29 minute read

Evolution Not Revolution…Driving A Digital Approach

EyeonVenues

Evolution Not Revolution:

Advertisement

Driving a digitalfirst approach

As part of a wider digital transformation within the organisation, the Waterfront Hall and Ulster Hall venues, alongside sister conferencing brand, ICC Belfast, made the decision to completely overhaul their marketing function to adopt a digital-first approach.

This digital strategy was set out to help the organisation achieve ambitious financial targets, as well as fulfil its compelling value proposition of delivering for Belfast and Northern Ireland socially, culturally and economically by showcasing the city and beyond as a unique, vibrant and flourishing business tourism and live entertainment hotspot. Business EYE took the opportunity to speak to Ashleigh Davidson, Head of Entertainments and Exhibitions for Waterfront Hall and Ulster Hall about how redesigning the online customer experience have has had a massive impact on the iconic venues.

“Entertainment KPIs; occupancy rates and ticket sales were in decline and the potential of the e-commerce website,

a healthy social media community and targeted email marketing database were overlooked in campaign planning in favour of traditional marketing platforms.” explains Ashleigh.

“A printed entertainments brochure, Front Row events guide, was traditionally produced three times a year representing a significant marketing cost for print, production and distribution. As part of the digital overhaul, production of Front Row was upgraded to a weekly e-zine that is supplemented by a condensed flyer, which lists a smaller number of upcoming events in both venues over the next eight to ten weeks. This measured response to market demand and trends was a sizeable shift for the business, but one that was necessary to enable a divergence of budget to digital campaigns.”

“Furthermore, our previous ticketing system presented several challenges. It was imperative that we had a system in place that supported our goals and allowed us to maximise existing and additional revenue streams while supporting efficiencies throughout the sales process.”

The online purchase path was one of the primary areas that Waterfront Hall and Ulster Hall wanted to improve, which lead eventually led them to appoint Tessitura as the new ticketing provider and Dawson Andrews as the appointed agency for the design and build of the new Waterfront Hall and Ulster Hall e-commerce websites.

“Collaboration with partners has been a crucial part of our success.” explains Ashleigh.

“Having a network of suppliers that understand our objectives and inherit our KPIs as their own has helped us to grow our conversion rate by 15% when compared with the same period last year as well as an almost 20% increase in overall e-commerce revenue.”

So what’s next for the venues that form part of the fabric of Belfast’s live entertainment scene? “We’re delighted to announce that we’ve been shortlisted in the ‘Best Use of Data and Insight’ category at the Chartered Institute of Marketing awards, which validates everything the team have been working so hard on for the past few months.” The winners are to be announced at the awards ceremony in April.

Ashleigh concluded, “We’re constantly looking for ways to improve our customer offering and by adopting an approach of continuous improvement, we’re confident that we’ll be able to better serve the needs of customers whose next great live entertainment experience starts the moment they decide to purchase a ticket.”

For more information visit urban-hq.co.uk

Flexible Ofce Space No Deposits & Up to 3 Months Rent Free for All New Deals Summer 2020

UrbanHQ, Eagle Star House 5-7 Upper Queen Street, Belfast, BT1 6QD

Prime City Centre Location 500 Desks Across 8 Floors Platinum WiredScore Certified Rooftop Terrace Flexible Membership Packages Wellness Studio Members Lounge & Event Space

EyeonCSR

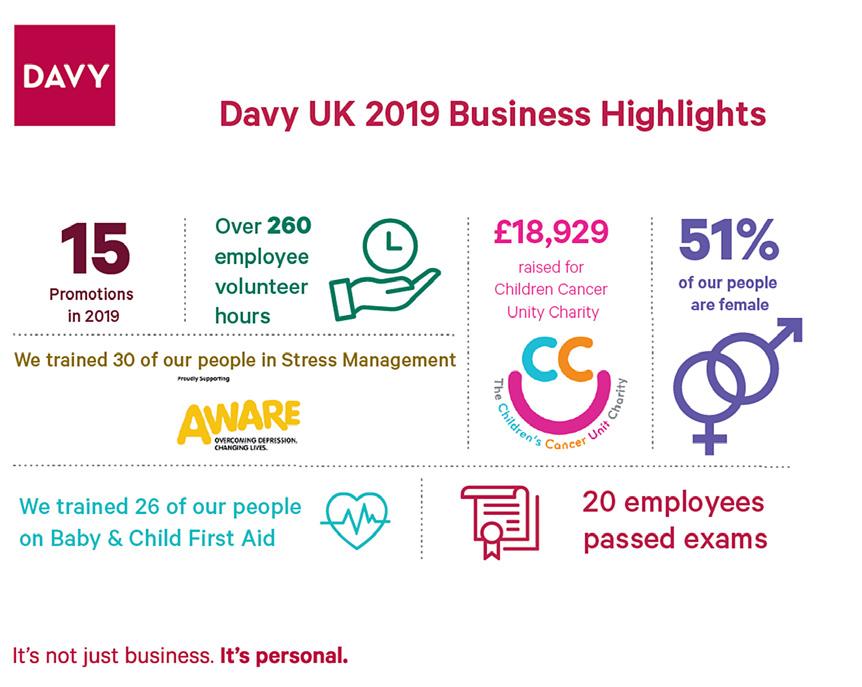

Davy UK Corporate Social Responsibility

At Davy, relationships matter to us. We care about our employees, our clients and the world we do business in.

Davy UK staff with one of the CCUC children, Henry who starred in the CCUC #SaveaseatforHenry Christmas campaign which Davy UK staff took part in.

Guided by our core values of one team, clients first and always growing, we work together with one ambition, supporting our colleagues across Davy while striving to make a meaningful impact in our clients’ worlds, whether they are individuals, businesses or institutions. Workplace

Within Davy UK, we aim to provide a great workplace, helping employees to reach their full potential. We recognise our responsibility as an employer to foster an inclusive working environment, where all employees are supported and enabled to succeed. We also recognise the importance of continuous learning. To this end, we encourage our staff to pursue self-development opportunities through the acquisition of professional qualifications once applicable to their role, formal training and active on-the-job coaching. We believe that continuous development not only widens employee’s skills and knowledge base but also equips them to perform their role more effectively and to reach their full potential.

EyeonCSR

(CCUC) is a key element of their CSR strategy, designed to enable staff make a positive impact in their community and to enable the company to do more to support local community causes. The CCUC’s primary focus is ensuring the frontline service, which provides the vital care for children affected by cancer, is supported through provision for essential equipment, improved infrastructure and additional staffing where necessary. Another equally important role of the Charity is to support families affected by childhood cancer from right across Northern Ireland.

So far, the partnership has been a huge success, creating new opportunities and boosting the potential for family events throughout the year. One of them was an event held at Davy UK offices in November, to coincide with the switching on of the Belfast Christmas lights. By opening their doors and hosting a Winter Wonderland

Source: Davy UK

experience for CCUC families, Davy UK demonstrated that this partnership is about more than just raising funds. Families were provided with an opportunity to enjoy something they would not normally have been able to do. Speaking about the partnership, Anna McDonald from the Children’s Cancer Unit Charity said:

“To carry out our work in supporting children and families affected by cancer, we depend on partnerships like the one we have with Davy UK. As well as the important funds they raise to help us provide equipment, staffing and other tools that the medical team needs, they also give us the capacity to support families directly by becoming an extension of our team. Not only have they welcomed every opportunity to get involved, but their enthusiasm and willingness to help is infectious and for that we are hugely grateful. It has been a pleasure to have the Davy team join the CCUC family.” If you haven’t yet selected a CSR partner, please visit https:// childrenscancerunit.com/ to find out how you can support them.

J&E Davy (UK) Limited and J&E Davy are part of the Davy Group of companies. Davy Private Clients UK and Davy UK are the trading names of J&E Davy (UK) Limited. J&E Davy (UK) Limited is authorised and regulated by the Financial Conduct Authority. J&E Davy, trading as Davy, is regulated by the Central Bank of Ireland. In the UK, Davy is authorised by the Central Bank of Ireland and authorised and subject to limited regulation by the Financial Conduct Authority. Details about the extent of Davy’s authorisation and regulation by the Financial Conduct Authority are available from us on request.

Conor McCann is Head of Business Development at Davy UK. You can contact Conor directly on 028 9072 8143 or email him at conor.mccann@davy.ie.

EyeonCover Story

Economic outlook points to a positive year for businesses

As the business outlook for 2020 becomes increasingly certain, and more optimistic, Lynsey Mallon, a Corporate and Commercial Partner at leading law firm Arthur Cox casts her eyes forward to the opportunities that lie ahead.

In recent years, the business landscape in Northern Ireland has been overshadowed by uncertainty. Whether due to the lack of local political leadership at Stormont or concerns around the UK’s departure from the European Union, the clouds have been all too evident. It is a climate with which Arthur Cox Corporate and Commercial Partner Lynsey Mallon is very familiar, as a senior leader at the leading law firm with a track record for expertise in the mergers and acquisitions market, operating at the very heart of the local economy.

But just a few weeks into a new year, with the recently formed Northern Ireland Executive and the UK moving into a transition period ahead of its changed relationship with the EU, she sees a new era of business certainty beckoning. Lynsey joined Arthur Cox in 2007, becoming Partner two years later, as she quickly gained a reputation for being equally at ease advising on domestic and cross-border transactions.

It is the strength of the M&A market, coupled with improving economic data that points to a brighter economic future in 2020, Lynsey said. “I think it is fair to say that for many businesses in Northern Ireland, recent years have been difficult due to a myriad of factors, not least the lack of local government and wider political uncertainty,” she commented. “However, there is a clear sense in the marketplace that things are changing.”

A senior member of Arthur Cox’s highlyrespected Corporate and Commercial team in Belfast, Lynsey is afforded an intimate insight into the strength of the Northern Ireland economic landscape.

Confidence It gives her grounds for confidence for the months ahead, buoyed by taking a fresh look at some of the most recent financial statistics, such as the latest Ulster Bank Purchasing Managers’ Index (PMI), considered a strong barometer for the state of the economy. It recorded a tenth successive month of declining activity in December, but positive indicators remained, as Lynsey explained: “Certainly, some of the data published over recent months has made for challenging reading.

“But the Ulster Bank PMI also found that companies increased their staffing levels in December for the first time in a year

EyeonCover Story

and they have a more optimistic outlook for the next 12 months. “It is an indicator of an upturn in sentiment that is mirrored in other reports, including the latest Northern Ireland Construction Bulletin which has recorded a strong rise in activity, particularly in the infrastructure sector.” With this new positive outlook, will it mean more M&A activity and investment in Northern Ireland this year?

Many analysts believe so and for Arthur Cox, 2020 has already proved busy in the M&A market. Lynsey commented: “Although still in the early part of the year, we have already been advising on some significant transactions and see a positive deal flow ahead.

The Corporate and Commercial group at Arthur Cox is headed by Alan Taylor, one of the bestknown and highly regarded corporate lawyers in Northern Ireland, while Paul McBride, who

most highly accomplished in the sector, clients trust us for advice, drawn by our expertise that has seen us work on some of the most significant deals to take place in the local landscape.”

was formerly Head of Office for a Top 100 international law firm is also among the Partners.

Trusted by a broad clientele, the team advises a wide spectrum of organisations, both overseas and indigenous firms, from large multinationals to fledgling start-ups, on a range of corporate law concerns. Lynsey said: “With a strong leadership team, bolstered by a group of associate solicitors who are among the Working across a range of industries, and jurisdictions, the Arthur Cox Corporate and Commercial team advised on a wide variety of deals, including among the highest value transactions to take place in Northern Ireland during the last twelve months.

With a rich vein of deals anticipated throughout 2020, Lynsey cautioned that special considerations should be made, in light of UK’s exit from the EU, for those involved in M&A activity.

“There is no doubt that Northern Ireland remains an attractive place in which to do business and to invest,” she said.

“However, investors from outside the jurisdiction will need to be cognisant of factors relating to the UK’s departure from the EU when embarking on the purchase of or merger with a local entity.

“With offices in Dublin, Belfast, London, and the United States – and experts grounded in each location – we are well placed to provide locally focused advice from a global perspective.”

The wide range of advisory teams at Arthur Cox are well positioned to advise on all legal requirements. Call +44 28 9023 0007 for further information from Lynsey, or your regular Arthur Cox contact.

EyeonFinance

New Decade, New Approach… it’s not just for the Politicians!

Judith Totten Founder and Managing Director, and Alan Wardlow Sales Director at Upstream Working Capital discuss entering a new decade with optimism and ambition.

Who remembers 2019? Wasn’t great, was it? We would turn on our TV’s every night to hear Laura Kuenssberg or Mark Davenport tell us how we were about to fall into the abyss created by a ‘no deal’ Brexit and a dysfunctional Stormont Executive.

Whilst, at least for now, these ‘terrible twins’ of doom seem to have been dealt with, it’s time to focus on the positives in this New Decade - let’s optimistically call this the ‘Roaring Twenties !’. At Upstream, we have also undergone a major transformation which will allow us to provide funding using a ‘New Approach’. Having spent eight years building a solid platform and providing much needed working capital into the SME sector at a time when Bank funding became harder to source, we realised last year that it was time to spread our wings and do even more. Upstream has now secured the support of an ambitious new funding partner who has provided us with access to major capital that simply wasn’t available to us previously. This has already allowed us to fund proposals that we would have had to pass on, only a matter of months ago. In December alone, we have funded a major NI client in the Food sector allowing him to take on a major new contract. This opportunity came as a result of open and practical debate between the owner, his prime Bank and us and we structured a solution which optimised the outcome for all parties. This kind of collaborative funding is the way forward as we see it – with a ‘Win:Win’ for all.

We have also just taken a stake in a G.B. based Commercial Finance provider and we are providing their prime funding line. This will allow them to expand and diversify their portfolio in the Midlands and expands Upstream’s footprint across the UK.

However this is only the proverbial tip of the iceberg as we see it - opportunities abound across the U.K. and Ireland and we are now seeking to support Companies requiring funding of up to £10M (and potentially beyond) providing innovative and tailored working capital solutions to free up cash to really grow your business, not just fund a short term cashflow requirement. Imagine how your business or, if you are an adviser, your client’s business, could be transformed if you had – to use that famous word – “unfettered” access to cash freed up by Upstream. One method of doing this which has been availed of successfully by many of our clients is by using our funding to pay your supply chain, thereby allowing you the capital and the time to significantly increase your sales. Just think about the negotiating position you would be in if you were settling your suppliers up front rather than seeking credit terms.

Many of our clients are securing prices from their suppliers that readily off-sets the cost of funding. Importantly, this funding does not impact on your relationship with you with your existing Bank as we do not seek additional Corporate security. In fact, we are now complementing local Banks, in support of non-standard transactions which fall outside their normal suite of products.

We have reinvented the Upstream brand, to reflect the needs of growing businesses into the Roaring Twenties. We recognise that BREXIT and global growth brings unique challenges, but our new partners are themselves global funders with an appetite to tailor working capital products to match the full working capital cycle of a transaction – from idea to execution.

We’d be delighted to hear how your business plans to grow rapidly into the New Decade without the financial constraints you’ve previously experienced. Give us a call or contact us by e-mail. What do you have to lose - except maybe, a great opportunity?

EyeonCommunications

Think digital in 2020 or risk getting left behind

By Stuart Carson, Rainbow Communications

SMEs in Northern Ireland are a resilient bunch. Despite the regular economic, political and global curve balls, Northern Ireland Plc has remained relatively strong. Most businesses here have a clear understanding of the importance of innovating, creativity, training and focusing on the right areas for improvement.

Indeed, the consumer-driven digital revolution has touched almost every business in some way, with the majority of these already incorporating a variety of new technology forms that fits their needs or which are building in additional cloud capacity to provide the future room to grow. However, as 2020 gets under way, speed is of the essence, and the pace of consumer-driven change is continuing to take many companies by complete surprise.

Technology is already changing our lives, our jobs and how our businesses are run. Most companies will have a social media presence, a website, already be using the cloud, selling or promoting online or leveraging data analytics for better commercial gain. But is it enough? There is already broad consensus that digital transformation is much more than simply enhancing your communications and technology platforms. Forwardthinking organisations are now urgently developing digital business strategies that include modernising the culture, redefining operating models, innovating product and service strategies and developing and honing the skills necessary to serve today’s digitally savvy customers. Without question, whatever industry you’re in, your organisation must transform for a digital world.

According to the recent PwC Global CEO Survey, 81 percent of respondents agreed that technological progress will fundamentally change their organisation, with the pressure to move faster seen

The time is now to harness the power of digital transformation.

Stuart Carson is Sales and Marketing Director at Rainbow Communications, Northern Ireland’s largest independent telecom provider. For more information on its full range of services, including bespoke solutions, visit www.rainbowcomms.com

as unrelenting. It also revealed that over a third of the UK’s largest companies had appointed a dedicated digital leader to drive advantage in this area. When I talk about digital transformation, I’m referring to the process of adapting or overhauling current business processes to incorporate digital strategies and technology into a company. This could be anything from ensuring employees can access files remotely and securely, bringing in new devices so employees can work from wherever they are, creating a mobile app to improve internal communication, ensuring your communications network is fit for the future.

‘Digital transformation’ may be one of the buzzwords of our time, but even though most companies know it’s something they should be doing, many are still unsure what it actually means, let alone where to start.

Put simply, it’s about changing the way a business interacts with its

customers and how they provide their customers with a consistent experience whenever and wherever they need it. So, what should you consider when formulating a Digital Transformation Strategy?

HEAD FOR THE CLOUD If you haven’t moved already, it’s really time you did. From greater efficiencies, enhanced security, flexibility and the capacity to expand, it’s a no-brainer to get things going.

ASSESS THE CURRENT REALITY To find out where you are on the journey, take a look at where you are on the journey now. Where are the gaps, in what areas could we be better and where are our successes? This should give you a good idea of the technology and digital capacity you need.

CUSTOMERS AND CLIENTS COME FIRST It’s not companies driving change. It’s consumers. Today, customers expect relevant content in relation to what they’re doing anytime, anywhere and in the format and on the device of their choosing. Make sure you put them first.

MAKE IT INTEGRATED Make sure all your activity can work seamlessly together. Bring your business communications together – from phone, mobile to messaging – in a fully managed cloud service that provides outstanding flexibility and value for money.

BE SECURITY CONSCIOUS The risk of cyberattacks, malware and the impact of GDPR rules means security concerns are ever present. Address this as a priority with the many solutions available.

BE CLEAR The key is to understand what you’re trying to achieve and then get the right technology and culture in place to deliver this. Finding a provider that has the right expertise in delivering successful digital transformation projects has never been more vital.

Innovate to Advance

Join the hundreds of Northern Irish businesses innovating

TRITEMP by TriMedika

EyeonFinance

IQ & Co Fast Growing Force In Financial Services

EyeonFinance

2019 was quite a year for partners Tanya Martin & Angela Forsythe and the rapidly growing team at Holywood-based wealth management specialists IQ & Co.

The company didn’t just take a major step forward by becoming an appointed representative of St. James’s Place Wealth Management, but it also continued on a growth trajectory which has seen the firm expand to a team of 35 professionals and quadrupling the amount of funds managed on behalf of clients. That makes IQ & Co one of the largest firm of its kind in Northern Ireland for issued business. It’s an achievement that’s made even more impressive by the fact that it’s been achieved from a standing start since joining St. James’s Place in March of last year. Since March, the Northern Ireland firm has climbed rapidly through the St. James’s Place ranks. The duo of Tanya Martin and Angela Forsythe tend to deflect credit away from themselves and on to the efforts of their team, but there’s little doubt that the pair’s dynamism, hard work and market knowledge has been instrumental in the firm’s growth. They have also been quick to see the value of marketing, working on social media and launching a unique billboard campaign as part of a strategic programme. It’s a level of growth which has made the financial services marketplace, and plenty of clients and potential clients, sit up and take notice. The very fact that IQ & Co was invited to join St. James’s Place stands testament to that. “We’re delighted to be part of St. James’s Place,” says Tanya Martin. “It is a really big and experienced organisation with in excess of £100 billion under management, and, as well as the advice and expertise we offer our clients, they can now benefit from the expertise available from one of the UK’s leading wealth management firms.” IQ & Co now has an experienced team of 22 professional advisers, including a number of former bank and building society managers, backed up by a dedicated support staff. That makes the firm a major player in a Northern Ireland financial services marketplace which is dominated by much smaller wealth management advisory firms, many of them one or two-person operations. “We might be a fast-growing firm, but old school financial advice is right at the heart of what we do,” adds Angela Forsythe. “Personal service, personal contact and personal advice is what this business is all about and we haven’t changed the way we do things from our very early days. We keep close to our clients and we’ll work really hard to achieve the right results for them. “If that means working after hours or breaking into our weekends or holidays, so be it. That’s what customer service is all about.” It’s a bold mantra in an industry that isn’t always well known for its level of customer service. How many clients through the years have been sold a product by a Financial Adviser and then rarely contacted again? IQ & Co is a sister company of Mortgage IQ, a mortgage specialist company with a network of 11 offices around Northern Ireland and some 8,000 clients. “There are clear synergies between the two companies. Our mortgage clients don’t always need wider financial advice, but often they do and we’ve also been able to provide mortgage solutions to those who’ve come to us for wealth management advice,” adds Angela. Recent changes to pensions legislation have helped to boost the number of enquiries coming in IQ & Co’s direction, and the company has opened its first High Street branch in Ballymena in response to increased demand. In 2019, to support with strategy and structure, Tanya and Angela recruited Janine Davis from Ulster Bank as Operations Manager. Tanya said that “There has been a lot going on over the last year or so and Janine has been crucial in building a professional structure around ourselves, our advisers and everything we do. This business is about people and it will always be about people... our people, our advisers and our clients. We’re passionate about what we do, and the comments we receive from our clients, as well as our Google reviews, reflect that passion.” IQ & Co’s achievements have also been noticed by the wider marketplace. The firm was a finalist in this year’s Women In Business Awards,has also reached the final of the NatWest Local Hero Awards and has been awarded the Northern Ireland Diversity Charter Mark.

Your home may be repossessed if you do not keep up repayments on your mortgage.

EyeonFinance

The IQ & Co Senior Team

Ian is based in the Holywood office and holds a Certificate in Mortgage Advice & Practice, a Diploma in Financial Advice, a BA (Hons) in Business & Finance as well as several management and leadership qualifications. Ian has been in financial services for 30 years having moved to IQ&Co from Nationwide Building Society. Ian added that “Helping clients find personal financial solutions is important to me and I enjoy assisting customers with personal, face to face advice. I am passionate about great customer service and building long term relationships”. Ian Milligan

Neal joined IQ&Co in 2019 and has 16 years’ experience in the financial services industry having most recently worked as an Investment Manager (UK Expats, SW France) and a Discretionary Fund Manager (Multi-Asset, Edinburgh). Neal holds a BA(Hons.) in Accounting & Economics, a MSc. Finance and is a CFA (Level 7) Charter holder. Neal told us “I am passionate about helping clients achieve their financial goals by providing personal face to face advice.” Neal specialises in Inheritance Tax Solutions, Pension Planning & Trusts and told us that he truly believes in the mantra” Be the person today that your future self will be proud of.” Neal said he applies this across all aspects of his life including how he serves and supports customers. Neal Caldwell

Trusts are not regulated by the Financial Conduct Authority.

Gillian joined IQ&Co 2 years ago from having worked in Halifax and Lloyds banking group, she has been in Financial Services for 35 years and holds her Certificate in Mortgage Advice & Practice and her Diploma in Financial Advice. Gillian is based in our Holywood office and told us; “I believe strongly that everyone should have a financial plan. This helps you focus the way you manage your money so it’s easier to stay on track and be able to do the things you want - both now and in the future. Life can often throw unexpected events in our direction but if you have a well-prepared financial plan you will have more peace of mind whatever happens. “ Gillian Walsh

EyeonFinance

Janine is the Operations Manger in IQ&Co and sister company Mortgage IQ. Although based primarily in Holywood, Janine supports all branches across Northern Ireland with operational procedures and processes. Janine also supports with the implementation of overall business strategy and changes. Janine moved to IQ&Co in May 2019 having spent her previous career with Ulster Bank as an Area Quality Development Manger for mortgages and, most recently, a Risk Manager. Janine told us, “Having spent my whole career in Ulster Bank it was big step to move companies but after speaking with Tanya and Angela I was blown away by the companies values, positive attitude and the outstanding focus on customers.” Janine Davis

Tennielle McIlroy is based in the Antrim and Ballymena areas and holds her Certificate in Mortgage Advice & Practice and her Diploma in Financial Advice. Tennielle has been in Financial Services for 21 years and previously spent time as a Branch Manager in both Halifax & Santander before joining IQ&Co 5 years ago. Tennielle told us that “my advice covers all areas of mortgages and protection and wealth management, including, retirement planning, wealth, protection, savings and investment planning. I believe in everyone having access to financial planning to help them plan for a better future and that they should have that along with great service and an adviser they can trust and depend on.” Your home may be repossessed if you do not keep up repayments on your mortgage. Tennielle McIlroy

Matthew is the most recent Financial Adviser to join IQ&Co, moving from Santander having had a very successful career as one of their top Advisers nationally. Matthew is based in Holywood and holds his Diploma in financial advice, Certificate in Mortgage advice and his Certificate in Equity release. Matthew specialises in holistic financial planning and told us; “I am truly passionate about helping my clients define their financial goals and the path to getting there. I have an extremely strong work ethic and a passion for helping others which means I am truly dedicated to my clients and helping them achieve their financial goals, as a population we need to be smarter with our finances and I am here to support my customers with that.” Matthew Higgins

EyeonTax

Passing The Baton

reluctance to give up control and financial security, and a natural tendency to avoid the potentially emotional issues of transferring the business to the next generation.

Caroline Keenan, ASM Director

Family-owned and ownermanaged businesses are a key part of the Northern Ireland economy. However, empirical evidence indicates that many family businesses do not survive beyond the first generation, highlighting the importance of succession planning.

Develop a plan Adapting to change is a key attribute of successful family businesses. As part of the process of embracing change and evolution, it is important to put a succession plan in place. Frequently owner-managers avoid addressing the succession issue. The reasons for this are understandable – Management Transition There may be a natural family successor who will become the new owner-manager, but if not, this can give clarity at an early stage that a third-party sale or management buy-out could be the best option to realise the value of the business.

Where the right successor has been identified, the management transition may take several years so early implementation is crucial. The owner-manager may want to leave altogether or still contribute to the business.

Ownership Transition When the time is right to transfer the business to the next generation, shares may be passed on as lifetime transfers or on death. Trusts can potentially be used where children are considered too young to have direct ownership, and also to protect the shares in the event of marriage breakdown, bankruptcy or incapacity of family members. The outgoing owner-manager will also want to secure financial independence from the company for their retirement. A healthy pension and adequate savings should assist the process of surrendering control. It may also be possible to release capital with a purchase of own shares, or charge rent where property is held outside the trading company.

Tax Planning Tax planning should follow once the plans and wishes of the ownermanager have been communicated. The key tax reliefs available are as follows:

1. GIFT HOLD-OVER RELIEF Where qualifying assets (for example, shares in a personal company) are given away, a joint claim for Gift Hold-Over Relief results in Capital Gains Tax payable by the transferor with the transferee inheriting the base cost of the transferor.

2. BUSINESS RELIEF The transfer of a trading business during the transferor’s lifetime represents a Potentially Exempt Transfer (PET) for Inheritance Tax (IHT) purposes. A PET will only become chargeable if the transferor dies within 7 years of the transfer, however if the transferee still owns the business at the date of death, 100% Business Relief will be available. Business Relief is also available where ‘relevant business property’ is still owned by the original ownermanager as part of the death estate.

3. ENTREPRENEURS’ RELIEF

For disposals of shares that qualify for Entrepreneurs’ Relief the rate of Capital Gains Tax is just 10%. Shares must be in a trading company (or holding company of a trading group), be held for 2 years up to the date of sale and the seller must be an employee or office holder of the company.

Start Planning Early and Take Advice It is important to start the succession planning process early and put a clear strategy in place. ASM’s core client base is local family-owned businesses, providing them with sound professional advice to complement commercial strategies.

ASM are running a Succession Planning Breakfast Event in conjunction with MKB Law on Wednesday 11th March 2020 at The Merchant Hotel. To reserve your place, please contact linda.arbuthnot@asmbelfast.com / 028 9024 9222

The content of this article is for information purposes only and advice particular to your circumstances should be sought from a professional adviser.

ASM Chartered Accountants has six offices – Belfast, Dublin, Dundalk, Dungannon, Magherafelt and Newry. The 120 strong team specialises in a range of accountancy disciplines including Audit and Accounting, Business Consultancy, Corporate Finance, Forensic Accounting, Hotel and Tourism Consultancy, Internal Audit and Taxation Services.

This is an empty space. It’s our least favourite thing.