the frst time in Australia, eligible frst home buyers will be given the choice between paying a smaller annual property payment or upfront stamp duty on properties up to $1.5 million.

Though the First Home Buyer Choice will not begin until 16 January 2023, frst home buyers from this weekend will be eligible to retrospectively opt into the annual payment. They can apply from 16 January to opt in and have any stamp duty paid refunded.

Premier Dominic Perrottet said this choice will empower frst home buyers as they head out to auctions and inspections over the weekend.

“Starting today, frst home buyers will get a huge boost with a system that helps rather than hinders their journey to owning their frst home,” Mr Perrottet said.

Treasurer Matt Kean said more than 6,000 frst home buyers are estimated to choose the annual property fee each year.

“This is about giving home hunters the chance to decide what works best for them. It will give people greater fexibility as they approach one of the biggest investment decisions most will make in their lifetime,” Mr Kean said.

The First Home Buyer Choice is a key component of the Government’s $2.8 billion Housing Package announced in the 202223 NSW Budget.

Eligible frst home buyers can register their interest at: https://www. service.nsw.gov.au/ get-notifed-about-frsthome-buyer-choice