Greetings from HKFI Chairman

Iamhonoured to be appointed the HKFI Chairman for the 2024/2025 term. In the next 12 months, our utmost dedication will remain on fostering the growth of our industry, safeguarding the interests of our Members, and contributing to the welfare of the community at large. In this regard, I look forward to your invaluable guidance and unwavering support. Let us join forces to pave the way for a promising future and a sustainable market for our insurance industry.

Meeting with Chief Executive’s Policy Unit

The HKFI Think Tank released a report in April 2023 outlining nine key recommendations to revitalize Hong Kong’s status as international insurance and risk management hub. Since then, we have been actively engaging with government officials and relevant stakeholders to communicate our position and advocate for the implementation of these recommendations.

On 8 May 2024, we were engaged in a collaborative dialogue with the Head and Deputy Head of the Chief Executive’s Policy Unit. The meeting served as a follow-up to our initial meeting on the Think Tank proposals in August 2023. Together, we delved into strategies to enhance the capacity of Hong Kong's insurance sector, exploring topics of common interests such as Contractor's All Risks (CAR) insurance of infrastructure projects, captive insurance, marine insurance, talent development, etc.

Joint Briefing on the Safeguarding National Security Ordinance

Following the consultation of “Safeguarding National Security: Basic Law Article 23 Legislation” conducted by the Security Bureau in January 2024, the Safeguarding National Security Ordinance (Ordinance) was passed by the Legislative Council and has taken effect upon gazettal on 23 March 2024.

To foster a comprehensive understanding of the Ordinance and empower our industry to effectively articulate the advantages of the new legislation to international counterparts, Legislative Council Members Hon KP Chan and Hon PL Chan together with the HKFI had jointly organized a briefing session on 31 May 2024 with Convenor of Non-Official Members of Executive Council Hon Mrs Regina Ip addressing the session. Through her in-depth elaborations and the use of vivid case examples, the participants gained a deeper understanding of the Ordinance.

Issue No.322 May

2024

Ivan Tam HKFI Chairman

Briefing on Taxi Fleet Regime

On 17 May 2024, a briefing session was conducted by the Transport and Logistics Bureau and the Transport Department on the introduction of the taxi fleet regime. The presentation was followed by a Q&A session which provided insurers with a deeper understanding of the details of the regime and the potential benefits it could bring to the overall ecosystem.

While we were appreciative of the Administration’s efforts in improving the safety and service standards of the taxi trade, we also shared our views over the efficacy of the new measures and what could be introduced to ensure better outcomes.

HKFI as IUMI’s Asia Hub

Beingthe Asia Hub of the International Union of Marine Insurance (IUMI), HKFI is delighted to host the entire IUMI Executive Committee and more than 200 delegates from 18 markets at the 2024 Asia Forum on 4 June and 5 June 2024.

At the same time, we are invited to join the Shanghai Institute of Marine Insurance (SIMI) at its “Opening-up, Cooperation & Future – SIMI/IUMI Conference” in Shanghai. HKFI Chief Executive Ms Selina Lau delivered a presentation on the role of HKFI and how we support the IUMI in the Asia region.

Going forward, we aim to collaborate more closely with both IUMI and SIMI, further strengthening our role as a super-connector and driving greater synergies and collective impact.

On6 May 2024, the Insurance Complaints Bureau (ICB) held the first ever strategy session to navigate the ever-changing insurance market and plan for ICB’s continued success.

At the invitation of the ICB Chairman Mrs Pamela Chan, IA CEO Mr Clement Cheung shared his insights on the cross-boundary collaboration driven by Greater Bay Area (GBA) development. Mr Yuman Chan, Convenor of HKFI’s Focus Group on Medical Insurance, provided an overview on the latest trend and development in the medical insurance market.

The second half of the session culminated in an engaging and interactive discussion involving the members of the ICB General Committee and the Insurance Claims Complaints Panel. The discussion was moderated by former HKFI and ICCB Chairman Mr Roddy Anderson, who guided the participants in examining critical industry issues, as well as identifying both challenges and opportunities.

To ensure ICB remains an indispensable alternative dispute resolution mechanism amidst the evolving insurance landscape, its General Committee will spearhead the development of a comprehensive three-year strategic plan. This strategic roadmap will help ICB adapt and evolve to better serve the needs of all stakeholders.

ICB Strategy Session

ICB Strategy Session

ETDP Matching Result Announcement

The

above mentorship programme launched by the HKFI aims to pass down the invaluable business wisdom and extensive experience of insurance veterans to the younger generation.

We are delighted to announce that the fourth cohort of the programme has received an overwhelming response from our Members. With the enthusiastic support of our Members and seasoned practitioners, we have successfully matched 16 pairs of mentor-mentee for this cohort. Over the next 12 months, mentees will have the opportunity to fully immerse themselves in this program, benefiting from the wealth of knowledge and insights shared by their experienced mentors. For more information, please visit our official website.

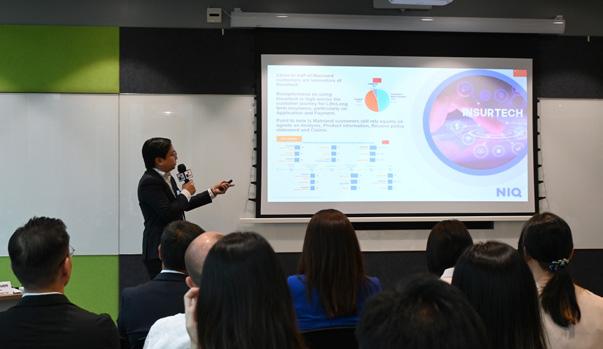

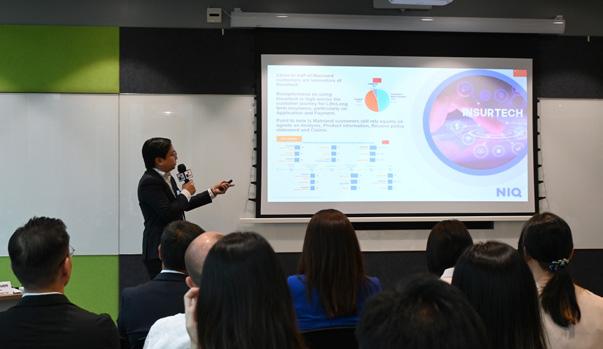

Underthe steer of the Task Force on Customer Advocacy, the HKFI has resumed its Insurance Market Research. This year, the study has expanded its scope to include InsurTech and digital services, encompassing nine cities within the GBA. The findings of the industrywide research were released to the subscribers, followed by a briefing on the results by the appointed consultant NielsenIQ on 29 May 2024.

This market research serves as a valuable resource for members, enabling them to stay abreast of customer preferences and behaviors in both Hong Kong and the Mainland China. It provides insightful guidance for product development, service enhancement, effectiveness of various promotional channels, as well as growth opportunities within the GBA.

This year, in celebration of its 10th anniversary, we are thrilled to launch the Hong Kong Insurance Awards 2024 with our partner South China Morning Post! Hong Kong Insurance Awards 2024

The application will open in early June 2024. Submit your entries on or before 31 July 2024 to showcase your excellent accomplishments in the past year. The Awards Presentation Ceremony cum Gala Dinner will be held on 24 October 2024. Stay tuned to our official website for details.

Membership News

EAIC 2024

The EAIC 2024 Hong Kong Conference is just four months away. Registration is now open with early bird rates available until 21 June 2024.

Don't miss the chance, visit the official website for registration now. We look forward to welcoming you all in Hong Kong this September to join this signature event!

Change of Authorised Representative General Insurance Member: Starr International Insurance (Asia) Limited – Mr Mark Johnson

HKFI Membership

As at 31 May 2024, the HKFI has 81 General Insurance Members and 53 Life Insurance Members.

Insurance Market Research

ICB Strategy Session

ICB Strategy Session