2 minute read

Business Confdence Surges as Infation Declines, Hitting a Two-Year High

ROBERT HEYWARD

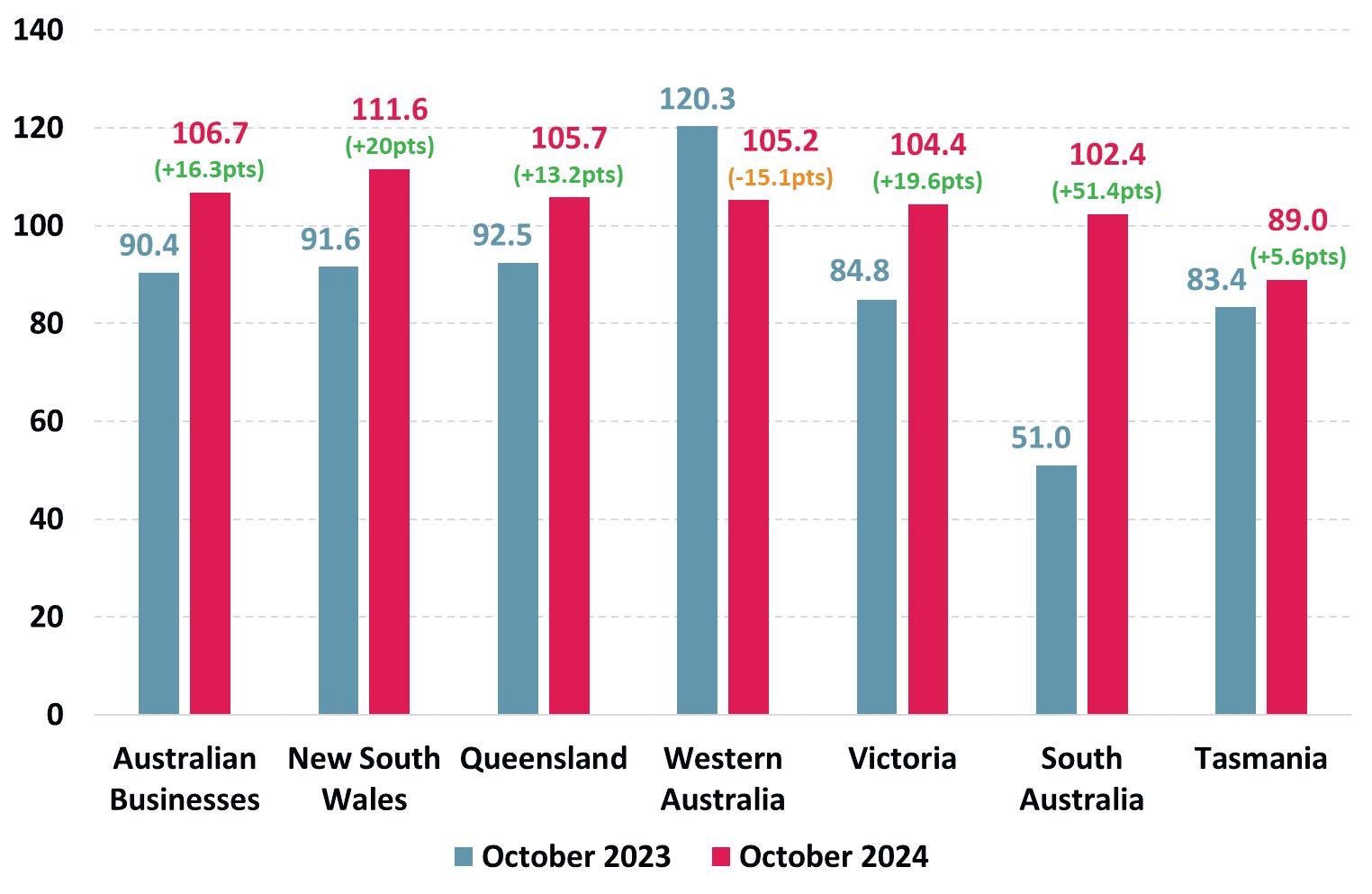

Roy Morgan Business Confdence rose sharply in October 2024, increasing by 12.4 points to 106.7. This marked the most positive sentiment in over two years, driven by falling infation and growing optimism about the Australian economy and business investment.

Key Drivers of the Increase in Confdence

The October rise in Business Confdence coincided with signifcant declines in infation:

• Monthly infation: Dropped to 2.1% in September, as announced in late October, down from 2.7% in August and 3.5% in July.

• Quarterly infation: Reached 2.8% for the September quarter, its lowest level since March 2021 and within the RBA’s target range of 2–3%.

This decline in infation has improved economic sentiment and heightened expectations of future interest rate cuts, aligning Australia with trends seen in central banks overseas.

Improved Sentiment Across Key Indicators

• Financial outlook: o 46.3% of businesses (up 5.2 percentage points) expect to be better off fnancially in a year. o Only 20.6% (down 4.4 points) anticipate being worse off.

• Economic outlook: o 59% of businesses (up 6.8 points) expect “good times” economically over the next year, the highest level since February 2022. o Confdence about the economy over the next fve years also rose, with 35.6% expecting “good times” (up 4.4 points).

• Investment sentiment: o 42.9% (up 6.9 points) believe the next 12 months is a “good time to invest” in growing their business. o Only 35.2% (down 10.4 points) consider it a “bad time to invest,” the lowest level since June 2021.

State-by-State Analysis

Business Confdence improved across most states, with New South Wales leading at 111.6, followed by Queensland (105.7), Western Australia (105.2),

Victoria (104.4), and South Australia (102.4). Tasmania (89.0) was the only state with confdence below the neutral level of 100, refecting political instability within its Liberal-led government. Industry Performance The most confdent industries in September and October included:

1. Public Administration & Defence: 160.1 (+48.9 points year-on-year).

2. Education & Training: 127.3 (+6.7 points).

3. Finance & Insurance: 121.6 (+20.7 points).

4. Recreation & Personal: 112.0 (+16.9 points).

5. Professional, Scientifc & Technical Services: 111.0 (+11.9 points).

At the lower end, industries like Transport, Postal & Warehousing (72.6), Mining (78.3), and Agriculture (85.7) reported subdued confdence, with the Transport sector consistently lagging throughout the year.

Source- Roy Morgan Business Single Source, Dec 2010-Oct 2024. Average monthly sample over the last 12 months = 1,591.

Commentary from Roy Morgan CEO Michele Levine

“Roy Morgan Business Confdence surged in October, reaching its highest level since April 2022,” Ms. Levine said. “This increase was driven by improved optimism about the economy and growing sentiment that the next 12 months is a good time to invest in business growth. The rapid decline in infation, combined with expectations of potential interest rate cuts, has fostered greater positivity among businesses.”

Ms. Levine also noted strong performances across major states and industries but highlighted the need for targeted support in lagging sectors such as Transport, Postal & Warehousing, and Tasmania’s struggling economy.

Conclusion Roy Morgan Business Confdence is now just 4.5 points below its long-term average of 111.2, signalling a steady recovery in sentiment as infation declines and businesses prepare for a potentially favourable economic environment. For more detailed insights, the Roy Morgan Business Confdence Report is available via subscription.