Greetings from HKFI Chairman

Iamhonoured to be the HKFI Chairman for this new term 2023/2024. As we emerge from the pandemic, the next 12 months hold both challenges and opportunities. With your unwavering support and insightful guidance, we are confident in our ability to continue providing high-quality services and professional support to our Members. I look forward to working closely with you in the year ahead.

Orchis Li HKFI Chairman

Nominations for Task Forces, Working Groups and Steering Committees

Overthe years, thanks to the collaborative efforts of various Task Forces, Working Groups and Steering Committee formed under the Governing Committee (GC), General Insurance Council (GIC) and Life Insurance Council (LIC), we have been able to accomplish numerous critical initiatives for our industry. To sustain this positive momentum and encourage more industry practitioners to join our cause, we are welcoming nominations from all Member Companies to support ongoing and new initiatives in the upcoming term. Together we can continue to drive progress and advance our shared goals for the greater good of our industry and community at large. For details, please refer to our circular (Circular Ref: Mv042/23).

Amendment Bill on RBC

InApril, the Government published the Insurance (Amendment) Bill 2023 (Amendment Bill) in the Gazette to amend the Insurance Ordinance and other relevant legislation for implementing the Riskbased Capital (RBC) regime. The Financial Services and the Treasury Bureau (FSTB) has introduced the Amendment Bill at the Legislative Council (LegCo) and a Bills Committee with the Hon K P Chan as chair and the Hon P L Chan as deputy chair has been set up to review it clause by clause. In principle, we support the implementation of RBC regime in Hong Kong which will help to strengthen Hong Kong's position as the International Risk Management Centre. In fact, our two Task Forces on RBC under GIC and LIC have worked closely with the IA over the past few years to support this initiative and resolved many technical issues.

For the current clause by clause review exercise at the LegCo, we have engaged an independent lawyer to look at the Amendment Bill from the legal perspective. We have also gathered views on tax issues from the two Task Forces on RBC. All comments and observations received were incorporated into formal submissions to the Bills Committee which included an overview and enquiries concerning specific clauses.

Use of AI and Chatbots

Unilateral Recognition Insurance Products for Northbound Travel for HK Vehicles

Starting from 1 July 2023, Hong Kong private car owners or drivers entering Guangdong under the Northbound Travel for Hong Kong Vehicles (the Scheme) can procure unilateral recognition insurance products from Hong Kong insurers. This means that car owners can ride on their Hong Kong statutory motor insurance policy to purchase coverage for the Mainland compulsory liability motor insurance and/or the selective top-up coverage in Hong Kong.

To facilitate Hong Kong car owners / drivers to take out unilateral recognition insurance products, we have launched a dedicated webpage with information on the 16 insurers offering these products and the relevant claims procedures. At the same time, an interactive session was conducted by the Accident Insurance Association last week where the Hon P L Chan, the Hon K P Chan and IA’s Executive Director Mr Simon Lam shared with more than 80 representatives of motor insurers the latest update and points to look out for when communicating with prospective customers.

In mid-May, IA’s Head of Market Conduct Mr Peter Gregoire shared his views on the deployment of chatbots and artificial intelligence (AI) from the regulatory lens in the latest issue of Conduct In Focus

As technology continues to play a more significant role in enhancing business operations and customer experiences, it has become increasingly prevalent in our sector. However, it is crucial to balance the innovation with compliance to ensure that the integration of technology is done in a responsible and sustainable manner. To address this evolving topic proactively, Chairmen of the InsurTech Task Forces and Legal Working Groups under GIC and LIC, and the Professional Standards Working Group under LIC will join force to discuss the relevant issues, identify common goals and plan for the next steps. We will soon convene an internal meeting to kick start this joint initiative.

Shenzhen-HK Liaison Event Promoting 30 Financial Support Measures for Qianhai

On18 May 2023, the HKFI Chairman Ms Orchis Li and Chief Executive Ms Selina lau joined the financial sector delegation led by Secretary for Financial Services and the Treasury to Qianhai. Speaking on behalf of the HKFI at the event, Ms Li highlighted the strategic role of Hong Kong as nation’s risk management centre and our industry’s readiness to participate in the GBA development more proactively including the setting up of the customer service centres in the GBA.

People Development

Talentshortage in the insurance industry has been a significant challenge in recent years. To address this issue, our Think Tank report includes a recommendation to create sustainable talent pools for Hong Kong’s insurance industry. In support of this recommendation, we have expanded and transformed our Steering Committee of Training into a Task Force on People Development. Led by Mr Alger Fung, the Task Force will adopt a more comprehensive approach to talent development, taking a step forward in realizing our goal.

The Green and Sustainable Finance CrossAgency Steering Group (CASG) releases an online portal which centralises relevant resources of the CASG SME Questionnaire, including questionnaire templates, step-by-step reporting guidance, training videos and presentation decks, and other learning information. For details, you are welcome to visit the website of HKMA on CASG SME Questionnaire on Climate and Environmental Risk. The Task Force on Green Insurance will continue to monitor the developments of the SME questionnaire and provide update to Members as appropriate.

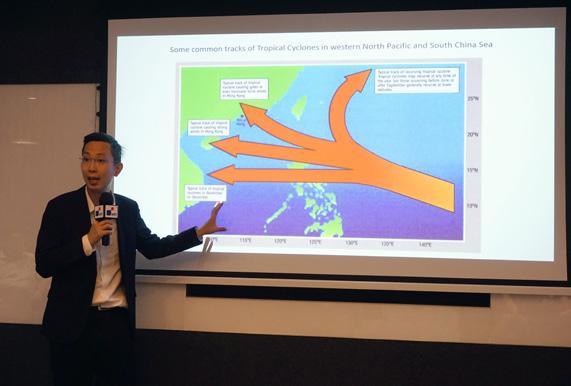

Tropical Cyclone Related Hazards & Impacts of Climate Changes on Tropical Cyclones

On31 May 2023, Mr Choy Chun Wing, Acting Senior Scientific Officer, Hong Kong Observatory (HKO) shared at the above Briefing the climate change impacts on tropical cyclones, including frequency, intensity, precipitation, track pattern and storm surge. He also introduced how to access meteorological data at the HKO’s website. Members found the sharing very useful. We look forward to having more collaborations with the HKO to combat climate change.

We are excited to launch the Hong Kong Insurance Awards 2023!

This year, to mark the 35th Anniversary of HKFI, we are rolling out the Lifetime Achievement Award again. In addition to forming the Panel of Judges of notable figures to adjudicate various categories, we especially formed a separate judging panel to select two most deserved nominees from the general insurance and life insurance sectors respectively to receive the Lifetime Achievement Award.

The application will open in early June 2023. Submit your entries for various categories to showcase your excellent accomplishments as well as nominating an industry veteran for the Lifetime Achievement Award. Stay tuned to our official website www.hkfi.org.hk/hkia for details!

EAIC 2024 Sponsorship Opportunities

Thesponsorship programme for the 30 th EAIC 2024 Conference is now available!

Our sponsorship programme offers a variety of attractive opportunities for you to increase your visibility, network with industry influencers, and make a positive impact for the future. We encourage you to take advantage of this unique platform to showcase your brand and contribute to the success of this prestigious event, which will be held in Hong Kong between 24 and 27 September 2024. Please contact sponsor@eaic2024.hk if you want to learn more about the conference and the offers available.

CASG SME Question Online Portal

CASG SME Question Online Portal