2 minute read

RBA Governor Acknowledges Economic Strain as More Australians Seek Help Amid Slowdown

Reserve Bank of Australia (RBA)

Governor Michele Bullock has recognized the growing number of Australians seeking assistance from community organizations as the country’s economy slows and unemployment rises. In a speech to the Anika Foundation in Sydney, Ms. Bullock highlighted the increasing financial strain on lower-income borrowers and those with variable-rate mortgages, acknowledging that many are facing significant hardships as inflation and interest rates continue to bite.

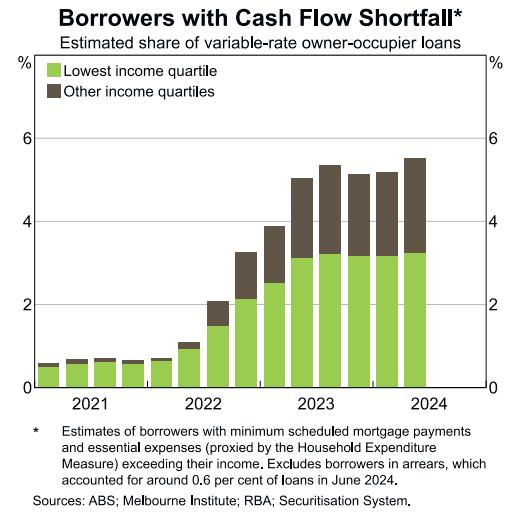

Ms. Bullock emphasized that the RBA is working to bring inflation down and stabilize the economy, though she acknowledged the difficult situation many households are experiencing. “Lowerincome borrowers are over-represented among those really struggling right now,” she said. Additionally, owner-occupiers with variable-rate loans are seeing a rise in cash flow shortfalls, where essential spending and mortgage repayments outstrip their income.

Economic Slowdown and Inflation Fight Australia’s economy grew by just 0.2% in the June quarter and 1% over the past year, the slowest pace since the 1990s recession, as households cut back on spending. The economic downturn follows the RBA’s 13 interest rate hikes since mid-2022, aimed at curbing high inflation. Underlying inflation remains at 3.8%, above the RBA’s target of 2.5%.

Ms. Bullock acknowledged that while the RBA’s policies are painful for many, they are necessary to return inflation to manageable levels. The central bank dipping into savings, or working extra hours. In some cases, homeowners are being forced to sell and rising demand, are likely to persist for some time, offering little relief to renters in the near expects inflation to reach its target by the end of 2026, assuming the slowdown progresses as anticipated.

Increasing Financial Hardships

According to Ms. Bullock, around 5% of their properties.

She further stressed that lower-income borrowers are disproportionately affected, and the ongoing pressure from high interest rates and inflation is taking a heavy toll on vulnerable owner-occupiers with variable-rate loans are in a particularly challenging situation, where their essential spending and mortgage repayments exceed their income. Many of these households are making significant adjustments, including cutting back on non-essential spending, groups.

Rising Costs for Renters

Housing costs and market services inflation remain key drivers of high inflation, with renter households particularly hard-hit.

Ms. Bullock noted that rent increases, driven by limited housing supply future. New dwelling inflation, though slightly lower than its peak, remains elevated due to labour shortages and high construction costs.

The Importance of Controlling Inflation

Ms. Bullock underscored the longterm dangers of high inflation, warning that the longer it persists, the more damage it could cause to the economy. She pointed out that many Australians, particularly those under 40, have not experienced high inflation before the recent surge, which has eroded savings, reduced purchasing power, and disproportionately hurt low-income households.

“We are very conscious of the hardship being caused by our policies,” she said. “But high inflation hurts everyone, especially the most vulnerable. It’s essential we return inflation to manageable levels, so it no longer distorts the economy and puts such strain on households.”

September

12, 2024