Q2 2024 IN THIS ISSUE Meet Our Bellevue Team Protecting Your Intellectual Property Nonprofit Fraud Risks Where Will Your Retirement Money Come From? a publication of Banking news and stories to help you maximize the financial success of your business GROWING A LOCAL BUSINESS CAPITAL COLLISION CENTERS + HERITAGE BANK

Shaun

Whitney Gibson

Creative

Erica Bolvin

Managing

Stephanie Neurer

Abigail Kunkel

Contributors

Bill Jordan

Jess Daly

Dennis D’Ambrosio

Sandra Ramsey

John Stearns

David Stegmeier

Rob Stewart

Customer Profile: Capital Collision Centers 2 Cross-Selling and Upselling to Increase Sales ......................................... 5 Avoid Check Fraud with Heritage Direct ....................................................7 Meet our Bellevue Commercial Team ............................................................ 10 Recent Changes to SBA Loan Programs .................................................. 13 Achieve Growth by Buying Another Business 14 Industry Profile: Software and IT 20 Four Signs Your Business is Set to Expand 23 Benefits of B Corp Certification 26 How a Commercial Card Program Can Modernize Business 28 IN EVERY ISSUE Heritage Helps 6 In this section, we highlight the good we're doing in our communities. Business Banking Mentor 8 Protect your intellectual property for the success of your business Nonprofit Corner 16 Financial and reputational fraud risks for nonprofits Wealth Strategies......................................................................................................................... 19 PNWonderland 22 Explore the unique sights and experiences of our Pacific Northwest. My Heritage 24 Fraud and Cybersecurity 29 Financial Dictionary 29 Empowering you to make smart business decisions by demystifying banking terminology. Equal Housing Lender | Member FDIC

Business is a publication of Heritage Bank Director of Marketing

Carson Editor-In-Chief

Banking

Director

Editors

3615 Pacific Avenue Tacoma, WA 98418 800.455.6126 heritagebanknw.com © 2024 Heritage Bank, Member FDIC, Equal Housing Lender. The information in this magazine is general education or marketing in nature and is not intended to be accounting, legal, tax, investment or financial advice. Although Heritage Bank believes this information to be accurate as of the date published, it cannot ensure that it will remain accurate. Statements of individuals are their own—and do not necessarily reflect the position or ideas of Heritage Bank. Contact us at 800.455.6126 or visit heritagebanknw.com to make an appointment with one of our local experienced relationship managers to discuss your individual business banking needs. Contents

of our job—and when we’re out in the community—is to try to be a source of value, meaning we get to be the connectors; we’re the conduit between people.” - Mike Arellano, Heritage Bank Bellevue Commercial Team Leader 8 19 16 Shutterstock Shutterstock Shutterstock

“Part

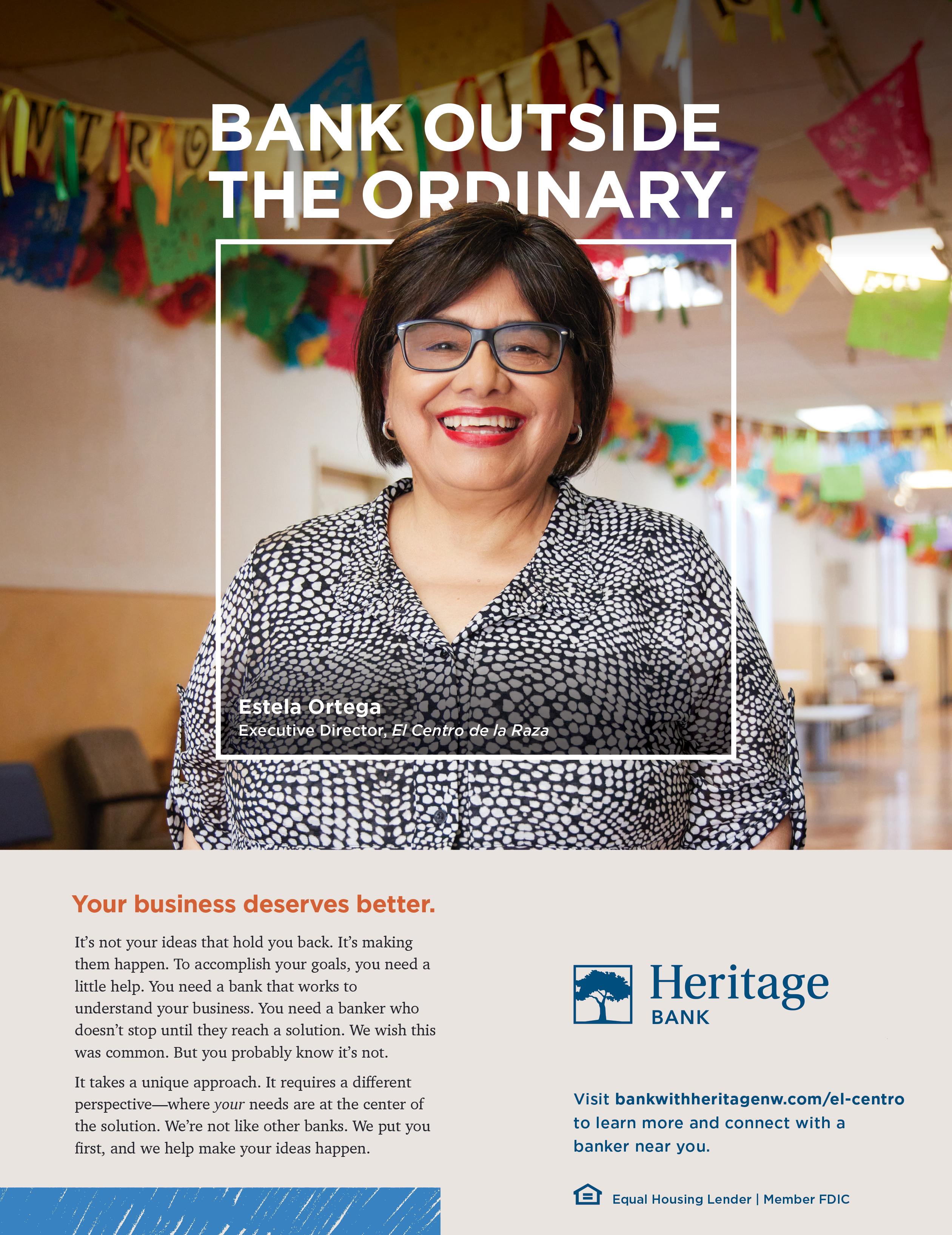

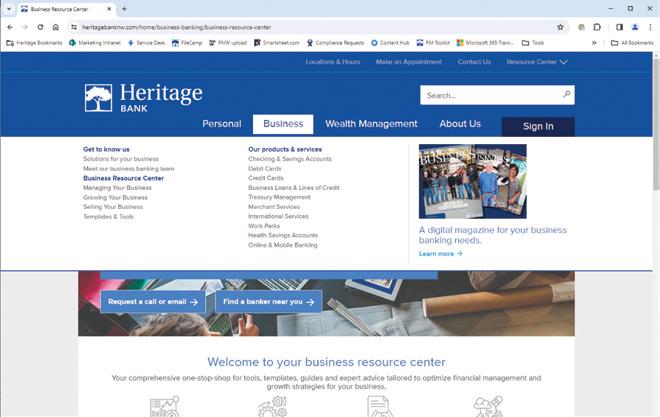

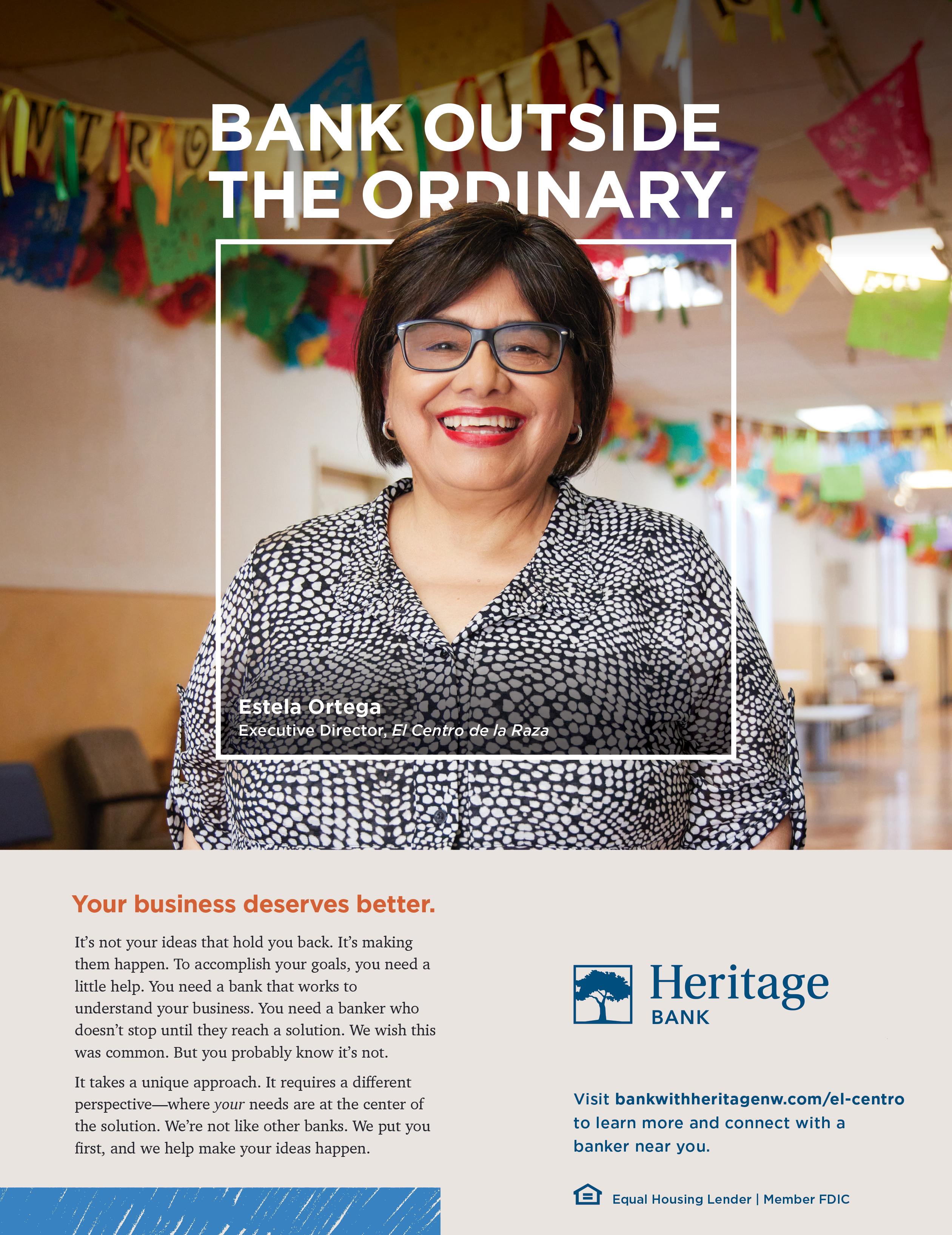

In this issue, you’ll find a range of valuable articles that are centered around empowering your business to grow, from a new online business resource center (page 28) to understanding where your retirement money will come from (page 19). Plus, we cover ways a commercial card program can help modernize your business (page 28) and how to protect your business from check fraud (page 7).

On page 8, we delve into the crucial topic of protecting intellectual property, a cornerstone of business success in today’s knowledgebased economy. Our expert insights shed light on best practices for safeguarding valuable intellectual assets and maximizing their commercial potential.

Additionally, we are proud to be one of the five founding banks of the Bankers Care initiative, which underscores our commitment to supporting the communities we serve. Through this initiative, we are committed to more than just financial transactions—we are dedicated to investment in the welfare of the communities we serve and the principles of corporate social responsibility. We strive for this through charitable giving, community programs, volunteering, financial education, loan programs, crisis response and environmental sustainability. Finally, we explore the signs that indicate a business is poised for expansion (page 23). By identifying these indicators early on, entrepreneurs can capitalize on opportunities and navigate the expansion process with confidence.

As always, thank you for reading Banking Business and for choosing us as your banking partner.

Sincerely,

Jeff Deuel President and CEO

Jeff Deuel President and CEO

Jeff Deuel is chief executive officer at Heritage Bank. He has more than 40 years of banking experience. Prior to joining Heritage, he worked at JPMorgan Chase, WaMu, Bank United, First Union, CoreStates and First Pennsylvania Bank. Jeff is a past chair of the Washington Bankers Association. He currently serves on the board of the Oregon Bankers Association and Pacific Coast Banking School. He is an avid cyclist and has climbed to the top of Mt. Rainier.

A MESSAGE FROM OUR CEO

Heritage Bank

1 Equal Housing Lender | Member FDIC heritagebanknw.com

BEST BANK

“They take good care of us”

ARTICLE BY JOHN STEARNS

Capital

Center manager on Heritage Bank

Collision

Mabus Agency / Heritage Bank 2 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

When Capital Collision Center was busting at the seams with more collision repair business than its facilities could support about 10 years ago, Heritage Bank was there to finance expansion, said Rick Conley, manager of the facility in Olympia, Washington.

The bank also has supported three other collision centers in a four-shop family that includes shops spanning the greater South Puget Sound region from Chehalis, 30 minutes south of Olympia, to Lacey, which neighbors Olympia to the east, to Shelton about 30 minutes northwest of Washington’s capital city.

They operate under the names: Capital Collision Center, Lacey Collision Center, Chehalis Collision Center and Extreme Collision Center in Shelton. The centers’ relationship with Heritage dates back to 2015.

“They take good care of us,” Conley said of Heritage. “It seems like any time we need something, they’re there for us and the partnership that they’ve extended out to us has been great.”

The group’s first shop in Lacey opened its doors in 1976 under William Doyle and Creighton Mueller. The two expanded with Capital Collision Center in 1993, Chehalis Collision Center in 2012 and Extreme Collision Center in 2020, the latter an acquisition. Mueller passed away in 2021. Mueller’s wife, Linda co-owns the four shops with Doyle. Jeff Durkin, who manages the Lacey shop, and Conley, who’s managed the Olympia collision center for 16 years, were given ownership stakes in the Chehalis and Shelton shops. Conley and Durkin would like to own all four someday.

As the shops’ names imply, the centers do vehicle body and mechanical repairs after accidents plus painting and refinishing. The four shops combined completed nearly 7,500 repairs last year.

The Olympia and Lacey shops also do recalibrations of advanced driver-assistance systems that include technologies that assist drivers with the safe operation of a vehicle, such as calibrating blind-spot monitors, forward-facing cameras, front radar, surround-view cameras, lane-keeping assist, millimeter wave radar, rearview cameras, seat weight sensors and more. The Shelton and Chehalis shops can scan those systems’ functionality, but recalibration work is done at the Lacey or Olympia shops.

As vehicle technology gets increasingly sophisticated, the shops have worked hard to ensure they’re trained for all such repairs, Conley said.

Opposite page: Heritage banker Scott Michie with Capital Collision Center’s Rick Conley. This page: Rick Conley (l) and Jeff Durkin (r).

Automakers have invested billions of dollars in research for today’s vehicles, “and we want to make sure that we’re ahead of the curve,” he said. “Investing in the tooling … over the years has been a benefit to us and a benefit to our customers.”

As more vehicles transition to electric vehicles (EVs), the shops are adapting there as well, Conley said. The Lacey and Olympia sites have separate areas specifically for EV repairs and have invested in more training to keep current with EV technology and repair. The two shops are also in the process of becoming Tesla-certified for repair work.

In addition to repairing environmentally friendly vehicles, the shops employ their own sustainability initiatives, including using all waterborne base coats from paint manufacturer PPG, Conley said. That greatly reduces use of solvents that need disposal and recycling into reusable wash thinners, he said.

All four locations also have state-of-the-art spray booths for painting and filtering air and emissions, which greatly minimizes airborne particulates, he said.

Chehalis has a 65-foot spray booth that can accommodate tractor-trailers, boats, even airplanes, which are typically painted in sections, Conley said.

3 Equal Housing Lender | Member FDIC heritagebanknw.com

Capital Collision Centers

All the shops also recycle large amounts of metal from parts that must be replaced.

Training the next generation

The Capital and Lacey locations also partner with New Market Skills Center through the Tumwater School District to help train high school students for jobs in the industry, Conley said. His own path into auto repair began at New Market Skills Center when he was a student at Olympia High School. He’s been in the industry 31 years now.

The shops help advise the Skills Center on the best curriculum for the industry’s direction and for students and host student apprentices onsite.

“We put them with a skillful tech that has the ability and patience to teach them what we do, and how to do it correctly,” Conley said.

Students need to learn about the advanced technology in vehicles today, he said.

“It’s not the day of just fixing dents and painting—we still do that—but there’s so much more involved in our industry than just that,” he said.

“It’s an industry that also can provide a good living because there’s such high demand for skilled labor,” he continued, noting his rise through the ranks from washing cars and sweeping floors to paint preparation, painting, learning body work, then estimating, management and now co-ownership.

“Helping the Skills Center isn’t just about helping fill the labor pipeline for their own shops, but it also shows youth other career pathways,” Conley said.

“You don’t have to go to college to be successful,” he said.

“It’s great for some people; it’s not made for everybody.”

The shops also support the New Market Skills Center Foundation, a community-based organization that solicits, receives, manages and disburses funds to support New Market Skills Center students, programs and Skills Center projects.

The shops’ community involvement goes beyond training future tradespeople. They also support community events that include Olympus Rally, Lacey in Tune, Lacey’s Independence Day celebration, Tumwater’s Fourth of July fireworks show and parade, Tumwater Artesian Brewfest, Boys & Girls Clubs, Lacey Cultural Celebration and local schools’ sports programs, among others.

The locally owned collision centers want to support the community that supports them, Conley said.

“If your insurance company gives you three options (for repair facilities) … I want them to remember Capital as the

“You don’t feel like a number; you feel like they’re a true partner.”

first thing that pops in their head, ‘Oh, they’re local, I’ll go there,’” he said.

Heritage’s personal touch

Conley said the shops’ banker at Heritage, Scott Michie, has been great to work with and is always responsive.

If Conley has questions, he said he’s able to reach out to Michie, a senior vice president, commercial banking officer in the bank’s Olympia office, and if Michie doesn’t have the answer, he finds it, Conley said.

“He’s been a great partner as well,” Conley said.

The same applies to Daryl Fourtner, Heritage’s commercial banking regional manager in Olympia, Conley said.

“They give you the ins and outs of everything,” he said.

The bank also arranged Paycheck Protection Program loans in 2020 for the Capital, Chehalis and Lacey shops to help deal with some of the pandemic effects on business, providing financial peace of mind until the worst of the pandemic passed and business returned to normal.

Asked what insight he could offer on working with Heritage, Conley said “I think the biggest benefit is it’s more of a personal level,” Conley said. “You don’t feel like a number; you feel like they’re a true partner. They’re there for you and they’re fighting for you, I guess is the biggest thing for me.

And when somebody puts forth that much effort and gives you that much definitiveness, I think that means more to me than just being able to get a loan from anybody or to have banking through somebody else.”

He added, “The size of your bank account doesn’t seem like, from my perspective, that they give you any less attention one way or the other.”

And they’re responsive.

“I can email any one of those guys right now and they’ll respond within probably minutes,” he said.

4 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

Cross-Selling & Upselling to Increase Sales

Both cross-selling and upselling can be useful methods for increasing your business’ sales. But there are also genuine benefits for your customers. They’ll appreciate being offered an item that either complements or adds value to their original purchase.

The art of cross-selling

Cross-selling is convincing your customers to buy a complementary item to go with their main purchase. It’s been most famously explained as, “Would you like fries with that?”

When deciding what items to cross-sell, look at not only what you can add to increase your profit margins but also what might satisfy your customer’s needs.

Common cross-selling techniques

Although certain methods of cross-selling are largely dependent on what kind of product or service you’re offering, there are some basic, tried-and-true techniques that can be applied to almost every business.

Getting the hang of cross-selling and making a habit of it are essential if you want to increase your sales and provide additional benefits to your customers.

An important part of successful cross-selling is to be prepared. It’s not something you should improvise. Think about the products or services you’re offering and plan in advance the ones you can sell together. What you’re offering as a cross-sell should be cheaper than the original purchase.

Some of the best and easiest ways to cross sell are:

• Bundling products together, where it’s compulsory to buy more than one item.

• Incentivize customers to spend just a bit more in return for a reward. For example, free delivery, volume discounts or complementary products or services are cheaper.

• Combine products and services. This is a great method if the primary part of your business does one thing but you can complement it with the other.

• Complementary add-ons. Suggest to your customers that what they’ve just bought would be so much better

with another product—one that they will, in fact, need at some point. Or try, “Buyers that bought these items, also bought these.” Amazon wouldn’t be the same if you weren’t offered suggestions of what else to buy.

The key to upselling

Upselling is a slightly different selling technique where you’re aiming to convince your customers to purchase a more expensive item or upgrade to the next product (or service).

Quite often you’ll be informing your customers of other options that they may not have even considered, with the aim of selling more and maximizing your profits.

Common upselling techniques

In restaurants, upselling is commonplace and an accepted way of conducting business. Customers generally view it positively, which is an important point to check.

Some techniques you might consider when upselling include:

• Preparing your website so prior to each customer reaching the checkout, they’re offered a comparative item (one that’s the next price level up). Highlight the features and benefits of upgrading in this instance.

• Listening to your customers and pick up key information, like how much they’re willing to spend, what they’re looking for and which products or services they’re more interested in.

• Providing two or three options, each at a higher price, allowing the customer to choose what price they’d like to pay.

• Stocking or having access to higher priced items.

Use your experience and confidence

Learning the arts of cross-selling and upselling isn’t something you should ignore. They’re essential marketing tools and highly effective ways of increasing your sales and, inevitably, your profits.

They’re also selling techniques that you’ll get better at the more you try them. As you gain experience and confidence, you’ll get a feeling for when cross-selling or upselling opportunities present themselves.

5 Equal Housing Lender | Member FDIC heritagebanknw.com

Building & Sustaining Strong, Economically Resilient Communities

Heritage is proud to participate in the Washington Bankers Association Bankers Care initiative.

By participating in Bankers Care, we demonstrate our commitment to more than just financial transactions—it shows our investment in the welfare of the communities we serve and a dedication to the principles of corporate social responsibility.

These activities include:

Community Programs Participating in or sponsoring local events, financial literacy programs or initiatives that support community development.

Charitable Giving Donating to local charities, nonprofit organizations or other causes that benefit the community and those in need.

Volunteering Encouraging employees to volunteer their time to support local initiatives and community projects through bank-organized events or partnerships with local organizations.

Loan Programs Offering special loan programs or services aimed at helping underserved parts of the community, such as small business loans for minorityowned businesses or affordable housing programs.

Financial Education Offering free or low-cost financial education workshops or materials to individuals and small businesses to help them make better financial decisions.

Crisis Response Providing support in times of local or national crisis, such as natural disasters, by offering financial relief programs or additional support to affected customers and businesses.

Environmental Sustainability Implementing and promoting environmentally sustainable practices within the bank’s operations and through its lending policies.

To learn more, scan the QR code with your mobile device or visit bankerscare.com.

6 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

Protect against check fraud with Heritage Direct

Check fraud and business email compromise are two of the biggest threats to businesses and nonprofits.

Here’s a real-life story of check fraud to illustrate how it happens:

A nonprofit serving Puget Sound communities mailed a $25,000 grant check. They took the check directly to the post office. Like most of us, once it’s dropped in the mail, it’s out of sight, out of mind. The check cleared but a week later the payee said, “I never got the check.”

Somewhere between mailing and delivery it was intercepted. After a little chemical erasing or computer magic, a fraudster created a check with their name on it and cashed it as their own. Although banks have procedures in place for situations like this, there are circumstances where funds cannot be recovered, resulting in a loss to the business or the bank.

Despite declining check use, the U.S. has seen a nationwide surge in check fraud schemes targeting U.S. mail to steal checks. The thefts are committed by individuals who fish mail out of blue collection boxes or break into mail delivery trucks, commercial mail centers and roadside mailboxes.

Checks are an easy target. Your account number is right on the bottom of the check for anyone to see. If your business must use checks, order checks with security features that include:

• Void indicators that appear if the check is copied or scanned

• Chemically-reactive paper that discolors if chemicals are used to alter or wash the check

Consider more secure electronic options like ACH or wire transfer, especially for recurring payments. These choices allow the payment to go directly into the payee’s account and you control when it clears your account.

When setting up ACH or wire transfers, ensure you have the correct account information by double-checking the details by phone, not email. Scammers have been known to hack email accounts to impersonate a vendor and redirect payments to accounts they control. This is called business email compromise. You’ll also want to send a test transaction the first time to verify it’s received. If your vendor says they have a new account, repeat this verification process. It sounds like an unnecessary step, but fraud can happen anytime and, to quote Benjamin Franklin, “An ounce of prevention is worth a pound of cure.”

CONTRIBUTOR:

DENNIS D’AMBROSIO

Dennis joined Heritage Bank in 2019. He is currently the vice president, fraud risk/investigations manager. Dennis has more than 25 years of experience in banking and fraud risk management and is vice president of the Northwest Chapter of International Association of Financial Crimes Investigators (IAFCI).

If you do send checks, enroll in Payee Positive Pay and check it daily. It’s the best way to know the check you issued reached the intended recipient. Additional options include using a separate account for accounts payable so it’s easier to spot an unusual payment. You might also consider letting the recipient know when the check is in the mail and ask for confirmation when received.

For more information on fraud prevention and for help setting up these services, contact your relationship manager.

Shutterstock 7 Equal Housing Lender | Member FDIC heritagebanknw.com

Anything you create or build has the potential to be copied by someone else, and depending on how mission-critical the idea is, you may want to protect it legally.

Protecting your intellectual property (IP) assets also lets you maintain a competitive advantage and ensures that your hard work and financial investments are used to your business’s advantage.

Protecting your IP in the U.S.

If you need to register a patent, design, trademark or plant variety, the United States Patent and Trademarks Office (USPTO) website has information and search tools to help you prepare to apply for IP protection. For example, the USPTO Trademark Electronic Search System checks that the item you want to protect isn’t currently trademarked.

Protecting your IP overseas

The World Intellectual Property Organization (WIPO) helps businesses protect IP assets overseas. It’s a global forum site for intellectual property services, policy, information and cooperation.

Be careful who you speak with

Before talking to another person about your idea, research their credentials thoroughly. Look on the internet for information about their career and double check by speaking with a few of their previous clients or partners. You can also draw up a confidentiality agreement for the other person or company to sign before sharing trade secrets or patents.

Document everything

If you are ever drawn into a legal battle, it will help enormously if you have written and dated proof of everything relating to your ideas. Make it a business-wide habit to have all paperwork documented twice, making use of a cloud service or physical hard drive to back everything up.

BUSINESS BANKING MENTOR Shutterstock 8 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

Copyright

Sometimes you don’t have to apply for intellectual property protection. If you’ve written a book, composed a song, filmed a movie or painted a work of art, it will be protected by “copyright” automatically. Keep your original notes, drafts, photos and other documentation to help you prove authorship in the event of a dispute, but you don’t officially have to “apply” for copyright. Protection exists immediately after you’ve created the work. You don’t even need to use the © symbol, although it is a helpful signal to others to not plagiarize the work. The amount of time a copyright is enforced before it becomes public domain varies depending on if the creator is an individual or a company.

The following categories of works are copyrightable:

• Literary, musical and dramatic works

• Pantomimes and choreographic works

• Pictorial, graphic and sculptural works

• Sound recordings

• Computer programs

• Architectural works

It’s also worth noting that if you do submit for official copyright, each individual piece requires a separate application and associated fee.

The advent of artificial intelligence (AI) has raised copyright law and policy issues regarding the use of copyrighted works in the generation of content via AI tools and protection for creators. Find the latest policy information at copyright.gov

Trademarks

A trademark uniquely identifies your business among others. It could be a logo or a brand name (word, name, symbol or device) that indicates the source of the goods. A service mark is the same except that it identifies the source of a service rather than a product.

Trademarks can include:

• Words like Nike’s “Just do it” catchphrase

• Logos such as the golden arches of McDonald’s

• Shapes like Coca-Cola’s bottle design

• Colors such as the UPS’ Pullman brown

• Sounds like the roar of the MGM lion

A trademark protects your item, not the individual parts of it. Once you register your trademark, you may use the ® symbol

alongside it. Until then, you can “claim” it by using the ™ symbol, as many companies do before or during the formal application process.

Patents

Patents stop others from using, making or selling a certain invention for up to 20 years. A patent is an exclusive right granted by the government that protects the concept or idea behind your product.

Patents will usually protect:

• New processes; machines; articles of manufacture or compositions of matter; or any new and useful improvements

• New, original and ornamental designs

• Plant rights for any distinct and new variety of plant

Be aware, if you discuss, publish, sell or demonstrate your invention or design in public before filing a patent or design registration application, it may be rejected (as the idea is in the public domain). To help you share any new idea, draw up a confidentiality agreement so all employees, potential investors and other parties of interest sign it before you disclose any confidential information. Visit the USPTO website at uspto.gov for more information or to register a trademark or patent.

Trade secrets

A trade secret could be a formula, pattern, method or process that’s used in your business and gives you an advantage over your competitors that you don’t want to legally protect because it’s either too expensive, it’s not that unique or you don’t want everyone to know after 20 years. A famous example is KFC’s eleven herbs and spices recipe, which is a trade secret only.

The USPTO provides a guide to protecting your trade secrets. Go to uspto.gov and search “Trade Secret Intellectual Property Toolkit” to download the pdf.

Summary

In the end, the last thing you want is for your IP to fall into the wrong hands. You don’t want your competitors profiting from your ideas and hard work nor do you want disgruntled employees walking off with trade secrets. It’s often a good idea to talk to a lawyer who specializes in IP law so you can be sure you have the right kind of protection for your business.

9 Equal Housing Lender | Member FDIC heritagebanknw.com

Bellevue bankers Making beneficial connections for customers and community JOHN STEARNS Olli Tumelius / seattleheadshotpro.com 10 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

Heritage Bank’s Bellevue, Washington, commercial banking office is all about making connections, whether linking customers to lending, or community members and organizations to one another.

It’s no wonder that Mike Arellano, senior vice president, commercial banking team leader in the Bellevue office, sits on the board of Friends of the Grand Connection. That’s a group helping organize support for the city’s vision to build a 2,000-foot-long pedestrian and bike bridge over Interstate 405 to provide a safe, uninterrupted link between downtown Bellevue and the Wilburton neighborhood east of I-405. The bridge is on the eastern end of what the city calls the Grand Connection.

The 1½-mile Grand Connection is designed to enhance street-level activity for shops, restaurants, plazas, parks, entertainment venues, offices and more from Meydenbauer Bay Park to Eastrail. The latter is a 42-mile bike and pedestrian trail from Renton to Snohomish County that’s about halfway completed and passes through Bellevue’s Wilburton neighborhood abutting the east side of I-405. Eventually, Bellevue would like to build a park lid over a section of I-405 next to and immediately south of the bridge.

Additionally, Heritage’s Amy Curran, the bank’s executive vice president, director of commercial lending, sits on the board of the Bellevue Downtown Association, a Grand Connection supporter whose CEO, along with an Amazon executive, cochairs the Friends of the Grand Connection.

One could say the Grand Connection is a metaphor for Heritage’s work in Bellevue and beyond.

“Part of our job—and when we’re out in the community—is to try to be a source of value, meaning we get to be the connectors; we’re the conduit between people,” Arellano said. “And as long as we continue to be the conduit, people are always going to come to us because they trust us and know we can connect them with the right people or organizations who can help move their business forward. Whether it’s accessing capital, support for expansion or connections to professional services such as accountants or attorneys, our job is to really be a one stop shop for our customers and a trusted resource for them.”

It’s not just about doing loans, he said.

“We’re in the community, we’re on the boards, and we’re helping raise awareness for the philanthropic efforts our clients and partners are making,” Arellano said, adding the bank doesn’t do it for attention. “We just want to be able to help where we can.”

Case in point: Jason Hollaway, senior vice president, commercial banking officer, who sits on the EvergreenHealth Foundation board as treasurer and finance chair, used his connections through Heritage to help the foundation’s efforts to raise enough money for a new TrueBeam linear accelerator for advanced and precise cancer treatments at EvergreenHealth’s Kirkland hospital. Heritage was an underwriting sponsor for Evergreen’s 2022 Gala that raised $1.3 million toward the machine.

Hollaway also sits on the board of the Shoreline-based Firland Foundation & Workshop, which provides employment for people with disabilities and uses workshop income to support research and treatment of tuberculosis (TB) and other respiratory diseases. Firland occupies the grounds of a former TB hospital.

BUSINESS IN BELLEVUE BY THE NUMBERS

Major industries: Information Technology, Business Services, Retail and Healthcare

Major employers: Puget Sound Energy, Symetra Financial, Microsoft, The Pokémon Company International, Boeing, T-Mobile USA, Verizon, Nordstrom, Overlake Hospital and Group Health Medical Center

According to the 2020 City of Bellevue Economic Development Plan, nearly 90% of workers employed in Bellevue live outside the city, making it an employment destination.

Sources: visitbellevuewa.com and bellevuewa.gov

ABOUT OUR BELLEVUE COMMERCIAL TEAM

Combined banker experience: More than 250 years

Volunteer hours served in 2023: 287

Charitable giving in 2023: $56,000

Top nonprofits: Encompass, Bellevue Downtown Association, EvergreenHealth Foundation, Boys and Girls Club of Bellevue, Stronger Families

CONTACT OR VISIT

10500 N.E. 8th Street, Suite 1500 Bellevue, WA 98004 425.455.2400

Melissa Vaughn, Branch Manager

Melissa has nearly 20 years of banking experience, with nearly 15 years at Heritage Bank. She’s worked in a number of positions before becoming the branch manager. Her primary focus is on building new and current relationships and understanding that personal/business needs and situations vary. She embraces and familiarizes herself with ongoing change so she can support her customers with new and current products and services that may suit their needs. She currently volunteers at Volunteers of America, Goodwill, Domestic Violence Services of Snohomish County, Housing Hope and the Boys and Girls Club of Snohomish County. Outside of work, Melissa likes to be outdoors camping, boating, snowmobiling and playing tennis.

11 Equal Housing Lender | Member FDIC heritagebanknw.com

Opposite, left to right: Mike Arellano, David Stegmeier, Sandra Ramsey, Aaron Moraca-Savva, Rob Raile, Dean Peterson, Michael Tibbits, Curtis Drury, Riq Molina. Not pictured: Jason Hollaway.

Hollaway also volunteers with the Progressive Animal Welfare Society (PAWS) which is based in Lynnwood with a satellite location in Seattle. Heritage Bank helped finance construction of PAWS’ outdoor recovery habitats at its Snohomish Wildlife Center, where a project to expand PAWS’ capacity for rehabilitating wildlife is expected to be completed this year.

Community service courses through the Bellevue office’s veins as it does throughout all Heritage offices in Washington, Oregon, and Idaho. Other Bellevue bankers volunteering locally include Sandra Ramsey, senior vice president, commercial banking officer, who is on the board for Encompass, which offers early learning, pediatric therapy and family enrichment programs for children and their families. Ramsey’s also a member of the Rotary Club of Snoqualmie Valley.

Riq Molina, senior vice president, commercial banking officer, is a corporate work study board member for Cristo Rey Jesuit Seattle High School. He connects decision makers in the business community to the school’s innovative Corporate Work Study program. Student associates work one day per week for all four years of high school in a professional setting, earning the majority of their education and gaining invaluable experience from intentional mentorship in the workplace. Molina, Hollaway, and Ramsey are also heavily involved in helping nonprofit sector clients with their banking needs.

Other Bellevue bankers are Michael Tibbits, senior vice president, commercial banking team leader along with Arellano; Aaron Moraca-Savva, vice president, commercial banking officer; Curtis Drury, senior vice president, commercial banking officer; David Stegmeier, senior vice president, commercial banking officer; Dean Peterson, senior vice president, commercial banking officer; and Rob Raile, senior vice president, commercial banking officer.

Others in the office, located on the 15th floor of Bellevue Place, across from Bellevue Square, include Melissa Vaughn, branch manager; Dolores Bedner, team leader for loan production assistants; and Matthew Small and Robin Porter, senior analysts.

Many of the staff have been in the Bellevue market for years, beginning with Bellevue-based Puget Sound Bank, which Heritage acquired in 2018.

Whether working with new or existing customers, they’re all part of a team that creates a welcoming and efficient environment to handle documentation, analysis, credit risk, underwriting, covenants and more, Arellano said.

“The speed in which we get to ‘yes’ with the client really helps us to differentiate ourselves in the market,” he said, praising the team’s work.

The Bellevue office focuses heavily on professional services, from lawyers and CPAs to construction groups and contractors.

It also works with more mature technology companies, not the household names, but smaller companies, many of which provide ancillary services to the large companies or are vendors to them, Arellano said. It also works with nonprofits and does significant work with homeowners’ associations (HOAs) for building upgrades.

One of the tech companies Heritage’s Bellevue team works with is Blink UX, a design consulting firm with more than 20 years in user experience research, strategy and design, partnering with innovative industry leaders. The company does a lot to optimize companies’ online platform engagement with customers, Arellano said, noting the bank offers lines of credit for things like customer and employee acquisition costs, plus standard treasury management services for Blink’s business banking needs.

The Bellevue office also does numerous loans for HOAs needing work done for large maintenance projects that include new roofs, siding, paint and more.

“We do a lot of HOA real estate construction and land development (RECLAD) loans, not specifically in Bellevue because the buildings are newer, but in Capitol Hill to along the water in Kirkland and down south in Gig Harbor and Tacoma. We do a lot of HOA update types of loans that’ll allow us to help the community and help those homeowners retain their property values,” Arellano said.

The office also works with Seattle-based Pagliacci Pizza, which opened its 26th location in the Greater Seattle area on December 29th in Bellevue’s Eastgate area. Heritage helps with the company’s numerous tenant improvement loans, including the Eastgate site, which is a converted Pizza Hut location.

“We continue to support their growth as they continue to pick up various retail spots,” Arellano said.

Heritage’s Bellevue team also supports some single-family and multifamily builders for projects, and for multifamily refinancing and purchases on King County’s Eastside, plus in Seattle’s Green Lake, Fremont, Ballard and Capitol Hill areas. The bank will follow clients to where they have projects, including one who is purchasing investment property in Montana.

It all comes back to connections, helping link clients to capital or other resources and helping communities achieve their goals, Arellano said.

“That’s the fun part; doing lending’s just our job,” he said. “When you get to have an impact on the community and help it have its voice and also be the voice for those who may not feel as influential or feel like their voice is being heard, it’s important to have a part in the way we want our city to continue to grow and make sure that we’re the right stewards of it.”

12 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

The U.S. Small Business Administration Announces Changes to Its Flagship Programs

The U.S. Small Business Administration (SBA) has introduced important changes to its flagship 7(a) and 504 lending programs. These programs are designed to assist small business owners in obtaining the funds they need to start and expand their businesses.

Since April 2023, updates to the SBA’s lending criteria aim to simplify the process, increase access to SBA loans and provide better support to underserved communities, including women, minorities, veterans and rural entrepreneurs. It also expands access to capital by modernizing the programs.

Why the changes were announced

In making its announcements, the SBA noted that small business owners, especially those in underserved communities, struggle with accessing funding. In 2022, two out of three business owners who applied for credit did not obtain the funding they needed, according to one news release.1

Essentially, the SBA changes will allow more small business owners to access vital funding that will enable them to expand and grow their businesses. Additionally, it should now be easier for borrowers to find appropriate lenders, navigate the SBA loan process and be approved for any loans they’re eligible for. The SBA noted that the purpose of the changes was to “address persistent gaps in access to capital impacting small business owners in underserved communities.”1

1 www.sba.gov/article/2023/04/12/us-small-businessadministration-implements-rules-address-persistent-capital

Equity injection changes

Equity injection is any new cash or acceptable assets that are added to a project but were not on the borrower’s balance sheet before the equity injection. Startups no longer require equity injection based on SBA guidelines. The amount of equity needed will be determined by the bank’s internal credit policy.

In addition to these changes, the SBA announced it was reducing the documentation that lenders are required to collect to verify the borrower’s equity.

Partial changes of ownership

SBA loans can now be used for partial business acquisitions, allowing more flexible deal structures. Selling owners can remain involved in the business.

Affiliation consideration

The complex “control” element in determining affiliation has been removed. Affiliation will now be primarily based on ownership percentage, with 50% generally being the threshold. Lenders will only evaluate owner percentage, not control.

Personal resource test elimination

SBA lenders no longer need to assess the personal resources of loan applicants during the review process.

Simplified lending criteria for small loans

For loans under $500,000, the SBA has streamlined lending criteria, reducing the due diligence and documentation requirements. Lenders can consider

Heritage Bank is a preferred SBA Lender, which means we can help borrowers get the funds they need faster than a bank that does not have that classification. Our experts will spend time with you and help you understand the right solution for your business. Acquiring SBA funding can be a long process, but to help your dream come true, it’s well worth the time. Learn more at heritagebanknw.com

credit score, earnings or collateral when approving such loans. The SBA is allowing lenders to make loan decisions based on their existing policies for similarly sized non-SBA loans.

The SBA is also providing additional flexibility for loans under $150,000, reducing the cost and complexity of small-dollar lending. Because the paperwork will be streamlined, lenders can spend more time with applicants and less time on paperwork.

Simplified debt refinancing

The new guidelines make it easier for lenders to refinance both their own debt and the debt of other lenders.

Insurance requirements

Life insurance is no longer mandatory for 7(a) and 504 loans. The decision to use life insurance as collateral is now up to individual lenders.

What the changes mean for small business owners

These changes will make it easier for business owners to apply for loans and determine whether they’ve been approved. Business owners will also have more options for lenders when they apply for 7(a) and 504 loans, especially if they seek smaller loans.

For more about these changes, visit sba.gov/about-sba/sba-newsroom

CONTRIBUTOR: ROB STEWART

Rob’s banking career began as a file clerk and driveup teller. He’s worked in retail banking, commercial banking and was CEO of a federal credit union for nine years. Now as our director of SBA lending, Rob leads, manages and oversees all aspects of the SBA department that offers a full suite of products and services to help small businesses succeed.

Shutterstock 13 Equal Housing Lender | Member FDIC heritagebanknw.com

Achieve Growth by Buying Another Business

Successful business owners are those who are always looking for new ways to expand and grow their business, and there are tried-and-true techniques for doing so. One of them is to buy another business, such as a competitor or a supplier.

Buying a supplier can be a successful tactic to grow if they’re a critical part of your success. You’ll be able to stabilize your supply and costs and have an opportunity to control sales to similar businesses. Purchasing an established competitor enables you to grow your business overnight, while eliminating a rival that was eating into your market share.

Benefits of purchasing a supplier

If you’re a retailer and you buy out your manufacturer, you’ve diversified your business and can engage in supplying other businesses. But there are several other benefits to buying a supplier, such as:

• Lower costs—you’re eliminating the markup a supplier would add to the price.

• Quality control—if you own the supplier, you’ve got more control over the quality of the products you sell.

• Logistics—you control the flow of information and products so you can implement your own plans for distribution. You can fill orders faster, which means you avoid running out of supplies.

• Increase profit—ideally the supplier is making an independent profit. Adding synergies and efficiencies could improve profit across both businesses.

If one of your suppliers comes up for sale, consider what purchasing it could mean for your business. If you can check off all of the above, it’s likely to be a wise investment.

Benefits of purchasing a competitor

Buying out a competitor has various benefits and not just because you’ve eliminated them as a rival. You’ll open up new opportunities for business growth, such as:

Shutterstock 14 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

• Increasing your market share—it’s simple numbers as you’ll add their customer base to yours. Maybe they have a significant customer you’ve always wanted.

• Boosting your operational capacity—your competitor might have staff, machinery or expertise that can double or triple your output, especially if you have an existing contract to fulfill.

• Acquiring their assets—it could be cheaper to buy a competitor’s land, facility, inventory or equipment than to purchase brand new. They may even have a great location that you’ll benefit from when you buy them out.

• Increasing profits—in some businesses you can reorganize administrative functions to lower overhead, increase efficiency and eliminate duplication. You might also be able to buy in larger quantities for bigger discounts.

What are they really worth?

Determining the market value for any business can be tricky. The amount you’re prepared to pay will be a combination of the business’ worth to you and the approximate market value. If the current owner has over-capitalized in certain areas or made poor investment decisions, that may decrease the value (and also present opportunities for improvement if you buy). On the other hand, the business could have intangible assets, such as an exclusive license to sell certain products in a particular area, or have secured future orders that reduce your risk when buying the business.

You obviously don’t want to pay more for the business than it’s worth. To avoid this:

• Arrange a business valuation to determine a rough market price. Business brokers are experts in helping assess values. Ideally, find a broker with experience in your industry.

• Investigate the location of the business and any future plans for the area.

• Research likely future profits and risks.

Don’t be fazed by what the business made last year. You need to focus on the profit it’s capable of producing over the next several years.

Steps to take

As with any major purchase, complete your due diligence and conduct thorough research into your intended acquisition.

• Have a clear idea of how they make their money so you know what kind of profits to expect. This is the kind of task you should undertake with your accountant or business advisor as they’ll be able to pinpoint any flaws in the balance sheet.

• Understand their employee structure. Will all of them be included in the purchase, and if so, are they happy to move to you? Are there key positions you intend to retain or eliminate?

• Make sure their business culture is in line with yours. Clashes over operations and management can be stressful, time-consuming and expensive.

• Are you confident that the purchase makes financial sense? While nothing is guaranteed, you should be certain that the risks involved are worth taking.

• It’s also important to take into account your own capacity to manage the new business. Is it something you will do yourself or will you appoint a key employee to run it?

Growing your business through acquisition may help you reduce costs, enjoy more control and have the opportunity to sell to other businesses, giving you a competitive advantage. It’s a challenging process, so plan ahead for the increased workload and be sure that you have the capacity and ability to handle it. It’s critical that your accountant and lawyer are involved throughout the process as they’ll keep everything on track legally and financially. Depending on the size of your company and team dynamics, you may also want to involve or inform your staff or leadership team so that the acquisition doesn’t come as an overwhelming surprise.

Vecteezy 15 Equal Housing Lender | Member FDIC heritagebanknw.com

Resources

Visit these sources for legislative and legal advocacy, civic engagement support, collaboration opportunities, news articles and more.

National Council of Nonprofits councilofnonprofits.org

Nonprofit Risk Management Center nonprofitrisk.org/

Nonprofit Association of Oregon nonprofitoregon.org/resource-library/

Idaho Nonprofit Center

idahononprofits.org/resources.html

Nonprofit Association of Washington nonprofitwa.org/learn/learning-library/ by-topic-finance/

Washington Secretary of State sos.wa.gov/sites/default/files/202209/2022-Nonprofit-Handbook.pdf

Heritage Bank

Business Resource Center

Whether you are just getting started, experiencing growing pains or transitioning your organization to new leadership, we have resources for you at heritagebanknw.com/brc

Protecting your Nonprofit from Financial Fraud & Reputational Risk

Fraud is a growing concern across all industries, but it can be particularly damaging for a nonprofit organization who depends on a flow of funds to fulfill their mission. In 2023, over 90,000 registered nonprofits and countless charities operated across Washington, Oregon and Idaho.

Compounding the devastation of a financial loss is the risk of reputational damage. Fraud in nonprofit settings can attract unrelenting media attention, breaching the trust of donors and supporters, resulting in lost revenue, negative publicity and a decrease in productivity and morale. Reputational damage caused by negative online reviews (whether true or not), a database breach of donor information or a poorly handled service experience can also result in a loss of funding from public sources.

SECURITY AND FRAUD ISSUES UNIQUE TO NONPROFITS

Nonprofit organizations can be more vulnerable to fraud for several reasons: Board member turnover. Nonprofit organizations cycle through board members, some more frequently than others. As a result, there are frequent account signer changes. If the organization’s computer system is hacked, the perpetrator becomes aware of this and begins to initiate signer changes and other damaging activity.

Limited resources. Many of the people operating a nonprofit are volunteers who do so because they are passionate about the cause but not necessarily skilled in the role they perform for the organization.

Lack of documentation. An organization with limited resources and a large volunteer workforce can rely heavily on specific people to be knowledgeable in their role. However, responsibilities and nuances of the role may not get documented, leaving the organization scrambling to fulfill the tasks or find information should a key person leave. A lack of documentation also leaves the organization vulnerable to fraud as it’s not clear who does what or where to begin investigating a suspected issue.

Inefficient business processes. In some cases, the individual with the most authority is far removed from day-to-day banking and not in a position to manage it appropriately. For example, when an organization’s founder no longer manages day-to-day operations but is reluctant to let go of online administrator authority, other employees must ask them to perform a banking task, which can slow operations.

Inconsistent cash flow. According to the Nonprofit Finance Fund’s State of the Sector survey1, many nonprofits report that they have less than three months of operating reserves on hand, making them even more vulnerable to a disruption in services should fraud occur. However, they still tend to hold large balances as a cushion to protect against less predictable or “lumpy” revenue through slower fundraising periods.

Check fraud is one of the biggest threats we see to businesses and nonprofits. Go to page 7 to read a real-life story of check fraud and learn about more secure options for payments.

NONPROFIT CORNER

Shutterstock 16 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

i

WHAT TO DO

Put safeguards in place to protect the organization from financial fraud and reputational damage.

• Install virus and security software on your network and lock computers with passwords.

• Protect large balances. Your banker should be proactive in recommending fraud protection services as well as separating these large reserves from your more exposed operating accounts.

• Create internal controls like running background checks on employees who handle transactions and donor information, clearly defining who has access to specific information and who is responsible for granting access and maintaining security of that information.

• Have written policies regarding the handling of cash and donor information, internet security standards, dual control of financial access such as ACH transfers and two-party checks and detailed procedures regarding expenses and reimbursements.

• Document the responsibilities of each role within the organization. Note and link to the systems used and include step-by-step instructions for any processes that are complicated or unique to your organization. For example, if the same person has planned and run your annual fundraising event for over a decade, ask them to document the roles, responsibilities, timelines and processes involved to ensure the event can continue smoothly if someone else needs to take over.

• Create a whistleblower policy that states how and to whom suspected fraud and misconduct should be reported. This promotes transparency and empowers employees and volunteers to report suspicions.

• Clarify the role of the board in responding to and investigating fraud. Move swiftly to address embezzlement, fraud or unethical behavior.

• Acknowledge, both publicly and to your team, the facts and address the actions being taken to mitigate and prevent additional loss.

• Contact your banker so they can flag your accounts and make any necessary changes to accounts or permissions to prevent additional fraud. They will also connect you with the fraud department to file a report and try to recover lost funds.

• Update passwords on your banking and donation software and platforms, removing user permissions if needed.

Balance donor security with the need to create a steady income stream with recurring and subscription donations.

• Provide multiple avenues for contributions as some people seek convenience and others may be wary of digital or internet donation methods.

• Ensure you have policies and processes in place for collecting cash donations.

• Only collect and store donor information that is necessary for processing donations and recognizing their contribution.

• Consider a secure digital platform that helps you accept donations online, over the phone, in person and via mobile app.

1 nff.org/learn/survey, 2022

Heritage Bank has partnered with Elavon, a leader in payment processing services, to streamline donation collection for nonprofit organizations. Converge connects to your accounts via our online banking platform and allows you to pull reports and set administrative permissions. The equipment and technology are secure and backed with personalized support from your banking team. Contact your relationship manager for more information.

CONTRIBUTOR: JESS DALY

Jess is passionate about nonprofit banking and has a diverse background in client management within the technology, healthcare and sustainability industries. She has many years of business banking experience, including portfolio management, treasury management, commercial lending, SBA expansion and business acquisition. Her main goal is to build strong relationships with her clients to help them succeed financially. Outside of work, Jess is ingrained in her community. She currently serves on the Cascade AIDS Project (CAP) Ambassador Council; is a camp counselor for CAP’s Camp KC, a free summer camp for kids living with and/or affected by HIV/AIDS; teaches financial literacy classes; and volunteers at the Oregon Food Bank, SOLVE and Friends of Trees. She is also an avid supporter and educator of diversity, equity and inclusion and LGBTQAI+ initiatives.

Shutterstock 17 Equal Housing Lender | Member FDIC heritagebanknw.com

Where Will Your Retirement Money Come From?

What workers anticipate in terms of retirement income sources may differ considerably from what retirees actually experience. For many people, retirement income may come from a variety of sources. Here’s a quick review of the six main sources.

Social Security

Social Security is the government-administered retirement income program. Workers become eligible after paying Social Security taxes for 10 years. Benefits are based on each worker’s 35 highest earning years. If there are fewer than 35 years of earnings, non-earning years are averaged in as zero. In 2023, the average monthly benefit is estimated at $1,827.1,2

Personal Savings and Investments

Personal savings and investments outside of retirement plans can provide income during retirement. Retirees often prefer to go for investments that offer monthly guaranteed income over potential returns.

Individual Retirement Account

Traditional IRAs have been around since 1974. Contributions you make to a traditional IRA may be fully or partially deductible, depending on your individual circumstances. In most circumstances, once you reach age 73, you must begin taking required minimum distributions from a traditional IRA. Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. You may continue to contribute to a traditional IRA past age 70½ as long as you meet the earned-income requirement.

Roth IRAs were created in 1997. Roth IRA contributions cannot be made by taxpayers with high incomes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawals can also be taken under certain other circumstances, including the owner’s death. The original Roth IRA owner is not required to take minimum annual withdrawals.

Defined Contribution Plans

Many workers are eligible to participate in a definedcontribution plan such as a 401(k), 403(b) or 457 plan. Eligible workers can set aside a portion of their pre-tax income into an account, which then accumulates, tax-deferred.

In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Defined Benefit Plans

Defined benefit plans are “traditional” pensions—employersponsored plans under which benefits, rather than contributions, are defined. Benefits are normally based on factors such as salary history and duration of employment. The number of traditional pension plans has dropped dramatically during the past 30 years.3

Continued Employment

In a recent survey, 73% of workers stated that they planned to keep working in retirement. In contrast, only 23% of retirees reported that continued employment was a major or minor source of retirement income.4

For help with a personalized financial plan, visit heritagewealthstrategies.com for more information and to connect with one of our wealth strategies professionals.

1 SSA.gov, 2023 2 SSA.gov, 2023 3 Investopedia.com, Dec.30, 2022 4 EBRI.org, 2023

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite. Heritage Wealth Strategies is a marketing name of Cetera Investment Services. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/ SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 1000 SW Broadway, Suite 2170, Portland, OR 97205, (888) 360-0052.

brought to you by

find

to

Shutterstock 19 heritagebanknw.com

Visit heritagewealthstrategies.com to

an advisor near you. We’re here

help.

Resources

United States Patent and Trademark Office

uspto.gov

Web Accessibility Initiative w3.org/WAI

Information Technology Industry Council itic.org

Consumer Technology Association cta.tech

Office of Digital Services Industries trade.gov/about-us/office-digitalservices-industries

INDUSTRY PROFILE: Software & IT

Opportunities in the IT industry continue to increase, and the industry is a leader in innovation. From healthcare to telecommunications, transportation to entertainment, the work of software and IT companies has become integral to the success of countless other industries.

Recent world events had a significant impact on the technology sector, affecting supply (raw materials, chips and assembly in Asia), disrupting the electronics value chain and causing price increases. More positively though, the disruptions accelerated the adoption of remote work and a focus on evaluating and de-risking the end-to-end value chain.

Finally, cybersecurity breaches continue to highlight the risks of failing to secure a business’s data, pressuring demand for security software.

Overview

The industry’s workforce is concentrated in cities and typically well-educated, young and earning above-average pay. Although much of the industry is famously located in northern California’s Silicon Valley, metro regions here in the Pacific Northwest have vibrant IT sectors and self-employed contractors across the country cater to the extra demand.

IT and software businesses can generally be divided into those providing services (typically IT infrastructure) and those developing products (typically software as a service or cloud-based product).

More than half of software companies export their services so, while the head offices of businesses developing and exporting software (“weightless exports”) are largely based in the U.S., they typically require a presence in their export markets of offices and staff for marketing, sales and after-sales support, for example.

Success characteristics

Successful software and IT businesses share these common attributes:

• Have robust business continuity plans in place to deal with major disruptions (like global events or security breaches)

• Can recruit and retain skilled staff, offering work/life balance and career development

• Leverage social media and the IT community to promote their business and form partnerships

• Deliver excellent after-sales support in real time

• Raise capital to invest in expansion/research and development

• Source innovative ideas from customers, staff and business networks

• Are aware of and look into all available support, not just financial

• Keep an eye on competitors and advances in relevant technologies

• Consider growth through exporting

• Protect their intellectual property

• Are clear on the benefits of what they sell

Shutterstock 20 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

Research and development

Almost half of all businesses in the IT sector invest in expansion—almost twice the national average. One third undertook research and development, four times the national average.

State and federal government offices offer initiatives targeted toward encouraging business innovation in cybersecurity and efficiency, supporting the growth of the IT and software sectors.

Challenges

The rise in remote work has introduced challenges such as setting up and managing remote workers as well as how to maintain the culture of a team working in different locations and time zones. Other issues to consider include:

• Understanding a potential market’s needs and addressing the costs and logistical challenges setting up and when it may not be possible to visit in person.

• Recruiting highly skilled professionals.

• Complying with foreign employment law if employing offshore staff.

• Accessing capital for future growth and how to value a business for equity investment.

• Failing to validate the market, resulting in difficulty maintaining momentum after an initial launch.

• Shifting resources from a product and management heavy workforce in the startup phase into sales and distribution as a company stabilizes.

• Inexperience in valuing and protecting intellectual assets such as market knowledge, code, experience, customer needs assessments, reputation and credibility.

See page 8 for more on what qualifies as intellectual property and how to protect it.

Software & IT trends

User and customer experience focus

Software is ultimately tied to user and customer experience, and that emphasis will continue to drive long-term success. Investment into connectivity, speed, data storage and computing capabilities as well as intuitive user interfaces, such as conversational AI, gesture analysis and virtual reality, will be critical.

Accessibility standards

Web Content Accessibility Guidelines (WCAG) are developed in cooperation with organizations around the world to provide a single shared standard for web content accessibility. WCAG aims to ensure everyone can access software, tools and digital content.

For example, software must:

• Provide text alternatives for non-text content.

• Provide captions and other alternatives for multimedia.

• Make all functionality available from a keyboard, gestures or voice commands.

• Give users time to search, navigate, read and use content.

• Make text readable and legible.

• Make content display and function in predictable ways.

• Help users avoid and correct mistakes.

• Maximize compatibility with current and future user tools.

Privacy and security focus

Scores of privacy failures from technology companies in recent years have highlighted how critical privacy and data security is. Software companies must adopt strict processes to protect their (and customers’) data as cybercriminals continually test for holes in security systems, causing service disruptions and stealing valuable data. Software developers will have to continue to stay one step ahead of hackers and strengthen their security measures and systems.

A global mindset

It’s increasingly easier for software businesses to compete globally. Having a global mindset in your software development includes ensuring the product you’re developing will work for different regions, different languages, different devices and different internet connection speeds.

The other global mindset is towards coworkers and those that you work with. With flexibility becoming important for the next generation of workers, it is important to cater to those who work from multiple locations or remotely. You may work with people (partners, suppliers, customers) who you’ll never meet in person. The future of work will be global, remote and borderless.

Outsourcing

The outsourcing market is growing every year worldwide, where businesses in almost every field, like finance, health care and e-learning software development are hiring fullstack developers. Not only are there opportunities for smaller U.S. businesses to become contractors to larger companies, corporations have a global talent pool from which to source highly educated and skilled software developers.

The use of apps

Software and IT companies will be early adopters of apps and the benefits they provide and some will be way ahead of any trend.

CONTRIBUTOR: DAVID STEGMEIER

David has over 20 years of commercial banking and finance experience and brings a deep understanding of credit analysis, operations and IT proficiency. He works closely with family-owned companies and businesses who are in the restaurant, hospitality, retail and technology industries. He also assists customers with in-city residential development projects.

21 Equal Housing Lender | Member FDIC heritagebanknw.com

Wherever yougo ,

The Pacific Northwest is marked by an entrepreneurial spirit, looking back to our cultural history while moving forward towards innovation. It’s where celebrations like a music festival in the forest happen barely a stone’s throw from the 500-acre Microsoft campus. Summer is a great time to get out and support the people that make the PNW a thriving region where the past and the future are celebrated side-by-side.

Sample Your Way Through a Farmers Market

Your local farmers market is a wonderful way to meet small business owners and farmers in your community. Markets are held in a variety of venues, including city streets and even mall parking lots. Many are open on weekends in the summer, but you can find weekday markets if you want to pop over on your work break to purchase fresh produce, handmade sauces and baked goods, seafood and more. The market is the perfect place to buy affordable seasonal flower bouquets or a unique birthday or “just because” gift.

Get your Midway on at a County Fair

County fairs were originally a venue to demonstrate and promote agricultural methods and innovation. Don’t worry, you’ll still find plenty of livestock, giant pumpkins and beekeeper exhibits amidst the deep-fried novelties and noise of the midway at a county fair. In between cotton candy and coaster rides, stroll exhibits of local flowers, food, folk arts and animals while the judges crown the Quirkiest Quilts, Most Beautiful Bovines, and Juiciest Jams of the entries.

Immerse Yourself in the Arts

The Pacific Northwest has a thriving music and arts scene. While you can certainly see big-name acts, traveling musicals and Greek sculptures at the region’s biggest venues, you’ll be in for a treat if you seek out small venues and local music festivals that feature local talent. Specialty museums dedicated to a particular style, medium (such as Tacoma’s Museum of Glass) or location; bars and restaurants that host regular live music events; and smaller, local theaters are excellent ways to immerse yourself in the spirit of a community.

SHOPPING SMALL KEEPS DOLLARS LOCAL

> $68 out of every $100 spent at local stores remains in the local economy

> Dollars spent at an independent business recirculate in the local economy an average of six to 15 times. Statistics from capitaloneshopping.com/research/shopping-local-statistics/

Shop Local

The Main Street or city center of any community is a great place to shop. This is where you’re likely to find art galleries, specialty gift shops, bakeries, local wine, cheese and confections, handmade décor and independent bookstores. The folks running and staffing the shops are generally extremely knowledgeable about events and activities in the area and happy to show off their goods. Shopping and retail districts host events such as Girls’ Night Out, ArtsWalk and sidewalk sales, where you can grab a bargain or enjoy fun perks like wine tastings and swag bags provided by the downtown or small business district association.

Celebrate Your Community’s Heritage at a Festival

Every town has at least one annual festival celebrating its economic and cultural roots. From strawberry festivals to maritime celebrations to logging fests, it’s not hard to find an event filled with tasty, informative and sometimes silly fun (Geoduck Festival, anyone?) for the entire family. If you’re traveling, visit the city website of your destination to see if an event will be happening during your visit.

Dine at a Local Restaurant or Food Truck

There’s no better way to literally get a taste of the local culture than by choosing a locally-owned and operated restaurant, coffee shop or food truck. The food will be fresher, the ambiance more unique and, if you return often enough, the staff will remember your name AND how you like your eggs. Farm-to-table restaurants are becoming increasingly common and you’ll be supporting not only the restaurant, but the farmers and producers they purchase their ingredients from.

Lend a Helping Hand

With fewer resources and a smaller volunteer pool than national organizations, the nonprofit groups in your community need your support. Even small donations of a few dollars or hours of your time make an impact when multiplied over time. If you don’t already, consider getting involved in a cause in your community that you believe in. Other ideas for community activism include visiting seniors at a nursing home, coaching a youth sports group, mentoring entrepreneurs in a business incubator or joining the parent-teacher association (PTA) or booster club at your child’s school.

At Heritage Bank, we are deeply invested in the communities we serve. Check out the Heritage Helps story in each issue of Banking Business magazine or visit our website at heritagebanknw.com/community to learn more.

PNWONDERLAND

22 Issue 13 | 2024 Q2 Banking Business a publication of Heritage Bank

FOUR

Growing your business is one thing but building it to scale is another by managing increased capacity (hopefully in response to user demand) and profit without adding heavy and costly infrastructure. It’s the reason we’re seeing so many online businesses. Their business model allows them to scale fast, because once processes and software are in place, there’s very little cost to add new users. This is compared to traditional businesses that may have to add production lines, equipment, employees, raw materials or products when trying to expand.

Evolving your business to scale requires careful planning and preparation to make sure appropriate resources and systems are in place at each stage of growth.

You have horizon money

Horizon money is having enough capital to be able to invest in the business, usually covering overheads for a period of months or years until you have enough customers to start making a profit.

Funds can come from your own savings or cash reserves of the business, or you may wish to seek external funds from business colleagues, friends and family. Other financing may involve angel investors (external business owners willing to inject dollars into the business) or venture capitalists.

There is a clear vision

Scaling your business will require vision, leadership, teamwork and a bit of bravado. People associated with the business want to know what the plan is to take the company to new heights. Business leaders must assess opportunities to work with other companies, enter new markets, recruit top talent and think beyond the balance sheet to cultivate their unique vision and ambition. The ability to clearly articulate what the company does and where it will go is essential to rally the support of investors, customers, vendors and employees.

You’ve assembled an experienced management team

You can achieve scale by playing to your strengths and delegating your weaknesses, acknowledge what you do best and where you’ll need help. Though you may be the company founder—and you did an admirable job of guiding the new business through the startup phase— you may lack the knowledge required to scale the

business. A business with revenue of $500,000 is quite different from one that’s $100 million, involving more complex rules, different competitors, more compliance and internal structure and much higher stakes.

Getting to that size will probably require an infusion of management talent with advanced skills in areas such as opening international operations, developing products, supervising complex technology-based systems, raising venture capital, etc.

Your product or service doesn’t require specialized labor to deploy